false0001809104Alight, Inc. / Delaware00018091042024-07-122024-07-12

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): July 12, 2024 |

Alight, Inc.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Delaware |

001-39299 |

86-1849232 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

320 South Canal Street 50th Floor, Suite 5000 |

|

Chicago, Illinois |

|

60069 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: (224) 737-7000 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Class A Common Stock, par value $0.0001 per share |

|

ALIT |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.01 Completion of Acquisition or Disposition of Assets.

On July 12, 2024, Alight, Inc. (together with its subsidiaries, the “Company” or “Alight”) and Tempo Acquisition LLC, a subsidiary of the Company, completed the previously announced sale (the “Transaction”) of Alight’s Professional Services segment and Alight’s Payroll & HCM Outsourcing business within the Employer Solutions segment (collectively, the “Divested Business”) to Axiom Buyer, LLC, a newly-formed entity and an affiliate of H.I.G. Capital, L.L.C. (“Buyer”), pursuant to the terms of the Stock and Asset Purchase Agreement (the “Purchase Agreement”), dated as of March 20, 2024. The Transaction as well as the Purchase Agreement referenced herein are more fully described in the Company’s Current Report on Form 8-K filed with the U.S. Securities and Exchange Commission on March 20, 2024, which description is incorporated herein by reference. The Purchase Agreement is filed as Exhibit 2.1 hereto and is incorporated by reference herein.

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

Katie J. Rooney Departure

In its Current Report on Form 8-K filed on May 8, 2024, Alight disclosed that Ms. Rooney would remain the Company’s Chief Operating Officer focusing on the closing of the Transaction, after which she would step down. In connection with the closing of the Transaction, Ms. Rooney has departed from the Company, effective as of July 12, 2024. Ms. Rooney will be entitled to receive the post-employment payments and benefits associated with a termination without cause under her employment agreement dated as of August 18, 2021.

Special Transaction Awards

On July 12, 2024, the Compensation Committee of the Company’s Board of Directors approved the grant of cash bonus awards (the “Special Transaction Awards”) to several executive officers, including: (i) Jeremy J. Heaton, the Company’s Chief Financial Officer, in the amount of $750,000, (ii) Martin T. Felli, the Company’s Chief Legal Officer and Corporate Secretary, in the amount of $750,000, and (iii) to Gregory R. Goff, the Company’s President, in the amount of $800,000, in recognition of their significant efforts to consummate the Transaction. Each Special Transaction Award will become payable in the next practical payroll period following the Closing, subject to applicable withholding taxes.

Item 7.01 Regulation FD Disclosure.

Press Release

On July 12, 2024, the Company issued a press release announcing the completion of the Transaction. A copy of the press release is attached hereto as Exhibit 99.1 and is incorporated by reference herein.

Webcast

Alight expects to post a webcast to the Events and Presentations section of the Company’s Investor Relations website at 8:30 a.m. (ET) on July 18, 2024, during which management will review a supplemental presentation (the "Supplemental Presentation") regarding the close of the transaction. During the webcast, Mr. Heaton will state in his presentation that management expects Q2 revenue and adjusted EBITDA results for the continuing business to be in-line with expectations set during the Q1 earnings call and that the divested business is anticipated to be slightly below expectations.

Investor Presentation

On July 18, 2024, the Company will make the Supplemental Presentation, entitled "Alight Supplemental Presentation", available through the Investors section of its website (http://investor.alight.com). The Company may use the investor presentation, which contains financial and other data, from time to time with investors, analysts, and other interested parties to assist in their understanding of the Company and the Transaction. The information found on, or otherwise accessible through, the Company's website is not incorporated by reference herein.

The information in Item 7.01 of this report, including Exhibit 99.1, shall be deemed “furnished” and not “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as may be set forth by specific reference in that filing.

Item 9.01 Financial Statements and Exhibits.

(b) Pro Forma Financial Information.

The Unaudited Pro Forma Condensed Consolidated Balance Sheet as of March 31, 2024 gives effect to the Disposition Adjustments and Other Transaction Adjustments as if they had occurred or become effective March 31, 2024. The Unaudited Pro Forma Condensed Consolidated Statements of Operations for the three months ended March 31, 2024, the years ended December 31, 2023, and 2022, the six months ended December 31, 2021 (Successor), and the six months ended June 30, 2021 (Predecessor), give effect to the Disposition Adjustments and Other Transaction Adjustments as if they had occurred or become effective on January 1, 2021, the beginning of the earliest period presented. Other Transaction Adjustments are only presented within the Unaudited Pro Forma Condensed Consolidated Statements of Operations for the three months ended March 31, 2024, and the year ended December 31, 2023. These financial statements are filed as Exhibit 99.2 hereto and is incorporated herein by reference.

(d) Exhibits.

|

|

|

|

2.1 |

Stock and Asset Purchase Agreement, dated as of March 20, 2024, by and among Tempo Acquisition LLC, Axiom Buyer, LLC, the Company (for the limited purposes set forth therein) and Axiom Intermediate I, LLC (for the limited purposes set forth therein) (incorporated by reference to Exhibit 2.1 to the Company’s Current Report on Form 8-K, filed with the SEC on March 20, 2024)† |

99.1 |

Press Release of the Company dated July 12, 2024 |

99.2 |

Unaudited Pro Forma Condensed Consolidated Financial Statements of Alight, Inc. |

104 |

Cover Page Interactive Data File (embedded within the Inline XBRL document) |

† The related exhibits and schedules are not being filed herewith. The registrant agrees to furnish supplementally a copy of any such exhibits and schedules to the Securities and Exchange Commission upon request.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

Alight, Inc. |

|

|

|

|

Date: |

July 18, 2024 |

By: |

/s/ Martin Felli |

|

|

|

Martin Felli, Chief Legal Officer and Corporate Secretary |

Alight Completes Sale of Payroll and Professional Services Business

Company to post webcast on July 18th to accompany pro forma disclosures

Chicago, Ill. – July 12, 2024 – Alight, Inc. (NYSE: ALIT or the “Company”), a leading cloud-based human capital technology and services provider, today announced that it has closed the previously announced sale of its Professional Services segment and its Payroll & HCM Outsourcing businesses within the Employer Solutions segment (the “Payroll & Professional Services business”) to an affiliate of H.I.G. Capital. The sale of the Payroll & Professional Services business, which will operate as an independent business and has been renamed Strada, includes a transaction value of up to $1.2 billion, in the form of upfront gross proceeds of $1 billion in cash and up to $200 million in seller notes, of which $150 million is contingent upon Strada reaching certain 2025 financial targets, which are substantially in line with current performance levels.

As previously discussed, the Company anticipates using the majority of its initial net proceeds to reduce its debt, resulting in a pro forma net leverage ratio of below three times. The remaining proceeds and future cash flow generation are expected to be used for share repurchases and for general corporate purposes.

“Today’s announcement represents a strategic milestone that will accelerate Alight’s transformation toward a simplified and focused platform company for employee wellbeing and benefits,” said Chief Executive Officer Stephan Scholl. “I am pleased with the tremendous collaboration across both organizations in accomplishing this pivotal transaction and commencing our strategic partnership with substantial momentum while preserving our client value proposition. Together, we will continue to keep our clients front and center, delivering improved cost, experience and productivity outcomes for organizations and their valued employees.”

“Culminating in today’s announcement, Alight is now embarking on its next chapter as a simplified company with even greater agility and a renewed focus on its sophisticated proprietary technology,” said Chair of the Board William P. Foley, II. “This strategic transaction unlocks great potential for a streamlined Alight to drive sustainable, profitable growth and shareholder value over the long-term.”

Webcast Details

Alight expects to disclose its historic pro forma results for the continuing business four days after the completion of the transaction.

In conjunction with the disclosure, Alight will post a webcast to the Events and Presentations section of the Company’s Investor Relations website at 8:30 a.m. (ET) on July 18, 2024, during which management will review supplemental materials regarding the close of the transaction.

About Alight Solutions

Alight is a leading cloud-based human capital technology and services provider for many of the world’s largest organizations. Through the administration of employee benefits, Alight powers confident health, wealth, leaves and wellbeing decisions for 35 million people and dependents. Our Alight Worklife® platform empowers employers to gain a deeper understanding of their workforce and engage them throughout life’s most important moments with personalized benefits

management and data-driven insights, leading to increased employee wellbeing, engagement and productivity. Learn how Alight unlocks growth for organizations of all sizes at alight.com.

About Strada

Strada is a global leader in full-lifecycle human capital management and payroll technology and services. With over 8,000 employees across the world, the Company provides an end-to-end offering of technology and services, including U.S. and multi-country global payroll, HR administration & outsourced services, and cloud technology advisory, deployment & application managed services. Through its differentiated breadth of services, proprietary technology, and decades-long commitment to innovation, Strada delivers mission-critical solutions to enterprise clients across 185 countries. For more information, visit stradaglobal.com.

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended. These statements include, but are not limited to, statements regarding the anticipated benefits of the sale of our Payroll and Professional Services business to an affiliate of H.I.G. Capital (including the achievement of our financial objectives), support plans, opportunities, anticipated future performance and statements regarding our use of proceeds and expected stock buyback programs. In some cases, these forward-looking statements can be identified by the use of words such as “outlook,” “believes,” “expects,” “potential,” “continues,” “may,” “will,” “should,” “could,” “seeks,” “projects,” “predicts,” “intends,” “plans,” “estimates,” “anticipates” or the negative version of these words or other comparable words. Such forward-looking statements are subject to various risks and uncertainties including, among others, risks related to declines in economic activity in the industries, markets, and regions our clients serve, including as a result of elevated interest rates or changes in monetary and fiscal policies, competition in our industry, risks related to the performance of our information technology systems and networks, risks related to our ability to maintain the security and privacy of confidential and proprietary information, risks related to actions or proposals from activist stockholders, risks related to the ability to meet the contingent payment conditions of the seller note, and risks related to changes in regulation, including developments on the use of artificial intelligence and machine learning. Additional factors that could cause Alight’s results to differ materially from those described in the forward-looking statements can be found under the section entitled “Risk Factors” of Alight’s Annual Report on Form 10-K, filed with the Securities and Exchange Commission (the "SEC") on February 29, 2024, as such factors may be updated from time to time in Alight's filings with the SEC, which are, or will be, accessible on the SEC's website at www.sec.gov. Accordingly, there are or will be important factors that could cause actual outcomes or results to differ materially from those indicated in these statements. These factors should not be construed as exhaustive and should be considered along with other factors noted in this presentation and in Alight’s filings with the SEC. Alight undertakes no obligation to publicly update or review any forward-looking statement, whether as a result of new information, future developments or otherwise, except as required by law.

Non-GAAP Financial Measures

Included in this press release are certain non-GAAP financial measures, such as Net Leverage Ratio, designed to complement the financial information presented in accordance with U.S. GAAP because management believes Net Leverage Ratio is useful to investors. This non-GAAP

financial measure should be considered only as supplemental to, and not superior to, financial measures provided in accordance with GAAP.

Because GAAP financial measures on a forward-looking basis are not accessible, and reconciling information is not available without unreasonable effort, we have not provided reconciliations for forward-looking non-GAAP measures, including our anticipated Net Leverage Ratio following the completion of the transaction.

Investors:

Jeremy Cohen

Investor.Relations@alight.com

Media:

Mariana Fischbach

mariana.fischbach@alight.com

UNAUDITED PRO FORMA CONDENSED CONSOLIDATED FINANCIAL INFORMATION

On July 12, 2024, Alight, Inc. (together with its subsidiaries, the “Company” or “Alight”) and Tempo Acquisition LLC, a subsidiary of the Company, completed the previously announced sale (the “Transaction”) of Alight’s Professional Services segment and Alight’s Payroll & HCM Outsourcing business within the Employer Solutions segment (collectively, the “Divested Business”) to Axiom Buyer, LLC, a newly-formed entity and an affiliate of H.I.G. Capital, L.L.C. (“Buyer”), pursuant to the terms of the Stock and Asset Purchase Agreement (the “Purchase Agreement”), dated as of March 20, 2024, as further described in Note 1, Description of the Disposition and Basis of Presentation.

The following unaudited pro forma condensed consolidated financial statements have been derived from the Company’s historical consolidated financial statements, prepared based on the most reliable information available to management, along with their estimates, and in accordance with Article 11 of Regulation S-X, Pro Forma Financial Information, as amended by the Final Rule, Release No. 33-10786 “Amendments to Financial Disclosures about Acquired and Disposed Businesses” (“Article 11 of Regulation S-X”). The unaudited pro forma condensed consolidated financial statements have been prepared for illustrative and informational purposes only and are not intended to represent what Alight’s results of operations or financial position would have been had the Transaction occurred on the dates indicated. The unaudited pro forma condensed consolidated financial statements also should not be considered indicative of Alight’s future results of operations or financial position. The actual financial position and results of operations may differ significantly from the pro forma amounts reflected herein due to various factors.

The unaudited pro forma condensed consolidated financial statements as of March 31, 2024, and for the three months ended March 31, 2024, the years ended December 31, 2023, and 2022, the six months ended December 31, 2021 (Successor), and the six months ended June 30, 2021 (Predecessor), should be read in conjunction with:

•The accompanying notes to the unaudited pro forma condensed consolidated financial statements;

•Alight’s historical audited consolidated financial statements and accompanying notes for the years ended December 31, 2023 and December 31, 2022, the six months ended December 31, 2021 (Successor), and the six months ended June 30, 2021 (Predecessor) which were prepared in accordance with generally accepted accounting principles in the United States of America (“U.S. GAAP”), included in Alight’s annual reports on Form 10-K filed with the U.S. Securities and Exchange Commission (the “SEC”) on February 29, 2024, March 1, 2023, and March 10, 2022, respectively; and

•Alight’s historical unaudited condensed consolidated financial statements and accompanying notes as of and for the three months ended March 31, 2024, which were prepared in accordance with U.S. GAAP, included in Alight’s quarterly report on Form 10-Q filed with the SEC on May 8, 2024.

Article 11 of Regulation S-X requires that pro forma financial information with respect to a transaction to which pro forma effect is being given include the following pro forma adjustments to the historical financial statements of the registrant:

•Transaction accounting adjustments, which reflect the application of required accounting for the Transaction (please refer to the Disposition Adjustments and Other Transactions Adjustments further discussed below); and

•Autonomous entity adjustments, which are necessary to reflect the operations and financial position of the registrant as an autonomous entity when the registrant was previously part of another entity.

In addition, Article 11 of Regulation S-X permits registrants to reflect, in the explanatory notes to the pro forma financial information, management adjustments that depict synergies or dis-synergies of the transaction to which the pro forma effect is being given.

The Company’s historical consolidated financial statements (“Historical Alight”) have been adjusted in accordance with Article 11 of Regulation S-X in the accompanying unaudited pro forma condensed consolidated financial statements and related notes to give effect to the following pro forma Transaction accounting adjustments further described in Note 2, Pro Forma Adjustments and Assumptions:

•Disposition Adjustments:

oThe separation and transfer of the operations, assets, and liabilities of the Company’s historical financial results directly attributable to the Divested Business in accordance with the Accounting Standards Codification (“ASC”) 360, Property, Plant, and Equipment (“ASC 360”), and discontinued operations as prescribed by ASC 205, Presentation of Financial Statements (“ASC 205”) to the Buyer.

•Other Transaction Adjustments:

oAdjustments to reflect the receipt of consideration from the Transaction, net of estimated transaction costs and closing costs;

oAdjustments to reflect transaction costs and closing costs that would have been incurred to complete the Transaction; and

oAdjustments to reflect other contractual arrangements that are directly attributable to the Transaction, including a Transition Services Agreement (“TSA”) between the Company and Buyer.

The unaudited pro forma condensed consolidated financial statements do not include autonomous entity adjustments or management adjustments to reflect any potential synergies or dis-synergies in connection with the Transaction.

The Unaudited Pro Forma Condensed Consolidated Balance Sheet as of March 31, 2024 gives effect to the Disposition Adjustments and Other Transaction Adjustments as if they had occurred or become effective March 31, 2024. The Unaudited Pro Forma Condensed Consolidated Statements of Operations for the three months ended March 31, 2024, the years ended December 31, 2023, and 2022, the six months ended December 31, 2021 (Successor), and the six months ended June 30, 2021 (Predecessor), give effect to the Disposition Adjustments and Other Transaction Adjustments as if they had occurred or become effective on January 1, 2021, the beginning of the earliest period presented. Other Transaction Adjustments are only presented within the Unaudited Pro Forma Condensed Consolidated Statements of Operations for the three months ended March 31, 2024, and the year ended December 31, 2023. Further information on the unaudited pro forma condensed consolidated financial statements is provided in Note 1, Description of the Disposition and Basis of Presentation.

UNAUDITED PRO FORMA CONDENSED CONSOLIDATED BALANCE SHEET

As of March 31, 2024

($ in millions)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Pro Forma Adjustments |

|

|

|

|

|

Historical Alight |

|

Disposition Adjustments (Note 2a) |

|

Notes |

|

Other Transaction

Adjustments |

|

Notes |

|

Pro Forma Alight |

Assets |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Current Assets |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

$ |

256 |

|

$ |

953 |

|

2(b), 2(d) |

|

$ |

- |

|

|

|

$ |

1,209 |

Receivables, net |

|

393 |

|

|

- |

|

|

|

|

- |

|

|

|

|

393 |

Other current assets |

|

217 |

|

|

- |

|

|

|

|

- |

|

|

|

|

217 |

Fiduciary assets |

|

250 |

|

|

- |

|

|

|

|

- |

|

|

|

|

250 |

Current assets held for sale |

|

2,501 |

|

|

(2,501) |

|

2(c) |

|

|

- |

|

|

|

|

- |

Total Current Assets |

$ |

3,617 |

|

$ |

(1,548) |

|

|

|

$ |

- |

|

|

|

$ |

2,069 |

Goodwill |

|

3,212 |

|

|

- |

|

|

|

|

- |

|

|

|

|

3,212 |

Intangible assets, net |

|

3,066 |

|

|

- |

|

|

|

|

- |

|

|

|

|

3,066 |

Fixed assets, net |

|

387 |

|

|

- |

|

|

|

|

- |

|

|

|

|

387 |

Deferred tax assets, net |

|

86 |

|

|

- |

|

|

|

|

(26) |

|

2(g) |

|

|

60 |

Other assets |

|

346 |

|

|

101 |

|

2(b) |

|

|

- |

|

|

|

|

447 |

Long-term assets held for sale |

|

- |

|

|

- |

|

|

|

|

- |

|

|

|

|

- |

Total Assets |

$ |

10,714 |

|

$ |

(1,447) |

|

|

|

$ |

(26) |

|

|

|

$ |

9,241 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Liabilities and Stockholders' Equity |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Liabilities |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Current Liabilities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Accounts payable and accrued liabilities |

$ |

278 |

|

$ |

- |

|

|

|

$ |

- |

|

|

|

$ |

278 |

Current portion of long-term debt, net |

|

25 |

|

|

- |

|

|

|

|

- |

|

|

|

|

25 |

Other current liabilities |

|

282 |

|

|

15 |

|

2(d) |

|

|

(12) |

|

2(g) |

|

|

285 |

Fiduciary liabilities |

|

250 |

|

|

- |

|

|

|

|

- |

|

|

|

|

250 |

Current liabilities held for sale |

|

1,475 |

|

|

(1,475) |

|

2(c) |

|

|

- |

|

|

|

|

- |

Total Current Liabilities |

$ |

2,310 |

|

$ |

(1,460) |

|

|

|

$ |

(12) |

|

|

|

$ |

838 |

Deferred tax liabilities |

|

32 |

|

|

- |

|

|

|

|

- |

|

|

|

|

32 |

Long-term debt, net |

|

2,762 |

|

|

- |

|

|

|

|

- |

|

|

|

|

2,762 |

Long-term tax receivable agreement |

|

784 |

|

|

- |

|

|

|

|

- |

|

|

|

|

784 |

Financial instruments |

|

132 |

|

|

- |

|

|

|

|

- |

|

|

|

|

132 |

Other liabilities |

|

166 |

|

|

- |

|

|

|

|

- |

|

|

|

|

166 |

Long-term liabilities held for sale |

|

- |

|

|

- |

|

|

|

|

- |

|

|

|

|

- |

Total Liabilities |

$ |

6,186 |

|

$ |

(1,460) |

|

|

|

$ |

(12) |

|

|

|

$ |

4,714 |

Commitments and Contingencies |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Stockholders' Equity |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Preferred stock |

$ |

- |

|

$ |

- |

|

|

|

$ |

- |

|

|

|

$ |

- |

Class A Common Stock |

|

- |

|

|

- |

|

|

|

|

- |

|

|

|

|

- |

Class B Common Stock |

|

- |

|

|

- |

|

|

|

|

- |

|

|

|

|

- |

Class V Common Stock |

|

- |

|

|

- |

|

|

|

|

- |

|

|

|

|

- |

Class Z Common Stock |

|

- |

|

|

- |

|

|

|

|

- |

|

|

|

|

- |

Treasury stock |

|

(52) |

|

|

- |

|

|

|

|

- |

|

|

|

|

(52) |

Additional paid-in-capital |

|

5,113 |

|

|

- |

|

|

|

|

- |

|

|

|

|

5,113 |

Retained deficit |

|

(617) |

|

|

13 |

|

2(b), 2(c), 2(d) |

|

|

(14) |

|

2(g) |

|

|

(618) |

Accumulated other comprehensive income |

|

75 |

|

|

- |

|

|

|

|

- |

|

|

|

|

75 |

Total Alight, Inc. Stockholders' Equity |

|

4,519 |

|

|

13 |

|

|

|

|

(14) |

|

|

|

|

4,518 |

Noncontrolling interest |

|

9 |

|

|

- |

|

|

|

|

- |

|

|

|

|

9 |

Total Stockholders' Equity |

$ |

4,528 |

|

$ |

13 |

|

|

|

$ |

(14) |

|

|

|

$ |

4,527 |

Total Liabilities and Stockholders' Equity |

$ |

10,714 |

|

$ |

(1,447) |

|

|

|

$ |

(26) |

|

|

|

$ |

9,241 |

The accompanying Notes are an integral part of the unaudited pro forma condensed consolidated financial statements.

UNAUDITED PRO FORMA CONDENSED CONSOLIDATED STATEMENT OF OPERATIONS

For The Three Months Ended March 31, 2024

($ in millions, except share and per share data)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Pro Forma Adjustments |

|

|

|

|

|

Historical Alight |

|

Disposition Adjustments (Note 2a) |

|

Other Transaction

Adjustments |

|

Notes |

|

Pro Forma

Alight |

Revenue |

$ |

559 |

|

$ |

- |

|

$ |

9 |

|

2(f) |

|

$ |

568 |

Cost of services, exclusive of depreciation and amortization |

|

356 |

|

|

- |

|

|

(6) |

|

2(e) |

|

|

350 |

Depreciation and amortization |

|

21 |

|

|

- |

|

|

- |

|

|

|

|

21 |

Gross Profit |

|

182 |

|

|

- |

|

|

15 |

|

|

|

|

197 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating Expenses |

|

|

|

|

|

|

|

|

|

|

|

|

|

Selling, general and administrative |

|

146 |

|

|

- |

|

|

- |

|

|

|

|

146 |

Depreciation and intangible amortization |

|

76 |

|

|

- |

|

|

- |

|

|

|

|

76 |

Total Operating expenses |

|

222 |

|

|

- |

|

|

- |

|

|

|

|

222 |

Operating Income (Loss) From Continuing Operations |

|

(40) |

|

|

- |

|

|

15 |

|

|

|

|

(25) |

Other (Income) Expense |

|

|

|

|

|

|

|

|

|

|

|

|

|

(Gain) Loss from change in fair value of financial

instruments |

|

21 |

|

|

- |

|

|

- |

|

|

|

|

21 |

(Gain) Loss from change in fair value of tax receivable

agreement |

|

55 |

|

|

- |

|

|

- |

|

|

|

|

55 |

Interest expense |

|

31 |

|

|

- |

|

|

- |

|

|

|

|

31 |

Other (income) expense, net |

|

1 |

|

|

- |

|

|

- |

|

|

|

|

1 |

Total Other (income) expense, net |

|

108 |

|

|

- |

|

|

- |

|

|

|

|

108 |

Income (Loss) From Continuing Operations Before

Taxes |

|

(148) |

|

|

- |

|

|

15 |

|

|

|

|

(133) |

Income tax expense (benefit) |

|

(27) |

|

|

- |

|

|

3 |

|

2(h) |

|

|

(24) |

Net Income (Loss) From Continuing Operations |

|

(121) |

|

|

- |

|

|

12 |

|

|

|

|

(109) |

Net income (loss) from continuing operations attributable

to noncontrolling interests |

|

(2) |

|

|

- |

|

|

- |

|

|

|

|

(2) |

Net Income (Loss) From Continuing Operations

Attributable to Alight, Inc. |

$ |

(119) |

|

$ |

- |

|

$ |

12 |

|

|

|

$ |

(107) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Earnings Per Share |

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average shares outstanding – basic |

|

540,780,315 |

|

|

|

|

|

|

|

|

|

|

540,780,315 |

Weighted average shares outstanding – dilutive |

|

541,969,471 |

|

|

|

|

|

|

|

|

|

|

541,969,471 |

Basic |

$ |

(0.22) |

|

|

|

|

|

|

|

|

|

$ |

(0.20) |

Diluted |

$ |

(0.22) |

|

|

|

|

|

|

|

|

|

$ |

(0.20) |

The accompanying Notes are an integral part of the unaudited pro forma condensed consolidated financial statements.

UNAUDITED PRO FORMA CONDENSED CONSOLIDATED STATEMENT OF OPERATIONS

For The Year Ended December 31, 2023

($ in millions, except share and per share data)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Pro Forma Adjustments |

|

|

|

|

|

Historical Alight |

|

Disposition Adjustments (Note 2a) |

|

Other Transaction

Adjustments |

|

Notes |

|

Pro Forma

Alight |

Revenue |

$ |

3,410 |

|

$ |

(1,024) |

|

$ |

36 |

|

2(f) |

|

$ |

2,422 |

Cost of services, exclusive of depreciation and amortization |

|

2,188 |

|

|

(684) |

|

|

(22) |

|

2(e) |

|

|

1,482 |

Depreciation and amortization |

|

82 |

|

|

(10) |

|

|

- |

|

|

|

|

72 |

Gross Profit |

|

1,140 |

|

|

(330) |

|

|

58 |

|

|

|

|

868 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating Expenses |

|

|

|

|

|

|

|

|

|

|

|

|

|

Selling, general and administrative |

|

754 |

|

|

(164) |

|

|

- |

|

|

|

|

590 |

Depreciation and intangible amortization |

|

339 |

|

|

(38) |

|

|

- |

|

|

|

|

301 |

Goodwill impairment |

|

148 |

|

|

(148) |

|

|

- |

|

|

|

|

- |

Total Operating expenses |

|

1,241 |

|

|

(350) |

|

|

- |

|

|

|

|

891 |

Operating Income (Loss) From Continuing Operations |

|

(101) |

|

|

20 |

|

|

58 |

|

|

|

|

(23) |

Other (Income) Expense |

|

|

|

|

|

|

|

|

|

|

|

|

|

(Gain) Loss from change in fair value of financial

instruments |

|

10 |

|

|

- |

|

|

- |

|

|

|

|

10 |

(Gain) Loss from change in fair value of tax receivable

agreement |

|

118 |

|

|

- |

|

|

- |

|

|

|

|

118 |

Interest expense |

|

131 |

|

|

- |

|

|

- |

|

|

|

|

131 |

Other (income) expense, net |

|

6 |

|

|

(9) |

|

|

- |

|

|

|

|

(3) |

Total Other (income) expense, net |

|

265 |

|

|

(9) |

|

|

- |

|

|

|

|

256 |

Income (Loss) From Continuing Operations Before

Taxes |

|

(366) |

|

|

29 |

|

|

58 |

|

|

|

|

(279) |

Income tax expense (benefit) |

|

(4) |

|

|

(5) |

|

|

13 |

|

2(h) |

|

|

4 |

Net Income (Loss) From Continuing Operations |

|

(362) |

|

|

34 |

|

|

45 |

|

|

|

|

(283) |

Net income (loss) from continuing operations attributable to

noncontrolling interests |

|

(17) |

|

|

- |

|

|

- |

|

|

|

|

(17) |

Net Income (Loss) From Continuing Operations

Attributable to Alight, Inc. |

$ |

(345) |

|

$ |

34 |

|

$ |

45 |

|

|

|

$ |

(266) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Earnings Per Share |

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average shares outstanding – basic |

|

489,461,259 |

|

|

|

|

|

|

|

|

|

|

489,461,259 |

Weighted average shares outstanding – dilutive |

|

489,461,259 |

|

|

|

|

|

|

|

|

|

|

489,461,259 |

Basic |

$ |

(0.70) |

|

|

|

|

|

|

|

|

|

$ |

(0.54) |

Diluted |

$ |

(0.70) |

|

|

|

|

|

|

|

|

|

$ |

(0.54) |

The accompanying Notes are an integral part of the unaudited pro forma condensed consolidated financial statements.

UNAUDITED PRO FORMA CONDENSED CONSOLIDATED STATEMENT OF OPERATIONS

For The Year Ended December 31, 2022

($ in millions, except share and per share data)

|

|

|

|

|

|

|

|

|

|

|

|

Pro Forma Adjustments |

|

|

|

Historical Alight |

|

Disposition Adjustments

(Note 2a) |

|

Pro Forma

Alight |

Revenue |

$ |

3,132 |

|

$ |

(926) |

|

$ |

2,206 |

Cost of services, exclusive of depreciation and amortization |

|

2,080 |

|

|

(609) |

|

|

1,471 |

Depreciation and amortization |

|

56 |

|

|

(7) |

|

|

49 |

Gross Profit |

|

996 |

|

|

(310) |

|

|

686 |

|

|

|

|

|

|

|

|

|

Operating Expenses |

|

|

|

|

|

|

|

|

Selling, general and administrative |

|

671 |

|

|

(192) |

|

|

479 |

Depreciation and intangible amortization |

|

339 |

|

|

(38) |

|

|

301 |

Total Operating expenses |

|

1,010 |

|

|

(230) |

|

|

780 |

Operating Income (Loss) From Continuing Operations |

|

(14) |

|

|

(80) |

|

|

(94) |

Other (Income) Expense |

|

|

|

|

|

|

|

|

(Gain) Loss from change in fair value of financial instruments |

|

(38) |

|

|

- |

|

|

(38) |

(Gain) Loss from change in fair value of tax receivable agreement |

|

(41) |

|

|

- |

|

|

(41) |

Interest expense |

|

122 |

|

|

(1) |

|

|

121 |

Other (income) expense, net |

|

(16) |

|

|

4 |

|

|

(12) |

Total Other (income) expense, net |

|

27 |

|

|

3 |

|

|

30 |

Income (Loss) From Continuing Operations Before Taxes |

|

(41) |

|

|

(83) |

|

|

(124) |

Income tax expense (benefit) |

|

31 |

|

|

(8) |

|

|

23 |

Net Income (Loss) From Continuing Operations |

|

(72) |

|

|

(75) |

|

|

(147) |

Net income (loss) from continuing operations attributable to noncontrolling interests |

|

(10) |

|

|

- |

|

|

(10) |

Net Income (Loss) From Continuing Operations Attributable to Alight, Inc. |

$ |

(62) |

|

$ |

(75) |

|

$ |

(137) |

|

|

|

|

|

|

|

|

|

Earnings Per Share |

|

|

|

|

|

|

|

|

Weighted average shares outstanding – basic |

|

458,558,192 |

|

|

|

|

|

458,558,192 |

Weighted average shares outstanding – dilutive |

|

458,558,192 |

|

|

|

|

|

458,558,192 |

Basic |

$ |

(0.14) |

|

|

|

|

$ |

(0.30) |

Diluted |

$ |

(0.14) |

|

|

|

|

$ |

(0.30) |

The accompanying Notes are an integral part of the unaudited pro forma condensed consolidated financial statements.

UNAUDITED PRO FORMA CONDENSED CONSOLIDATED STATEMENT OF OPERATIONS

For The Six Months Ended December 31, 2021 (Successor)

($ in millions, except share and per share data)

|

|

|

|

|

|

|

|

|

|

|

|

Pro Forma Adjustments |

|

|

|

Historical Alight Successor |

|

Disposition Adjustments

(Note 2a) |

|

Pro Forma

Alight |

Revenue |

$ |

1,554 |

|

$ |

(460) |

|

$ |

1,094 |

Cost of services, exclusive of depreciation and amortization |

|

1,001 |

|

|

(300) |

|

|

701 |

Depreciation and amortization |

|

21 |

|

|

(3) |

|

|

18 |

Gross Profit |

|

532 |

|

|

(157) |

|

|

375 |

|

|

|

|

|

|

|

|

|

Operating Expenses |

|

|

|

|

|

|

|

|

Selling, general and administrative |

|

304 |

|

|

(85) |

|

|

219 |

Depreciation and intangible amortization |

|

163 |

|

|

(19) |

|

|

144 |

Total Operating expenses |

|

467 |

|

|

(104) |

|

|

363 |

Operating Income (Loss) From Continuing Operations |

|

65 |

|

|

(53) |

|

|

12 |

Other (Income) Expense |

|

|

|

|

|

|

|

|

(Gain) Loss from change in fair value of financial instruments |

|

65 |

|

|

- |

|

|

65 |

(Gain) Loss from change in fair value of tax receivable agreement |

|

(37) |

|

|

- |

|

|

(37) |

Interest expense |

|

57 |

|

|

- |

|

|

57 |

Other (income) expense, net |

|

3 |

|

|

(3) |

|

|

- |

Total Other (income) expense, net |

|

88 |

|

|

(3) |

|

|

85 |

Income (Loss) From Continuing Operations Before Taxes |

|

(23) |

|

|

(50) |

|

|

(73) |

Income tax expense (benefit) |

|

25 |

|

|

8 |

|

|

33 |

Net Income (Loss) From Continuing Operations |

|

(48) |

|

|

(58) |

|

|

(106) |

Net income (loss) from continuing operations attributable to noncontrolling interests |

|

(13) |

|

|

- |

|

|

(13) |

Net Income (Loss) From Continuing Operations Attributable to Alight, Inc. |

$ |

(35) |

|

$ |

(58) |

|

$ |

(93) |

|

|

|

|

|

|

|

|

|

Earnings Per Share |

|

|

|

|

|

|

|

|

Weighted average shares outstanding – basic |

|

439,800,624 |

|

|

|

|

|

439,800,624 |

Weighted average shares outstanding – dilutive |

|

439,800,624 |

|

|

|

|

|

439,800,624 |

Basic |

$ |

(0.08) |

|

|

|

|

$ |

(0.21) |

Diluted |

$ |

(0.08) |

|

|

|

|

$ |

(0.21) |

The accompanying Notes are an integral part of the unaudited pro forma condensed consolidated financial statements.

UNAUDITED PRO FORMA CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

For The Six Months Ended June 30, 2021 (Predecessor)

($ in millions)

|

|

|

|

|

|

|

|

|

|

|

|

Pro Forma Adjustments |

|

|

|

Historical Alight Predecessor |

|

Disposition Adjustments (Note 2a) |

|

Pro Forma Alight |

Revenue |

$ |

1,361 |

|

$ |

(461) |

|

$ |

900 |

Cost of services, exclusive of depreciation and amortization |

|

888 |

|

|

(294) |

|

|

594 |

Depreciation and amortization |

|

38 |

|

|

(4) |

|

|

34 |

Gross Profit |

|

435 |

|

|

(163) |

|

|

272 |

|

|

|

|

|

|

|

|

|

Operating Expenses |

|

|

|

|

|

|

|

|

Selling, general and administrative |

|

222 |

|

|

(83) |

|

|

139 |

Depreciation and intangible amortization |

|

111 |

|

|

(6) |

|

|

105 |

Total Operating expenses |

|

333 |

|

|

(89) |

|

|

244 |

Operating Income (Loss) From Continuing Operations |

|

102 |

|

|

(74) |

|

|

28 |

Other (Income) Expense |

|

|

|

|

|

|

|

|

Interest expense |

|

123 |

|

|

(1) |

|

|

122 |

Other (income) expense, net |

|

9 |

|

|

(8) |

|

|

1 |

Total Other (income) expense, net |

|

132 |

|

|

(9) |

|

|

123 |

Income (Loss) From Continuing Operations Before Taxes |

|

(30) |

|

|

(65) |

|

|

(95) |

Income tax expense (benefit) |

|

(5) |

|

|

(3) |

|

|

(8) |

Net Income (Loss) From Continuing Operations Attributable to Alight, Inc. |

$ |

(25) |

|

$ |

(62) |

|

$ |

(87) |

The accompanying Notes are an integral part of the unaudited pro forma condensed consolidated financial statements.

NOTES TO THE UNAUDITED PRO FORMA CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

Note 1 – Description of the Disposition and Basis of Presentation

The Disposition

On July 12, 2024, Alight completed the Transaction pursuant to the terms of the Purchase Agreement. Under the terms of the Purchase Agreement, the Buyer agreed to acquire the Divested Business for total consideration of up to $1.2 billion, in the form of (1) $1.0 billion in cash (the “Closing Cash Consideration”) payable at the closing of the transactions (the “Closing”) contemplated by the Purchase Agreement, (2) a note with an aggregate principal amount of $50.0 million and fair value of $35.4 million as of July 12, 2024 issued at Closing (the “Seller Note”) by an indirect parent of Buyer (the “Note Issuer”) and (3) contingent upon the financial performance of the Divested Business for the 2025 fiscal year, a note with an aggregate principal amount of up to $150.0 million (the “Additional Seller Note”) and fair value of $66 million as of July 12, 2024 to be issued by the Note Issuer.

At the end of the first quarter of 2024, the Company determined that the criteria for held-for-sale as prescribed in ASC 360 and discontinued operations as prescribed by ASC 205 were met, constituting a significant disposition. The Company presented the Divested Business in its quarterly report on Form 10-Q for the quarter ended March 31, 2024 as held-for-sale as of March 31, 2024, and December 31, 2023, and as discontinued operations for the three months ended March 31, 2024 and March 31, 2023.

The Basis of Presentation

The unaudited pro forma condensed consolidated financial statements and related notes are prepared in accordance with Article 11 of Regulation S-X. The Unaudited Pro Forma Condensed Consolidated Balance Sheet as of March 31, 2024, is presented herein in accordance with Rule 11-02(c)(1) of Regulation S-X. The respective periods of the Unaudited Pro Forma Condensed Consolidated Statements of Operations are presented herein in accordance with Rule 11-02(c)(2)(ii) of Regulation S-X.

While the historical consolidated financial statements reflect the company’s past financial results, the pro forma condensed consolidated financial statements are included solely for informational purposes and are intended to illustrate how the Transaction might have affected the historical consolidated financial statements had it been completed earlier, as indicated herein:

•The Unaudited Pro Forma Condensed Consolidated Balance Sheet as of March 31, 2024, as adjusted, gives effect to the Disposition Adjustments and Other Transaction Adjustments as if they had occurred or become effective March 31, 2024;

•The Unaudited Pro Forma Condensed Consolidated Statements of Operations for the three months ended March 31, 2024, the years ended December 31, 2023, and 2022, the six months ended December 31, 2021 (Successor), and the six months ended June 30, 2021 (Predecessor), as adjusted, give effect to the Disposition Adjustments and Other Transaction Adjustments as if they had occurred or become effective on January 1, 2021. Other Transaction Adjustments are only presented within the Unaudited Pro Forma Condensed Consolidated Statements of Operations for the three months ended March 31, 2024, and the year ended December 31, 2023.

The unaudited pro forma condensed consolidated financial statements Disposition Adjustments column combines balances of the Divested Business of Alight’s Professional Services segment and Alight’s Payroll & HCM Outsourcing business within the Employer Solutions segment to illustrate the separation and transfer of the operations, assets, and liabilities of the Company’s historical financial results in accordance with ASC 205 and ASC 360 to the Buyer for each respective period.

The unaudited pro forma condensed consolidated financial statements do not project Alight’s future consolidated financial statements, nor are they intended to represent or indicate the actual consolidated financial statements that the Company would have had if the Transaction had occurred on the indicated dates. Furthermore, the unaudited pro forma condensed consolidated financial statements do not reflect the realization of any expected cost savings, synergies, or dis-synergies resulting from the Transaction, and they do not encompass all actions that the Company may undertake subsequent to the closing of the Transaction.

Note 2 – Pro Forma Adjustments

Adjustments included in the Pro Forma Adjustments column in the accompanying unaudited pro forma condensed consolidated financial statements are as follows:

a)Disposition Adjustments: The Disposition Adjustments columns of the Unaudited Pro Forma Condensed Consolidated Balance Sheet and Unaudited Pro Forma Condensed Consolidated Statements of Operations represent the Pro Forma Adjustments to historical financial results directly attributable to the Transaction in accordance with ASC 205. This reflects the separation of the discontinued operations, including the elimination of associated assets, liabilities, equity, and income (loss) attributable to the Transaction, that were included in the Company’s historical financial statements. In accordance with ASC 205, the amounts exclude general corporate overhead costs that were historically allocated to the Divested Business and do not meet the requirements to be presented in discontinued operations. Such allocations included labor and non-labor expenses related to the Divested Business’s corporate support functions (e.g., finance, accounting, tax, treasury, information technology, human resources, and legal, among others). As the Company determined that the criteria for discontinued operations as prescribed by ASC 205 were met as of March 31, 2024, the adjustments directly attributable to the Transaction are reflected within the Historical Alight unaudited condensed consolidated statement of operations for the three months ended March 31, 2024.

b)Reflects the fair value of total consideration received from the closing of the Transaction of $1.1 billion, which represents (a) $1.0 billion cash, after customary closing adjustments under the terms of the Purchase Agreement for estimated closing date net working capital, and acquired cash and indebtedness, (b) the $35.4 million Seller Note at fair value, and (c) $66.0 million Additional Seller Note, at fair value. The Seller Note has a stated interest rate of 8.0% and is recorded in Other assets at its fair value of $35.4 million. The Additional Seller Note is contingent upon the financial performance of the Divested Business in 2025 based on Adjusted EBITDA and is recorded in Other assets at its fair value of $66.0 million.

The adjustment to Cash and cash equivalents represents the pro forma impact on net cash proceeds received as of March 31, 2024. The final sales price is subject to change based on adjustments to transaction costs and post-closing adjustments as defined in the Purchase Agreement. Thus, the final net cash proceeds will be determined subsequent to the closing of the Transaction and may differ from the adjustment mentioned herein:

|

|

|

|

$ in millions |

|

|

Amount |

Pro forma Disposition Adjustments: |

|

|

|

Fair value of total consideration received |

|

$ |

1,101 |

Less fair value of Seller Note |

|

|

(35) |

Less fair value of Additional Seller Note |

|

|

(66) |

Total cash proceeds from the Transaction |

|

|

1,000 |

Estimated transaction, TSA, and closing costs |

|

|

(47) |

Net cash proceeds pro forma transaction accounting adjustment to Cash and cash equivalents |

|

$ |

953 |

c)This adjustment that represents the estimated gain at the closing of the Transaction before accounting for actual taxes, fees, and other adjustments related to the Divested Business is comprised as follows:

|

|

|

|

$ in millions |

|

|

Amount |

Pro forma Disposition Adjustments: |

|

|

|

Fair value of total consideration received from the Transaction |

|

$ |

1,101 |

Net assets of the Divested Business |

|

|

(1,026) |

Estimated transaction, TSA, and closing costs |

|

|

(47) |

Estimated gain on sale |

|

$ |

28 |

For purposes of the Unaudited Pro Forma Condensed Consolidated Balance Sheet, the estimated pro forma gain on disposal is recognized in Stockholders’ Equity based on the historical net carrying value as of March 31, 2024, of the Divested Business rather than as of the closing date of the Transaction. The final gain on disposition will be calculated based on the final fair value of consideration received, carrying value of the Divested Business at the closing date, and the finalization of the Company’s current fiscal year tax provision. As a result, the pro forma gain reflected herein may materially differ from the actual gain on the Transaction recorded as of the closing date.

The estimated pro forma gain on disposal has not been reflected in the Unaudited Pro Forma Condensed Consolidated Statements of Operations, as this amount pertains to discontinued operations and does not have a continuing impact on the Company’s consolidated results.

d)The adjustment of $47.0 million represents the estimated net transaction and closing costs subsequent to the quarterly report on Form 10-Q for the quarter ended March 31, 2024 as well as a $15.0 million credit for certain post-closing services to be provided in accordance with the TSA agreement.

e)In conjunction with the Transaction, the company has entered into a TSA with the Buyer. The TSA outlines the terms under which the Company will provide certain post-closing services on a transitional basis. The significant components related to fixed services are anticipated to be provided for an initial period of up to 18 months, with the option to extend for an additional six months. The financial statements reflect a pro forma adjustment resulting in a reduction of $22.3 million and $5.6 million to Cost of services, exclusive of depreciation and amortization, representing fixed fees, exclusive of variable amounts, for the year ended December 31, 2023, and three months ended March 31, 2024, respectively.

f)In conjunction with the Transaction, the Company entered into a commercial agreement at market rate to provide customer care services to the Buyer that would have generated an estimated $36.2 million and $8.6 million in Revenue for the year ended December 31, 2023, and three months ended March 31, 2024, respectively.

g)Adjustment reflects the estimated deferred tax assets and liabilities attributable to the Divested Business that will reverse in the Transaction. The tax impact of the gain-on-sale Transaction is still being analyzed and has not been finalized; as such, the deferred tax and payable adjustments may differ from the results reflected herein.

h)The adjustment reflects the tax effects of the transaction accounting pro forma adjustments at the expected applicable statutory income tax rates in the respective jurisdictions and the expected tax effects on the gain on disposition. An assumed blended tax rate of 22.9% and 24.4% for the year ended December 31, 2023 and three months ended March 31, 2024 is used in calculating the adjustment. Income tax adjustments are anticipated to be settled within twelve months of the close of the Transaction. The estimated income tax adjustments are subject to change, and actual amounts may differ from the results reflected herein.

v3.24.2

Document And Entity Information

|

Jul. 12, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Jul. 12, 2024

|

| Entity Registrant Name |

Alight, Inc. / Delaware

|

| Entity Central Index Key |

0001809104

|

| Entity Emerging Growth Company |

false

|

| Entity File Number |

001-39299

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Tax Identification Number |

86-1849232

|

| Entity Address, Address Line One |

320 South Canal Street

|

| Entity Address, Address Line Two |

50th Floor, Suite 5000

|

| Entity Address, City or Town |

Chicago

|

| Entity Address, State or Province |

IL

|

| Entity Address, Postal Zip Code |

60069

|

| City Area Code |

(224)

|

| Local Phone Number |

737-7000

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Class A Common Stock, par value $0.0001 per share

|

| Trading Symbol |

ALIT

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

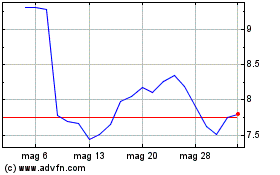

Grafico Azioni Alight (NYSE:ALIT)

Storico

Da Nov 2024 a Dic 2024

Grafico Azioni Alight (NYSE:ALIT)

Storico

Da Dic 2023 a Dic 2024