Form 8-K - Current report

03 Settembre 2024 - 10:06PM

Edgar (US Regulatory)

0001174922false00011749222024-09-032024-09-03

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): September 3, 2024

WYNN RESORTS, LIMITED

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | |

| Nevada | 000-50028 | 46-0484987 |

(State or other jurisdiction

of incorporation) | (Commission

File Number) | (I.R.S. Employer

Identification No.) |

| 3131 Las Vegas Boulevard South | | |

| Las Vegas, | Nevada | | 89109 |

| (Address of principal executive offices) | | (Zip Code) |

(702) 770-7555

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common stock, par value $0.01 | | WYNN | | Nasdaq Global Select Market |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| | | | | |

| Item 7.01 | Regulation FD Disclosure. |

On September 3, 2024, Wynn Macau, Limited ("WML"), an indirect subsidiary of Wynn Resorts, Limited (the "Registrant") with its ordinary shares of common stock listed on The Stock Exchange of Hong Kong Limited (the "HKSE"), filed with the HKSE an announcement (the "Announcement") in relation to an adjustment to the conversion price of its 4.50% convertible bonds due 2029 (the “Convertible Bonds”) as provided under the terms and conditions of the Convertible Bonds. Such terms and conditions provide, among others, that an adjustment be made to the conversion price of the Convertible Bonds if and whenever WML pays or makes any capital distributions, including cash dividends, to its shareholders. Accordingly, effective on September 4, 2024, the conversion price of the Convertible Bonds will be adjusted from HK$10.24375 to HK$10.01212, as a result of the payment by WML of a final dividend of HK$0.075 per share in respect of the year ended December 31, 2023 and an interim dividend of HK$0.075 in respect of the six months ended June 30, 2024. Other than the conversion price adjustment, all other terms and conditions of the Convertible Bonds remain unchanged.

The Registrant owns approximately 72% of WML's ordinary shares of common stock. A copy of the Announcement is furnished herewith as Exhibit 99.1 and incorporated herein by reference.

The information furnished under Item 7.01 of this Current Report on Form 8-K, including Exhibit 99.1 attached hereto, shall not be deemed "filed" for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, except as shall be expressly set forth by specific reference in such filing.

| | | | | |

| Item 9.01 | Financial Statements and Exhibits. |

(d)Exhibits.

| | | | | |

| Exhibit No. | Description |

| |

| 99.1 | |

| 104 | Cover Page Interactive Data File - the cover page XBRL tags are embedded within the Inline XBRL document |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | |

| | | | WYNN RESORTS, LIMITED |

| | |

| Dated: September 3, 2024 | | By: | | /s/ Julie Cameron-Doe |

| | | | Julie Cameron-Doe |

| | | | Chief Financial Officer |

1 * For identification purposes only. Hong Kong Exchanges and Clearing Limited and The Stock Exchange of Hong Kong Limited take no responsibility for the contents of this announcement, make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this announcement. This announcement is for information purposes only and does not constitute an invitation or solicitation of an offer to acquire, purchase or subscribe for securities or an invitation to enter into an agreement to do any such things, nor is it calculated to invite any offer to acquire, purchase or subscribe for any securities. Neither this announcement nor anything herein forms the basis for any contract or commitment whatsoever. The securities referred to herein have not been and will not be registered under the U.S. Securities Act, or with any securities regulatory authority of any state of the United States or other jurisdiction and may not be offered or sold in the United States or to U.S. persons, except pursuant to an applicable exemption from, or in a transaction not subject to, the registration requirements of the U.S. Securities Act and applicable state or local securities laws. No public offer of securities is to be made in the United States. (incorporated in the Cayman Islands with limited liability) (Stock Code: 1128 and Debt Stock Codes: 5279, 5280, 40102, 40259, 40357, 5754) ADJUSTMENT TO CONVERSION PRICE OF THE CONVERTIBLE BONDS (Debt Stock Code: 5754) Reference is made to (i) the announcements of Wynn Macau, Limited (the “Company”) dated 2 March 2023, 3 March 2023 and 7 March 2023 (collectively, the “Announcements”) and the offering memorandum of the Company dated 2 March 2023 (the “Circular”) in relation to the issuance of US$600 million 4.50% convertible bonds due 2029 under general mandate (the “Bonds”); (ii) the annual results announcement of the Company dated 21 March 2024 (the “2023 Annual Results Announcement”); and (iii) the interim results announcement of the Company dated 15 August 2024 (the “2024 Interim Results Announcement”). Unless otherwise stated, capitalised terms used herein shall have the same meanings as those defined in the Announcements and the Circular.

2 ADJUSTMENT TO THE CONVERSION PRICE The terms and conditions of the Bonds provide, among others, that if and whenever the Company shall pay or make any Capital Distribution (such as cash dividend by the Company) to the Shareholders (except to the extent that the Conversion Price falls to be adjusted under Condition 6(C)(2) of the terms and conditions of the Bonds), the Conversion Price shall be adjusted by multiplying the Conversion Price in force immediately before such Capital Distribution by the following fraction: A - B A where: A is the Current Market Price of one Share on the date on which the Capital Distribution is first publicly announced; and B is the Fair Market Value of the portion of the Capital Distribution on the date of such announcement attributable to one Share. Such adjustment shall become effective on the date that such Capital Distribution is actually made or if a record date is fixed therefor, immediately after such record date (the “Record Date”). As announced in the 2023 Annual Results Announcement, the Board recommended the payment of a final dividend of HK$0.075 per Share in respect of the year ended 31 December 2023 (the “2023 Final Dividend”) and, as announced in the 2024 Interim Results Announcement, the Board declared an interim dividend of HK$0.075 per Share for the six months ended 30 June 2024 (the “2024 Interim Dividend”) to the Shareholders whose names appear on the register of members of the Company on 3 September 2024, being the Record Date. Pursuant to the terms and conditions of the Convertible Bonds, the Conversion Price is subject to adjustment for, among other things, capital distributions made by the Company. Accordingly, the Conversion Price was adjusted from HK$10.24375 to HK$10.01212 as a result of the payment of the 2023 Final Dividend and the 2024 Interim Dividend, and such adjustment will become effective on 4 September 2024 (Hong Kong time) (being the date immediately after the Record Date) in connection with the declaration and payment of the 2024 Interim Dividend (collectively, the “Adjustment”). Apart from the Adjustment, all other terms and conditions of the Convertible Bonds will remain unchanged. As at the date of this announcement, the total number of issued Shares of the Company is 5,249,137,600 Shares. Following the Adjustment and assuming full conversion of the Convertible Bonds, the Convertible Bonds are convertible into approximately 470,411,861 Shares, representing approximately 9.0% of the total issued share capital of the Company as at the date of this announcement, and approximately 8.2% of the enlarged total issued share capital of the Company resulting from the full conversion of the Bonds (assuming that there is no other change to the issued share capital of the Company).

3 Holders of the Bonds who are in any doubt as to the action to be taken should consult their professional adviser. By order of the Board Wynn Macau, Limited Dr. Allan Zeman Chairman Hong Kong, 3 September 2024 As at the date of this announcement, the Board comprises Craig S. Billings and Frederic Jean-Luc Luvisutto (as Executive Directors); Linda Chen (as Executive Director and Vice Chairman); Ellen F. Whittemore and Julie M. Cameron-Doe (as Non-Executive Directors); Allan Zeman (as Independent Non-Executive Director and Chairman); and Lam Kin Fung Jeffrey, Bruce Rockowitz, Nicholas Sallnow-Smith and Leah Dawn Xiaowei Ye (as Independent Non-Executive Directors).

v3.24.2.u1

Document and Entity Information

|

Sep. 03, 2024 |

| DEI [Abstract] |

|

| Title of 12(b) Security |

Common stock, par value $0.01

|

| Entity Incorporation, State or Country Code |

NV

|

| Entity File Number |

000-50028

|

| Entity Tax Identification Number |

46-0484987

|

| Entity Address, Address Line One |

3131 Las Vegas Boulevard South

|

| Entity Address, City or Town |

Las Vegas,

|

| Entity Address, State or Province |

NV

|

| Document Type |

8-K

|

| Entity Registrant Name |

WYNN RESORTS, LIMITED

|

| Entity Central Index Key |

0001174922

|

| Document Period End Date |

Sep. 03, 2024

|

| Entity Address, Postal Zip Code |

89109

|

| City Area Code |

702

|

| Local Phone Number |

770-7555

|

| Written Communications |

false

|

| Trading Symbol |

WYNN

|

| Security Exchange Name |

NASDAQ

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

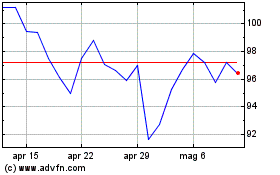

Grafico Azioni Wynn Resorts (NASDAQ:WYNN)

Storico

Da Ott 2024 a Nov 2024

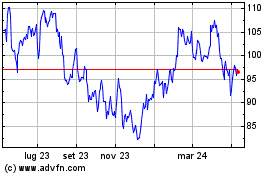

Grafico Azioni Wynn Resorts (NASDAQ:WYNN)

Storico

Da Nov 2023 a Nov 2024