Franklin Lexington Private Markets Fund (FLEX)

offers access to institutional domain via new perpetual

offering

Franklin Templeton announced today the launch of its first

open-end fund focused on secondary private equity investments.

Co-advised by Franklin Templeton and Lexington Partners, a pioneer

in the private equity secondary and co-investment markets, the

Franklin Lexington Private Markets Fund (“FLEX”) provides

simplified access to a diversified portfolio of private equity

investments acquired through secondary transactions and

co-investments in new private equity transactions alongside leading

sponsors.

Designed for wealth channel clients seeking long-term growth

opportunities, FLEX offers access to an asset class that until

recently was primarily available to institutional investors. The

new fund comes to market with $904.5 million in assets under

management (AUM) through an initial partnership with two leading

U.S.-based wealth management firms.

“Heading into 2025, selecting the right investment partner is

more important than ever,” said Wil Warren, Partner and President

of Lexington Partners, a specialist investment manager of Franklin

Templeton. “We are pleased to announce the formation of FLEX, a

product designed to provide a diversified portfolio of private

investment fund interests and co-investments to a broader investor

base. FLEX complements our institutional drawdown funds, which

currently represent $72.4 billion in assets, and reflects our

commitment to delivering strong, risk-adjusted returns. By

leveraging our experience and leadership in private markets, FLEX

will play a pivotal role in our long-term strategy to expand our

capital base and enhance value creation for our investors.”

Lexington estimates that 2024 was the fourth consecutive year in

which secondary industry volume surpassed $100 billion. With the

IPO market stalled and distributions slowed, institutions may find

themselves accessing the secondary market for liquidity. These

market dynamics are also driving the growth of continuation vehicle

transactions whereby private equity sponsors are utilizing the

secondary market to capitalize these deals.

Franklin Templeton believes that secondary private equity looks

attractive as it provides several potential advantages for the

wealth channel. In particular, individual investors could benefit

from the shorter period before receiving distributions as well as

diversification of general partners, vintages, geographies and

industries.

“We are dedicated to being a trusted partner to our investors in

FLEX,” said Dave Donahoo, Head of U.S. Wealth Management

Alternatives. “This addition to the Alternatives by Franklin

Templeton product range builds on our robust line-up of

institutional capabilities delivered in perpetual wrappers for the

wealth community. We are excited to continue expanding the ways we

support our most strategic partnerships.”

FLEX is registered under the Investment Company Act of 1940 as a

closed-end tender offer fund and features lower minimum investments

than the private equity funds available to institutional investors

as well as 1099 tax reporting, monthly subscriptions and quarterly

liquidity.

With more than 40 years of experience in alternatives and nearly

400 alternative investment professionals around the world, Franklin

Templeton is one of the largest managers in alternative assets

globally. The firm’s alternatives assets represent 15% (US$250

billion) of Franklin Templeton’s $1.68 trillion in total assets

under management as of September 30, 2024. Its specialist

investment managers, each with deep domain expertise, provide a

diverse range of alternative asset capabilities including private

credit and real estate debt from Benefit Street Partners-Alcentra,

real estate equity from Clarion Partners, hedged strategies from

Franklin Templeton Investment Solutions and pre-IPO growth equity

investments from Franklin Venture Partners in addition to

Lexington’s offerings.

About Lexington Partners

Lexington Partners is one of the world’s largest and most

successful managers of secondary private equity and co-investment

funds. Lexington helped pioneer the development of the

institutional secondary market over 30 years ago and created one of

the first independent, discretionary co-investment programs 26

years ago.

Lexington has total capital in excess of $76 billion and has

acquired over 5,000 interests through more than 1,000 transactions.

Lexington’s global team is strategically located in major centers

for private equity and alternative asset investing across North

America, Europe, Asia and Latin America. Additional information can

be found at www.lexingtonpartners.com.

About Franklin Templeton

Franklin Resources, Inc. [NYSE:BEN] is a global investment

management organization with subsidiaries operating as Franklin

Templeton and serving clients in over 150 countries. Franklin

Templeton’s mission is to help clients achieve better outcomes

through investment management expertise, wealth management and

technology solutions. Through its specialist investment managers,

the company offers specialization on a global scale, bringing

extensive capabilities in fixed income, equity, alternatives and

multi-asset solutions. With more than 1,500 investment

professionals, and offices in major financial markets around the

world, the California-based company has over 75 years of investment

experience and approximately $1.6 trillion in assets under

management as of December 31, 2024. For more information, please

visit franklintempleton.com and follow us on LinkedIn, X and

Facebook.

Before investing, carefully consider a fund’s investment

objectives, risks, charges and expenses. You can find this and

other information in each prospectus, and summary prospectus, if

available, at www.franklintempleton.com or contact your Franklin

Templeton representative. Please read the prospectus carefully

before investing.

Discussions referenced herein are the opinion of the investment

manager and there is no assurance that any estimate, forecast or

projection will be realized.

This material is intended to be of general interest only and

should not be construed as individual investment advice or a

recommendation or solicitation to buy, sell or hold any security or

to adopt any investment strategy. It does not constitute legal or

tax advice. This material may not be reproduced, distributed or

published without prior written permission from Franklin

Templeton.

The views expressed are those of the investment manager and the

comments, opinions and analyses are rendered as at publication date

and may change without notice. The underlying assumptions and these

views are subject to change based on market and other conditions

and may differ from other portfolio managers or of the firm as a

whole. The information provided in this material is not intended as

a complete analysis of every material fact regarding any country,

region or market. There is no assurance that any prediction,

projection or forecast on the economy, stock market, bond market or

the economic trends of the markets will be realized. The value of

investments and the income from them can go down as well as up and

you may not get back the full amount that you invested. Past

performance is not necessarily indicative nor a guarantee of future

performance. All investments involve risks, including possible loss

of principal.

Alternative investment strategies (such as private

credit, private equity and real estate) are complex and

speculative, entail significant risk and should not be considered a

complete investment program. Depending on the product invested in,

such investments and strategies may provide for only limited

liquidity and are suitable only for persons who can afford to

lose the entire amount of their investment. Private investments

present certain challenges and involve incremental risks as opposed

to investments in public companies, such as dealing with the lack

of available information about these companies as well as their

general lack of liquidity. There also can be no assurance that

companies will list their securities on a securities exchange, as

such, the lack of an established, liquid secondary market for some

investments may have an adverse effect on the market value of those

investments and on an investor's ability to dispose of them at a

favorable time or price. Diversification does not ensure

against loss.

Private equity secondaries are transactions that offer

liquidity solutions to owners of interests in private equity and

other alternative investment funds. Private equity primary

investments are made directly in newly formed private equity

funds to gain exposure to privately held companies.

Any research and analysis contained in this material has been

procured by Franklin Templeton for its own purposes and may be

acted upon in that connection and, as such, is provided to you

incidentally. Data from third party sources may have been used in

the preparation of this material and Franklin Templeton ("FT") has

not independently verified, validated or audited such data.

Although information has been obtained from sources that Franklin

Templeton believes to be reliable, no guarantee can be given as to

its accuracy and such information may be incomplete or condensed

and may be subject to change at any time without notice. The

mention of any individual securities should neither constitute nor

be construed as a recommendation to purchase, hold or sell any

securities, and the information provided regarding such individual

securities (if any) is not a sufficient basis upon which to make an

investment decision. FT accepts no liability whatsoever for any

loss arising from use of this information and reliance upon the

comments, opinions and analyses in the material is at the sole

discretion of the user.

Products, services and information may not be available in all

jurisdictions and are offered outside the U.S. by other FT

affiliates and/or their distributors as local laws and regulation

permits. Please consult your own financial professional or Franklin

Templeton institutional contact for further information on

availability of products and services in your jurisdiction.

Issued in the U.S. by Franklin Distributors, LLC, One Franklin

Parkway, San Mateo, California 94403-1906, (800) DIAL BEN/342-5236,

franklintempleton.com - Franklin Distributors, LLC, member

FINRA/SIPC, is the principal distributor of Franklin Templeton U.S.

registered products, which are not FDIC insured; may lose value;

and are not bank guaranteed and are available only in jurisdictions

where an offer or solicitation of such products is permitted under

applicable laws and regulation.

Copyright © 2025 Franklin Templeton. All rights reserved.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250113757065/en/

Lisa Tibbitts (904) 942-4451

Lisa.Tibbitts@franklintempleton.com

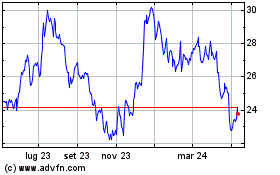

Grafico Azioni Franklin Resources (NYSE:BEN)

Storico

Da Gen 2025 a Feb 2025

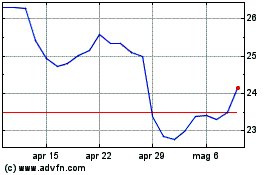

Grafico Azioni Franklin Resources (NYSE:BEN)

Storico

Da Feb 2024 a Feb 2025