NFLX Stock: How Did Netflix Perform In Q4 of 2022?

23 Gennaio 2023 - 10:56AM

Finscreener.org

Netflix (NASDAQ: NFLX)

announced its quarterly results for Q4 of 2022 yesterday and

reported revenue of $7.85 billion and adjusted earnings of $0.12

per share. It also added 7.66 million subscribers in

Q4.

Comparatively, Wall Street

forecast the streaming

giant to report revenue of $7.85 billion and earnings of $0.45 per

share in the quarter.

While Netflix met revenue

estimates, it missed earnings consensus by a wide margin. But NFLX

stock is up over 7% in pre-market trading as it blew past Wall

Street’s subscriber estimates. The company added 7.66 million

subscribers in the quarter, much higher than forecasts of 4.57

million subscriber additons.

During the earnings call, Netflix

also disclosed that co-CEO Reed Hastings would step down from his

position, transitioning to the role of an executive

chairman.

What impacted NetflixU+02019s earnings in Q4 of

2022?

Netflix attributed its earnings

miss to a loss tied to euro-denominated debt. However, its margins

of 7% surpassed analyst estimates. The December quarter was the

first time that Netflix included details of its ad-supported

service in its financials. This tier was launched in November, and

the company has not disclosed how many subscribers are from users

who opted for the lower-priced service.

Netflix claimed user engagement

from the ad-supported tier was similar to other regular plans. It

also confirmed that there has not been a massive shift in the

number of people switching to ad-supported plans.

Netflix CFO Spencer Neumann

stated, “We wouldn’t be getting into this business if it couldn’t

be a meaningful portion of our business. We’re over $30 billion in

revenue, almost $32 billion in revenue, in 2022 and we wouldn’t get

into a business like this if we didn’t believe it could be bigger

than at least 10% of our revenue.”

Netflix remains optimistic about

its shift to an ad-supported business model. But the company will

no longer offer subscriber guidance in future earnings reports as

it remains focused on expanding revenue which will now be Netflix’s

north star metric instead of membership growth.

Netflix explained, “2022 was a

tough year, with a bumpy start but a brighter finish. We believe we

have a clear path to reaccelerate our revenue growth: continuing to

improve all aspects of Netflix, launching paid sharing and building

our ads offering. As always, our north stars remain pleasing our

members and building even greater profitability over

time.”

What next for NFLX stock and investors?

Netflix continues to spend

billions of dollars each year to create proprietary content and

expand its subscriber base across geographies. It now expects

revenue in Q1 of 2023 to increase by 4% year over year, compared to

the 3.7% top-line forecast by Wall Street. Netflix expects revenue

growth will be driven by an increase in paid memberships and more

money per paid membership.

The upcoming quarter ending in

March will also be the first where Netflix will roll out its paid

sharing program. Here, it might be able to increase sales from

users who previously shared passwords with those outside their

homes.

The streaming heavyweight also

said it expects a portion of its users who borrow passwords to stop

watching content on its platform as they are not added as extra

members to existing accounts.

Valued at a market cap of $140

billion, Netflix stock is down 54% from all-time highs. After

increasing sales by 6.5% year over year in 2022, analysts expect

the top line to expand by 7.3% to $33.9 billion in 2023. However,

its earnings are likely to narrow from $11.2 per share in 2021 to

$10.4 per share in 2023.

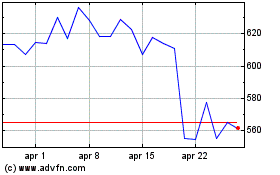

Grafico Azioni Netflix (NASDAQ:NFLX)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Netflix (NASDAQ:NFLX)

Storico

Da Apr 2023 a Apr 2024