0001108524FALSE00011085242024-08-282024-08-28

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

________________________________________________________

FORM 8-K

________________________________________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

August 28, 2024

Date of Report (date of earliest event reported)

_________________________________________________________

Salesforce, Inc.

(Exact name of registrant as specified in its charter)

__________________________________________________________

| | | | | | | | | | | | | | |

| Delaware | | 001-32224 | | 94-3320693 |

(State or other jurisdiction

of incorporation) | | (Commission

File Number) | | (IRS Employer

Identification No.) |

Salesforce Tower

415 Mission Street, 3rd Fl

San Francisco, California 94105

(Address of principal executive offices)

Registrant’s telephone number, including area code: (415) 901-7000

N/A

(Former name or former address, if changed since last report)

_________________________________________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below): | | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock, par value $0.001 per share | | CRM | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). | | | | | |

| If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. | ☐ |

Section 2 – Financial Information

Item 2.02 Results of Operations and Financial Condition.

On August 28, 2024, Salesforce, Inc. (the “Company”) issued a press release announcing its results for the fiscal quarter ended July 31, 2024. A copy of the press release is attached as Exhibit 99.1 to this current report on Form 8-K and is incorporated by reference herein.

The information furnished with this Item 2.02, including Exhibit 99.1 attached hereto, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, regardless of any general incorporation language in such filing.

Section 5 - Corporate Governance and Management

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On August 28, 2024, the Company announced that Amy Weaver will step down from her role as President and Chief Financial Officer of the Company effective upon the appointment of her successor or upon the filing of the Company’s annual report on Form 10-K for the fiscal year ending January 31, 2025 (the “10-K Filing Date”), if earlier. Thereafter, Ms. Weaver has agreed to continue to serve the Company as Special Advisor to the Chief Executive Officer through April 2026, assisting in the transition of her duties, transaction integration and activities, transformation-related projects, and customer-related matters. The Company’s search process to fill the Chief Financial Officer role will consider internal and external candidates.

The Company has entered into an agreement (the “Transition Agreement”) with Ms. Weaver setting forth the terms of Ms. Weaver’s transition arrangements. Ms. Weaver will be employed on a full-time basis through the 10-K Filing Date and will thereafter be reasonably available to the Company for up to thirty hours per week during the remainder of her employment as Special Advisor (the “Transition Period”). The Transition Period may be terminated earlier by the Company for cause, as defined in the Transition Agreement, or by Ms. Weaver for any reason upon ten days’ written notice, and the Transition Agreement provides for automatic termination upon Ms. Weaver’s acceptance of employment or other full-time services with a third party. Through the 10-K Filing Date, Ms. Weaver’s cash compensation will be composed of salary at her current rate and annual bonus. For the remainder of the Transition Period, her cash compensation will be calculated based on a rate of $75,000 per year. During the Transition Period, previously granted equity awards will continue to vest in accordance with their terms. The Transition Agreement provides for a customary release of claims by Ms. Weaver and reaffirmation of her obligations under an employee inventions and proprietary rights assignment agreement.

Section 9 – Financial Statements and Exhibits

Item 9.01 Financial Statements and Exhibits.

(d)Exhibits | | | | | | | | |

| 99.1 | | |

| 104 | | Cover Page Interactive Data File—the cover page XBRL tags are embedded within the Inline XBRL document |

Signature

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| Dated: | August 28, 2024 | | Salesforce, Inc. |

| | |

| | | /s/ Sundeep Reddy |

| | | Sundeep Reddy

Executive Vice President,

Chief Accounting Officer

(Principal Accounting Officer) |

Salesforce Announces Second Quarter Fiscal 2025 Results

SAN FRANCISCO, Calif. - August 28, 2024 - Salesforce (NYSE: CRM), the #1 AI CRM, today announced results for its second quarter fiscal 2025 ended July 31, 2024.

Second Quarter Highlights

•Second Quarter Revenue of $9.33 Billion, up 8% Year-Over-Year ("Y/Y"), up 9% in Constant Currency ("CC"), inclusive of Subscription & Support Revenue of $8.76 Billion, up 9% Y/Y, up 10% Y/Y in CC

•Second Quarter GAAP Operating Margin of 19.1% and non-GAAP Operating Margin of 33.7%

•Current Remaining Performance Obligation of $26.5 Billion, up 10% Y/Y, up 11% Y/Y in CC

•Second Quarter Operating Cash Flow of $0.89 Billion, up 10% Y/Y, and Free Cash Flow of $0.76 Billion, up 20% Y/Y

•Returned $4.3 Billion in the Form of Share Repurchases and $0.4 Billion in Dividend Payments to Stockholders

FY25 Guidance Highlights

•Initiates Third Quarter FY25 Revenue Guidance of $9.31 Billion to $9.36 Billion, up 7% Y/Y

•Maintains Full Year FY25 Revenue Guidance of $37.7 Billion to $38.0 Billion, up 8% - 9% Y/Y and Maintains Full Year FY25 Subscription & Support Revenue Growth Guidance of Slightly Below 10% Y/Y & Approximately 10% in CC

•Updates Full Year FY25 GAAP Operating Margin Guidance to 19.7% and Updates non-GAAP Operating Margin Guidance to 32.8%

•Raises Full Year FY25 Operating Cash Flow Growth Guidance to 23% to 25% Y/Y

“In Q2, we delivered strong performance across revenue, cash flow, margin and cRPO, and raised our fiscal year non-GAAP operating margin and cash flow growth guidance,” said Marc Benioff, Chair and CEO, Salesforce. “With our new Agentforce AI platform, we’re reimagining enterprise software for a new world where humans with autonomous Agents drive customer success together. Salesforce is the only company with the leading apps, trusted data and agent-first platform to deliver this vision at scale and help companies realize the incredible benefits of AI.”

“We continue to deliver disciplined profitable growth and this quarter, operating margins closed at record highs with GAAP operating margin of 19.1%, up 190 basis points year-over-year, and Non-GAAP operating margin of 33.7%, up 210 basis points year-over year.” said Amy Weaver, President and CFO of Salesforce. “Our capital return program remains a priority and we now expect to more than fully offset our dilution from FY25 stock based compensation.”

Guidance

Our guidance includes GAAP and non-GAAP financial measures.

| | | | | | | | | | | | | | | | | |

| Q3 FY25 Guidance | | Full Year FY25

Guidance | | | | | | |

Total Revenue | $9.31 - $9.36 Billion | | $37.7 - $38.0 Billion | | | | | | |

Y/Y Growth | 7% | | 8 - 9% | | | | | | |

FX Impact(1) | None | | ($100M) Y/Y FX | | | | | | |

Subscription & Support Revenue Growth (Y/Y)(2)(3) | N/A | | Slightly below 10%, Approx 10% CC | | | | | | |

| GAAP Operating Margin | N/A | | 19.7% | | | | | | |

Non-GAAP Operating Margin(3) | N/A | | 32.8% | | | | | | |

GAAP Diluted Earnings per Share(3) | $1.41 - $1.43 | | $6.05 - $6.13 | | | | | | |

Non-GAAP Diluted Earnings per Share(3) | $2.42 - $2.44 | | $10.03 - $10.11 | | | | | | |

Operating Cash Flow Growth (Y/Y) | N/A | | 23% - 25% | | | | | | |

| Current Remaining Performance Obligation Growth (Y/Y) | 9% | | N/A | | | | | | |

FX Impact(4) | $100M Y/Y FX | | N/A | | | | | | |

(1) Revenue FX impact is calculated by taking the current period rates compared to the prior period average rates.

(2) Subscription & Support revenue excludes professional services revenue.

(3) Non-GAAP CC revenue growth, non-GAAP operating margin and non-GAAP Diluted EPS are non-GAAP financial measures. See below for an explanation of non-GAAP financial measures. The Company's shares used in computing GAAP Diluted EPS guidance and non-GAAP Diluted EPS guidance excludes any impact to share count from potential Q3 - Q4 FY25 repurchase activity under our share repurchase program.

(4) Current Remaining Performance Obligation FX impact is calculated by taking the current period rates compared to the prior period ending rates.

The following is a reconciliation of GAAP operating margin guidance to non-GAAP operating margin guidance for the full year:

| | | | | | | | |

| | Full Year FY25

Guidance |

GAAP operating margin(1) | | 19.7% |

| Plus | | |

Amortization of purchased intangibles(2) | | 4.3% |

Stock-based compensation expense(2)(3) | | 8.4% |

Restructuring(2)(3) | | 0.4% |

Non-GAAP operating margin(1) | | 32.8% |

(1) GAAP operating margin is the proportion of GAAP income from operations as a percentage of GAAP revenue. Non-GAAP operating margin is the proportion of non-GAAP income from operations as a percentage of GAAP revenue.

(2) The percentages shown above have been calculated based on the midpoint of the low and high ends of the revenue guidance for full year FY25.

(3) The percentages shown in the restructuring line have been calculated based on charges associated with the Company's restructuring initiatives. Stock-based compensation expense excludes stock-based compensation expense related to the Company's restructuring initiatives, which is included in the restructuring line.

The following is a per share reconciliation of GAAP diluted EPS to non-GAAP diluted EPS guidance for the next quarter and the full year: | | | | | | | | | | | |

| | Fiscal 2025 |

| | Q3 | | FY25 |

GAAP diluted earnings per share range(1)(2) | $1.41 - $1.43 | | $6.05 - $6.13 |

| Plus | | | |

| Amortization of purchased intangibles | $ | 0.36 | | | $ | 1.66 | |

| Stock-based compensation expense | $ | 0.85 | | | $ | 3.26 | |

Restructuring(3) | $ | 0.03 | | | $ | 0.17 | |

| Less | | | |

Income tax effects and adjustments(4) | $ | (0.23) | | | $ | (1.11) | |

Non-GAAP diluted earnings per share(2) | $2.42 - $2.44 | | $10.03 - $10.11 |

Shares used in computing basic net income per share (millions)(5) | 960 | | | 964 | |

Shares used in computing diluted net income per share (millions)(5) | 972 | | | 977 | |

(1) The Company's GAAP tax provision is expected to be approximately 24% for the three months ended October 31, 2024, and approximately 22.0% for the year ended January 31, 2025. The GAAP tax rates may fluctuate due to discrete tax items and related effects in conjunction with certain provisions in the Tax Cuts and Jobs Act, future acquisitions or other transactions.

(2) The Company's projected GAAP and non-GAAP diluted EPS assumes no change to the value of our strategic investment portfolio as it is not possible to forecast future gains and losses. The impact of future gains or losses from the Company’s strategic investment portfolio could be material.

(3) The estimated impact to GAAP diluted EPS is in connection with the Company's restructuring initiatives.

(4) The Company’s non-GAAP tax provision uses a long-term projected tax rate of 22.0%, which reflects currently available information and could be subject to change.

(5) The Company's shares used in computing GAAP earnings per share guidance and non-GAAP earnings per share guidance excludes any impact to share count from potential Q3 - Q4 FY25 repurchase activity under our share repurchase program.

For additional information regarding non-GAAP financial measures see the reconciliation of results and related explanations below.

Management will provide further commentary around these guidance assumptions on its earnings call.

Chief Financial Officer Transition

Amy Weaver has made the decision to step down from her role as President and Chief Financial Officer at Salesforce. She will remain CFO until a successor is appointed. After that time, Amy will be an advisor to the company.

“Amy has been an incredible executive at Salesforce, leading many of the company’s most important strategic and operational initiatives over the last decade. And, she has been an amazing partner to me personally,” said Benioff. “Among her many contributions, Amy oversaw our successful financial transformation over the past several years – which has resulted in unprecedented margin expansion, increased operational excellence, and financial discipline across our organization. We are grateful that Amy’s transition period will allow us to conduct a thoughtful search for our next CFO, and we expect this to be a seamless transition.”

“My time at Salesforce has been an amazing journey, and it’s been a privilege to work alongside such a talented, dedicated and compassionate team,” said Weaver. “I’m especially proud of our work to drive increased profitability and productivity and introduce an enhanced capital return program, all while keeping our customers and our values as our north star. I am confident that Salesforce is well-positioned to accelerate its success in this next chapter.”

Product Releases and Enhancements

Three times a year Salesforce delivers new product releases, services, or enhancements to current products and services. These releases are a result of significant research and development investments made over multiple years, designed to help customers drive cost savings, boost efficiency, and build trust.

To view our major product releases and other highlights as part of the Summer 2024 Product Release, visit: www.salesforce.com/products/summer-24-release.

Environmental, Social, and Governance (ESG) Strategy

To learn more about our latest initiatives and priorities, review our Stakeholder Impact Report: https://salesforce.com/stakeholder-impact-report.

Quarterly Conference Call

Salesforce plans to host a conference call at 2:00 p.m. (PT) / 5:00 p.m. (ET) to discuss its financial results with the investment community. A live webcast and replay details of the event will be available on the Salesforce Investor Relations website at www.salesforce.com/investor.

About Salesforce

Salesforce is the #1 AI CRM, empowering companies to connect with their customers in a whole new way through the power of CRM + AI + Data + Trust on one unified platform: Einstein 1. For more information visit: www.salesforce.com (NYSE: CRM).

Mike Spencer

Salesforce

Investor Relations

investor@salesforce.com

Carolyn Guss

Salesforce

Public Relations

415-536-4966

pr@salesforce.com

###

"Safe harbor" statement under the Private Securities Litigation Reform Act of 1995: This press release contains forward-looking statements about the Company's financial and operating results and guidance, which include, but are not limited to, expected GAAP and non-GAAP financial and other operating and non-operating results, including revenue, net income, earnings per share, operating cash flow growth, operating margin, expected revenue growth, expected foreign currency exchange rate impact, expected current remaining performance obligation growth, expected tax rates or provisions, stock-based compensation expenses, amortization of purchased intangibles, shares outstanding, market growth, strategic investments, expected restructuring expense or charges and expected timing of product releases and enhancements. The achievement or success of the matters covered by such forward-looking statements involves risks, uncertainties and assumptions. If any such risks or uncertainties materialize or if any of the assumptions prove incorrect, the Company’s results or outcomes could differ materially and adversely from those expressed or implied by our forward-looking statements. Readers are cautioned not to place undue reliance on such forward-looking statements.

The risks and uncertainties referred to above include -- but are not limited to -- risks associated with:

•our ability to maintain sufficient security levels and service performance, avoid downtime and prevent, detect and remediate performance degradation and security breaches;

•our ability to secure sufficient data center capacity;

•our reliance on third-party infrastructure providers, including hardware, software and platform providers and the organizations responsible for the development and maintenance of the infrastructure of the Internet;

•uncertainties regarding AI technologies and their integration into our product offerings;

•our ability to achieve our aspirations, goals and projections related to our environmental, social and governance (“ESG”) initiatives;

•the effect of evolving government regulations, including those related to our industry and providing services on or accessing the Internet, and those addressing ESG matters, data privacy, cybersecurity, cross-border data transfers, government contracting and procurement, and import and export controls;

•current and potential litigation and regulatory investigations involving us or our industry;

•our ability to successfully expand or introduce new services and product features, including related to AI and Agentforce;

•our ability to successfully complete, integrate and realize the benefits from acquisitions or other strategic transactions;

•uncertainties regarding the pace of change and innovation and our ability to compete in the markets in which we participate;

•our ability to successfully execute our business strategy and our business plans, including efforts to expand internationally and related risks;

•our ability to predict and meet expectations regarding our operating results and cash flows, including revenue and remaining performance obligation, including as a result of the seasonal nature of our sales cycle and the variability in our results arising from the accounting for term license revenue products and some complex transactions;

•our ability to predict and limit customer attrition and costs related to those efforts;

•the demands on our personnel and infrastructure resulting from significant growth in our customer base and operations, including as a result of acquisitions;

•our real estate and office facilities strategy and related costs and uncertainties;

•the performance of our strategic investment portfolio, including fluctuations in the fair value of our investments;

•our ability to protect our intellectual property rights;

•our ability to maintain and enhance our brands;

•uncertainties regarding the valuation and potential availability of certain tax assets;

•the impact of new accounting pronouncements and tax laws;

•uncertainties affecting our ability to estimate our tax rate, including our tax obligations in connection with potential jurisdictional transfer of intellectual property;

•uncertainties regarding the effect of geopolitical events, inflationary pressures, market and macroeconomic volatility, financial institution instability, changes in monetary policy, foreign currency exchange rate and interest rate fluctuations, a potential shutdown of the U.S. federal government and climate change, natural disasters and actual or threatened public health emergencies on our workforce, business, and operating results;

•uncertainties regarding the impact of expensing stock options and other equity awards;

•the sufficiency of our capital resources, including our ability to execute our share repurchase program and declare future cash dividends;

•our ability to comply with our debt covenants and lease obligations; and

•uncertainties regarding impacts to our workforce and workplace culture, such as those arising from our current and future office environments or remote work policies or our ability to realize the expected benefits of the restructuring plan.

Further information on these and other factors that could affect the Company’s actual results or outcomes is included in the reports on Forms 10-K, 10-Q and 8-K and in other filings it makes with the Securities and Exchange Commission from time to time. These documents are available on the SEC Filings section of the Financials section of the Company’s website at http://investor.salesforce.com/financials/.

Salesforce, Inc. assumes no obligation and does not intend to revise or update publicly any forward-looking statements for any reason, except as required by law.

© 2024 Salesforce, Inc. All rights reserved. Salesforce and other marks are trademarks of Salesforce, Inc. Other brands featured herein may be trademarks of their respective owners.

#

Salesforce, Inc.

Condensed Consolidated Statements of Operations

(in millions, except per share data)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| 2 | Three Months Ended July 31, | | Six Months Ended July 31, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Revenues: | | | | | | | |

| Subscription and support | $ | 8,764 | | | $ | 8,006 | | | $ | 17,349 | | | $ | 15,648 | |

| Professional services and other | 561 | | | 597 | | | 1,109 | | | 1,202 | |

| Total revenues | 9,325 | | | 8,603 | | | 18,458 | | | 16,850 | |

| Cost of revenues (1)(2): | | | | | | | |

| Subscription and support | 1,556 | | | 1,515 | | | 3,116 | | | 3,025 | |

| Professional services and other | 603 | | | 598 | | | 1,205 | | | 1,213 | |

| Total cost of revenues | 2,159 | | | 2,113 | | | 4,321 | | | 4,238 | |

| Gross profit | 7,166 | | | 6,490 | | | 14,137 | | | 12,612 | |

| Operating expenses (1)(2): | | | | | | | |

| Research and development | 1,349 | | | 1,220 | | | 2,717 | | | 2,427 | |

| Sales and marketing | 3,224 | | | 3,113 | | | 6,463 | | | 6,267 | |

| General and administrative | 711 | | | 632 | | | 1,358 | | | 1,270 | |

| Restructuring | 99 | | | 49 | | | 107 | | | 760 | |

| | | | | | | |

| Total operating expenses | 5,383 | | | 5,014 | | | 10,645 | | | 10,724 | |

| Income from operations | 1,783 | | | 1,476 | | | 3,492 | | | 1,888 | |

| | | | | | | |

| | | | | | | |

| Losses on strategic investments, net | (37) | | | (29) | | | 0 | | | (170) | |

| Other income | 91 | | | 45 | | | 212 | | | 100 | |

| Income before provision for income taxes | 1,837 | | | 1,492 | | | 3,704 | | | 1,818 | |

| Provision for income taxes | (408) | | | (225) | | | (742) | | | (352) | |

| Net income | $ | 1,429 | | | $ | 1,267 | | | $ | 2,962 | | | $ | 1,466 | |

| Basic net income per share | $ | 1.48 | | | $ | 1.30 | | | $ | 3.06 | | | $ | 1.50 | |

| Diluted net income per share (3) | $ | 1.47 | | | $ | 1.28 | | | $ | 3.03 | | | $ | 1.49 | |

| Shares used in computing basic net income per share | 964 | | | 975 | | | 967 | | | 977 | |

| Shares used in computing diluted net income per share | 973 | | | 986 | | | 979 | | | 987 | |

| | | | | | | |

(1)Amounts include amortization of intangible assets acquired through business combinations, as follows: | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended July 31, | | Six Months Ended July 31, |

| | 2024 | | 2023 | | 2024 | | 2023 |

| Cost of revenues | $ | 231 | | | $ | 250 | | | $ | 469 | | | $ | 498 | |

| Sales and marketing | 223 | | | 222 | | | 446 | | | 445 | |

| | | | | | | |

(2)Amounts include stock-based compensation expense, as follows: | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended July 31, | | Six Months Ended July 31, |

| | 2024 | | 2023 | | 2024 | | 2023 |

| Cost of revenues | $ | 132 | | | $ | 112 | | | $ | 251 | | | $ | 215 | |

| Research and development | 276 | | | 256 | | | 536 | | | 497 | |

| Sales and marketing | 309 | | | 277 | | | 599 | | | 540 | |

| General and administrative | 91 | | | 79 | | | 172 | | | 152 | |

| Restructuring | 2 | | | 0 | | | 2 | | | 16 | |

(3)During the three months ended July 31, 2024 and 2023, losses on strategic investments impacted GAAP diluted EPS by $(0.03) and $(0.02) based on a U.S. tax rate of 24.5% and non-GAAP diluted EPS by $(0.03) and $(0.02) based on a non-GAAP tax rate of 22.0% and 23.5%, respectively. During the six months ended July 31, 2024 and 2023, losses on strategic

investments impacted GAAP diluted EPS by $0.00 and $(0.13) based on a U.S. tax rate of 24.5% and non-GAAP diluted EPS by $0.00 and $(0.13) based on a non-GAAP tax rate of 22.0% and 23.5%, respectively.

Salesforce, Inc.

Condensed Consolidated Statements of Operations

(As a percentage of total revenues)

(Unaudited) | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended July 31, | | Six Months Ended July 31, |

| | 2024 | | 2023 | | 2024 | | 2023 |

| Revenues: | | | | | | | |

| Subscription and support | 94 | % | | 93 | % | | 94 | % | | 93 | % |

| Professional services and other | 6 | | | 7 | | | 6 | | | 7 | |

| Total revenues | 100 | | | 100 | | | 100 | | | 100 | |

| Cost of revenues (1)(2): | | | | | | | |

| Subscription and support | 17 | | | 18 | | | 17 | | | 18 | |

| Professional services and other | 6 | | | 7 | | | 6 | | | 7 | |

| Total cost of revenues | 23 | | | 25 | | | 23 | | | 25 | |

| Gross profit | 77 | | | 75 | | | 77 | | | 75 | |

| Operating expenses (1)(2): | | | | | | | |

| Research and development | 14 | | | 14 | | | 15 | | | 14 | |

| Sales and marketing | 35 | | | 36 | | | 35 | | | 37 | |

| General and administrative | 8 | | | 7 | | | 7 | | | 8 | |

| Restructuring | 1 | | | 1 | | | 1 | | | 5 | |

| | | | | | | |

| Total operating expenses | 58 | | | 58 | | | 58 | | | 64 | |

| Income from operations | 19 | | | 17 | | | 19 | | | 11 | |

| | | | | | | |

| | | | | | | |

| Losses on strategic investments, net | 0 | | | 0 | | | 0 | | | (1) | |

| Other income | 1 | | | 0 | | | 1 | | | 1 | |

| Income before provision for income taxes | 20 | | | 17 | | | 20 | | | 11 | |

| Provision for income taxes | (5) | | | (2) | | | (4) | | | (2) | |

| Net income | 15 | % | | 15 | % | | 16 | % | | 9 | % |

(1)Amounts include amortization of intangible assets acquired through business combinations as a percentage of total revenues, as follows:

| | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended July 31, | | Six Months Ended July 31, |

| | 2024 | | 2023 | | 2024 | | 2023 |

| Cost of revenues | 3 | % | | 3 | % | | 3 | % | | 3 | % |

| Sales and marketing | 2 | | | 2 | | | 2 | | | 3 | |

| | | | | | | |

(2)Amounts include stock-based compensation expense as a percentage of total revenues, as follows: | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended July 31, | | Six Months Ended July 31, |

| | 2024 | | 2023 | | 2024 | | 2023 |

| Cost of revenues | 2 | % | | 1 | % | | 1 | % | | 1 | % |

| Research and development | 3 | | | 3 | | | 3 | | | 3 | |

| Sales and marketing | 3 | | | 3 | | | 3 | | | 3 | |

| General and administrative | 1 | | | 1 | | | 1 | | | 1 | |

| Restructuring | 0 | | | 0 | | | 0 | | | 0 | |

Salesforce, Inc.

Condensed Consolidated Balance Sheets

(in millions)

| | | | | | | | | | | |

| July 31, 2024 | | January 31, 2024 |

| Assets | (unaudited) | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 7,682 | | | $ | 8,472 | |

| Marketable securities | 4,954 | | | 5,722 | |

| Accounts receivable, net | 5,391 | | | 11,414 | |

| Costs capitalized to obtain revenue contracts, net | 1,851 | | | 1,905 | |

| Prepaid expenses and other current assets | 1,984 | | | 1,561 | |

| Total current assets | 21,862 | | | 29,074 | |

| Property and equipment, net | 3,580 | | | 3,689 | |

| Operating lease right-of-use assets, net | 2,130 | | | 2,366 | |

| Noncurrent costs capitalized to obtain revenue contracts, net | 2,201 | | | 2,515 | |

| | | |

| Strategic investments | 5,017 | | | 4,848 | |

| Goodwill | 48,941 | | | 48,620 | |

| Intangible assets acquired through business combinations, net | 4,415 | | | 5,278 | |

| Deferred tax assets and other assets, net | 4,034 | | | 3,433 | |

| Total assets | $ | 92,180 | | | $ | 99,823 | |

| Liabilities and stockholders’ equity | | | |

| Current liabilities: | | | |

| Accounts payable, accrued expenses and other liabilities | $ | 5,220 | | | $ | 6,111 | |

| Operating lease liabilities, current | 559 | | | 518 | |

| Unearned revenue | 15,222 | | | 19,003 | |

| | | |

| Debt, current | 0 | | | 999 | |

| Total current liabilities | 21,001 | | | 26,631 | |

| Noncurrent debt | 8,430 | | | 8,427 | |

| Noncurrent operating lease liabilities | 2,404 | | | 2,644 | |

| Other noncurrent liabilities | 2,712 | | | 2,475 | |

| Total liabilities | 34,547 | | | 40,177 | |

| | | |

| Stockholders’ equity: | | | |

| Common stock | 1 | | | 1 | |

| Treasury stock, at cost | (18,182) | | | (11,692) | |

| Additional paid-in capital | 62,143 | | | 59,841 | |

| Accumulated other comprehensive loss | (236) | | | (225) | |

| Retained earnings | 13,907 | | | 11,721 | |

| Total stockholders’ equity | 57,633 | | | 59,646 | |

| Total liabilities and stockholders’ equity | $ | 92,180 | | | $ | 99,823 | |

Salesforce, Inc.

Condensed Consolidated Statements of Cash Flows

(in millions)

(Unaudited) | | | | | | | | | | | | | | | | | | | | | | | | | |

| 2 | Three Months Ended July 31, | | Six Months Ended July 31, |

| 2024 | | 2023 | | 2024 | | 2023 | | |

| Operating activities: | | | | | | | | | |

| Net income | $ | 1,429 | | | $ | 1,267 | | | $ | 2,962 | | | $ | 1,466 | | | |

| Adjustments to reconcile net income to net cash provided by operating activities: | | | | | | | | | |

| Depreciation and amortization (1) | 907 | | | 890 | | | 1,786 | | | 2,144 | | | |

| Amortization of costs capitalized to obtain revenue contracts, net | 526 | | | 476 | | | 1,043 | | | 946 | | | |

| Stock-based compensation expense | 810 | | | 724 | | | 1,560 | | | 1,420 | | | |

| | | | | | | | | |

| Losses on strategic investments, net | 37 | | | 29 | | | 0 | | | 170 | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| Changes in assets and liabilities, net of business combinations: | | | | | | | | | |

| Accounts receivable, net | (1,136) | | | (768) | | | 6,026 | | | 5,355 | | | |

| Costs capitalized to obtain revenue contracts, net | (427) | | | (331) | | | (675) | | | (606) | | | |

| Prepaid expenses and other current assets and other assets | (477) | | | (52) | | | (991) | | | (343) | | | |

| | | | | | | | | |

| | | | | | | | | |

| Accounts payable and accrued expenses and other liabilities | 220 | | | (376) | | | (535) | | | (1,779) | | | |

| Operating lease liabilities | (158) | | | (167) | | | (243) | | | (335) | | | |

| Unearned revenue | (839) | | | (884) | | | (3,794) | | | (3,139) | | | |

| Net cash provided by operating activities | 892 | | | 808 | | | 7,139 | | | 5,299 | | | |

| Investing activities: | | | | | | | | | |

| Business combinations, net of cash acquired | 0 | | | 0 | | | (338) | | | 0 | | | |

| Purchases of strategic investments | (104) | | | (182) | | | (307) | | | (287) | | | |

| Sales of strategic investments | 52 | | | 13 | | | 105 | | | 22 | | | |

| Purchases of marketable securities | (550) | | | (1,798) | | | (3,802) | | | (2,166) | | | |

| Sales of marketable securities | 2,482 | | | 533 | | | 3,098 | | | 802 | | | |

| Maturities of marketable securities | 898 | | | 462 | | | 1,534 | | | 1,247 | | | |

| Capital expenditures | (137) | | | (180) | | | (300) | | | (423) | | | |

| Net cash provided by (used in) investing activities | 2,641 | | | (1,152) | | | (10) | | | (805) | | | |

| Financing activities: | | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| Repurchases of common stock | (4,335) | | | (1,949) | | | (6,468) | | | (4,003) | | | |

| Proceeds from employee stock plans | 202 | | | 362 | | | 735 | | | 811 | | | |

| Principal payments on financing obligations | (285) | | | (282) | | | (405) | | | (392) | | | |

| Repayments of debt | (1,000) | | | (181) | | | (1,000) | | | (1,182) | | | |

| Payments of dividends | (384) | | | 0 | | | (772) | | | 0 | | | |

| Net cash used in financing activities | (5,802) | | | (2,050) | | | (7,910) | | | (4,766) | | | |

| Effect of exchange rate changes | (7) | | | 11 | | | (9) | | | 28 | | | |

| Net decrease in cash and cash equivalents | (2,276) | | | (2,383) | | | (790) | | | (244) | | | |

| Cash and cash equivalents, beginning of period | 9,958 | | | 9,155 | | | 8,472 | | | 7,016 | | | |

| Cash and cash equivalents, end of period | $ | 7,682 | | | $ | 6,772 | | | $ | 7,682 | | | $ | 6,772 | | | |

(1) Includes amortization of intangible assets acquired through business combinations, depreciation of fixed assets and amortization and impairment of right-of-use assets.

Salesforce, Inc.

Additional Metrics

(Unaudited)

Supplemental Revenue Analysis

Remaining Performance Obligation

Remaining performance obligation ("RPO") represents contracted revenue that has not yet been recognized, which includes unearned revenue and unbilled amounts that will be recognized as revenue in future periods. RPO is influenced by several factors, including seasonality, the timing of renewals, the timing of software license deliveries, average contract terms and foreign currency exchange rates. Remaining performance obligation is also impacted by acquisitions. Unbilled portions of RPO denominated in foreign currencies are revalued each period based on the period end exchange rates. The portion of RPO that is unbilled is not recorded on the condensed consolidated balance sheets.

RPO consisted of the following (in billions): | | | | | | | | | | | | | | | | | |

| | Current | | Noncurrent | | Total |

| As of July 31, 2024 | $ | 26.5 | | | $ | 27.0 | | | $ | 53.5 | |

| As of April 30, 2024 | 26.4 | | | 27.5 | | | 53.9 | |

| As of January 31, 2024 | 27.6 | | | 29.3 | | | 56.9 | |

| As of October 31, 2023 | 23.9 | | | 24.4 | | | 48.3 | |

| As of July 31, 2023 | 24.1 | | | 22.5 | | | 46.6 | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

Unearned Revenue

Unearned revenue represents amounts that have been invoiced in advance of revenue recognition and is recognized as revenue when transfer of control to customers has occurred or services have been provided. The change in unearned revenue was as follows (in millions): | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended July 31, | | Six Months Ended July 31, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Unearned revenue, beginning of period | $ | 16,061 | | | $ | 15,121 | | | $ | 19,003 | | | $ | 17,376 | |

| Billings and other (1) | 8,430 | | | 7,723 | | | 14,538 | | | 13,660 | |

| Contribution from contract asset | 56 | | | (4) | | | 126 | | | 51 | |

| Revenue recognized over time | (8,852) | | | (8,178) | | | (17,423) | | | (16,015) | |

| | | | | | | |

| Revenue recognized at a point in time | (473) | | | (425) | | | (1,035) | | | (835) | |

| Unearned revenue from business combinations | 0 | | | 0 | | | 13 | | | 0 | |

| Unearned revenue, end of period | $ | 15,222 | | | $ | 14,237 | | | $ | 15,222 | | | $ | 14,237 | |

(1) Other includes, for example, the impact of foreign currency translation.

Disaggregation of Revenue

Subscription and Support Revenue by the Company's service offerings

Subscription and support revenues consisted of the following (in millions):

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended July 31, | | Six Months Ended July 31, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Sales | $ | 2,071 | | | $ | 1,895 | | | $ | 4,069 | | | $ | 3,705 | |

| Service | 2,257 | | | 2,049 | | | 4,439 | | | 4,013 | |

| Platform and Other | 1,786 | | | 1,638 | | | 3,504 | | | 3,205 | |

| Marketing and Commerce | 1,308 | | | 1,238 | | | 2,590 | | | 2,408 | |

| Integration and Analytics (1) | 1,342 | | | 1,186 | | | 2,747 | | | 2,317 | |

| $ | 8,764 | | | $ | 8,006 | | | $ | 17,349 | | | $ | 15,648 | |

(1) In the fourth quarter of fiscal 2024, the Company renamed the service offering previously referred to as Data to Integration and Analytics, which includes Mulesoft and Tableau.

Total Revenue by Geographic Locations

Revenues by geographical region consisted of the following (in millions): | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended July 31, | | Six Months Ended July 31, |

| | 2024 | | 2023 | | 2024 | | 2023 |

| Americas | $ | 6,201 | | | $ | 5,769 | | | $ | 12,263 | | | $ | 11,251 | |

| Europe | 2,184 | | | 1,974 | | | 4,329 | | | 3,925 | |

| Asia Pacific | 940 | | | 860 | | | 1,866 | | | 1,674 | |

| $ | 9,325 | | | $ | 8,603 | | | $ | 18,458 | | | $ | 16,850 | |

| | | | | | | |

| | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

Constant Currency Growth Rates

Subscription and support revenues constant currency growth rates by the Company's service offerings were as follows:

| | | | | | | | | | | | | | | | | |

| Three Months Ended

July 31, 2024

Compared to Three Months

Ended July 31, 2023 | | Three Months Ended

April 30, 2024

Compared to Three Months

Ended April 30, 2023 | | Three Months Ended

July 31, 2023

Compared to Three Months

Ended July 31, 2022 |

| Sales | 10% | | 11% | | 12% |

| Service | 11% | | 11% | | 12% |

| Platform and Other | 10% | | 10% | | 11% |

| Marketing and Commerce | 7% | | 10% | | 10% |

| Integration and Analytics (1) | 14% | | 25% | | 16% |

(1) In the fourth quarter of fiscal 2024, the Company renamed the service offering previously referred to as Data to Integration and Analytics, which includes Mulesoft and Tableau.

Revenue constant currency growth rates by geographical region were as follows: | | | | | | | | | | | | | | | | | |

| Three Months Ended

July 31, 2024

Compared to Three Months

Ended July 31, 2023 | | Three Months Ended

April 30, 2024

Compared to Three Months

Ended April 30, 2023 | | Three Months Ended

July 31, 2023

Compared to Three Months

Ended July 31, 2022 |

| Americas | 8% | | 11% | | 10% |

| Europe | 11% | | 9% | | 11% |

| Asia Pacific | 16% | | 21% | | 24% |

| Total growth | 9% | | 11% | | 11% |

Current remaining performance obligation constant currency growth rates were as follows: | | | | | | | | | | | | | | | | | | | |

| July 31, 2024

Compared to

July 31, 2023 | | April 30, 2024

Compared to

April 30, 2023 | | July 31, 2023

Compared to

July 31, 2022 | | |

| Total growth | 11% | | 10% | | 11% | | |

Salesforce, Inc.

GAAP Results Reconciled to Non-GAAP Results

The following tables reflect selected GAAP results reconciled to Non-GAAP results.

(in millions, except per share data)

(Unaudited) | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended July 31, | | Six Months Ended July 31, |

| | 2024 | | 2023 | | 2024 | | 2023 |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Non-GAAP income from operations | | | | | | | |

| GAAP income from operations | $ | 1,783 | | | $ | 1,476 | | | $ | 3,492 | | | $ | 1,888 | |

| Plus: | | | | | | | |

| Amortization of purchased intangibles (1) | 454 | | | 472 | | | 915 | | | 943 | |

| Stock-based compensation expense (2)(3) | 808 | | | 724 | | | 1,558 | | | 1,404 | |

| Restructuring | 99 | | | 49 | | | 107 | | | 760 | |

| Non-GAAP income from operations | $ | 3,144 | | | $ | 2,721 | | | $ | 6,072 | | | $ | 4,995 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Non-GAAP operating margin as a percentage of revenues | | | | | | | |

| Total revenues | $ | 9,325 | | | $ | 8,603 | | | $ | 18,458 | | | $ | 16,850 | |

| GAAP operating margin (4) | 19.1 | % | | 17.2 | % | | 18.9 | % | | 11.2 | % |

| Non-GAAP operating margin (4) | 33.7 | % | | 31.6 | % | | 32.9 | % | | 29.6 | % |

| Non-GAAP net income | | | | | | | |

| GAAP net income | $ | 1,429 | | | $ | 1,267 | | | $ | 2,962 | | | $ | 1,466 | |

| Plus: | | | | | | | |

| Amortization of purchased intangibles (1) | 454 | | | 472 | | | 915 | | | 943 | |

| Stock-based compensation expense (2)(3) | 808 | | | 724 | | | 1,558 | | | 1,404 | |

| Restructuring | 99 | | | 49 | | | 107 | | | 760 | |

| | | | | | | |

| | | | | | | |

| Income tax effects and adjustments | (295) | | | (418) | | | (640) | | | (805) | |

| Non-GAAP net income | $ | 2,495 | | | $ | 2,094 | | | $ | 4,902 | | | $ | 3,768 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended July 31, | | Six Months Ended July 31, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Non-GAAP diluted net income per share | | | | | | | |

| GAAP diluted net income per share | $ | 1.47 | | | $ | 1.28 | | | $ | 3.03 | | | $ | 1.49 | |

| Plus: | | | | | | | |

| Amortization of purchased intangibles (1) | 0.47 | | | 0.48 | | | 0.93 | | | 0.96 | |

| Stock-based compensation expense (2)(3) | 0.83 | | | 0.73 | | | 1.59 | | | 1.42 | |

| Restructuring | 0.10 | | | 0.05 | | | 0.11 | | | 0.77 | |

| | | | | | | |

| | | | | | | |

| Income tax effects and adjustments | (0.31) | | | (0.42) | | | (0.65) | | | (0.82) | |

| Non-GAAP diluted net income per share | $ | 2.56 | | | $ | 2.12 | | | $ | 5.01 | | | $ | 3.82 | |

| Shares used in computing non-GAAP diluted net income per share | 973 | | | 986 | | | 979 | | | 987 | |

(1)Amortization of purchased intangibles was as follows: | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended July 31, | | Six Months Ended July 31, |

| | 2024 | | 2023 | | 2024 | | 2023 |

| Cost of revenues | $ | 231 | | | $ | 250 | | | $ | 469 | | | $ | 498 | |

| Sales and marketing | 223 | | | 222 | | | 446 | | | 445 | |

| | | | | | | |

| $ | 454 | | | $ | 472 | | | $ | 915 | | | $ | 943 | |

(2)Stock-based compensation expense, excluding stock-based compensation expense related to restructuring, was as follows: | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended July 31, | | Six Months Ended July 31, |

| | 2024 | | 2023 | | 2024 | | 2023 |

| Cost of revenues | $ | 132 | | | $ | 112 | | | $ | 251 | | | $ | 215 | |

| Research and development | 276 | | | 256 | | | 536 | | | 497 | |

| Sales and marketing | 309 | | | 277 | | | 599 | | | 540 | |

| General and administrative | 91 | | | 79 | | | 172 | | | 152 | |

| $ | 808 | | | $ | 724 | | | $ | 1,558 | | | $ | 1,404 | |

(3) Stock-based compensation expense included in the GAAP to non-GAAP reconciliation tables above excludes stock-based compensation expense related to restructuring activities for the three months ended July 31, 2024 and 2023 of $2 and $0 million, respectively, and for the six months ended July 31, 2024 and 2023 of $2 and $16 million, respectively, which are included in the restructuring line.

(4) GAAP operating margin is the proportion of GAAP income from operations as a percentage of GAAP revenue. Non-GAAP operating margin is the proportion of non-GAAP income from operations as a percentage of GAAP revenue. Non-GAAP income from operations excludes the impact of the amortization of purchased intangibles, stock-based compensation expense and charges associated with the Company's restructuring activities.

Salesforce, Inc.

Computation of Basic and Diluted GAAP and Non-GAAP Net Income Per Share

(in millions, except per share data)

(Unaudited) | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended July 31, | | Six Months Ended July 31, |

| | 2024 | | 2023 | | 2024 | | 2023 |

| GAAP Basic Net Income Per Share | | | | | | | |

| Net income | $ | 1,429 | | | $ | 1,267 | | | $ | 2,962 | | | $ | 1,466 | |

| Basic net income per share | $ | 1.48 | | | $ | 1.30 | | | $ | 3.06 | | | $ | 1.50 | |

| Shares used in computing basic net income per share | 964 | | | 975 | | | 967 | | | 977 | |

| | | | | | | |

| | Three Months Ended July 31, | | Six Months Ended July 31, |

| | 2024 | | 2023 | | 2024 | | 2023 |

| Non-GAAP Basic Net Income Per Share | | | | | | | |

| Non-GAAP net income | $ | 2,495 | | | $ | 2,094 | | | $ | 4,902 | | | $ | 3,768 | |

| Non-GAAP basic net income per share | $ | 2.59 | | | $ | 2.15 | | | $ | 5.07 | | | $ | 3.86 | |

| Shares used in computing non-GAAP basic net income per share | 964 | | | 975 | | | 967 | | | 977 | |

| | | | | | | |

| | Three Months Ended July 31, | | Six Months Ended July 31, |

| | 2024 | | 2023 | | 2024 | | 2023 |

| GAAP Diluted Net Income Per Share | | | | | | | |

| Net income | $ | 1,429 | | | $ | 1,267 | | | $ | 2,962 | | | $ | 1,466 | |

| Diluted net income per share (3) | $ | 1.47 | | | $ | 1.28 | | | $ | 3.03 | | | $ | 1.49 | |

| Shares used in computing diluted net income per share | 973 | | | 986 | | | 979 | | | 987 | |

| | | | | | | |

| | Three Months Ended July 31, | | Six Months Ended July 31, |

| | 2024 | | 2023 | | 2024 | | 2023 |

| Non-GAAP Diluted Net Income Per Share | | | | | | | |

| Non-GAAP net income | $ | 2,495 | | | $ | 2,094 | | | $ | 4,902 | | | $ | 3,768 | |

| Non-GAAP diluted net income per share | $ | 2.56 | | | $ | 2.12 | | | $ | 5.01 | | | $ | 3.82 | |

| Shares used in computing non-GAAP diluted net income per share | 973 | | | 986 | | | 979 | | | 987 | |

Supplemental Cash Flow Information

Computation of Free Cash Flow, a Non-GAAP Measure

(in millions)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended July 31, | | Six Months Ended July 31, |

| | 2024 | | 2023 | | 2024 | | 2023 |

| GAAP net cash provided by operating activities | $ | 892 | | | $ | 808 | | | $ | 7,139 | | | $ | 5,299 | |

| Capital expenditures | (137) | | | (180) | | | (300) | | | (423) | |

| Free cash flow | $ | 755 | | | $ | 628 | | | $ | 6,839 | | | $ | 4,876 | |

Non-GAAP Financial Measures: This press release includes information about non-GAAP operating margin, non-GAAP net income per share, non-GAAP tax rates, free cash flow, constant currency revenue, constant currency subscription and support revenue growth rate and constant currency current remaining performance obligation growth rates (collectively the “non-GAAP financial measures”). These non-GAAP financial measures are measurements of financial performance that are not prepared in accordance with U.S. generally accepted accounting principles and computational methods may differ from those used by other companies. Non-GAAP financial measures are not meant to be considered in isolation or as a substitute for comparable GAAP measures and should be read only in conjunction with the Company’s consolidated financial statements prepared in accordance with GAAP. Management uses both GAAP and non-GAAP measures when planning, monitoring and evaluating the Company’s performance.

The primary purpose of using non-GAAP measures is to provide supplemental information that may prove useful to investors and to enable investors to evaluate the Company’s results in the same way management does. Management believes that supplementing GAAP disclosure with non-GAAP disclosure provides investors with a more complete view of the Company’s operational performance and allows for meaningful period-to-period comparisons and analysis of trends in the Company’s business. Further to the extent that other companies use similar methods in calculating non-GAAP measures, the provision of supplemental non-GAAP information can allow for a comparison of the Company’s relative performance against other companies that also report non-GAAP operating results.

Non-GAAP Operating Margin is the proportion of non-GAAP income from operations as a percentage of GAAP revenue. Non-GAAP income from operations excludes the impact of the following items: stock-based compensation expense, amortization of acquisition-related intangibles and charges associated with the Company's restructuring activities. Non-GAAP net income per share excludes, to the extent applicable, the impact of the following items: stock-based compensation expense, amortization of purchased intangibles, charges related to the Company's restructuring activities and income tax adjustments. These items are excluded because the decisions that give rise to them are not made to increase revenue in a particular period, but instead for the Company’s long-term benefit over multiple periods.

As described above, the Company excludes or adjusts for the following in its non-GAAP results and guidance:

•Stock-Based Compensation Expense: The Company’s compensation strategy includes the use of stock-based compensation expense to attract and retain employees and executives. It is principally aimed at aligning their interests with those of our stockholders and at long-term employee retention, rather than to motivate or reward operational performance for any particular period. Thus, stock-based compensation expense varies for reasons that are generally unrelated to operational decisions and performance in any particular period.

•Amortization of Purchased Intangibles: The Company views amortization of acquisition-related intangible assets, such as the amortization of the cost associated with an acquired company’s research and development efforts, trade names, customer lists and customer relationships, and, in some cases, acquired lease intangibles, as items arising from pre-acquisition activities determined at the time of an acquisition. While these intangible assets are continually evaluated for impairment, amortization of the cost of purchased intangibles is a static expense, which is not typically affected by operations during any particular period. Although the Company excludes the amortization of purchased intangibles from these non-GAAP measures, management believes that it is important for investors to understand that such intangible assets were recorded as part of purchase accounting and contribute to revenue generation.

•Restructuring: Restructuring charges are costs associated with a formal restructuring plan and may include employee notice period costs and severance payments, lease or contract termination costs, asset impairments, accelerated depreciation and amortization and other related expenses. The Company excludes these restructuring charges because they are distinct from ongoing operational costs and it does not believe they are reflective of current and expected future business performance and operating results.

•Gains (Losses) on Strategic Investments, net: The Company records all fair value adjustments to its equity securities held within the strategic investment portfolio through the statement of operations. As it is not possible to forecast future gains and losses, the Company assumes no change to the value of its strategic investment portfolio in its GAAP and non-GAAP estimates for future periods, including its guidance. Gains (Losses) on Strategic Investments, net, are included in its GAAP financial statements.

•Income Tax Effects and Adjustments: The Company utilizes a fixed long-term projected non-GAAP tax rate in order to provide better consistency across the interim reporting periods by eliminating the effects of items such as changes in the tax valuation allowance and tax effects of acquisition-related costs, since each of these can vary in size and

frequency. When projecting this long-term rate, the Company evaluated a three-year financial projection that excludes the direct impact of the following non-cash items: stock-based compensation expenses and the amortization of purchased intangibles. The projected rate also considers factors including the Company’s expected tax structure, its tax positions in various jurisdictions and key legislation in major jurisdictions where the Company operates. For fiscal 2024, the Company used a projected non-GAAP tax rate of 23.5%. For fiscal 2025, the Company uses a projected non-GAAP tax rate of 22.0%, which reflects currently available information, as well as other factors and assumptions. The non-GAAP tax rate could be subject to change for a variety of reasons, including the rapidly evolving global tax environment, significant changes in the Company’s geographic earnings mix due to acquisition activity or other changes to the Company’s strategy or business operations. The Company will re-evaluate its long-term rate as appropriate.

The Company presents constant currency information to provide a framework for assessing how the Company's underlying business performed excluding the effect of foreign currency rate fluctuations. To present constant currency revenue growth rates, current and comparative prior period results for entities reporting in currencies other than United States dollars are converted into United States dollars at the weighted average exchange rate for the quarter being compared to rather than the actual exchange rates in effect during that period. To present current remaining performance obligation growth rates on a constant currency basis, current remaining performance obligation balances in local currencies in previous comparable periods are converted using the United States dollar currency exchange rate as of the most recent balance sheet date.

The Company defines the non-GAAP measure free cash flow as GAAP net cash provided by operating activities, less capital expenditures.

v3.24.2.u1

Document and Entity Information

|

Aug. 28, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Aug. 28, 2024

|

| Entity Registrant Name |

Salesforce, Inc.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-32224

|

| Entity Tax Identification Number |

94-3320693

|

| Entity Address, Address Line One |

Salesforce Tower

|

| Entity Address, Address Line Two |

415 Mission Street, 3rd Fl

|

| Entity Address, City or Town |

San Francisco

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

94105

|

| City Area Code |

415

|

| Local Phone Number |

901-7000

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.001 per share

|

| Trading Symbol |

CRM

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0001108524

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

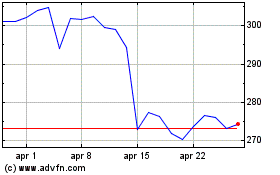

Grafico Azioni Salesforce (NYSE:CRM)

Storico

Da Nov 2024 a Dic 2024

Grafico Azioni Salesforce (NYSE:CRM)

Storico

Da Dic 2023 a Dic 2024