UNITED STATES SECURITIES

AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

Report of Foreign

Private Issuer

Pursuant to Rule 13a-16

or 15d-16 of the Securities Exchange Act of 1934

For the month of October

2024

Commission File Number

001-35754

Infosys Limited

(Exact name of Registrant

as specified in its charter)

Not Applicable

(Translation of Registrant's

name into English)

Indicate by check mark whether the registrant files or will file annual

reports under cover Form 20-F or Form 40-F:

Form 20-F þ

Form 40-F o

Indicate by check mark if the registrant is submitting the Form 6-K in paper

as permitted by Regulation S-T Rule 101(b)(1): o

Indicate by check mark if the registrant is submitting the Form 6-K in paper

as permitted by Regulation S-T Rule 101(b)(7): o

TABLE OF CONTENTS

DISCLOSURE OF RESULTS

OF OPERATIONS AND FINANCIAL CONDITION

Infosys

Limited (“we” or “the Company”) hereby furnishes the United States Securities and Exchange Commission with copies

of the following information concerning our public disclosures regarding our results of operations and financial condition for the quarter

and half year ended September 30, 2024.

The following information shall not be deemed

"filed" for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), or incorporated

by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by

specific reference in such a filing.

On October 17, 2024, we announced our results of operations

for the quarter and half year ended September 30, 2024. A copy of the outcome of the board meeting is attached to this Form 6-K as Exhibit

99.1.

We issued press releases announcing our results under

International Financial Reporting Standards ("IFRS"), copies of which are attached to this Form 6-K as Exhibit 99.2.

We have placed the form of release to stock exchanges

concerning our results of operations for the quarter and half year ended September 30, 2024 under Indian Accounting Standards (Ind-AS).

A copy of the release to stock exchanges is attached to this Form 6-K as Exhibit 99.3.

The Board of Directors of the Company declared interim

dividend of  21/- per equity share, fixed October 29, 2024 as a record date and November 8, 2024 as a payout date.

21/- per equity share, fixed October 29, 2024 as a record date and November 8, 2024 as a payout date.

Based on the recommendation of the Nomination

and Remuneration Committee, the Board of Directors of the Company, considered and approved the grant of 22,880 RSUs to six eligible employees

under the 2015 Stock Incentive Compensation Plan effective from November 1, 2024.

The Board of Directors of the Company amongst

other matters, approved acquisition of Blitz 24-893 SE and approved merger of WongDoody Inc (wholly owned subsidiary) and Blue Acorn iCi

Inc, Outbox Systems Inc., d.b.a Simplus and Kaleidoscope Animations Inc (step-down subsidiaries) with Infosys Nova Holdings LLC (wholly

owned subsidiary).

Also, The Board of Directors of the Company

approved the Postal Ballot Notice to seek approval of the shareholders for the following:-

| a) | Material Related Party Transactions between Infosys

Limited and subsidiaries with Stater N.V. |

| b) | Material Related Party Transactions between Infosys

Limited and subsidiaries with Stater Nederland B.V. |

Postal Ballot Notice shall be sent to the shareholders in due course

and the same shall be filed with the exchanges.

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto

duly authorized.

.

| |

Infosys Limited

|

| |

|

Date: October 17, 2024 |

Inderpreet Sawhney

General Counsel

and Chief Compliance Officer |

INDEX TO EXHIBITS

| Exhibit

No. |

Description

of Document |

| 99.1 |

Outcome

of the Board Meeting |

| 99.2 |

IFRS

USD press release |

| 99.3 |

Form

of Release to Stock Exchanges |

Exhibit 99.1

Outcome of the Board meeting

Exhibit 99.2

IFRS USD Press Release

Strong performance with

broad based revenue growth in CC of 3.1% sequentially and 3.3% YoY

FY25 revenue guidance

revised to 3.75%-4.50%;

Margin guidance retained at 20%-22%

Bengaluru, India –

October 17, 2024:

Infosys (NSE, BSE, NYSE: INFY), a global leader in next-generation digital services and consulting, delivered

broad based growth

performance with $4,894 million in Q2 revenues, sequential growth of 3.1% and year on year growth of 3.3% in

constant currency. Operating

margin for Q2 was at 21.1%. Free cash flow for Q2 was at $839 million, growing 25.2% year on year. TCV of large deal

wins was $2.4 billion,

41% being net new.

H1 revenues grew at 2.9% year

over year in constant

currency. Operating margin for H1 was at 21.1%.

“We had strong growth of 3.1% quarter-on-quarter

in constant currency in Q2. The growth was broad based with good momentum in financial services. This stems from our strength in industry

expertise, market leading capabilities in cloud with Cobalt and generative AI with Topaz, resulting in growing client preference to

partner with us”, said Salil Parekh, CEO and MD. “Our large deals at $2.4 billion in Q2 reflect our differentiated

position. I am grateful to our employees for their unwavering commitment to our client as we further strengthen our market leadership”

he added.

Guidance

for FY25:

| · | | Revenue growth of

3.75%-4.50% in constant currency |

| · | | Operating margin

of 20%-22% |

|

For quarter ended September 30, 2024

|

For the six months ended September

30, 2024

|

·

Revenues in CC terms grew by 3.3% YoY and 3.1% QoQ

·

Reported revenues at $4,894 million, growth of 3.7% YoY

·

Operating margin at 21.1%, decline of 0.1% YoY and flat QoQ

·

Basic EPS at $0.19, growth of 3.4% YoY

·

FCF at $839 million, growth of 25.2% YoY; FCF conversion at 107.8% of net profit

|

·

Revenues in CC terms grew by 2.9% YoY

·

Reported revenues at $9,608 million, growth of 2.9% YoY

·

Operating margin at 21.1%, growth of 0.1% YoY

·

Basic EPS at $0.37, growth of 4.4% YoY

·

FCF at $1,933 million, growth of 41.2% YoY; FCF conversion at 125.3% of net profit

|

“We continue to focus

on accelerating revenue growth with a sharp focus on margin performance. Operating margins for the quarter was at 21.1%, driven by

continued benefits from value-based pricing and utilization despite higher employee payouts. Our focus on cash generation resulted

in another quarter of over 100% Free Cash Flow conversion to net profits” said Jayesh Sanghrajka, CFO. “The Board

announced an interim dividend of  21 per share, 16.7% increase from last year” he added.

21 per share, 16.7% increase from last year” he added.

1. Client wins &

Testimonials

| · | Infosys announced that it has entered into a long-term collaboration with Metro Bank to enhance

some of its IT and support functions, while digitally transforming the bank’s business operations. Daniel Frumkin, Metro

Bank Chief Executive Officer, said, “This collaboration with a world class provider like Infosys builds on the solid

foundations we have already laid, unleashing our true potential, and creating a sustainably profitable and scalable organization

that is fit for the future. At the end of this transformation, we will be a very different business, but the true essence of Metro

Bank will remain the same – a high-quality service organization putting customers centre-stage. Metro Bank expects to deliver

£80m of annualized cost savings this year across multiple initiatives, as it progresses towards the target of reaching mid-to-high

teen Return on Tangible Equity by 2027. Our vision for Metro Bank in 2025 and beyond, places our store network firmly at its heart,

as we continue with our plans to open new stores and bring the Metro Bank experience to the north of England." |

| · | Infosys

announced a strategic collaboration with Proximus to help unlock new business opportunities.

Antonietta Mastroianni, Chief Digital & IT Officer at Proximus, said: “We

are delighted to strengthen our long-standing collaboration with Infosys. By leveraging Infosys’

global reach and our expertise in CPaaS and DI Solutions, the collaboration will drive innovation

and deliver superior customer experiences for our joint customers. We are confident that

our mutual deep expertise and proven track record will be instrumental in this two-way partnership." |

|

·

|

Infosys announced its collaboration with TDC Net to help them transform from a traditional infrastructure

company to a leading customer-centric technology company. Campbell Fraser, CTIO, TDC Net said, "At TDC Net, we are

committed to delivering exceptional value to our customers through a transformation in our IT landscape. Our collaboration with

Infosys will enable us to leverage industry-standard processes and platform to create better customer experiences. Infosys' deep

expertise in the telecommunications domain, coupled with their proven capabilities in driving end-to-end transformations, gives

us confidence in achieving our goals. This collaboration represents a significant milestone in our journey towards becoming a fully

digital and customer-centric technology company." |

|

·

|

Infosys announced the extension of its existing collaboration with Posti to help it enhance customer

experience and operational efficiency while continuing to innovate, scale, and grow its IT operations. Petteri Naulapää,

CIO & SVP, ICT and Digitalization, Posti Group, said, “We are pleased to announce the renewal of our collaboration

with Infosys for another seven years. By harnessing the power of AI through Infosys Topaz and cloud capabilities through Infosys

Cobalt, we aim to create a more efficient and customer centric organization. The collaboration with Infosys will accelerate our

digital transformation journey and help us deliver exceptional services, optimize our operations, and strengthen our position as

a leading delivery and logistics provider.” |

|

·

|

Infosys announced a strategic collaboration with Sally Beauty Holdings, Inc. (SBH) to drive enterprise-scale

IT transformation and implement best practices in IT operations to bring efficiencies through the optimization of IT service delivery.

Scott Lindblom, CIO, Sally Beauty, said "We are excited to be collaborating with Infosys as we take SBH into the future

by modernizing our IT service delivery and meeting the goals set by our “Fuel for Growth” initiative. Embracing AI-amplified

IT is a significant step forward for us in enabling us to, in turn, deliver exceptional experiences for our customers.” |

|

·

|

Infosys announced a strategic collaboration with Polestar to create a base for Polestar’s

development of in-car infotainment, Software and Electrical/ Electronics (SW&EE) engineering, user experience (UX), and cloud-powered

digital services. Sven Bauer, Head of Software at Polestar, said, “Polestar is starting a new chapter in the company’s

global setup with our partner Infosys in Bengaluru. We look forward to building automotive competence in the Polestar Tech Hub

to support our growing vehicle portfolio and new model launches.” |

|

·

|

Infosys announced a successful collaboration with the Life Insurance Corporation of India (LIC)

to spearhead its digital transformation initiative called DIVE. Shri Siddhartha Mohanty, CEO & MD, LIC, said, “Our

collaboration with Infosys marks a significant milestone in our digital transformation journey. It will not only enhance our operational

capabilities, but also enable us to cater to our vast customer, agent and employee base with newer, more personalized experiences.

We are committed to leveraging the latest technologies that Infosys has to offer, including Cloud and Enterprise AI, to drive innovation

and improve our offerings.” |

2. Recognitions

Brand

| · | Recognized as India’s Best Workplaces™ for Women 2024: Top 50 (Large)

for the fourth consecutive

year by Great Place to Work® Institute |

| · | Recognized as India's Best Workplaces™ in Diversity, Equity, Inclusion &

Belonging 2024: Top

25 by Great Place to Work® Institute |

| · | Recognized among 'Best Companies for Women in India (BCWI) study, 2024' by Avtar

& Seramount, and

among 'Best Companies - Hall of Fame' for having featured in the list, six editions in a row |

| · | Recognized as the ‘Champion of Inclusion’ in the Most Inclusive

Companies Index 2024 by Avtar

and Seramount for the fifth year |

AI and Cloud Services

| · | Positioned as a leader in 2024 Gartner Magic Quadrant for Public Cloud IT

Transformation Services |

| · | Rated as a leader in End-to-End Cloud Infrastructure Management Services NEAT 2024

by NelsonHall |

| · | Recognized as a leader in Constellation Shortlist 2024: Artificial Intelligence

and Machine Learning Best-of-Breed

Platforms |

| · | Recognized as a leader in Constellation Shortlist 2024: AI-Driven Cognitive

Applications |

| · | Recognized as a leader in Constellation Shortlist 2024: AI Services: Global |

| · | Recognized as a leader in Constellation Shortlist 2024: Public Cloud

Transformation Services: Global |

Key Digital Services

| · | Recognized as a leader in Global In-house Center (GIC) Setup Capabilities in India

- Provider PEAK Matrix®

Assessment 2024 by Everest |

| · | Recognized as a leader in Digital Transformation Consulting Services PEAK

Matrix® Assessment 2024

– North America by Everest |

| · | Recognized as a leader in Salesforce Services PEAK Matrix® Assessment 2024 by

Everest |

| · | Recognized as a leader in Open Banking IT Services PEAK Matrix® Assessment

2024 by Everest |

| · | Recognized as a leader in Private Equity IT Services PEAK Matrix® Assessment

2024 by Everest |

| · | Recognized as leader in Life & Annuity (L&A) Insurance IT Services PEAK

Matrix® Assessment

2024 by Everest |

| · | Recognized as a leader in Digital Commerce Services PEAK Matrix® Assessment

2024 by Everest |

| · | Recognized as a leader in Digital Workplace Services PEAK Matrix® Assessment

2024 – Europe by

Everest |

| · | Recognized as a leader in Digital Workplace Services PEAK Matrix® Assessment

2024 – North America

by Everest |

| · | Recognized as a leader in Focus on Appian - Low-code Application Development

Services PEAK Matrix®

Assessment 2024 by Everest |

| · | Recognized as a leader in Focus on OutSystems - Low-code Application Development

Services PEAK Matrix®

Assessment 2024 by Everest |

| · | Recognized as a leader in Focus on Microsoft Power Apps - Low-code Application

Development Services PEAK

Matrix® Assessment 2024 by Everest |

| · | Rated as a leader in IDC MarketScape: Asia/Pacific SAP Implementation Services

2024 Vendor Assessment |

| · | Positioned as a leader in HFS Horizons: The Best Service Providers for Core

Banking Modernization |

| · | Rated as a leader Learning Platforms NEAT 2024 by NelsonHall |

| · | Recognized as a leader in Constellation Shortlist 2024: Metaverse Design and

Services |

| · | Recognized as a leader in Constellation Shortlist 2024: Custom Software

Development Services |

| · | Recognized as a leader in Constellation Shortlist 2024: Digital Transformation

Services (DTX): Global |

| · | Recognized as a leader in Constellation Shortlist 2024: Customer Experience (CX)

Operations Services:

Global |

| · | Recognized as a leader in Constellation Shortlist 2024: Customer Experience (CX)

Design & Execution

Services: Global |

| · | Won the SAP LeanIX Growth Partner of the Year Award at the SAP Transformation

Excellence Summit |

| · | Infosys BPM recognized as a Leader in the Lending Services PEAK Matrix®

Assessment 2024 by Everest |

| · | Infosys BPM recognized as a leader in ISG Provider LensTM Global Financing &

Accounting Outsourcing

Services Study (P2P, O2C, R2R and FP&A) |

| · | Infosys BPM won the Avasant Digital Masters Award 2024 in the Business Process

Transformation category |

| · | Infosys BPM ranked as Innovators in Avasant Digital Masters Business Process

Transformation Radarview™ |

| · | Infosys BPM won an award at NIQR Lean Six Sigma Case Study Contest 2024 |

Industry & Solutions

| · | Rated as a leader in IDC FinTech 2024 Rankings |

| · | Infosys BPM recognized as a leader in the Finance & Accounting Outsourcing

(FAO) PEAK Matrix®

Assessment 2024 by Everest |

| · | Infosys Finacle positioned as a leader in the IDC MarketScape: Worldwide Cash

Management Systems 2024

Vendor Assessment; Worldwide Integrated Bank Payment Systems 2024 Vendor Assessment; North America Digital Core

Banking Platforms 2024

Vendor Assessment; Europe, Middle East, and Africa Digital Core Banking Platforms 2024 Vendor Assessment;

Asia/Pacific Digital Core Banking

Platforms 2024 Vendor Assessment |

| · | Infosys McCamish ranked as a leader in ISG Provider LensTM Insurance Platform

Solutions study in North

America |

| · | Infosys Finacle won Excellence in Corporate Digital Banking with Zand Bank at the

Finnovex Awards Middle

East 2024 |

| · | Infosys Finacle won 2 industry awards at Finnovex Awards Southern Africa 2024:

‘Excellence in Customer

Experience with Standard Bank’, ‘Excellence in Payment Solutions for Finacle Payments’ |

Read more about our Awards

& Recognitions

here.

About

Infosys

|

Infosys is a global leader in next-generation

digital services and consulting. Over 300,000 of our people work to amplify human potential and create the

next opportunity for people,

businesses and communities. We enable clients in more than 56 countries to navigate their digital

transformation. With over four decades

of experience in managing the systems and workings of global enterprises, we expertly steer clients, as they

navigate their digital transformation

powered by the cloud. We enable them with an AI-powered core, empower the business with agile digital at

scale and drive continuous improvement

with always-on learning through the transfer of digital skills, expertise, and ideas from our innovation

ecosystem. We are deeply committed

to being a well-governed, environmentally sustainable organization where diverse talent thrives in an

inclusive workplace.

Visit

www.infosys.com

to

see how Infosys (NSE, BSE, NYSE: INFY) can help your enterprise navigate your next.

|

|

Safe

Harbor

Certain statements in this release

concerning

our future growth prospects, our future financial or operating performance, the McCamish cybersecurity incident

and the related review

and notification process are forward-looking statements intended to qualify for the 'safe harbor' under the

Private Securities Litigation

Reform Act of 1995, which involve a number of risks and uncertainties that could cause actual results or outcomes

to differ materially

from those in such forward-looking statements. The risks and uncertainties relating to these statements include,

but are not limited to,

risks and uncertainties regarding the execution of our business strategy, increased competition for talent, our

ability to attract and

retain personnel, increase in wages, investments to reskill our employees, our ability to effectively implement a

hybrid working model,

economic uncertainties and geo-political situations, technological disruptions and innovations such as Generative

AI, the complex and

evolving regulatory landscape including immigration regulation changes, our ESG vision, our capital allocation

policy and expectations

concerning our market position, future operations, margins, profitability, liquidity, capital resources, our

corporate actions including

acquisitions, the amount of any additional costs, including indemnities or damages or claims, resulting directly

or indirectly from the

McCamish cybersecurity incident and the outcome and effect of pending litigation. Important factors that may cause

actual results or outcomes

to differ from those implied by the forward-looking statements are discussed in more detail in our US Securities

and Exchange Commission

filings including our Annual Report on Form 20-F for the fiscal year ended March 31, 2024. These filings are

available at

www.sec.gov.

Infosys may, from time to time, make additional written and oral forward-looking statements, including statements

contained in the Company's

filings with the Securities and Exchange Commission and our reports to shareholders. The Company does not

undertake to update any forward-looking

statements that may be made from time to time by or on behalf of the Company unless it is required by law.

Contact

|

Investor

Relations

|

Sandeep

Mahindroo

+91

80 3980 1018

Sandeep_Mahindroo@infosys.com

|

|

|

Media

Relations

|

Rishi

Basu

+91

80 4156 3998

Rajarshi.Basu@infosys.com

|

Harini

Babu

+1

469 996 3516

Harini_Babu@infosys.com

|

Infosys

Limited and subsidiaries

Extracted

from the Condensed Consolidated Balance Sheet under IFRS as at:

(Dollars

in millions)

|

|

September 30, 2024 |

March 31, 2024 |

|

ASSETS |

|

|

|

Current assets |

|

|

|

Cash and cash equivalents |

2,601 |

1,773 |

|

Current investments |

887 |

1,548 |

|

Trade receivables |

3,820 |

3,620 |

|

Unbilled revenue |

1,559 |

1,531 |

|

Other current assets |

1,817 |

2,250 |

|

Total current assets |

10,684

|

10,722

|

|

Non-current assets |

|

|

|

Property, plant and equipment and Right-of-use assets |

2,284 |

2,323 |

|

Goodwill and other Intangible assets |

1,604 |

1,042 |

|

Non-current investments |

1,189 |

1,404 |

|

Unbilled revenue |

255 |

213 |

|

Other non-current assets |

912 |

819 |

|

Total non-current assets |

6,244 |

5,801 |

|

Total assets |

16,928 |

16,523 |

|

LIABILITIES AND EQUITY |

|

|

|

Current liabilities |

|

|

|

Trade payables |

458 |

474 |

|

Unearned revenue |

860 |

880 |

|

Employee benefit obligations |

343 |

314 |

|

Other current liabilities and provisions |

3,210 |

2,983 |

|

Total current liabilities |

4,871 |

4,651 |

|

Non-current liabilities |

|

|

|

Lease liabilities |

756 |

767 |

|

Other non-current liabilities |

463 |

500 |

|

Total non-current liabilities |

1,219 |

1,267 |

|

Total liabilities |

6,090 |

5,918 |

|

Total equity attributable to equity holders of the company |

10,789

|

10,559 |

|

Non-controlling interests |

49 |

46 |

|

Total equity |

10,838 |

10,605 |

|

Total liabilities and equity |

16,928 |

16,523 |

Extracted

from the Condensed Consolidated statement of Comprehensive Income under IFRS for:

(Dollars

in millions except per equity share data)

|

|

3 months ended September 30, 2024 |

3 months ended September 30, 2023 |

6 months ended September 30, 2024 |

6 months ended September 30, 2023 |

|

Revenues |

4,894 |

4,718 |

9,608 |

9,334 |

|

Cost of sales |

3,400 |

3,271 |

6,659 |

6,481 |

|

Gross profit |

1,494 |

1,447 |

2,949 |

2,853 |

|

Operating expenses: |

|

|

|

|

|

Selling and marketing expenses |

221 |

213 |

454 |

429 |

|

Administrative expenses |

240 |

234 |

469 |

463 |

|

Total operating expenses |

461 |

447 |

923 |

892 |

|

Operating profit |

1,033 |

1,000 |

2,026 |

1,961 |

| Other

income, net (3) |

72 |

60 |

160 |

117 |

|

Profit before income taxes |

1,105 |

1,060 |

2,186 |

2,078 |

|

Income tax expense |

327

|

309

|

644

|

603

|

|

Net profit (before minority interest) |

778 |

751 |

1,542 |

1,475 |

|

Net profit (after minority interest) |

777 |

751 |

1,540 |

1,475 |

|

Basic EPS ($) |

0.19 |

0.18 |

0.37 |

0.36 |

|

Diluted EPS ($) |

0.19 |

0.18 |

0.37 |

0.36 |

NOTES:

|

1.

|

|

The above information is extracted

from the audited

condensed consolidated Balance sheet and Statement of Comprehensive Income for the quarter and six months

ended September 30, 2024, which

have been taken on record at the Board meeting held on October 17, 2024.

|

|

2.

|

|

A

Fact Sheet providing the operating metrics of the Company can be downloaded from

www.infosys.com

.

|

|

3.

|

|

Other

income is net of Finance Cost

|

|

4.

|

|

As the quarter and six months ended

figures are

taken from the source and rounded to the nearest digits, the quarter figures in this statement added up to

the figures reported for the

previous quarter might not always add up to the six months ended figures reported in this statement.

|

Exhibit 99.3

Form of Release to Stock Exchanges

|

Infosys Limited

Regd. office: Electronics City, Hosur Road,

Bengaluru 560 100, India |

CIN : L85110KA1981PLC013115

Website: www.infosys.com

email: investors@infosys.com

T: 91 80 2852 0261, F: 91 80 2852 0362 |

Statement of Consolidated Audited Results of Infosys

Limited and its subsidiaries for the quarter and half-year ended September 30, 2024 prepared in compliance with the Indian Accounting

Standards (Ind-AS)

(in  crore, except per equity share data)

crore, except per equity share data)

| Particulars |

Quarter

ended

September 30, |

Quarter

ended

June 30, |

Quarter

ended

September 30, |

Half-year ended September 30, |

Year ended

March 31, |

| |

2024 |

2024 |

2023 |

2024 |

2023 |

2024 |

| |

Audited |

Audited |

Audited |

Audited |

Audited |

Audited |

| Revenue from operations |

40,986 |

39,315 |

38,994 |

80,300 |

76,927 |

153,670 |

| Other income, net |

712 |

838 |

632 |

1,551 |

1,193 |

4,711 |

| Total Income |

41,698 |

40,153 |

39,626 |

81,851 |

78,120 |

158,381 |

| Expenses |

|

|

|

|

|

|

| Employee benefit expenses |

21,564 |

20,934 |

20,796 |

42,498 |

41,577 |

82,620 |

| Cost of technical sub-contractors |

3,190 |

3,169 |

3,074 |

6,359 |

6,198 |

12,232 |

| Travel expenses |

458 |

478 |

439 |

936 |

901 |

1,759 |

| Cost of software packages and others |

3,949 |

3,455 |

3,387 |

7,404 |

6,106 |

13,515 |

| Communication expenses |

169 |

147 |

179 |

316 |

361 |

677 |

| Consultancy and professional charges |

451 |

445 |

387 |

895 |

734 |

1,726 |

| Depreciation and amortization expenses |

1,160 |

1,149 |

1,166 |

2,310 |

2,339 |

4,678 |

| Finance cost |

108 |

105 |

138 |

214 |

228 |

470 |

| Other expenses |

1,396 |

1,250 |

1,292 |

2,645 |

2,546 |

4,716 |

| Total expenses |

32,445 |

31,132 |

30,858 |

63,577 |

60,990 |

122,393 |

| Profit before tax |

9,253 |

9,021 |

8,768 |

18,274 |

17,130 |

35,988 |

| Tax expense: |

|

|

|

|

|

|

| Current tax |

3,146 |

2,998 |

2,491 |

6,144 |

4,798 |

8,390 |

| Deferred tax |

(409) |

(351) |

62 |

(760) |

172 |

1,350 |

| Profit for the period |

6,516 |

6,374 |

6,215 |

12,890 |

12,160 |

26,248 |

| Other comprehensive income |

|

|

|

|

|

|

| Items that will not be reclassified subsequently to profit or loss |

|

|

|

|

|

|

| Remeasurement of the net defined benefit liability/asset, net |

78 |

20 |

(64) |

98 |

23 |

120 |

| Equity instruments through other comprehensive income, net |

(9) |

14 |

40 |

5 |

40 |

19 |

| Items that will be reclassified subsequently to profit or loss |

|

|

|

|

|

|

| Fair value changes on derivatives designated as cash flow hedges, net |

(21) |

(3) |

23 |

(24) |

29 |

11 |

| Exchange differences on translation of foreign operations |

560 |

(104) |

5 |

456 |

21 |

226 |

| Fair value changes on investments, net |

86 |

40 |

(20) |

126 |

55 |

144 |

| Total other comprehensive income/(loss), net of tax |

694 |

(33) |

(16) |

661 |

168 |

520 |

| Total comprehensive income for the period |

7,210 |

6,341 |

6,199 |

13,551 |

12,328 |

26,768 |

| Profit attributable to: |

|

|

|

|

|

|

| Owners of the company |

6,506 |

6,368 |

6,212 |

12,874 |

12,157 |

26,233 |

| Non-controlling interests |

10 |

6 |

3 |

16 |

3 |

15 |

| |

6,516 |

6,374 |

6,215 |

12,890 |

12,160 |

26,248 |

| |

|

|

|

|

|

|

| Total comprehensive income attributable to: |

|

|

|

|

|

|

| Owners of the company |

7,190 |

6,337 |

6,196 |

13,527 |

12,328 |

26,754 |

| Non-controlling interests |

20 |

4 |

3 |

24 |

– |

14 |

| |

7,210 |

6,341 |

6,199 |

13,551 |

12,328 |

26,768 |

| |

|

|

|

|

|

|

Paid up share capital (par value  5/- each, fully paid) 5/- each, fully paid) |

2,072 |

2,072 |

2,070 |

2,072 |

2,070 |

2,071 |

| Other equity *# |

86,045 |

86,045 |

73,338 |

86,045 |

73,338 |

86,045 |

Earnings per equity share (par value  5/- each)** 5/- each)** |

|

|

|

|

|

|

Basic (in  per share) per share) |

15.71 |

15.38 |

15.01 |

31.09 |

29.38 |

63.39 |

Diluted (in  per share) per share) |

15.68 |

15.35 |

14.99 |

31.02 |

29.34 |

63.29 |

| * | | Balances for the quarter and half year ended September 30, 2024 and quarter ended June

30, 2024 represent balances as per the audited Balance Sheet as at March 31, 2024 and balances for the quarter and half year ended September

30, 2023 represent balances as per the audited Balance Sheet as at March 31, 2023 as required by SEBI (Listing and Other Disclosure Requirements)

Regulations, 2015 |

| ** | | EPS is not annualized for the quarter and half year ended September 30, 2024, quarter

ended June 30, 2024 and quarter and half year ended September 30, 2023. |

| # | | Excludes non-controlling interest |

1. Notes pertaining to the current quarter

a) The audited interim condensed consolidated

financial statements for the quarter and half year ended September 30, 2024 have been taken on record by the Board of Directors at its

meeting held on October 17, 2024. The statutory auditors, Deloitte Haskins & Sells LLP have expressed an unmodified audit opinion.

The information presented above is extracted from the audited interim condensed consolidated financial statements. Those interim condensed

consolidated financial statements are prepared in accordance with the Indian Accounting Standards (Ind-AS) as prescribed under Section

133 of the Companies Act, 2013 read with Rule 3 of the Companies (Indian Accounting Standards) Rules, 2015 and relevant amendment rules

thereafter.

b) Update on employee stock grants

The Board, on October 17, 2024, based on the recommendations

of the Nomination and Remuneration Committee, approved grant of 22,880 RSUs to six eligible employees under the 2015 Stock Incentive Compensation

Plan w.e.f November 1, 2024. The RSUs would vest equally over a period of two to four years and the exercise price will be equal to the

par value of the share.

c) Update on acquisition

On July 17, 2024, Infosys Germany GmBH acquired 100%

voting interests in in-tech Holding GmbH, leading provider of Engineering R&D services headquartered in Germany, for a consideration

of EUR 465 million ( 4,213 crore).

4,213 crore).

2. Information on dividends for the quarter and

half year ended September 30, 2024

The Board of Directors declared an interim dividend

of  21/- per equity share. The record date for the payment is October 29, 2024.The interim dividend will be paid on November 8,

2024. The interim dividend declared in the previous year was

21/- per equity share. The record date for the payment is October 29, 2024.The interim dividend will be paid on November 8,

2024. The interim dividend declared in the previous year was  18/- per equity share.

18/- per equity share.

(in  )

)

| Particulars |

Quarter

ended

September 30, |

Quarter

ended

June 30, |

Quarter

ended

September 30, |

Half-year ended September 30, |

Year ended

March 31, |

| |

2024 |

2024 |

2023 |

2024 |

2023 |

2024 |

Dividend per share (par value  5/- each) 5/- each) |

|

|

|

|

|

|

| Interim dividend |

21.00 |

– |

18.00 |

21.00 |

18.00 |

18.00 |

| Final dividend |

– |

– |

– |

– |

– |

20.00 |

| Special dividend |

– |

– |

– |

– |

– |

8.00 |

3. Audited Consolidated Balance Sheet

(in  crore)

crore)

| Particulars |

As at |

| |

September 30, 2024 |

March 31, 2024 |

| ASSETS |

|

|

| Non-current assets |

|

|

| Property, plant and equipment |

11,780 |

12,370 |

| Right of use assets |

6,692 |

6,552 |

| Capital work-in-progress |

505 |

293 |

| Goodwill |

10,191 |

7,303 |

| Other Intangible assets |

3,254 |

1,397 |

| Financial assets |

|

|

| Investments |

9,962 |

11,708 |

| Loans |

25 |

34 |

| Other financial assets |

3,450 |

3,105 |

| Deferred tax assets (net) |

556 |

454 |

| Income tax assets (net) |

3,864 |

3,045 |

| Other non-current assets |

2,060 |

2,121 |

| Total non-current assets |

52,339 |

48,382 |

| Current assets |

|

|

| Financial assets |

|

|

| Investments |

7,432 |

12,915 |

| Trade receivables |

32,013 |

30,193 |

| Cash and cash equivalents |

21,799 |

14,786 |

| Loans |

255 |

248 |

| Other financial assets |

12,688 |

12,085 |

| Income tax assets (net) |

2,418 |

6,397 |

| Other current assets |

12,926 |

12,808 |

| Total current assets |

89,531 |

89,432 |

| Total Assets |

141,870 |

137,814 |

| |

|

|

| EQUITY AND LIABILITIES |

|

|

| Equity |

|

|

| Equity share capital |

2,072 |

2,071 |

| Other equity |

88,391 |

86,045 |

| Total equity attributable to equity holders of the Company |

90,463 |

88,116 |

| Non-controlling interests |

367 |

345 |

| Total equity |

90,830 |

88,461 |

| |

|

|

| Liabilities |

|

|

| Non-current liabilities |

|

|

| Financial liabilities |

|

|

| Lease liabilities |

6,336 |

6,400 |

| Other financial liabilities |

2,011 |

2,130 |

| Deferred tax liabilities (net) |

1,686 |

1,794 |

| Other non-current liabilities |

177 |

235 |

| Total non-current liabilities |

10,210 |

10,559 |

| |

|

|

| Current liabilities |

|

|

| Financial liabilities |

|

|

| Lease liabilities |

2,468 |

1,959 |

| Trade payables |

3,841 |

3,956 |

| Other financial liabilities |

17,988 |

16,959 |

| Other Current Liabilities |

10,706 |

10,539 |

| Provisions |

1,436 |

1,796 |

| Income tax liabilities (net) |

4,391 |

3,585 |

| Total current liabilities |

40,830 |

38,794 |

| Total equity and liabilities |

141,870 |

137,814 |

The disclosure is an extract of the audited Consolidated

Balance Sheet as at September 30, 2024 and March 31, 2024 prepared in compliance with the Indian Accounting Standards (Ind-AS).

4. Audited Consolidated Statement of Cash Flows

(in  crore)

crore)

| Particulars |

Half-year ended September 30, |

| |

2024 |

2023 |

| Cash flow from operating activities |

|

|

| Profit for the period |

12,890 |

12,160 |

| Adjustments to reconcile net profit to net cash provided by operating activities: |

|

|

| Income tax expense |

5,384 |

4,970 |

| Depreciation and amortization |

2,310 |

2,339 |

| Interest and dividend income |

(1,257) |

(1,006) |

| Finance cost |

214 |

228 |

| Impairment loss recognized / (reversed) under expected credit loss model |

95 |

206 |

| Exchange differences on translation of assets and liabilities, net |

(298) |

(1) |

| Stock compensation expense |

420 |

279 |

| Provision for post sale client support |

26 |

168 |

| Other adjustments |

876 |

732 |

| Changes in assets and liabilities |

|

|

| Trade receivables and unbilled revenue |

(2,735) |

(1,751) |

| Loans, other financial assets and other assets |

(233) |

(251) |

| Trade payables |

(147) |

(661) |

| Other financial liabilities, other liabilities and provisions |

1,078 |

(768) |

| Cash generated from operations |

18,623 |

16,644 |

| Income taxes paid |

(2,165) |

(4,538) |

| Net cash generated by operating activities |

16,458 |

12,106 |

| Cash flows from investing activities |

|

|

| Expenditure on property, plant and equipment and intangibles |

(968) |

(1,299) |

| Deposits placed with corporation |

(579) |

(636) |

| Redemption of deposits placed with corporation |

357 |

439 |

| Interest and dividend received |

1,217 |

973 |

| Payment towards acquisition of business, net of cash acquired |

(3,155) |

- |

| Payment of contingent consideration pertaining to acquisition of business |

– |

(59) |

| Other receipts |

5 |

127 |

| Payments to acquire Investments |

|

|

| Tax free bonds and government bonds |

(2) |

– |

| Liquid mutual fund units |

(33,517) |

(33,038) |

| Certificates of deposit |

(1,885) |

(2,179) |

| Commercial Papers |

(2,227) |

(2,903) |

| Non-convertible debentures |

(1,051) |

(104) |

| Other Investments |

(17) |

(5) |

| Proceeds on sale of Investments |

|

|

| Liquid mutual funds |

34,012 |

31,292 |

| Certificates of deposit |

3,970 |

4,912 |

| Commercial Papers |

7,135 |

1,254 |

| Non-convertible debentures |

1,030 |

875 |

| Government securities |

200 |

299 |

| Net cash generated / (used in) from investing activities |

4,525 |

(52) |

| Cash flows from financing activities: |

|

|

| Payment of lease liabilities |

(1,190) |

(920) |

| Payment of dividends |

(11,592) |

(7,246) |

| Loan repayment of in-tech Holding GmbH |

(985) |

– |

| Payment of dividend to non-controlling interest of subsidiary |

(2) |

(2) |

| Shares issued on exercise of employee stock options |

3 |

3 |

| Other receipts |

– |

20 |

| Other payments |

(265) |

(334) |

| Net cash used in financing activities |

(14,031) |

(8,479) |

| Net increase / (decrease) in cash and cash equivalents |

6,952 |

3,575 |

| Effect of exchange rate changes on cash and cash equivalents |

61 |

(35) |

| Cash and cash equivalents at the beginning of the period |

14,786 |

12,173 |

| Cash and cash equivalents at the end of the period |

21,799 |

15,713 |

| Supplementary information: |

|

|

| Restricted cash balance |

407 |

365 |

The disclosure is an extract of the audited Consolidated

Statement of Cash flows for the half year ended September 30, 2024 and September 30, 2023 prepared in compliance with Indian Accounting

Standard (Ind AS) 34 Interim Financial Reporting.

5. Segment reporting (Consolidated - Audited)

(in  crore)

crore)

| Particulars |

Quarter

ended

September 30, |

Quarter

ended

June 30, |

Quarter

ended

September 30, |

Half-year ended September 30, |

Year ended

March 31, |

| |

2024 |

2024 |

2023 |

2024 |

2023 |

2024 |

| Revenue by business segment |

|

|

|

|

|

|

| Financial Services (1) |

11,156 |

10,816 |

10,705 |

21,971 |

21,366 |

42,158 |

| Retail (2) |

5,446 |

5,428 |

5,913 |

10,873 |

11,426 |

22,504 |

| Communication (3) |

4,879 |

4,744 |

4,463 |

9,622 |

8,904 |

17,991 |

| Energy, Utilities, Resources and Services |

5,546 |

5,220 |

4,957 |

10,767 |

9,846 |

20,035 |

| Manufacturing |

6,424 |

5,778 |

5,574 |

12,201 |

10,924 |

22,298 |

| Hi-Tech |

3,266 |

3,147 |

3,053 |

6,414 |

6,109 |

12,411 |

| Life Sciences (4) |

3,004 |

2,866 |

3,050 |

5,871 |

5,799 |

11,515 |

| All other segments (5) |

1,265 |

1,316 |

1,279 |

2,581 |

2,553 |

4,758 |

| Total |

40,986 |

39,315 |

38,994 |

80,300 |

76,927 |

153,670 |

| Less: Inter-segment revenue |

– |

– |

– |

– |

– |

– |

| Net revenue from operations |

40,986 |

39,315 |

38,994 |

80,300 |

76,927 |

153,670 |

| Segment profit before tax, depreciation and non-controlling interests: |

|

|

|

|

|

|

| Financial Services (1) |

2,860 |

2,612 |

2,579 |

5,472 |

5,124 |

9,324 |

| Retail (2) |

1,768 |

1,751 |

1,674 |

3,519 |

3,303 |

6,882 |

| Communication (3) |

892 |

796 |

1,035 |

1,688 |

2,019 |

3,688 |

| Energy, Utilities , Resources and Services |

1,435 |

1,557 |

1,352 |

2,992 |

2,642 |

5,523 |

| Manufacturing |

1,297 |

1,006 |

1,033 |

2,303 |

2,005 |

4,197 |

| Hi-Tech |

794 |

814 |

788 |

1,608 |

1,590 |

3,153 |

| Life Sciences (4) |

614 |

611 |

799 |

1,226 |

1,501 |

2,898 |

| All other segments (5) |

149 |

290 |

180 |

439 |

320 |

760 |

| Total |

9,809 |

9,437 |

9,440 |

19,247 |

18,504 |

36,425 |

| Less: Other Unallocable expenditure |

1,160 |

1,149 |

1,166 |

2,310 |

2,339 |

4,678 |

| Add: Unallocable other income |

712 |

838 |

632 |

1,551 |

1,193 |

4,711 |

| Less: Finance cost |

108 |

105 |

138 |

214 |

228 |

470 |

| Profit before tax and non-controlling interests |

9,253 |

9,021 |

8,768 |

18,274 |

17,130 |

35,988 |

| (1) | | Financial Services include enterprises in Financial Services and Insurance |

| (2) | | Retail includes enterprises in Retail, Consumer Packaged Goods and Logistics |

| (3) | | Communication includes enterprises in Communication, Telecom OEM and Media |

| (4) | | Life Sciences includes enterprises in Life sciences and Health care |

| (5) | | All other segments include operating segments of businesses in India, Japan, China, Infosys

Public Services & other enterprises in Public Services |

Notes on segment information

Business segments

Based on the "management approach" as required

by Ind-AS 108 - Operating Segments, the Chief Operating Decision Maker evaluates the Group's performance and allocates resources based

on an analysis of various performance indicators by business segments. Accordingly, information has been presented along these business

segments. The accounting principles used in the preparation of the financial statements are consistently applied to record revenue and

expenditure in individual segments.

Segmental capital employed

Assets and liabilities used in the Group's business

are not identified to any of the reportable segments, as these are used interchangeably between segments. The Management believes that

it is currently not practicable to provide segment disclosures relating to total assets and liabilities since a meaningful segregation

of the available data is onerous.

6. Audited financial results of Infosys Limited

(Standalone Information)

(in  crore)

crore)

| Particulars |

Quarter

ended

September 30, |

Quarter

ended

June 30, |

Quarter

ended

September 30, |

Half-year ended September 30, |

Year ended

March 31, |

| |

2024 |

2024 |

2023 |

2024 |

2023 |

2024 |

| Revenue from operations |

34,257 |

33,283 |

32,629 |

67,540 |

64,440 |

128,933 |

| Profit before tax |

9,407 |

8,128 |

8,517 |

17,535 |

16,663 |

35,953 |

| Profit for the period |

6,813 |

5,768 |

6,245 |

12,581 |

12,202 |

27,234 |

The audited results of Infosys Limited for the above

mentioned periods are available on our website, www.infosys.com and on the Stock Exchange website www.nseindia.com and www.bseindia.com.

The information above has been extracted from the audited interim standalone financial statements as stated.

| |

By order of the Board

for Infosys Limited

|

| Bengaluru, India |

Salil Parekh |

| October 17, 2024 |

Chief Executive Officer and Managing Director |

The Board has also taken on record the consolidated

results of Infosys Limited and its subsidiaries for the quarter and half-year ended September 30, 2024, prepared as per International

Financial Reporting Standards (IFRS) and reported in US dollars. A summary of the financial statements is as follows:

(in US$ million, except per equity share data)

| Particulars |

Quarter

ended

September 30, |

Quarter

ended

June 30, |

Quarter

ended

September 30, |

Half-year ended September 30, |

Year ended

March 31, |

| |

2024 |

2024 |

2023 |

2024 |

2023 |

2024 |

| |

Audited |

Audited |

Audited |

Audited |

Audited |

Audited |

| Revenues |

4,894 |

4,714 |

4,718 |

9,608 |

9,334 |

18,562 |

| Cost of sales |

3,400 |

3,259 |

3,271 |

6,659 |

6,481 |

12,975 |

| Gross profit |

1,494 |

1,455 |

1,447 |

2,949 |

2,853 |

5,587 |

| Operating expenses |

461 |

461 |

447 |

923 |

892 |

1,753 |

| Operating profit |

1,033 |

994 |

1,000 |

2,026 |

1,961 |

3,834 |

| Other income, net |

85 |

101 |

77 |

186 |

145 |

568 |

| Finance cost |

13 |

13 |

17 |

26 |

28 |

56 |

| Profit before income taxes |

1,105 |

1,082 |

1,060 |

2,186 |

2,078 |

4,346 |

| Income tax expense |

327 |

318 |

309 |

644 |

603 |

1,177 |

| Net profit |

778 |

764 |

751 |

1,542 |

1,475 |

3,169 |

| Earnings per equity share * |

|

|

|

|

|

|

| Basic (in $ per share) |

0.19 |

0.18 |

0.18 |

0.37 |

0.36 |

0.77 |

| Diluted (in $ per share) |

0.19 |

0.18 |

0.18 |

0.37 |

0.36 |

0.76 |

| Total assets |

16,928 |

17,270 |

15,689 |

16,928 |

15,689 |

16,523 |

| Cash and cash equivalents and current investments |

3,488 |

3,022 |

2,805 |

3,488 |

2,805 |

3,321 |

| * | | EPS is not annualized for the quarter and half year ended September 30, 2024, quarter

ended June 30, 2024 and quarter and half year ended September 30, 2023. |

Certain statements in this release concerning our future

growth prospects, our future financial or operating performance, the McCamish cybersecurity incident and the related review and notification

process are forward-looking statements intended to qualify for the 'safe harbor' under the Private Securities Litigation Reform Act of

1995, which involve a number of risks and uncertainties that could cause actual results or outcomes to differ materially from those in

such forward-looking statements. The risks and uncertainties relating to these statements include, but are not limited to, risks and uncertainties

regarding the execution of our business strategy, increased competition for talent, our ability to attract and retain personnel, increase

in wages, investments to reskill our employees, our ability to effectively implement a hybrid working model, economic uncertainties and

geo-political situations, technological disruptions and innovations such as Generative AI, the complex and evolving regulatory landscape

including immigration regulation changes, our ESG vision, our capital allocation policy and expectations concerning our market position,

future operations, margins, profitability, liquidity, capital resources, our corporate actions including acquisitions, the amount of any

additional costs, including indemnities or damages or claims, resulting directly or indirectly from the McCamish cybersecurity incident

and the outcome and effect of pending litigation. Important factors that may cause actual results or outcomes to differ from those implied

by the forward-looking statements are discussed in more detail in our US Securities and Exchange Commission filings including our Annual

Report on Form 20-F for the fiscal year ended March 31, 2024. These filings are available at www.sec.gov. Infosys may, from time to time,

make additional written and oral forward-looking statements, including statements contained in the Company's filings with the Securities

and Exchange Commission and our reports to shareholders. The Company does not undertake to update any forward looking statements that

may be made from time to time by or on behalf of the Company unless it is required by law.

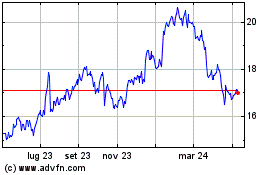

Grafico Azioni Infosys (NYSE:INFY)

Storico

Da Feb 2025 a Mar 2025

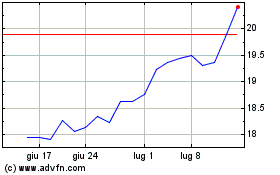

Grafico Azioni Infosys (NYSE:INFY)

Storico

Da Mar 2024 a Mar 2025