false

0001065088

0001065088

2024-10-01

2024-10-01

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C.

20549

FORM 8-K

CURRENT REPORT

Pursuant to

Section 13 or 15(d) of

the Securities

Exchange Act of 1934

Date of Report

(Date of earliest event reported): October 1, 2024

eBay Inc.

(Exact name

of registrant as specified in its charter)

| Delaware |

001-37713 |

77-0430924 |

| (State

or other jurisdiction |

(Commission

File Number) |

(I.R.S.

Employer |

| of

incorporation) |

|

Identification

No.) |

2025 Hamilton

Avenue

San Jose,

California 95125

(Address of

principal executive offices)

(408) 376-7108

(Registrant’s

telephone number, including area code)

Not Applicable.

(Former name

or former address, if changed since last report.)

Check the appropriate

box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any

of the following provisions:

| ☐ | Written communications pursuant

to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant

to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications

pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications

pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

Trading

symbol(s) |

Name

of exchange on which registered |

| Common

stock |

EBAY |

The

Nasdaq Global Select Market |

Indicate by check mark whether the

registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter)

or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate

by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 7.01. Regulation FD Disclosure.

On October 1, 2024, eBay Inc. (the “Company”) announced certain

business plans internally with a letter to Company employees from Jamie Iannone, its President and Chief Executive Officer, which is attached

to this Current Report on Form 8-K as Exhibit 99.1 and is incorporated herein by reference.

The information in this Item 7.01 and Exhibit 99.1 are furnished and shall

not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934 (the “Exchange Act”),

or otherwise subject to the liabilities of that Section, and shall not be deemed incorporated by reference into any filing under the Securities

Act of 1933, as amended (the “Securities Act”), regardless of any general incorporation language in such filing, unless expressly

incorporated by specific reference in such filing.

Cautions Regarding Forward Looking Statements

This Current Report on Form 8-K contains “forward-looking statements”

within the meaning of Section 27A of the Securities Act and Section 21E of the Exchange Act, including, but not limited to, statements

related to the Company’s expected business performance; its plans for selling fees, buyer-facing fees and various service offerings

to its customers, including the Company’s monetization roadmap in relation to implementation of these plans; the expected timing

of implementing these plans; the expected benefits of these plans, including the potential to drive holistic growth and unlock more of

the Company’s target addressable market opportunity in recommerce; expected benefits of horizontal innovations; and the Company’s

plan to disclose further details regarding its future plans. Words such as “plan,” “believe,” “will,”

“could,” “future,” and variations of such words and similar expressions are intended to identify such forward-looking

statements. These forward-looking statements are based upon the Company’s current plans, assumptions, beliefs, and expectations.

Forward-looking statements are subject to the occurrence of many events outside of the Company’s control. Actual results and the

timing of events may differ materially from those contemplated by such forward-looking statements due to numerous factors that involve

substantial known and unknown risks and uncertainties. These risks and uncertainties include, among other things, the risk that the Company’s

business plans may negatively impact the Company’s overall financial performance and revenue, long-term growth, business operations

and reputation with or ability to serve buyers and sellers; the risk that the Company’s business plans and strategic initiatives

may not generate their intended benefits to the extent or as quickly as anticipated; and other risks and uncertainties discussed in the

reports on Forms 10-K, 10-Q and 8-K and in other filings the Company makes with the Securities and Exchange Commission from time to time,

available at www.sec.gov. Forward-looking statements should be considered in light of these risks and uncertainties. Investors and others

are cautioned not to place undue reliance on forward-looking statements. All forward-looking statements contained herein speak only as

of the date hereof. The Company assumes no obligation and does not intend to update these forward-looking statements, except as required

by law.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

The following materials are attached

as exhibits to this Current Report on Form 8-K:

SIGNATURES

Pursuant to

the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf

by the undersigned hereunto duly authorized.

| |

eBay

Inc. |

| |

(Registrant) |

| |

|

|

| Date:

October 1, 2024 |

/s/

Molly Finn |

| |

Name:

Molly Finn |

| |

Title:

Vice President & Deputy General Counsel, Corporate & Assistant Secretary |

| |

|

|

Exhibit 99.1

Team,

I wanted to share some exciting news just announced in the UK. Beginning today, eBay is removing selling fees for consumer-to-consumer (C2C) sellers in the UK for domestic

transactions across all categories, excluding motors. This follows the introduction of free selling in pre-owned apparel categories

for UK C2C sellers earlier this year.

Additionally, we are introducing significant enhancements for our

UK customers, including a streamlined listing process, simple delivery, a revamped local pickup experience, and enhanced wallet functionality

through eBay Balance.

Today’s announcement was many months in the making, and made

possible through the hard work and collaboration of teams across the company. Importantly, this initiative was contemplated in our financial

outlook provided to the investment community at Q2 2024 earnings.

We have a robust monetization roadmap to ensure these changes are

good for both customers and our business overall. This includes value-added services like first-party advertising, financial services,

and a new value proposition in shipping that we plan to scale in Q4. We are also planning to introduce a buyer-facing fee in the UK in

early 2025 alongside a set of buyer enhancements that provide additional value. There will be more we can share on our future plans at

Q3 2024 earnings and our next Global All Hands event.

Strategic focus on C2C

This is our second major initiative of its kind in as many years,

and I believe it’s important to take this opportunity to discuss the strategic rationale behind our C2C initiatives.

C2C sellers make our marketplace more vibrant by bringing some of

the most unique, hard-to-find, and well-priced inventory. C2C selling drives holistic growth on our marketplace, as buyers who sell, on

average, purchase roughly twice as much on eBay as non-sellers, with most of their incremental spend supporting small business sellers.

Our initiative in Germany last year has shown us that eliminating

selling fees can strengthen our marketplace by lowering the barriers to C2C selling, which improves the breadth and depth of inventory

on eBay. Meaningful product experience improvements, many optimized for the German market, also improved important leading indicators

like net promoter scores (NPS) and customer satisfaction (CSAT) in the region, which preceded a material improvement in GMV trends.

Our research tells us there are hundreds of millions of unused items

in UK households that could be sold on eBay. We believe our efforts to reduce friction in C2C selling will unlock more of our target addressable

market opportunity in recommerce, complemented by horizontal innovations like our Magical Listing experience.

I would like to thank the teams for your bold innovations, consistent

execution, and effective cross functional collaboration. Your hard work is meaningfully changing the eBay experience for our sellers and

buyers.

I am excited for what’s ahead.

Jamie

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

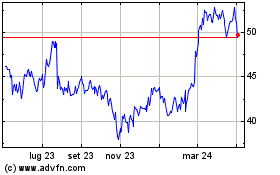

Grafico Azioni eBay (NASDAQ:EBAY)

Storico

Da Gen 2025 a Feb 2025

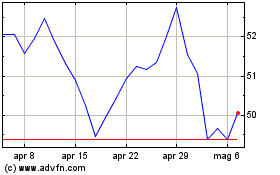

Grafico Azioni eBay (NASDAQ:EBAY)

Storico

Da Feb 2024 a Feb 2025