As filed with the Securities and Exchange Commission on February 23, 2024

Registration Statement No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-3

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

AVALONBAY COMMUNITIES, INC.

(Exact Name of registrant as specified in its charter)

| |

Maryland

(State of or other jurisdiction

of incorporation or organization)

|

|

|

77-0404318

(I.R.S. Employer

Identification Number)

|

|

4040 Wilson Blvd., Suite 1000

Arlington, Virginia 22203

(703) 329-6300

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Benjamin W. Schall

Chief Executive Officer and President

AvalonBay Communities, Inc.

4040 Wilson Blvd., Suite 1000

Arlington, VA 22203

(703) 329-6300

(Name, address, including zip code, and telephone number, including area code, of agent for service)

With copies to:

Audrey S. Leigh

William T. Goldberg

Goodwin Procter LLP

620 Eighth Avenue

New York, New York 10018

(212) 813-8800

Approximate date of commencement of proposed sale to the public:

From time to time after this Registration Statement becomes effective.

If the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box. ☐

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. ☒

If this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| |

Large accelerated filer ☒

Non-accelerated filer ☐

|

|

|

Accelerated filer ☐

Smaller reporting company ☐

Emerging growth company ☐

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided by Section 7(a)(2)(B) of the Securities Act. ☐

Prospectus

AVALONBAY COMMUNITIES, INC.

Debt Securities

Preferred Stock

Common Stock

This prospectus provides you with a general description of debt and equity securities that AvalonBay Communities, Inc. may offer and sell from time to time. We may sell these securities independently, or together in any combination that may include other securities set forth in an accompanying prospectus supplement, in one or more offerings, for sale directly to purchasers or through underwriters, dealers or agents to be designated at a future date. Each time we sell securities we will provide a prospectus supplement that will contain specific information about the terms of that sale and may add to or update the information in this prospectus, including the names of any underwriters, dealers or agents involved in the sale of any securities. Securities may also be offered by securityholders, if so provided in a prospectus supplement hereto. We will provide specific information about any selling securityholders in one or more supplements to this prospectus. You should read this prospectus and any applicable prospectus supplement carefully before you invest in our securities.

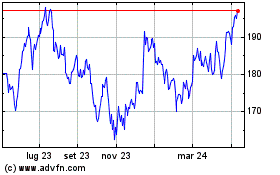

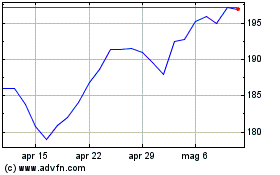

Our common stock is listed on the New York Stock Exchange under the symbol “AVB.” On February 22, 2024, the closing price of our common stock on the New York Stock Exchange was $176.12.

Investing in our securities involves various risks. Beginning on page 1, we have discussed several “Risk Factors” that you should consider before investing in our securities.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

February 23, 2024

Table of Contents

| |

|

|

|

|

|

1 |

|

|

| |

|

|

|

|

|

2 |

|

|

| |

|

|

|

|

|

4 |

|

|

| |

|

|

|

|

|

4 |

|

|

| |

|

|

|

|

|

4 |

|

|

| |

|

|

|

|

|

6 |

|

|

| |

|

|

|

|

|

8 |

|

|

| |

|

|

|

|

|

9 |

|

|

| |

|

|

|

|

|

36 |

|

|

| |

|

|

|

|

|

42 |

|

|

| |

|

|

|

|

|

44 |

|

|

| |

|

|

|

|

|

51 |

|

|

| |

|

|

|

|

|

53 |

|

|

| |

|

|

|

|

|

81 |

|

|

| |

|

|

|

|

|

82 |

|

|

| |

|

|

|

|

|

83 |

|

|

| |

|

|

|

|

|

83

|

|

|

Unless the context otherwise requires, all references to “we,” “us,” “our,” “our company,” “AvalonBay,” or similar expressions in this prospectus refer collectively to AvalonBay Communities, Inc., a Maryland corporation, and its subsidiaries, and their respective predecessor entities for the applicable periods, considered as a single enterprise.

Risk Factors

Investment in any securities offered pursuant to this prospectus and the applicable prospectus supplement involves risks. Before acquiring any offered securities pursuant to this prospectus, you should carefully consider the information contained or incorporated by reference in this prospectus or in any accompanying prospectus supplement, including, without limitation, the risk factors incorporated by reference to our most recent Annual Report on Form 10-K and any subsequent Quarterly Reports on Form 10-Q or Current Reports on Form 8-K we file after the date of this prospectus, and the other information contained or incorporated by reference in this prospectus, as updated by our subsequent filings under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and the risk factors and other information contained in the applicable prospectus supplement. The occurrence of any of these risks might cause you to lose all or a part of your investment in the offered securities.

Forward-Looking Statements

This prospectus, including the information incorporated by reference, contain statements that are forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Exchange Act. We intend such forward-looking statements to be covered by the safe harbor provisions for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995. You can identify forward-looking statements by our use of the words “believe,” “expect,” “anticipate,” “intend,” “estimate,” “assume,” “project,” “plan,” “may,” “shall,” “will,” “pursue” and other similar expressions that predict or indicate future events and trends and that do not report historical matters. These statements include, among other things, statements regarding our intent, belief or expectations with respect to:

•

our potential development, redevelopment, acquisition or disposition of communities;

•

the timing and cost of completion of apartment communities under construction, reconstruction, development or redevelopment;

•

the timing of lease-up, occupancy and stabilization of apartment communities;

•

the pursuit of land on which we are considering future development;

•

the anticipated operating performance of our communities;

•

cost, yield, revenue, net operating income and earnings estimates;

•

the impact of landlord-tenant laws and rent regulations;

•

our expansion into new regions;

•

our declaration or payment of dividends;

•

our joint venture activities;

•

our policies regarding investments, indebtedness, acquisitions, dispositions, financings and other matters;

•

our qualification as a real estate investment trust (“REIT”) under the Internal Revenue Code of 1986, as amended (the “Code”);

•

the real estate markets in Metro New York/New Jersey, Northern and Southern California, Denver, Colorado, Southeast Florida, Dallas and Austin, Texas and Charlotte and Raleigh-Durham, North Carolina, and markets in selected states in the Mid-Atlantic, New England and Pacific Northwest regions of the United States and in general;

•

the availability of debt and equity financing;

•

interest rates;

•

general economic conditions, including the potential impacts from current economic conditions, including rising interest rates and general price inflation;

•

trends affecting our financial condition or results of operations;

•

regulatory changes that may affect us; and

•

the impact of legal proceedings.

We cannot assure the future results or outcome of the matters described in these statements; rather, these statements merely reflect our current expectations of the approximate outcomes of the matters discussed. We do not undertake a duty to update these forward-looking statements, and therefore they may not represent our estimates and assumptions after the date of this prospectus. You should not rely on forward-looking statements because they involve known and unknown risks, uncertainties and other factors, some of which are beyond our control. These risks, uncertainties and other factors may cause our actual results, performance or achievements to differ materially from the anticipated future results, performance or achievements expressed or implied by these forward-looking statements. You should carefully review the discussion under the caption “Risk Factors” in our Annual Reports on Form 10-K and Quarterly Reports

on Form 10-Q as well as other disclosure about risks and uncertainties in these reports and in the other reports and documents that are incorporated by reference in this prospectus for further discussion of risks associated with forward-looking statements.

Some of the factors that could cause our actual results, performance or achievements to differ materially from those expressed or implied by these forward-looking statements include, but are not limited to, the following:

•

we may fail to secure development opportunities due to an inability to reach agreements with third parties to obtain land at attractive prices or to obtain desired zoning and other local approvals;

•

we may abandon or defer development opportunities for a number of reasons, including changes in local market conditions which make development less desirable, increases in costs of development, increases in the cost of capital or lack of capital availability, resulting in losses;

•

construction costs of a community may exceed our original estimates;

•

we may not complete construction and lease-up of communities under development or redevelopment on schedule, resulting in increased interest costs and construction costs and a decrease in our expected rental revenues;

•

occupancy rates and market rents may be adversely affected by competition and local economic and market conditions which are beyond our control;

•

financing may not be available on favorable terms or at all, and our cash flows from operations and access to cost-effective capital may be insufficient for the development of our pipeline, which could limit our pursuit of opportunities;

•

the impact of new landlord-tenant laws and rent regulations may be greater than we expect;

•

an outbreak of disease or other public health event may affect the multifamily industry and general economy, including from measures taken by businesses and the government and the preferences of consumers and businesses for living and working arrangements both during and after such an event;

•

our cash flows may be insufficient to meet required payments of principal and interest, and we may be unable to refinance existing indebtedness or the terms of such refinancing may not be as favorable as the terms of existing indebtedness;

•

we may be unsuccessful in our management of joint ventures and the REIT vehicles that are used with certain joint ventures;

•

laws and regulations implementing rent control or rent stabilization, or otherwise limiting our ability to increase rents, charge fees or evict tenants, may impact our revenue or increase our costs;

•

our expectations, estimates and assumptions as of the date of this filing regarding legal proceedings are subject to change;

•

the possibility that we may choose to pay dividends in our stock instead of cash, which may result in stockholders having to pay taxes with respect to such dividends in excess of the cash received, if any; and

•

investments made under the Structured Investment Program (the “SIP”) in either mezzanine debt or preferred equity of third-party multifamily development may not be repaid as expected or the development may not be completed on schedule, which could require us to engage in litigation, foreclosure actions, and/or first party project completion to recover our investment, which may not be recovered in full or at all in such event.

About this Prospectus

This prospectus is part of a registration statement that we filed with the Securities and Exchange Commission (the “SEC” or the “Commission”) utilizing a shelf registration process. Under this shelf process, we may sell an indeterminate number or amount of any combination of the securities described in this prospectus in one or more offerings, and the selling securityholders to be named in a supplement to this prospectus may, from time to time, sell our securities in one or more offerings as described in this prospectus. This prospectus provides you with a general description of the securities we may offer. Each time we or the selling securityholders sell securities, we will provide a prospectus supplement that will contain specific information about the terms of that offering. The prospectus supplement may also add, update or change information contained in this prospectus. You should read both this prospectus and any applicable prospectus supplement together with additional information described below under the heading “Where You Can Find More Information.”

Where You Can Find More Information

We are subject to the information requirements of the Exchange Act, and in accordance with the Exchange Act, we file annual, quarterly, and current reports, proxy statements, and other information with the SEC. Our SEC filings are available to the public free of charge from the SEC’s website at http://www.sec.gov. We have a website located at http://www.avalonbay.com. The information on our website is not a part of this prospectus and is included herein as an inactive textual reference only.

Incorporation of Certain Documents by Reference

The SEC allows us to incorporate by reference the information we file with it, which means that we can disclose important information to you by referring you to these documents. The information incorporated by reference is an important part of this prospectus, and information that we file later with the SEC will automatically update and supersede the information already incorporated by reference. AvalonBay’s SEC file number is 001-12672. We are incorporating by reference the documents listed below, which were previously filed by us with the SEC:

•

•

•

the Current Reports on Form 8-K filed on January 29, 2024 and February 13, 2024 (except for information furnished to the SEC that is not deemed to be “filed” for purposes of the Exchange Act); and

•

the description of the AvalonBay Communities, Inc. common stock in AvalonBay Communities, Inc.’s Registration Statement on Form 8-B, filed on June 8, 1995, as updated by Exhibit 4.10 to AvalonBay Communities, Inc.’s Annual Report on Form 10-K for the year ended December 31, 2023, filed on February 23, 2024, including any amendments or reports filed for the purpose of updating such description.

All documents filed by us with the SEC pursuant to Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act on or after the date of this prospectus and prior to the date of termination of this offering or of the withdrawal of the registration statement of which this prospectus forms a part, except as to any portion of any future report or document that is not deemed filed under such provisions, shall be deemed incorporated by reference in this prospectus and to be a part of this prospectus from the date of filing of those documents.

Upon written or oral request, we will provide, without charge, to each person to whom a copy of this prospectus is delivered a copy of the documents incorporated by reference in this prospectus. You may

request a copy of these filings, and any exhibits we have specifically incorporated by reference as an exhibit in this prospectus, by writing or telephoning us at the following:

AvalonBay Communities, Inc.

4040 Wilson Blvd., Suite 1000

Arlington, VA 22203

Attention: Investor Relations

(703) 329-6300

This prospectus is part of a registration statement we filed with the SEC. We have incorporated exhibits into this registration statement. You should read the exhibits carefully for provisions that may be important to you.

You should rely only on the information incorporated by reference or provided in this prospectus or any prospectus supplement. We have not authorized anyone to provide you with different information. We are not making an offer of these securities in any state where the offer is not permitted. You should not assume that the information in this prospectus or in the documents incorporated by reference is accurate as of any date other than the date on the front of this prospectus or those documents.

About AvalonBay Communities, Inc.

AvalonBay Communities, Inc. is a Maryland corporation that has elected to be treated as a REIT for federal income tax purposes. We develop, redevelop, acquire, own and operate multifamily apartment communities in New England, the New York/New Jersey metro area, the Mid-Atlantic, the Pacific Northwest, and Northern and Southern California, as well as in our expansion regions of Raleigh-Durham and Charlotte, North Carolina, Southeast Florida, Dallas and Austin, Texas, and Denver, Colorado. We focus on leading metropolitan areas that we believe are generally characterized by growing employment in high wage sectors of the economy, higher cost of home ownership and a diverse and vibrant quality of life. We believe these market characteristics have offered, and will continue to offer, the opportunity for superior risk-adjusted returns over the long-term on apartment community investments relative to other markets that do not have these characteristics.

We generally obtain ownership in an apartment community by developing a new community on either vacant land or land with improvements that we raze, or by acquiring an existing community. In selecting sites for development or acquisition, we favor locations that are near expanding employment centers and convenient to transportation, recreation areas, entertainment, shopping and dining.

Our principal financial goal is to increase long-term shareholder value through the development, redevelopment, acquisition, ownership, operation and asset management and, when appropriate, disposition of apartment communities in our markets. To help meet this goal, we regularly (i) monitor our investment allocation by geographic market and product type, (ii) develop, redevelop and acquire interests in apartment communities in our selected markets, (iii) efficiently operate our communities to maximize resident satisfaction and shareholder return, (iv) selectively sell apartment communities that no longer meet our long-term strategy or when opportunities are presented to realize a portion of the value created through our investment and redeploy the proceeds from those sales and (v) maintain a capital structure that we believe is aligned with our business risks and allows us to maintain continuous access to cost-effective capital. We also seek to generate additional shareholder value from investments in other real estate-related ventures, including through the SIP, our platform to provide mezzanine loans or preferred equity to third-party multifamily developers in our existing regions. We undertake our development and redevelopment activities primarily through in-house development and redevelopment teams, and buy and dispose of assets through our in-house investments platform. We believe that our organizational structure, which includes dedicated development and operational teams, and strong culture are key differentiators. We pursue our development, redevelopment, investment and operating activities with the purpose of “Creating a Better Way to Live.”

We seek to be a leading apartment company in select U.S. markets that are characterized by growing employment in high wage sectors of the economy, higher home prices and a diverse and vibrant quality of life. From an operating perspective, we seek to deliver seamless, personalized experiences for our residents on an efficient and effective basis by our resident-focused on-site associates that are supported by our centralized shared services operating organization and flexible technology platform that incorporates automation and artificial intelligence. We operate ourapartment communities under four core brands:

•

Avalon, our core “Avalon” brand, focuses on upscale apartment living and high end amenities and services;

•

AVA targets customers in high energy, transit-served neighborhoods and generally feature smaller apartments, many of which are designed for roommate living, and a variety of active common spaces that encourage socialization;

•

eaves by Avalon is targeted to the cost conscious, “value” segment primarily in suburban areas; and

•

Kanso is designed to create an apartment living experience that offers simplicity without sacrifice at a more moderate price point, featuring high-quality apartment homes, limited-to-no community amenities and a low-touch, largely self-service operating model that leverages technology and smart access.

We believe that this branding differentiation allows us to target our product offerings to multiple customer groups and submarkets within our existing geographic footprint.

AvalonBay elected to qualify as a REIT for U.S. federal income tax purposes for the taxable year ended December 31, 1994, and has not terminated or revoked that election. As a REIT, with limited exceptions, we will not be taxed under federal and certain state income tax laws at the corporate level on our net income to the extent net income is distributed to our stockholders. We have historically made sufficient distributions to avoid tax on retained income, and we intend to make sufficient distributions to avoid income tax at the corporate level. While we believe that we are organized and qualified as a REIT and we intend to operate in a manner that will allow us to continue to qualify as a REIT, there can be no assurance that we will be successful in this regard. Qualification as a REIT involves the application of highly technical and complex provisions of the Code, for which there are limited judicial and administrative interpretations and involves the determination of a variety of factual matters and circumstances not entirely within our control. See — “Certain U.S. Federal Income Tax Considerations and Consequences of Your Investment.”

Our principal executive offices are located at 4040 Wilson Boulevard, Suite 1000, Arlington, Virginia 22203, and our telephone number is 703-329-6300. Our website is located at http://www.avalonbay.com. Information on our website is not deemed to be a part of this prospectus and is included herein as an inactive textual reference only. Our common stock is listed on the New York Stock Exchange (the “NYSE”) under the symbol “AVB.”

Use of Proceeds

Unless we provide otherwise in a supplement to this prospectus, we intend to use the net proceeds from the sale of the securities for one or more of the following:

•

capital expenditures, including development and redevelopment of apartment communities and acquisitions of land, and apartment communities and portfolios of apartment communities;

•

working capital;

•

repayment and refinancing of debt, funding our SIP investments or, to the extent applicable, redemption and repurchases of our securities; and

•

other general corporate purposes.

We will not receive any proceeds from sales of securities by selling securityholders.

Description of Debt Securities

We may issue debt securities, which we sometimes refer to in this prospectus as notes, in one or more series under one or more indentures, including debt securities that we may issue under the Indenture dated as of February 23, 2024 (the “2024 Indenture”) between AvalonBay and U.S. Bank Trust Company, National Association, as trustee (“USB”). We have filed the 2024 Indenture as an exhibit to the registration statement of which this prospectus is a part, and any description of the particular terms of any series of debt securities issued under the 2024 Indenture, and any debt securities that we offer as part of the reopening of that series, is qualified by reference to the text of the 2024 Indenture. The terms of the debt securities of any series will be those specified in or pursuant to the 2024 Indenture and in the applicable debt securities of that series, and those made part of the relevant Indenture by the Trust Indenture Act of 1939, as amended (the “Trust Indenture Act”).

As described below under “— Reopening of Prior Issues of Notes,” we may issue additional notes of a series that may be outstanding in the future under the 2024 Indenture, which we sometimes refer to in this prospectus as the reopening of a series of notes. We may also issue additional notes of an outstanding series that were issued (1) pursuant to the Indenture dated as of February 23, 2018 (the “2018 Base Indenture”) between AvalonBay and The Bank of New York Mellon, as trustee (“BNYM”), as amended by the First Supplemental Indenture dated as of March 26, 2018 between AvalonBay and BNYM (the “2018 First Supplemental Indenture”) and the Second Supplemental Indenture dated as of May 29, 2018 between AvalonBay and BNYM (the “2018 Second Supplemental Indenture” and, together with the 2018 Base Indenture and the 2018 First Supplemental Indenture, the “2018 Indenture”), (2) pursuant to the 2018 Base Indenture, as amended by the 2018 First Supplemental Indenture but before we entered into the 2018 Second Supplemental Indenture or (3) pursuant to the Indenture, dated as of January 16, 1998 (the “1998 Base Indenture”), as supplemented by the First Supplemental Indenture, dated as of January 20, 1998, the Second Supplemental Indenture, dated as of July 7, 1998, the Amended and Restated Third Supplemental Indenture, dated as of July 10, 2000, the Fourth Supplemental Indenture, dated as of September 18, 2006 and the Fifth Supplemental Indenture, dated as of November 21, 2014 (collectively, together with the 1998 Base Indenture, the “1998 Indenture”), between AvalonBay and BNYM, as successor trustee. We have filed each of the 2018 Base Indenture, the 1998 Base Indenture and each of their supplemental indentures referred to above as exhibits to the registration statement of which this prospectus is a part, and any description of the particular terms of any series of debt securities issued under the 2018 Indenture or the 1998 Indenture that we offer as part of the reopening of that series is qualified by reference to the text of the 2018 Indenture or the 1998 Indenture, as applicable. The only series of notes outstanding under the 2018 Base Indenture, as amended by the 2018 First Supplemental Indenture, is our 4.35% Medium-Term Notes due April 15, 2048, issued on March 26, 2018 in the aggregate principal amount of $300,000,000 (the “4.35% Notes due 2048”).

Except as otherwise required by the context, references to the “Indentures” refer to the 2018 Indenture and 2024 Indenture collectively, and references to the “Trustee” refer, with respect to the 2024 Indenture, to USB, and with respect to the 2018 Indenture and the 1998 Indenture, to BNYM, and to such trustee or any other trustee for any particular series of debt securities issued under the applicable indenture, and to any successor trustee.

General

The following description of selected provisions of the 2024 Indenture and the debt securities that may be issued thereunder is not complete, and the description of selected terms of the debt securities of a particular series included in the applicable prospectus supplement also will not be complete. You should review the 2024 Indenture, any supplemental indenture and the form of the applicable debt securities, which forms have been or will be filed as exhibits to the registration statement of which this prospectus is a part, or as exhibits to documents which have been or will be incorporated by reference in this prospectus. To obtain a copy of the 2024 Indenture or the form of the debt securities, see “Where You Can Find More Information” in this prospectus. The following description of debt securities and the description of the debt securities of the particular series in the applicable prospectus supplement are qualified in their entirety by reference to all of the provisions of the 2024 Indenture, any supplemental indentures and the applicable debt

securities, which provisions, including defined terms, are incorporated by reference in this prospectus. Capitalized terms used but not defined in this section shall have the meanings assigned to those terms in the 2024 Indenture.

The following description of our debt securities describes general terms and provisions of the series of debt securities to which any prospectus supplement may relate. When the debt securities of a particular series are offered for sale, the specific terms of such debt securities will be described in the applicable prospectus supplement. If any particular terms of such debt securities described in a prospectus supplement are inconsistent with any of the terms of the debt securities generally described in this prospectus, then the terms described in the applicable prospectus supplement will supersede the terms described in this prospectus.

Reopening of Prior Issues of Notes. We may, from time to time, on one or more occasions and without the consent of the holders of the applicable series of debt securities, reopen and issue additional notes of a series of outstanding notes. In each such instance, the debt securities that we issue would have the same terms and conditions (including maturity, interest payment terms and CUSIP number) as the then-outstanding debt securities of that series that we had issued on an earlier date, except for the issue date and, to the extent applicable, the issue price, the payment of interest accruing prior to the issue date, and the first interest payment date. After we issue such additional debt securities, they will be fungible with the other debt securities of that series issued on such earlier date or dates. If we issue any such debt securities, we will file a prospectus supplement that describes the terms of the debt securities of that series then outstanding and any additional terms applicable to the debt securities that we will issue in connection with the reopening of that series of debt securities.

Terms of the Debt Securities

We may issue an unlimited principal amount of debt securities under the 2024 Indenture. The 2024 Indenture provides that debt securities of any series may be issued up to the aggregate principal amount which may be authorized from time to time by us. Please read the applicable prospectus supplement relating to the debt securities of the particular series being offered thereby for the specific terms of such debt securities, including the following terms, among others and to the extent applicable:

•

the title of the series of debt securities and whether the debt securities are senior or subordinated;

•

the aggregate principal amount of debt securities of the series and any limit thereon;

•

whether such debt securities are to be issuable in global form or in registered securities;

•

the date or dates, or the method or methods, if any, by which such date or dates shall be determined, on which we will pay the principal of and premium, if any, on debt securities of the series, or the method used to determine such date or dates;

•

the rate or rates, which may be fixed or variable, at which debt securities of the series will bear interest, if any, or the method or methods, if any, used to determine such rate or rates;

•

the basis used to calculate interest, if any, on the debt securities of the series if other than a 360-day year of twelve 30-day months;

•

the date or dates, if any, from which interest on the debt securities of the series will accrue, or the method or methods, if any, used to determine such date or dates;

•

the date or dates, if any, on which the interest on the debt securities of the series will be payable and the record dates for any such payment of interest;

•

the terms and conditions, if any, upon which we are required to, or may, at our option, redeem debt securities of the series;

•

the terms and conditions, if any, upon which we will be required to repurchase debt securities of the series at the option of the holders of debt securities of the series;

•

the terms of any sinking fund or analogous provision;

•

if other than the entire principal amount thereof, the portion of the principal amount of the debt securities of the series which will be payable upon acceleration if other than the full principal amount;

•

the authorized denominations in which debt securities of the series will be issued, if other than minimum denominations of $2,000 and any integral multiple of $1,000 in excess thereof;

•

the place or places where (1) amounts due on the debt securities of the series will be payable, (2) the debt securities of the series may be surrendered for registration of transfer or exchange, (3) the debt securities of the series may be surrendered for conversion or exchange and (4) notices or demands to or upon us in respect of the debt securities of the series or the 2024 Indenture may be served, if different than the corporate trust office of the Trustee;

•

the terms and conditions, if any, upon which the debt securities will be convertible into and/or exchangeable into equity of us or any other Person or into any other securities;

•

whether the amount of payments on the debt securities of the series may be determined with reference to an index, formula, or other method or methods (any of those debt securities being referred to as “Indexed Securities”) and the manner used to determine those amounts;

•

any addition to, modification of, or deletion of, any covenant or Event of Default with respect to debt securities of the series or any guarantee;

•

whether the securities will be secured;

•

the covenants subject to covenant defeasance;

•

the terms and conditions, if any, upon which debt securities are to be issuable upon the exercise of warrants;

•

the identity of the depositary for the global debt securities;

•

the circumstances under which we will or any guarantor will pay any additional amounts which are required by the 2024 Indenture or by the terms of any series of debt securities established pursuant to Section 301 of the 2024 Indenture that we are obligated to pay under specified circumstances in respect of certain taxes, duties, levies, imposts, assessments or other governmental charges imposed on holders (“Additional Amounts”) and whether we will have the option to redeem such debt securities rather than pay the Additional Amounts;

•

if there is more than one trustee, the identity of the trustee that has any obligations, duties and remedies with respect to the debt securities and, if not the trustee, the identity of each security registrar, paying agent or authenticating agent with respect to the debt securities;

•

the terms of any guarantee of the debt securities and the identity of any guarantor or guarantors of the debt securities;

•

if the principal amount payable at the stated maturity of the debt securities of the series will not be determinable as of any one or more dates prior to the stated maturity, the amount which shall be deemed to be the principal amount of such debt securities as of any date;

•

whether the debt securities will not be issued in a transaction registered under the Securities Act and any restriction or condition on the transferability of the debt securities of such series;

•

the exchanges, if any, on which the debt securities of the series may be listed;

•

the price or prices at which the debt securities of the series will be sold;

•

if debt securities issuable in global form are to be issuable in definitive form, then the forms and terms related to such issuance;

•

the Person to whom any interest on any registered security shall be payable, if other than the person in whose name such security is registered at the close of business on the regular record date for such payment and the manner in which any interest payable on a temporary global security will be paid if other than in the manner provided in the 2024 Indenture;

•

any additional covenants subject to waiver by the act of the holders of debt securities pursuant to the 2024 Indenture; and

•

any other terms of debt securities of the series and any deletions from or modifications or additions to the 2024 Indenture in respect of such securities.

As used in this prospectus, references to the principal of and premium, if any, and interest, if any, on the debt securities of a series include Additional Amounts, if any, payable on the debt securities of such series in that context.

We may issue debt securities as original issue discount securities to be sold at a substantial discount below their principal amount. In the event of an acceleration of the maturity of any original issue discount security, the amount payable to the holder upon acceleration will be determined in the manner described in the applicable prospectus supplement. Important U.S. federal income tax and other considerations applicable to original issue discount securities will be described in the applicable prospectus supplement.

The terms of the debt securities of any series may be inconsistent with the terms of the debt securities of any other series. Unless otherwise specified in the applicable prospectus supplement, we may, without the consent of, or notice to, the holders of the debt securities of any series, reopen an existing series of debt securities and issue additional debt securities of that series.

Other than the covenants described below under “— Additional Covenants Applicable to Notes Issued Under the 2024 Indenture or the 2018 Indenture,” “— Additional Covenants Applicable to the 4.35% Notes due 2048” and “— Additional Covenants Applicable to Notes Issued Under the 1998 Indenture,” and except to the extent provided with respect to the debt securities of a particular series and described in the applicable prospectus supplement, none of the 2024 Indenture, the 2018 Indenture or the 1998 Indenture contains any provisions that would limit our ability to incur indebtedness or to substantially reduce or eliminate our consolidated assets, which may have a material adverse effect on our ability to service our indebtedness (including the debt securities) or that would afford holders of the debt securities protection in the event of:

(1)

a highly leveraged or similar transaction involving our management, or any affiliate of any of those parties;

(2)

a change of control; or

(3)

a reorganization, restructuring, merger, or similar transaction involving us or our affiliates.

Redemption and Repurchase

The debt securities of any series may be redeemable at our option, or may be subject to mandatory redemption by us as required by a sinking fund or otherwise. In addition, the debt securities of any series may be subject to repurchase by us at the option of the holders. The applicable prospectus supplement will describe the terms and conditions regarding any optional or mandatory redemption or option to repurchase the debt securities of the related series.

Covenants

The covenants contained in the 2024 Indenture and the 2018 Indenture include the covenants described below, which is not a complete list of such covenants. The 1998 Indenture contains covenants that are generally similar to, but not entirely the same as, those contained in the Indentures. Certain financial covenants contained in the Indentures and similar covenants contained in the 1998 Indenture are described below under the caption “— Additional Covenants.”

Except as otherwise stated, capitalized terms used without definition in this prospectus and any accompanying prospectus supplement have the meanings specified in the Indentures. Capitalized terms used below under the caption “— Additional Covenants” have the meanings specified in the 2024 Indenture, the 2018 Indenture, the 2018 Base Indenture and the 2018 First Supplemental Indenture, and the 1998 Indenture, as applicable.

Existence

Except as described under “— Merger, Consolidation and Sale” below, we, and any guarantor, will do or cause to be done all things necessary to preserve and keep in full force and effect our, or its, existence, rights (by charter and statutory) and franchises. However, neither we, nor any guarantor, will be required to

preserve any such right or franchise if we determine that the preservation of the right or franchise is no longer desirable in the conduct of the business.

Maintenance of Properties

We will cause all of our material properties used or useful in the conduct of our business or the business of any Subsidiary to be maintained and kept in good condition, repair and working order, normal wear and tear, casualty and condemnation excepted, and supplied with all necessary equipment. Our obligations with respect to the maintenance of these properties is subject to our judgment as to what may be necessary so that the business carried on in connection with these properties may be properly conducted in all material respects at all times. We and our Subsidiaries will not be prevented from (1) removing permanently any property that has been condemned or suffered a casualty loss, if it is in our best interests, (2) discontinuing maintenance or operation of any property if, in our judgment, doing so is in our best interest and is not disadvantageous in any material respect to the holders of the debt securities, or (3) selling or otherwise disposing of any properties for value in the ordinary course of business.

Insurance

We will, and will cause each of our Subsidiaries to, keep in force insurance policies on all our insurable properties. The insurance policies will be issued by responsible companies in such amounts and covering all such risks as is reasonable as determined by us in accordance with prevailing market conditions and availability.

Payment of Taxes and Other Claims

We will pay or discharge or cause to be paid or discharged, before the same shall become delinquent:

•

all material taxes, assessments and governmental charges levied or imposed upon us or any Subsidiary or upon our or any Subsidiary’s income, profits or property;

•

all material lawful claims for labor, materials and supplies which, if unpaid, might by law become a material lien upon our property or the property of any Subsidiary; and

•

excluding, however, any tax, assessment, charge or claim whose amount, applicability or validity is being contested in good faith.

Additional Covenants

We may issue notes pursuant to the 2024 Indenture or the 2018 Indenture, which may include a reopening of an outstanding series of notes previously issued pursuant to the applicable Indenture. We may also issue additional 4.35% Notes due 2048 as a reopening of that series of notes, if there are 4.35% Notes due 2048 that remain outstanding at that time. Further, we may issue additional notes of a series outstanding at that time under the 1998 Indenture as a reopening of that series.

Notes issued pursuant to the 2024 Indenture or the 2018 Indenture, including any notes of an outstanding series issued pursuant to the applicable Indenture, will have certain covenants that are different from those applicable to (1) any additional 4.35% Notes due 2048 and (2) any notes outstanding under the 1998 Indenture. Some of the additional covenants applicable to notes issued pursuant to the Indentures, additional 4.35% Notes due 2048 and the 1998 Indenture are described below. Notes issued pursuant to the Indentures and the 4.35% Notes due 2048 (including any such notes issued in a reopening of that series) are subject to events of default that are different from those that apply to notes outstanding under the 1998 Indenture (including any such notes issued in a reopening of any such series). See “Events of Default.”

Additional Covenants Applicable to Notes Issued Under the 2024 Indenture or the 2018 Indenture

The notes will be issued pursuant to the 2024 Indenture or the 2018 Indenture, each as may be amended and supplemented from time to time after the date of this prospectus.

Limitations on Incurrence of Debt. The following covenants will apply to the notes. The descriptions below are qualified by reference to more detailed descriptions of our debt securities and the 2024 Indenture or the 2018 Indenture elsewhere in this prospectus and to the complete text of the applicable Indenture.

Aggregate Debt Test. We will not, and will not permit any of our Subsidiaries to, incur any Debt if, immediately after giving effect to the incurrence of such Debt and any other Debt incurred or repaid since the end of the most recent Reporting Date prior to the incurrence of such Debt and the application of the proceeds from such Debt and such other Debt on a pro forma basis, the aggregate principal amount of our Debt would exceed 65% of the sum of the following (without duplication): (1) our Total Assets as of such Reporting Date; (2) the aggregate purchase price of any assets acquired, and the aggregate amount of proceeds received from any incurrence of other Debt and any securities offering proceeds received (to the extent such proceeds were not used to acquire assets or used to reduce Debt), by the Company or any of our Subsidiaries since the end of the most recent Reporting Date prior to the incurrence of such Debt; and (3) the proceeds or assets obtained from the incurrence of such Debt and other securities issued as part of the same transaction on a pro forma basis (including assets to be acquired in exchange for debt assumption and security issuance as in the case of a merger).

Secured Debt Test. We will not, and will not permit any of our Subsidiaries to, incur any Secured Debt if, immediately after giving effect to the incurrence of such Secured Debt and any other Secured Debt incurred or repaid since the end of the most recent Reporting Date prior to the incurrence of such Secured Debt and the application of the proceeds from such Secured Debt and such other Secured Debt on a pro forma basis, the aggregate principal amount of our Secured Debt would exceed forty percent (40%) of the sum of the following (without duplication): (1) our Total Assets as of such Reporting Date; (2) the aggregate purchase price of any assets acquired, and the aggregate amount of proceeds received from any incurrence of other Debt and any securities offering proceeds received (to the extent such proceeds were not used to acquire assets or used to reduce Debt), by the Company or any of our Subsidiaries since the end of the most recent Reporting Date prior to the incurrence of such Debt; and (3) the proceeds or assets obtained from the incurrence of such Secured Debt and other securities issued as part of the same transaction on a pro forma basis (including assets to be acquired in exchange for debt assumption and security issuance as in the case of a merger).

Debt Service Test. We will not, and will not permit any of our Subsidiaries to, incur any Debt if, immediately after giving effect to the incurrence of such Debt and the application of the proceeds from such Debt on a pro forma basis, the ratio of EBITDA to Interest Expense for the four (4) consecutive fiscal quarters ended on the most recent Reporting Date prior to the incurrence of such Debt would be less than 1.50 to 1.00, and calculated on the following assumptions (without duplication): (1) such Debt and any other Debt incurred since such Reporting Date and outstanding on the date of determination had been incurred, and the application of the proceeds from such Debt (including to repay or retire other Debt) had occurred, on the first day of such four-quarter period; (2) the repayment or retirement of any other Debt since such Reporting Date had occurred on the first day of such four-quarter period; and (3) in the case of any acquisition or disposition by the Company or any of our Subsidiaries of any asset or group of assets since such Reporting Date, whether by merger, stock purchase or sale or asset purchase or sale or otherwise, such acquisition or disposition had occurred as of the first day of such four-quarter period with the appropriate adjustments with respect to such acquisition or disposition being included in such pro forma calculation. If any Debt incurred during the period from such Reporting Date to the date of determination bears interest at a floating rate, then, for purposes of calculating the Interest Expense, the interest rate on such Debt will be computed on a pro forma basis as if the average daily rate during such interim period had been the applicable rate for entire relevant four-quarter period. For purposes of the foregoing, Debt will be deemed to be incurred by a Person whenever such Person creates, assumes, guarantees or otherwise becomes liable in respect thereof.

Maintenance of Total Unencumbered Assets. As of each Reporting Date, our Unencumbered Assets will not be less than 125% of our Unsecured Debt.

Definitions. Terms used but not defined below shall have the meanings set forth in the applicable Indenture. The following terms have the following meanings:

“Acquisition Property” means a Property acquired by the Company or any Subsidiary of the Company that has been owned for less than four (4) consecutive full fiscal quarters.

“Capitalization Rate” means 6.75%.

“Capitalized Property Value” means, as of any date, with respect to the Company and our Subsidiaries, (i) Property EBITDA for the four (4) consecutive fiscal quarters ended on the most recent Reporting Date, excluding from the calculation of Property EBITDA the financial contributions that would otherwise apply thereto from Acquisition Properties, Development Properties and Gross Book Value Properties, which net amount is then (ii) capitalized at the Capitalization Rate (i.e., divided by the Capitalization Rate expressed as a decimal number).

“Corporation” includes corporations, partnerships, associations, limited liability companies and other companies, and business trusts (which term shall expressly include real estate investment trusts). The term “corporation” means a corporation and does not include partnerships, associations, limited liability companies or other companies or business trusts. Except to the extent expressly provided to the contrary, Corporation does not include joint ventures.

“Debt” means, without duplication, our aggregate principal amount of indebtedness in respect of (i) borrowed money evidenced by bonds, notes, debentures or similar instruments, as determined in accordance with GAAP, (ii) indebtedness secured by any mortgage, pledge, lien, charge, encumbrance or any security interest existing on Property or other assets owned by the Company, as determined in accordance with GAAP, (iii) reimbursement obligations in connection with any letters of credit actually issued and called, (iv) any lease of property by the Company or any Subsidiary of the Company as lessee which is reflected in our balance sheet as a capitalized lease, in accordance with GAAP; provided that Debt also includes, to the extent not otherwise set forth above, any obligation by the Company or any Subsidiary to be liable for, or to pay, as obligor, guarantor or otherwise, items of indebtedness of another Person (other than the Company or any Subsidiary) described in clauses (i) through (iv) above (or, in the case of any such obligation made jointly with another Person, our or our Subsidiary’s allocable portion of such obligation based on its ownership interest in the related real estate assets or such other applicable assets); and provided, further, that Debt excludes Intercompany Debt.

“Development Property” means a Property currently under development. A Property will remain a Development Property until four (4) consecutive full fiscal quarters after the earlier of (a) 18 calendar months after substantial completion of construction of the Property and (b) the quarter in which the physical occupancy level of residential units of the Property is at least 93%.

“EBITDA” means, with respect to any Person, for any period and without duplication, net earnings (loss) of such Person for such period excluding the impact of the following amounts with respect to any Person (but only to the extent included in determining net earnings (loss) for such period): (i) depreciation and amortization expense and other non-cash charges of such Person for such period, as such Person shall determine in good faith; (ii) interest expense, including prepayment penalties, of such Person for such period; (iii) income tax expense of such Person in respect of such period; (iv) extraordinary and nonrecurring gains and losses, as such Person shall determine in good faith, of such Person for such period, including without limitation, gains and losses from the sale of assets, write-offs and forgiveness of debt, foreign currency translation gains or losses; and (v) non-controlling interests. In each case for such period, such Person will reasonably determine the amounts in accordance with GAAP, except to the extent GAAP is not applicable with respect to the determination of non-cash and non-recurring items.

“Encumbered Asset Value” means, with respect to the Company and our Subsidiaries, as of any date, the portion of Total Assets serving as collateral for Secured Debt.

“GAAP” and “generally accepted accounting principles” means accounting principles generally accepted in the United States of America, consistently applied, as in effect from time to time; provided that if, as of a particular date as of which compliance with the covenants contained in the applicable Indenture is being determined, there have been changes in accounting principles generally accepted in the United States of America from those that applied to our consolidated financial statements included in the Annual Report on Form 10-K for the year ended December 31, 2017 (with respect to the 2018 Indenture) and for the year ended December 31, 2023 (with respect to the 2024 Indenture), the Company may, in its sole discretion, determine compliance with the covenants contained in the applicable Indenture using accounting principles generally accepted in the United States of America, consistently applied, as in effect as of the end of any calendar quarter selected by us, in our sole discretion, that is on or after December 31, 2017 (with respect to the 2018 Indenture) and on or after December 31 2023 (with respect to the 2024 Indenture) and

prior to the date as of which compliance with the covenants in the applicable Indenture is being determined (“Fixed GAAP”), and, solely for purposes of calculating the covenants as of such date, “GAAP” shall mean Fixed GAAP.

“Gross Book Value Property” means, as of any date, a Property, other than Development Properties or Acquisition Properties, for which:

(a) the value of such Property, when calculated by taking the contribution of such Property to Property EBITDA (or, put another way and with the same intended result, taking the result of calculating Property EBITDA as if such Property were the only Property owned by the Company) for the four (4) consecutive fiscal quarters ended on the most recent Reporting Date and capitalizing such amount by the Capitalization Rate (i.e., dividing such contributed amount by the Capitalization Rate expressed as a decimal number), is less than

(b) the current undepreciated book value of such Property determined in accordance with GAAP.

“Intercompany Debt” means, as of any date, Debt to which the only parties are the Company and any of our Subsidiaries, but only so long as that Debt is held solely by any of the Company and any of our Subsidiaries as of that date and, provided that, in the case of Debt owed by the Company to any Subsidiary, the Debt is subordinated in right of payment to the holders of the notes.

“Interest Expense” means, for any period, our interest expense for such period, with other adjustments as are necessary to exclude: (i) the effect of items classified as extraordinary items in accordance with GAAP; (ii) amortization of debt issuance costs; (iii) prepayment penalties; and (iv) non-cash swap ineffectiveness charges.

“Person” and “person” mean any individual, corporation, joint-stock company, trust, unincorporated organization or government or any agency or political subdivision thereof.

“Property” means a parcel (or group of related parcels) of real property.

“Property EBITDA” means, for any period, our EBITDA for such period adjusted to add back the impact of corporate level general and administrative expenses.

“Reporting Date” means the date ending the most recently ended fiscal quarter of the Company for which our consolidated financial statements are publicly available, it being understood that at any time when the Company is not subject to the informational requirements of the Exchange Act, the term “Reporting Date” shall be deemed to refer to the date ending the fiscal quarter covered by our most recent quarterly financial statements delivered to the Trustee or, in the case of the last fiscal quarter of the year, our annual financial statements delivered to the Trustee.

“Secured Debt” means Debt secured by any mortgage, lien, pledge, encumbrance or security interest of any kind upon any of our Property or other assets or the Property or other assets of any Subsidiary.

“Subsidiary” means, with respect to the Company or any other Person, any Person (excluding an individual), a majority of the outstanding voting stock, partnership interests, membership interests or other equity interests, as the case may be, of which is owned or controlled, directly or indirectly, by the Company or by one or more other Subsidiaries of the Company. For the purposes of this definition, “voting stock” means stock having voting power for the election of directors, trustees or managers, as the case may be, whether at all times or only so long as no senior class of stock or equity interest has such voting power by reason of any contingency. Unless the context otherwise requires, “Subsidiary” refers to a Subsidiary of the Company.

“Total Assets” means, as of any date, the sum (without duplication) of: (a) the Capitalized Property Value of the Company and our Subsidiaries; (b) all cash and cash equivalents (excluding tenant deposits and other cash and cash equivalents the disposition of which is restricted) of the Company and our Subsidiaries at such time; (c) the current undepreciated book value of Development Properties; (d) the current undepreciated book value of Acquisition Properties; (e) the current undepreciated book value of Gross Book Value Properties; and (f) all other assets of the Company and our Subsidiaries excluding accounts

receivable and any assets classified as intangible under GAAP. The value of any assets under clauses (b), (c), (d) (e) and (f) above shall be determined in accordance with GAAP.

“Unencumbered Assets” means, as of any date, Total Assets as of such date less Encumbered Asset Value as of such date; provided, however, that all investments by the Company and our Subsidiaries in unconsolidated joint ventures, unconsolidated limited partnerships, unconsolidated limited liability companies and other unconsolidated entities shall be excluded from Unencumbered Assets to the extent such investments would otherwise have been included.

“Unsecured Debt” means Debt that is not secured by any mortgage, lien, pledge, encumbrance or security interest of any kind upon any Property or other assets of the Company or the Property or other assets of any Subsidiary.

Additional Covenants Applicable to the 4.35% Notes due 2048

The following covenants and related definitions will apply to any additional 4.35% Notes due 2048 in the event that we reopen such series of notes:

Debt Service Test. We will not, and will not permit any of our Subsidiaries to, incur any Debt if, immediately after giving effect to the incurrence of such Debt and the application of the proceeds from such Debt on a pro forma basis, the ratio of EBITDA to Interest Expense for the four (4) consecutive fiscal quarters ended on the most recent Reporting Date prior to the incurrence of such Debt would be less than 1.50 to 1.00, and calculated on the following assumptions (without duplication): (1) such Debt and any other Debt incurred since such Reporting Date and outstanding on the date of determination had been incurred, and the application of the proceeds from such Debt (including, without limitation, to repay or retire other Debt) had occurred, on the first day of such four-quarter period; (2) the repayment or retirement of any other Debt since such Reporting Date had occurred on the first day of such four-quarter period; and (3) in the case of any acquisition or disposition by the Company or any of its Subsidiaries of any asset or group of assets since such Reporting Date, whether by merger, stock purchase or sale or asset purchase or sale or otherwise, such acquisition or disposition had occurred as of the first day of such four-quarter period with the appropriate adjustments with respect to such acquisition or disposition being included in such pro forma calculation. If any Debt incurred during the period from such Reporting Date to the date of determination bears interest at a floating rate, then, for purposes of calculating the Interest Expense, the interest rate on such Debt will be computed on a pro forma basis as if the average daily rate during such interim period had been the applicable rate for the entire relevant four-quarter period. For purposes of the foregoing, Debt will be deemed to be incurred by a Person whenever such Person creates, assumes, guarantees or otherwise becomes liable in respect thereof.

Aggregate Debt Test. We will not, and will not permit any of our Subsidiaries to, incur any Debt if, immediately after giving effect to the incurrence of such Debt and any other Debt incurred or repaid since the end of the most recent Reporting Date prior to the incurrence of such Debt and the application of the proceeds from such Debt and such other Debt on a pro forma basis, the aggregate principal amount of our Debt would exceed 65% of the sum of the following (without duplication): (1) our Total Assets as of such Reporting Date; (2) the aggregate purchase price of any assets acquired, and the aggregate amount of proceeds received from any incurrence of other Debt and any securities offering proceeds received (to the extent such proceeds were not used to acquire assets or used to reduce Debt), by the Company or any of its Subsidiaries since the end of the most recent Reporting Date prior to the incurrence of such Debt; and (3) the proceeds or assets obtained from the incurrence of such Debt and other securities issued as part of the same transaction on a pro forma basis (including assets to be acquired in exchange for debt assumption and security issuance as in the case of a merger).

Secured Debt Test. We will not, and will not permit any of our Subsidiaries to, incur any Secured Debt if, immediately after giving effect to the incurrence of such Secured Debt and any other Secured Debt incurred or repaid since the end of the most recent Reporting Date prior to the incurrence of such Secured Debt and the application of the proceeds from such Secured Debt and such other Secured Debt on a pro forma basis, the aggregate principal amount of our Secured Debt would exceed forty percent (40%) of the sum of the following (without duplication): (1) our Total Assets as of such Reporting Date; (2) the aggregate purchase price of any assets acquired, and the aggregate amount of proceeds received from any

incurrence of other Debt and any securities offering proceeds received (to the extent such proceeds were not used to acquire assets or used to reduce Debt), by the Company or any of its Subsidiaries since the end of the most recent Reporting Date prior to the incurrence of such Debt; and (3) the proceeds or assets obtained from the incurrence of such Secured Debt and other securities issued as part of the same transaction on a pro forma basis (including assets to be acquired in exchange for debt assumption and security issuance as in the case of a merger).

Debt Service Test. We will not, and will not permit any of our Subsidiaries to, incur any Debt if, immediately after giving effect to the incurrence of such Debt and the application of the proceeds from such Debt on a pro forma basis, the ratio of EBITDA to Interest Expense for the four (4) consecutive fiscal quarters ended on the most recent Reporting Date prior to the incurrence of such Debt would be less than 1.25 to 1.00, and calculated on the following assumptions (without duplication): (1) such Debt and any other Debt incurred since such Reporting Date and outstanding on the date of determination had been incurred, and the application of the proceeds from such Debt (including, without limitation, to repay or retire other Debt) had occurred, on the first day of such four-quarter period; (2) the repayment or retirement of any other Debt since such Reporting Date had occurred on the first day of such four-quarter period; and (3) in the case of any acquisition or disposition by the Company or any of its Subsidiaries of any asset or group of assets since such Reporting Date, whether by merger, stock purchase or sale or asset purchase or sale or otherwise, such acquisition or disposition had occurred as of the first day of such four-quarter period with the appropriate adjustments with respect to such acquisition or disposition being included in such pro forma calculation. If any Debt incurred during the period from such Reporting Date to the date of determination bears interest at a floating rate, then, for purposes of calculating the Interest Expense, the interest rate on such Debt will be computed on a pro forma basis as if the average daily rate during such interim period had been the applicable rate for the entire relevant four-quarter period. For purposes of the foregoing, Debt will be deemed to be incurred by a Person whenever such Person creates, assumes, guarantees or otherwise becomes liable in respect thereof.

Maintenance of Total Unencumbered Assets. As of each Reporting Date, our Unencumbered Assets will not be less than 125% of our Unsecured Debt.

Definitions. As used in this “Additional Covenants Applicable to the 4.35% Notes due 2048” with respect to any notes issued pursuant to a reopening of the 4.35% Notes due 2048, the following defined terms have the meanings indicated:

“Acquisition Property” means a Property acquired by the Company or any Subsidiary of the Company during the most recent four (4) consecutive fiscal quarters.

“Capitalized Property Value” means, with respect to any Person, (a) Property EBITDA of such Person for the four (4) consecutive fiscal quarters ended on a Reporting Date divided by (b) the Capitalization Rate.

“Capitalization Rate” means 6.75%.

“Corporation” includes corporations, partnerships, associations, limited liability companies and other companies, and business trusts (which term shall expressly include real estate investment trusts). The term “corporation” means a corporation and does not include partnerships, associations, limited liability companies or other companies or business trusts. Except to the extent expressly provided to the contrary, Corporation does not include joint ventures.

“Debt” means, without duplication, our aggregate principal amount of indebtedness in respect of (i) borrowed money evidenced by bonds, notes, debentures or similar instruments, as determined in accordance with GAAP, (ii) indebtedness secured by any mortgage, pledge, lien, charge, encumbrance or any security interest existing on Property or other assets owned by the Company, as determined in accordance with GAAP, (iii) reimbursement obligations in connection with any letters of credit actually issued and called, (iv) any lease of property by the Company or any Subsidiary as lessee which is reflected in our balance sheet as a capitalized lease, in accordance with GAAP; provided, that Debt also includes, to the extent not otherwise set forth above, any obligation by the Company or any Subsidiary to be liable for, or to pay, as obligor, guarantor or otherwise, items of indebtedness of another Person (other than the Company or any Subsidiary) described in clauses (i) through (iv) above (or, in the case of any such obligation made jointly with another Person, the Company’s or the Subsidiary’s allocable portion of such obligation based on its

ownership interest in the related real estate assets or such other applicable assets); and provided, further, that Debt excludes Intercompany Debt.

“Development Property” means a Property currently under development on which the improvements have not been completed, or a Property where development has been completed as evidenced by a certificate of occupancy for the entire Property for the 36 month period following the issuance of such certificate of occupancy (provided that we may at our option elect to remove a Property from the category of Development Properties prior to the completion of the 36 month period, but any such Property may not be reclassified as a Development Property). “Development Property” shall include Property of the type described in the immediately preceding sentence to be (but not yet) acquired by the Company or any Subsidiary upon completion of construction pursuant to a contract in which the seller of such Property is required to develop or renovate prior to, and as a condition precedent to, such acquisition.

“EBITDA” means, with respect to any Person, for any period and without duplication, net earnings (loss) of such Person for such period excluding the impact of the following amounts with respect to any Person (but only to the extent included in determining net earnings (loss) for such period): (i) depreciation and amortization expense and other non-cash charges of such Person for such period, as such Person shall determine in good faith; (ii) interest expense, including prepayment penalties, of such Person for such period; (iii) income tax expense of such Person in respect of such period; (iv) extraordinary and nonrecurring gains and losses, as such Person shall determine in good faith, of such Person for such period, including, without limitation, gains and losses from the sale of assets, write-offs and forgiveness of debt, foreign currency translation gains or losses; and (v) non-controlling interests. In each case for such period, such Person will reasonably determine the amounts in accordance with GAAP, except to the extent GAAP is not applicable with respect to the determination of non-cash and non-recurring items.

“Encumbered Asset Value” means, with respect to any Person, for any date, the portion of Total Assets serving as collateral for Secured Debt as of such date.

“GAAP” and “generally accepted accounting principles” means accounting principles generally accepted in the United States of America, consistently applied, as in effect from time to time; provided that if, as of a particular date as of which compliance with the covenants contained in the 2018 Base Indenture, as amended and supplemented by the 2018 First Supplemental Indenture, is being determined, there have been changes in accounting principles generally accepted in the United States of America from those that applied to our consolidated financial statements included in the Annual Report on Form 10-K for the year ended December 31, 2017, we may, in our sole discretion, determine compliance with the covenants contained in the 2018 Base Indenture, as amended and supplemented by the 2018 First Supplemental Indenture, using accounting principles generally accepted in the United States of America, consistently applied, as in effect as of the end of any calendar quarter selected by us, in our sole discretion, that is on or after December 31, 2017 and prior to the date as of which compliance with the covenants in the 2018 Base Indenture, as amended and supplemented by the 2018 First Supplemental Indenture, is being determined (“Fixed GAAP”), and, solely for purposes of calculating the covenants as of such date, “GAAP” shall mean Fixed GAAP.

“Intercompany Debt” means, as of any date, Debt to which the only parties are the Company and any of its Subsidiaries, but only so long as that Debt is held solely by any of the Company and any of its Subsidiaries as of that date and, provided that, in the case of Debt owed by the Company to any Subsidiary, the Debt is subordinated in right of payment to the holders of the Securities.

“Interest Expense” means, for any period, our interest expense for such period, with other adjustments as are necessary to exclude: (i) the effect of items classified as extraordinary items in accordance with GAAP; (ii) amortization of debt issuance costs; (iii) prepayment penalties; and (iv) non-cash swap ineffectiveness charges.

“Property” means a parcel (or group of related parcels) of real property.

“Property EBITDA” means, for any period, our EBITDA for such period adjusted to add back the impact of corporate level general and administrative expenses.

“Reporting Date” means the date ending the most recently ended fiscal quarter of the Company for which our consolidated financial statements are publicly available, it being understood that at any time when the Company is not subject to the informational requirements of the Exchange Act, the term “Reporting Date” shall be deemed to refer to the date ending the fiscal quarter covered by our most recent quarterly financial statements delivered to the Trustee or, in the case of the last fiscal quarter of the year, our annual financial statements delivered to the Trustee.

“Secured Debt” means Debt secured by any mortgage, lien, pledge, encumbrance or security interest of any kind upon any of our Property or other assets or the Property or other assets of any Subsidiary.

“Subsidiary” means, with respect to the Company or any other Person, any Person (excluding an individual), a majority of the outstanding voting stock, partnership interests, membership interests or other equity interests, as the case may be, of which is owned or controlled, directly or indirectly, by the Company or by one or more other Subsidiaries of the Company. For the purposes of this definition, “voting stock” means stock having voting power for the election of directors, trustees or managers, as the case may be, whether at all times or only so long as no senior class of stock or equity interest has such voting power by reason of any contingency. Unless the context otherwise requires, “Subsidiary” refers to a Subsidiary of the Company.