Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

26 Febbraio 2024 - 2:51PM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

Form 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 of

the Securities Exchange Act of 1934

| For the month of: February 2024 |

| |

| Commission File Number: 001-15160 |

Brookfield

Corporation

(Name of Registrant)

Brookfield

Place

Suite 100

181 Bay Street, P.O. Box 762

Toronto, Ontario, Canada M5J 2T3

(Address of Principal Executive Offices)

Indicate by check mark whether

the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Exhibit 99.1 of this Form 6-K shall

be incorporated by reference as an exhibit to the Registration Statement of Brookfield Corporation and Brookfield Finance Inc. on Form F-10

(File Nos. 333-267243 and 333-267243-02).

EXHIBIT INDEX

SIGNATURE

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto

duly authorized.

| |

BROOKFIELD CORPORATION |

| |

|

| Date: February 26, 2024 |

By: |

/s/ Swati Mandava |

| |

|

Name: |

Swati Mandava |

| |

|

Title: |

Managing Director, Legal & Regulatory |

Exhibit

99.1

A

final base shelf prospectus containing important information relating to the securities described in this document has been filed with

the securities regulatory authorities in each of the provinces of Canada. A copy of the final base shelf prospectus, any amendment to

the final base shelf prospectus and any applicable shelf prospectus supplement that has been filed, is required to be delivered with

this document.

This

document does not provide full disclosure of all material facts relating to the securities offered. Investors should read the final base

shelf prospectus, any amendment and any applicable shelf prospectus supplement for disclosure of those facts, especially risk factors

relating to the securities offered, before making an investment decision.

BROOKFIELD FINANCE INC.

US$[●]

[●]% NOTES DUE 2054

PRELIMINARY TERM SHEET

February 26, 2024

| Issuer: |

Brookfield Finance Inc. |

| Guarantor: |

Brookfield Corporation |

| Guarantee: |

The Notes (as defined below) will be fully and unconditionally guaranteed as to payment of principal, premium (if any) and interest and certain other amounts by Brookfield Corporation. |

| Guarantor’s Ticker: |

BN |

| Security: |

[●]% Senior Unsecured Notes due March 4, 2054 (the “Notes”) |

| Format: |

SEC registered |

| Size: |

US$ Benchmark

One or more

of the underwriters may sell to affiliates of Brookfield Reinsurance Ltd. US$[●] aggregate principal amount (if any) of the

Notes at the public offering price (for which no underwriting discount or commissions will be paid). |

| Trade Date: |

February 26, 2024 |

| Expected Settlement Date: |

March 4, 2024 (T+5) |

| Maturity Date: |

March 4, 2054 |

| Coupon: |

[●]% |

| Interest Payment Dates: |

March 4 and September 4, commencing September 4, 2024 |

| Price to Public: |

[●]% |

| Benchmark Treasury: |

[The Spread to Benchmark Treasury, and any disclosure relating to the Spread to Benchmark Treasury, has been removed in accordance with subsection 9A.3(4) of National Instrument 44-102 – Shelf Distributions (“NI 44-102”).] |

| Benchmark Treasury Price & Yield: |

[The Spread to Benchmark Treasury, and any disclosure relating to the Spread to Benchmark Treasury, has been removed in accordance with subsection 9A.3(4) of NI 44-102.] |

| Spread to Benchmark Treasury: |

[The Spread to Benchmark Treasury, and any disclosure relating to the Spread to Benchmark Treasury, has been removed in accordance with subsection 9A.3(4) of NI 44-102.] |

| Yield: |

[●]% |

| Denominations: |

Initial denominations of US$2,000 and subsequent multiples of US$1,000 |

| Covenants: |

Change of control (put @ 101%)

Negative pledge

Consolidation, merger, amalgamation and sale of substantial assets |

| Redemption Provisions: |

|

| Make-Whole Call: |

Prior to September 4, 2053 (six months prior to maturity), treasury rate plus [●] basis points |

| Par Call: |

At any time on or after September 4, 2053 (six months prior to maturity), at 100% of the principal amount of the Notes to be redeemed |

| Use of Proceeds: |

The net proceeds from the sale of the Notes will be used for general corporate purposes |

| CUSIP/ISIN: |

11271L AL6 / US11271LAL62 |

| Joint Book-Running

Managers1: |

Wells Fargo Securities, LLC

SMBC Nikko Securities America, Inc. |

| Co-Managers: |

[●] |

Capitalized terms used and not defined herein have the meanings assigned

in the Issuer and the Guarantor’s Prospectus Supplement, dated February 26, 2024 to the Short Form Base Shelf Prospectus

dated September 16, 2022.

Under Rule 15c6-1 under the Exchange Act,

trades in the secondary market generally are required to settle in two business days unless the parties to any such trade expressly agree

otherwise. Accordingly, purchasers who wish to trade the Notes prior to the delivery of the Notes hereunder will be required, by virtue

of the fact that the Notes initially will settle in T+5, to specify an alternative settlement cycle at the time of any such trade to prevent

a failed settlement. Purchasers of the Notes who wish to trade the Notes prior to their date of delivery hereunder should consult their

own advisors.

| 1 | This offering will be made in Canada by Wells Fargo Securities Canada, Ltd., a broker-dealer affiliate of Wells Fargo Securities,

LLC. |

The Notes will be issued as a separate series

of debt securities under a tenth supplemental indenture to be dated as of the date of the issuance of the Notes (the “Tenth Supplemental

Indenture”) to the base indenture dated as of June 2, 2016 (the “Base Indenture”) (together with the Tenth Supplemental

Indenture, the “Indenture”), between Brookfield Finance Inc., Brookfield Corporation, as guarantor, and Computershare Trust

Company of Canada, as trustee. The foregoing is a summary of certain of the material attributes and characteristics of the Notes, which

does not purport to be complete and is qualified in its entirety by reference to the Indenture.

No PRIIPs or UK PRIIPs key information document

(KID) has been prepared as European Economic Area or UK retail investors are not targeted.

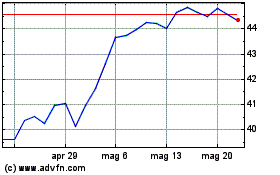

Grafico Azioni Brookfield (NYSE:BN)

Storico

Da Mar 2024 a Apr 2024

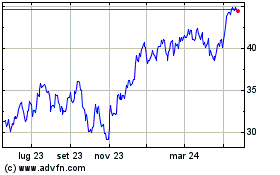

Grafico Azioni Brookfield (NYSE:BN)

Storico

Da Apr 2023 a Apr 2024