0001665300false00016653002024-10-242024-10-24

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): October 24, 2024 |

Phunware Inc.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Delaware |

001-37862 |

30-1205798 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

1002 West Avenue |

|

Austin, Texas |

|

78701 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: 512 693-4199 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common Stock, par value $0.0001 per share |

|

PHUN |

|

The Nasdaq Stock Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material Definitive Agreement.

As previously reported, on February 18, 2022, certain stockholders filed a lawsuit against Phunware, Inc. (the "Company" or "Phunware") and certain of our prior and then existing individual officers and directors. The case, captioned Wild Basin Investments, LLC, et al. v. Phunware, Inc., et al., was filed in the Court of Chancery of the State of Delaware (Cause No. 2022-0168-LWW). Plaintiffs allege that they invested in Phunware through various early rounds of financing while the Company was private and that following completion of the business combination transactions resulting in Phunware becoming a public company, Plaintiffs received new shares of Phunware common stock and Phunware warrants that were, but should not have been, subjected to a 180-day “lock up” period. Plaintiffs also allege that Phunware’s stock price dropped significantly during the lock up period and seek damages, costs and professional fees.

On or about October 24, 2024, Plaintiffs, Phunware and individual director and officer defendants entered into a Confidential Settlement Agreement, and on about October 28, 2024, Plaintiffs, Phunware, the individual director and officer defendants and Phunware's insurers entered into a Settlement Agreement and Mutual Release (collectively, the “Settlement Agreements”). The Settlement Agreements collectively provide for, among other things, the settlement and release of the Plaintiffs' claims against the individual director and officer defendants, certain agreements between the Plaintiffs and Phunware, including the Plaintiffs' agreement to stay collection of any judgment obtained by the Plaintiffs against Phunware until the settlement or conclusion of the Company's arbitration proceeding with respect to it's legal proceedings with Wilson Sonsini Goodrich and Rosati, PC ("WSGR"). Further, the Settlement Agreements provide for a payment of $2.8 million from the Company’s insurance carriers to the Plaintiffs, the payment of $0.2 million of insurance proceeds to Phunware and the release of the insurance carriers’ subrogation claims against Phunware recoveries from WSGR or its insurers in the WSGR arbitration proceeding. The Plaintiffs' claims against Phunware in the Wild Basin Litigation remain in effect and the case remains scheduled for bench trial in March 2025.

We intend to vigorously defend Phunware against the remaining claims in this lawsuit and any appeals. We have not recorded a liability related to this matter because any potential loss is not currently probable or possible to reasonably estimate. Additionally, we cannot presently estimate the range of loss, if any, that may result from this lawsuit.

The foregoing summary of the Settlement Agreements does not purport to be complete and is qualified by reference to the full text of the Settlement Agreements, which are filed as Exhibits 10.1 and 10.2 to this Current Report on Form 8-K.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

Phunware, Inc. |

|

|

|

|

Date: |

November 5, 2024 |

By: |

/s/ Stephen Chen |

|

|

|

Stephen Chen

Interim Chief Executive Officer |

CONFIDENTIAL SETTLEMENT AGREEMENT

This Confidential Settlement Agreement (this “Agreement”) dated as of September ___, 2024 (the “Effective Date”), by and among Gene Marshall Betts Revocable Trust Dated 12/18/2001, by and through Gene Marshall Betts, Trustee; Wild Basin Investments LLC; Richard F. Timmins Living Trust Dated 06/23/2008, by and through Richard F. Timmins, Trustee; Ken Shifrin; Edward W. Charrier; Lance Adams; Matula Family, LP – Class 1; Star Vista Capital, LLC; Lois Schaefer, in her individual capacity and on behalf of the estate of George Schaefer; Paul Michael Bedell; John Wages; Prospect Hill Capital, LLC; Woodgen, LLC; and Craig Dubois, (collectively, “Plaintiffs”) on the one hand, and Phunware, Inc. f/k/a Stellar Acquisition III, Inc. (“Phunware”); Phunware OpCo, Inc. f/k/a Phunware, Inc. (collectively “Phunware” or the “Phunware Entity Defendants”) Alan Knitowski; Luan Dang; Randall Crowder; Matt Aune; Prokopios Akis Tsirigakis; George Syllantavos; Lori Tauber Marcus; Kathy Tan Mayor; Keith Cowan; Winston Damarillo; Chase Fraser; John Kahan; and Eric Manlunas (collectively, the “Individual Defendants” on the other hand). The Phunware Entity Defendants and the Individual Defendants may be referred to in this Agreement individually as a “Defendant” and collectively as the “Defendants”); and the Defendants and Plaintiffs may be referred to in this Agreement individually as a “Party” and collectively as the “Parties.”

RECITALS

WHEREAS, on February 18, 2022, Plaintiffs filed a Complaint in the Delaware Court of Chancery captioned as Wild Basin Investments, LLC, et. al. v. Phunware, Inc., et al., Case No. 2022-0168-NAC (the “Delaware Lawsuit”) alleging violations of Delaware common law, 8 Del. C. § 158, and 6 Del. C. § 8-401, by the Phunware Entity Defendants, breaches of fiduciary duty by the Individual Defendants, and fraud claims under the Texas Securities Act and Texas Business and Commerce Code against all Defendants in connection with a series of transactions through which Phunware became a publicly traded company, all as more fully set forth in the Delaware Lawsuit Complaint;

WHEREAS, on June 16, 2023 the Delaware Court of Chancery dismissed Plaintiffs’ fraud claims under the Texas Securities Act and Texas Business and Commerce Code;

WHEREAS, Defendants deny all liability to Plaintiffs, deny all allegations of wrongdoing, and enter into this Agreement solely for the purposes set forth herein;

WHEREAS, Defendants are insureds under Phunware’s director and officer insurance policy (UMR: B0146ERUSA1801075) (the “D&O Policy”); and

WHEREAS, Plaintiffs and Defendants have fully and fairly settled any and all claims Plaintiffs might have against the Individual Defendants only (reserving all claims as set forth in Count I of the Delaware Lawsuit against the Phunware Entity Defendants), known or unknown, including all claims in connection with the Delaware Lawsuit brought against the Individual Defendants and any other claims against the Individual Defendants, known or unknown, and arising out of or connected with the subject matter of the Delaware Lawsuit from the beginning of time through and including the Effective Date.

CONFIDENTIAL - Page 1 of 17

NOW THEREFORE, consistent with the above premises, and for good and valuable consideration, the receipt and sufficiency of which is acknowledged, the Parties agree as follows:

1.Settlement Payment and Dismissal.

a. Defendants agree to cause the issuing insurers of the D&O Policy (the “Insurers”), within thirty (30) days after the Effective Date, to pay (or cause to be paid) D&O Policy proceeds to George Brothers Kincaid & Horton, LLP (“Plaintiffs’ Counsel”) for the benefit of the Plaintiffs in an amount equal to Two Million Eight Hundred Thousand Dollars ($2,800,000) (“Partial Settlement Payment”). The Plaintiffs hereby authorize and direct the Partial Settlement Payment to be tendered directly to the Law Offices of George Brothers Kincaid & Horton, L.L.P. by wire transfer as follows:

i.Account Name: George Brothers Kincaid & Horton, LLP IOLTA Account.

ii.Routing Number: [to be furnished]

iii.Account Number: [to be furnished]

iv.Bank: [to be furnished]

b.Except as expressly set forth in this Agreement, none of Plaintiffs nor Plaintiffs’ Counsel shall request or have any right in or to receive from the Individual Defendants, the Insurers, or any other Defendant, any other monetary or other consideration solely in connection with any of the Claims (defined below) which are released by each of the Plaintiffs and/or any of the Individual Defendants under this Agreement (collectively, “Released Claims”), other than the Partial Settlement Payment.

c.Each Party represents and warrants to, and acknowledges and agrees with, each other Party that the Partial Settlement Payment and any other consideration given under this Agreement was negotiated for and that the Partial Settlement Payment is fair and reasonable consideration for the release of the Released Claims and the other rights and obligations set forth in this Agreement.

d.By no later than five (5) business days after Plaintiffs’ Counsel’s receipt of the Partial Settlement Payment, Plaintiffs or Plaintiffs’ Counsel shall file all required court papers, in form and substance reasonably satisfactory to Defendants and their counsel, to effectuate dismissal of Counts II and III of the Delaware Lawsuit with prejudice, and to confirm prior dismissal of Counts IV and V of the Delaware Lawsuit with prejudice. The Individual Defendants are not responsible for the payment of any Plaintiffs’ attorneys’ fees and costs incurred in connection with the Delaware Lawsuit.

2.Release and Waiver by Plaintiffs and Additional Agreements.

a.Except for the rights and obligations created by this Agreement, for value received, the receipt and adequacy of which is hereby acknowledged, upon receipt by Plaintiffs or Plaintiffs’ Counsel of the Partial Settlement Payment, Plaintiffs hereby

CONFIDENTIAL - Page 2 of 17

generally and mutually, and irrevocably and unconditionally, release, waive, relinquish and forever disavow and discharge any and all claims, demands, liabilities, obligations, debts, losses, injuries, costs, remedies, damages (including general, special, consequential, incidental, exemplary, punitive, etc.) and causes of action of any kind or character, in law or in equity, whether direct or indirect, known or unknown (collectively, “Claims”), that they have or might have against the Individual Defendants only, including but not limited to Claims alleged in the Delaware Lawsuit. The Individual Defendants have not assigned any claims against any Phunware Entity Defendant to Plaintiffs, and Plaintiffs will not assert any such claims against any Phunware Entity Defendant. Plaintiffs further acknowledge that the Individual Defendants have complied with all of their respective discovery and other obligations in the Delaware Lawsuit up to and including the Effective Date under Delaware, Texas and other applicable law. The foregoing release and waiver shall extend to each of Individual Defendant’s successors, assigns, heirs, executors, and personal representatives. For the avoidance of doubt, Plaintiffs’ claims against the Phunware Entity Defendants in Count I of the Delaware Lawsuit and Plaintiffs’ rights set forth under Section 5 below are not released hereby.

b.Plaintiffs and the Individual Defendants acknowledge and agree that none of the Individual Defendants nor any of their successors, assigns, heirs, executors or personal representatives have sold, assigned or transferred, directly or indirectly, any rights, interests or Claims which any Individual Defendants have or may have under, relating to or in connection with any law, regulation agreement, organizational document, or otherwise, to which any Individual Defendant or any Phunware Entity Defendant is a party or is otherwise subject or otherwise subject to or otherwise has any rights or interests under or with respect to, as applicable to any Plaintiff.

c.Except for the purpose of enforcing Plaintiffs rights provided in Section 5 hereof, each of the Plaintiffs agree that they shall not, on or after the Effective Date, initiate, facilitate, join in or otherwise participate in or support, directly or indirectly, any demand, lawsuit, or other legal proceeding (such as arbitration) against any of the Defendants relating to the Delaware Lawsuit, or any other matter released by this Agreement. Plaintiffs agree they will not seek to file an amended complaint in the Delaware Lawsuit that adds any new plaintiff not already named in Delaware Lawsuit, provided that Lois Schaefer or the estate of George Schafer may take whatever legal action necessary to properly pursue Count I against the Phunware Entity Defendants on behalf of the estate of George Schaefer in accordance with this Agreement. In addition, the Parties agree to oppose any attempt to intervene in the Delaware Lawsuit. The Plaintiffs agree not to oppose Defendants’ opposition to any attempt by a prospective plaintiff to join the Delaware Lawsuit.

d.Except as provided in Section 6 hereof, Plaintiffs shall not, on or after the Effective Date, initiate, facilitate, join in or otherwise participate in or support, directly or indirectly, any demand, lawsuit, or other legal proceeding (such as arbitration) seeking payment or recovery of any legal fees, costs, expenses or other amounts

CONFIDENTIAL - Page 3 of 17

against any of the Defendants or any other person or entity relating to any of Counts II, III, IV or V of the Delaware Lawsuit.

e.It is understood by the Parties hereto that this Section 2 extends to all Claims of every nature and kind whatsoever against the Individual Defendants, known or unknown, suspected or unsuspected, existing, claimed to exist or which may hereafter arise out of facts, events or circumstances that presently exist and result from or are connected with the facts alleged in the Delaware Lawsuit.

3.Release and Waiver by Individual Defendants and Additional Agreements.

a.Except for the rights and obligations created by this Agreement, for value received, the receipt and adequacy of which is hereby acknowledged, upon receipt by Plaintiffs or Plaintiffs’ Counsel of the Partial Settlement Payment, the Individual Defendants hereby generally and mutually, and irrevocably and unconditionally, release, waive, relinquish and forever disavow and discharge any and all claims, demands, liabilities, obligations, debts, losses, injuries, costs, remedies, damages (including general, special, consequential, incidental, exemplary, punitive, etc.) and causes of action of any kind or character, in law or in equity, whether direct or indirect, known or unknown (collectively, “Claims”), that they have or might have against any of the Plaintiffs, any of the Phunware Entity Defendants, and any of their respective prior, current or future officers, directors, employees, affiliates, shareholders, attorneys and agents, and any of their respective successors and assigns (each, a “Phunware Entity Party”), including but not limited to all Claims alleged in the Delaware Lawsuit, all Claims under or related to any agreements between any Individual Defendant and any other Defendant or any Plaintiff and any Defendant, and all Claims under or related to any organizational documents of any Phunware Entity Defendant which are or may be applicable to any Individual Defendant, and all costs, attorneys’ fees or expenses incurred with respect to Counts I, II, III, IV and/or V of the Delaware Lawsuit, and acknowledge that the Plaintiffs and Phunware Entity Defendants have complied with all of their respective discovery and other obligations in the Delaware Lawsuit up to and including the Effective Date under Delaware, Texas and other applicable law. The foregoing release shall extend to each Individual Defendant’s respective successors, assigns, heirs, executors, and personal representatives.

b.Each of the Individual Defendants agree that they shall not, on or after the Effective Date, initiate, join in or otherwise participate in or support, directly or indirectly, any demand, lawsuit, or other legal proceeding (such as arbitration) or otherwise pursue or seek any other Claims against any of the Plaintiffs, any of the Phunware Entity Defendants, or any Phunware Entity Party, relating to the Delaware Lawsuit.

c.It is understood by the Parties hereto that this Section 3 extends to all Claims of every nature and kind whatsoever against the Plaintiffs, any Phunware Entity Defendant and any Phunware Entity Party, known or unknown, suspected or unsuspected, existing, claimed to exist or which may hereafter arise out of facts,

CONFIDENTIAL - Page 4 of 17

events or circumstances that presently exist and result from or are connected with the facts alleged in the Delaware Lawsuit.

4.Ongoing Claims Against Phunware.

a.Each of the Plaintiffs agree that they will not, on or after the Effective Date, directly or indirectly, initiate, facilitate, join in, participate in, or support, directly or indirectly, any demand, lawsuit, or other legal proceeding (such as arbitration) of or by any other person or entity against Phunware or any other Defendant asserting any Claims relating to any alleged acts or omissions of Phunware or any other Defendant in connection with the disclosure, implementation or enforcement of any other Claim arising from or relating to any lock up or other failure to deliver restriction on delivery of any Phunware shares of commons stock issued in connection with the SPAC Transaction (as defined below).

b.The Parties agree that any award of monetary damages to Plaintiffs by judgment of the Delaware Court of Chancery resulting from Phunware’s liability for Count I, or any amendment to Count 1, asserted in the Delaware Lawsuit (“Delaware Lawsuit Damages”) will immediately be offset and reduced by the amount of the Partial Settlement Payment, unless the Court already and specifically reduced the Delaware Lawsuit Damages by the amount of the Partial Settlement Payment in its judgment.

5.Pending Arbitration Between Phunware and Wilson Sonsini.

a.Attached hereto as Exhibit A is a true and correct copy of the stay of the Phunware arbitration against Wilson Sonsini, JAMS Ref. No. 5110000159 (the “Wilson Sonsini Arbitration”). Phunware will use best efforts to maintain the stay until the earlier to occur of the date on which a final judgment is rendered by the Delaware Court of Chancery on Count I of the Delaware Lawsuit or the final settlement of the Delaware Lawsuit by Phunware and the Plaintiffs, whichever occurs first. If Wilson Sonsini refuses to comply with the stay, Phunware will file a motion with the arbitrator to enforce such compliance with the stay. Phunware will keep Plaintiffs’ Counsel informed on the status of the stay. For the avoidance of doubt, Phunware may proceed with the Wilson Sonsini Arbitration immediately upon entry of judgment by the Delaware Court of Chancery and need not stay the Wilson Sonsini Arbitration through any appeal of such judgment.

b.Notwithstanding the foregoing, Phunware may engage in and pursue discussions, fact finding, and settlement (subject to Section 5.d. hereof, as applicable) of any claims alleged by or against Phunware in the Wilson Sonsini Arbitration at any time and from time to time.

c.If Plaintiffs are awarded Delaware Lawsuit Damages by judgment of the Delaware Court of Chancery and Phunware elects not to immediately pay or satisfy all such Delaware Lawsuit Damages, the Parties agree to comply with the following

CONFIDENTIAL - Page 5 of 17

provisions until the date on which the Delaware Lawsuit Damages have been paid or satisfied in full:

i. Plaintiffs will stay all efforts to collect any Delaware Lawsuit Damages from or relating to such judgment until the earlier to occur of the date of final completion of the Wilson Sonsini Arbitration or the full and final settlement of the Wilson Sonsini Arbitration.

ii.Phunware will remain in control of and shall have and exercise full authority in pursuing any and all of its Claims and other rights and remedies against Wilson Sonsini, its insurers and any other person or entity in and with respect to the Wilson Sonsini Arbitration (the “Phunware - WSGR Claims”).

iii.Plaintiffs’ Counsel will have the right to consult with Phunware and Phunware’s counsel regarding the status of the Wilson Sonsini Arbitration under a common interest privilege and confidentiality agreement.

iv. Phunware agrees to deposit all payments received by Phunware from Wilson Sonsini and its insurers as settlement of the Wilson Sonsini Arbitration or in satisfaction of any award made to Phunware in the Wilson Sonsini Arbitration into an escrow account established by Phunware with a bank to then be distributed in the following order: (1) Phunware’s counsel in the Wilson Sonsini Arbitration shall be paid the amount of their contingency fee (not to exceed 25%) and expenses advanced by such counsel; (2) Plaintiffs shall be paid an amount in the escrow account up to the then outstanding unpaid amount of Delaware Lawsuit Damages; and (3) Phunware shall be paid any remaining amount in the escrow account.

v. If Wilson Sonsini prevails in the Wilson Sonsini Arbitration, or if the balance of amounts remaining in the escrow account after giving effect to the payments described in Section 5.c.i. is insufficient to satisfy the outstanding unpaid amount of Delaware Lawsuit Damages, Plaintiffs may proceed with collection against Phunware for the remaining balance of such damages.

vi.Prior to the trial court adjudication of the Delaware Lawsuit, the acceptance by Phunware of any offer to settle the Phunware - WSGR Claims will require Plaintiffs’ prior written consent, which Plaintiffs may withhold in their sole discretion.

6.Cooperation of Individual Defendants.

a. Each of the Individual Defendants hereby agrees to promptly, diligently and fully comply and cooperate in good faith with Phunware, and its directors, officers and counsel, with respect to and in connection with the Delaware Lawsuit and the Wilson Sonsini Arbitration (including appeals) until such lawsuit and such arbitration proceeding have been terminated (including during and following the

CONFIDENTIAL - Page 6 of 17

Delaware Lawsuit and prior to, during and following commencement of the Wilson Sonsini Arbitration, and prior to and following (and in connection with) any settlement of the Delaware Lawsuit and the Wilson Sonsini Arbitration), including without limitation (upon reasonable prior written notice and request from Phunware or its counsel) responding to and complying with reasonable requests or requirements of Phunware or any of its counsel for Q&A, information, data, interviews, production of documents, interrogatories, depositions, subpoenas and service as witnesses, and testifying at or in connection with any hearing, trial or proceeding, directly or indirectly in, for, with respect to or in connection with, and at any time prior to or during, the Delaware Lawsuit and/or the Wilson Sonsini Arbitration.

b. Phunware will agree to pay or reimburse reasonable and necessary travel-related costs and expenses incurred by any Individual Defendant which are pre-approved by Phunware in complying or cooperating with the foregoing but Phunware will not be required to provide compensation for time incurred by any Individual Defendant or any other person or entity for any such compliance or cooperation or otherwise, directly or indirectly, for, about, involving or relating to the Delaware Lawsuit, the Wilson Sonsini Arbitration or any claims by or against Phunware therein or relating thereto. Nothing in this Agreement shall diminish an Individual Defendant’s indemnity and advancement rights under Phunware’s bylaws or separate written agreements with Phunware.

a.The Parties agree to keep the terms and existence of this Agreement, all documents and things exchanged during settlement negotiations leading up to this Agreement, and all factual allegations in the Wilson Sonsini Arbitration, collectively “Confidential Information,” strictly confidential, and shall not disclose or otherwise reveal any Confidential Information to any other person or entity, except: (a) as required by law or order of a court or any other government authority; (b) as is reasonably necessary to be disclosed to the Parties’ accountants, consultants, tax advisors, investors, potential investors, attorneys, employees, representatives, bankers, or bondholders (provided that any such person or entity is subject to an agreement with the disclosing Party to keep all such Confidential Information so received strictly confidential); (c) as is reasonably necessary to the defense or enforcement of any action to which the terms of this Agreement apply; (d) to the extent required for any Defendant to negotiate, seek to negotiate, or consummate any business transaction that would be adversely affected by any term of this Agreement; (e) to the extent required in connection with any purchase, acquisition, or potential purchase of a Party’s assets or liabilities; (f) as any Defendant determines to be necessary to insurers and/or with the court or arbitrator in any legal proceedings against any insurer to which Defendants tendered the Delaware Lawsuit for defense and indemnity or any insurer of Wilson Sonsini in connection with or the arbitrator in the Wilson Sonsini Arbitration; (g) in response to a valid subpoena or as otherwise compelled by an order of a court of competent jurisdiction or arbitrator or a governmental agency; (h) as required or deemed advisable by any

CONFIDENTIAL - Page 7 of 17

Defendant under or in connection with any applicable securities laws, including filings with the Securities and Exchange Commission; (i) to defend against any demand or lawsuit initiated on or after the Effective Date that makes claims similar to those in the Delaware Lawsuit; (j) to legal, tax, or financial advisors as necessary to ensure compliance with applicable state or federal law; and (k) to the Delaware Court of Chancery.

b.If any Party receives an informal request, discovery request or subpoena for the disclosure of Confidential Information, then that Party must first notify the other Parties within ample time to seek a protective order or other relief before the requested Party or its counsel produces Confidential Information. If asked or required, the Parties may state only that the Delaware Lawsuit was resolved.

c.Plaintiffs and Plaintiffs’ Counsel acknowledge and agree that the confidentiality requirements of this Agreement prohibit them from making any further disclosures of or related or alluding to any of the factual allegations forming the basis of any claims, directly or indirectly, of or in the Delaware Lawsuit or similar allegations.

d.This Section 7, and its confidentiality obligations, shall be binding on each Party and such Party’s respective successors and assigns and shall survive the termination or expiration of this Agreement, the Delaware Lawsuit and the Wilson Sonsini Arbitration.

8.Representations and Warranties.

a.Each Plaintiff represents and warrants to each other Party that such person or entity: (i) has no knowledge of the existence of any further Claims of any Plaintiff against any Defendant, any of the Released Parties. or any Phunware Entity Party; and (ii) has no knowledge of any other person or entity who or which is investigating or has expressed intent to assert or file any Claims against any Defendant, any of the Released Parties, or any Phunware Entity Party.

b. Each Party represents and warrants to each other Party at all times while this Agreement remains in effect that such person or entity has not sold, assigned, transferred, directly or indirectly, released, or settled (other than via this Agreement), in whole or in part (i) any Claim against or relating to any Defendant or any other Released Party; (ii) any Claim involving or relating to the subject matter of the Delaware Lawsuit or the Wilson Sonsini Arbitration; or (iii) any of the Claims released by any Party under this Agreement.

c. Each Party represents and warrants to each other Party at all times while this Agreement remains in effect that, in executing, delivering and performing this Agreement, (i) such Party is not relying and has not relied upon any representation, promise or statement made by any other Party or any other person or entity which is not recited, contained, or embodied in this Agreement; (ii) such Party has received independent legal advice or has had the opportunity to receive independent legal advice from such Party’s respective attorneys with respect to the advisability

CONFIDENTIAL - Page 8 of 17

of executing this Agreement; and (iii) such Party is entering into this Agreement wholly of such Party’s own free will and volition.

d. Each Party represents and warrants to each other Party at all times while this Agreement remains in effect that: (i) such Party is authorized to execute, deliver and perform under this Agreement; (ii) any notices, filings, consents, authorizations, or approvals required for such Party’s execution, delivery and performance have been made or obtained; and (iii) this Agreement (A) does not violate any law or regulation applicable to such Party or any agreement to which such Party is a party, (B) has been duly executed and delivered by such Party and (C) constitutes the legal, valid and binding obligations of such Party, enforceable against such Party in accordance with its terms.

e. None of the representations or warranties in this Section 9 are intended, or shall be construed, to violate rule 5.6 of the American Bar Association’s Rules of Professional Conduct or any state law equivalent.

9.Materiality of Representations.

The Parties acknowledge and agree that the representations and warranties in this Agreement are essential and material terms of this Agreement, and that Defendants would not have entered into this Agreement if it had known that any such representations and warranties were incomplete or incorrect.

Each Party to this Agreement shall bear such Party’s respective fees, costs and expenses (including attorneys’ fees) incurred by such Party from, as a result of or in connection with this Agreement and the Delaware Lawsuit, and any claims which are released hereunder.

11.Choice of Law and Venue.

This Agreement shall be governed by, and construed and interpreted in accordance with, the laws of Delaware without regard to conflicts of laws principles. Each of the Parties (a) submits itself to the personal jurisdiction of any state court sitting in Wilmington, Delaware, as well as to the jurisdiction of all courts to which an appeal may be taken from courts, in any suit, action, or proceeding arising out of relating to this Agreement, or any of the transactions contemplated by this Agreement, (b) agrees that all claims with respect to such suit, action or proceeding shall be brought, heard, and determined exclusively in the Court of Chancery of the State of Delaware (provided that in the event that subject matter jurisdiction is unavailable in that court, then all such claims shall be brought, heard, and determined exclusively in any other state court sitting in Wilmington, Delaware), (c) agrees not to bring any action or proceeding arising out of or relating to this Agreement, or any of the transactions contemplated by this Agreement, in any other court, and (d) expressly waives and agrees not to plead or make any claim that any such action or proceeding is subject (in whole or in part) to a jury trial. Each of the Parties waives any defense of

CONFIDENTIAL - Page 9 of 17

inconvenient forum to the maintenance of any action or proceeding so brought. All claims arising out of this Agreement shall be initiated and maintained in the Delaware Court of Chancery located in Wilmington, Delaware or, if the Court of Chancery lacks jurisdiction, another court sitting in Wilmington, Delaware.

12.No Admission of Liability or Release of Claims.

The Parties acknowledge and agree that this Agreement and the performance of the obligations herein, including the amount of the Partial Settlement Payment, are made and entered into in connection with compromising disputed claims which are denied and contested and this Agreement and its terms shall not be construed as an admission of any liability of any kind by any Party, any such liability is expressly denied by each Party. The Parties agree not to assert that this Agreement is an admission of guilt, wrongdoing, or liability on the part of any other Party.

This Agreement shall be binding upon each of the Parties and shall inure to the benefit of each of the Parties and their respective heirs, successors, attorneys, accountants, agents, principals, partners, servants, employees, administrators, directors, officers, shareholders, trustees, insurers, representatives, and assigns.

If any legal action or other proceeding is brought by any Party for the enforcement of this Agreement or because of any alleged dispute, breach, default or misrepresentation in connection with any of the provisions of this Agreement, the prevailing Party upon issuance of a non-appealable order or order for which appeal has been waived shall be entitled to recover such Party’s reasonable attorneys’ fees and other fees and costs incurred in any such action or proceeding in addition to any other relief to which such Party may be entitled.

This Agreement comprises and contains the entire agreement between the Parties respecting the matters set forth in this Agreement, and supersedes and replaces all prior negotiations, understandings, proposed agreements, and agreements between or among the Parties, written or oral. No Party has made any statement, representation, or promise, other than as expressly set forth herein, to any other Party in entering into this Agreement, which has been relied upon by any other Party entering into this Agreement.

16.Modification and Amendment.

This Agreement may not be modified or amended in any way, except by a writing signed by all Parties to this Agreement.

CONFIDENTIAL - Page 10 of 17

17.Construction of this Agreement.

This Agreement shall be construed and interpreted as a whole according to its fair meaning and not strictly for or against any Party hereto. All Parties have participated in drafting this Agreement, which is the result of negotiations between the Parties, all of which have been represented by counsel during such negotiations or have had the opportunity to be represented by counsel. Accordingly, for purposes of construing and interpreting this Agreement, it shall be considered that this Agreement was jointly drafted by all of the Parties. The Parties understand and expressly assume the risk that any fact not recited, contained or embodied herein may turn out hereafter to be other than, different from, or contrary to the facts now known to them or believed by them to be true. Nevertheless, the Plaintiffs and Individual Defendants intend by this Agreement to release finally, fully and forever, all matters released hereunder and agree that this Agreement shall be effective in all respects notwithstanding any such difference in facts, and shall not be subject to termination, modification or rescission by reason of any such difference in facts.

Each Party hereto warrants and represents to the other Party that such person or entity is the lawful owner of all rights, title and interest in and to every claim being released by such person or entity herein. The Parties will not assign or transfer, directly or indirectly, by way of subrogation, hypothecation, or other disposition, any claim, right, title, interest, demand, or obligation of such Party hereunder or relating to the matters set forth herein.

This Agreement may be executed and delivered in multiple counterparts, each of which when so executed and delivered shall be deemed to be an original, and all such counterparts together shall constitute one and the same agreement. Facsimile and PDF signatures shall have the same force and effect as original signatures.

Unless advised in writing of a different name and address, all notices, submissions, and communications of any kind required or otherwise made under this Agreement shall be sent (as required) to the following via trackable form of delivery and email:

CONFIDENTIAL - Page 11 of 17

If to any Defendant:

Michael J. Biles

King & Spalding

500 W. 2nd, Suite 1800

Austin, TX 78701

(512) 457-2000

If to Plaintiffs:

D. Douglas Brothers | Partner

George Brothers Kincaid & Horton, L.L.P.

1100 Norwood Tower

114 West 7th St

Austin, TX 78701

(512) 495-1400

dbrothers@gbkh.com

CONFIDENTIAL - Page 12 of 17

PLEASE READ CAREFULLY THIS CONFIDENTIAL SETTLEMENT AGREEMENT, WHICH INCLUDES A RELEASE OF CERTAIN CLAIMS.

IN WITNESS WHEREOF, each of the undersigned do hereby duly execute this Agreement, effective as of the Effective Date.

CONFIDENTIAL - Page 13 of 17

|

|

Gene Marshall Betts Revocable trust dated 12/18/2001, by and through Gene Marshall Betts, Trustee. Date: |

Wild Basin Investments LLC Date: |

Richard F. Timmins Living Trust Dales 06/23/2008, by and through Richard F. Timmins, Trustee Date: |

Ken Shifrin Date: |

Edward W. Charrier Date: |

Lance Adams Date: |

Matula Family, LP – Class 1 Date: |

Star Vista Capital, LLC Date: |

Lois Schaefer in her individual capacity and on behalf of the estate of George Schaefer Date: |

Paul Michael Bedell Date: |

CONFIDENTIAL - Page 14 of 17

|

|

John Wages Date: |

Prospect Hill Capital, LLC Date: |

Woodgen, LLC Date: |

Craig Dubois Date: |

CONFIDENTIAL - Page 15 of 17

|

|

Phunware OpCo, Inc. f/k/a Phunware Inc. By: Title: Date: |

Phunware, Inc. F/K/A Stellar

Acquisition III, Inc. By: Title: Date: |

Alan Knitowski Date: |

Randall Crowder Date: |

Matt Aune Date: |

Prokopios Akis Tsirigakis Date: |

George Syllantavos Date: |

Lori Tauber Marcus Date: |

Kathy Tan Mayor Date: |

Keith Cowan Date: |

CONFIDENTIAL - Page 16 of 17

|

|

Winston Damarillo Date: |

Chase Fraser Date: |

John Kahan Date: |

Eric Manlunas Date: |

CONFIDENTIAL - Page 17 of 17

SETTLEMENT agreement AND mutual RELEASE

This Settlement Agreement and Mutual Release (“Agreement”) by and among all of the Underwriters at Lloyd’s, London which subscribed to Policy No. B0146ERUSA1801075 each of which is identified as such on the signature pages hereof as parties hereto (“Underwriters”), Phunware, Inc., a Delaware corporation (“Phunware”), and each of the individuals identified on the signature pages hereof as parties hereto (the “Individuals”). The persons and entities which are signatories to this Agreement are referenced in this Agreement individually as a “Party” and collectively as the “Parties.”

PREAMBLE

WHEREAS, Underwriters issued Policy No. B0146ERUSA1801075 to Phunware for the policy period December 24, 2018 to December 24, 2019 which provided $5 million of primary coverage (the “Policy”);

WHEREAS, the submission concerns the notification of a pre-suit petition styled Wild Basin Investments LLC, et al. v. Phunware, Inc. f/k/a/ Stellar Acquisition III, Inc. et al. that was initially noticed to the Policy by email dated December 17, 2019 (the “Petition”), and which ultimately evolved into a lawsuit styled Gene Marshall Betts Revocable Trustee Dated 12/18/2001 et al. v. Phunware, Inc. f/k/a Stellar Acquisition III, Inc., et al. that was filed in the Court of Chancery of the State of Delaware, C.A. No. 2022-0168-NAC (the “Delaware Lawsuit”);

WHEREAS, Phunware tendered the Petition and the Delaware Lawsuit (collectively hereinafter referred to as the “Lawsuit”) for coverage under the Policy;

WHEREAS, Underwriters acknowledged receipt of and coverage for the Lawsuit under the Policy, subject to a reservation of rights, including (but not limited to) the right to recover certain fees and costs advanced on behalf of the individually-named director and officer defendants to the Lawsuit (the “Individual Defendants”) when, , Phunware failed to satisfy the applicable

Settlement Agreement and Mutual Release.v2

$2 million self-insured retention and ceased to advance or reimburse these Individual Defendants in part for legal fees incurred in connection with defending the Lawsuit;

WHEREAS, the Parties in the Lawsuit intend to partially settle the Lawsuit subject to terms to be agreed upon in the applicable settlement agreement (the “Lawsuit Settlement”);

WHEREAS, Phunware and the Individual Defendants, as insureds under the Policy, have requested, and Underwriters have agreed, to contribute $3 million toward the Lawsuit Settlement (the “Settlement Payment”) in exchange for a full and final claim and Policy release; and

WHEREAS, the Parties understand and appreciate that $1.5 million of the Policy has previously been eroded in conjunction with Underwriters’ contribution toward the settlement of the unrelated Uber matter.

NOW, THEREFORE, in consideration of the mutual promises and releases contained herein and for other good and valuable consideration, the receipt and sufficiency of which hereby are acknowledged, the Parties agree as follows:

1.1 Upon Underwriters’ receipt of all tax identification, payment information and contact information for an out-of-band authentication for the payment information necessary for the Underwriters to make the Settlement Payment, Underwriters shall pay $3 million to Phunware, in U.S. Dollars, in cash and in immediately available funds, within twenty (20) business days after the Effective Date. The Effective Date shall be the first business day after this Agreement has been fully executed by the Parties, that is, when counterparts to this Agreement, which taken together bear the signatures of the Parties, have been executed and delivered to counsel or representatives for the Parties, either by e-mail, overnight delivery service, or U.S. mail.

Settlement Agreement and Mutual Release.v2

2

2.1The Parties agree and acknowledge that this Agreement and the performance of the obligations herein are the result of a compromise and shall not be construed as an admission by any Party of any liability, coverage, wrongdoing, or responsibility on such Party’s part or on the part of such Party’s predecessors, successors, assigns, agents, parents, subsidiaries, affiliates, officers, directors, employees, or attorneys.

3.1Upon Underwriters’ delivery of payment of the Settlement Payment to Phunware, and in exchange for the other consideration set forth in this Agreement, and except for the rights and obligations created by this Agreement, Phunware and its predecessors, successors, parents, subsidiaries, affiliates, assigns, transferees, agents, representatives, attorneys, current and former directors and officers (including the Individual Defendants), members, managers, partners and employees, and any person acting on their behalf (collectively, the “Phunware Related Parties”) hereby absolutely, irrevocably, unconditionally and forever release and discharge Underwriters and their respective predecessors, successors, parents, subsidiaries, affiliates, assigns, transferees, agents, managing agents, reinsurers, representatives, attorneys, directors, officers, members, managers, partners, employees, and reinsurers (collectively, the “Underwriter Related Parties”) from any and all claims, potential claims, rights, damages, debts, liabilities, accounts, attorneys’ fees, reckonings, obligations, costs, expenses, pre- or post-judgment interest, liens, actions and causes of action of every kind and nature whatsoever, whether now known or unknown, which any of them respectively now has, owns or holds, or at any time heretofore had, owned or held, or could, shall or may hereafter have, own, or hold, directly or indirectly for, based upon, arising out of, or resulting from:

(a)any claim for coverage for the Lawsuit under the Policy;

Settlement Agreement and Mutual Release.v2

3

(b)any claim for coverage under the Policy relating to or arising from the same facts, circumstances, and/or allegations made in the Lawsuit;

(d)any claim for misrepresentations, fraud, indemnity, contribution, breach of contract, breach of duty, negligence, “bad faith,” violation of statute or regulation, unfair claims handling, or damages of any kind whatsoever arising out of or relating to the claim for coverage for the Lawsuit under the Policy.

3.2Upon Underwriters’ delivery of payment of the Settlement Payment to Phunware, in exchange for the other consideration set forth in this Agreement, and except for the rights and obligations created by this Agreement, the Underwriter Related Parties hereby absolutely, irrevocably, unconditionally and forever release and discharge the Phunware Related Parties from any and all claims, potential claims, rights, damages, debts, liabilities, accounts, attorneys’ fees, reckonings, obligations, costs, expenses, pre- or post-judgment interest, liens, actions and causes of action of every kind and nature whatsoever, whether now known or unknown, which any of them respectively now has, owns or holds, or at any time heretofore had, owned or held, or could, shall or may hereafter have, own, or hold, directly or indirectly for, based upon, arising out of, or resulting from:

(a)any claim for coverage for the Lawsuit under the Policy;

(b)any claim for coverage under the Policy relating to or arising from the same facts, circumstances, and/or allegations made in the Lawsuit;

Settlement Agreement and Mutual Release.v2

4

(d)any claim for misrepresentations, fraud, indemnity, contribution, breach of contract, breach of duty, negligence, “bad faith,” violation of statute or regulation, unfair claims handling, or damages of any kind whatsoever arising out of or relating to the claim for coverage for the Lawsuit under the Policy; or

(e)any claim or other rights to subrogation, contribution, indemnification, reimbursement, recovery recoupment, or any other right to participate in any claim or remedy of Phunware, any Individual or any other person or entity has or may have against any other person or entity, including Phunware’s former or current attorneys, relating to the Lawsuit or any facts, allegations, claims or other matters arising from or relating to the Lawsuit or any other litigation, arbitration or other legal proceeding.

3.3Each of the Parties acknowledges that (a) each and any Party may have sustained damages, losses, fees, costs or expenses that are presently unknown or unsuspected; (b) this Agreement has been negotiated and agreed upon in light of such possible damages, losses, fees, costs or expenses; and (c) the Underwriters shall have no obligation to any other Party, and the Parties shall have no obligation to the Underwriters, except as expressly set forth in this Agreement, for any such damages, losses, fees, costs or expenses. The Parties agree that, notwithstanding any statute or provision of the common law that provides that a general release does not extend to claims that a releasor does not know or suspect to exist at the time of executing the release, the releases provided for in this Agreement shall be deemed to constitute a full release in accordance with their respective terms.

Settlement Agreement and Mutual Release.v2

5

The foregoing waiver includes, without limitation, the waiver of all rights provided by California Civil Code section 1542, or by any other similar provision of federal, state or territorial law, which provides:

A GENERAL RELEASE DOES NOT EXTEND TO CLAIMS THAT THE CREDITOR OR RELEASING PARTY DOES NOT KNOW OR SUSPECT TO EXIST IN HIS OR HER FAVOR AT THE TIME OF EXECUTING THE RELEASE AND THAT, IF KNOWN BY HIM OR HER, WOULD HAVE MATERIALLY AFFECTED HIS OR HER SETTLEMENT WITH THE DEBTOR OR RELEASED PARTY.

The Parties knowingly, voluntarily and expressly waive, to the fullest extent permitted by law, any and all rights they may have under any statute or common law principle that would limit the effect of the foregoing releases based upon their knowledge at the time they execute this Agreement. The Parties understand the provisions of this paragraph and knowingly and voluntarily enter into this waiver with the intention of executing this Agreement to discharge each other from any and all present and future, foreseen and unforeseen, claims and causes of action as provided in Sections 3.1 and 3.2 of this Agreement. Each of the Parties acknowledges and agrees that this waiver is an essential and material term of this Agreement, and that, without such waiver, the Agreement would not have been entered into.

4.REPRESENTATIONS AND WARRANTIES

4.1Each Party represents and warrants to the other Parties that such Party has the power and authority to enter into and perform such Party’s obligations under this Agreement.

4.2Each Party represents and warrants to the other Parties that such Party has not assigned, and will not assign, to any other person or entity any claims released by such Party pursuant to this Agreement.

4.3Each of the Parties acknowledges and agrees that such Party has carefully read and fully understands all of the provisions of this Agreement. Each of the Parties acknowledges and

Settlement Agreement and Mutual Release.v2

6

agrees that such Party is entering into this Agreement knowingly and voluntarily and that this Agreement is a product of good faith negotiations between the Parties.

4.4Each Party represents and warrants to the other Parties that (a) such Party is authorized to enter into and perform its obligations under this Agreement; (b) the execution, delivery and performance of this Agreement will not conflict with or result in any violation of or default under (i) any provision of any articles of incorporation, charter, by-laws or partnership agreement or other agreement of such Party or to which such Party is a party or (ii) any decree, statute, law, ordinance, rule or regulation applicable to such Party; (c) no further consent, approval, order, authorization or filing with any court, governmental authority or any other person or entity is required to be made or obtained by such Party in connection with the execution, delivery or performance by such Party of this Agreement which has not been made or obtained by such Party; (d) this Agreement has been duly executed and delivered by such Party; and (e) this Agreement constitutes the legal, valid and binding obligation of such Party, and is enforceable against such Party in accordance with its terms.

5.ADDITIONAL TERMS AND PROVISIONS

5.1Each Party understands, acknowledges and agrees that if any fact now believed to be true by such Party is found hereafter to be other than, or different from, that which is now believed, such Party expressly assumes the risk of such difference in fact and agrees that this Agreement shall and will remain effective notwithstanding any such difference in fact.

5.2The Parties agree that this Agreement shall not be admissible in any other suit, action or other proceeding between or involving any of the Parties, except in a suit, action or proceeding to interpret or enforce this Agreement.

Settlement Agreement and Mutual Release.v2

7

5.3Each Party agrees that such Party will not bring or commence any suit, action or other proceeding against any other Party for any claim, action, cause of action, right or obligation released in this Agreement.

5.4All agreements and understandings between the Parties regarding the matters agreed to herein are embodied in and expressed in this Agreement, and any prior agreements or understandings relating to such matters are fully superseded by this Agreement. Each Party acknowledges that, except as expressly set forth herein, no representations of any kind or character have been made to such Party by the Underwriters to induce the execution of this Agreement.

5.5In the event any of the provisions of this Agreement are deemed to be invalid and unenforceable, those provisions shall be severed from the remainder of this Agreement only if and to the extent agreed upon by the Parties in writing.

5.6This Agreement may be executed in counterparts, each of which shall be deemed an original, but all of which together shall constitute one and the same Agreement. Copies of all or part of this Agreement, including executed counterparts hereto, which are transmitted by facsimile or e-mail shall be presumed valid.

5.7The Parties and their counsel each have contributed to the drafting of this Agreement. No provision of this Agreement shall be construed against any Party by reason of authorship.

5.8This Agreement may not be amended or modified except in a writing signed by all Parties.

5.9 This Agreement shall be governed by, and construed and interpreted in accordance with, the laws of the State of Texas.

Settlement Agreement and Mutual Release.v2

8

IN WITNESS WHEREOF, this Agreement has been executed by each Party hereto as of the date specified below.

Phunware, Inc.

_________________________________ DATE: October 24, 2024

By: Stephen Chen

Title: Chief Executive Officer

Alan Knitowski

_________________________________ DATE: _______________________

By:

Title:

Luan Dang

_________________________________ DATE: _______________________

By:

Title:

Randall Crowder

_________________________________ DATE: _______________________

By:

Title:

Matt Aune

_________________________________ DATE: _______________________

By:

Title:

Settlement Agreement and Mutual Release.v2

9

Prokopios Akis Tsirigakis

_________________________________ DATE: _______________________

By:

Title:

George Syllantavos

_________________________________ DATE: _______________________

By:

Title:

Lori Tauber Marcus

_________________________________ DATE: _______________________

By:

Title:

Kathy Tan Mayor

_________________________________ DATE: _______________________

By:

Title:

Keith Cowan

_________________________________ DATE: _______________________

By:

Title:

Settlement Agreement and Mutual Release.v2

10

Winston Damarillo

_________________________________ DATE: _______________________

By:

Title:

Chase Fraser

_________________________________ DATE: _______________________

By:

Title:

Eric Manlunas

_________________________________ DATE: _______________________

By:

Title:

John Kahan

_________________________________ DATE: _______________________

By:

Title:

Underwriter Subscribing to

Policy No. B0146ERUSA1801075 (Beazley)

________________________________ DATE: _______________________

By:

Title:

Settlement Agreement and Mutual Release.v2

11

Underwriter Subscribing to

Policy No. B0146ERUSA1801075 (Startpoint)

________________________________ DATE: _______________________

By:

Title:

DOCVARIABLE ndGeneratedStamp * MERGEFORMAT 4891-1416-6743.v1

Settlement Agreement and Mutual Release.v2

12

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

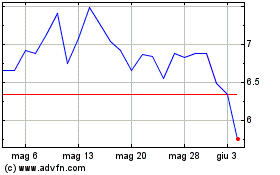

Grafico Azioni Phunware (NASDAQ:PHUN)

Storico

Da Ott 2024 a Nov 2024

Grafico Azioni Phunware (NASDAQ:PHUN)

Storico

Da Nov 2023 a Nov 2024