Form 8-K - Current report

13 Gennaio 2025 - 2:31PM

Edgar (US Regulatory)

false

0001739104

0001739104

2025-01-13

2025-01-13

0001739104

us-gaap:CommonStockMember

2025-01-13

2025-01-13

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D. C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported):

January 13, 2025

Elanco

Animal Health Incorporated

(Exact name of registrant as specified

in its charter)

| Indiana | |

001-38661 | |

82-5497352 |

(State

or other jurisdiction

of incorporation) | |

(Commission

File Number) | |

(I.R.S. Employer Identification No.) |

2500 Innovation Way

Greenfield, Indiana (Address of principal executive offices)

| |

46140 (Zip

Code) |

Registrant’s telephone number, including area code: (877)

352-6261

Not Applicable

(Former Name or Address, if Changed Since Last

Report)

Check the appropriate

box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the

following provisions (see General Instruction A.2. below):

| ¨ | Written communications

pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant

to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications

pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications

pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each

class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which

registered |

| Common stock, no par value |

|

ELAN |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

¨ Emerging

growth company

If an emerging growth company, indicate by check mark if the

registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act. ¨

On January 14, 2025, Elanco Animal

Health Incorporated (the “Company”) will present at the 43rd Annual J.P. Morgan Healthcare Conference (the “JPM Conference”).

A copy of the Company’s presentation is furnished as Exhibit 99.1.

The information in this Item 7.01, including

Exhibit 99.1 attached hereto, is being furnished and shall not be deemed “filed” for the purposes of Section 18 of the Securities

Exchange Act of 1934, as amended (“Exchange Act”), or otherwise subject to the liabilities of that Section and shall not be

incorporated by reference into any registration statement or other document pursuant to the Securities Act of 1933, as amended, or the

Exchange Act, except as otherwise expressly stated in such filing.

| Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the

Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly

authorized.

| |

Elanco Animal Health Incorporated |

| |

|

|

| Date: January 13, 2025 |

By: |

/s/ Todd Young |

| |

|

Name: |

Todd Young |

| |

|

Title: |

Executive Vice President and Chief Financial Officer |

Exhibit 99.1

| J.P. Morgan Healthcare

Conference

January 14, 2025

Jeff Simmons

President & Chief Executive Officer |

| © 2025 Elanco or its affiliates

This presentation contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934 (Exchange Act),

including, without limitation, our expected 2024 full year and fourth quarter results, our 2025 outlook and long-term expectations, our expectations regarding debt levels and expectations

regarding out industry and our operations, performance and financial condition, and including, in particular, statements relating to our business, growth strategies, distribution strategies, product

development efforts and future expenses. Forward-looking statements are based on our current expectations and assumptions regarding our business, the economy and other future

conditions. Because forward-looking statements relate to the future, by their nature, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict. As

a result, our actual results may differ materially from those contemplated by the forward-looking statements.

Important factors that could cause actual results to differ materially from those in the forward-looking statements include regional, national, or global political, economic, business, competitive,

market, and regulatory conditions, including but not limited to the following: operating in a highly competitive industry; the success of our research and development (R&D) and licensing efforts;

the impact of disruptive innovations and advances in veterinary medical practices, animal health technologies and alternatives to animal-derived protein; competition from generic products that

may be viewed as more cost-effective; changes in regulatory restrictions on the use of antibiotics in farm animals; an outbreak of infectious disease carried by farm animals; risks related to the

evaluation of animals; consolidation of our customers and distributors; the impact of increased or decreased sales into our distribution channels resulting in fluctuations in our revenues; our

dependence on the success of our top products; our ability to complete acquisitions and divestitures and to successfully integrate the businesses we acquire; our ability to implement our

business strategies or achieve targeted cost efficiencies and gross margin improvements; manufacturing problems and capacity imbalances, including at our contract manufacturers;

fluctuations in inventory levels in our distribution channels; risks related to the use of artificial intelligence (AI) in our business; our dependence on sophisticated information technology systems

and infrastructure, including the use of third-party, cloud-based technologies, and the impact of outages or breaches of the information technology systems and infrastructure we rely on; the

impact of weather conditions, including those related to climate change, and the availability of natural resources; demand, supply and operational challenges associated with the effects of a

human disease outbreak, epidemic, pandemic or other widespread public health concern; the loss of key personnel or highly skilled employees; adverse effects of labor disputes, strikes and/or

work stoppages; the effect of our substantial indebtedness on our business, including restrictions in our debt agreements that limit our operating flexibility and changes in our credit ratings that

lead to higher borrowing expenses and may restrict access to credit; changes in interest rates that may adversely affect our earnings and cash flows; risks related to the write-down of goodwill

or identifiable intangible assets; the lack of availability or significant increases in the cost of raw materials; risks related to our presence in foreign markets; risks related to currency rate

fluctuations; risks related to underfunded pension plan liabilities; our current plan not to pay dividends and restrictions on our ability to pay dividends; the potential impact that actions by activist

shareholders could have on the pursuit of our business strategies; risks related to tax expense or exposure; actions by regulatory bodies, including as a result of their interpretation of studies

on product safety; the possible slowing or cessation of acceptance and/or adoption of our farm animal sustainability initiatives; the impact of increased regulation or decreased governmental

financial support related to the raising, processing or consumption of farm animals; risks related to the modification of foreign trade policy; the impact of litigation, regulatory investigations, and

other legal matters, including the risk to our reputation and the risk that our insurance policies may be insufficient to protect us from the impact of such matters; challenges to our intellectual

property rights or our alleged violation of rights of others; misuse, off-label or counterfeiting use of our products; unanticipated safety, quality or efficacy concerns and the impact of identified

concerns associated with our products; insufficient insurance coverage against hazards and claims; compliance with privacy laws and security of information; and risks related to environmental,

health and safety laws and regulations.

For additional information about the factors that could cause actual results to differ materially from forward-looking statements, please see our latest Form 10-K and subsequent Form 10-Qs

filed with the Securities and Exchange Commission. We undertake no duty to update forward-looking statements.

Forward-looking statements

2 |

| J.P. Morgan Healthcare Conference

| January 2025

3

Six potential blockbusters on track,

expected to accelerate revenue to

mid

-single digit (MSD) organic

constant currency growth in 2025

Launching Our Diverse

Portfolio of Innovation

Five key updates since November earnings call: ✓ Launching and shipping Credelio Quattro this month ✓ Zenrelia tracking to expectations, adding several

hundred clinics per week; accelerating DTC to start this

month

✓ Increasing AdTab peak sales opportunity to blockbuster

status

✓ Blockbuster status achieved for Experior in the U.S.

alone; heifer clearance driving continued growth

✓ Carbon inset market proven as dairy farmers earned

~$10M for credits created by using Rumensin

3 |

| Attractive, Growing Markets

Delivering Consistent,

High-Impact Innovation

Sustainable Revenue Growth,

Margin Expansion

Multiple Expansion

Opportunity

Positioned to Win and

Gain Market Share

~$41B1 global animal health pharmaceutical industry across Pet Health

($16B) and Farm Animal ($25B) with consistent MSD growth driven by

durable trends

Top-tier global player with portfolio diversity across pets and farm animals,

growing leadership in Farm Animal and Pet Retail, and innovation

launching in key pet health markets

Six potential blockbusters contributing to an expected incremental $600-

$700 million in revenue from innovation in 2025, with parallel focus on

advancing the next wave of the pipeline

Accelerating revenue growth expected in 2024 and 2025, with increasing

contribution from innovation and stabilizing base business leading to

sustainable growth over time; optimized infrastructure enabling margin

expansion in 2026 and beyond

Accelerating topline growth, anticipated margin expansion, and improving

leverage profile create opportunity for shareholder value creation

J.P. Morgan Healthcare Conference | January 2025

4

An Animal Health Leader Entering the Next Era

Well-positioned to deliver sustainable revenue growth and meaningful long-term value

1

Industry figures represent Elanco analysis of 2024 market data and internal estimates for animal health medicines and vaccines. |

| © 2025 Elanco or its affiliates 5

Animal Health:

Attractive, Growing Markets with Positive Long-Term Tailwinds

J.P. Morgan Healthcare Conference | January 2025

Farm Animal

$25B Global Industry1

Protein demand growth globally

driven by GDP and expanding

protein diets

Producers focused on

food safety, disease prevention,

and productivity

Livestock sustainability expected

to create the next economic

opportunity in the industry

Pet Health

$16B Global Industry1

Pet ownership and

“humanization” of pets

a continued tailwind globally

Increased compliance

and convenience

expected to drive growth

Innovation and channel

expansion across the

value chain

Elanco Equipped with Industry Success Factors:

Broad Portfolios, Innovation, Omnichannel, Value-Added Capabilities and Global Reach

1

Industry figures represent Elanco analysis of 2024 market data and internal estimates for animal health medicines and vaccines. |

| © 2025 Elanco or its affiliates

Elanco at a Glance

A Global, Independent

Leader Reaching

the World’s Animals

1Non-GAAP financial measure. See Appendix to this presentation for more information, including GAAP to non-GAAP reconciliations.

2

Facts and figures shown are as of Dec. 31, 2023; excluding contribution from the aqua business which the company divested July 9, 2024.

We provide medicines

and services to help

veterinarians, and pet owners

improve care for pets

and enable farmers to

raise healthier livestock

more sustainably

$4.44 B

Revenue

$0.92

Adj. EPS1

$915 M

Adj. EBITDA1

Diverse, Global Portfolio2

9 Blockbusters

>$100M in

annual revenue

5 Core Species

Pet health & farm animals

Dogs, cats, cattle, swine, and poultry

90+

countries served

200+ brands

sold for pets &

farm animals

Balanced Portfolio

Between pet health and

livestock products revenue

55%

Revenue from

outside the U.S.

~1,000

R&D Employees

~2,000

Sales Representatives

~9,300 Employees worldwide 18

Manufacturing

sites

Key Financial Metrics

2024 Guidance Midpoint (as of November 7, 2024)

J.P. Morgan Healthcare Conference | January 2025

6 |

| © 2025 Elanco or its affiliates

Established

Foundation

Focused on

Animal Health

Acquisitions for portfolio

diversity; Spin-out of

Eli Lilly with 2018 IPO;

Dedicated sites & systems

An independent leader with

an optimized cost base positioned to

reach the world’s animals at scale

Balanced Mix &

Increased Scale

Portfolio diversifying

acquisition of Bayer Animal

Health increased global

scale, with productivity focus

Acquisitions balanced portfolio

mix between pet health and farm

animal, U.S. and International,

with expansion into omnichannel and

innovative technologies, including

monoclonal antibodies. Productivity

focus drove cost savings and

enhanced efficiency

Innovation

Delivered &

Enhanced

Capabilities

Late-stage pipeline delivered;

Strategy streamlined;

Launch efforts re-imagined

Refined R&D approach delivered

late-stage pipeline assets, while

reinforcing commitment to most

significant value creation opportunities

in pet health and livestock

sustainability

Expansion and enhancement of

commercial sales force in pet health

to capitalize on innovative products.

Strategic divesture of aqua business

drove significant reduction in balance

sheet leverage

Elanco’s Strategic

Trajectory Poised for

Sustainable

Revenue Growth

Multiple approved potential

blockbusters and a

stabilizing base to drive

growth

Accelerating contribution from

innovation, majority already

approved, and a stabilizing

base business expected to drive

sustainable growth. Leveraging

the existing cost base allows

for expected margin expansion in

2026 and beyond

J.P. Morgan Healthcare Conference | January 2025

7

From a Pharma Division

to a Global, Independent

Leader

2021-2024

2018-2020

2019-2021

2025 & Beyond |

| © 2025 Elanco or its affiliates

n

I

novation

Portfolio

Productivity

Customer

Veterinarian

Farmer

Pet Owner

IPP:

Innovation,

Portfolio,

Productivity

Elanco’s Strategy

to Deliver Value to

All Stakeholders,

Rooted in a Deep Focus

on the Customer

Deliver

consistent,

high-impact

Innovation

Continuously improve

Productivity & cash

flow

8

Optimize

our diverse

Portfolio to

grow market

share

J.P. Morgan Healthcare Conference | January 2025 |

| © 2025 Elanco or its affiliates

Accelerating Topline Growth Driven by Portfolio Diversity,

Innovation Contribution and Key Growth Enablers

1YTD Data as of Sep. 30, 2024; excludes the aqua business and contract manufacturing. 2Pet Health revenue represents dogs and cats. 3Cattle revenue represents all ruminants,

inclusive of beef and dairy cattle, sheep and goats. 4Excludes impact of aqua divestiture which was completed July 9, 2024.

Diversity Across Geography and Species

Drives Durability1

Revenue category

by geography

Revenue

by species

51%

23% 18%

8%

Pet Health2

Cattle3

Poultry

Swine

Percentages may not add due to rounding.

-3%

1%

3%

-5%

-3%

-1%

1%

3%

5%

7%

2022 2023 2024e 2025e

23%

30%

18%

29%

Pet Health

Farm Animal

International

U.S.

J.P. Morgan Healthcare Conference | January 2025

nI novation

Portfolio

Productivity

Customer

-3%

1%

3%4

MSD%4

9

Expected Revenue Trajectory

Constant currency change year over year |

| © 2025 Elanco or its affiliates

Vision

Helping pets

live longer,

healthier, more

active lives

Global Pet Health Market Positioning

Strategic Framework

IL-31 mAb

Parasiticides Dermatology Pain & Other

Therapeutics

10

Differentiated entrant

into fast growing global

market with robust

pipeline including

monoclonal antibody

product and multiple

shots on goal

Omnichannel offerings

with retail leadership and

innovation to drive growth

in largest pet health market

Broad portfolio for dogs

and cats, including pain

products across modes

of action, indications,

and disease stages

Pet Health

Key Enablers

Innovation Address unmet needs and expand portfolio

Share of Voice Increase product awareness with our customers

Physical Availability Maximize access to our products

Price Execution Optimize value based on willingness to pay

FAMILY

FAMILY

J.P. Morgan Healthcare Conference | January 2025

`

1 US only.

nI novation

Portfolio

Productivity

Customer

Vaccines1

Prevention

coverage for a

number of

important pet

health risks

One of only two animal health companies to have full pet health portfolio |

| © 2024 Elanco or its affiliates

Portfolio Comprehensive, complementary product offerings

Value Beyond Product Data and analytics to drive improved outcomes

Innovation Solutions to producers’ greatest challenges

Price Execution Optimize value based on willingness to pay

Global Farm Animal

Strategic Framework

Efficiency &

Performance

Disease Prevention

& Treatment

11

Trusted partners

with best-in-class

products and services

that create solutions

to animal health

challenges

Market leading

portfolio of medicated

feed additives that

increase production

efficiency providing

value for the producer

J.P. Morgan Healthcare Conference | January 2025

Vision

Helping

farmers improve

animal health

and wellbeing,

and raise

livestock more

sustainably

Food Safety

Partnering with

producers by

offering a portfolio

of vaccines,

insecticides, and

feed additives

and serving as

a leading industry

advocate

Sustainability

Building new market

with portfolio of

innovative sustainability

solutions that provide

an economic benefit

to cattle farmers

Farm Animal

Key Enablers

Market Positioning nI novation

Portfolio

Productivity

Customer |

| © 2025 Elanco or its affiliates

A Livestock Carbon Inset Marketplace

Creating Value for Dairy Farmers

& Food Companies

Dairy farmers now have a new value

stream opportunity by using product

interventions and third-party accepted

protocols to monetize GHG emissions

reductions via the newly established

carbon inset market

The carbon inset marketplace

establishes the forum to connect food

companies with their direct dairy supply

chain and allow for value exchange to

compensate for the use of tools to

reduce greenhouse gas emissions

Market Established

Food companies have a viable path

to directly reducing the environmental

footprint of their supply chains allowing for

alignment to changing consumer

preferences, increased brand strength, and

advancement toward stated goals

Multiple Nodes

of Value Creation Developed tools

to measure an operations

on-farm carbon footprint

Delivered product

interventions,

associated research and

approved protocols to efficiently

reduce greenhouse gas

emissions at scale

Invested in carbon

inset marketplace

and helped shape

development

J.P. Morgan Healthcare Conference | January 2025

Elanco

Driving

Progress

12 |

| © 2025 Elanco or its affiliates 13

Focused on Delivering Consistent, High-Impact Innovation

Life Cycle

Management

Extending the life and value of our existing

brands with targeted life cycle management

(LCM) is core to Elanco’s value proposition to

customers and contributes to a stabilizing base

LCM Opportunity Examples

Label claim extensions

Geographic expansions

Species expansions

Presentation and delivery

Packaging and safety

Regulatory registration renewals

Advance Pipeline

with Next Wave

To deliver consistent, high-impact innovation

over time, we are refilling our early-stage

pipeline with the next wave of innovation –

focused on first and best-in-class opportunities

Targeted Areas of Focus

Concentrated efforts in next generation:

Pet parasiticides

Pet dermatology

Pet pain

Livestock sustainability

Leveraging existing platforms (e.g. mAb)

and emerging spaces of unmet need

Pipeline Progression:

Shifting to

Launch Mode

First-in-class or differentiated potential

blockbusters in high-value pet health market and

pioneering new frontier markets with livestock

sustainability

Farm Animal

Pet Health

IL-31 mAb

J.P. Morgan Healthcare Conference | January 2025

With three clear parallel priorities for the R&D organization

nI novation

Portfolio

Productivity

Customer |

| 14

Asset Market Focus Species Approval1 Launch2

Peak Sales

Opportunity3 Commentary

Experior

Ammonia Reduction

U.S. Beef

Feedlot (Rx)

First-in-class; Combo clearance

approval to drive expanded use in

heifers

Canine Parvovirus

Monoclonal AB (CPMA) U.S. Vet (Rx)

First-in-class; Elanco’s first

monoclonal antibody; pursuing full

approval via USDA

AdTab

Oral Flea/Tick EU Retail (OTC) Sales expectations increased

to blockbuster potential

Bovaer®

Methane Reduction U.S. Dairy Q3 2024 First-in-class

Zenrelia

Dermatology Global Vet (Rx)

Differentiated efficacy and

convenience; Int’l approvals to date:

Brazil, Japan, Canada

Credelio Quattro

Endecto Parasiticide U.S. Vet (Rx) Differentiated coverage launching into

fast growing endecto market segment

IL-31 SA Antibody

Dermatology Global Vet (Rx) 2025 Differentiated monoclonal antibody

pending USDA approval

≥$100M

Q2 2024 Q3 2024

Q3 2024 Q3 2024

Q4 2024

Q2 2023 conditional Q3 2023

1Expected approval timing is subject to regulatory agency outcomes. 2Expected launch timing is based on regulatory agency outcomes and internal estimates and could change as

programs evolve. 3Potential peak sales represent the level of annual sales expected for a product on a global basis at its peak.

Seven Potential Blockbusters Expected to Fuel

Revenue Growth in 2025 and Beyond

nI novation

Portfolio

Productivity

Customer

J.P. Morgan Healthcare Conference | January 2025

Update since Q3 2024 Earnings Call

January 2025

Q2 2023 Q2 2023 |

| Pet Health Farm Animal

2021

2022

2023

2024-2025

Expected1

Innovation Expected to Deliver an Incremental

$600-$700 Million of Revenue in 2025

1Expected launch timing is based on regulatory timelines and internal timeline estimates for regulatory, manufacturing and supply chain.

The company typically expects to launch products 2 to 4 months after regulatory approval.

Note: Expected innovation revenue of $600-$700 million is incremental in reference to 2020 sales and does not include the expected impact of cannibalization on the base portfolio.

IL-31 Dermatology

2021

Actual

2022

Actual

2023

Actual

2024

Expected

2025

Expected

$72

$133

$275

$600-$700

Farm Animal

Pet Health

Future contribution skewed toward profitable Pet Health launches, with peak sales expected beyond 2025

Key Product Approvals & Launches

$420-$450

J.P. Morgan Healthcare Conference | January 2025

15

nI novation

Portfolio

Productivity

Customer |

| © 2025 Elanco or its affiliates

Major Innovation Product: Zenrelia

J.P. Morgan Healthcare Conference | January 2025

Strong launch trajectory in growing canine dermatology market

Momentum leading to acceleration of

investment in DTC and other marketing

Attractive

Global Canine

Dermatology

Market

~$1.8B market1

demonstrating

robust double-digit

growth over the

last decade

Efficacy

Validated

Real world

outcomes since

launch in line with

H2H study,

now published

U.S. Leading

Indicators Strong

Clinic penetration

pacing ahead of

expectations

+ Reorder rates

accelerating

= Accelerating

number of clinics

ordering monthly

Value

Resonating

Convenience

(once daily from

the start) and

affordability valued

by consumers

and veterinarians

International

Launches Begin

Brazil and Japan

launches tracking to

expectations; Canada

expected to launch

in January; 2025

approvals expected in

Europe and Australia

16

1

Industry figures represent Elanco analysis of 2024 market data and internal estimates for animal health medicines and vaccines. |

| © 2025 Elanco or its affiliates

Confidence in Zenrelia Launch Trajectory

17

J.P. Morgan Healthcare Conference | January 2025

Positive launch momentum

leading to acceleration

of DTC into January

Atopic dermatitis leading

cause of veterinarian visits

Positive real world efficacy

supplements recently published

head-to-head study

Value resonating with KOLs,

veterinarians, and consumers

Game changer for my dog! |

| © 2025 Elanco or its affiliates

Major Innovation Product: Credelio Quattro

J.P. Morgan Healthcare Conference | January 2025

Launching into the fastest-growing segment in Animal Health

Launching and shipping in January;

investment expected to drive pet

owner preference

Emerging Endecto

Market

Significant growth in

broad spectrum

(endecto) market, now

25%+ of U.S. vet

parasiticide market

($3.8B), taking share

from legacy options

Accretive

Opportunity

Meaningful growth

opportunity with

minimal

cannibalization

expected

on existing ~$300M

vet parasiticide

portfolio

Differentiation Value

3 dimensions of

differentiation: broad

coverage with

tapeworm, others;

heartworm

prevention after one

month; and speed of

tick kill

Enhanced Portfolio

Relevance

Significantly

increases portfolio

competitiveness

and Elanco’s value

proposition in the

U.S. vet market

18

1

Industry figures represent Elanco analysis of 2024 market data and internal estimates for animal

health medicines and vaccines.

Canine Parasiticide Market Growth

1 |

| © 2025 Elanco or its affiliates

Major Innovation Product: Bovaer

Livestock carbon inset marketplace creating value for dairy farmers & CPG companies

Continued progress building a new market

in livestock sustainability

Carbon Inset

Market Providing

Value

~$10M earned by

producers in 2024

from monetizing

GHG emissions

reductions created

by use of Rumensin

CPG Demand

Multiple CPGs

contracted with

Athian to buy Bovaer

credits in 2025

Differentiation

A first-in-class

methane reducing

feed ingredient for

cattle (dairy)

Farmer Demand

Over 900K dairy

cows enrolled on

UpLook , Elanco’s

digital solution for

quantifying GHG

emissions reductions

Portfolio Value

Demonstrated

Introduction of

innovation has

provided additional

demand for other

portfolio products,

like Rumensin,

helping to insulate

and stabilize the base

J.P. Morgan Healthcare Conference | January 2025

19 |

| © 2025 Elanco or its affiliates

Anticipate future capital allocation flexibility

available as leverage moves below 3x

Financial Strength and Discipline Drive Improved Debt Profile

1Based on the company’s 2024 full year guidance and 2025 outlook as provided on November 7, 2024.

2Comparing the Operating Activities section of the Statement of Cash Flows from the nine months ended September 30, 2024 to the nine months ended September 30, 2023.

Disciplined capital allocation strategy supports continued investment in the business and deleveraging

Capital Allocation Priorities

Debt Paydown

Investment

in Business

Primary use of free cash flow

Targeting below 3x over time

R&D, manufacturing capex,

commercial launches investment

expected to drive sustainable topline

growth in 2025 and beyond

Balance Sheet Strengthens

Expect gross debt reduction of $1.45B in 20241

Company-wide focus on cash conversion

results in $250M YoY operating cash improvement2

J.P. Morgan Healthcare Conference | January 2025

20

nI novation

Portfolio

Productivity

Customer

5.6x

2.5

3

3.5

4

4.5

5

5.5

6

Adj. Net Leverage Ratio

Substantial Improvement to Adj. Net Leverage Ratio

Mid 4x1 Low 4x-High 3x1

2023 2024e 2025e |

| Tailwinds

Innovation sales ramp to $600-$700 million with multiple drivers,

including: Zenrelia, Credelio Quattro, AdTab, CPMA, Bovaer, Experior

OTC Pet Health retail strength

Cattle & Poultry leadership

Price growth

Lower interest expense

Headwinds

Competition in U.S. Pet Health vet clinic business

Farm Animal generics and poor swine economics

Gross profit headwind related U.K. CMO ($25M-$35M)

Elevated strategic investment in launching expected blockbusters

Increased capex to support

capacity expansion for mAb manufacturing

Foreign exchange rate uncertainty

1Based on the company’s 2024 full year guidance and 2025 outlook as provided on November 7, 2024 with Fx rates as of late October. 2Refers to organic constant currency growth,

excluding the impact of foreign exchange rates and the aqua business that was divested on July 9, 2024. 3Based on base business performance, excluding potential impacts from Fx.

2025 Outlook Calls for Topline Growth Acceleration1

Expectations Revenue

Growth2

Accelerates to MSD %

Adjusted

EBITDA Growth3

LSD % including U.K. CMO

Net

Leverage

High 3x to Low 4x

21 |

| J.P. Morgan Healthcare Conference

| January 2025

22

Six potential blockbusters on track,

expected to accelerate revenue to

mid

-single digit (MSD) organic

constant currency growth in 2025

Launching Our Diverse

Portfolio of Innovation

Five key updates since November earnings call: ✓ Launching and shipping Credelio Quattro this month ✓ Zenrelia tracking to expectations, adding several

hundred clinics per week; accelerating DTC to start this

month

✓ Increasing AdTab peak sales opportunity to blockbuster

status

✓ Blockbuster status achieved for Experior in the U.S.

alone; heifer clearance driving continued growth

✓ Carbon inset market proven as dairy farmers earned

~$10M for credits created by using Rumensin

22 |

| Guidance and GAAP reported to

non-GAAP adjusted reconciliations

Appendix |

| Full Year 2024

Financial

Guidance1

$ millions, except

per share values

2024

Revenue $4,420 - $4,450

Reported Net Income $286 - $317

Adjusted EBITDA2 $900 - $930

Reported Diluted EPS $0.58 - $0.64

Adjusted Diluted EPS2 $0.89 - $0.95

1Represents 2024 full year guidance, as provided in the Company’s Q3 2024 earnings presentation issued on November 7, 2024.

2Non-GAAP financial measure. See slides 25 and 26 for the GAAP to non-GAAP reconciliations.

24 |

| Full Year 2024

EPS Guidance

Reconciliation1

Note: Numbers may not add due to rounding.

1Represents 2024 full year guidance, as provided in the Company’s Q3 2024 earnings presentation issued on November 7, 2024.

2Adjusted EPS is calculated as the sum of reported EPS and total adjustments to EPS.

25

Reported Earnings per Share $0.58 - $0.64

Amortization of Intangible Assets Approx. $1.06

Asset Impairment, Restructuring, and Other Special Charges $0.29 - $0.31

Gain on Divestiture Approx. $1.28

Other Expenses, Net Approx. $0.04

Subtotal $0.11 - $0.13

Tax Impact of Adjustments $0.19 - $0.20

Total Adjustments to Earnings per Share $0.31 - $0.32

Adjusted Earnings per Share2 $0.89 - $0.95 |

| Full Year 2024

$ millions

EBITDA

Guidance

Reconciliation1

Note: Numbers may not add due to rounding

1Represents 2024 full year guidance, as provided in the Company’s Q3 2024 earnings presentation issued on November 7, 2024. 26

Reported Net Income $286 - $317

Net Interest Expense Approx. $235

Income Tax Expense $190 - $199

Depreciation and Amortization Approx. $660

EBITDA $1,373 - $1,413

Non-GAAP Adjustments

Asset Impairment, Restructuring, and Other Special Charges Approx. $155

Gain on divestiture Approx. $(640)

Other Expense (Income), Net Approx. $5

Adjusted EBITDA $900 - $930

Adjusted EBITDA Margin 20.4% - 20.9% |

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementEquityComponentsAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

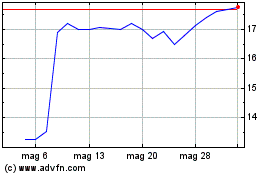

Grafico Azioni Elanco Animal Health (NYSE:ELAN)

Storico

Da Gen 2025 a Feb 2025

Grafico Azioni Elanco Animal Health (NYSE:ELAN)

Storico

Da Feb 2024 a Feb 2025