Essex Reports Characteristics of 2023 Dividends

19 Gennaio 2024 - 10:15PM

Business Wire

Essex Property Trust, Inc. (NYSE:ESS) announced today the income

tax treatment for its 2023 distributions to shareholders. The 2023

distribution characteristics are as follows:

Common Stock – CUSIP Number 297178105:

Record Date

Payment Date

Cash Distribution Per

Share

Ordinary Taxable

Dividend

Qualified

Dividend

Return of

Capital

Capital Gain (20%

rate)

Unrecaptured Section 1250

Capital Gain (25% rate)

Section 199A

Dividend

Section 897

Gain

1/3/2023

1/13/2023

$2.20000

$1.94610

$0.00000

$0.00000

$0.18300

$0.07090

$1.94610

$0.25390

3/31/2023

4/14/2023

$2.31000

$2.04340

$0.00000

$0.00000

$0.19215

$0.07445

$2.04340

$0.26660

6/30/2023

7/14/2023

$2.31000

$2.04340

$0.00000

$0.00000

$0.19215

$0.07445

$2.04340

$0.26660

9/29/2023

10/13/2023

$2.31000

$2.04340

$0.00000

$0.00000

$0.19215

$0.07445

$2.04340

$0.26660

Totals:

$9.13000

$8.07630

$0.00000

$0.00000

$0.75945

$0.29425

$8.07630

$1.05370

Percentages:

100%

88.459%

0.000%

8.318%

3.223%

The Company did not incur any foreign taxes during 2023.

Shareholders are encouraged to consult with their tax advisors

as to their specific tax treatment of Essex Property Trust, Inc.

dividends.

About Essex Property Trust,

Inc.

Essex Property Trust, Inc., an S&P 500 company, is a fully

integrated real estate investment trust (REIT) that acquires,

develops, redevelops, and manages multifamily residential

properties in selected West Coast markets. Essex currently has

ownership interests in 252 apartment communities comprising

approximately 62,000 apartment homes with an additional property in

active development. Additional information about the Company can be

found on the Company’s website at www.essex.com.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240119999563/en/

Loren Rainey Director, Investor Relations (650) 655-7800

lrainey@essex.com

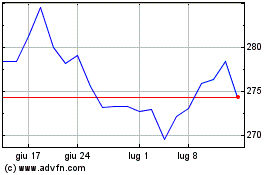

Grafico Azioni Essex Property (NYSE:ESS)

Storico

Da Dic 2024 a Gen 2025

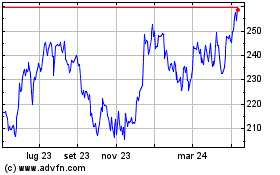

Grafico Azioni Essex Property (NYSE:ESS)

Storico

Da Gen 2024 a Gen 2025