Essex Property Trust Acquires Joint Venture Partner’s Interest in Four Communities Comprising 1,480 Apartment Homes

25 Marzo 2024 - 2:00PM

Business Wire

Essex Property Trust, Inc. (NYSE:ESS) announced today that it

acquired its joint venture partner’s 49.9% interest in the BEXAEW

portfolio for a total purchase price of $505.0 million on a gross

basis. The seller’s cap rate is approximately 5.25%; however, after

incorporating additional economic benefits by fully integrating

this portfolio into our operating platform, we estimate a 5.9%

year-one yield. Concurrent with closing, the Company repaid $219.9

million of debt encumbering the properties and consolidated the

communities on the Company’s financials. The portfolio is comprised

of four properties totaling 1,480 apartment homes. The portfolio

generated an 11.4% IRR and the Company will recognize approximately

$1.5 million in promote income, which will be excluded from Core

FFO.

About Essex Property Trust,

Inc.

Essex Property Trust, Inc., an S&P 500 company, is a fully

integrated real estate investment trust (REIT) that acquires,

develops, redevelops, and manages multifamily residential

properties in selected West Coast markets. Essex currently has

ownership interests in 252 apartment communities comprising

approximately 62,000 apartment homes with an additional property in

active development. Additional information about the Company can be

found on the Company’s website at www.essex.com.

Safe Harbor Statement

This press release includes “forward-looking statements” within

the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as

amended. Forward-looking statements are statements which are not

historical facts, including statements regarding our expectations,

estimates, assumptions, hopes, intentions, beliefs and strategies

regarding the future. Words such as “expects,” “assumes,”

“anticipates,” “may,” “will,” “intends,” “plans,” “projects,”

“believes,” “seeks,” “future,” “estimates,” and variations of such

words and similar expressions are intended to identify such

forward-looking statements. Such forward-looking statements

include, among other things, statements related to the Company’s

expected year-one yield, recognition of promote income and annual

accretion to Core FFO. We cannot assure the future results or

outcome of the matters described in these statements; rather, these

statements merely reflect our current expectations of the

approximate outcomes of the matters discussed. Factors that might

cause our actual results, performance or achievements to differ

materially from those expressed or implied by these forward-looking

statements include, but are not limited to, those associated with

market risks and uncertainties, as well as the risks referenced in

our most recent annual report on Form 10-K and any subsequent

current reports on Form 8-K filed (and not furnished) by us with

the SEC, as well as those risk factors and special considerations

set forth in our other filings with the SEC which may cause our

actual results, performance or achievements to be materially

different from any future results, performance or achievements

expressed or implied by such forward-looking statements. All

forward-looking statements are made as of the date hereof, we

assume no obligation to update or supplement this information for

any reason, and therefore, they may not represent our estimates and

assumptions after the date of this press release.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240325778145/en/

Loren Rainey Director, Investor Relations (650) 655-7800

lrainey@essex.com

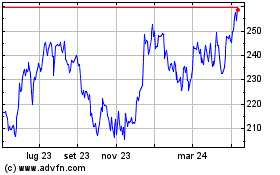

Grafico Azioni Essex Property (NYSE:ESS)

Storico

Da Dic 2024 a Gen 2025

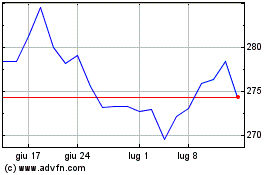

Grafico Azioni Essex Property (NYSE:ESS)

Storico

Da Gen 2024 a Gen 2025