Aames Investment Corporation (NYSE:AIC), a mortgage real estate

investment trust, today reported financial results for the first

quarter of 2005. Total loans held for investment increased to $2.9

billion, the Company declared a $0.27 per share dividend for the

quarter and diluted net loss per share equaled $0.01. During the

quarter, the Company reported a mark-to-market derivative gain

under FASB 133 of $9.5 million, or $0.16 per share. Excluding this

gain, core diluted loss per share totaled $0.17. First Quarter

Highlights -- Loans held for investment in the REIT portfolio

increased by 66% over December 31, 2004 to $2.9 billion; -- The

Company generated a 4.6% net interest margin on average loans; --

Total REIT portfolio delinquencies equaled 1.1%; -- Total mortgage

loan production of $1.4 billion, of which 62% was wholesale and 38%

retail. Mr. A. Jay Meyerson, Chairman and CEO of Aames, commented,

"Our results for the first quarter of 2005 demonstrate our ability

to successfully execute our strategy as a mortgage REIT. We

continued to build a mortgage portfolio through the origination of

loans that meet our underwriting standards and our yield

requirements. Pursuing a portfolio strategy enables Aames to

produce more stable and predictable earnings and a dividend stream

that is less sensitive to quarterly changes in production compared

to a reliance on one-time gains produced through whole-loan sales"

Meyerson continued, "In addition, we have begun to see the benefits

from our efficiency initiatives and are making solid progress in

achieving our long-term cost cutting goals while maintaining a

sound production platform. We continue to review our product

offering and pricing to assure that we remain competitive. We will

not, however, focus simply on lending volume, but will manage to

maximize the returns on and quality of our loan portfolio."

Financial Summary The net loss for the quarter ended March 31, 2005

totaled $766,000, or a diluted loss per share of $0.01. Included in

the net loss was a $9.5 million pretax mark-to-market derivative

gain, which represents a non-cash market adjustment to the

Company's interest rate hedges that reduced interest expense for

the quarter. Excluding this gain, the net loss of the quarter

totaled $10.3 million, or $0.17 per share. Total operating revenue

for the first quarter equaled $42.0 million, with net interest

income of $33.4 million after a $6.5 million provision for loan

losses, gain on sale of loans of $5.7 million and loan servicing

revenue of $2.9 million. Excluding the FASB 133 hedge related fair

value adjustment, core operating revenue equaled $32.4 million,

with core net interest income after provision for loan losses of

$23.8 million. The net yield on average loans for the quarter was

4.55%. The net gain on sale rate for the first quarter equaled

1.77%. Total non-interest expense equaled $42.0 million, or 3.08%

of total loan production. Comparison of the Quarter Ended March 31,

2005 and 2004 Total operating revenue for the first quarter of 2005

decreased by $25.9 million from the first quarter of 2004 while

core operating revenue declined by $35.4 million. The decline

resulted from the continuing transition to a mortgage REIT, which

changed the composition of the Company's earnings from primarily a

gain on sale model to an interest income driven loan portfolio

model. Gain on sale of loans for the 2005 quarter equaled $5.7

million, compared to $54.6 million in the year ago quarter, as the

Company retained the majority of its higher value hybrid production

in its loan portfolio, and sold approximately 24% of its production

in the first quarter of 2005, primarily second lien, fixed rate and

Alt-A loans. Net interest income after the provision for losses for

the March 2005 quarter increased $22.3 million from the 2004

quarter, while core net interest income after the provision for

losses for the 2005 quarter increased $12.7 million. Included in

net interest income for the first quarter of 2005 was a provision

for loan losses of $6.5 million. There was no provision in the

March 2004 quarter. Total non interest expense for the first

quarter of 2005 declined by $5.1 million compared to the year ago

period, driven by lower compensation and production costs from

reduced loan volumes as well as lower general and administrative

expense due to the Company's efficiency initiatives. Comparison of

the Quarter Ended March 31, 2005 and December 31, 2004 Total

operating revenue for the first quarter of 2005 increased by $9.0

million over the fourth quarter of 2004, while core operating

revenue decreased by $497,000. Core net interest income after

provision for losses increased by $1.5 million, with a $6.5 million

provision for loan losses in the first quarter of 2005 compared to

a $1.2 million provision for loan losses in fourth quarter of 2004.

Gain on sale of loans for the quarter decreased by $4.1 million,

again due to the Company's focus on building its loans held for

investment portfolio. Non-interest expense for the first quarter

2005 decreased by $428,000 compared to core non-interest expense

for the fourth quarter of 2004, which excludes $22.0 million of one

time charges related to the REIT conversion and corporate

reorganization for that period. Balance Sheet Total loans held for

investment as of March 31, 2005 increased to $2.9 billion, compared

to $1.7 billion as of December 31, 2004. During the quarter, the

Company closed a $1.2 billion on-balance sheet securitization, and

retained an additional $31.2 million of loans held for investment

but not yet securitized on its March 31, 2005 balance sheet. As of

the close of the first quarter of 2005, Aames also held $383.5

million of loans for sale into the secondary markets, which were

comprised primarily of fixed rate, second mortgage and Alt-A loans.

Average loans for the first quarter equaled $2.7 billion, including

$2.3 billion of loans held for investment and $366.2 million of

loans held for sale into the secondary markets. The allowance for

loan losses as of March 31, 2005 totaled $8.4 million, or 0.29% of

the held for investment portfolio. During the first quarter of

2005, the Company provided $6.5 million for losses. The Company did

not experience any charge-offs in its held for investment portfolio

in the quarter, due primarily to the early seasoning of its held

for investment portfolio. Loan delinquencies in the held for

investment portfolio as of March 31 were 1.1%, and were below

estimated levels. Total equity as of March 31, 2005 equaled $356.8

million, compared to $357.6 million as of December 31, 2004. The

Company continues to build its loans held for investment portfolio

with a targeted leverage ratio of approximately 12 to 14 times

equity. The actual leverage ratio (total loans held for investment

divided by total stockholders' equity) at March 31, 2005 was

approximately 8 times equity, and the Company anticipates achieving

its target ratio in mid 2005. After reaching this target, the

Company will assess the relative benefits in capital and earnings

generation from selling the majority of its loan production for

cash gains or raising additional capital to fund further portfolio

growth. Operating Results Net interest income for the first quarter

of 2005 totaled $39.9 million. The core net interest income equaled

$30.3 million, or 4.55% of average loans. Management anticipates

closing an on-balance sheet securitization of approximately $1.2

billion in the second quarter of 2005 as part its target to

increase the loan portfolio to approximately $4.0 billion.

Management believes that the net interest income from loans held

for investment will represent a majority of revenue as the Company

becomes fully levered and that such income will be a more

sustainable, stable source of earnings than cash gain on sale. Gain

on sale of loans for the March 2005 quarter equaled $5.7 million.

During the quarter, Aames sold approximately $320.6 million of

loans into the secondary markets for cash gain, receiving an

average net premium of 1.77%. As in the fourth quarter of 2004, the

Company generated a lower gain on sale rate as it sold lower value

fixed rate, second mortgage and Alt-A loans, retaining hybrid loans

for its held for investment portfolio. In addition, competitive

pricing pressures and increased market interest rates resulted in

lower premiums paid for whole-loan sales in the first quarter of

2005. While management anticipates continued pricing pressure on

secondary market premiums, the composition of loan sales is

expected to generate higher gain on sale margins. Upon achieving

its targeted leverage ratio, Aames intends to sell a larger volume

of higher value hybrid loans into the secondary market, which it

expects will generate higher premiums than the loans that the

Company currently sells. Loan servicing income for the first

quarter of 2005 totaled $2.9 million, generated primarily by the

Company's portfolio of on-balance sheet securitizations. As the

Company continues to grow its loan portfolio, the components of

servicing fees will move from fees earned on loans serviced for

third parties to fees earned on retained loans, including late fees

and prepayment penalties. Non-interest expense for the March 2005

quarter equaled $42.0 million, comprised of $22.3 million of

compensation expense, $8.8 million of expenses related to loan

production and $10.8 million of general and administrative

expenses. Total expenses as a percentage of loan production equaled

3.08%. In response to the margin compression created by the

competitive environment and in an effort to maximize the return on

its loan portfolio, management initiated a number of cost reduction

programs in the first quarter to lower net operating cost as a

percentage of loan production. The Company believes that the

results of these initiatives will begin to contribute to its

financial results in the second half of 2005. Compared to the

fourth quarter of 2004, the total dollar volume of operating

expenses, excluding the $22.0 million reorganization charge in the

fourth quarter of 2004, decreased by approximately $500,000 during

the March 2005 quarter. Core compensation expense decreased by

$717,000 with production and core general and administrative

expenses up slightly. Core expenses eliminate the impact of one

time charges taken in the fourth quarter of 2004 related to the

Company's conversion to a REIT and its initial public offering.

Loan Production The Company originated $1.4 billion of mortgage

loans during the first quarter of 2005, compared to $1.7 billion in

the fourth quarter of 2004 and $1.9 billion in the first quarter of

2004. The decreased production resulted from the sustained

competitive environment, including aggressive actions by a number

of peers on loan coupons and terms, as well as the impact of higher

interest rates on origination volumes. In response to the current

challenging market environment, the Company has focused more on the

quality of and returns generated by its loan portfolio and its

overall cost to originate loans, rather than simply on absolute

volume. The Company remains committed, however, to offering

competitive products that meet the borrowing needs of its core

customers. Wholesale loan originations for the first quarter

equaled $845.1 million, or 62.1% of total production, while retail

originations equaled $516.6 million, or 37.9% of total production.

For the fourth quarter of 2004, wholesale and retail originations

accounted for 66.4% and 33.6% of total production, respectively.

Management believes that the value of its retail franchise is

maximized in the current lending environment, where direct access

to the consumer and ability to achieve better loan pricing will

increase the value of loan production. During the first quarter,

the Company opened 3 Super Branches and closed 11 traditional

retail branches. About Aames Investment Corporation Aames is a

mortgage REIT and, through its subsidiary Aames Financial

Corporation, originates mortgage loans in 47 states. Aames

Financial is a fifty-year old national mortgage banking company

focused primarily on originating subprime residential mortgage

loans through wholesale and retail channels under the name "Aames

Home Loan." To find out more about Aames, please visit

www.aames.net. Information Regarding Forward Looking Statements

This press release may contain forward-looking statements under

federal securities laws. These statements are based on management's

current expectations and beliefs and are subject to a number of

trends and uncertainties that could cause actual results to differ

materially from those described in the forward-looking statements.

The risks and uncertainties that may cause our performance and

results to vary include: (i) changes in overall economic conditions

and interest rates; (ii) an inability to originate subprime

hybrid/adjustable mortgage loans; (iii) increased delinquency rates

in our portfolio; (iv) adverse changes in the securitization and

whole loan market for mortgage loans; (v) declines in real estate

values; (vi) limited cash flow to fund operations and dependence on

short-term financing facilities; (vii) concentration of operations

in California, Florida, New York and Texas; (viii) extensive

government regulation;(ix) intense competition in the mortgage

lending industry and (x) an inability to comply with the federal

tax requirements applicable to REITs and effectively operate within

limitations imposed on REITs by federal tax rules. For a more

complete discussion of these risks and uncertainties and

information relating to the company, see the Form 10-K for the year

ended December 31, 2004 and other filings with the SEC made by the

company pursuant to the Securities Exchange Act of 1934. Aames

Investment expressly disclaims any obligation to update or revise

any forward-looking statements in this press release. Further

Information For more information, contact Steven Canup, Senior Vice

President, Corporate Development and Investor Relations, in Aames

Investment's Investor Relations Department at (323) 210-5311 or at

info@aamescorp.com via email. -0- *T AAMES INVESTMENT CORPORATION

and SUBSIDIARIES Condensed financial statements (In thousands)

CONDENSED BALANCE SHEETS ------------------------- March 31,

December 31, 2005 2004 ------------ ----------- (unaudited) Cash

and cash equivalents 128,366 $37,780 Loans held for sale, at lower

of cost or market 383,478 484,963 Loans held for investment, net

2,862,407 1,725,046 Advances and other receivables 24,579 22,740

Residual interests, at estimated fair value 18,862 39,082

Derivative instruments, at estimated fair value 51,970 31,947

Prepaid and other assets 58,449 59,317 -------------- -----------

Total assets $3,528,111 $2,400,875 -------------- -----------

Financings on loans held for investment $2,258,106 $1,157,470

Revolving warehouse and repurchase facilities 854,383 809,213 Other

borrowings - 7,680 Other liabilities 58,814 68,886 --------------

----------- 3,171,303 2,043,249 Stockholders' equity 356,808

357,626 -------------- ----------- Total liabilities and

stockholders' equity $3,528,111 $2,400,875 --------------

----------- Shares outstanding 61,421,757 61,360,271 --------------

----------- *T -0- *T AAMES INVESTMENT CORPORATION and SUBSIDIARIES

Condensed financial statements (In thousands, except per share

data) Three Months Ended March 31, -------------------- 2005 2004

-------------------- (Unaudited) Interest income $51,768 $17,678

Interest expense 11,916 6,579 ----------- -------- Net interest

income 39,852 11,099 Provision for losses on loans held for

investment 6,500 - ----------- -------- Net interest income after

provision for losses 33,352 11,099 Noninterest income: Gain on sale

of loans 5,683 54,599 Loan servicing 2,924 2,155 -----------

-------- Total noninterest income 8,607 56,754 ----------- --------

Net interest income and noninterest income 41,959 67,853

Noninterest expense: Personnel 22,347 25,348 Production 8,800

10,333 General and administrative 10,813 11,375 -----------

-------- Total noninterest expense 41,960 47,056 -----------

-------- Income (loss) before income taxes (1) 20,797 Provision

(benefit) for income taxes 765 (93) -------------------- Net income

(loss) $(766) $20,890 -------------------- Net income (loss) to

common stockholders: Basic $(766) $18,021 --------------------

Diluted $(766) $21,412 -------------------- Net income (loss) per

common share: Basic $(0.01) $2.53 -------------------- Diluted

$(0.01) $0.20 -------------------- Weighted average number of

common shares outstanding: Basic 61,420 7,120 --------------------

Diluted 61,420 104,800 -------------------- Mark to market on

interest rate cap agreements designed to hedge interest rate risk

on financings of loans held for investments $9,532 $- Income (loss)

before income taxes, excluding mark to market adjustment (9,533)

20,797 Provision (benefit) for income taxes 765 (93)

-------------------- Net income (loss) to common stockholders,

excluding mark to market adjustment $(10,298) $20,890

-------------------- Diluted net income (loss) per common share,

excluding mark to market adjustment $(0.17) $0.20 *T -0- *T AAMES

INVESTMENT CORPORATION and SUBSIDIARIES Other financial data

(Unaudited) (In thousands) Condensed Statement of Cash Flow

Information Three Months Ended March 31,

------------------------------ 2005 2004 ------------ ----------

Net cash provided by (used in): Operating activities $101,221

$(82,947) Investing activities (1,144,929) (930) Financing

activities 1,134,294 89,337 ------------ ---------- Net increase

(decrease) in cash and cash equivalents 90,586 5,460 Cash and cash

equivalents, beginning of period 37,780 11,611 ------------

---------- Cash and cash equivalents, end of period $128,366

$17,071 ------------ ---------- *T -0- *T AAMES INVESTMENT

CORPORATION and SUBSIDIARIES Supplemental Information LOAN

PRODUCTION: (In thousands) Three Months Ended

----------------------------------- March 31, December 31, 2005

2004 2004 ----------------------- ----------- (Unaudited) RETAIL

PRODUCTION Total dollar amount $516,558 $586,527 $574,625 Number of

loans 3,718 4,677 4,431 Average loan amount $138,934 $125,407

$129,683 Average initial LTV 75.88% 77.85% 75.82% Weighted average

interest rate 7.53% 7.26% 7.36% WHOLESALE PRODUCTION Total dollar

amount $845,058 $1,279,701 $1,134,911 Number of loans 6,028 8,630

7,841 Average loan amount $140,189 $148,285 $144,741 Average

initial LTV 81.25% 81.68% 81.19% Weighted average interest rate

7.60% 7.17% 7.46% TOTAL PRODUCTION Total dollar amount $1,361,616

$1,866,228 $1,709,536 Number of loans 9,746 13,307 12,272 Average

loan amount $139,710 $140,244 $139,304 Average initial LTV 79.21%

80.47% 79.38% Weighted average interest rate 7.57% 7.20% 7.43%

Total production by loan purpose:

---------------------------------- Cash-out refinance $799,342

$1,146,498 $1,019,194 Purchase money 519,656 616,352 636,722

Rate/term refinance 42,618 103,378 53,620 ----------- -----------

----------- Total $1,361,616 $1,866,228 $1,709,536 -----------

----------- ----------- Total production by property type:

---------------------------------- Single family $1,194,927

$1,630,242 $1,510,413 Multi-family 94,399 136,211 111,322

Condominiums 72,290 99,775 87,801 ----------- -----------

----------- Total $1,361,616 $1,866,228 $1,709,536 -----------

----------- ----------- Total production by state/region produced:

---------------------------------- California $372,922 $617,210

$523,701 Florida 296,851 364,132 345,653 New York 93,558 151,579

103,796 Texas 111,392 119,119 129,579 Other Western states 139,291

193,433 184,520 Other Midwestern states 95,226 168,125 140,751

Other Northeastern states 145,853 139,870 161,677 Other

Southeastern states 106,523 112,760 119,859 ----------- -----------

----------- Total $1,361,616 $1,866,228 $1,709,536 -----------

----------- ----------- *T -0- *T AAMES INVESTMENT CORPORATION and

SUBSIDIARIES Supplemental Information Production by interest rate

type: Three Months Ended

------------------------------------------------- March 31, 2005

March 31, 2004 December 31, 2004 --------------- ---------------

----------------- Hybrid: Traditional $947,520 $1,396,112

$1,252,757 Interest only 148,807 - 91,203 Fixed rate 265,289

470,116 365,576 --------------- --------------- -----------------

$1,361,616 $1,866,228 $1,709,536 --------------- ---------------

----------------- Loan production by credit grade during the three

months ended March 31, 2005 (in thousands): Average Weighted

Weighted Credit Dollar Amount % of Credit Average Average Grade of

Loans Total Score Interest LTV Rate ----------- --------------

---------- ------------- --------- -------- A + $1,045,216 77% 627

7.4% 80% A 135,323 10% 584 7.6% 77% A - 57,664 4% 557 8.0% 75% B

76,578 6% 559 8.4% 76% C 37,533 3% 552 9.0% 70% C- 9,302 NM 550

10.4% 64% -------------- ---------- ------------- ---------

-------- Total $1,361,616 100% 610 7.6% 79% --------------

---------- ------------- --------- -------- Loan production by

credit grade during the three months ended March 31, 2004 (in

thousands): Average Weighted Weighted Credit Dollar Amount % of

Credit Average Average Grade of Loans Total Score Interest LTV Rate

------------ ------------- ----------- ------------- --------

-------- A + $1,341,449 72% 625 7.0% 82% A 242,310 13% 591 7.2% 80%

A - 105,960 6% 562 7.6% 78% B 118,208 6% 562 8.0% 77% C 47,070 4%

554 8.6% 71% C- 11,063 1% 540 9.8% 67% D 168 NM 503 6.7% 71%

------------- ----------- ------------- -------- -------- Total

$1,866,228 100% 609 7.2% 80% ------------- -----------

------------- -------- -------- *T -0- *T AAMES INVESTMENT

CORPORATION and SUBSIDIARIES Supplemental Information Loan

production by credit score range during the three months ended

March 31, 2005 (in thousands): Weighted Weighted Credit Score

Dollar Amount % of Average Average Range of Loans Total Interest

Rate LTV -------------- ------------- -------- ---------------

--------------- Above 700 $88,485 6% 7.0% 79% 661-700 176,452 13%

7.0% 79% 621-660 371,222 27% 7.3% 81% 581-620 329,911 27% 7.4% 80%

541-580 230,475 17% 8.1% 79% 540 and below 163,907 12% 8.6% 74% Not

available 1,164 NM 8.2% 84% ------------- -------- ---------------

--------------- Total $1,361,616 100% 7.6% 79% -------------

-------- --------------- --------------- Loan production by credit

score range during the three months ended March 31, 2004 (in

thousands): Weighted Weighted Credit Score Dollar Amount % of

Average Average Range of Loans Total Interest Rate LTV

-------------- ------------- --------- --------------

-------------- Above 700 $122,334 7% 6.6% 79% 661-700 239,961 13%

6.8% 82% 621-660 466,311 25% 7.0% 81% 581-620 424,989 23% 7.1% 81%

541-580 363,860 19% 7.6% 81% 540 and below 246,350 13% 8.1% 76% Not

available 2,423 NM 7.6% 81% ------------- --------- --------------

-------------- Total $1,866,228 100% 7.6% 80% -------------

--------- -------------- -------------- *T -0- *T AAMES INVESTMENT

CORPORATION and SUBSIDIARIES Supplemental Information LOAN

SERVICING (Dollars in thousands) March 31, December 31, 2005 2004

2004 ------------ ----------- --------------- (Unaudited) Mortgage

loans serviced: Loans held for investment $2,858,192 $- $1,718,696

Loans serviced on an interim basis 625,211 2,074,602 771,830 Loan

subserviced for others on a long-term basis 119,908 - 129,016 Loans

in securitization trusts 106,522 260,743 224,345 ------------

----------- --------------- Serviced in-house 3,709,833 2,335,345

2,843,887 Loans serviced by others - 59,727 ------------

----------- --------------- Total servicing portfolio $3,709,833

$2,395,072 $2,843,887 ------------ ----------- ---------------

Percentage serviced in-house 100.0% 97.5% 100.0% ------------

----------- --------------- At or During the Three Months Ended

March 31, December 31, ------------------- 2005 2004 2004

----------- ----------- ----------- (Unaudited) Percentage of

dollar amount of delinquent loans serviced (period end): One month

0.5% 0.4% 0.3% Two months 0.3% 0.2% 0.2% Three or more months: Not

foreclosed 1.4% 2.5% 1.8% Foreclosed 0.2% 0.3% 0.2% -----------

----------- ----------- Total 2.4% 3.4% 2.5% -----------

----------- ----------- Percentage of dollar amount of delinquent

loans in: Loans held for investment (1) 1.1% - 0.2% Loans serviced

on an interim basis (2) 4.2% 0.7% 1.5% Loans subserviced for others

on a long-term basis 5.5% 1.7% 4.8% Loans in off-balance

securitization trusts serviced: In-house 23.2% 15.8% 22.5% By

others - 39.8% - Percentage of dollar amount of loans foreclosed

during the period to servicing portfolio 0.1% 0.2% 0.1% Number of

loans foreclosed during the period 42 61 68 Principal amount of

foreclosed loans during the period $2,351 $4,659 $3,585 Number of

loans liquidated during the period 69 125 163 Net losses on

liquidations during the period $2,104 $4,518 $6,778 Percentage of

annualized losses to servicing portfolio 0.3% 0.6% 0.5% Servicing

portfolio at period end $3,710,000 $2,395,000 $2,844,000 (1) REIT

portfolio of loans held for investment (2) Loans held for sale and

loan sold to third parties with pending transfer of servicing *T

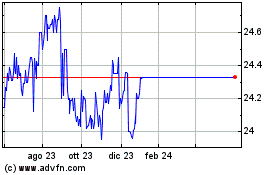

Grafico Azioni Arlington Asset Investment (NYSE:AIC)

Storico

Da Apr 2024 a Mag 2024

Grafico Azioni Arlington Asset Investment (NYSE:AIC)

Storico

Da Mag 2023 a Mag 2024