false

0001507605

0001507605

2024-01-31

2024-01-31

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d)

of

the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): January 31, 2024

MARATHON

DIGITAL HOLDINGS, INC.

(Exact

name of Registrant as Specified in Its Charter)

| Nevada |

|

001-36555 |

|

01-0949984 |

(State

or Other Jurisdiction

of

Incorporation) |

|

(Commission

File

Number) |

|

(IRS

Employer

Identification

No.) |

101

NE Third Avenue, Suite 1200

Fort

Lauderdale, FL 33301

(Address

of principal executive offices and zip code)

(800)

804-1690

(Registrant’s

telephone number, including area code)

Not

Applicable

(Former

Name or Former Address, if Changed Since Last Report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| |

☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

|

| |

☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

|

| |

☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

|

| |

☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange

on

which registered

|

| Common

Stock |

|

MARA |

|

The

Nasdaq Capital Market |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 5.02. |

Departure of Directors or Certain Officers;

Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers. |

Compensatory

Arrangements of Certain Executive Officers

On

January 31, 2024, the Compensation Committee (the “Committee”) of the Board of Directors of Marathon Digital Holdings, Inc.

(the “Company”) approved the following compensatory updates and awards for certain members of the Company’s senior

management team, including Fred Thiel, Chief Executive Officer and Chairman, Salman Khan, Chief Financial Officer, James Crawford, Chief

Operating Officer, Ashu Swami, Chief Technology Officer, Adam Swick, Chief Growth Officer, and John Lee, Chief Accounting Officer:

| ● | FY

2023 Annual LTIP Grants; |

| ● | FY

2023 Annual Performance Bonuses; |

| ● | FY

2024 Annual Base Salaries; and |

| ● | FY

2024 Annual Performance Bonus Targets. |

The

FY 2023 Annual LTIP Grants were granted pursuant to the Company’s Long Term Incentive Program (“LTIP”) established

under the 2018 Equity Incentive Plan (the “Plan”). LTIP grants are tied to the performance of the Company when comparing

the Company’s total shareholder returns to those of its peer group, which consists of other publicly traded Bitcoin mining companies

or publicly traded companies involved in the Bitcoin ecosystem.

The

Company previously signaled that there would be a maximum target award when the Company’s performance is at the 85% percentile

and above as compared to its peer group as disclosed in the Company’s Quarterly Report on Form 8-K, filed with the Securities and

Exchange Commission on October 2, 2023. However, following its annual review of benchmark data and a review of compensation practices

of certain peer companies of the Company, the Committee approved the FY 2023 LTIP Grants described below, which reflect revised LTIP

targets intended to align total compensation for the Company’s management team with certain of its peer companies.

The

Committee believes the updates and awards described below continue to reward long-term performance and align the Company’s executive

officers’ interests with the Company’s stockholders.

FY

2023 Annual LTIP Grants

The

Committee approved annual LTIP grants as a result of, among other things, the Company’s stock price performance, which was at the

top of the performance range relative to its peer group for the fiscal year ended December 31, 2023 (“FY 2023”). The FY 2023

Annual LTIP Grants consist of restricted stock units (“RSUs”) for each named executive officer in the amount set forth opposite

such officer’s name in the table below:

| Name | |

FY

2023 Annual Base Salary | | |

FY

2023 Annual LTIP Grant Amount (1)(2) | |

| Fred Thiel | |

$ | 800,000 | | |

$ | 22,400,000 | |

| Salman Khan | |

$ | 475,000 | (3) | |

$ | 13,300,000 | |

| James Crawford | |

$ | 309,000 | | |

$ | 4,017,000 | |

| Adam Swick | |

$ | 300,000 | | |

$ | 3,900,000 | |

| Ashu Swami | |

$ | 285,312 | | |

$ | 5,209,063 | |

| John Lee | |

$ | 303,750 | | |

$ | 3,341,250 | |

(1)

The number of RSUs shall equal the grant amount divided by the moving average closing price of the Company’s common stock for the

100 consecutive trading days prior to and including the grant date.

(2)

The FY 2023 Annual LTIP Grants shall vest over a three-year period, with 25% of the RSUs vesting immediately, and the remaining portion

vesting in twelve quarterly installments of 6.25% thereafter, subject to the named executive officer’s continued service to the

Company through each vesting date.

(3)

Mr. Salman commenced employment in June 2023, so his pro rata base salary for the fiscal year was $241,099.

FY

2023 Annual Performance

The

Committee approved the payment of annual performance bonuses based on the achievement of certain performance objectives and targets for

FY 2023 for each named executive officer in the amount set forth opposite such officer’s name in the table below:

| Name | |

FY

2023 Annual Performance Bonus | |

| Fred Thiel | |

$ | 1,800,000 | |

| Salman Khan | |

$ | 623,438 | |

| James Crawford | |

$ | 463,500 | |

| Adam Swick | |

$ | 450,000 | |

| Ashu Swami | |

$ | 427,969 | |

| John Lee | |

$ | 379,688 | |

FY

2024 Annual Base Salaries for Named Executive Officers

The

Committee approved annual base salary increases for the named executive officers for the fiscal year ending December 31, 2024 (“FY

2024”), which are retroactive to January 1, 2024. The annual base salary received for FY 2023 and to be received for FY 2024 by

each named executive officer are set forth opposite such officer’s name in the table below:

| Name | |

FY

2024 Annual Base Salary | |

| Fred Thiel | |

$ | 950,000 | |

| Salman Khan | |

$ | 625,000 | |

| James Crawford | |

$ | 350,000 | |

| Adam Swick | |

$ | 350,000 | |

| Ashu Swami | |

$ | 350,000 | |

| John Lee | |

$ | 325,000 | |

FY

2024 Annual Bonus Targets

Following

its annual review of benchmark data provided by the Company’s independent compensation consultant, the Committee approved annual

bonus targets for FY 2024 for each named executive officer as set forth opposite such officer’s name in the table below:

| Name | |

FY

2024 Annual Base Salary | | |

FY

2024 Annual Bonus Target Percentage | |

FY

2024 Annual Bonus Target Amount | |

| Fred Thiel | |

$ | 950,000 | | |

up to

225% | |

$ | 2,137,500 | |

| Salman Khan | |

$ | 625,000 | | |

up to 225% | |

$ | 1,406,250 | |

| James Crawford | |

$ | 350,000 | | |

up to 150% | |

$ | 525,000 | |

| Adam Swick | |

$ | 350,000 | | |

up to 150% | |

$ | 525,000 | |

| Ashu Swami | |

$ | 350,000 | | |

up to 150% | |

$ | 525,000 | |

| John Lee | |

$ | 325,000 | | |

up to 125% | |

$ | 406,250 | |

The

annual bonuses shall be determined based on the achievement of certain performance objectives and targets for FY 2024 to be established

by the Committee.

Compensatory

Arrangement for the Board of Directors

FY

2023 Annual RSU Grants

The

Committee approved annual RSU grants for FY 2023 for each member of the board of directors as set forth opposite such director’s

name in the table below:

| Name | |

FY

2022 Annual RSU Grant(1)(2) | |

| Fred Thiel | |

$ | 850,000 | |

| Doug Mellinger | |

$ | 850,000 | |

| Said Ouissal | |

$ | 850,000 | |

| Sarita James | |

$ | 850,000 | |

| Georges Antoun | |

$ | 850,000 | |

| Kevin DeNuccio | |

$ | 850,000 | |

| Jay Leupp | |

$ | 850,000 | |

| (1) | The

number of RSUs shall equal the grant amount divided by the moving average closing price of

the Company’s common stock for the 100 consecutive trading days prior to and including

the grant date. |

| | | |

| (2) | The

RSUs shall vest in full immediately. |

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

MARATHON

DIGITAL HOLDINGS, INC. |

| |

|

|

| Date:

February 2, 2024 |

By: |

/s/

Zabi Nowaid |

| |

Name: |

Zabi

Nowaid |

| |

Title: |

General

Counsel |

v3.24.0.1

Cover

|

Jan. 31, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Jan. 31, 2024

|

| Entity File Number |

001-36555

|

| Entity Registrant Name |

MARATHON

DIGITAL HOLDINGS, INC.

|

| Entity Central Index Key |

0001507605

|

| Entity Tax Identification Number |

01-0949984

|

| Entity Incorporation, State or Country Code |

NV

|

| Entity Address, Address Line One |

101

NE Third Avenue

|

| Entity Address, Address Line Two |

Suite 1200

|

| Entity Address, City or Town |

Fort

Lauderdale

|

| Entity Address, State or Province |

FL

|

| Entity Address, Postal Zip Code |

33301

|

| City Area Code |

(800)

|

| Local Phone Number |

804-1690

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common

Stock

|

| Trading Symbol |

MARA

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| Entity Information, Former Legal or Registered Name |

Not

Applicable

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

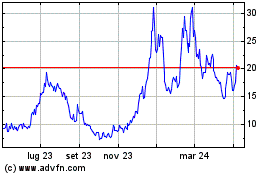

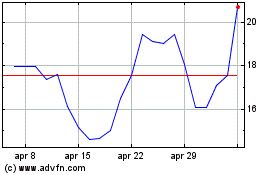

Grafico Azioni Marathon Digital (NASDAQ:MARA)

Storico

Da Apr 2024 a Mag 2024

Grafico Azioni Marathon Digital (NASDAQ:MARA)

Storico

Da Mag 2023 a Mag 2024