0001606757false00016067572024-02-052024-02-05

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported) February 5, 2024

KIMBALL ELECTRONICS, INC.

________________________________________________________________________________________________________

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| | | | | |

| Indiana | | 001-36454 | | 35-2047713 |

| (State or other jurisdiction of | | (Commission File | | (IRS Employer Identification No.) |

| incorporation) | | Number) | | |

| | | | | | | | |

| | | |

1205 Kimball Boulevard, Jasper, Indiana | | 47546 |

| (Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code (812) 634-4000

| | |

| Not Applicable |

| (Former name or former address, if changed since last report) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

| | | | | | | | |

| Securities registered pursuant to Section 12(b) of the Act: |

| Title of each Class | Trading Symbol | Name of each exchange on which registered |

| Common Stock, no par value | KE | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (Section 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (Section 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition

On February 5, 2024, the Company issued an earnings release for the second quarter ended December 31, 2023. The earnings release is attached as Exhibit 99.1.

The information in Item 2.02 of this Form 8-K, including Exhibit 99.1, is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that Section. The information in this Form 8-K shall not be incorporated by reference into any filing under the Securities Act of 1933, as amended, or under the Securities Exchange Act of 1934, as amended, except as shall otherwise be expressly set forth by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits

| | | | | | | | |

| Exhibit | | |

| Number | | Description |

| 99.1 | | |

| 104 | | Cover Page Interactive Data File (formatted in Inline XBRL) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | |

| | |

| | KIMBALL ELECTRONICS, INC. |

| | |

| By: | /s/ Jana T. Croom |

| | JANA T. CROOM

Chief Financial Officer |

Date: February 5, 2024

Exhibit 99.1

KIMBALL ELECTRONICS REPORTS Q2 RESULTS; COMPANY UPDATES GUIDANCE FOR FISCAL 2024

•Net sales totaled $421.2 million, a 4% decrease compared to the second quarter of fiscal 2023; foreign currency had a 1% favorable impact on net sales year-over-year

•Operating income of $16.6 million, or 3.9% of net sales, compared to $17.5 million or 4.0% of net sales, in the same period last year

•Adjusted operating income of $17.1 million, or 4.1% of net sales, compared to $17.8 million, or 4.1% of net sales, in the same period last year

•Net income of $8.3 million, or $0.33 per diluted share, compared to $10.7 million, or $0.43 per diluted share, in the second quarter of fiscal 2023

JASPER, Ind., February 5, 2024 -- (BUSINESS WIRE) -- Kimball Electronics, Inc. (Nasdaq: KE) today announced financial results for the second quarter of fiscal 2024.

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

| Three Months Ended | | Six Months Ended |

| December 31, | | December 31, |

| (Amounts in Thousands, except EPS) | 2023 | | 2022 | | 2023 | | 2022 |

| Net Sales | $ | 421,235 | | | $ | 436,696 | | | $ | 859,316 | | | $ | 842,585 | |

| Operating Income | $ | 16,610 | | | $ | 17,489 | | | $ | 36,100 | | | $ | 31,060 | |

Adjusted Operating Income (non-GAAP) (1) | $ | 17,094 | | | $ | 17,829 | | | $ | 36,407 | | | $ | 31,165 | |

| Operating Income % | 3.9 | % | | 4.0 | % | | 4.2 | % | | 3.7 | % |

| Adjusted Operating Income (non-GAAP) % | 4.1 | % | | 4.1 | % | | 4.2 | % | | 3.7 | % |

| Net Income | $ | 8,290 | | | $ | 10,720 | | | $ | 19,044 | | | $ | 20,229 | |

Adjusted Net Income (non-GAAP) (1) | $ | 8,290 | | | $ | 10,999 | | | $ | 19,044 | | | $ | 20,508 | |

| Diluted EPS | $ | 0.33 | | | $ | 0.43 | | | $ | 0.75 | | | $ | 0.81 | |

Adjusted Diluted EPS (non-GAAP) (1) | $ | 0.33 | | | $ | 0.44 | | | $ | 0.75 | | | $ | 0.82 | |

(1) A reconciliation of GAAP and non-GAAP financial measures is included below.

Richard D. Phillips, Chief Executive Officer, stated, “As we expected, the second quarter of fiscal 2024 was hard fought, with our team navigating a challenging operating environment. Global macro headwinds have persisted, and the consumer is pulling back. The markets we serve are experiencing demand softening, and our customers are changing production schedules and delivery date requirements. Sales in Q2 declined compared to the same period last year, with manufacturing output in the quarter being reduced to meet the lower demand. Margins, on the other hand, remained stable, thanks in part to proactive measures taken to align our cost structure with slowing sales. We expect industry-wide pressures for the remainder of fiscal 2024, and we have updated our guidance for sales and operating income for the full year to reflect these trends.”

Mr. Phillips continued, “Based on what we know today, it seems likely the macro environment will remain challenging for some time. Despite this near-term choppiness, we did not change our guidance for capital expenditures in fiscal 2024 as we continue to invest in long-term growth opportunities. With a strong funnel of new business supported by favorable industry megatrends, we’re deploying a balanced capital allocation strategy focused on organic growth, global expansion, and long-lasting customer relationships.”

The Company ended the second quarter of fiscal 2024 with cash and cash equivalents of $39.9 million and borrowings outstanding on credit facilities of $321.8 million, including $235.0 million classified as long term, and $65.8 million of borrowing capacity available. Cash flow used from operating activities in the second quarter of fiscal 2024 was $30.7 million and capital expenditures were $13.2 million.

Net Sales by Vertical Market for Q2 Fiscal 2024:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | | | Six Months Ended | | |

| December 31, | | | | December 31, | | |

| (Amounts in Millions) | 2023 | | * | | 2022 | | * | | Percent Change | | 2023 | | * | | 2022 | | * | | Percent Change |

| | | | | | | | | | | | | | | | | | | |

Automotive (1) | $ | 200.2 | | | 47 | % | | $ | 205.2 | | | 47 | % | | (2) | % | | $ | 412.7 | | | 48 | % | | $ | 393.4 | | | 47 | % | | 5 | % |

Medical (1) | 108.1 | | | 26 | % | | 125.6 | | | 29 | % | | (14) | % | | 210.5 | | | 25 | % | | 241.6 | | | 28 | % | | (13) | % |

Industrial (1) | 112.9 | | | 27 | % | | 105.9 | | | 24 | % | | 7 | % | | 236.1 | | | 27 | % | | 207.6 | | | 25 | % | | 14 | % |

| | | | | | | | | | | | | | | | | | | |

| Total Net Sales | $ | 421.2 | | | | | $ | 436.7 | | | | | (4) | % | | $ | 859.3 | | | | | $ | 842.6 | | | | | 2 | % |

| | | | | | | | | | | | | | | | | | | |

*As a percent of Total Net Sales | | | | | | | | | | | | |

| (1) Beginning in fiscal year 2024, miscellaneous sales previously reported in Other are now reported in the respective three end market verticals; all prior periods have been recast to conform to current period presentation |

| | | | | | | | | | | | | | | | | | | |

–Automotive includes electronic power steering, body controls, automated driver assist systems, and electronic braking systems |

–Medical includes sleep therapy and respiratory care, image guided therapy, in vitro diagnostics, drug delivery, AED, and patient monitoring |

–Industrial includes climate controls, automation controls, optical inspection, and public safety |

| | | | | | | | | | | | | | | | | | | |

Guidance for Fiscal Year 2024

The Company updated its guidance for fiscal year 2024 with net sales expected to decline 2% to 4%, compared to fiscal year 2023. As a reminder, the previous guidance was an estimate of net sales flat with the prior year. Operating income is now expected to be in the range of 4.2% to 4.6% of net sales, compared to the prior estimate of flat with fiscal 2023. The guidance for capital expenditures did not change with a range of $70 to $80 million.

Commenting on today’s update, Jana T. Croom, Chief Financial Officer, stated, “It is important to highlight that our second quarter results included an atypical charge in selling and administrative expenses. We recorded a $2 million allowance for credit losses associated with a customer who is not in bankruptcy, but their ability to pay an outstanding balance was deemed questionable. This item negatively impacted our operating income by approximately 40 basis points in the quarter.”

Ms. Croom continued, “We remain focused on working capital management, and while inventory levels did improve in Q2, we still have an opportunity to drive down cash conversion days with better management of receivables and payables which will support a return to free cash flow generation in future quarters.”

Forward-Looking Statements

Certain statements contained within this release are considered forward-looking, including our fiscal year 2024 guidance, under the Private Securities Litigation Reform Act of 1995. The statements may be identified by the use of words such as “expect,” “should,” “goal,” “predict,” “will,” “future,” “optimistic,” “confident,” and “believe.” Undue reliance should not be placed on these forward-looking statements. These statements are based on current expectations of future events and thus are inherently subject to uncertainty. If underlying assumptions prove inaccurate or known or unknown risks or uncertainties materialize, actual results could vary materially from our expectations and projections. These forward-looking statements are subject to risks and uncertainties including, without limitation, global economic conditions, geopolitical environment and conflicts such as the war in Ukraine, global health emergencies, availability or cost of raw materials and components, foreign exchange rate fluctuations, and our ability to convert new business opportunities into customers and revenue. Additional cautionary statements regarding other risk factors that could have an effect on the future performance of the company are contained in its Annual Report on Form 10-K for the year ended June 30, 2023.

Non-GAAP Financial Measures

This press release contains non-GAAP financial measures. The non-GAAP financial measures contained herein include constant currency growth, adjusted operating income, adjusted net income, adjusted diluted EPS, and ROIC. Reconciliations of the reported GAAP numbers to these non-GAAP financial measures are included in the Reconciliation of Non-GAAP Financial Measures section below. Management believes these measures are useful and allow investors to meaningfully trend, analyze, and benchmark the performance of the company’s core operations. The company’s non-GAAP financial measures are not necessarily comparable to non-GAAP information used by other companies.

About Kimball Electronics, Inc.

Kimball Electronics is a multifaceted manufacturing solutions provider of electronics and diversified contract manufacturing services to customers around the world. From our operations in the United States, China, India, Japan, Mexico, Poland, Romania, Thailand, and Vietnam, our teams are proud to provide manufacturing services for a variety of industries. Recognized for a reputation of excellence, we are committed to a high-performance culture that values personal and organizational commitment to quality, reliability, value, speed, and ethical behavior. Kimball Electronics, Inc. (Nasdaq: KE) is headquartered in Jasper, Indiana.

To learn more about Kimball Electronics, visit: www.kimballelectronics.com.

| | | | | | | | |

| Conference Call / Webcast |

| | |

| Date: | | February 6, 2024 |

| Time: | | 10:00 AM Eastern Time |

| Live Webcast: | | investors.kimballelectronics.com/events-and-presentations/events |

| Dial-In #: | | 404-975-4839 (other locations - 833-470-1428) |

| Conference ID: | | 626792 |

For those unable to participate in the live webcast, the call will be archived at investors.kimballelectronics.com.

Lasting relationships. Global success.

Financial highlights for the second quarter and year-to-date period ended December 31, 2023 are as follows:

| | | | | | | | | | | | | | | | | | | | | | | |

| Condensed Consolidated Statements of Income | | | | | | |

| (Unaudited) | Three Months Ended |

| (Amounts in Thousands, except Per Share Data) | December 31, 2023 | | December 31, 2022 |

| Net Sales | $ | 421,235 | | | 100.0 | % | | $ | 436,696 | | | 100.0 | % |

| Cost of Sales | 386,802 | | | 91.8 | % | | 402,505 | | | 92.2 | % |

| Gross Profit | 34,433 | | | 8.2 | % | | 34,191 | | | 7.8 | % |

| Selling and Administrative Expenses | 17,823 | | | 4.3 | % | | 16,702 | | | 3.8 | % |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Operating Income | 16,610 | | | 3.9 | % | | 17,489 | | | 4.0 | % |

| Interest Income | 101 | | | — | % | | 26 | | | — | % |

| Interest Expense | (6,137) | | | (1.5) | % | | (4,048) | | | (0.9) | % |

| Non-Operating Income (Expense), net | 702 | | | 0.3 | % | | 726 | | | 0.2 | % |

| Other Income (Expense), net | (5,334) | | | (1.2) | % | | (3,296) | | | (0.7) | % |

| Income Before Taxes on Income | 11,276 | | | 2.7 | % | | 14,193 | | | 3.3 | % |

| Provision for Income Taxes | 2,986 | | | 0.7 | % | | 3,473 | | | 0.8 | % |

| Net Income | $ | 8,290 | | | 2.0 | % | | $ | 10,720 | | | 2.5 | % |

| | | | | | | |

| Earnings Per Share of Common Stock: | | | | | | | |

| Basic | $ | 0.33 | | | | | $ | 0.43 | | | |

| Diluted | $ | 0.33 | | | | | $ | 0.43 | | | |

| | | | | | | |

| Average Number of Shares Outstanding: | | | | | | | |

| Basic | 25,094 | | | | | 24,881 | | | |

| Diluted | 25,211 | | | | | 25,000 | | | |

| | | | | | | |

|

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

| (Unaudited) | Six Months Ended |

| (Amounts in Thousands, except Per Share Data) | December 31, 2023 | | December 31, 2022 |

| Net Sales | $ | 859,316 | | | 100.0 | % | | $ | 842,585 | | | 100.0 | % |

| Cost of Sales | 789,341 | | | 91.9 | % | | 779,073 | | | 92.5 | % |

| Gross Profit | 69,975 | | | 8.1 | % | | 63,512 | | | 7.5 | % |

| Selling and Administrative Expenses | 33,875 | | | 3.9 | % | | 32,452 | | | 3.8 | % |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Operating Income | 36,100 | | | 4.2 | % | | 31,060 | | | 3.7 | % |

| Interest Income | 400 | | | — | % | | 43 | | | — | % |

| Interest Expense | (11,584) | | | (1.3) | % | | (5,968) | | | (0.7) | % |

| Non-Operating Income (Expense), net | (429) | | | (0.1) | % | | 1,226 | | | 0.1 | % |

| Other Income (Expense), net | (11,613) | | | (1.4) | % | | (4,699) | | | (0.6) | % |

| Income Before Taxes on Income | 24,487 | | | 2.8 | % | | 26,361 | | | 3.1 | % |

| Provision for Income Taxes | 5,443 | | | 0.6 | % | | 6,132 | | | 0.7 | % |

| Net Income | $ | 19,044 | | | 2.2 | % | | $ | 20,229 | | | 2.4 | % |

| | | | | | | |

| Earnings Per Share of Common Stock: | | | | | | | |

| Basic | $ | 0.76 | | | | | $ | 0.81 | | | |

| Diluted | $ | 0.75 | | | | | $ | 0.81 | | | |

| | | | | | | |

| Average Number of Shares Outstanding: | | | | | | | |

| Basic | 25,067 | | | | | 24,854 | | | |

| Diluted | 25,240 | | | | | 24,985 | | | |

| | | | | | | | | | | |

| Condensed Consolidated Statements of Cash Flows | Six Months Ended |

| (Unaudited) | December 31, |

| (Amounts in Thousands) | 2023 | | 2022 |

| Net Cash Flow used for Operating Activities | $ | (17,922) | | | $ | (71,921) | |

| Net Cash Flow used for Investing Activities | (24,365) | | | (41,886) | |

| Net Cash Flow provided by Financing Activities | 38,859 | | | 91,435 | |

| Effect of Exchange Rate Change on Cash, Cash Equivalents, and Restricted Cash | 368 | | | (593) | |

| Net Decrease in Cash, Cash Equivalents, and Restricted Cash | (3,060) | | | (22,965) | |

| Cash, Cash Equivalents, and Restricted Cash at Beginning of Period | 43,864 | | | 49,851 | |

| Cash, Cash Equivalents, and Restricted Cash at End of Period | $ | 40,804 | | | $ | 26,886 | |

| | | | | | | | | | | |

| (Unaudited) | | |

| Condensed Consolidated Balance Sheets | December 31,

2023 | | June 30,

2023 |

| (Amounts in Thousands) |

| ASSETS | | | |

| Cash and cash equivalents | $ | 39,947 | | | $ | 42,955 | |

| Receivables, net | 309,702 | | | 308,167 | |

| Contract assets | 81,891 | | | 78,798 | |

| Inventories | 455,736 | | | 450,319 | |

| Prepaid expenses and other current assets | 43,226 | | | 49,188 | |

| | | |

| Property and Equipment, net | 275,984 | | | 267,684 | |

| Goodwill | 12,011 | | | 12,011 | |

| Other Intangible Assets, net | 10,993 | | | 12,335 | |

| Other Assets | 47,544 | | | 38,262 | |

| Total Assets | $ | 1,277,034 | | | $ | 1,259,719 | |

| | | |

LIABILITIES AND SHARE OWNERS’ EQUITY | | | |

| | | |

| | | |

| Current portion of borrowings under credit facilities | $ | 86,765 | | | $ | 46,454 | |

| Accounts payable | 279,909 | | | 322,274 | |

| Advances from customers | 42,717 | | | 33,905 | |

| | | |

| Accrued expenses | 63,448 | | | 72,515 | |

| Long-term debt under credit facilities, less current portion | 235,000 | | | 235,000 | |

| Long-term income taxes payable | 3,255 | | | 5,859 | |

| Other long-term liabilities | 18,951 | | | 19,718 | |

| Share Owners’ Equity | 546,989 | | | 523,994 | |

| Total Liabilities and Share Owners’ Equity | $ | 1,277,034 | | | $ | 1,259,719 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Other Financial Metrics | | | | | | |

| (Unaudited) | | | | | | | |

| (Amounts in Millions, except CCD) | | | | | | | |

| At or For the | | | | |

| Three Months Ended | | Six Months Ended |

| December 31, | | December 31, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Depreciation and Amortization | $ | 9.1 | | | $ | 8.0 | | | $ | 18.1 | | | $ | 15.6 | |

| Stock-Based Compensation | $ | 2.0 | | | $ | 1.7 | | | $ | 3.7 | | | $ | 3.4 | |

Cash Conversion Days (CCD) (1) | 117 | | | 97 | | | | | |

Open Orders (2) | $ | 836 | | | $ | 1,037 | | | | | |

| | | | | | | |

(1) Cash Conversion Days (“CCD”) are calculated as the sum of Days Sales Outstanding plus Contract Asset Days plus Production Days Supply on Hand less Accounts Payable Days and less Advances from Customers Days. CCD, or a similar metric, is used in our industry and by our management to measure the efficiency of managing working capital.

(2) Open Orders are the aggregate sales price of production pursuant to unfulfilled customer orders.

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Reconciliation of Non-GAAP Financial Measures | | | | | | | | | | | |

| (Unaudited) | | | | | | | | | | | |

| (Amounts in Thousands, except Per Share Data) | | | | | | | | | | | |

| | | | | | | | | | | |

|

| Three Months Ended | | Six Months Ended | | |

| December 31, | | December 31, | | |

| 2023 | | 2022 | | 2023 | | 2022 | | | | |

| Net Sales Growth (vs. same period in prior year) | (4) | % | | 39 | % | | 2 | % | | 39 | % | | | | |

| Foreign Currency Exchange Impact | 1 | % | | (5) | % | | 1 | % | | (5) | % | | | | |

| Constant Currency Growth | (5) | % | | 44 | % | | 1 | % | | 44 | % | | | | |

| | | | | | | | | | | |

Selling and Administrative Expenses, as reported | $ | 17,823 | | | $ | 16,702 | | | $ | 33,875 | | | $ | 32,452 | | | | | |

SERP | (484) | | | (340) | | | (307) | | | (105) | | | | | |

Adjusted Selling and Administrative Expenses | $ | 17,339 | | | $ | 16,362 | | | $ | 33,568 | | | $ | 32,347 | | | | | |

| | | | | | | | | | | |

| Operating Income, as reported | $ | 16,610 | | | $ | 17,489 | | | $ | 36,100 | | | $ | 31,060 | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| SERP | 484 | | | 340 | | | 307 | | | 105 | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Adjusted Operating Income | $ | 17,094 | | | $ | 17,829 | | | $ | 36,407 | | | $ | 31,165 | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

|

| | | | | |

| | | | | |

| | | | | | | | | | | |

| Net Income, as reported | $ | 8,290 | | | $ | 10,720 | | | $ | 19,044 | | | $ | 20,229 | | | | | |

| | | | | | | | | | | |

| Adjustments After Measurement Period on GES Acquisition | — | | | 279 | | | — | | | 279 | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Adjusted Net Income | $ | 8,290 | | | $ | 10,999 | | | $ | 19,044 | | | $ | 20,508 | | | | | |

| | | | | | | | | | | |

| | | | | | | | |

| | | | | | | | | | | |

|

| | | | | |

| | | | | |

| | | | | | | | | | | |

| Diluted Earnings per Share, as reported | $ | 0.33 | | | $ | 0.43 | | | $ | 0.75 | | | $ | 0.81 | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Adjustments After Measurement Period on GES Acquisition | — | | | 0.01 | | | — | | | 0.01 | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Adjusted Diluted Earnings per Share | $ | 0.33 | | | $ | 0.44 | | | $ | 0.75 | | | $ | 0.82 | | | | | |

| | | | | | | | | | | |

| | | Twelve Months Ended | | | | |

| | | December 31, | | | | |

| | | | | 2023 | | 2022 | | | | |

| Operating Income | | | | | $ | 92,769 | | | $ | 71,915 | | | | | |

| | | | | | | | | | | |

| SERP | | | | | 903 | | | (1,773) | | | | | |

| Legal Recovery | | | | | (212) | | | — | | | | | |

| Adjusted Operating Income (non-GAAP) | | | | | $ | 93,460 | | | $ | 70,142 | | | | | |

| Tax Effect | | | | | 23,204 | | | 18,856 | | | | | |

| After-tax Adjusted Operating Income | | | | | $ | 70,256 | | | $ | 51,286 | | | | | |

Average Invested Capital (1) | | | | | $ | 770,051 | | | $ | 605,772 | | | | | |

| ROIC | | | | | 9.1 | % | | 8.5 | % | | | | |

(1) Average invested capital is computed using Share Owners’ equity plus current and non-current debt less cash and cash equivalents averaged for the last five quarters.

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

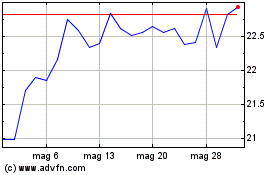

Grafico Azioni Kimball Electronics (NASDAQ:KE)

Storico

Da Ott 2024 a Nov 2024

Grafico Azioni Kimball Electronics (NASDAQ:KE)

Storico

Da Nov 2023 a Nov 2024