Will Office Depot's Earnings Beat? - Analyst Blog

29 Aprile 2013 - 12:40PM

Zacks

Office Depot, Inc.

(ODP) is slated to report its first-quarter 2013 results on Apr 30,

2013. In the last quarter, it posted a negative surprise of 66.7%.

Let’s see how things are shaping up for this announcement.

Growth Factors this

Past Quarter

Office Depot’s disappointing

bottom-line performance was due to lower revenues that muted the

company’s cost containment efforts. After declining 5% in the third

quarter, Office Depot’s total revenue fell 11.7% in the fourth

quarter. Business budget remains tight, consumers remain more

cautious than ever before and companies are trying hard to navigate

through the challenging environment. Consumers and small businesses

remain frugal about big-ticket spending on items such as business

machines and other durable products.

Earnings

Whispers?

Our proven model does not

conclusively show that Office Depot is likely to beat earnings this

quarter. This is because a stock needs to have both a positive

Earnings ESP (Read: Zacks Earnings ESP: A Better Method) and a

Zacks Rank #1, #2 or #3 for this to happen. This is not the case

here as you will see below.

Zacks ESP: ESP for

Office Depot is -60.00%. This is because the Most Accurate Estimate

stands at 2 cents, while the Zacks Consensus Estimate is pegged at

5 cents.

Zacks Rank #5 (Strong

Sell): Office Depot’s Zacks Rank #5 (Strong Sell) lowers

the predictive power of ESP because the Zacks Rank #5 when combined

with a negative ESP makes surprise prediction difficult. We caution

against stocks with Zacks Ranks #4 and #5 (Sell rated stocks) going

into the earnings announcement, especially when the company is

seeing negative estimate revisions momentum.

Stocks that Warrant a

Look

Here are some other companies you

may want to consider as our model shows they have the right

combination of elements to post an earnings beat this quarter:

Hertz Global Holdings,

Inc. (HTZ), Earnings ESP of +5.56% and a Zacks Rank #1

(Strong Buy)

J&J Snack Foods

Corp. (JJSF), Earnings ESP of +9.84% and a Zacks Rank #2

(Buy)

Amazon.com Inc.

(AMZN), Earnings ESP of +14.29% and a Zacks Rank #3 (Hold).

AMAZON.COM INC (AMZN): Free Stock Analysis Report

HERTZ GLBL HLDG (HTZ): Free Stock Analysis Report

J&J SNACK FOODS (JJSF): Free Stock Analysis Report

OFFICE DEPOT (ODP): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

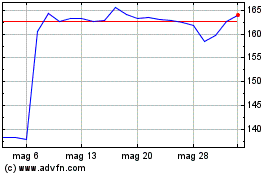

Grafico Azioni J and J Snack Foods (NASDAQ:JJSF)

Storico

Da Lug 2024 a Ago 2024

Grafico Azioni J and J Snack Foods (NASDAQ:JJSF)

Storico

Da Ago 2023 a Ago 2024