– Announces CEO succession plan –

– Continuing operations BPaaS revenue

increased 13% –

– 97% of 2024 Revenue Under Contract

–

– Key wins with UPS, Wayfair, American Honda

Motor Company & The Adecco Group –

– Completed cloud migration program and

fully decommissioned data center –

– Repurchased $80 million of common stock

–

Alight, Inc. (NYSE: ALIT), a leading cloud-based provider of

integrated digital human capital and business solutions, today

reported results for the second quarter ended June 30, 2024.

“Alight is entering its next chapter following the

accomplishment of several key strategic milestones including its

recent divestiture,” said CEO Stephan Scholl. “As a simplified and

focused wellbeing & benefits company, we have accelerated our

financial profile, underscored by the immediate margin expansion

and future earnings power. As I look to what is next for Alight, we

are well-positioned to navigate a dynamic environment with

tremendous long-standing relationships, world class services &

technology, and highly impressive colleagues to serve our thousands

of clients.”

CEO Succession Plan

In line with the closing of the Payroll & Professional

Services sale, the Company announced that Stephan Scholl will step

down as CEO and member of the Board, effective after the Board

names a successor. Scholl will continue as CEO and Director during

the search process. In addition, the Board has appointed Dave

Guilmette, an independent Director, as Vice Chair of the Board. In

this role, he will work closely with Scholl to ensure a smooth

transition.

Chair of the Board William P. Foley, II, said, “On behalf of the

entire Board, I want to thank Stephan for his commitment and

vision. He has made a meaningful impact as our CEO, bringing the

company public amidst the challenging COVID environment, and

overseeing our path in developing the Alight Worklife® platform for

employee wellbeing and benefits. With the divestiture behind us we

are well positioned to deliver differentiated benefit services to

our clients and profitable growth with significant margin and cash

flow expansion for our shareholders. Stephan’s continued efforts

and support through this transitionary period will help our next

CEO hit the ground running with a substantially improved financial

and operating model.”

Foley continued, “The Board has for months been actively

planning for CEO succession and with the divestiture now closed, we

look forward to bringing in a new leader to guide Alight in its

exciting next chapter."

Presentation of Results

Beginning with the quarter ended March 31, 2024, the Company

began accounting for the assets and liabilities of the Payroll

& Professional Services business as “held for sale” and its

operating results as discontinued operations. As such, the

financial information contained in this release is presented on a

continuing operations basis, unless otherwise noted. The Payroll

& Professional Services business transaction closed subsequent

to the end of the second quarter and accordingly, this press

release also presents total company results.

Second Quarter 2024 Continuing Operations Highlights (all

comparisons are relative to second quarter 2023)

- Revenue decreased 4.1% to $538 million

- Business Process as a Service (BPaaS) revenue grew 12.7% to

$115 million, representing 21.4% of total revenue

- Gross profit of $167 million and gross profit margin of 31.0%,

compared to $187 million and 33.3% in the prior year period,

respectively, and adjusted gross profit of $196 million and

adjusted gross profit margin of 36.4%, compared to $212 million and

37.8%, in the prior year period, respectively

- Net loss of $4 million compared to the prior year period net

loss of $72 million primarily driven by non-operating fair value

remeasurements of financial instruments and the tax receivable

agreement

- Adjusted EBITDA of $105 million compared to the prior year

period of $119 million

- Diluted earnings (loss) per share of $(0.01) compared to

$(0.14) in the prior year period, and adjusted diluted earnings per

share of $0.05 compared to $0.11 per share in the prior year

period

- New wins, including new logos or expanded relationships with

companies including UPS, Wayfair, American Honda Motor Company and

The Adecco Group

- Repurchased $80 million of common stock under existing share

repurchase program

Continuing Operations Second Quarter 2024 Results

Revenue decreased 4.1% to $538 million, as compared to $561

million in the prior year period. Excluding the exited Hosted

business, revenue decreased 2.5%. The decrease was driven by lower

volumes, net commercial activity, and project revenue within our

Employer Solutions segment and the wind-down of our Hosted business

operations. Recurring revenues were 91.6% of total revenue.

Gross profit was $167 million, or 31.0% of revenue, compared to

$187 million, or 33.3% of revenue in the prior year period. The

decrease in gross profit was primarily driven by lower revenue as

noted above, and partially offset by productivity savings.

Selling, general and administrative expenses decreased $3

million when compared to the prior year period. This was driven by

lower compensation expenses primarily related to share-based awards

and lower costs incurred from our previously announced

restructuring program, partially offset by professional fees

incurred related to the sale of our Payroll & Professional

Services business.

Interest expense of $33 million was flat from the prior year

period. Interest expense benefited from the opportunistic repricing

of our 2028 term loan and higher interest income and was offset by

lower swap payments.

The Company’s loss from continuing operations before income tax

expense was $2 million compared to loss from continuing operations

before income tax benefit of $80 million in the prior year period.

The improvement was primarily due to the non-operating fair value

remeasurements of financial instruments and the tax receivable

agreement.

Balance Sheet Highlights

As of June 30, 2024, the Company’s cash and cash equivalents

balance was $183 million, total debt was $2,780 million and total

debt net of cash and cash equivalents was $2,597 million.

During the quarter, the Company completed a repricing of its

2028 term loan that decreased its interest rate by 50 basis points

for $10 million of anticipated annualized interest expense savings

following the Company's deleveraging in July 2024.

Subsequent Events

On July 12, 2024, the Company announced that it completed the

sale of its Payroll and Professional Services business.

On July 15, 2024, the Company commenced its $75 million

accelerated share repurchase agreement with final settlement

expected in the third quarter of 2024.

Following the repayment of $740 million of debt during July

2024, the interest rates on the Company’s debt are 100% fixed

through 2024 and 70% through 2025.

Second Half 2024 Business Outlook

For the second half of 2024, we expect:

- Revenue of $1.207 billion to $1.232 billion.

- BPaaS Revenue of $265 to $275 million.

- Adjusted EBITDA of $326 million to $351 million.

- Adjusted EBITDA margin range of 26.5% to 29.1%.

- Adjusted diluted EPS of $0.31 to $0.36.

- Operating Cash Flow Conversion rate of 55-65%.

Reconciliations of the historical financial measures used in

this press release that are not recognized under U.S. generally

accepted accounting principles ("GAAP") are included below. Because

GAAP financial measures on a forward-looking basis are not

accessible, and reconciling information is not available without

unreasonable effort, we have not provided reconciliations for

forward-looking non-GAAP measures. For the same reasons, we are

unable to address the probable significance of the unavailable

information, which could be material to future results.

Earnings Conference Call and Webcast Information

A conference call to discuss the Company’s second quarter 2024

financial results is scheduled for today, August 6, 2024 at 7:30

a.m. Central Time (8:30 a.m. Eastern Time). Interested parties can

access the live webcast and accompanying presentation materials by

logging on to the Investor Relations section on the Company’s

website at http://investor.alight.com. A replay of the conference

call and the accompanying presentation materials will be available

on the investor relations website for approximately 90 days.

About Alight Solutions

Alight is a leading cloud-based human capital technology and

services provider for many of the world’s largest organizations.

Through the administration of employee benefits, Alight powers

confident health, wealth, leaves and wellbeing decisions for 35

million people and dependents. Our Alight Worklife® platform

empowers employers to gain a deeper understanding of their

workforce and engage them throughout life’s most important moments

with personalized benefits management and data-driven insights,

leading to increased employee wellbeing, engagement and

productivity. Learn how Alight unlocks growth for organizations of

all sizes at alight.com.

Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as

amended. These statements include, but are not limited to,

statements regarding our management and director succession plans,

statements regarding the anticipated benefits of the sale of our

Payroll & Professional Services business including the

achievement of our financial objectives, statements related to our

cloud migration project and its expected impact, statements related

to our expected revenue under contract and statements related to

the expectations regarding the performance and outlook for Alight’s

business, financial results, liquidity and capital resources. In

some cases, these forward-looking statements can be identified by

the use of words such as “outlook,” “believes,” “expects,”

“potential,” “continues,” “may,” “will,” “should,” “could,”

“seeks,” “projects,” “predicts,” “intends,” “plans,” “estimates,”

“anticipates” or the negative version of these words or other

comparable words. Such forward-looking statements are subject to

various risks and uncertainties including, among others, risks

related to declines in economic activity in the industries,

markets, and regions our clients serve, including as a result of

elevated interest rates or changes in monetary and fiscal policies,

competition in our industry, risks related to our ability to

successfully separate our Payroll and Professional Services

business, risks related to the performance of our information

technology systems and networks, risks related to our ability to

maintain the security and privacy of confidential and proprietary

information, risks related to actions or proposals from activist

stockholders, risks related to the ability to meet the contingent

payment conditions of the seller note, and risks related to changes

in regulation, including developments on the use of artificial

intelligence and machine learning. Additional factors that could

cause Alight’s results to differ materially from those described in

the forward-looking statements can be found under the section

entitled “Risk Factors” of Alight’s Annual Report on Form 10-K,

filed with the Securities and Exchange Commission (the "SEC") on

February 29, 2024 and in the Quarterly Report on Form 10-Q filed

with the SEC on May 8, 2024, as such factors may be updated from

time to time in Alight's filings with the SEC, which are, or will

be, accessible on the SEC's website at www.sec.gov. Accordingly,

there are or will be important factors that could cause actual

outcomes or results to differ materially from those indicated in

these statements. These factors should not be construed as

exhaustive and should be considered along with other factors noted

in this presentation and in Alight’s filings with the SEC. Alight

undertakes no obligation to publicly update or review any

forward-looking statement, whether as a result of new information,

future developments or otherwise, except as required by law.

Non-GAAP Financial Measures and Other Information

This press release includes supplemental information presenting

the results of our operations on a total company basis that

includes the Payroll & Professional Services business. This

presentation is not considered to be prepared in accordance with

GAAP. However, as the Payroll & Professional Services business

continued to operate as a business of Alight until the closing of

the transaction, we believe the total company results provide a

meaningful basis of comparison and are useful in identifying

current business trends for the periods presented.

The Company also refers to certain non-GAAP financial measures

in this press release, including: Adjusted EBITDA From Continuing

Operations, Adjusted EBITDA Margin From Continuing Operations,

Adjusted Net Income From Continuing Operations, Adjusted Diluted

Earnings Per Share From Continuing Operations, Operating Cash Flow

Conversion, Adjusted Gross Profit and Adjusted Gross Profit Margin.

Please see below for additional information and for reconciliations

of such non-GAAP financial measures. The presentation of non-GAAP

financial measures is used to enhance our investors’ and lenders’

understanding of certain aspects of our financial performance. This

discussion is not meant to be considered in isolation, superior to,

or as a substitute for the directly comparable financial measures

prepared in accordance with GAAP.

Adjusted EBITDA From Continuing Operations, which is defined as

earnings from continuing operations before interest, taxes,

depreciation and intangible amortization adjusted for the impact of

certain non-cash and other items that we do not consider in the

evaluation of ongoing operational performance. Adjusted EBITDA

Margin From Continuing Operations is defined as Adjusted EBITDA

From Continuing Operations divided by revenue. Both Adjusted EBITDA

From Continuing Operations and Adjusted EBITDA Margin From

Continuing Operations are non-GAAP financial measures used by

management and our stakeholders to provide useful supplemental

information that enables a better comparison of our performance

across periods as well as to evaluate our core operating

performance.

Adjusted Net Income From Continuing Operations, which is defined

as net income (loss) from continuing operations adjusted for

intangible amortization and the impact of certain non-cash items

that we do not consider in the evaluation of ongoing operational

performance, is a non-GAAP financial measure used solely for the

purpose of calculating Adjusted Diluted Earnings Per Share From

Continuing Operations.

Adjusted Diluted Earnings Per Share From Continuing Operations

is defined as Adjusted Net Income From Continuing Operations

divided by the adjusted weighted-average number of shares of Alight

Inc. common stock, diluted. Adjusted Diluted Earnings Per Share

From Continuing Operations is used by us and our investors to

evaluate our core operating performance and to benchmark our

operating performance against our competitors.

Operating Cash Flow Conversion is defined as cash provided by

operating activities divided by Adjusted EBITDA. Operating Cash

Flow Conversion is used by management and stakeholders to evaluate

our core operating performance.

Adjusted Gross Profit is defined as revenue less cost of

services adjusted for depreciation, amortization and share-based

compensation, and Adjusted Gross Profit Margin is defined as

Adjusted Gross Profit divided by revenue. Management uses Adjusted

Gross Profit and Adjusted Gross Profit Margin as key measures in

making financial, operating and planning decisions and in

evaluating our performance. We believe that presenting Adjusted

Gross Profit and Adjusted Gross Profit Margin is useful to

investors as it eliminates the impact of certain non-cash expenses

and allows a direct comparison between periods.

Revenue Under Contract is an operational metric that represents

management’s estimate of anticipated revenue expected to be

recognized in the period referenced based on available information

that includes historical client contracting practices. The metric

does not reflect potential future events such as unexpected client

volume fluctuations, early contract terminations or early contract

renewals. Our metric may differ from similar terms used by other

companies and therefore comparability may be limited.

Condensed Consolidated

Statements of Income (Loss)

(Unaudited)

Three Months Ended June

30,

Six Months Ended June

30,

(in millions, except per share

amounts)

2024

2023

2024

2023

Revenue

$

538

$

561

$

1,097

$

1,147

Cost of services, exclusive of

depreciation and amortization

345

356

701

738

Depreciation and amortization

26

18

47

35

Gross Profit

167

187

349

374

Operating Expenses

Selling, general and administrative

146

149

292

300

Depreciation and intangible

amortization

73

74

149

150

Total Operating expenses

219

223

441

450

Operating Income (Loss) From Continuing

Operations

(52

)

(36

)

(92

)

(76

)

Other (Income) Expense

(Gain) Loss from change in fair value of

financial instruments

(52

)

—

(31

)

25

(Gain) Loss from change in fair value of

tax receivable agreement

(31

)

11

24

19

Interest expense

33

33

64

66

Other (income) expense, net

—

—

1

1

Total Other (income) expense, net

(50

)

44

58

111

Income (Loss) From Continuing

Operations Before Taxes

(2

)

(80

)

(150

)

(187

)

Income tax expense (benefit)

2

(8

)

(25

)

(31

)

Net Income (Loss) From Continuing

Operations

(4

)

(72

)

(125

)

(156

)

Net Income (Loss) From Discontinued

Operations, Net of Tax

27

—

32

10

Net Income (Loss)

23

(72

)

(93

)

(146

)

Net income (loss) attributable to

noncontrolling interests

—

(5

)

(2

)

(11

)

Net Income (Loss) Attributable to

Alight, Inc.

$

23

$

(67

)

$

(91

)

$

(135

)

Earnings Per Share

Basic and Diluted

Continuing operations

$

(0.01

)

$

(0.14

)

$

(0.23

)

$

(0.30

)

Discontinued operations

$

0.05

$

0.00

$

0.06

$

0.02

Net Income (Loss)

$

0.04

$

(0.14

)

$

(0.17

)

$

(0.28

)

Condensed Consolidated Balance

Sheets

(Unaudited)

June 30, 2024

December 31,

2023

(in millions, except par values)

Assets

Current Assets

Cash and cash equivalents

$

183

$

324

Receivables, net

372

435

Other current assets

210

260

Fiduciary assets

217

234

Current assets held for sale

2,461

1,523

Total Current Assets

3,443

2,776

Goodwill

3,212

3,212

Intangible assets, net

2,995

3,136

Fixed assets, net

393

331

Deferred tax assets, net

86

38

Other assets

344

341

Long-term assets held for sale

—

948

Total Assets

$

10,473

$

10,782

Liabilities and Stockholders'

Equity

Liabilities

Current Liabilities

Accounts payable and accrued

liabilities

$

249

$

325

Current portion of long-term debt, net

329

25

Other current liabilities

261

233

Fiduciary liabilities

217

234

Current liabilities held for sale

1,461

1,370

Total Current Liabilities

2,517

2,187

Deferred tax liabilities

32

32

Long-term debt, net

2,451

2,769

Long-term tax receivable agreement

757

733

Financial instruments

80

109

Other liabilities

159

142

Long-term liabilities held for sale

—

68

Total Liabilities

$

5,996

$

6,040

Commitments and Contingencies

Stockholders' Equity

Preferred stock at $0.0001 par value: 1.0

shares authorized, none issued and outstanding

$

—

$

—

Class A Common Stock: $0.0001 par value,

1,000.0 shares authorized; 541.4 and 510.9 issued and outstanding

as of June 30, 2024 and December 31, 2023, respectively

—

—

Class B Common Stock: $0.0001 par value,

20.0 shares authorized; 9.8 and 9.9 issued and outstanding as of

June 30, 2024 and December 31, 2023, respectively

—

—

Class V Common Stock: $0.0001 par value,

175.0 shares authorized; 0.6 and 29.0 issued and outstanding as of

June 30, 2024 and December 31, 2023, respectively

—

—

Class Z Common Stock: $0.0001 par value,

12.9 shares authorized; 0.6 and 3.4 issued and outstanding as of

June 30, 2024 and December 31, 2023, respectively

—

—

Treasury stock, at cost (16.6 and 6.4

shares at June 30, 2024 and December 31, 2023, respectively)

(132

)

(52

)

Additional paid-in-capital

5,134

4,946

Retained deficit

(594

)

(503

)

Accumulated other comprehensive income

65

71

Total Alight, Inc. Stockholders'

Equity

$

4,473

$

4,462

Noncontrolling interest

4

280

Total Stockholders' Equity

$

4,477

$

4,742

Total Liabilities and Stockholders'

Equity

$

10,473

$

10,782

Condensed Consolidated Statements of

Cash Flows

(Unaudited)

Six Months Ended June

30,

(in millions)

2024

2023

Operating activities:

Net Income (Loss) From Continuing

Operations

$

(125

)

$

(156

)

Adjustments to reconcile net income (loss)

to net cash provided by operating activities:

Depreciation

56

44

Intangible asset amortization

140

141

Noncash lease expense

6

7

Financing fee and premium amortization

(1

)

(1

)

Share-based compensation expense

48

64

(Gain) loss from change in fair value of

financial instruments

(31

)

25

(Gain) loss from change in fair value of

tax receivable agreement

24

19

Release of unrecognized tax provision

(2

)

(1

)

Deferred tax expense (benefit)

(39

)

(3

)

Other

2

4

Changes in operating assets and

liabilities:

Accounts receivable

62

34

Accounts payable and accrued

liabilities

(75

)

(120

)

Other assets and liabilities

28

56

Cash provided by operating activities -

continuing operations

93

113

Cash provided by operating activities -

discontinued operations

65

49

Net cash provided by operating

activities

$

158

$

162

Investing activities:

Capital expenditures

(67

)

(78

)

Cash used for investing activities -

continuing operations

(67

)

(78

)

Cash used in investing activities -

discontinued operations

(11

)

(11

)

Net cash used in investing

activities

$

(78

)

$

(89

)

Financing activities:

Net increase (decrease) in fiduciary

liabilities

(17

)

(17

)

Repayments to banks

(13

)

(13

)

Principal payments on finance lease

obligations

(14

)

(13

)

Payments on tax receivable agreements

(62

)

(7

)

Tax payment for shares/units withheld in

lieu of taxes

(58

)

(6

)

Deferred and contingent consideration

payments

—

(4

)

Repurchase of shares

(80

)

(14

)

Cash used for financing activities -

continuing operations

(244

)

(74

)

Cash provided by (used in) financing

activities - discontinued operations

22

(201

)

Net Cash provided by (used for)

financing activities

$

(222

)

$

(275

)

Effect of exchange rate changes on

cash, cash equivalents and restricted cash - discontinued

operations

(3

)

5

Net increase (decrease) in cash, cash

equivalents and restricted cash

(145

)

(197

)

Cash, cash equivalents and restricted

cash balances from:

Continuing operations - beginning of

year

$

558

$

482

Discontinued operations - beginning of

year(a)

1,201

1,277

Less Discontinued operations - end of

period(a)

1,214

1,079

Continuing operations - end of

period

$

400

$

483

(a)Reported as assets held for sale on our

condensed consolidated balance sheets.

Reconciliation of Net Income (Loss)

From Continuing Operations to Adjusted EBITDA from Continuing

Operations (Unaudited)

Three Months Ended June

30,

Six Months Ended June

30,

(in millions)

2024

2023

2024

2023

Net Income (Loss) From Continuing

Operations (1)

$

(4

)

$

(72

)

$

(125

)

$

(156

)

Interest expense

33

33

64

66

Income tax expense (benefit)

2

(8

)

(25

)

(31

)

Depreciation

30

22

56

44

Intangible amortization

69

70

140

141

EBITDA From Continuing

Operations

130

45

110

64

Share-based compensation

20

30

48

64

Transaction and integration expenses

(2)

19

8

36

10

Restructuring

18

25

33

48

(Gain) Loss from change in fair value of

financial instruments

(52

)

—

(31

)

25

(Gain) Loss from change in fair value of

tax receivable agreement

(31

)

11

24

19

Other

1

—

1

1

Adjusted EBITDA From Continuing

Operations

$

105

$

119

$

221

$

231

Revenue

$

538

$

561

$

1,097

$

1,147

Adjusted EBITDA Margin From Continuing

Operations (3)

19.5

%

21.2

%

20.1

%

20.1

%

(1)

Adjusted EBITDA excludes the impact of discontinued operations.

Comparable periods have been recast to exclude these impacts.

(2)

Transaction and integration expenses primarily relate to

acquisition and divestiture activities.

(3)

Adjusted EBITDA Margin From Continuing Operations is defined as

Adjusted EBITDA from Continuing Operations as a percentage of

revenue.

Reconciliation of Net Income (Loss)

From Continuing Operations to Adjusted Net Income and Adjusted

Diluted Earnings per Share From Continuing Operations

(Unaudited)

Three Months Ended June

30,

Six Months Ended June

30,

2024

2023

2024

2023

(in millions, except share and per share

amounts)

Numerator:

Net Income (Loss) From Continuing

Operations Attributable to Alight, Inc. (1)

$

(4

)

$

(67

)

$

(123

)

$

(145

)

Conversion of noncontrolling interest

—

(5

)

(2

)

(11

)

Intangible amortization

69

70

140

141

Share-based compensation

20

30

48

64

Transaction and integration expenses

(2)

19

8

36

10

Restructuring

18

25

33

48

(Gain) Loss from change in fair value of

financial instruments

(52

)

—

(31

)

25

(Gain) Loss from change in fair value of

tax receivable agreement

(31

)

11

24

19

Other

2

—

2

1

Tax effect of adjustments (3)

(12

)

(12

)

(41

)

(41

)

Adjusted Net Income From Continuing

Operations

$

29

$

60

$

86

$

111

Denominator:

Weighted average shares outstanding -

basic

546,174,400

490,306,205

543,376,024

483,358,533

Dilutive effect of the exchange of

noncontrolling interest units

554,568

—

554,568

—

Dilutive effect of RSUs

374,688

—

—

—

Weighted average shares outstanding -

diluted

547,103,656

490,306,205

543,930,592

483,358,533

Exchange of noncontrolling interest

units(4)

107,673

44,103,939

2,714,155

51,055,250

Impact of unvested RSUs(5)

9,222,832

10,109,595

9,597,520

10,109,595

Adjusted shares of Class A Common Stock

outstanding - diluted(6)(7)

556,434,161

544,519,739

556,242,267

544,523,378

Basic (Net Loss) Earnings Per Share

From Continuing Operations

$

(0.01

)

$

(0.14

)

$

(0.23

)

$

(0.30

)

Diluted (Net Loss) Earnings Per Share

From Continuing Operations

$

(0.01

)

$

(0.14

)

$

(0.23

)

$

(0.30

)

Adjusted Diluted Earnings Per Share

From Continuing Operations

$

0.05

$

0.11

$

0.15

$

0.20

(1)

Excludes the impact of discontinued

operations. Comparable periods have been recast to exclude these

impacts.

(2)

Transaction and integration expenses

primarily relate to acquisition and divestiture activities.

(3)

Income tax effects have been calculated

based on the statutory tax rates for both U.S. and foreign

jurisdictions based on the Company's mix of income and adjusted for

significant changes in fair value measurement.

(4)

Assumes the full exchange of the units

held by noncontrolling interests for shares of Class A Common Stock

of Alight, Inc. pursuant to the exchange agreement.

(5)

Includes non-vested time-based restricted

stock units that were determined to be antidilutive for U.S. GAAP

diluted earnings per share purposes.

(6)

Excludes two tranches of contingently

issuable seller earnout shares: (i) 7.5 million shares will be

issued if the Company's Class A Common Stock's volume-weighted

average price ("VWAP") is >$12.50 for any 20 trading days within

a consecutive period of 30 trading days; (ii) 7.5 million shares

will be issued if the Company's Class A Common Stock VWAP is

>$15.00 for any 20 trading days within a consecutive period of

30 trading days. Both tranches have a seven-year duration.

(7)

Excludes approximately 14.1 million and

30.2 million performance-based units, which represents the gross

number of shares expected to vest based on achievement of

performance conditions as of June 30, 2024 and 2023,

respectively.

Gross Profit to Adjusted Gross Profit

Reconciliation by Segment

(Unaudited)

Three Months Ended June 30,

2024

($ in millions)

Employer Solutions

Other

Total

Gross Profit

$

167

$

—

$

167

Add: stock-based compensation

3

—

3

Add: depreciation and amortization

26

—

26

Adjusted Gross Profit

$

196

$

—

$

196

Gross Profit Margin

31.0

%

0.0

%

31.0

%

Adjusted Gross Profit Margin

36.4

%

0.0

%

36.4

%

Three Months Ended June 30,

2023

($ in millions)

Employer Solutions

Other

Total

Gross Profit

$

189

$

(2

)

$

187

Add: stock-based compensation

7

—

7

Add: depreciation and amortization

17

1

18

Adjusted Gross Profit

$

213

$

(1

)

$

212

Gross Profit Margin

34.2

%

(22.2

)%

33.3

%

Adjusted Gross Profit Margin

38.6

%

(11.1

)%

37.8

%

Other Select Financial Data

(Unaudited)

Three Months Ended June

30,

Six Months Ended June

30,

($ in millions)

2024

2023

2024

2023

Segment

Revenues

Employer Solutions:

Recurring

$

493

$

505

$

1,014

$

1,038

Project

45

47

83

90

Total Employer Solutions

538

552

1,097

1,128

Other (1)

—

9

—

19

Total revenue

$

538

$

561

$

1,097

$

1,147

Segment Gross

Profit

Employer Solutions

$

167

$

189

$

349

$

376

Other

—

(2

)

—

(2

)

Total gross profit

$

167

$

187

$

349

$

374

Segment Gross

Margin

Employer Solutions

31.0

%

34.2

%

31.8

%

33.3

%

Other

0.0

%

(22.2

)%

0.0

%

(10.5

)%

Total gross margin

31.0

%

33.3

%

31.8

%

32.6

%

Segment Adjusted

Gross Profit

Employer Solutions

$

196

$

213

$

404

$

423

Other

—

(1

)

—

—

Total adjusted gross profit

$

196

$

212

$

404

$

423

Segment Adjusted

Gross Margin Percent

Employer Solutions

36.4

%

38.6

%

36.8

%

37.5

%

Other

0.0

%

(11.1

)%

0.0

%

0.0

%

Total adjusted gross margin percent

36.4

%

37.8

%

36.8

%

36.9

%

Adjusted EBITDA From Continuing

Operations

$

105

$

119

$

221

$

231

Cash provided by continuing operating

activities

$

93

$

113

Other Key

Statistics

Recurring revenue, Ex. Other

$

493

$

505

$

1,014

$

1,038

BPaaS revenue

$

115

$

102

$

232

$

199

BPaaS revenue as % of total revenue

21.4

%

18.2

%

21.1

%

17.3

%

(1)

Other primarily attributable to the former Hosted Segment.

Supplemental Financial

Information

(Continuing Operations and

Discontinued Operations)

Alight, Inc. Condensed Consolidated

Statements of Income (Loss)

(Unaudited)

Three Months Ended June

30,

Six Months Ended June

30,

(in millions, except per share

amounts)

2024

2023

2024

2023

Revenue

$

787

$

806

$

1,603

$

1,637

Cost of services, exclusive of

depreciation and amortization

512

528

1,055

1,083

Depreciation and amortization

26

21

50

40

Gross Profit

249

257

498

514

Operating Expenses

Selling, general and administrative

197

193

380

378

Depreciation and intangible

amortization

72

85

157

170

Total operating expenses

269

278

537

548

Operating Income (Loss)

(20

)

(21

)

(39

)

(34

)

Other (Income) Expense

(Gain) Loss from change in fair value of

financial instruments

(52

)

—

(31

)

25

(Gain) Loss from change in fair value of

tax receivable agreement

(31

)

11

24

19

Interest expense

33

33

64

66

Other (income) expense, net

2

4

4

7

Total other (income) expense, net

(48

)

48

61

117

Income (Loss) Before Income Tax

28

(69

)

(100

)

(151

)

Income tax expense (benefit)

5

3

(7

)

(5

)

Net Income (Loss)

23

(72

)

(93

)

(146

)

Net loss attributable to noncontrolling

interests

—

(5

)

(2

)

(11

)

Net (Loss) Income Attributable to

Alight, Inc.

$

23

$

(67

)

$

(91

)

$

(135

)

Earnings Per Share

Basic (net loss) earnings per share

$

0.04

$

(0.14

)

$

(0.17

)

$

(0.28

)

Diluted (net loss) earnings per share

$

0.04

$

(0.14

)

$

(0.17

)

$

(0.28

)

Reconciliation of Net Income (Loss) to

Adjusted EBITDA

(Unaudited)

Three Months Ended June

30,

Three Months Ended June

30,

Six Months Ended June

30,

Six Months Ended June

30,

2024

2023

2024

2023

Net Income (Loss)

$

23

$

(72

)

$

(93

)

$

(146

)

Interest expense

33

33

64

66

Income tax expense (benefit)

5

3

(7

)

(5

)

Depreciation

29

26

58

50

Intangible amortization

69

80

149

160

EBITDA

159

70

171

125

Share-based compensation

18

38

46

75

Transaction and integration expenses

(1)

29

8

46

10

Restructuring

20

30

37

56

(Gain) Loss from change in fair value of

financial instruments

(52

)

—

(31

)

25

(Gain) Loss from change in fair value of

tax receivable agreement

(31

)

11

24

19

Other

2

—

2

1

Adjusted EBITDA

$

145

$

157

$

295

$

311

Revenue

$

787

$

806

$

1,603

$

1,637

Adjusted EBITDA Margin (2)

18.4

%

19.5

%

18.4

%

19.0

%

(1)

Transaction and integration expenses

primarily relate to acquisition and divestiture activities.

(2)

Adjusted EBITDA Margin is defined as Adjusted EBITDA as a

percentage of revenue.

Reconciliation of Net Income (Loss) to

Adjusted Net Income and Adjusted Diluted Earnings per Share

(Unaudited)

Three Months Ended June

30,

Three Months Ended June

30,

Six Months Ended June

30,

Six Months Ended June

30,

2024

2023

2024

2023

Numerator:

Net (Loss) Income Attributable to Alight,

Inc.

$

23

$

(67

)

$

(91

)

$

(135

)

Conversion of noncontrolling interest

—

(5

)

(2

)

(11

)

Intangible amortization

69

80

149

160

Share-based compensation

18

38

46

75

Transaction and integration expenses

(1)

29

8

46

10

Restructuring

20

30

37

56

(Gain) Loss from change in fair value of

financial instruments

(52

)

—

(31

)

25

(Gain) Loss from change in fair value of

tax receivable agreement

(31

)

11

24

19

Other

2

—

2

1

Tax effect of adjustments (2)

(15

)

(18

)

(47

)

(51

)

Adjusted Net Income

$

63

$

77

$

133

$

149

Denominator:

Weighted average shares outstanding -

basic

546,174,400

490,306,205

543,376,024

483,358,533

Dilutive effect of the exchange of

noncontrolling interest units

554,568

—

554,568

—

Dilutive effect of RSUs

374,688

—

—

—

Weighted average shares outstanding -

diluted

547,103,656

490,306,205

543,930,592

483,358,533

Exchange of noncontrolling interest units

(3)

107,673

44,103,939

2,714,155

51,055,250

Impact of unvested RSUs(4)

9,222,832

10,109,595

9,597,520

10,109,595

Adjusted shares of Class A Common Stock

outstanding - diluted (5)(6)

556,434,161

544,519,739

556,242,267

544,523,378

Basic (Net Loss) Earnings Per

Share

$

0.04

$

(0.14

)

$

(0.17

)

$

(0.28

)

Diluted (Net Loss) Earnings Per

Share

$

0.04

$

(0.14

)

$

(0.17

)

$

(0.28

)

Adjusted Diluted Earnings Per

Share

$

0.11

$

0.14

$

0.24

$

0.27

(1)

Transaction and integration expenses

primarily relate to acquisition and divestiture activities.

(2)

Income tax effects have been calculated

based on the statutory tax rates for both U.S. and foreign

jurisdictions based on the Company's mix of income and adjusted for

significant changes in fair value measurement.

(3)

Assumes the full exchange of the units

held by noncontrolling interests for shares of Class A Common Stock

of Alight, Inc. pursuant to the exchange agreement.

(4)

Includes non-vested time-based restricted

stock units that were determined to be antidilutive for U.S. GAAP

diluted earnings per share purposes.

(5)

Excludes two tranches of contingently

issuable seller earnout shares: (i) 7.5 million shares will be

issued if the Company's Class A Common Stock's volume-weighted

average price ("VWAP") is >$12.50 for any 20 trading days within

a consecutive period of 30 trading days; (ii) 7.5 million shares

will be issued if the Company's Class A Common Stock VWAP is

>$15.00 for any 20 trading days within a consecutive period of

30 trading days. Both tranches have a seven-year duration.

(6)

Excludes approximately 14.1 million and

30.2 million performance-based units, which represents the gross

number of shares expected to vest based on achievement of

performance conditions as of June 30, 2024 and 2023,

respectively.

Gross Profit to Adjusted Gross Profit

Reconciliation

(Unaudited)

Three Months Ended June

30,

Six Months Ended June

30,

($ in millions)

2024

2023

2024

2023

Gross Profit

$

249

$

257

$

498

$

514

Add: stock-based compensation

3

9

8

18

Add: depreciation and amortization

26

21

50

40

Adjusted Gross Profit

$

278

$

287

$

556

$

572

Gross Profit Margin

31.6

%

31.9

%

31.1

%

31.4

%

Adjusted Gross Profit Margin

35.3

%

35.6

%

34.7

%

34.9

%

Total Company Revenue

Disaggregation

(Unaudited)

Three Months Ended June

30,

Six Months Ended June

30,

($ in millions)

2024

2023

2024

2023

Employer Solutions:

Recurring

$

493

$

505

$

1,014

$

1,038

Project

45

47

83

90

Total Employer Solutions

538

552

1,097

1,128

Revenue from Discontinued Operations

249

245

506

490

Total Revenue, excluding Hosted

787

797

1,603

1,618

Other (1)

—

9

—

19

Total Alight Revenue

$

787

$

806

$

1,603

$

1,637

(1)

Other primarily attributable to the formed Hosted segment.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240806309263/en/

Investors: Jeremy Cohen investor.relations@alight.com

Media: Mariana Fischbach mariana.fischbach@alight.com

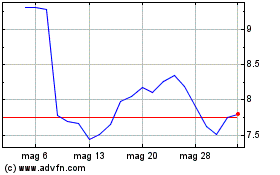

Grafico Azioni Alight (NYSE:ALIT)

Storico

Da Nov 2024 a Dic 2024

Grafico Azioni Alight (NYSE:ALIT)

Storico

Da Dic 2023 a Dic 2024