false

0000815097

0000815097

2025-01-13

2025-01-13

0000815097

CCL:CarnivalPLCMember

2025-01-13

2025-01-13

0000815097

CCL:CommonStock0.01ParValueMember

2025-01-13

2025-01-13

0000815097

CCL:OrdinarySharesEachRepresentedByAmericanDepositarySharesMember

CCL:CarnivalPLCMember

2025-01-13

2025-01-13

0000815097

CCL:Sec1.000SeniorNotesDue2029Member

CCL:CarnivalPLCMember

2025-01-13

2025-01-13

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (date of earliest event reported) January 13, 2025

| Carnival Corporation |

|

Carnival plc |

| (Exact

name of registrant as specified in its charter) |

|

(Exact

name of registrant as specified in its charter) |

| |

|

|

| Republic of Panama |

|

England and Wales |

| (State

or other jurisdiction of incorporation) |

|

(State

or other jurisdiction of incorporation) |

| |

|

|

| 001-9610 |

|

001-15136 |

| (Commission

File Number) |

|

(Commission

File Number) |

| |

|

|

| 59-1562976 |

|

98-0357772 |

| (I.R.S.

Employer Identification No.) |

|

(I.R.S.

Employer Identification No.) |

| |

|

|

|

3655 N.W. 87th Avenue

Miami, Florida 33178-2428 |

|

Carnival House, 100 Harbour Parade,

Southampton SO15 1ST, United Kingdom |

(Address of principal

executive offices)

(Zip code) |

|

(Address of principal

executive offices)

(Zip code) |

| |

|

|

| (305) 599-2600 |

|

011 44 23 8065 5000 |

| (Registrant’s

telephone number, including area code) |

|

(Registrant’s

telephone number, including area code) |

| |

|

|

| None |

|

None |

| (Former

name or former address, if changed since last report.) |

|

(Former

name or former address, if changed since last report.) |

| CIK |

0001125259 |

| Amendment Flag |

False |

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrants under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section

12(b) of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock ($0.01 par value) |

|

CCL |

|

New York Stock Exchange, Inc. |

| |

|

|

|

|

| Ordinary Shares each represented by American Depositary Shares ($1.66 par value), Special Voting Share, GBP 1.00 par value and Trust Shares of beneficial interest in the P&O Princess Special Voting Trust |

|

CUK |

|

New York Stock Exchange, Inc. |

| |

|

|

|

|

| 1.000% Senior Notes due 2029 |

|

CUK29 |

|

New York Stock Exchange LLC |

Indicate by check mark whether the registrants

are emerging growth companies as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth companies ☐

If emerging growth companies, indicate by

check mark if the registrants have elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 1.01 | Entry into a Material Definitive Agreement. |

Repricing Amendments

On January 13, 2025,

Carnival Corporation (the “Company”) entered into (x) the Repricing Amendment No. 2 (the “2027 Repricing Amendment”)

to the Term Loan Agreement dated August 8, 2023 (as amended to the date hereof, the “2027 Term Loan Credit Agreement”), among

the Company and Carnival Finance, LLC, as borrowers, Carnival plc, as a guarantor, certain other subsidiary guarantors party thereto,

and JPMorgan Chase Bank, N.A., as administrative agent and (y) the Repricing Amendment No. 7 (the “2028 Repricing Amendment”,

and together with the 2027 Repricing Amendment, the “Repricing Amendments”) to the Term Loan Agreement dated as of June 30,

2020 (as amended to the date hereof, the “2028 Term Loan Credit Agreement”), among the Company and Carnival Finance, LLC,

as borrowers, Carnival plc, as a guarantor, certain other subsidiary guarantors party thereto, and JPMorgan Chase Bank, N.A., as administrative

agent. The 2027 Repricing Amendment repriced approximately $700 million of first-priority senior secured term loans maturing in 2027 (the

“2027 Repriced Loans”) under the 2027 Term Loan Credit Agreement and the 2028 Repricing Amendment repriced approximately $1.75

billion of first-priority senior secured term loans maturing in 2028 (the “2028 Repriced Loans”) under the 2028 Term Loan

Credit Agreement Credit Agreement.

The 2027 Repriced Loans

and the 2028 Repriced Loans bear interest at a rate per annum equal to SOFR with a 0.75% floor, plus a margin equal to 2.00%.

J.P. Morgan acted as

lead arranger, joint bookrunner and sole global coordinator for the marketing of the 2027 Repriced Loans and the 2028 Repriced Loans.

| Item 2.03 | Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant. |

The information in

Item 1.01 of this Current Report on Form 8-K is incorporated by reference in this Item 2.03.

| Item 7.01 | Regulation FD Disclosure. |

On January 13, 2025, the Company issued a

press release announcing the entry into the Repricing Amendments. A copy of the press release is furnished herewith as Exhibit 99.1

and is incorporated by reference herein.

The information in this Item 7.01 (including

Exhibit 99.1) shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended,

or otherwise subject to the liabilities of that section, and shall not be deemed to be incorporated by reference into any of the Company’s

filings under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, whether made before or after

the date hereof and regardless of any general incorporation language in such filings, except to the extent expressly set forth by specific

reference in such filing.

|

Item 9.01 |

Financial Statements and Exhibits. |

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange

Act of 1934, each of the registrants has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| CARNIVAL CORPORATION |

|

CARNIVAL PLC |

| |

|

|

|

|

| By: |

/s/ David Bernstein |

|

By: |

/s/ David Bernstein |

| Name: |

David Bernstein |

|

Name: |

David Bernstein |

| Title: |

Chief Financial Officer and Chief Accounting Officer |

|

Title: |

Chief Financial Officer and Chief Accounting Officer |

| |

|

|

|

|

Date: January 13, 2025 |

|

Date: January 13, 2025 |

EXHIBIT 99.1

Carnival Corporation & plc Announces

Repricing of Senior Secured First Lien Term Loan B Facilities as Part of Ongoing Interest Expense Reduction

MIAMI, January 13, 2025

/PRNewswire/ -- Carnival Corporation & plc (NYSE/LSE: CCL; NYSE: CUK) today announced that Carnival Corporation (the “Company”)

has closed its repricing of approximately $700 million of term loans (such repriced loans, the “2027 Repriced Loans”) under

its first-priority senior secured term loan facility maturing in 2027 and approximately $1.75 billion of term loans (such repriced loans,

the “2028 Repriced Loans”) under its first-priority senior secured term loan facility maturing in 2028 (together, the “Repricing

Transactions”).

The Repricing

Transactions are a continuation of the Company’s ongoing interest expense reduction. The reduction in interest rates is expected

to result in interest expense savings of approximately $18 million on an annualized basis.

The 2027

Repriced Loans and the 2028 Repriced Loans bear interest at a rate per annum equal to SOFR with a 0.75% floor, plus a margin equal to

2.00%.

About Carnival Corporation & plc

Carnival Corporation & plc is the largest

global cruise company, and among the largest leisure travel companies, with a portfolio of world-class cruise lines - AIDA Cruises, Carnival

Cruise Line, Costa Cruises, Cunard, Holland America Line, P&O Cruises (Australia), P&O Cruises (UK), Princess Cruises, and Seabourn.

Cautionary Note Concerning Forward-Looking

Statements

Carnival Corporation and Carnival plc and their

respective subsidiaries are referred to collectively in this press release as “Carnival Corporation & plc,” “our,”

“us” and “we.” Some of the statements, estimates or projections contained in this press release are “forward-looking

statements” that involve risks, uncertainties and assumptions with respect to us, including some statements concerning the financing

transactions described herein, future results, operations, outlooks, plans, goals, reputation, cash flows, liquidity and other events

which have not yet occurred. These statements are intended to qualify for the safe harbors from liability provided by Section 27A of

the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934, as amended. All statements other than statements of

historical facts are statements that could be deemed forward-looking. These statements are based on current expectations, estimates,

forecasts and projections about our business and the industry in which we operate and the beliefs and assumptions of our management.

We have tried, whenever possible, to identify these statements by using words like “will,” “may,” “could,”

“should,” “would,” “believe,” “depends,” “expect,” “goal,” “aspiration,”

“anticipate,” “forecast,” “project,” “future,” “intend,” “plan,”

“estimate,” “target,” “indicate,” “outlook,” and similar expressions of future intent

or the negative of such terms.

Forward-looking statements include those statements

that relate to our outlook and financial position including, but not limited to, statements regarding:

| · | Interest,

tax and fuel expenses |

| · | Liquidity

and credit ratings |

| · | The

transactions described herein |

Because forward-looking statements involve

risks and uncertainties, there are many factors that could cause our actual results, performance or achievements to differ materially

from those expressed or implied by our forward-looking statements. This note contains important cautionary statements of the known factors

that

we consider could materially affect the accuracy

of our forward-looking statements and adversely affect our business, results of operations and financial position. These factors include,

but are not limited to, the following:

| · | Events

and conditions around the world, including geopolitical uncertainty, war and other military

actions, pandemics, inflation, higher fuel prices, higher interest rates and other general

concerns impacting the ability or desire of people to travel could lead to a decline in demand

for cruises as well as have significant negative impacts on our financial condition and operations. |

| · | Incidents

concerning our ships, guests or the cruise industry may negatively impact the satisfaction

of our guests and crew and lead to reputational damage. |

| · | Changes

in and non-compliance with laws and regulations under which we operate, such as those relating

to health, environment, safety and security, data privacy and protection, anti-money laundering,

anti-corruption, economic sanctions, trade protection, labor and employment, and tax may

be costly and lead to litigation, enforcement actions, fines, penalties and reputational

damage. |

| · | Factors

associated with climate change, including evolving and increasing regulations, increasing

global concern about climate change and the shift in climate conscious consumerism and stakeholder

scrutiny, and increasing frequency and/or severity of adverse weather conditions could have

a material impact on our business. |

| · | Inability

to meet or achieve our targets, goals, aspirations, initiatives, and our public statements

and disclosures regarding them, including those related to sustainability matters, may expose

us to risks that may adversely impact our business. |

| · | Cybersecurity

incidents and data privacy breaches, as well as disruptions and other damages to our principal

offices, information technology operations and system networks and failure to keep pace with

developments in technology have adversely impacted and may in the future materially adversely

impact our business operations, the satisfaction of our guests and crew and may lead to fines,

penalties and reputational damage. |

| · | The

loss of key team members, our inability to recruit or retain qualified shoreside and shipboard

team members and increased labor costs could have an adverse effect on our business and results

of operations. |

| · | Increases

in fuel prices, changes in the types of fuel consumed and availability of fuel supply may

adversely impact our scheduled itineraries and costs. |

| · | We

rely on suppliers who are integral to the operations of our businesses. These suppliers and

service providers may be unable to deliver on their commitments, which could negatively impact

our business. |

| · | Fluctuations

in foreign currency exchange rates may adversely impact our financial results. |

| · | Overcapacity

and competition in the cruise and land-based vacation industry may negatively impact our

cruise sales, pricing and destination options. |

| · | Inability

to implement our shipbuilding programs and ship repairs, maintenance and refurbishments may

adversely impact our business operations and the satisfaction of our guests. |

| · | We

require a significant amount of cash to service our debt and sustain our operations. Our

ability to generate cash depends on many factors, including those beyond our control, and

we may not be able to generate cash required to service our debt and sustain our operations. |

| · | Our

substantial debt could adversely affect our financial health and operating flexibility. |

| · | The

risk factors included in Carnival Corporation’s and Carnival plc’s Annual Report

on Form 10-K filed with the SEC on January 26, 2024. |

The ordering of the risk factors set forth

above is not intended to reflect our indication of priority or likelihood. Additionally, many of these risks and uncertainties are currently,

and in the future may continue to be, amplified by our substantial debt balance incurred during the pause of our guest cruise operations.

There may be additional risks that we consider

immaterial or which are unknown.

Forward-looking statements should not be relied

upon as a prediction of actual results. Subject to any continuing obligations under applicable law or any relevant stock exchange rules,

we expressly disclaim any obligation to disseminate, after the date of this document, any updates or revisions to any such forward-looking

statements to reflect any change in expectations or events, conditions or circumstances on which any such statements are based.

Forward-looking and other statements in this

document may also address our sustainability progress, plans, and goals (including climate change and environmental-related matters).

In addition, historical, current, and forward-looking sustainability- and climate-related statements may be based on standards and tools

for measuring progress that are still developing, internal controls and processes that continue to evolve, and assumptions and predictions

that are subject to change in the future and may not be generally shared.

SOURCE Carnival

Corporation & plc

Carnival Corporation

& plc Media Contact: Jody Venturoni, Carnival Corporation, jventuroni@carnival.com, (469) 797-6380

Carnival Corporation

& plc Investor Relations Contact: Beth Roberts, Carnival Corporation, eroberts@carnival.com, (305) 406-4832

v3.24.4

Cover

|

Jan. 13, 2025 |

| Entity Information [Line Items] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Jan. 13, 2025

|

| Entity File Number |

001-9610

|

| Entity Registrant Name |

Carnival Corporation

|

| Entity Central Index Key |

0000815097

|

| Entity Tax Identification Number |

59-1562976

|

| Entity Incorporation, State or Country Code |

R1

|

| Entity Address, Address Line One |

3655 N.W. 87th Avenue

|

| Entity Address, City or Town |

Miami

|

| Entity Address, State or Province |

FL

|

| Entity Address, Postal Zip Code |

33178-2428

|

| City Area Code |

305

|

| Local Phone Number |

599-2600

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Common Stock |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

Common Stock ($0.01 par value)

|

| Trading Symbol |

CCL

|

| Security Exchange Name |

NYSE

|

| Carnival PLC |

|

| Entity Information [Line Items] |

|

| Entity File Number |

001-15136

|

| Entity Registrant Name |

Carnival plc

|

| Entity Central Index Key |

0001125259

|

| Entity Tax Identification Number |

98-0357772

|

| Entity Incorporation, State or Country Code |

X0

|

| Entity Address, Address Line One |

Carnival House

|

| Entity Address, Address Line Two |

100 Harbour Parade

|

| Entity Address, City or Town |

Southampton

|

| Entity Address, Country |

GB

|

| Entity Address, Postal Zip Code |

SO15 1ST

|

| City Area Code |

011

|

| Local Phone Number |

44 23 8065 5000

|

| Carnival PLC | Ordinary Shares |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

Ordinary Shares each represented by American Depositary Shares ($1.66 par value)

|

| Trading Symbol |

CUK

|

| Security Exchange Name |

NYSE

|

| Carnival PLC | 1.000% Senior Notes due 2029 |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

1.000% Senior Notes due 2029

|

| Trading Symbol |

CUK29

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionISO 3166-1 alpha-2 country code.

| Name: |

dei_EntityAddressCountry |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:countryCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=CCL_CommonStock0.01ParValueMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

dei_LegalEntityAxis=CCL_CarnivalPLCMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=CCL_OrdinarySharesEachRepresentedByAmericanDepositarySharesMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=CCL_Sec1.000SeniorNotesDue2029Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

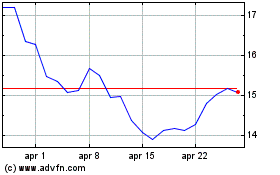

Grafico Azioni Carnival (NYSE:CCL)

Storico

Da Dic 2024 a Gen 2025

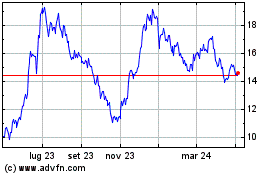

Grafico Azioni Carnival (NYSE:CCL)

Storico

Da Gen 2024 a Gen 2025