Trending: BBVA Warns of Rising Cost of Risk

31 Ottobre 2023 - 5:04PM

Dow Jones News

1534 GMT - Banco Bilbao Vizcaya Argentaria is among the most

mentioned companies across news items over the past eight hours,

according to Factiva data. The Spanish bank reported third-quarter

results that exceeded consensus expectations at both the top and

bottom lines, but warned that it expects its cost of risk to be

higher than previously anticipated. BBVA made a third-quarter net

profit of 2.08 billion euros ($2.21 billion), up 13% on the

year-earlier period, on gross income--the bank's top-line

figure--that rose 16% to EUR7.96 billion thanks to higher interest

rates. Analysts had forecast net profit of EUR2.01 billion on gross

income of EUR7.38 billion, according to consensus estimates

provided by the bank. However, BBVA said its cost of risk ratio

rose to 1.11% in the first nine months of the year, up from 1.04%

for the half year, and the bank expects it to be slightly above

current levels by year-end against its previous expectation of 1%

for the full year. The deterioration in BBVA's cost of risk could

make the market nervous, Renta4 analyst Nuria Alvarez wrote in a

note to clients. BBVA shares at 1526 GMT traded 1.3% lower at

EUR7.40. Dow Jones & Co. owns Factiva.

(adria.calatayud@dowjones.com)

(END) Dow Jones Newswires

October 31, 2023 11:49 ET (15:49 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

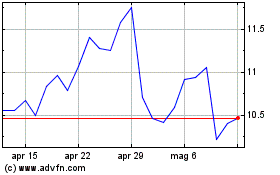

Grafico Azioni BBVA Bilbao Vizcaya Arge... (NYSE:BBVA)

Storico

Da Ott 2024 a Dic 2024

Grafico Azioni BBVA Bilbao Vizcaya Arge... (NYSE:BBVA)

Storico

Da Dic 2023 a Dic 2024