Aames Investment Corporation (NYSE: AIC): -- Company to Convert to

C Corp. Status Through Corporate Restructuring and Creation of

Captive REIT -- Wholesale Cost Reductions Begun with Closure of 2

Centers and Elimination of 100 Positions -- Core EPS for the

Quarter of $0.02, GAAP EPS Loss of $0.07 Aames Investment

Corporation (NYSE: AIC), a nationwide subprime mortgage lender

today announced full financial results for the fourth quarter of

2005 and provided an update on recently announced corporate

changes. Diluted core EPS for the quarter equaled $0.02, while

diluted net loss per common share for the December 2005 quarter

equaled $0.07 on a GAAP basis. During the quarter, the Company

recorded a pretax mark-to-market derivative loss under FASB 133 of

$5.3 million, representing a diluted non-core loss per share of

$0.09. Fourth Quarter 2005 Highlights -- Net cost to originate of

1.75%, compared to 2.08% in the September 2005 quarter; -- Total

loan production of $1.9 billion, with the Retail Channel accounting

for 43% of total; -- Taxable portfolio net interest margin of

2.75%; -- Weighted average interest rate of 7.81% on the quarter's

production, up 40 basis points from the third quarter of 2005. Mr.

A. Jay Meyerson, Chairman and CEO of Aames, commented, "The fourth

quarter results highlight our commitment to improving our

efficiency, further growing our retail originations and to

increasing the coupons on our loan production. We were pleased to

achieve a 1.75% net cost to originate ratio, well below where we

started the year, and to have our retail channel contribute over

40% of total production. We also made progress during the quarter

in raising rates on our production, a trend that continues in the

first quarter of 2006. Notwithstanding these improvements, the

mortgage banking business faced a sustained challenge to sell loans

at a profitable level in the fourth quarter. While whole loan sale

pricing decreased across the board during the quarter, prices paid

for second lien and selected other loans in particular decreased

quickly and impacted our net gain rate. We remain cautious

regarding whole loan sales premiums moving into early 2006, and

will focus on making significant reductions in our cost to

originate ratio in response to this outlook." Update on Corporate

Restructuring Mr. Meyerson commented on the Company's

restructuring, "In our summary earnings announcement on the 17th of

March we mentioned our plan to eliminate our REIT status at the

parent company level and to expand our corporate cost reduction

initiatives. The actions that we are taking are designed to

substantially reduce our cost to originate, increase our

stockholders' equity and improve our ability to generate meaningful

net income. We have taken these steps because we believe that the

recent challenges in the subprime sector are likely to continue

into the foreseeable future. Aames, however, has a number of unique

assets through which we can effectively address the challenges

currently faced by the subprime industry, including our strong

retail franchise, and $304.1 million of net operating loss

carry-forward (NOLs) in our taxable REIT subsidiary." Elimination

of REIT Status Meyerson stated, "In order to take full advantage of

our NOLs, while eliminating the REIT status at the parent company

level to preserve capital, we decided to reorganize so that Aames

Financial, our current TRS will become our parent company and a C

Corp for tax purposes, and our existing REIT will become a captive

REIT subsidiary. This structure will allow us to utilize our NOLs

to shelter the vast majority of the income produced by our current

loan portfolio. In addition, we currently believe that the captive

REIT structure will allow us to potentially access the preferred

stock market to fund additional portfolio growth." Aames expects to

file shortly a proxy/registration statement with the SEC in

connection with the corporate restructuring and will seek

shareholder approval of the change at a special shareholders

meeting in the next several months. Wholesale Consolidation Mr.

Meyerson also commented on the consolidation of the Company's

wholesale operations and the resulting cost reductions. "We

continue to improve our efficiency in our retail platform, lowering

our net cost to originate each quarter of 2005. Our wholesale

operation, however, has struggled to achieve meaningful operating

leverage in the current environment, requiring us to make a number

of structural changes to our cost base. We are in the process of

closing two wholesale operating centers, in Deerfield, Florida and

Parsippany, New Jersey, and will consolidate the functions

previously performed in those centers into our Irvine, California,

Jacksonville, Florida and Dallas, Texas locations. We have also

eliminated 100 positions in our wholesale channel. We estimate that

the combined annual savings from these initial actions will be $10

million. We have identified additional cost reductions in operating

expenses of approximately $10 million, which we plan on eliminating

within the next four months. We are making a number of other

changes to our wholesale operations, in order to reduce our fixed

and variable cost components and move the net cost ratio down to a

level that allows us to achieve a profit in our wholesale division

in the current market environment. We have made solid progress in

achieving our goal of a 2006 net cost to originate ratio at or

below our current level." In connection with these cost reduction

initiatives, Aames estimates that it will incur a first quarter

2006 charge of approximately $2.0 million. The Company anticipates

that it will begin to realize the benefits of these cost reductions

beginning in the second quarter of 2006. Aames also continues to

review its entire cost structure to determine additional expense

reductions to further improve efficiency. Earnings Guidance Policy

The Company believes that current market conditions preclude it

from providing a narrow range of estimates for earnings at this

time and that any estimates are subject to changes given the

volatile market conditions in the subprime sector. Based on the

Company's current outlook, core EPS for 2006 is estimated to range

from $0.80 to $1.00 per share. The Company expects that the current

loan pricing environment, along with its focus on restructuring

activities will result in a core net loss for the first quarter of

2006, with a target of returning to profitability by the second

quarter. The Company will review its guidance policy each quarter

based on changes in market conditions and its own financial

performance. Financial Disclosure The Company has included

measurements of core financial metrics, including core net interest

income, core net income and loss and core diluted earnings and loss

per share, which are non-GAAP financial metrics. Core earnings

excludes the mark-to-market derivative gain or loss under FASB 133,

as well as non-core charges or credits to income. The Company does

not account for its derivative financial instruments as cash flow

or fair value hedges under the provisions of Statement of Financial

Accounting Standards No. 133 (Accounting for Derivative Financial

Instruments and Hedging Activities) and, as a result, the

unrealized mark to market gains or losses on the derivative

instruments are recorded as income or losses, even thought the cash

flows will not be received until sometime in the future. By

excluding the impact of the mark-to-market gain or loss from the

net income or net loss, management believes that core net interest

income and core net income or loss can provide a useful measurement

of the Company's operating performance. Throughout this press

release, the Company will provide comparisons between the fourth

quarter of 2005 and both the third quarter of 2005 and the fourth

quarter of 2004. Due to the change in the Company's primary

operating strategy following its November 2004 reorganization from

a mortgage banking platform, where the Company originated and sold

all of its production for a cash gain, to a mortgage REIT in which

the Company retains a substantial portion of its production for its

loans held for investment portfolio and generates interest income,

management believes that some comparisons to prior year periods do

not provide the best measurement of the Company's financial

performance. Revenue The following table details the components of

total and core revenues for the quarters ended December and

September 2005 and December 2004. -0- *T (dollars in Quarter Ended

Percentage Change thousands) ----------------------------------

----------------- 12/31/2005 12/31/2004 9/30/2005 Y-Y Sequential

----------- ----------- ---------- ------ ---------- Net interest

income after provision for loan losses(1) $34,734 $21,690 $42,677

60.1% -18.6% Noninterest income 2,554 10,989 21,300 -76.8% -88.0%

----------- ----------- ---------- Total revenue 37,288 32,679

63,977 14.1% -41.7% Mark-to-market loss (gain) on derivative

financial instruments 5,300 (6,344) (7,121) nm -174.4% -----------

----------- ---------- Total core revenue $42,588 $26,335 $56,856

61.7% -25.1% =========== =========== ========== (1) NII for all

2005 periods includes the FASB 133 mark-to-market gain or loss on

derivative financial instruments. *T Total core revenue for the

December 2005 quarter equaled $42.6 million, a 25% sequential

decrease from the September 2005 quarter. The decrease resulted

from an 88% decline in non interest income, related entirely to the

net gain on sale for the December quarter falling to $0.3 million

from $19.6 million in the September quarter. Total revenue for the

fourth quarter of 2005 was $37.3 million compared to $64.0 million

in the third quarter of the year. Included in the total revenue

numbers were a mark to market loss of $5.3 million for the fourth

quarter and a mark to market gain of $7.1 million in the third

quarter. Net Interest Income The following table details the

components of net interest income before the provision for loan

losses for the quarters ended December and September 2005 and

December 2004. -0- *T (dollars in Quarter Ended Percentage Change

thousands) ---------------------------------- -----------------

12/31/2005 12/31/2004 9/30/2005 Y-Y Sequential -----------

----------- ---------- ------ ---------- Interest earned on: Loans

held for investment $71,371 $15,957 $74,651 347.3% -4.4% Loans held

for sale 18,987 15,289 10,601 24.2% 79.1% Overnight investments

1,120 281 812 298.6% 37.9% Income from derivative financial

instruments 11,922 488 8,244 nm 44.6% Amortization of net deferred

loan origination costs (1,578) (200) (1,345) nm 17.3% Prepayment

penalty fees 9,015 88 7,946 nm 13.5% Other 92 121 82 -24.0% 12.2%

----------- ----------- ---------- Total interest income $110,929

$32,024 $100,991 246.4% 9.8% Interest expense $59,134 $12,525

$48,731 372.1% 21.3% Mark-to-market (gain) loss on derivative

financial instruments 5,300 (6,344) (7,121) nm nm Amortization of

financing costs 2,662 1,718 3,550 54.9% -25.0% Other 170 535 154

-68.2% 10.4% ----------- ----------- ---------- Total interest

expense $67,266 $8,434 $45,314 697.6% 48.4% Net interest income(1)

$43,663 $23,590 $55,677 85.1% -21.6% Add (subtract) mark-to-market

(gain) loss on derivative financial instruments 5,300 (6,344)

(7,121) ----------- ----------- ---------- Core net interest

income(1) $48,963 $17,246 $48,556 183.9% 0.8% ===========

=========== ========== (1) Before the provision for losses on loans

held for investment. *T Core net interest income for the fourth

quarter of 2005, which excludes the impact of any mark-to-market

gains or losses on derivative instruments, was $49.0 million,

compared to $48.6 million in the third quarter of 2005. Net

interest income for the quarter reflected higher interest income

from loans held for sale, the benefit of the Company's interest

rate derivative instruments, higher prepayment penalty income and

lower amortization of financing costs, offset by lower income from

loans held for investment and higher interest expense. During the

fourth quarter of 2005, the average balance of loans held for

investment decreased by approximately $126 million to $4.1 billion,

as the Company chose to sell the majority of lower coupon loans

produced earlier in the quarter as it increased coupons and retain

for its portfolio the higher coupon loans originated later in the

quarter. The table below provides the details of the components of

the REIT net interest margin for the December and September 2005

quarters. -0- *T Quarter Ended ---------------------- 12/31/2005

9/30/2005 ----------- ---------- Gross yield on LHFI 6.97% 7.07%

Prepayment penalty fees 0.88% 0.75% Amortization of premiums -0.70%

-0.43% Amortization of deferred loan fees and costs -0.15% -0.13%

----------- ---------- Net yield on LHFI 7.00% 7.26% Net cost of

funding for LHFI 3.63% 3.63% Hedge premium amortization 0.07% 0.76%

----------- ---------- Net interest margin 3.30% 2.87% Servicing

costs -0.47% -0.45% ----------- ---------- Portfolio net interest

margin 2.83% 2.42% Net charge-offs -0.11% 0.00% Portfolio income

margin 2.72% 2.42% =========== ========== LHFI = Loans held for

investment *T The net interest margin for the Company's REIT

portfolio for the fourth quarter of 2005 equaled 2.72%, compared to

2.42% in the third quarter of the year. The increase in the net

interest margin resulted from a lower funding cost, driven by a

reduced amortization of interest rate hedge expenses, partially

offset by a lower interest income ratio, driven by a lower gross

yield on loans held for investment and higher amortization of

deferred premium. The reduced hedge premium amortization for the

quarter reflected a true up of the amortization level to more

closely match the income expected from the derivative financial

instruments. The Company had been amortizing its hedge premiums

based on estimated notional balance run-off. The Company estimates

that a normalized hedge premium amortization is approximately 65

basis points, which results in a pro forma fourth quarter 2005

portfolio income margin of 2.14%. Noninterest Income The following

table details the components of noninterest income for the quarters

ended December and September 2005 and December 2004. -0- *T

(dollars in Quarter Ended Percentage Change thousands)

---------------------------------- ----------------- 12/31/2005

12/31/2004 9/30/2005 Y-Y Sequential ----------- -----------

---------- ------ ---------- Noninterest income: Gain on sale of

loans $348 $10,258 $19,580 -96.6% -98.2% Loan servicing revenue

2,206 731 1,720 201.8% 28.3% ----------- ----------- ----------

Total noninterest income $2,554 $10,989 $21,300 -76.8% -88.0%

=========== =========== ========== *T Total noninterest income for

the fourth quarter of 2005 decreased by $18.7 million compared to

the third quarter of 2005, due to a decrease in the net gain on

sale of loans, partially offset by higher servicing revenue. The

following table details the components of the gain on sale of loans

for the quarters ended December and September 2005 and December

2004. -0- *T (dollars in Quarter Ended Percentage Change thousands)

---------------------------------- ----------------- 12/31/2005

12/31/2004 9/30/2005 Y-Y Sequential ----------- -----------

---------- ------ ---------- Gain on sale of loans: Gain on whole

loan sales $14,087 $9,417 $21,838 49.6% -35.5% Loan originations

fees, net 330 2,160 1,558 -84.7% -78.8% Provision for

representation, warranty and other losses (13,848) (494) (3,796) nm

264.8% Gains (losses) on interest rate cap hedges for loans held

for sale - (584) - nm Miscellaneous costs (221) (241) (20) -8.3%

1005.0% ----------- ----------- ---------- Total gain on sale of

loans $348 $10,258 $19,580 -96.6% -98.2% =========== ===========

========== Whole loan market sales $1,165,887 $426,736 $915,457

Gross gain on sale rate 1.21% 2.21% 2.39% Net gain on sale rate

0.03% 2.40% 2.14% *T The gross gain on sale of loans for the fourth

quarter of 2005 equaled 1.21% of loans sold, a ratio that reflects

both the composition of the loans sold as well as current market

premiums for whole loan sales. During the fourth quarter, a number

of issues impacted the gain on sale of loans, including the

dramatic reduction in the demand and pricing for second lien loans

and the rapid increase in the coupons required by loan buyers on

loans to obtain premium pricing. Loans originated during the third

quarter and held for sale into the fourth quarter accounted for

40.0% of total loan sales for the December quarter and had coupons

below the prevailing rate on more recent loans. Second lien loans

accounted for 8.8% of total loan sales during the fourth quarter.

During the fourth quarter, pricing for second liens decreased

dramatically, with most second loans trading below par, reflecting

the market's concern over general credit conditions and home

values. The proportion of second liens in the total loan sales also

negatively impacted the net points and fees realized in the gain on

sale ratio, since the majority of the Company's second lien loans

are originated in the wholesale channel where Aames collects only

modest amounts of such revenue. Combined with a $13.8 million

provision for LOCOM, representation, warranty and other losses, the

lower points and fees resulted in a net gain on sale ratio of 0.03%

for the December 2005 quarter. The provision for representation,

warranty and other losses included the following items for the

fourth quarter of 2005. -0- *T (dollars in thousands) Provision for

representation, warranty and other losses: Lower of cost or market

provision (15,193) Representation and warranty provision 1,345

--------- Total $(13,848) ========= *T The provision for

representations, warranty and other losses on loans sold during the

quarter also contributed to the substantially reduced net gain on

sale of loans. Based on the market valuation of loans held for sale

as of December 31, 2005, the Company made a lower of cost or market

provision of $15.2 million. This was partially offset by a benefit

for representations and warranty contingencies of $1.3 million, as

the contingent exposure on certain loans sold in earlier periods

expired with lower actual representation and warranty losses than

anticipated. Servicing revenue for the December 2005 quarter

equaled $2.2 million, compared to $1.7 million in the September

quarter. The increase reflects higher late charges and other fees

collected on loans serviced, primarily in the Company's held for

investment portfolio. Noninterest Expense The following table

details the components of noninterest expense for the quarters

ended December and September 2005 and December 2004. -0- *T

(dollars in Quarter Ended Percentage Change thousands)

---------------------------------- ----------------- 12/31/2005

12/31/2004 9/30/2005 Y-Y Sequential ----------- -----------

---------- ------ ---------- Noninterest expense: Personnel $24,107

$40,064 $23,783 -39.8% 1.4% Production 8,716 8,605 9,258 1.3% -5.9%

General and administrative 8,567 15,476 10,312 -44.6% -16.9%

----------- ----------- ---------- Total noninterest expense 41,390

64,145 43,353 -35.5% -4.5% Non-core income (expense) - (21,512)

1,635 nm nm ----------- ----------- ---------- Core noninterest

expense $41,390 $42,633 $44,988 -2.9% -8.0% =========== ===========

========== *T Total core noninterest expense for the December 2005

quarter decreased by approximately $3.6 million, or 8% compared to

the September 2005 quarter. The sequential decrease in core

noninterest expense reflects lower production and G&A expense,

offset slightly by higher personnel expenses. During the fourth

quarter the Company undertook additional cost reduction actions,

including the consolidation of additional retail branches into

Super Branch locations. As of December 31, 2005, the Company had a

total of 76 retail locations, down from 83 at September 30, 2005.

As of December 31, 2005, 50 of the Company's 76 retail branches

were Super Branches. Net Cost to Originate The net cost to

originate loans is a non GAAP measurement of the Company's

efficiency trends within the meaning of Regulation G promulgated by

the Securities and Exchange Commission. The data represents

reported operating expenses, plus the origination costs deferred

under SFAS No. 91 (Accounting for Nonrefundable Fees and Costs

Associated with Origination or Acquiring Loans and Initial Direct

Costs of Leases), less (i) the cost of servicing the Company's

loans held for investment portfolio, (ii) certain corporate

overhead costs and (iii) the fees received on originations less

points paid on wholesale originations. The Company believes that

the non GAAP measurement of the net cost to originate is indicative

of its ability to generate profits from the sale of its loans into

the secondary markets and an indication of its overall efficiency.

The table below details the components of the net cost to originate

loans for the quarters ended December and September 2005 and

December 2004. -0- *T (dollars in Quarter Ended Percentage Change

thousands) ----------------------------------- -----------------

12/31/2005 12/31/2004 9/30/2005 Y-Y Sequential -----------

----------- ----------- ------ ---------- Total noninterest expense

$41,390 $64,145 $43,353 -35.5% -4.5% Non-core income (expense) -

(21,512) 1,635 nm nm Deferred loan origination costs 24,306 19,619

24,319 23.9% -0.1% Loan servicing and other costs (3,274) (1,739)

(2,733) 88.3% 19.8% ----------- ----------- ----------- Total

expenses 62,422 60,513 66,574 3.2% -6.2% Loan origination fees

received (29,567) (13,820) (26,716) 113.9% 10.7% -----------

----------- ----------- Net cost to originate $32,855 $46,693

$39,858 -29.6% -17.6% =========== =========== =========== Total

loan originations $1,882,603 $1,709,536 $1,913,296 10.1% -1.6% Cost

Ratios: Core noninterest expense 2.20% 2.49% 2.35% -11.8% -6.5%

Deferred loan origination costs 1.29% 1.15% 1.27% 12.5% 1.6% Loan

servicing and other costs -0.17% -0.10% -0.14% 71.0% 21.7%

----------- ----------- ----------- Total expenses 3.32% 3.54%

3.48% -6.3% -4.7% Loan origination fees received -1.57% -0.81%

-1.40% 94.3% 12.5% ----------- ----------- ----------- Net cost to

originate 1.75% 2.73% 2.08% -36.1% -16.2% =========== ===========

=========== *T The net cost to originate for the December 2005

quarter equaled 1.75% of total loan production, a 16% decrease from

the third quarter of 2005. The improvement in the cost ratio

resulted from retail loans representing a higher percentage of

total originations and lower core operating expenses. As previously

stated, the Company believes that in the current market

environment, a cost to originate ratio in the 1.40% to 1.50% range

is required to produce net profits in its mortgage banking

division. The Company intends to achieve this lower cost ratio

through a combination of a higher percentage of originations from

the retail channel as well as the planned wholesale cost

reductions. Loan Portfolio Total loans held for investment as of

December 31, 2005 equaled $4.1 billion, compared to $4.2 billion as

of September 30, 2005. The Company also had $951.2 million of loans

held for sale as of December 31, 2005. At the end of the fourth

quarter, the Company's leverage ratio, defined as total loans held

for investment divided by total consolidated shareholders' equity,

equaled 15.2 times. This leverage ratio is slightly higher than the

previous 12 to 14 times equity range of the Company's targets. As a

C Corp, the Company currently expects to maintain a leverage ratio

near 15 times its equity base. Loan Production The following table

details the Company's loan production for the quarters ended

December and September 2005 and December 2004. -0- *T (dollars in

Quarter Ended Percentage Change thousands)

----------------------------------- ---------------- 12/31/2005

12/31/2004 9/30/2005 Y-Y Sequential ----------- -----------

----------- ----- ---------- Retail $811,096 $574,625 $793,851

41.2% 2.2% Wholesale 1,071,507 1,134,911 1,119,445 -5.6% -4.3%

----------- ----------- ----------- Total loan production

$1,882,603 $1,709,536 $1,913,296 10.1% -1.6% ===========

=========== =========== *T Loan production for the fourth quarter

of 2005 equaled $1.9 billion, a $30.7 million sequential decrease

from the third quarter of 2005 primarily as a result of normal

seasonal volatility. Retail loans increased by 2.2% over the

September 2005 level and by 41.2% over the December 2004 quarter,

while wholesale loans decreased by 4.3% and 5.6% respectively for

the same periods. Wholesale production accounted for 56.9% of total

production for the fourth quarter of 2005, compared to 58.5% for

the third quarter, while retail production accounted for 43.1% for

the December 2005 quarter and 41.5% for the September quarter.

Credit Quality The allowance for loan losses for the loans held for

investment portfolio as of December 31, 2005 equaled $43.4 million,

or 1.05% of the gross loans held for investment portfolio. The

Company provided $8.9 million for loan losses during the fourth

quarter of 2005. Total delinquencies in the loans held for

investment portfolio equaled 7.0% at the end of the December 2005

quarter, compared to 4.4% at the end of the September 2005 quarter.

While the level of delinquencies in the held for investment

portfolio is higher than anticipated, the Company continues to

experience loan losses that are better than expectations. The

December 2005 quarter was the first quarter in which the REIT

portfolio experienced any net charge-offs, with total net losses of

$1.4 million, or an annualized 0.14% of the average held for

investment portfolio. The Company continues to anticipate an

increase in the level of delinquencies and credit losses as the

loans held for investment portfolio seasons and less new loans are

added to the portfolio. The Company continues to evaluate exposure

to its production levels and delinquencies as a result of

hurricanes Katrina, Rita and Wilma. While no assurances can be

given, the Company currently believes that its consolidated

financial position and results of operations will not be materially

effected by the events. About Aames Investment Corporation Aames is

a fifty-year old national mortgage banking company that originating

subprime residential mortgage loans in 47 states through wholesale

and retail channels under the name "Aames Home Loan." To find out

more about Aames, please visit www.aames.com. Information Regarding

Forward Looking Statements This press release may contain

forward-looking statements under federal securities laws. These

statements are based on management's current expectations and

beliefs and are subject to a number of trends and uncertainties

that could cause actual results to differ materially from those

described in the forward-looking statements. The risks and

uncertainties that may cause the Company's performance and results

to vary include: (i) limited cash flow to fund operations and

dependence on short-term financing facilities; (ii) changes in

overall economic conditions and interest rates; (iii) increased

delinquency rates in the portfolio; (iv) intense competition in the

mortgage lending industry; (v) adverse changes in the

securitization and whole loan market for mortgage loans; (vi)

declines in real estate values; (vii) an inability to originate

subprime hybrid/adjustable mortgage loans; (viii) obligations to

repurchase mortgage loans and indemnify investors; (ix)

concentration of operations in California, Florida, New York and

Texas; the occurrence of natural disasters (including the adverse

impact of hurricanes Katrina, Rita and Wilma); (x) extensive

government regulation; and (xi) an inability to comply with the

federal tax requirements applicable to REITs and effectively

operate within limitations imposed on REITs by federal tax rules.

For a more complete discussion of these risks and uncertainties and

information relating to the Company, see the Form 10-K for the year

ended December 31, 2005 and other filings with the SEC made by the

Company. Aames Investment expressly disclaims any obligation to

update or revise any forward-looking statements in this press

release. Further Information For more information, contact Steven

C. Canup, Senior Vice President, Corporate Development and Investor

Relations, in Aames Investment's Investor Relations Department at

(323) 210-5311 or at investorinfo@aamescorp.com Financial tables

and supplementary information follows. -0- *T AAMES INVESTMENT

CORPORATION and SUBSIDIARIES Condensed Balance Sheets (In

thousands) December 31, December 31, 2005 2004 -------------

--------------- (unaudited) Assets Cash and cash equivalents:

Unrestricted $36,078 $31,641 Restricted 87,094 6,139 Loans held for

sale, at lower of cost or market 951,177 484,963 Loans held for

investment, net 4,085,536 1,725,046 Advances and other receivables

39,591 22,740 Derivative financial instruments, at estimated fair

value 58,147 31,947 Prepaid and other assets 70,012 98,399

------------- --------------- Total assets $5,327,635 $2,400,875

------------- --------------- Liabilities and Stockholders' Equity

Financings on loans held for investment $3,623,188 $1,157,470

Revolving warehouse and repurchase facilities 1,341,683 809,213

Other borrowings 16,487 7,680 Other liabilities 76,773 68,886

------------- --------------- Total liabilities 5,058,131 2,043,249

Stockholders' equity 269,504 357,626 ------------- ---------------

Total liabilities and stockholders' equity $5,327,635 $2,400,875

------------- --------------- Shares outstanding 61,828 61,360

------------- --------------- AAMES INVESTMENT CORPORATION and

SUBSIDIARIES Condensed Statements of Operations (Unaudited) (In

thousands, except per share data) Three Months Twelve Months Ended

Ended December 31, December 31, -------------------

------------------ 2005 2004 2005 2004 --------- ---------

--------- -------- Interest income $110,929 $32,024 $340,515

$93,181 Interest expense 67,266 8,434 170,942 32,396 ---------

--------- --------- -------- Net interest income 43,663 23,590

169,573 60,785 Provision for losses on loans held for investment

8,929 1,900 40,294 1,900 --------- --------- --------- -------- Net

interest income after provision for loan losses 34,734 21,690

129,279 58,885 --------- --------- --------- -------- Noninterest

income: Gain on sale of loans 348 10,258 30,277 177,607 Loan

servicing 2,206 731 6,330 6,634 --------- --------- ---------

-------- Total noninterest income 2,554 10,989 36,607 184,241

--------- --------- --------- -------- Net interest income after

provision for loan losses and noninterest income 37,288 32,679

165,886 243,126 --------- --------- --------- -------- Noninterest

expense: Personnel 24,107 40,064 91,217 120,608 Production 8,716

8,605 35,351 36,504 General and administrative 8,567 15,476 44,707

49,162 --------- --------- --------- -------- Total noninterest

expense 41,390 64,145 171,275 206,274 --------- --------- ---------

-------- Income (loss) before income taxes (4,102) (31,466) (5,389)

36,852 Income tax provision (benefit) 73 37 842 (4,933) ---------

--------- --------- -------- Net income (loss) $(4,175) $(31,503)

$(6,231) $41,785 --------- --------- --------- -------- Net income

(loss) to common stockholders: Basic $(4,175) $(32,595) $(6,231)

$32,085 Diluted $(4,175) $(31,503) $(6,231) $41,785 Net income

(loss) per common share: Basic $(0.07) $(0.53) $(0.10) $0.52

Diluted $(0.07) $(0.51) $(0.10) $0.68 Weighted average number of

common shares outstanding: Basic 62,512 61,335 62,517 61,316

Diluted 62,512 61,335 62,517 61,348 AAMES INVESTMENT CORPORATION

and SUBSIDIARIES Other Financial Data (Unaudited) (In thousands)

Twelve Months Ended December 31, ---------------------------------

2005 2004 -------------- ----------------- Condensed Statement of

Cash Flows Information Net cash provided by (used in): Operating

activities $(450,756) $255,422 Investing activities (2,406,124)

(1,730,704) Financing activities 2,942,272 1,501,451 --------------

----------------- Net increase (decrease) in cash and cash

equivalents 85,392 26,169 Cash and cash equivalents, beginning of

period 37,780 11,611 -------------- ----------------- Cash and cash

equivalents, end of period $123,172 $37,780 --------------

----------------- December 31, December 31, 2005 2004

-------------- ----------------- Revolving Warehouse and Repurchase

Facilities Committed facilities $2,700,000 $2,450,000 Uncommitted

facilities 100,000 100,000 -------------- ----------------- Total

warehouse and repurchase facilities $2,800,000 $2,550,000

-------------- ----------------- Amount utilized on committed

$1,341,683 $809,213 -------------- ----------------- Borrowing

capacity on committed $1,358,317 $1,640,787 --------------

----------------- Liquidity Unrestricted cash $36,078 $31,641 Plus:

Unencumbered loans held for sale 87,597 87,955 Less: Margin and

ineligible mortgage collateral (80,962) (22,153) Plus: Capacity

available under S/T collateralized financing facility 9,154 -

-------------- ----------------- $51,867 $97,443 --------------

----------------- AAMES INVESTMENT CORPORATION (Parent Company

Only) (Unaudited) (In thousands) December 31,

---------------------------- Condensed Balance Sheets(1) 2005 2004

---------------------------- ---------------------------- Cash and

cash equivalents: Unrestricted $13,042 $7,206 Restricted 87,094

6,139 Loans held for investment, net: Securitized 3,659,657

1,187,435 Not yet securitized 461,452 531,261 Net deferred loan

origination costs 7,787 8,250 Deferred loan acquisition premium

41,131 29,226 Allowance for loan losses (43,359) (1,900)

------------ -------------- Total loans held for investment, net

4,126,668 1,754,272 ------------ -------------- Investment in

subsidiaries 78,697 149,028 Accrued interest and other 57,480

24,208 Derivative financial instruments 58,147 31,947 ------------

-------------- Total assets $4,421,128 $1,972,800 ============

============== Financings on loans held for investment $3,623,188

$1,157,470 Revolving warehouse and repurchase facilities 433,241

409,199 Other borrowings 16,487 - Other liabilities 37,577 19,279

------------ -------------- Total liabilities 4,110,493 1,585,948

Stockholders' equity 310,635 386,852 ------------ --------------

Total liabilities and stockholders' equity $4,421,128 $1,972,800

============ ============== (1) Before intercompany elimination

entries. Three Months Twelve Months Ended Ended December 31,

December 31, Condensed Statements of Operations 2005 2005

---------------------------------- ------------- -------------- Net

interest income $24,491 $113,270 Provision for losses on loans held

for investment (8,929) (40,294) ------------ -------------- Net

interest income after provision for loan losses 15,562 72,976

Noninterest expense (1,302) (8,784) ------------ --------------

Income before equity in net loss of subsidiary 14,260 64,192 Equity

in net loss of subsidiary (25,266) (58,518) ------------

-------------- Net income $(11,006) $5,674 ============

============== GAAP Net Income to Taxable Income Reconciliation

------------------------------------------------ Net income

$(11,006) $5,674 Equity in net loss of subsidiary 25,266 58,518

------------ -------------- Income before equity in net loss of

subsidiary 14,260 64,192 Tax basis adjustments 11,018 20,833

------------ -------------- Estimated taxable income $25,278

$85,025 ============ ============== AAMES INVESTMENT CORPORATION

and SUBSIDIARIES Loan Production Information (Unaudited) Three

Months Ended ----------------------------------- December 31,

September 30, 2005 2004 2005 ----------- --------- -------------

Retail Loan Production Total dollar amount (in thousands) $811,096

$574,625 $793,851 Number of loans 5,269 4,431 5,194 Average loan

amount $153,937 $129,683 $152,840 Average initial LTV 75.05% 75.82%

75.51% Weighted average interest rate 7.56% 7.36% 7.27% Wholesale

Loan Production Total dollar amount (in thousands) $1,071,507

$1,134,911 $1,119,445 Number of loans 7,356 7,841 7,809 Average

loan amount $145,664 $144,741 $143,353 Average initial LTV 81.90%

81.19% 81.80% Weighted average interest rate 8.00% 7.46% 7.51%

Total Loan Production Total dollar amount (in thousands) $1,882,603

$1,709,536 $1,913,296 Number of loans 12,625 12,272 13,003 Average

loan amount $149,117 $139,304 $147,143 Average initial LTV 78.95%

79.38% 79.19% Weighted average interest rate 7.81% 7.43% 7.41%

Twelve Months Ended ----------------------- December 31, 2005 2004

----------- ----------- Retail Loan Production Total dollar amount

(in thousands) $2,746,321 $2,421,525 Number of loans 18,496 19,088

Average loan amount $148,482 $126,861 Average initial LTV 75.63%

76.77% Weighted average interest rate 7.42% 7.38% Wholesale Loan

Production Total dollar amount (in thousands) $4,008,207 $4,998,120

Number of loans 28,023 34,140 Average loan amount $143,033 $146,401

Average initial LTV 81.37% 81.42% Weighted average interest rate

7.70% 7.37% Total Loan Production Total dollar amount (in

thousands) $6,754,528 $7,419,645 Number of loans 46,519 53,228

Average loan amount $145,199 $139,394 Average initial LTV 79.03%

79.90% Weighted average interest rate 7.59% 7.37% AAMES INVESTMENT

CORPORATION and SUBSIDIARIES Loan Production Information

(Unaudited) (In thousands) Three Months Ended

----------------------------------- December 31, September 30, 2005

2004 2005 ----------- -------- ------------- Loan Production by

Loan Purpose Cash-out refinance $1,106,317 $1,019,194 $1,100,577

Purchase money 710,890 636,721 742,363 Rate/term refinance 65,396

53,621 70,356 ----------- ----------- ----------- $1,882,603

$1,709,536 $1,913,296 ----------- ----------- ----------- Loan

Production by Property Type Single-family $1,638,562 $1,510,413

$1,649,844 Multi-family 136,022 111,322 149,188 Condominiums

108,019 87,801 114,264 ----------- ----------- -----------

$1,882,603 $1,709,536 $1,913,296 ----------- -----------

----------- Loan Production by State/Region Produced California

$389,707 $523,701 $390,278 Florida 459,669 345,653 493,682 New York

157,288 103,796 147,913 Texas 141,395 129,579 146,327 Other Western

states 164,982 184,520 161,850 Other Midwestern states 116,635

140,751 100,603 Other Northeastern states 275,863 161,677 291,243

Other Southeastern states 177,064 119,859 181,400 -----------

----------- ----------- $1,882,603 $1,709,536 $1,913,296

----------- ----------- ----------- Loan Production by Interest

Rate Type Hybrid: Traditional $1,297,802 $1,252,757 $1,172,707

Interest only 167,197 91,203 257,551 Fixed rate 417,604 365,576

483,038 ----------- ----------- ----------- $1,882,603 $1,709,536

$1,913,296 ----------- ----------- ----------- Twelve Months Ended

----------------------- December 31, 2005 2004 -----------

----------- Loan Production by Loan Purpose Cash-out refinance

$3,906,641 $4,423,226 Purchase money 2,618,182 2,674,084 Rate/term

refinance 229,705 322,335 ----------- ----------- $6,754,528

$7,419,645 ----------- ----------- Loan Production by Property Type

Single-family $5,883,238 $6,498,417 Multi-family 494,107 507,426

Condominiums 377,183 413,802 ----------- ----------- $6,754,528

$7,419,645 ----------- ----------- Loan Production by State/Region

Produced California $1,592,215 $2,393,732 Florida 1,623,052

1,444,562 New York 493,117 529,251 Texas 535,525 505,165 Other

Western states 594,704 749,268 Other Midwestern states 413,789

638,506 Other Northeastern states 890,394 683,193 Other

Southeastern states 611,732 475,968 ----------- -----------

$6,754,528 $7,419,645 ----------- ----------- Loan Production by

Interest Rate Type Hybrid: Traditional $4,432,645 $5,382,666

Interest only 763,666 274,180 Fixed rate 1,558,217 1,762,799

----------- ----------- $6,754,528 $7,419,645 -----------

----------- AAMES INVESTMENT CORPORATION and SUBSIDIARIES Loan

Servicing Information (Unaudited) (Dollars in thousands) December

31, December 31, 2005 2004 ------------- ------------- Servicing

Portfolio Mortgage loans serviced: Loans held for investment

$4,077,448 $1,718,696 Loans serviced on an interim basis 1,926,876

771,830 Loan subserviced for others on a long-term basis 92,213

129,016 Loans in off-balance sheet securitization trusts - 224,345

------------- ------------- Total serviced in-house 6,096,537

2,843,887 Loans held for investment subserviced by others 50,202 -

------------- ------------- Total servicing portfolio $6,146,739

$2,843,887 ------------- ------------- Percentage serviced in-house

99.2% 100.0% ------------- ------------- Loan Delinquencies

Percentage of dollar amount of delinquent loans serviced (period

end): One month 1.9% 0.3% Two months 0.9% 0.2% Three or more

months: Not foreclosed 2.5% 1.8% Foreclosed 0.1% 0.2% -------------

------------- 5.4% 2.5% ------------- ------------- Percentage of

dollar amount of delinquent loans in: Loans held for investment

serviced: In-house 7.0% 0.2% Loans serviced on an interim basis

2.0% 1.5% Loans subserviced for others on a long-term basis 8.9%

4.8% Loans in off-balance sheet securitization trusts serviced:

In-house N/A 22.5% AAMES INVESTMENT CORPORATION and SUBSIDIARIES

Loan Servicing Information (Unaudited) (Dollars in thousands) At or

During the Twelve Months Ended December 31, -----------------------

2005 2004 ----------- ----------- Loan Foreclosures Percentage of

dollar amount of loans foreclosed during the period to servicing

portfolio (period end) 0.3% 0.3% Number of loans foreclosed during

the period 147 152 Principal amount of loans foreclosed during the

period $16,317 $10,928 Number of loans liquidated during the period

226 397 Net losses on liquidations during the period from: Loans

held for investment serviced: In-house $161 $- Loans serviced on an

interim basis 5,494 2,960 Loans serviced for others on a long-term

basis 38 - Loans in off-balance sheet securitization trusts

serviced: In-house 2,850 12,009 ----------- ----------- $8,543

$14,969 ----------- ----------- Percentage of annualized losses to

servicing portfolio 0.2% 0.4% Servicing portfolio at period end

$6,147,000 $2,844,000 *T

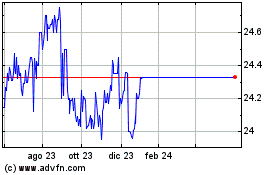

Grafico Azioni Arlington Asset Investment (NYSE:AIC)

Storico

Da Apr 2024 a Mag 2024

Grafico Azioni Arlington Asset Investment (NYSE:AIC)

Storico

Da Mag 2023 a Mag 2024