Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

22 Novembre 2023 - 7:08PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16 UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of November 2023

Commission File Number: 001-15160

BROOKFIELD CORPORATION

(Translation of registrant's name into English)

Brookfield Place, Suite 100, 181 Bay Street, P.O. Box 762 Toronto, Ontario, Canada M5J 2T3

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F [ ] Form 40-F [ X ]

EXHIBIT INDEX

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | | BROOKFIELD CORPORATION |

| | | (Registrant) |

| | | |

| | | |

| Date: November 22, 2023 | | /s/ Swati Mandava |

| | | Swati Mandava |

| | | Senior Vice President, Legal & Regulatory |

| | | |

EXHIBIT 99.1

Brookfield Corporation Announces Credit Rating Upgrade to “A”

BROOKFIELD, NEWS, Nov. 22, 2023 (GLOBE NEWSWIRE) -- Brookfield Corporation (NYSE: BN, TSX: BN) (“Brookfield”) today announced that it has received an upgrade to its senior unsecured debt rating from DBRS to “A” from A (low). The upgrade reflects the continued growth in the earnings and cashflows of the business, underpinned by a conservatively capitalized balance sheet. DBRS pointed to the strength of Brookfield’s premier global alternative asset management business, the scaling of its Insurance Solutions franchise, and the resilience and quality of the earnings and cashflows generated by its underlying operations.

Nicholas Goodman, President of Brookfield Corporation, stated “We are pleased with the credit rating upgrade, which reflects the strength of our franchise through cycles—including the growing scale and diversity of our business, the quality of our cashflows and our fortress balance sheet. The upgrade is further recognition of our longstanding commitment to conservative financing principles and our differentiated perpetual capital base of $140 billion.”

Brookfield Corporation also received an upgrade from DBRS on its preferred shares rating to Pfd-2 from Pfd-2 (low).

About Brookfield Corporation

Brookfield Corporation (NYSE: BN, TSX: BN) is focused on compounding capital over the long term to earn attractive total returns for our shareholders. Today, our capital is deployed across three businesses – Asset Management, Insurance Solutions and our Operating Businesses, generating substantial and growing free cash flows, all of which is underpinned by a conservatively capitalized balance sheet.

For more information, please visit our website at www.bn.brookfield.com or contact:

Communications & Media:

Kerrie McHugh Hayes

Tel: (212) 618-3469

Email: kerrie.mchugh@brookfield.com | Investor Relations:

Linda Northwood

Tel: (416) 359-8647

Email: linda.northwood@brookfield.com

|

Forward Looking Statements

This news release contains “forward-looking information” within the meaning of Canadian provincial securities laws and “forward-looking statements” within the meaning of the U.S. Securities Act of 1933, the U.S. Securities Exchange Act of 1934, “safe harbor” provisions of the United States Private Securities Litigation Reform Act of 1995 and in any applicable Canadian securities regulations (collectively, “forward-looking statements”). Forward-looking statements include statements that are predictive in nature, depend upon or refer to future results, events or conditions, and include, but are not limited to, statements which reflect management’s current estimates, beliefs and assumptions and which are in turn based on our experience and perception of historical trends, current conditions and expected future developments, as well as other factors management believes are appropriate in the circumstances. The estimates, beliefs and assumptions of Brookfield are inherently subject to significant business, economic, competitive and other uncertainties and contingencies regarding future events and as such, are subject to change. Forward-looking statements are typically identified by words such as “expect”, “anticipate”, “believe”, “foresee”, “could”, “estimate”, “goal”, “intend”, “plan”, “seek”, “strive”, “will”, “may” and “should” and similar expressions. In particular, the forward-looking statements contained in this news release include statements referring to the growth of Brookfield’s business.

Although Brookfield believes that such forward-looking statements are based upon reasonable estimates, beliefs and assumptions, certain factors, risks and uncertainties, which are described from time to time in our documents filed with the securities regulators in Canada and the United States, not presently known to Brookfield, or that Brookfield currently believes are not material, could cause actual results to differ materially from those contemplated or implied by forward-looking statements.

Readers are urged to consider these risks, as well as other uncertainties, factors and assumptions carefully in evaluating the forward-looking statements and are cautioned not to place undue reliance on such forward-looking statements, which are based only on information available to us as of the date of this news release. Except as required by law, Brookfield undertakes no obligation to publicly update or revise any forward-looking statements, whether written or oral, that may be as a result of new information, future events or otherwise.

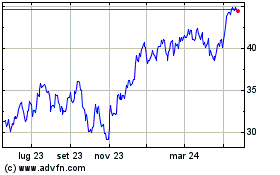

Grafico Azioni Brookfield (NYSE:BN)

Storico

Da Mar 2024 a Apr 2024

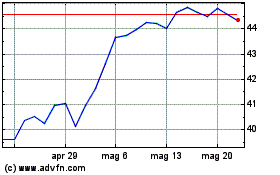

Grafico Azioni Brookfield (NYSE:BN)

Storico

Da Apr 2023 a Apr 2024