HASI and KKR Establish $2 Billion Strategic Partnership to Invest in Sustainable Infrastructure Projects

07 Maggio 2024 - 10:15PM

Business Wire

Hannon Armstrong Sustainable Infrastructure Capital, Inc.

("HASI," "we," "our" or the "Company") (NYSE: HASI), a leading

investor in climate solutions, and KKR, a leading global investment

firm, today announced an agreement to establish CarbonCount

Holdings 1 LLC (“CCH1”) to invest up to a combined $2 billion in

climate positive projects across the United States.

Per the agreement, signed May 4, 2024, HASI and KKR have each

made an initial capital commitment of up to $1 billion to CCH1, to

invest up to an aggregate of $2 billion in clean energy assets over

the next 18 months. HASI will source the investments for and manage

CCH1, remain the interface with its clients, and measure the

avoided emissions of all investments in CCH1 using its proprietary

CarbonCount® scoring tool. These investments will be consistent

with HASI’s existing investment strategy which is focused on

behind-the-meter, grid-connected, renewable natural gas and

transport projects.

At close, CCH1 will be seeded with assets representing

approximately 10% of the up to $2 billion total committed

amounts.

“Our strategic partnership with KKR perfectly aligns with our

Climate Clients Assets strategy, enabling us to capitalize on our

ambitious pipeline of opportunities and scale our business,” said

Jeffrey A. Lipson, President and Chief Executive Officer of HASI.

“We are excited to collaborate with the KKR team, who share our

commitment to accelerating the energy transition and whose interest

in the relationship serves as a testament to HASI's history of

success.”

“CCH1 represents a significant milestone in our objective to

migrate to a more capital light model and reduce reliance on public

equity markets for growth,” said Marc Pangburn, Chief Financial

Officer of HASI. “This transaction further increases the resilient,

non-cyclical nature of our business.”

“HASI has built an impressive portfolio of sustainable

infrastructure projects through strategic partnerships and we

believe their pipeline of future opportunities is highly

complementary to KKR’s existing clean energy investing strategy,”

said Cecilio Velasco, Managing Director on KKR’s Infrastructure

team. “We look forward to working together to advance projects in

the sustainable infrastructure space and accelerate the energy

transition.”

With over 15 years of experience in infrastructure investing,

KKR has invested more than $15 billion in renewable energy and

climate-related investments from its infrastructure platform alone.

According to BloombergNEF, KKR is the 10th largest owner of solar

assets operating and under construction in the U.S. KKR is funding

the investment from its core infrastructure strategy.

Morgan Stanley & Co. LLC acted as the financial advisor for

KKR, and Lazard acted as financial advisor for HASI.

CarbonCount: Measuring the Climate Impact of Every

Investment

HASI only invests in assets that are neutral to negative on

incremental carbon emissions or have some other tangible

environmental benefit, such as reducing water consumption. Since

2013, HASI has tracked and reported on the impact of all its

investments utilizing CarbonCount, a proprietary scoring tool for

evaluating real assets to determine the efficiency by which each

dollar of invested capital avoids annual carbon dioxide equivalent

emissions (CO2e). This first-of-its-kind methodology promotes

transparency in project finance by creating a simple and comparable

metric for infrastructure projects to be evaluated in terms of how

much capital investment is mitigating climate change.

About HASI

HASI (NYSE: HASI) is a leading climate positive investment firm

that actively partners with clients to deploy real assets that

facilitate the energy transition. With more than $12 billion in

managed assets, our vision is that every investment improves our

climate future. For more information, please visit hasi.com.

About KKR

KKR is a leading global investment firm that offers alternative

asset management as well as capital markets and insurance

solutions. KKR aims to generate attractive investment returns by

following a patient and disciplined investment approach, employing

world-class people, and supporting growth in its portfolio

companies and communities. KKR sponsors investment funds that

invest in private equity, credit and real assets and has strategic

partners that manage hedge funds. KKR’s insurance subsidiaries

offer retirement, life and reinsurance products under the

management of Global Atlantic Financial Group. References to KKR’s

investments may include the activities of its sponsored funds and

insurance subsidiaries. For additional information about KKR &

Co. Inc. (NYSE: KKR), please visit KKR’s website at www.kkr.com.

For additional information about Global Atlantic Financial Group,

please visit Global Atlantic Financial Group’s website at

www.globalatlantic.com.

Forward-Looking Statements

Some of the information contained in this press release is

forward-looking statements within the meaning of Section 27A of the

Securities Act of 1933, as amended, and Section 21E of the

Securities Exchange Act of 1934, as amended that are subject to

risks and uncertainties. For these statements, we claim the

protections of the safe harbor for forward-looking statements

contained in such Sections. These forward-looking statements

include information about possible or assumed future results of our

business, financial condition, liquidity, results of operations,

plans and objectives. When we use the words "believe," "expect,"

"anticipate," "estimate," "plan," "continue," "intend," "should,"

"may" or similar expressions, we intend to identify forward-looking

statements.

Forward-looking statements are subject to significant risks and

uncertainties. Investors are cautioned against placing undue

reliance on such statements. Actual results may differ materially

from those set forth in the forward-looking statements. Factors

that could cause actual results to differ materially from those

described in the forward-looking statements include those discussed

under the caption “Risk Factors” included in our most recent Annual

Report on Form 10-K as well as in other periodic reports that we

file with the U.S. Securities and Exchange Commission

Forward-looking statements are based on beliefs, assumptions and

expectations as of the date of this press release. We disclaim any

obligation to publicly release the results of any revisions to

these forward-looking statements reflecting new estimates, events

or circumstances after the date of this press release.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240507075158/en/

For HASI Conor Fryer media@hasi.com 443-321-5754

Neha Gaddam investors@hasi.com 410-571-6189

For KKR Liidia Liuksila or Emily Cummings media@kkr.com

(212) 750-8300

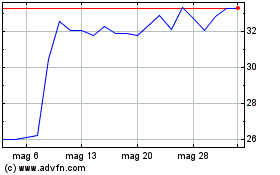

Grafico Azioni HA Sustainable Infrastru... (NYSE:HASI)

Storico

Da Nov 2024 a Dic 2024

Grafico Azioni HA Sustainable Infrastru... (NYSE:HASI)

Storico

Da Dic 2023 a Dic 2024