Franklin Resources, Inc. (the “Company”) (NYSE: BEN) today

announced net income1 of $163.6 million or $0.29 per diluted share

for the quarter ended December 31, 2024, as compared to net loss of

$84.7 million or $0.19 per diluted share for the previous quarter,

and net income of $251.3 million or $0.50 per diluted share for the

quarter ended December 31, 2023. Operating income was $219.0

million for the quarter ended December 31, 2024, as compared to

operating loss of $150.7 million for the previous quarter and

operating income of $206.5 million for the prior year.

As supplemental information, the Company is providing certain

adjusted performance measures which are based on methodologies

other than generally accepted accounting principles. Adjusted net

income2 was $320.5 million and adjusted diluted earnings per share2

was $0.59 for the quarter ended December 31, 2024, as compared to

$315.2 million and $0.59 for the previous quarter, and $328.5

million and $0.65 for the quarter ended December 31, 2023. Adjusted

operating income2 was $412.8 million for the quarter ended December

31, 2024, as compared to $451.6 million for the previous quarter

and $417.0 million for the prior year.

“Our first fiscal quarter results demonstrated progress across

key growth areas, enabling us to meet the evolving needs of our

clients, amid heightened market volatility,” said Jenny Johnson,

President and CEO of Franklin Resources, Inc. “Long-term inflows

improved by 34% from the prior year quarter (excluding reinvested

distributions) and we generated positive net flows in equity,

multi-asset and alternatives, totaling a combined $17 billion

during the quarter. While long-term net outflows were $50 billion,3

excluding Western Asset Management, our long-term net inflows were

$18 billion and positive in every asset class.

“At quarter-end, our institutional pipeline of won-but-unfunded

mandates increased by $2.3 billion to $18.1 billion and remains

diversified across asset classes and specialist investment

managers. Clients globally showed interest in a diverse range of

investment options, including ETFs, our custom indexing platform,

Canvas,® and retail SMAs.

“Fundraising in alternatives generated $6 billion this quarter,

of which $4.3 billion was in private market assets. In January, we

launched our first evergreen secondaries private equity fund

designed for the wealth channel and achieved our initial

fundraising cap of $900 million in assets under management.

“This past year has presented significant challenges for Western

Asset Management and we are committed to supporting them. In the

near term, we will integrate select corporate functions, creating

efficiencies and giving access to broader resources, while ensuring

Western’s investment team autonomy. These enhancements will be

seamless for clients.

“As one of the world’s most comprehensive global asset managers,

our broad investment capabilities, extensive global distribution

network and local asset management expertise continue to

differentiate us in an increasingly competitive industry. We remain

committed to strategically investing in the business to best serve

our clients while managing expenses and maintaining our focus on

enhancing shareholder value.”

Quarter Ended

% Change

Quarter Ended

% Change

31-Dec-24

30-Sep-24

Qtr. vs. Qtr.

31-Dec-23

Year vs. Year

Financial Results

(in millions, except per share data)

Operating revenues

$

2,251.6

$

2,211.2

2

%

$

1,991.1

13

%

Operating income (loss)

219.0

(150.7

)

NM

206.5

6

%

Operating margin

9.7

%

(6.8

%)

10.4

%

Net income (loss)1

$

163.6

$

(84.7

)

NM

$

251.3

(35

%)

Diluted earnings (loss) per share

0.29

(0.19

)

NM

0.50

(42

%)

As adjusted

(non-GAAP):2

Adjusted operating income

$

412.8

$

451.6

(9

%)

$

417.0

(1

%)

Adjusted operating margin

24.5

%

26.3

%

27.3

%

Adjusted net income

$

320.5

$

315.2

2

%

$

328.5

(2

%)

Adjusted diluted earnings per share

0.59

0.59

0

%

0.65

(9

%)

Assets Under Management

(in billions)

Ending

$

1,575.7

$

1,678.6

(6

%)

$

1,455.5

8

%

Average4

1,634.5

1,667.5

(2

%)

1,394.2

17

%

Long-term net flows

(50.0

)

(31.3

)

(5.0

)

Total assets under management (“AUM”) were $1,575.7 billion at

December 31, 2024, down $102.9 billion during the quarter due to

the negative impact of $52.9 billion of net market change,

distributions, and other, and $50.0 billion of long-term net

outflows, inclusive of $67.9 billion of long-term net outflows at

Western Asset Management and $20.1 billion of long-term reinvested

distributions.

Cash and cash equivalents and investments were $5.2 billion and,

including the Company’s direct investments in consolidated

investment products (“CIPs”), were $6.3 billion5 at December 31,

2024. Total stockholders’ equity was $13.2 billion and the Company

had 524.0 million shares of common stock outstanding at December

31, 2024. The Company repurchased 0.3 million shares of its common

stock for a total cost of $5.8 million during the quarter ended

December 31, 2024.

Conference Call Information

A written commentary on the results by Jenny Johnson, President

and CEO; Matthew Nicholls, Executive Vice President, CFO and COO;

and Adam Spector, Executive Vice President, Head of Global

Distribution will be available via investors.franklinresources.com

today at approximately 8:30 a.m. Eastern Time.

Ms. Johnson and Messrs. Nicholls and Spector will also lead a

live teleconference today at 11:00 a.m. Eastern Time to answer

questions. Access to the teleconference will be available via

investors.franklinresources.com or by dialing (+1) (877) 407-0989

in North America or (+1) (201) 389-0921 in other locations. A

replay of the teleconference can also be accessed by calling (+1)

(877) 660-6853 in North America or (+1) (201) 612-7415 in other

locations using access code 13750996 after 2:00 p.m. Eastern Time

on January 31, 2025 through February 7, 2025, or via

investors.franklinresources.com.

Analysts and investors are encouraged to review the Company’s

recent filings with the U.S. Securities and Exchange Commission and

to contact Investor Relations at

investorrelations@franklintempleton.com before the live

teleconference for any clarifications or questions related to the

earnings release or written commentary.

FRANKLIN RESOURCES, INC.

CONSOLIDATED STATEMENTS OF

INCOME

Unaudited

(in millions, except per share data)

Three Months Ended

December 31,

%

Change

2024

2023

Operating Revenues

Investment management fees

$

1,799.3

$

1,652.2

9

%

Sales and distribution fees

375.5

296.4

27

%

Shareholder servicing fees

63.5

32.5

95

%

Other

13.3

10.0

33

%

Total operating revenues

2,251.6

1,991.1

13

%

Operating Expenses

Compensation and benefits

991.4

968.3

2

%

Sales, distribution and marketing

512.3

400.8

28

%

Information systems and technology

156.0

131.0

19

%

Occupancy

75.1

66.7

13

%

Amortization of intangible assets

112.6

85.8

31

%

General, administrative and other

185.2

132.0

40

%

Total operating expenses

2,032.6

1,784.6

14

%

Operating Income

219.0

206.5

6

%

Other Income (Expenses)

Investment and other income, net

10.5

173.2

(94

%)

Interest expense

(23.1

)

(18.8

)

23

%

Investment and other income of

consolidated investment products,net

114.1

(23.8

)

NM

Expenses of consolidated investment

products

(7.3

)

(5.9

)

24

%

Other income, net

94.2

124.7

(24

%)

Income before taxes

313.2

331.2

(5

%)

Taxes on income

81.1

74.9

8

%

Net income

232.1

256.3

(9

%)

Less: net income (loss) attributable

to

Redeemable noncontrolling interests

49.6

9.5

422

%

Nonredeemable noncontrolling interests

18.9

(4.5

)

NM

Net Income Attributable to Franklin

Resources, Inc.

$

163.6

$

251.3

(35

%)

Earnings per Share

Basic

$

0.29

$

0.50

(42

%)

Diluted

0.29

0.50

(42

%)

Dividends Declared per Share

$

0.32

$

0.31

3

%

Average Shares Outstanding

Basic

517.4

487.0

6

%

Diluted

518.2

487.9

6

%

Operating Margin

9.7

%

10.4

%

FRANKLIN RESOURCES, INC.

CONSOLIDATED STATEMENTS OF

INCOME

Unaudited

(in millions, except per share data)

Three Months Ended

%

Change

Three Months Ended

31-Dec-24

30-Sep-24

30-Jun-24

31-Mar-24

31-Dec-23

Operating Revenues

Investment management fees

$

1,799.3

$

1,766.2

2

%

$

1,689.9

$

1,713.9

$

1,652.2

Sales and distribution fees

375.5

368.0

2

%

358.3

358.3

296.4

Shareholder servicing fees

63.5

67.0

(5

%)

61.8

68.0

32.5

Other

13.3

10.0

33

%

12.9

12.6

10.0

Total operating revenues

2,251.6

2,211.2

2

%

2,122.9

2,152.8

1,991.1

Operating Expenses

Compensation and benefits

991.4

940.8

5

%

893.8

1,028.2

968.3

Sales, distribution and marketing

512.3

496.9

3

%

481.1

484.3

400.8

Information systems and technology

156.0

177.4

(12

%)

156.6

155.1

131.0

Occupancy

75.1

77.7

(3

%)

104.8

76.2

66.7

Amortization of intangible assets

112.6

83.8

34

%

84.0

84.6

85.8

Impairment of intangible assets

—

389.2

NM

—

—

—

General, administrative and other

185.2

196.1

(6

%)

180.1

195.1

132.0

Total operating expenses

2,032.6

2,361.9

(14

%)

1,900.4

2,023.5

1,784.6

Operating Income (Loss)

219.0

(150.7

)

NM

222.5

129.3

206.5

Other Income (Expenses)

Investment and other income, net

10.5

95.3

(89

%)

74.5

52.5

173.2

Interest expense

(23.1

)

(25.0

)

(8

%)

(25.7

)

(27.7

)

(18.8

)

Investment and other income (losses) of

consolidated investment products, net

114.1

46.2

147

%

37.6

89.9

(23.8

)

Expenses of consolidated investment

products

(7.3

)

(12.0

)

(39

%)

(8.8

)

(5.9

)

(5.9

)

Other income, net

94.2

104.5

(10

%)

77.6

108.8

124.7

Income (loss) before taxes

313.2

(46.2

)

NM

300.1

238.1

331.2

Taxes on income

81.1

9.5

754

%

68.1

62.8

74.9

Net income (loss)

232.1

(55.7

)

NM

232.0

175.3

256.3

Less: net income (loss) attributable

to

Redeemable noncontrolling interests

49.6

32.6

52

%

43.0

42.8

9.5

Nonredeemable noncontrolling interests

18.9

(3.6

)

NM

15.0

8.3

(4.5

)

Net Income (Loss) Attributable to

Franklin Resources, Inc.

$

163.6

$

(84.7

)

NM

$

174.0

$

124.2

$

251.3

Earnings (Loss) per Share

Basic

$

0.29

$

(0.19

)

NM

$

0.32

$

0.23

$

0.50

Diluted

0.29

(0.19

)

NM

0.32

0.23

0.50

Dividends Declared per Share

$

0.32

$

0.31

3

%

$

0.31

$

0.31

$

0.31

Average Shares Outstanding

Basic

517.4

516.2

0

%

516.5

518.4

487.0

Diluted

518.2

516.2

0

%

517.2

519.2

487.9

Operating Margin

9.7

%

(6.8

)%

10.5

%

6.0

%

10.4

%

AUM AND FLOWS

(in billions)

Three Months Ended

December 31,

%

Change

2024

2023

Beginning AUM

$

1,678.6

$

1,374.2

22

%

Long-term inflows

97.8

68.9

42

%

Long-term outflows

(147.8

)

(73.9

)

100

%

Long-term net flows

(50.0

)

(5.0

)

900

%

Cash management net flows

—

4.7

(100

%)

Total net flows

(50.0

)

(0.3

)

NM

Net market change, distributions and

other6

(52.9

)

81.6

NM

Ending AUM

$

1,575.7

$

1,455.5

8

%

Average AUM

$

1,634.5

$

1,394.2

17

%

AUM BY ASSET CLASS

(in billions)

31-Dec-24

30-Sep-24

% Change

30-Jun-24

31-Mar-24

31-Dec-23

Equity

$

620.0

$

632.1

(2

%)

$

595.0

$

592.7

$

467.5

Fixed Income

469.5

556.4

(16

%)

564.5

571.4

511.7

Alternative

248.8

249.9

0

%

254.5

255.5

256.2

Multi-Asset

174.0

176.2

(1

%)

168.1

163.4

154.6

Cash Management

63.4

64.0

(1

%)

64.5

61.7

65.5

Total AUM

$

1,575.7

$

1,678.6

(6

%)

$

1,646.6

$

1,644.7

$

1,455.5

Average AUM for the Three-Month

Period

$

1,634.5

$

1,667.5

(2

%)

$

1,632.6

$

1,581.1

$

1,394.2

AUM BY SALES REGION

(in billions)

31-Dec-24

30-Sep-24

% Change

30-Jun-24

31-Mar-24

31-Dec-23

United States

$

1,102.5

$

1,177.1

(6

%)

$

1,155.0

$

1,155.9

$

1,019.4

International

Europe, Middle East and Africa

193.7

209.1

(7

%)

205.8

206.3

180.6

Asia-Pacific

165.2

178.0

(7

%)

174.1

170.4

150.5

Americas, excl. U.S.

114.3

114.4

0

%

111.7

112.1

105.0

Total international

473.2

501.5

(6

%)

491.6

488.8

436.1

Total

$

1,575.7

$

1,678.6

(6

%)

$

1,646.6

$

1,644.7

$

1,455.5

AUM AND FLOWS BY ASSET CLASS

(in billions)

for the three months ended

December 31, 2024

Equity

Fixed

Income

Alternative

Multi-Asset

Cash

Management

Total

AUM at October 1, 2024

$

632.1

$

556.4

$

249.9

$

176.2

$

64.0

$

1,678.6

Long-term inflows

55.9

26.4

4.3

11.2

—

97.8

Long-term outflows

(43.4

)

(93.1

)

(3.5

)

(7.8

)

—

(147.8

)

Long-term net flows

12.5

(66.7

)

0.8

3.4

—

(50.0

)

Cash management net flows

—

—

—

—

—

—

Total net flows

12.5

(66.7

)

0.8

3.4

—

(50.0

)

Net market change, distributions and

other6

(24.6

)

(20.2

)

(1.9

)

(5.6

)

(0.6

)

(52.9

)

AUM at December 31, 2024

$

620.0

$

469.5

$

248.8

$

174.0

$

63.4

$

1,575.7

(in billions)

for the three months ended

September 30, 2024

Equity

Fixed

Income

Alternative

Multi-Asset

Cash

Management

Total

AUM at July 1, 2024

$

595.0

$

564.5

$

254.5

$

168.1

$

64.5

$

1,646.6

Long-term inflows

36.8

33.0

4.0

8.7

—

82.5

Long-term outflows

(36.0

)

(66.9

)

(5.0

)

(5.9

)

—

(113.8

)

Long-term net flows

0.8

(33.9

)

(1.0

)

2.8

—

(31.3

)

Cash management net flows

—

—

—

—

(0.2

)

(0.2

)

Total net flows

0.8

(33.9

)

(1.0

)

2.8

(0.2

)

(31.5

)

Net market change, distributions and

other6

36.3

25.8

(3.6

)

5.3

(0.3

)

63.5

AUM at September 30, 2024

$

632.1

$

556.4

$

249.9

$

176.2

$

64.0

$

1,678.6

(in billions)

for the three months ended

December 31, 2023

Equity

Fixed

Income

Alternative

Multi-Asset

Cash

Management

Total

AUM at October 1, 2023

$

430.4

$

483.1

$

254.9

$

145.0

$

60.8

$

1,374.2

Long-term inflows

27.0

28.3

5.9

7.7

—

68.9

Long-term outflows

(26.8

)

(36.7

)

(3.2

)

(7.2

)

—

(73.9

)

Long-term net flows

0.2

(8.4

)

2.7

0.5

—

(5.0

)

Cash management net flows

—

—

—

—

4.7

4.7

Total net flows

0.2

(8.4

)

2.7

0.5

4.7

(0.3

)

Net market change, distributions and

other6

36.9

37.0

(1.4

)

9.1

—

81.6

AUM at December 31, 2023

$

467.5

$

511.7

$

256.2

$

154.6

$

65.5

$

1,455.5

Supplemental Non-GAAP Financial Measures

As supplemental information, we are providing performance

measures for “adjusted operating income,” “adjusted operating

margin,” “adjusted net income” and “adjusted diluted earnings per

share,” each of which is based on methodologies other than

generally accepted accounting principles (“non-GAAP measures”).

Management believes these non-GAAP measures are useful indicators

of our financial performance and may be helpful to investors in

evaluating our relative performance against industry peers.

“Adjusted operating income,” “adjusted operating margin,”

“adjusted net income” and “adjusted diluted earnings per share” are

defined below, followed by reconciliations of operating income

(loss), operating margin, net income attributable to Franklin

Resources, Inc. and diluted earnings per share on a U.S. GAAP basis

to these non-GAAP measures. Non-GAAP measures should not be

considered in isolation from, or as substitutes for, any financial

information prepared in accordance with U.S. GAAP, and may not be

comparable to other similarly titled measures of other companies.

Additional reconciling items may be added in the future to these

non-GAAP measures if deemed appropriate.

Adjusted Operating Income

We define adjusted operating income as operating income (loss)

adjusted to exclude the following:

- Elimination of operating revenues upon consolidation of

investment products.

- Acquisition-related items:

- Acquisition-related retention compensation.

- Other acquisition-related expenses including professional fees,

technology costs and fair value adjustments related to contingent

consideration assets and liabilities.

- Amortization of intangible assets.

- Impairment of intangible assets and goodwill, if any.

- Special termination benefits and other expenses related to

workforce optimization initiatives related to past acquisitions and

certain initiatives undertaken by the Company.

- Impact on compensation and benefits expense from gains and

losses on investments related to deferred compensation plans, which

is offset in investment and other income (losses), net.

- Impact on compensation and benefits expense related to minority

interests in certain subsidiaries, which is offset in net income

(loss) attributable to redeemable noncontrolling interests.

Adjusted Operating Margin

We calculate adjusted operating margin as adjusted operating

income divided by adjusted operating revenues. We define adjusted

operating revenues as operating revenues adjusted to exclude the

following:

- Elimination of operating revenues upon consolidation of

investment products.

- Acquisition-related performance-based investment management

fees which are passed through as compensation and benefits

expense.

- Sales and distribution fees and a portion of investment

management fees allocated to cover sales, distribution and

marketing expenses paid to the financial advisers and other

intermediaries who sell our funds on our behalf.

Adjusted Net Income and Adjusted Diluted Earnings Per

Share

We define adjusted net income as net income (loss) attributable

to Franklin Resources, Inc. adjusted to exclude the following:

- Activities of CIPs.

- Acquisition-related items:

- Acquisition-related retention compensation.

- Other acquisition-related expenses including professional fees,

technology costs and fair value adjustments related to contingent

consideration assets and liabilities.

- Amortization of intangible assets.

- Impairment of intangible assets and goodwill, if any.

- Interest expense for amortization of debt premium from

acquisition-date fair value adjustment.

- Special termination benefits and other expenses related to

workforce optimization initiatives related to past acquisitions and

certain initiatives undertaken by the Company.

- Net gains or losses on investments related to deferred

compensation plans which are not offset by compensation and

benefits expense.

- Net compensation and benefits expense related to minority

interests in certain subsidiaries not offset by net income (loss)

attributable to redeemable noncontrolling interests.

- Unrealized investment gains and losses.

- Net income tax expense of the above adjustments based on the

respective blended rates applicable to the adjustments.

We define adjusted diluted earnings per share as diluted

earnings per share adjusted to exclude the per share impacts of the

adjustments applied to net income in calculating adjusted net

income.

In calculating our non-GAAP measures, we adjust for the impact

of CIPs because it is not considered reflective of our underlying

results of operations. Acquisition-related items and special

termination benefits are excluded to facilitate comparability to

other asset management firms. We adjust for compensation and

benefits expense related to funded deferred compensation plans

because it is partially offset in other income (expense), net. We

adjust for compensation and benefits expense and net income (loss)

attributable to redeemable noncontrolling interests to reflect the

economics of certain profits interest arrangements. Sales and

distribution fees and a portion of investment management fees

generally cover sales, distribution and marketing expenses and,

therefore, are excluded from adjusted operating revenues. In

addition, when calculating adjusted net income and adjusted diluted

earnings per share we exclude unrealized investment gains and

losses included in investment and other income (losses) because the

related investments are generally expected to be held long

term.

The calculations of adjusted operating income, adjusted

operating margin, adjusted net income and adjusted diluted earnings

per share are as follows:

(in millions)

Three Months Ended

31-Dec-24

30-Sep-24

31-Dec-23

Operating income (loss)

$

219.0

$

(150.7

)

$

206.5

Add (subtract):

Elimination of operating revenues upon

consolidation of investment products*

12.5

12.7

11.4

Acquisition-related retention

45.8

46.3

69.1

Compensation and benefits expense from

gains on deferred compensation, net

0.9

15.7

19.0

Other acquisition-related expenses

9.4

31.8

6.8

Amortization of intangible assets

112.6

83.8

85.8

Impairment of intangible assets

—

389.2

—

Special termination benefits

0.4

12.0

6.7

Compensation and benefits expense related

to minority interests in certain subsidiaries

12.2

10.8

11.7

Adjusted operating income

$

412.8

$

451.6

$

417.0

Total operating revenues

$

2,251.6

$

2,211.2

$

1,991.1

Add (subtract):

Acquisition-related pass through

performance fees

(69.1

)

(10.5

)

(72.6

)

Sales and distribution fees

(375.5

)

(368.0

)

(296.4

)

Allocation of investment management fees

for sales, distribution and marketing expenses

(136.8

)

(128.9

)

(104.4

)

Elimination of operating revenues upon

consolidation of investment products*

12.5

12.7

11.4

Adjusted operating revenues

$

1,682.7

$

1,716.5

$

1,529.1

Operating margin

9.7

%

(6.8

%)

10.4

%

Adjusted operating margin

24.5

%

26.3

%

27.3

%

(in millions, except per share data)

Three Months Ended

31-Dec-24

30-Sep-24

31-Dec-23

Net income (loss) attributable to

Franklin Resources, Inc.

$

163.6

$

(84.7

)

$

251.3

Add (subtract):

Net (income) loss of consolidated

investment products*

4.2

(2.8

)

(2.2

)

Acquisition-related retention

45.8

46.3

69.1

Other acquisition-related expenses

12.7

32.0

10.8

Amortization of intangible assets

112.6

83.8

85.8

Impairment of intangible assets

—

389.2

—

Special termination benefits

0.4

12.0

6.7

Net (gains) losses on deferred

compensation plan investments not offset by compensation and

benefits expense

1.3

(2.9

)

(6.0

)

Unrealized investment (gains) losses

31.5

(23.9

)

(49.0

)

Interest expense for amortization of debt

premium

(4.9

)

(5.2

)

(6.4

)

Net compensation and benefits expense

related to minority interests in certain subsidiaries not offset by

net income (loss) attributable to redeemable noncontrolling

interests

4.1

2.3

(2.0

)

Net income tax expense of adjustments

(50.8

)

(130.9

)

(29.6

)

Adjusted net income

$

320.5

$

315.2

$

328.5

Diluted earnings (loss) per

share

$

0.29

$

(0.19

)

$

0.50

Adjusted diluted earnings per

share

0.59

0.59

0.65

__________________

*

The impact of CIPs is summarized as

follows:

(in millions)

Three Months Ended

31-Dec-24

30-Sep-24

31-Dec-23

Elimination of operating revenues upon

consolidation

$

(12.5

)

$

(12.7

)

$

(11.4

)

Other income (expenses), net

61.5

32.5

(8.6

)

Less: income (loss) attributable to

noncontrolling interests

53.2

17.0

(22.2

)

Net income (loss)

$

(4.2

)

$

2.8

$

2.2

Notes

- Net income (loss) represents net income (loss) attributable to

Franklin Resources, Inc.

- “Adjusted net income,” “adjusted diluted earnings per share,”

“adjusted operating income” and “adjusted operating margin” are

based on methodologies other than generally accepted accounting

principles. See “Supplemental Non-GAAP Financial Measures” for

definitions and reconciliations of these measures.

- Includes $20.1 billion of reinvested distributions.

- Average AUM is calculated as the average of the month-end AUM

for the trailing four months.

- Includes our direct investments in CIPs of $1.1 billion,

approximately $356 million of employee-owned and other third-party

investments made through partnerships, approximately $361 million

of investments that are subject to long-term repurchase agreements

and other net financing arrangements, and approximately $437

million of cash and investments related to deferred compensation

plans.

- Net market change, distributions and other includes

appreciation (depreciation), distributions to investors that

represent return on investments and return of capital, and foreign

exchange revaluation.

Franklin Resources, Inc. (NYSE: BEN) is a global investment

management organization with subsidiaries operating as Franklin

Templeton and serving clients in over 150 countries. Franklin

Templeton’s mission is to help clients achieve better outcomes

through investment management expertise, wealth management and

technology solutions. Through its specialist investment managers,

the Company offers specialization on a global scale, bringing

extensive capabilities in equity, fixed income, alternatives and

multi-asset solutions. With more than 1,500 investment

professionals, and offices in major financial markets around the

world, the California-based company has over 75 years of investment

experience and approximately $1.6 trillion in AUM as of December

31, 2024. The Company posts information that may be significant for

investors in the Investor Relations and News Center sections of its

website, and encourages investors to consult those sections

regularly. For more information, please visit

investors.franklinresources.com.

Forward-Looking Statements

Some of the statements herein may include forward-looking

statements that reflect our current views with respect to future

events, financial performance and market conditions. Such

statements are provided under the “safe harbor” protection of the

Private Securities Litigation Reform Act of 1995. Forward-looking

statements include all statements that do not relate solely to

historical or current facts and generally can be identified by

words or phrases written in the future tense and/or preceded by

words such as “anticipate,” “believe,” “could,” “depends,”

“estimate,” “expect,” “intend,” “likely,” “may,” “plan,”

“potential,” “seek,” “should,” “will,” “would,” or other similar

words or variations thereof, or the negative thereof, but these

terms are not the exclusive means of identifying such

statements.

Forward-looking statements involve a number of known and unknown

risks, uncertainties and other important factors that may cause

actual results and outcomes to differ materially from any future

results or outcomes expressed or implied by such forward-looking

statements, including market and volatility risks, investment

performance and reputational risks, global operational risks,

competition and distribution risks, third-party risks, technology

and security risks, human capital risks, cash management risks, and

legal and regulatory risks. While forward-looking statements are

our best prediction at the time that they are made, you should not

rely on them and are cautioned against doing so. Forward-looking

statements are based on our current expectations and assumptions

regarding our business, the economy and other possible future

conditions. Because forward-looking statements relate to the

future, they are subject to inherent uncertainties, risks and

changes in circumstances that are difficult to predict. They are

neither statements of historical fact nor guarantees or assurances

of future performance. Factors or events that could cause our

actual results to differ may emerge from time to time, and it is

not possible for us to predict all of them.

These and other risks, uncertainties and other important factors

are described in more detail in our recent filings with the U.S.

Securities and Exchange Commission, including, without limitation,

in Risk Factors and Management’s Discussion and Analysis of

Financial Condition and Results of Operations in our Annual Report

on Form 10-K for the fiscal year ended September 30, 2024 and our

subsequent Quarterly Reports on Form 10-Q. If a circumstance occurs

after the date of this press release that causes any of our

forward-looking statements to be inaccurate, whether as a result of

new information, future developments or otherwise, we undertake no

obligation to announce publicly the change to our expectations, or

to make any revision to our forward-looking statements, to reflect

any change in assumptions, beliefs or expectations, or any change

in events, conditions or circumstances upon which any

forward-looking statement is based, unless required by law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250130845295/en/

Franklin Resources, Inc. Investor Relations: Selene Oh, (650)

312-4091, selene.oh@franklintempleton.com Media Relations: Jeaneen

Terrio, (212) 632-4005, jeaneen.terrio@franklintempleton.com

investors.franklinresources.com

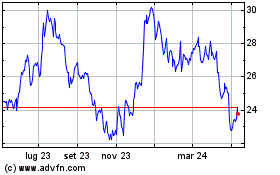

Grafico Azioni Franklin Resources (NYSE:BEN)

Storico

Da Gen 2025 a Feb 2025

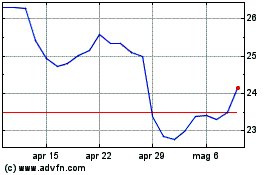

Grafico Azioni Franklin Resources (NYSE:BEN)

Storico

Da Feb 2024 a Feb 2025