Nasdaq Welcomed 171 IPOs in 2024

17 Dicembre 2024 - 2:05PM

Nasdaq (Nasdaq: NDAQ) announced today that in 2024, it

welcomed 171 initial public offerings (IPOs), raising a total

of $22.7 billion. A total of 123 operating companies and 48

SPACs listed on Nasdaq in 2024, representing an 81% win rate of

Nasdaq-eligible IPOs in the U.S. market, and extending Nasdaq’s

leadership to 44 consecutive quarters. In addition to IPOs, there

were 23 exchange transfers to Nasdaq, representing $180 billion in

market cap, including Palantir, the largest switch this year.

“We are proud to be the exchange of choice this year for the

largest IPO and exchange transfer, and 2024 saw marquee listings

across sectors coming to market,” said Jeff Thomas, Executive

Vice President, Chief Revenue Officer, and Global Head of Listings

at Nasdaq. “This year’s listings activity was at its highest volume

since 2021 and there are hundreds of companies waiting in the

wings. We are encouraged by the high volume of brands accessing the

public markets with Nasdaq and our IPO Pulse Index forecasts

listings momentum to carry through into 2025.”

A video accompanying this announcement is available at:

https://vimeo.com/1039757132/3e764fef6e

2024 NASDAQ U.S. LISTINGS

HIGHLIGHTS

- U.S. listings market leadership: Nasdaq

welcomed 171 IPOs, raising $22.7 billion. Marquee listings

include Lineage (largest IPO), Waystar (largest health-tech IPO of

the year), and the recent IPO of ServiceTitan. 2024 also saw a

significant volume of private equity and venture-capital backed

companies coming to market, representing 33% of IPOs on Nasdaq this

year and including Brightspring and Astera Labs.

- Achieving switch milestones: Nasdaq featured

23 switches in 2024, totaling $180 billion in market cap- including

the largest exchange transfer on a U.S. exchange year-to-date with

Palantir and the oldest-founded company to switch with Campbell’s.

509 companies have switched to Nasdaq since 2005.

- Leading U.S. exchange for healthcare,

technology and biotech IPOs: Nasdaq maintained its

strong track record in the healthcare, technology and biotech

sectors. Further, 100% of eligible biotech companies listed on

Nasdaq in what was a banner year for the sector, including the

listings of Ceribell, CG Oncology, and Tempus AI.

- Helping companies join the public markets via

SPACs: Nasdaq continued its influence in the SPAC

market, welcoming 87% of all eligible SPAC IPOs, raising $6.9

billion. A total of 60 SPAC business combinations also listed in

2024, representing a 91%-win rate in the U.S.

- Advancing regional structure: To strengthen

our market position across the region, Nasdaq welcomed Rachel Racz

as SVP, Head of Listings for Texas, Southern U.S. and Latin

America, this fall. The region currently supports over 493 clients

across industries, representing a total of $2.5 trillion in market

cap.

- Celebrating the 25th

MarketSite anniversary: This fall, Nasdaq

celebrated its 25th anniversary of the MarketSite in Times Square,

well-recognized as a marquee venue for listings across the global

capital markets. With a 10-story tower and state-of-the-art event

spaces, the MarketSite is a physical embodiment of the Nasdaq

exchange, signaling its commitment to supporting the companies

shaping the future, and helping to re-define the “New Wall

Street”.

- Recognizing Nasdaq listing anniversaries:

Nasdaq celebrated the listing anniversaries of Tractor Supply

Company (30 years), Alphabet, Inc (20 years), Micron Technology,

Inc. (15 years), Fortinet (15 years), Walgreens Boots Alliance,

Inc. (10 years), Crowdstrike Holdings, Inc. (5 years),

and the first listing anniversary of Arm Holdings plc, among many

others.

About NasdaqNasdaq (Nasdaq: NDAQ) is a global

technology company serving corporate clients, investment managers,

banks, brokers, and exchange operators as they navigate and

interact with the global capital markets and the broader financial

system. We aspire to deliver world-leading platforms that improve

the liquidity, transparency, and integrity of the global economy.

Our diverse offering of data, analytics, software, exchange

capabilities, and client-centric services enables clients to

optimize and execute their business vision with confidence. To

learn more about the company, technology solutions and career

opportunities, visit us on LinkedIn, on X @Nasdaq, or at

www.nasdaq.com.

Nasdaq Media Contact:

|

Sophia Weiss(646) 483-6960Sophia.weiss@nasdaq.com |

Cautionary Note Regarding Forward-Looking

Statements:Information set forth in this communication

contains forward-looking statements that involve a number of risks

and uncertainties. Nasdaq cautions readers that any forward-looking

information is not a guarantee of future performance and that

actual results could differ materially from those contained in the

forward-looking information. Forward-looking statements can be

identified by words such “will,” “plans,” “expects,” “may,”

“believe” and other words and terms of similar meaning. Such

forward-looking statements include, but are not limited to,

statements about the Company’s growth strategy and market

expectations, products and services, ability to enhance or innovate

new ways for companies to join the public markets, future listing

activity, and other statements that are not historical facts.

Forward-looking statements involve a number of risks,

uncertainties, or other factors beyond Nasdaq’s control. These

risks and uncertainties are detailed in Nasdaq’s filings with the

U.S. Securities and Exchange Commission, including its annual

reports on Form 10-K and quarterly reports on Form 10-Q which are

available on Nasdaq’s investor relations website at ir.nasdaq.com

and the SEC’s website at www.sec.gov. Nasdaq undertakes no

obligation to publicly update any forward-looking statement,

whether as a result of new information, future events or

otherwise.

-NDAQG-

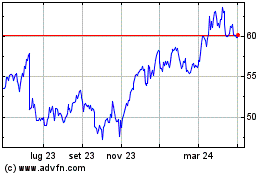

Grafico Azioni Nasdaq (NASDAQ:NDAQ)

Storico

Da Nov 2024 a Dic 2024

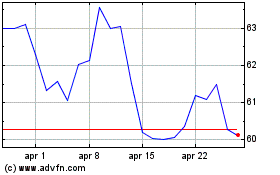

Grafico Azioni Nasdaq (NASDAQ:NDAQ)

Storico

Da Dic 2023 a Dic 2024