Will McGraw-Hill's Earnings Beat? - Analyst Blog

29 Aprile 2013 - 12:20PM

Zacks

The McGraw-Hill Companies,

Inc. (MHP) is slated to report its first-quarter 2013

results on Apr 30, 2013. In the last quarter, it posted bottom-line

results that met the Zacks Consensus Estimate. Let’s see how things

are shaping up for this announcement.

Growth Factors this

Past Quarter

McGraw-Hill's strategic investments

in businesses facilitate it to generate long-term profitability.

The formation of S&P Dow Jones Indices coupled with S&P

Capital IQ’s acquisitions of Credit Market Analysis Limited,

QuantHouse, R2 Financial Technologies and TheMarkets.com position

it well against its competitors to grab a wider market through

superior functionality and investor oriented services and in turn

help boost the top- and bottom-line results of the company.

Earnings

Whispers?

Our proven model does not

conclusively show that McGraw-Hill is likely to beat earnings this

quarter. This is because a stock needs to have both a positive

Earnings ESP (Read :Zacks Earnings ESP: A Better Method) and a

Zacks Rank #1, #2 or #3 for this to happen. This is not the case

here as you will see below.

Zacks ESP: ESP for

McGraw-Hill is 0.00%. This is because the Most Accurate Estimate

stands at 74 cents, which is in line with the Zacks Consensus

Estimate.

Zacks Rank #2

(Buy): McGraw-Hill’s Zacks Rank #2 (Buy) lowers the

predictive power of ESP because the Zacks Rank #2 when combined

with 0.00% ESP makes surprise prediction difficult. We caution

against stocks with Zacks Ranks #4 and #5 (Sell rated stocks) going

into the earnings announcement, especially when the company is

seeing negative estimate revisions momentum.

Stocks that Warrant a

Look

Here are some other companies you

may want to consider as our model shows they have the right

combination of elements to post an earnings beat this quarter:

Hertz Global Holdings,

Inc. (HTZ), Earnings ESP of +5.56% and a Zacks Rank #1

(Strong Buy)

J&J Snack Foods

Corp.(JJSF), Earnings ESP of +9.84% and a Zacks Rank #2

(Buy)

Amazon.com Inc.

(AMZN), Earnings ESP of +14.29% and a Zacks Rank #3 (Hold).

AMAZON.COM INC (AMZN): Free Stock Analysis Report

HERTZ GLBL HLDG (HTZ): Free Stock Analysis Report

J&J SNACK FOODS (JJSF): Free Stock Analysis Report

MCGRAW-HILL COS (MHP): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

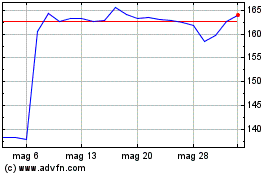

Grafico Azioni J and J Snack Foods (NASDAQ:JJSF)

Storico

Da Lug 2024 a Ago 2024

Grafico Azioni J and J Snack Foods (NASDAQ:JJSF)

Storico

Da Ago 2023 a Ago 2024