Eos Energy Enterprises, Inc. (NASDAQ: EOSE) ("Eos" or the

“Company”), a leading provider of safe, scalable, efficient, and

sustainable zinc-based long duration energy storage systems, today

announced a strategic investment of up to $315.5 million from an

affiliate of Cerberus Capital Management LP (“Cerberus”), to

support its growth plans during a secular shift in global energy

markets. The demand for safe alternatives to incumbent battery

technologies is increasing and the world is facing significant

energy growth along with an increased focus on higher energy

independence and security. Cerberus is a global leader in

alternative investing with a dedicated platform focused on supply

chain integrity and national security. The companies believe that

this investment should accelerate Eos’ operating capabilities and

industry position.

The long-duration energy storage segment is

forecasted to more than double by 2030, driven by increased energy

demand from data centers and artificial intelligence growth

combined with lower carbon energy mix targets and supportive

government policies. This investment is structured to allow the

Company to meet growing market demand effectively as evidenced by

Eos’ $13.3 billion pipeline and $602.7 million orders backlog as of

March 31, 2024. This funding supports Eos’ plan to scale operations

and execute on its path to profitability.

“We are thrilled to partner with Cerberus at a

pivotal moment in Eos’ history. This investment provides the

critical funding needed to execute our profitability roadmap, while

also providing our customers with the confidence that Eos can

produce at scale,” said Eos Chief Executive Officer Joe

Mastrangelo. “Cerberus’ investment, combined with their deep

operational and technical knowledge, enables us to expand our

manufacturing capacity, streamline our supply chain, and strengthen

our market position.”

This partnership leverages both companies’

commitments to advancing domestic manufacturing and innovation and

strengthens Eos’ position as a leading provider of American-made

energy storage solutions. As the United States continues to

transition towards a more sustainable and energy independent

future, demand is growing for long duration battery storage that

ensures grid stability, resilience, and efficiency.

“Cerberus is ecstatic to be investing in what we

believe to be the United States’ first scalable non-lithium BESS

platform. Eos has evolved dramatically in recent years in both cell

technology and manufacturing efficiency, making the Company now

ready to accelerate its first mover-advantage in long-duration

energy storage,” said Nick Robinson, Managing Director of Cerberus’

Supply Chain and Strategic Opportunities platform. “With Joe’s

leadership, plus Cerberus’ focus on U.S. innovation in critical

technologies and next-generation manufacturing capabilities, we

could not be more excited and prouder to help Eos build a big and

incredibly important company for the U.S. and our allies for many

years to come.”

The capital investment will be instrumental in

enabling Eos to deliver a differentiated product, a simple and safe

energy storage solution with proprietary software capabilities. The

investment by Cerberus is structured as a $210.5 million delayed

draw term loan that is partially based upon achieving operational

milestones, and a $105 million revolver that the Company may draw

upon, if required, at Cerberus’ discretion. In addition, Eos will

utilize a portion of the proceeds to retire its existing $100

million senior secured term loan on favorable terms, strengthening

the Company’s balance sheet. The Company reached an agreement to

extinguish this debt for $27 million, of which $20 million has been

paid and the remaining $7 million will be payable over the next

twelve months.

Eos Chief Financial Officer Nathan Kroeker

added, “The strategic investment announced today, combined with

Eos’ highly efficient manufacturing capacity model, supports our

capital needs as we execute on Project AMAZE. We look forward to

working with Cerberus and their strong network to continue driving

down product costs, improving performance of our storage systems,

and developing financing alternatives for our customers. Our

broader strategy remains unchanged, and we remain committed to the

cost-out milestones and our path to profitability previously

outlined at our December 2023 Strategy Call.”

Eos continues to work closely with the U.S.

Department of Energy with respect to closing on the previously

announced conditional commitment for a loan guarantee. With

Cerberus’ backing, Eos is well-positioned to accelerate its growth

to meet the increasing demand for sustainable energy solutions.

Mastrangelo concluded, “Today’s announcement is

a clear testament to the strength of Eos’ vision and serves as an

important validation for the need to scale an American-made battery

storage solution. It also demonstrates the commitment of a

recognized global strategic partner in Eos’ ability to provide

sustainable value to each of our stakeholders well into the

future.”

Strategic Investment Transaction

DetailsPursuant to Cerberus’ strategic investment, Eos’

ability to draw on a portion of the $210.5 million delayed draw

term loan is contingent upon achieving certain operational

milestones through April 2025 agreed between the parties, with the

remaining $105 million revolver to be drawn, if required, at

Cerberus’ discretion. As part of the strategic investment, assuming

the delayed draw term loan is fully funded and depending on the

Company’s ability to achieve the operational milestones, Cerberus

will receive penny warrants and non-voting convertible preferred

stock equivalent to 33% with the potential to reach 49%, depending

on the achievement of operational milestones, of the outstanding

equity of the Company, on a fully diluted basis. Initial funding of

$75 million in gross proceeds was received at closing on June 21,

2024, and Cerberus was issued 43.3 million penny warrants and

shares of non-voting redeemable non-convertible preferred stock

with a liquidation preference equivalent to 31.9 million shares of

common stock in connection with this initial funding. Subject to

receipt of stockholder approval under Nasdaq listing rules, the

non-voting convertible preferred stock would ultimately become

convertible into common stock.

Haynes Boone, LLP served as Eos’ legal advisor.

Cooley LLP served as Cerberus’ legal advisor.

Conference Call DetailsEos will

hold a webcast conference call on Monday, June 24, 2024, from 9:00

a.m. to 9:20 a.m. ET to discuss the strategic investment with

Cerberus. To access the call by webcast, please register in advance

using this link (Registration Link). Interested parties may join

the conference call beginning at 8:45 a.m. ET. A live webcast of

the conference call will be available on Eos’ Investor Relations

website at https://investors.eose.com.

The conference call replay will be available via

webcast through Eos’ investor relations website for a limited time.

The webcast replay will be available beginning at 11:30 a.m. ET on

June 24, 2024, and can be accessed by

visiting https://investors.eose.com/events-and-presentations.

About Eos Energy EnterprisesEos

Energy Enterprises, Inc. is accelerating the shift to clean energy

with positively ingenious solutions that transform how the world

stores power. Our breakthrough Znyth™ aqueous zinc battery was

designed to overcome the limitations of conventional lithium-ion

technology. It is safe, scalable, efficient, sustainable,

manufactured in the U.S., and the core of our innovative systems

that today provides utility, industrial, and commercial customers

with a proven, reliable energy storage alternative for 3 to 12-hour

applications. Eos was founded in 2008 and is headquartered in

Edison, New Jersey. For more information about Eos (NASDAQ: EOSE),

visit eose.com.

About CerberusFounded in 1992,

Cerberus is a global leader in alternative investing with

approximately $65 billion in assets across complementary credit,

real estate, and private equity strategies. We invest across the

capital structure where we believe our integrated investment

platforms and proprietary operating capabilities create an edge to

improve performance and drive long-term value. Our tenured teams

have experience working collaboratively across asset classes,

sectors, and geographies to seek strong risk-adjusted returns for

our investors. For more information about our people and platforms,

visit us at www.cerberus.com.

|

Contacts |

|

| Investors: |

ir@eose.com |

| Media: |

media@eose.com |

Important Information and Where You Can

Find It

This press release may be deemed to be

solicitation material in respect of a vote of stockholder to

approve the issuance of more than 19.99% of the outstanding common

stock under the warrants and the convertibility of the preferred

stock issued or issuable as part of the transaction. In connection

with the requisite stockholder approval, Eos will file with the SEC

a preliminary proxy statement and a definitive proxy statement,

which will be sent to the stockholders of Eos, seeking certain

approvals related to the exercisability of the warrants and the

convertibility of the preferred stock issued or issuable pursuant

to the transaction.

INVESTORS AND SECURITY HOLDERS OF EOS AND THEIR

RESPECTIVE AFFILIATES ARE URGED TO READ, WHEN AVAILABLE, THE PROXY

STATEMENT AND ANY OTHER RELEVANT DOCUMENTS FILED OR TO BE FILED

WITH THE SEC IN CONNECTION WITH THE TRANSACTION, AS WELL AS ANY

AMENDMENTS OR SUPPLEMENTS TO THOSE DOCUMENTS, BECAUSE THEY WILL

CONTAIN IMPORTANT INFORMATION ABOUT EOS AND THE TRANSACTION.

Investors and security holders will be able to obtain a free copy

of the proxy statement, as well as other relevant documents filed

with the SEC containing information about Eos, without charge, at

the SEC’s website (http://www.sec.gov). Copies of documents filed

with the SEC by Eos can also be obtained, without charge, by

directing a request to Investor Relations, Eos Energy Enterprises,

Inc. at 862-207-7955 or email ir@eose.com.

Participants in the Solicitation of

Proxies in Connection with Transaction

Eos and Cerberus and certain of their respective

directors, executive officers and employees may be deemed to be

participants in the solicitation of proxies in respect of the

requisite stockholder approvals under the rules of the SEC.

Information regarding Eos’ directors and executive officers is

available in its definitive proxy statement for its 2024 annual

stockholders meeting, which was filed with the SEC on April 2, 2024

and certain current reports on Form 8-K filed by Eos. Other

information regarding the participants in the solicitation of

proxies with respect to the proposed transaction and a description

of their direct and indirect interests, by security holdings or

otherwise, will be contained in the proxy statement and other

relevant materials to be filed with the SEC. Free copies of these

documents, when available, may be obtained as described in the

preceding paragraph.

Not an Offer of Securities

The information in this communication is for

informational purposes only and shall not constitute, or form a

part of, an offer to sell or the solicitation of an offer to sell

or the solicitation of an offer to buy any securities. The

securities that are the subject of the private placement have not

been registered under the Securities Act of 1933, as amended, and

may not be offered or sold in the United States absent registration

or an applicable exemption from registration requirements.

Forward Looking Statements

Except for the historical information contained

herein, the matters set forth in this press release are

forward-looking statements within the meaning of the "safe harbor"

provisions of the Private Securities Litigation Reform Act of 1995.

Forward-looking statements include, but are not limited to,

statements regarding our expected revenue, contribution margins,

orders backlog and opportunity pipeline for the fiscal year ended

December 31, 2024, our path to profitability and strategic outlook,

the tax credits available to our customers or to Eos pursuant to

the Inflation Reduction Act of 2022, the delayed draw term loan,

milestones thereunder and the anticipated use of proceeds

therefrom, statements regarding our ability to secure final

approval of a loan from the Department of Energy LPO, or our

anticipated use of proceeds from any loan facility provided by the

US Department of Energy, statements that refer to outlook,

projections, forecasts or other characterizations of future events

or circumstances, including any underlying assumptions. The words

"anticipate," "believe," "continue," "could," "estimate," "expect,"

"intends," "may," "might," "plan," "possible," "potential,"

"predict," "project," "should," "would" and similar expressions may

identify forward-looking statements, but the absence of these words

does not mean that a statement is not forward-looking.

Forward-looking statements are based on our management’s beliefs,

as well as assumptions made by, and information currently available

to, them. Because such statements are based on expectations as to

future financial and operating results and are not statements of

fact, actual results may differ materially from those

projected.

Factors which may cause actual results to differ

materially from current expectations include, but are not limited

to: changes adversely affecting the business in which we are

engaged; our ability to forecast trends accurately; our ability to

generate cash, service indebtedness and incur additional

indebtedness; our ability to achieve the operational milestones on

the delayed draw term loan; our ability to raise financing in the

future, including the discretionary revolving facility from

Cerberus; our customers’ ability to secure project financing; the

amount of final tax credits available to our customers or to Eos

pursuant to the Inflation Reduction Act, uncertainties around our

ability to meet the applicable conditions precedent and secure

final approval of a loan, in a timely manner or at all from the

Department of Energy, Loan Programs Office, or the timing of

funding and the final size of any loan that is approved; the

possibility of a government shutdown while we work to meet the

applicable conditions precedent and finalize loan documents with

the U.S. Department of Energy Loan Programs Office or while we

await notice of a decision regarding the issuance of a loan from

the Department Energy Loan Programs Office; our ability to continue

to develop efficient manufacturing processes to scale and to

forecast related costs and efficiencies accurately; fluctuations in

our revenue and operating results; competition from existing or new

competitors; our ability to convert firm order backlog and pipeline

to revenue; risks associated with security breaches in our

information technology systems; risks related to legal proceedings

or claims; risks associated with evolving energy policies in the

United States and other countries and the potential costs of

regulatory compliance; risks associated with changes to the U.S.

trade environment; risks resulting from the impact of global

pandemics, including the novel coronavirus, Covid-19; our ability

to maintain the listing of our shares of common stock on NASDAQ;

our ability to grow our business and manage growth profitably,

maintain relationships with customers and suppliers and retain our

management and key employees; risks related to the adverse changes

in general economic conditions, including inflationary pressures

and increased interest rates; risk from supply chain disruptions

and other impacts of geopolitical conflict; changes in applicable

laws or regulations; the possibility that Eos may be adversely

affected by other economic, business, and/or competitive factors;

other factors beyond our control; risks related to adverse changes

in general economic conditions; and other risks and

uncertainties.

The forward-looking statements contained in this

press release are also subject to additional risks, uncertainties,

and factors, including those more fully described in the Company’s

most recent filings with the Securities and Exchange Commission,

including the Company’s most recent Annual Report on Form 10-K and

subsequent reports on Forms 10-Q and 8-K. Further information on

potential risks that could affect actual results will be included

in the subsequent periodic and current reports and other filings

that the Company makes with the Securities and Exchange Commission

from time to time. Moreover, the Company operates in a very

competitive and rapidly changing environment, and new risks and

uncertainties may emerge that could have an impact on the

forward-looking statements contained in this press release.

Forward-looking statements speak only as of the

date they are made. Readers are cautioned not to put undue reliance

on forward-looking statements, and, except as required by law, the

Company assumes no obligation and does not intend to update or

revise these forward-looking statements, whether as a result of new

information, future events, or otherwise.

Key Metrics

Backlog. Our backlog represents

the amount of revenue that we expect to realize from existing

agreements with our customers for the sale of our battery

energy storage systems and performance of services. The

backlog is calculated by adding new orders in the current

fiscal period to the backlog as of the end of the prior fiscal

period and then subtracting the shipments in the current

fiscal period. If the amount of an order is modified or cancelled,

we adjust orders in the current period and our backlog accordingly,

but do not retroactively adjust previously published backlogs.

There is no comparable US-GAAP financial measure for backlog. We

believe that the backlog is a useful indicator regarding the future

revenue of our Company.

Pipeline. Our pipeline

represents projects for which we have submitted technical proposals

or non-binding quotes plus letters of intent (“LOI”) or firm

commitments from customers. Pipeline does not include lead

generation projects.

Booked Orders. Booked orders

are orders where we have legally binding agreements with a Purchase

Order (“PO”) or Master Supply Agreement (“MSA”) executed by both

parties.

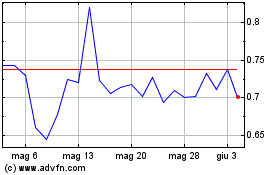

Grafico Azioni Eos Energy Enterprises (NASDAQ:EOSE)

Storico

Da Feb 2025 a Mar 2025

Grafico Azioni Eos Energy Enterprises (NASDAQ:EOSE)

Storico

Da Mar 2024 a Mar 2025