How is Kraft Foods Placed for 4Q? - Analyst Blog

12 Febbraio 2013 - 7:01PM

Zacks

Kraft Foods Group Inc. (KRFT) is set to report

fourth quarter 2012 results on Feb 15. Last quarter it posted a

16.18% positive surprise. Let’s see how things are shaping up for

this announcement.

Growth Factors This Past Quarter

Kraft Foods Group, reported its third quarter 2012 results,

after its spun off from the old Kraft Foods. The packaged food and

beverage company beat on both the top and bottom lines in its third

quarter 2012 on the back of innovation, productivity improvements,

volume growth, lower taxes and increased marketing investments. The

fourth quarter results will be Kraft’s first earnings report as a

standalone entity versus carve-out financials reported in the third

quarter.

Earnings Whispers?

Our proven model does not conclusively show that Kraft Foods

Group is likely to beat earnings this quarter. That is because a

stock needs to have both a positive Earnings ESP (Read: Zacks

Earnings ESP: A Better Method) and a Zacks Rank #1, 2 or 3 for this

to happen. That is not the case here as you will see below.

Negative Zacks ESP: Kraft Foods Group’s

currently has a negative Expected Surprise Prediction (ESP) of

-10.00%.

Zacks Rank #2 (Buy): Kraft Foods’ Zacks Rank #2

(Buy) when combined with a negative ESP makes surprise prediction

difficult. We caution against stocks with Zacks #4 and #5 Ranks

(Sell-rated stocks) going into the earnings announcement,

especially when the company is seeing negative estimate revisions

momentum.

Though brand building and innovation are expected to boost

consumption, the company expects revenues to be flat to down in the

fourth quarter from the year-ago levels due to difficult

comparisons and more product pruning. Product pruning is expected

to hurt the top line by 1.5 to 2 points in the quarter. In the

quarter, the company expects to record restructuring costs of $225

million.

Other Stocks to Consider

Here are some other companies you may want to consider as our

model shows they have the right combination of elements to post an

earnings beat this quarter:

Flowers Foods, Inc. (FLO), Earnings ESP of

5.56% and Zacks Rank #1 (Strong Buy)

J&J Snack Foods Corp. (JJSF), Earnings ESP

of 5.00% and Zacks Rank #1 (Strong Buy)

Kellogg Company (K), Earnings ESP of 0.97% and

Zacks Rank #2 (Buy)

FLOWERS FOODS (FLO): Free Stock Analysis Report

J&J SNACK FOODS (JJSF): Free Stock Analysis Report

KELLOGG CO (K): Free Stock Analysis Report

KRAFT FOODS GRP (KRFT): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

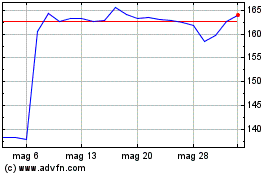

Grafico Azioni J and J Snack Foods (NASDAQ:JJSF)

Storico

Da Giu 2024 a Lug 2024

Grafico Azioni J and J Snack Foods (NASDAQ:JJSF)

Storico

Da Lug 2023 a Lug 2024