Will Target Beat Earnings? - Analyst Blog

21 Maggio 2013 - 4:20PM

Zacks

Target Corporation

(TGT), an S&P 500 company and the operator of general

merchandise and food discount stores in the United States, is set

to report its first-quarter fiscal 2013 results on May 22. In the

last quarter, it posted a positive surprise of 12.2%. Let’s see how

things are shaping up for this announcement.

Growth Factors this

Past Quarter

Target’s efficient marketing,

multi-channel strategy, product innovation, compelling pricing

strategy, and new merchandise assortments are driving

comparable-store sales and operating margins. The company’s P-fresh

remodel program and 5% REDcard Rewards program help sustain sales

momentum, continue to drive traffic and enhance customer shopping

experience. The company’s focus on “Expect More. Pay Less.” brand

promise is also bearing fruit.

Earnings

Whispers?

Our proven model does not

conclusively show that Target is likely to beat earnings this

quarter. That is because a stock needs to have both a positive

Earnings ESP (Read: Zacks Earnings ESP: A Better Method) and a

Zacks Rank of #1, #2 or #3 for this to happen. This is not the case

here as you will see below.

Zacks ESP: ESP for

Target is 0.00%. This is because the Most Accurate Estimate stands

at 86 cents, which is in line with the Zacks Consensus

Estimate.

Zacks Rank #3

(Hold): Target’s Zacks Rank #3 (Hold) lowers the

predictive power of ESP because the Zacks Rank #3 when combined

with a 0.00% ESP makes surprise prediction difficult. We caution

against stocks with Zacks Ranks #4 and #5 (Sell rated stocks) going

into the earnings announcement, especially when the company is

seeing negative estimate revisions momentum.

Other Stocks to

Consider

Here are some other companies you

may want to consider as our model shows they have the right

combination of elements to post an earnings beat this quarter:

Flowers Foods,

Inc. (FLO) with an Earnings ESP of +9.38% and a Zacks Rank

#1 (Strong Buy).

J&J Snack Foods

Corp. (JJSF) with an Earnings ESP of +0.90% and a Zacks

Rank #2 (Buy).

ConAgra Foods,

Inc. (CAG) with an Earnings ESP of +1.70% and a Zacks Rank

#3 (Hold).

CONAGRA FOODS (CAG): Free Stock Analysis Report

FLOWERS FOODS (FLO): Free Stock Analysis Report

J&J SNACK FOODS (JJSF): Free Stock Analysis Report

TARGET CORP (TGT): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

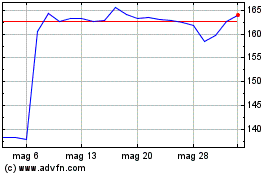

Grafico Azioni J and J Snack Foods (NASDAQ:JJSF)

Storico

Da Giu 2024 a Lug 2024

Grafico Azioni J and J Snack Foods (NASDAQ:JJSF)

Storico

Da Lug 2023 a Lug 2024