false

0001372299

0001372299

2024-11-06

2024-11-06

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

November 6, 2024

OCUGEN,

INC.

(Exact Name of Registrant as Specified in its

Charter)

| Delaware |

|

001-36751 |

|

04-3522315 |

(State

or other jurisdiction of

incorporation) |

|

(Commission

File Number) |

|

(IRS

Employer

Identification

No.) |

11

Great Valley Parkway, Malvern,

Pennsylvania 19355

(Address of Principal Executive Offices, and

Zip Code)

(484)

328-4701

Registrant’s Telephone Number, Including

Area Code

Check the appropriate box below if the Form 8-K filing is

intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b)

of the Act:

| (Title

of each class) |

|

(Trading

Symbol) |

|

(Name

of each exchange

on which registered) |

| Common

Stock, $0.01 par value |

|

OCGN |

|

The

Nasdaq Stock Market LLC

(The Nasdaq Capital Market) |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange

Act of 1934 (17 CFR §240.12b-2).

Emerging

growth company ¨

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act. ¨

Item 1.01. Entry Into a Material Definitive Agreement.

Loan and Security

Agreement

On

November 6, 2024 (the “Closing Date”), Ocugen, Inc. (the “Company”) and its wholly owned subsidiary

Ocugen OpCo, Inc., each as borrowers, entered into a Loan and Security Agreement (the “Loan and Security Agreement”),

with Avenue Capital Management II, L.P., as administrative agent and collateral agent (the “Agent”), Avenue Venture Opportunities

Fund II, L.P., as a lender (“Avenue 2”), and Avenue Venture Opportunities Fund, L.P., as a lender (“Avenue 1”,

and together with Avenue 2, the “Lenders”).

Amount.

The Loan and Security Agreement provides for term loans in an aggregate principal amount of up to $30.0 million (the “Loan Amount”)

to be delivered in one tranche on the Closing Date (the “Term Loans”). The Company intends to use the proceeds of the Term

Loans for working capital and general corporate purposes.

Maturity.

The Term Loans mature on November 1, 2028 (the “Maturity Date”).

Interest

Rate and Amortization. The principal balance of the Term Loans bears interest at a variable rate per annum equal to the sum of 4.25%

and the prime rate as reported in The Wall Street Journal, subject to a prime floor equal to The Wall Street Journal prime

rate on Closing Date. The Term Loans will amortize in equal payments of principal from the end of interest only period to the Maturity

Date.

Final

Payment. The Company will pay 4.25% of the Loan Amount, due upon the earlier of the Maturity Date or prepayment of the Term Loans

(the “Final Payment”).

Prepayment

Fee. The Company may, at its option at any time, prepay the Term Loans in their entirety by paying the then outstanding principal

balance and all accrued and unpaid interest on the Term Loans, subject to a prepayment premium equal to (i) 3.0% of the principal

amount outstanding if the prepayment occurs on or prior to the first anniversary following the Closing Date, (ii) 2.0% of the principal

amount outstanding if the prepayment occurs after the first anniversary following the Closing Date, but on or prior to the second anniversary

following the Closing Date, (iii) 1.0% of the principal amount outstanding if the prepayment occurs after the second anniversary

following the Closing Date, but on or prior to the third anniversary following the Closing Date, and (iv) 0.5% of the principal amount

outstanding if the prepayment occurs at any time thereafter.

Security.

The Loan and Security Agreement is collateralized by all of the Company’s assets in which the Agent is granted senior secured lien.

The Company also grants the Lenders a negative pledge on the Company’s intellectual property.

Covenants;

Representations and Warranties; Other Provisions. The Loan and Security Agreement contains customary representations, warranties and

covenants, including covenants by the Company limiting additional indebtedness, liens (including a negative pledge on intellectual property

and other assets), guaranties, mergers and consolidations, substantial asset sales, investments and loans, certain corporate changes,

transactions with affiliates and fundamental changes.

Default

Provisions. The Loan and Security Agreement provides for events of default customary for term loans of this type, including but not

limited to non-payment, breaches or defaults in the performance of covenants, insolvency, bankruptcy and the occurrence of a material

adverse effect on the Company. After the occurrence of an event of default, the Agent may (i) accelerate payment of all obligations,

impose an increased rate of interest, and terminate the Lenders’ commitments under the Loan and Security Agreement and (ii) exercise

any other right or remedy provided by contract or applicable law.

Conversion

Right. Additionally, the Lenders have the right to convert an aggregate amount of up to $6.0 million of the outstanding principal

amount into shares of Common Stock at a conversion price per share equal to a 80% of the trading price on the date of conversion, which

shall be at Lenders’ option. In the event the Company elects to prepay the Term Loans in full, Lenders shall have 10 days to elect

to exercise its conversion right prior to such prepayment. All conversion rights shall terminate on Term Loans payoff. Notwithstanding

the foregoing, the aggregate amount of Common Stock issued pursuant to the “Conversion Right” and the “Equity Grant”

shall not exceed a number of shares equal to 19.9% of the Company’s outstanding Common Stock.

The

Loan and Security Agreement will be filed as an exhibit to the Company’s Annual Report on Form 10-K for the year ending December 31,

2024 (the “Annual Report”). The representations, warranties and covenants Loan and Security Agreement were made only for purposes

of such agreement and as of specific dates and were solely for the benefit of the parties to such agreement.

Subscription Agreement

In

connection with the entry into the Loan and Security Agreement, the Company entered into a Subscription Agreement (the “Subscription

Agreement”) by and among the Company and the Lenders, pursuant to which the Company issued (i) 211,268 shares of Common Stock

to Avenue 1 and (ii) 845,070 shares of Common Stock to Avenue 2, with an issue date as of the Closing Date. The issuance of the shares

of Common Stock was made in reliance on the exemption from registration contained in Section 4(a)(2) of the Securities Act of

1933, as amended (the “Securities Act”), and Rule 506 of Regulation D thereunder, because the offer and sale of such

securities does not involve a “public offering” as defined in Section 4(a)(2) of the Securities Act, and other applicable

requirements are met.

Pursuant

to the Subscription Agreement, the Company shall use its commercially reasonable efforts to prepare and file with the SEC within 90 days

of the Closing Date a registration statement on Form S-3, registering the resale of the shares granted pursuant to the Subscription

Agreement, and the shares of Common Stock issuable upon Conversion Right pursuant to the Loan and Security Agreement.

The

Subscription Agreement will be filed as an exhibit to the Company’s Annual Report. The representations, warranties and covenants

Subscription Agreement were made only for purposes of such agreement and as of specific dates and were solely for the benefit of the parties

to such agreement.

Item 2.03. Creation of a Direct Financial Obligation

or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

The information provided in

Item 1.01 of this Current Report on Form 8-K regarding the Loan and Security Agreement is incorporated by reference into this Item

2.03.

Item 3.02. Unregistered Sales of Equity Securities.

The information provided in

Item 1.01 of this Current Report on Form 8-K regarding the Subscription Agreement is incorporated by reference into this Item 3.02.

Item 8.01. Other Events.

On November 7, 2024,

the Company issued a press release announcing the execution of the Loan and Security Agreement. A copy of the press release is attached

hereto as Exhibit 99.1 and is incorporated herein by reference.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

OCUGEN, INC. |

| |

|

|

| Date: November 8, 2024 |

/s/ Shankar Musunuri |

| |

Name: |

Shankar Musunuri |

| |

Title: |

Chairman, Chief Executive Officer, & Co-Founder |

Exhibit 99.1

Ocugen Secures $30 Million in Debt Funding

MALVERN, Pa., November 7, 2024 (GLOBE NEWSWIRE)—Ocugen, Inc.

(Nasdaq: OCGN), a biotechnology company focused on discovering, developing, and commercializing novel gene and cell therapies, biologics,

and vaccines, today announced that on November 6, 2024, the Company entered into a new $30 million credit facility with Avenue Venture

Opportunities Fund, L.P., a fund of Avenue Capital Group. Proceeds from the facility are intended for general corporate purposes, capital

expenditures, working capital, and general and administrative expenses.

The credit facility, which has a term of 4 years, provided $30 million

fully funded on the closing date.

“We are pleased to enter into this relationship with Avenue Capital

Group that provides what we believe is a shareholder-friendly financing for the Company,” said Dr. Shankar Musunuri, Chairman, Chief

Executive Officer, and Co-founder of Ocugen. “This additional working capital will support the clinical development of our three,

first-in-class modifier gene therapies and provide adequate funding to near completion of the OCU400 Phase 3 liMeliGhT clinical trial

and prepare for the BLA and MAA submissions.”

This most recent financing is part of Ocugen’s diversified strategy

to fund the business and appropriately allocate resources across the portfolio.

“We are pleased to partner with Ocugen with this financing as

the Company drives its next chapter of growth, based on its novel scientific platforms and dedication to fighting blindness diseases,”

said Chad Norman, Senior Portfolio Manager, Avenue Capital.

With net proceeds from this facility and current cash, cash equivalents,

and restricted cash, the Company’s expected cash runway extends into the first quarter of 2026.

Chardan and Titan Partners Group, a division of American Capital Partners,

acted as financial advisors to Ocugen on the transaction.

About Ocugen, Inc.

Ocugen, Inc. is a biotechnology company focused

on discovering, developing, and commercializing novel gene and cell therapies, biologics, and vaccines that improve health and offer

hope for patients across the globe. We are making an impact on patient’s lives through courageous innovation—forging new

scientific paths that harness our unique intellectual and human capital. Our breakthrough modifier gene therapy platform has the potential

to treat multiple retinal diseases with a single product, and we are advancing research in infectious diseases to support public health

and orthopedic diseases to address unmet medical needs. Discover more at www.ocugen.com and follow us on X and LinkedIn.

About Avenue Venture Opportunities

The Avenue Venture Debt Funds seek to provide creative financing

solutions to high-growth, venture capital-backed technology and life science companies, focusing generally on companies within the underserved

segment of the market created by the widening financing gap between commercial banks and larger debt funds. The Avenue Venture Debt funds

are part of the larger group of funds of Avenue Capital Group. For additional information on Avenue Capital Group, which is a global

investment firm with assets under management of approximately $12.2 billion, visit www.avenuecapital.com.

Cautionary Note on Forward-Looking Statements

This

press release contains forward-looking statements within the meaning of The Private Securities Litigation Reform Act of 1995,

including, but not limited to, strategy, business plans and objectives for Ocugen’s clinical programs, plans and timelines for

the preclinical and clinical development of Ocugen’s product candidates, including the therapeutic potential, clinical

benefits and safety thereof, expectations regarding timing, success and data announcements of current ongoing preclinical and

clinical trials, the ability to initiate new clinical programs; expectations regarding the satisfaction of closing conditions,

timing of the funding and the anticipated use of proceeds; Ocugen’s financial condition and expected cash runway into the

first quarter of 2026; and statements regarding qualitative assessments of available data, potential benefits, expectations for

ongoing clinical trials, anticipated regulatory filings and anticipated development timelines, which are subject to risks and

uncertainties. We may, in some cases, use terms such as “predicts,” “believes,” “potential,”

“proposed,” “continue,” “estimates,” “anticipates,” “expects,”

“plans,” “intends,” “may,” “could,” “might,” “will,”

“should,” or other words that convey uncertainty of future events or outcomes to identify these forward-looking

statements. Such statements are subject to numerous important factors, risks, and uncertainties that may cause actual events or

results to differ materially from our current expectations, including, but not limited to, the risks that preliminary, interim and

top-line clinical trial results may not be indicative of, and may differ from, final clinical data; that unfavorable new clinical

trial data may emerge in ongoing clinical trials or through further analyses of existing clinical trial data; that earlier

non-clinical and clinical data and testing of may not be predictive of the results or success of later clinical trials; and that

that clinical trial data are subject to differing interpretations and assessments, including by regulatory authorities. These and

other risks and uncertainties are more fully described in our annual and periodic filings with the Securities and Exchange

Commission (SEC), including the risk factors described in the section entitled “Risk Factors” in the quarterly and

annual reports that we file with the SEC. Any forward-looking statements that we make in this press release speak only as of the

date of this press release. Except as required by law, we assume no obligation to update forward-looking statements contained in

this press release whether as a result of new information, future events, or otherwise, after the date of this press

release.

Contact:

Tiffany Hamilton

Head of Communications

Tiffany.Hamilton@ocugen.com

v3.24.3

Cover

|

Nov. 06, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Nov. 06, 2024

|

| Entity File Number |

001-36751

|

| Entity Registrant Name |

OCUGEN,

INC.

|

| Entity Central Index Key |

0001372299

|

| Entity Tax Identification Number |

04-3522315

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

11

Great Valley Parkway,

|

| Entity Address, City or Town |

Malvern

|

| Entity Address, State or Province |

PA

|

| Entity Address, Postal Zip Code |

19355

|

| City Area Code |

484

|

| Local Phone Number |

328-4701

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common

Stock, $0.01 par value

|

| Trading Symbol |

OCGN

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

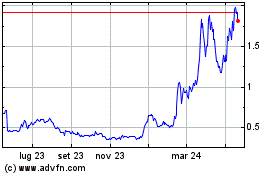

Grafico Azioni Ocugen (NASDAQ:OCGN)

Storico

Da Feb 2025 a Mar 2025

Grafico Azioni Ocugen (NASDAQ:OCGN)

Storico

Da Mar 2024 a Mar 2025