Strong Buy on Flowers Foods - Analyst Blog

26 Marzo 2013 - 11:10AM

Zacks

On Mar 22, Zacks Investment Research upgraded Flowers

Foods Inc. (FLO) to a Zacks Rank #1 (Strong Buy). Shares

of this bakery products producer have amassed an impressive return

of 58.1% in the last six months.

Why the Upgrade?

Flowers Foods has been witnessing rising earnings estimates on the

back of better-than-expected fourth-quarter 2012 results. The

bakery goods producer’s earnings per share surpassed the Zacks

Consensus Estimate for the first time after reporting in line

earnings in 3 consecutive quarters. Moreover, we believe that the

company’s strategy of expanding continuously through entering new

markets, building new bakeries and acquisitions have helped induce

an upward movement in the estimates.

Flowers Foods declared impressive results on Feb 7, 2013, wherein

earnings of 28 cents a share surpassed the Zacks Consensus Estimate

of 25 cents by 12.0%, and rose 64.7% from the year-ago quarter.

Net sales jumped 14.7% over the prior-year quarter to $749.4

million, and came ahead of the Zacks Consensus Estimate of $709

million. Volume increased of 10.3%, while net price/mix remained

unfavorable at 2.0%. Gross margin expanded 200 basis points to

47.9%, benefiting from higher sales volumes and improved

manufacturing efficiencies.

Further, the company has successfully expanded its reach of fresh

bakery products from about 38% of U.S. population in 2004 to more

than 70% now. Moreover, the company has a proven experience of

integrating acquisitions, having completed more than 100 since 1968

and three significant ones in just the last three years – Tasty

Baking, Lepage Bakeries, and the Sara Lee and Earthgrains brands in

California.

The Zacks Consensus Estimate for fiscal 2013 increased 1.6% to

$1.28 per share as most of the estimates were revised higher over

the last 30 days. Moreover, for fiscal 2014, the estimates were

revised higher over the same time frame, lifting the Zacks

Consensus Estimate by 5.8% to $1.46 per share.

Other Stocks to Consider

Besides Flowers Foods, other stocks in the foods industry that are

currently performing well include J&J Snack Foods

Corp. (JJSF), which has a Zacks Rank #1 (Strong Buy),

ConAgra Foods Inc. (CAG) and Kraft Foods

Group Inc. (KRFT), both of which hold a Zacks Rank #2

(Buy).

CONAGRA FOODS (CAG): Free Stock Analysis Report

FLOWERS FOODS (FLO): Free Stock Analysis Report

J&J SNACK FOODS (JJSF): Free Stock Analysis Report

KRAFT FOODS GRP (KRFT): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

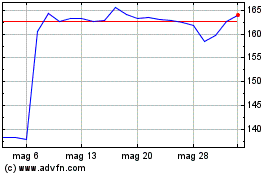

Grafico Azioni J and J Snack Foods (NASDAQ:JJSF)

Storico

Da Giu 2024 a Lug 2024

Grafico Azioni J and J Snack Foods (NASDAQ:JJSF)

Storico

Da Lug 2023 a Lug 2024