0001492691false00014926912023-10-192023-10-19

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

___________________________________________________________________________________________________________________________________

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): October 19, 2023

___________________________________________________________________________________________________________________________________

___________________________________________________________________________________________________________________________________

Knight-Swift Transportation Holdings Inc.

(Exact name of registrant as specified in its charter)

___________________________________________________________________________________________________________________________________

| | | | | | | | | | | | | | | | | |

| Delaware | | 001-35007 | | 20-5589597 |

| (State or other jurisdiction of incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

2002 West Wahalla Lane

Phoenix, Arizona 85027

(Address of principal executive offices and zip code)

(602) 269-2000

(Registrant's telephone number, including area code)

N/A

(Former name or former address, if changed since last report)

| | | | | | | | | | | | | | | | | |

| Check the appropriate box below if the Form 8-K is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions: |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| | | | | | | | | | | | | | | | | |

| Securities registered pursuant to Section 12(b) of the Act: |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

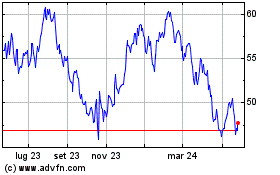

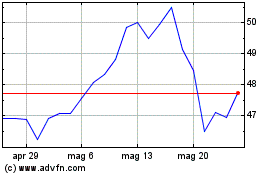

| Common Stock $0.01 Par Value | | KNX | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| | | | | |

| ITEM 2.02 | RESULTS OF OPERATIONS AND FINANCIAL CONDITION |

On October 19, 2023, Knight-Swift Transportation Holdings Inc. (the "Company") issued a press release (the "Press Release") announcing its financial results for the quarter ended September 30, 2023. A copy of the Press Release is attached to this Current Report on Form 8-K ("Current Report") as Exhibit 99.1 and is incorporated herein by reference.

The information in this Current Report that is furnished under Item 2.02, including the exhibits hereto, shall not be deemed "filed" for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), or otherwise subject to the liability of that section, or incorporated by reference in any filing under the Securities Act of 1933, as amended (the "Securities Act"), or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

| | | | | |

| ITEM 9.01 | FINANCIAL STATEMENTS AND EXHIBITS |

(d) Exhibits

| | | | | | | | |

| Exhibit | | Description |

| | |

| | |

Exhibit 104 | | Cover Page Interactive Data File |

The information in Items 2.02 and 9.01 of this report and the exhibits hereto may contain "forward-looking statements" within the meaning of Section 27A of the Securities Act and Section 21E of the Exchange Act and such statements are subject to the safe harbor created by those sections and the Private Securities Litigation Reform Act of 1995, as amended. Such statements are made based on the current beliefs and expectations of the Company's management and are subject to significant risks and uncertainties. Actual results or events may differ from those anticipated by the forward-looking statements. Please refer to the paragraphs at the end of the attached press release and at the beginning of the attached earnings presentation, as well as various disclosures by the Company in its press releases, stockholder reports, and filings with the Securities and Exchange Commission for information concerning risks, uncertainties, and other factors that may affect future results.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | | | | |

| | | | Knight-Swift Transportation Holdings Inc. |

| | | | (Registrant) |

| | | | | |

| Date: | October 19, 2023 | | /s/ Adam W. Miller |

| | | | Adam W. Miller |

| | | | Chief Financial Officer |

October 19, 2023

Phoenix, Arizona

| | |

Knight-Swift Transportation Holdings Inc. Reports Third Quarter 2023 Revenue and Earnings |

Knight-Swift Transportation Holdings Inc. (NYSE: KNX) ("Knight-Swift" or "the Company"), one of the largest and most diversified freight transportation companies, operating the largest full truckload fleet in North America, today reported third quarter 2023 net income attributable to Knight-Swift of $60.2 million and Adjusted Net Income Attributable to Knight-Swift1 of $67.2 million. GAAP earnings per diluted share for the third quarter of 2023 were $0.37, compared to $1.21 for the third quarter of 2022. The Adjusted EPS was $0.41 for the third quarter of 2023, compared to $1.27 for the third quarter of 2022.

During the third quarter of 2023, consolidated total revenue was $2.0 billion, which is a 6.5% increase from the third quarter of 2022. Consolidated operating income was $81.1 million, reflecting a decrease of 69.5%, as compared to the same quarter last year. Consolidated Net Income Attributable to Knight-Swift decreased by 69.1% to $60.2 million.

•Truckload — 94.9% Adjusted Operating Ratio, with a 21.9% year-over-year increase in revenue, excluding fuel surcharge and intersegment transactions driven by the inclusion of the truckload business of U.S. Xpress Enterprises, Inc. ("U.S. Xpress"), acquired effective July 1, 2023. This inclusion also negatively impacted the Adjusted Operating Ratio by 340 basis points.

•LTL — 84.9% Adjusted Operating Ratio, essentially flat year-over-year, while revenues, excluding fuel surcharge and intersegment transactions, increased 6.9% year-over-year. These results represent a sequential improvement in both revenue and operating income, which is counter to the typical seasonal trends.

•Logistics — 93.3% Adjusted Operating Ratio with a gross margin of 18.0% while load count decreased 10.3% year-over-year. Excluding the results of the U.S. Xpress logistics business, there was a 29.7% decline in load count. The Adjusted Operating Ratio was negatively impacted by 90 basis points due to the inclusion of the U.S. Xpress logistics business.

•Intermodal — 104.5% operating ratio, as revenue per load declined 26.6%, partially offset by load count growth of 5.5% year-over year.

•Non-reportable Segments — Operating loss narrowed sequentially to $5.4 million in the current quarter from $7.1 million in the prior quarter. Our third-party insurance business operating loss for the current quarter increased slightly to $15.9 million (or $0.08 per diluted share) from a $15.0 million operating loss (or $0.07 per diluted share) in the second quarter of 2023.

•Tax Rate Impact of U.S. Xpress Acquisition — As of the acquisition closing, U.S. Xpress had a valuation allowance associated with net operating loss ("NOL") and tax credit carryforward benefits that was partially released post-closing due to the ability of Knight-Swift to utilize those tax attributes, which had the effect of reducing the consolidated effective tax rate of Knight-Swift to (2.1)% for the current quarter. Our Adjusted EPS of $0.41 is calculated using a normalized 23.2% effective tax rate for the quarter and excludes the $0.09 per diluted share benefit of the lower tax rate.

| | | | | | | | | | | | | | | | | |

| Quarter Ended September 30, 1 |

| 2023 | | 2022 | | Change |

| (Dollars in thousands, except per share data) |

| Total revenue | $ | 2,019,936 | | | $ | 1,896,839 | | | 6.5 | % |

| Revenue, excluding truckload and LTL fuel surcharge | $ | 1,775,249 | | | $ | 1,649,982 | | | 7.6 | % |

| Operating income | $ | 81,056 | | | $ | 265,441 | | | (69.5) | % |

Adjusted Operating Income 2 | $ | 109,499 | | | $ | 279,055 | | | (60.8) | % |

| Net income attributable to Knight-Swift | $ | 60,194 | | | $ | 194,795 | | | (69.1) | % |

Adjusted Net Income Attributable to Knight-Swift 2 | $ | 67,162 | | | $ | 204,967 | | | (67.2) | % |

| Earnings per diluted share | $ | 0.37 | | | $ | 1.21 | | | (69.4) | % |

Adjusted EPS 2 | $ | 0.41 | | | $ | 1.27 | | | (67.7) | % |

1For information regarding comparability of the reported results due to acquisitions, refer to footnote 1 of the Condensed Consolidated Statements of Comprehensive Income in the schedules following this release.

2See GAAP to non-GAAP reconciliation in the schedules following this release.

Our GAAP and non-GAAP results for the quarter included certain positive and negative items that impact the comparability of year-over-year results. These items included a positive impact of $14.6 million in income tax (benefit) expense for the partial release of the tax benefit valuation allowance. The positive impact was more than offset by the $20.4 million increase in net interest expense and the $22.0 million reduction in operating income in our Iron Truck insurance program. Severance and acquisition-related expenses of $10.2 million are also excluded from our non-GAAP results.

David Jackson, CEO of Knight-Swift, commented, "Freight demand remains stable at low levels in the truckload market and relatively strong in the less-than-truckload market ("LTL"). Considerable truckload rate and cost pressure continue to mount as the truckload over-supply continues to rationalize and the industry approaches equilibrium. With truckload pricing resets now largely realized across our book of business combined with the recent climb in fuel prices serving as sequential headwinds to operating margins, our efforts to cut additional costs helped to improve the operating ratio slightly from the second quarter in our truckload business prior to the inclusion of U.S. Xpress. While this truckload business navigates an extremely difficult trough environment, the benefits of our diversification into the LTL industry shined. Our LTL segment grew revenue excluding fuel surcharge nearly 7.0% and Adjusted Operating Income nearly 4.0% year-over-year, with improvements in volumes and pricing building throughout the quarter. We remain excited about the future of this business and continue to work on growing organically and through strategic opportunities. As of the end of the third quarter, we have opened 14 new LTL service centers in the nearly two years since acquiring AAA Cooper and MME and have acquired several additional properties with the intention of bringing more service centers online. Logistics continues to maintain a low 90's operating ratio in a very weak demand environment, navigating rates that are falling faster than purchased transportation costs. Our intermodal business made progress and reached breakeven in September with what we believe to be further opportunity moving forward.

"The team at U.S. Xpress has made immediate improvement and continues to execute on cost and revenue opportunities while running ahead of the pace on our projected path to reach an operating profit in the first half of next year. Measurable progress is being made on implementing a decentralized operating model, improving pricing and freight selection, enhancing driver support and development, and capturing cost and revenue synergies, having already reached a $100 million annualized run rate of realized improvement. We are pleased with the ongoing progress, especially given the difficult operating environment, and we are excited for how this consequential truckload business is positioning for the future."

Other Income (Expense), net — We recorded $11.4 million of income within "Other income (expense), net" in the condensed consolidated statement of comprehensive income in the third quarter of 2023, as compared to $8.5 million of income in the third quarter of 2022.

Income Taxes — The effective tax rate was (2.1)% for the third quarter of 2023, compared to 25.2% for the third quarter of 2022. We expect the fourth quarter 2023 effective tax rate to be approximately 26%.

Dividend — On July 27, 2023, our board of directors declared a quarterly cash dividend of $0.14 per share of our common stock. The dividend was payable to the Company's stockholders of record as of September 8, 2023 and was paid on September 25, 2023.

| | |

| Segment Financial Performance |

Truckload Segment 1

| | | | | | | | | | | | | | | | | |

| Quarter Ended September 30, |

| 2023 | | 2022 | | Change |

| (Dollars in thousands) |

| Revenue, excluding fuel surcharge and intersegment transactions | $ | 1,179,978 | | | $ | 967,769 | | | 21.9 | % |

| Operating income | $ | 48,361 | | | $ | 175,802 | | | (72.5 | %) |

Adjusted Operating Income 2 | $ | 60,148 | | | $ | 176,126 | | | (65.8 | %) |

| Operating ratio | 96.5 | % | | 84.9 | % | | 1,160 | bps |

Adjusted Operating Ratio 2 | 94.9 | % | | 81.8 | % | | 1,310 | bps |

| | | | | |

1For information regarding comparability of the reported results due to acquisitions, refer to footnote 1 of the Condensed Consolidated Statements of Comprehensive Income in the schedules following this release.

2See GAAP to non-GAAP reconciliation in the schedules following this release.

Our diverse Truckload segment consists of our irregular route truckload, dedicated truckload, refrigerated, expedited, flatbed, and cross-border operations across our brands with approximately 17,000 irregular route tractors and nearly 7,200 dedicated tractors.

The Truckload segment continues to experience an extremely difficult environment, operating with a 94.9% Adjusted Operating Ratio as ongoing soft demand and a sustained increase in fuel prices were headwinds during the quarter. The Adjusted Operating Ratio of the truckload business, excluding U.S. Xpress that was acquired at the beginning of the quarter, was slightly improved from the second quarter of 2023 as a result of our cost reduction efforts, while the inclusion of U.S. Xpress negatively impacted the Adjusted Operating Ratio by 340 basis points. Revenue per loaded mile, excluding fuel surcharge and intersegment transactions, declined 14.0% year-over-year (11.8% before including the U.S. Xpress truckload business) as the spring bid activity is now fully realized. Excluding U.S. Xpress, miles per tractor increased 1.0%, which represents the first year-over-year increase in 2023. Revenue, excluding fuel surcharge and intersegment transactions, was $1.2 billion, an increase of 21.9% year-over-year, reflecting a 15.5% decline in the existing truckload business prior to the inclusion of U.S. Xpress. Excluding U.S. Xpress, revenue, excluding fuel surcharge, per tractor decreased 11.2% year-over-year as the decline in rates outweighed the improvement in miles per tractor.

LTL Segment

| | | | | | | | | | | | | | | | | |

| Quarter Ended September 30, |

| 2023 | | 2022 | | Change |

| (Dollars in thousands) |

| Revenue, excluding fuel surcharge | $ | 239,984 | | | $ | 224,443 | | | 6.9 | % |

| Operating income | $ | 32,275 | | | $ | 30,859 | | | 4.6 | % |

Adjusted Operating Income 1 | $ | 36,195 | | | $ | 34,891 | | | 3.7 | % |

| Operating ratio | 88.6 | % | | 88.9 | % | | (30 | bps) |

Adjusted Operating Ratio 1 | 84.9 | % | | 84.5 | % | | 40 | bps |

| | | | | |

1See GAAP to non-GAAP reconciliation in the schedules following this release.

Our LTL segment operated well, producing an 84.9% Adjusted Operating Ratio during the third quarter of 2023, as revenue, excluding fuel surcharge, grew 6.9% and Adjusted Operating Income increased 3.7% year-over-year. Volumes built throughout the quarter as a result of the disruption in the industry, though the operating leverage benefits of the incremental volumes were partially offset by the annual wage increase at the beginning of the quarter and the additional labor costs to maintain service levels as volume grew throughout the quarter. Shipments per day increased 4.8% year-over-year, reversing the trend of declines seen in the first half of the year. Revenue per hundredweight increased 10.7% excluding fuel surcharge, while revenue per shipment increased by 9.8%, excluding fuel surcharge, reflecting a 1.0% decrease in weight per shipment. We expect our connected LTL network and the expanding use of shipment dimensioning technology will provide additional opportunities for revenue growth. We remain encouraged by the strong performance within our LTL segment, and we continue to look for both organic and inorganic opportunities to geographically expand our footprint within the LTL market.

Logistics Segment 1

| | | | | | | | | | | | | | | | | |

| Quarter Ended September 30, |

| 2023 | | 2022 | | Change |

| (Dollars in thousands) |

| Revenue, excluding intersegment transactions | $ | 158,601 | | | $ | 209,964 | | | (24.5 | %) |

| Operating income | $ | 10,364 | | | $ | 27,459 | | | (62.3 | %) |

Adjusted Operating Income 2 | $ | 10,699 | | | $ | 27,794 | | | (61.5 | %) |

| Operating ratio | 93.5 | % | | 87.0 | % | | 650 | bps |

Adjusted Operating Ratio 2 | 93.3 | % | | 86.8 | % | | 650 | bps |

| | | | | |

1For information regarding comparability of the reported results due to acquisitions, refer to footnote 1 of the Condensed Consolidated Statements of Comprehensive Income in the schedules following this release.

2See GAAP to non-GAAP reconciliation in the schedules following this release.

The Logistics segment Adjusted Operating Ratio was 93.3%, with a gross margin of 18.0% in the third quarter of 2023, down from 20.9% in the third quarter of 2022 as pressure on top-line pricing is no longer being offset by corresponding reductions in purchased transportation costs. The logistics business effectively managed cost and navigated this challenging environment to maintain a low-90s Adjusted Operating Ratio before the inclusion of the U.S. Xpress logistics business. The U.S. Xpress logistics business is already improving its Adjusted Operating Ratio on a sequential basis since the acquisition, closing to within approximately 300 basis points of our existing logistics business as we improve our cost structure and pricing despite a difficult environment. The brokerage space continues to endure soft demand, causing our legacy logistics load count to decline by 29.7% year-over-year, before the addition of U.S. Xpress logistics volumes reduced the deficit year-over-year. The soft demand resulted in revenue per load decreasing by 15.8% year-over-year. We continue to leverage our network of trailers as we build out our power-only service. We continue to innovate with technology intended to remove friction and allow seamless connectivity, leading to services that we expect will capture new opportunities for revenue growth.

Intermodal Segment

| | | | | | | | | | | | | | | | | |

| Quarter Ended September 30, |

| 2023 | | 2022 | | Change |

| (Dollars in thousands) |

| Revenue, excluding intersegment transactions | $ | 101,219 | | | $ | 130,777 | | | (22.6 | %) |

| Operating (loss) income | $ | (4,524) | | | $ | 12,834 | | | (135.3 | %) |

| | | | | |

| Operating ratio | 104.5 | % | | 90.2 | % | | 1,430 | bps |

| | | | | |

| | | | | |

The Intermodal segment operated with a 104.5% operating ratio while total revenue decreased 22.6% to $101.2 million. While load count increased year-over-year by 5.5%, revenue per load declined 26.6% as a result of soft demand and competitive truck capacity. Improved rail partner pricing went into effect during the quarter, helping to offset the volume and price declines and improve operating margin slightly from the second quarter. This business reached breakeven in September, and we expect modest profitability in the fourth quarter. We remain focused on growing our load count and improving the efficiency of our assets as Intermodal continues to provide value to our customers and is complementary to the many services we offer.

Non-reportable Segments

| | | | | | | | | | | | | | | | | |

| Quarter Ended September 30, |

| 2023 | | 2022 | | Change |

| (Dollars in thousands) |

| Total revenue | $ | 119,677 | | | $ | 139,435 | | | (14.2 | %) |

| | | | | |

| Operating (loss) income | $ | (5,420) | | | $ | 18,487 | | | (129.3 | %) |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

The non-reportable segments include support services provided to our customers and third-party carriers, including insurance, equipment maintenance, equipment leasing, warehousing, trailer parts manufacturing, and warranty services. Our non-reportable segments also include certain corporate expenses (such as legal settlements and accruals, as well as $12.0 million in quarterly amortization of intangibles related to the 2017 merger between Knight and Swift and certain acquisitions).

Revenue declined 14.2% year-over-year, largely as a result of our actions to address the recent challenges within our third-party insurance program, including significantly reducing exposures. The $5.4 million operating loss within our non-reportable segments is modestly improved from the $7.1 million operating loss in the second quarter as improvement within other services provided greater offset to the ongoing losses in the third-party insurance business. We are evaluating strategic alternatives for the insurance business, including potential reinsurance strategies for the outstanding liabilities, in order to help insulate our business from the volatility primarily arising from prior years.

As noted previously, it will take some time for these changes in the insurance business to fully materialize in the results, but we are making progress raising premiums and improving the quality of risk as we work to mitigate volatility.

| | |

| Consolidated Liquidity, Capital Resources, and Earnings Guidance |

Cash Flow Sources (Uses) 1

| | | | | | | | | | | | | | | | | |

| | Year-to-Date September 30, |

| | 2023 | | 2022 | | Change |

| (In thousands) |

| Net cash provided by operating activities | $ | 873,502 | | | $ | 1,099,195 | | | $ | (225,693) | |

| Net cash used in investing activities | (1,088,030) | | | (358,626) | | | (729,404) | |

| Net cash provided by (used in) financing activities | 286,090 | | | (748,829) | | | 1,034,919 | |

Net increase (decrease) in cash, restricted cash, and equivalents 2 | $ | 71,562 | | | $ | (8,260) | | | $ | 79,822 | |

| Net capital expenditures | $ | (638,443) | | | $ | (356,692) | | | $ | (281,751) | |

| | | | | |

1For information regarding comparability of the reported results due to acquisitions, refer to footnote 1 of the Condensed Consolidated Statements of Comprehensive Income in the schedules following this release.

2"Net increase in cash, restricted cash, and equivalents" is derived from changes within "Cash and cash equivalents," "Cash and cash equivalents – restricted," and the long-term portion of restricted cash included in "Other long-term assets" in the condensed consolidated balance sheets.

Liquidity and Capitalization — As of September 30, 2023, we had a balance of $1.0 billion of unrestricted cash and available liquidity and $7.1 billion of stockholders' equity. The face value of our debt, net of unrestricted cash ("Net Debt") was $2.5 billion as of September 30, 2023. Free Cash Flow3 for the year-to-date period ended September 30, 2023 was $235.1 million. During the year-to-date period ending September 30, 2023, we generated $873.5 million in operating cash flows, paid down $44.4 million in finance lease liabilities and $68.1 million on our operating lease liabilities. We obtained financing of $250.0 million in new long-term debt and $257.0 million from net borrowings on our revolving credit facilities and assumed $337.9 million in liabilities related to the U.S. Xpress acquisition.

Equipment and Capital Expenditures — Gain on sale of revenue equipment was $11.4 million in the third quarter of 2023, compared to $15.6 million in the same quarter of 2022. The average age of the tractor fleet within our Truckload segment was 2.5 years in the third quarter of 2023, compared to 2.8 years in the same quarter of 2022. The average age of the tractor fleet within our LTL segment was 4.3 years in the third quarter of 2023 compared to 4.3 years in the same quarter of 2022. Cash capital expenditures, net of disposal proceeds, were $638.4 million for year-to-date September 30, 2023. We expect net cash capital expenditures will be in the range of $700 million – $750 million for full-year 2023. Our net cash capital expenditures primarily represent replacements of existing tractors and trailers, modest expansion of the U.S Xpress trailer fleet, and investments in our terminal network, driver amenities, and technology, and excludes acquisitions.

________

3See GAAP to non-GAAP reconciliations in the schedules following this release.

Guidance — We now expect that Adjusted EPS1 for full-year 2023 will range from $2.10 to 2.20. This is an update from our previously disclosed range of $2.10 to $2.30. Our expected Adjusted EPS1 range is based on the current truckload, LTL, and general market conditions, recent trends, and the current beliefs, assumptions, and expectations of management, as follows:

•Truckload rates stabilize at current levels for the fourth quarter,

•Truckload tractor count down modestly sequentially

•Excluding the results of U.S. Xpress, miles per tractor increase low single digits year-over-year in the fourth quarter,

•LTL revenue, excluding fuel surcharge increases mid-teens year-over-year in the fourth quarter with a similar margin profile,

•LTL shipment count and revenue per hundredweight, excluding fuel surcharge improve high single digit percent year-over-year in the fourth quarter,

•U.S. Xpress Adjusted EPS dilutive impact in the fourth quarter expected to be approximately ($0.05) as performance continues to improve,

•Logistics volume and revenue per load stabilize in the fourth quarter, with an operating ratio in the low 90s,

•Intermodal Operating Ratio slightly profitable with volumes stable sequentially,

•Non-reportable operating income to decline roughly $10 million - $15 million sequentially as third-party insurance losses are expected to be $10 million - $15 million and our other businesses experience their typical seasonal slowdown,

•Equipment gains to be in the range of $8 million to $12 million in the fourth quarter,

•Minimal increase in interest expense from the third quarter,

•Net cash capital expenditures for the full year 2023 expected range of $700 million - $750 million,

•Expected tax rate of approximately 26% for the fourth quarter of 2023.

The factors described under "Forward-Looking Statements," among others, could cause actual results to materially vary from this guidance. Further, we cannot estimate on a forward-looking basis, the impact of certain income and expense items on our earnings per share, because these items, which could be significant, may be infrequent, are difficult to predict, and may be highly variable. As a result, we do not provide a corresponding GAAP measure for, or reconciliation to, our Adjusted EPS1 guidance.

________

1Our calculation of Adjusted EPS starts with GAAP diluted earnings per share and adds back the after-tax impact of intangible asset amortization (which is expected to be approximately $0.35 for full-year 2023), as well as noncash impairments and certain other unusual items, if any.

Knight-Swift will host a live conference call with analysts and investors to discuss the earnings release, the results of operations, and other matters following its earnings press release on Thursday, October 19, 2023, at 5:30 p.m. EDT. The conference dial in information is +1 (888) 886-7786 (Conference ID: 87226411). Please note that since the call is expected to begin promptly as scheduled, you will need to join a few minutes before that time. Slides to accompany this call will be posted on the Company’s website and will be available to download just before the scheduled conference call. To view the presentation, please visit https://investor.knight-swift.com/, "Third Quarter 2023 Conference Call Presentation."

Knight-Swift Transportation Holdings Inc. is one of North America's largest and most diversified freight transportation companies, providing multiple full truckload, LTL, intermodal, and logistics services. Knight-Swift uses a nationwide network of business units and terminals in the United States and Mexico to serve customers throughout North America. In addition to operating one of the country's largest tractor fleet, Knight-Swift also contracts with third-party equipment providers to provide a broad range of transportation services to our customers while creating quality driving jobs for our driving associates and successful business opportunities for independent contractors.

| | |

| Investor Relations Contact Information |

David A. Jackson, President and Chief Executive Officer, or Adam W. Miller, Chief Financial Officer: (602) 606-6349

| | |

| Forward-Looking Statements |

This press release contains statements that may constitute forward-looking statements, which are based on information currently available, usually identified by words such as "anticipates," "believes," "estimates," "plans,'' "projects," "expects," "hopes," "intends," "strategy," ''focus," "outlook," "foresee," "will," "could," "should," "may," "feel", "goal," "continue," or similar expressions, which speak only as of the date the statement was made. Such statements are forward-looking statements and are within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, and such statements are subject to the safe harbor created by those sections and the Private Securities Litigation Reform Act of 1995. All statements, other than statements of historical or current fact, are statements that could be deemed forward-looking statements, including without limitation: any projections of or guidance regarding earnings, earnings per share, revenues, cash flows, dividends, share repurchases, leverage ratio, capital expenditures, or other financial items; any statement of plans, strategies, and objectives of management for future operations; any statements concerning proposed acquisition plans, new services or developments; any statements regarding future economic, industry, or Company conditions or performance, including, without limitation, expectations regarding future supply or demand, volume, or truckload capacity, and any statements of belief and any statement of assumptions underlying any of the foregoing. In this press release, such statements include, but are not limited to, statements concerning:

•any projections of or guidance regarding earnings, earnings per share, Adjusted EPS, revenues, cash flows, dividends, share repurchases, capital expenditures, or other financial items,

•expected freight environment, including freight demand, capacity, volumes, rates, costs, seasonality, and shipper inventory levels,

•future dividends,

•future effective tax rates,

•future performance or growth of our reportable segments, including expected network, technology, door count, and revenue within our LTL segment; expected load volumes, demand, gross margin, and technology with our Logistics segment; and expected asset efficiency and volumes within our Intermodal segment,

•future performance of our insurance businesses, including underwriting profitability, premium rates, and claims development,

•future capital structure, capital allocation, growth strategies and opportunities, costs, inflation, and liquidity,

•future capital expenditures, including nature and funding of capital expenditures, and

•the U.S. Xpress transaction, including future integration efforts and synergies and future operating performance and profitability.

Such forward-looking statements are inherently uncertain, and are based upon the current beliefs, assumptions, and expectations of management and current market conditions, which are subject to significant risks and uncertainties as set forth in the Risk Factors section of Knight-Swift's Quarterly Report on Form 10-Q for the quarter ended March 31, 2023, Annual Report on Form 10-K for the year ended December 31, 2022, and various disclosures in our press releases, stockholder reports, and Current Reports on Form 8-K.

| | |

Condensed Consolidated Statements of Comprehensive Income (Unaudited) 1 |

| | | | | | | | | | | | | | | | | | | | | | | |

| Quarter Ended September 30, | | Year-to-Date September 30, |

| | 2023 | | 2022 | | 2023 | | 2022 |

| (In thousands, except per share data) |

| Revenue: | | | | | | | |

| Revenue, excluding truckload and LTL fuel surcharge | $ | 1,775,249 | | | $ | 1,649,982 | | | $ | 4,615,990 | | | $ | 4,992,391 | |

| Truckload and LTL fuel surcharge | 244,687 | | | 246,857 | | | 593,857 | | | 692,568 | |

| Total revenue | 2,019,936 | | | 1,896,839 | | | 5,209,847 | | | 5,684,959 | |

| Operating expenses: | | | | | | | |

| Salaries, wages, and benefits | 710,543 | | | 559,849 | | | 1,780,522 | | | 1,645,861 | |

| Fuel | 272,376 | | | 231,128 | | | 628,435 | | | 678,763 | |

| Operations and maintenance | 142,913 | | | 115,918 | | | 343,604 | | | 318,525 | |

| Insurance and claims | 148,865 | | | 116,493 | | | 424,210 | | | 316,769 | |

| Operating taxes and licenses | 30,506 | | | 26,628 | | | 84,728 | | | 85,869 | |

| Communications | 8,411 | | | 5,095 | | | 20,344 | | | 16,709 | |

| Depreciation and amortization of property and equipment | 176,613 | | | 150,363 | | | 488,960 | | | 442,889 | |

| Amortization of intangibles | 18,907 | | | 16,254 | | | 51,595 | | | 48,635 | |

| Rental expense | 50,401 | | | 15,216 | | | 81,542 | | | 42,109 | |

| Purchased transportation | 330,683 | | | 364,394 | | | 869,671 | | | 1,135,750 | |

| Impairments | — | | | — | | | — | | | 810 | |

| Miscellaneous operating expenses | 48,662 | | | 30,060 | | | 116,363 | | | 62,965 | |

| Total operating expenses | 1,938,880 | | | 1,631,398 | | | 4,889,974 | | | 4,795,654 | |

| Operating income | 81,056 | | | 265,441 | | | 319,873 | | | 889,305 | |

| Other (expenses) income: | | | | | | | |

| Interest income | 5,542 | | | 1,221 | | | 16,099 | | | 2,357 | |

| Interest expense | (39,354) | | | (14,679) | | | (86,799) | | | (30,704) | |

| Other income (expense), net | 11,433 | | | 8,488 | | | 30,815 | | | (31,493) | |

| Total other (expenses) income, net | (22,379) | | | (4,970) | | | (39,885) | | | (59,840) | |

| Income before income taxes | 58,677 | | | 260,471 | | | 279,988 | | | 829,465 | |

| Income tax (benefit) expense | (1,220) | | | 65,679 | | | 53,474 | | | 206,943 | |

| Net income | 59,897 | | | 194,792 | | | 226,514 | | | 622,522 | |

| Net loss attributable to noncontrolling interest | 297 | | | 3 | | | 1,290 | | | 102 | |

| Net income attributable to Knight-Swift | $ | 60,194 | | | $ | 194,795 | | | $ | 227,804 | | | $ | 622,624 | |

| Other comprehensive income (loss) | 152 | | | 243 | | | 1,772 | | | (1,991) | |

| Comprehensive income | $ | 60,346 | | | $ | 195,038 | | | $ | 229,576 | | | $ | 620,633 | |

| | | | | | | |

| Earnings per share: | | | | | | | |

| Basic | $ | 0.37 | | | $ | 1.21 | | | $ | 1.41 | | | $ | 3.82 | |

| Diluted | $ | 0.37 | | | $ | 1.21 | | | $ | 1.41 | | | $ | 3.80 | |

| | | | | | | |

| Dividends declared per share: | $ | 0.14 | | | $ | 0.12 | | | $ | 0.42 | | | $ | 0.36 | |

| | | | | | | |

| Weighted average shares outstanding: | | | | | | | |

| Basic | 161,332 | | | 160,665 | | | 161,124 | | | 162,785 | |

| Diluted | 161,888 | | | 161,572 | | | 161,782 | | | 163,720 | |

_________

1The reported results do not include the results of operations of U.S. Xpress and its subsidiaries prior to its acquisition by Knight-Swift on July 1, 2023 in accordance with the accounting treatment applicable to the transaction.

| | |

Condensed Consolidated Balance Sheets (Unaudited) 1 |

| | | | | | | | | | | |

| September 30, 2023 | | December 31, 2022 |

| (In thousands) |

| ASSETS | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 193,372 | | | $ | 196,770 | |

| Cash and cash equivalents – restricted | 259,979 | | | 185,792 | |

| Restricted investments, held-to-maturity, amortized cost | 1,028 | | | 7,175 | |

Trade receivables, net of allowance for doubtful accounts of $29,144 and $22,980, respectively | 971,175 | | | 842,294 | |

| Contract balance – revenue in transit | 12,122 | | | 15,859 | |

| Prepaid expenses | 132,594 | | | 108,081 | |

| Assets held for sale | 77,008 | | | 40,602 | |

| Income tax receivable | 60,211 | | | 58,974 | |

| | | |

| Other current assets | 53,684 | | | 38,025 | |

| Total current assets | 1,761,173 | | | 1,493,572 | |

| Property and equipment, net | 4,504,459 | | | 3,835,043 | |

| Operating lease right-of-use assets | 505,795 | | | 192,358 | |

| | | |

| | | |

| Goodwill and intangible assets, net | 5,921,678 | | | 5,295,908 | |

| Other long-term assets | 147,176 | | | 134,785 | |

| Total assets | $ | 12,840,281 | | | $ | 10,951,666 | |

| | | |

| LIABILITIES AND STOCKHOLDERS' EQUITY | | | |

| Current liabilities: | | | |

| Accounts payable | $ | 299,039 | | | $ | 220,849 | |

| Accrued payroll and purchased transportation | 183,450 | | | 171,381 | |

| Accrued liabilities | 228,465 | | | 81,528 | |

| Claims accruals – current portion | 442,014 | | | 311,822 | |

Finance lease liabilities and long-term debt – current portion | 434,863 | | | 71,466 | |

| Operating lease liabilities – current portion | 142,543 | | | 36,961 | |

| | | |

| Total current liabilities | 1,730,374 | | | 894,007 | |

| Revolving line of credit | 300,000 | | | 43,000 | |

Long-term debt – less current portion | 1,261,711 | | | 1,024,668 | |

| Finance lease liabilities – less current portion | 320,270 | | | 344,377 | |

| Operating lease liabilities – less current portion | 394,921 | | | 149,992 | |

| Accounts receivable securitization | 361,681 | | | 418,561 | |

| Claims accruals – less current portion | 310,075 | | | 201,838 | |

| Deferred tax liabilities | 959,306 | | | 907,893 | |

| Other long-term liabilities | 72,142 | | | 12,049 | |

| Total liabilities | 5,710,480 | | | 3,996,385 | |

| Stockholders’ equity: | | | |

| Common stock | 1,613 | | | 1,607 | |

| Additional paid-in capital | 4,418,981 | | | 4,392,266 | |

| Accumulated other comprehensive loss | (664) | | | (2,436) | |

| Retained earnings | 2,693,568 | | | 2,553,567 | |

| Total Knight-Swift stockholders' equity | 7,113,498 | | | 6,945,004 | |

| Noncontrolling interest | 16,303 | | | 10,277 | |

| Total stockholders’ equity | 7,129,801 | | | 6,955,281 | |

| Total liabilities and stockholders’ equity | $ | 12,840,281 | | | $ | 10,951,666 | |

_______

1The reported balances include U.S. Xpress and its subsidiaries as of September 30, 2023.

| | |

| Segment Operating Statistics (Unaudited) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Quarter Ended September 30, | | Year-to-Date September 30, |

| 2023 | | 2022 | | Change | | 2023 | | 2022 | | Change |

Truckload 1 | | | | | | | | | | | |

Average revenue per tractor 2 | $ | 48,842 | | | $ | 53,186 | | | (8.2 | %) | | $ | 155,081 | | | $ | 159,959 | | | (3.0 | %) |

| Non-paid empty miles percentage | 13.6 | % | | 14.8 | % | | (120 | bps) | | 14.5 | % | | 14.5 | % | | — | bps |

| Average length of haul (miles) | 400 | | | 398 | | | 0.5 | % | | 393 | | | 395 | | | (0.5 | %) |

| Miles per tractor | 20,384 | | | 19,391 | | | 5.1 | % | | 62,781 | | | 57,853 | | | 8.5 | % |

| Average tractors | 24,159 | | | 18,196 | | | 32.8 | % | | 20,054 | | | 18,072 | | | 11.0 | % |

Average trailers 3 | 95,976 | | | 75,432 | | | 27.2 | % | | 85,125 | | | 73,476 | | | 15.9 | % |

| | | | | | | | | | | |

LTL 4 | | | | | | | | | | | |

| Shipments per day | 19,712 | | | 18,809 | | | 4.8 | % | | 18,771 | | | 19,083 | | | (1.6 | %) |

| Weight per shipment (pounds) | 1,042 | | | 1,052 | | | (1.0 | %) | | 1,053 | | | 1,072 | | | (1.8 | %) |

| Average length of haul (miles) | 562 | | | 512 | | | 9.8 | % | | 548 | | | 519 | | | 5.6 | % |

| Revenue per shipment | $ | 196.59 | | | $ | 188.18 | | | 4.5 | % | | $ | 191.36 | | | $ | 186.05 | | | 2.9 | % |

| Revenue xFSC per shipment | $ | 165.80 | | | $ | 151.07 | | | 9.8 | % | | $ | 161.74 | | | $ | 151.14 | | | 7.0 | % |

| Revenue per hundredweight | $ 18.86 | | | $ | 17.89 | | | 5.4 | % | | $ 18.17 | | | $ | 17.35 | | | 4.7 | % |

| Revenue xFSC per hundredweight | $ 15.91 | | | $ | 14.37 | | | 10.7 | % | | $ 15.36 | | | $ | 14.09 | | | 9.0 | % |

Average tractors 5 | 3,206 | | | 3,223 | | | (0.5 | %) | | 3,177 | | | 3,147 | | | 1.0 | % |

Average trailers 6 | 8,496 | | | 8,472 | | | 0.3 | % | | 8,445 | | | 8,392 | | | 0.6 | % |

| | | | | | | | | | | |

Logistics 1 | | | | | | | | | | | |

Revenue per load 7 | $ | 1,671 | | | $ | 1,985 | | | (15.8 | %) | | $ | 1,680 | | | $ | 2,310 | | | (27.3 | %) |

| Gross margin | 18.0 | % | | 20.9 | % | | (290 | bps) | | 19.0 | % | | 21.8 | % | | (280) | bps |

| | | | | | | | | | | |

| Intermodal | | | | | | | | | | | |

Average revenue per load 7 | $ | 2,714 | | | $ | 3,699 | | | (26.6 | %) | | $ | 2,889 | | | $ | 3,608 | | | (19.9 | %) |

| Load count | 37,292 | | | 35,354 | | | 5.5 | % | | 109,430 | | | 103,343 | | | 5.9 | % |

| Average tractors | 677 | | | 628 | | | 7.8 | % | | 647 | | | 612 | | | 5.7 | % |

| Average containers | 12,669 | | | 12,138 | | | 4.4 | % | | 12,780 | | | 11,552 | | | 10.6 | % |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

1Refer to Condensed Consolidated Statements of Comprehensive Income — footnote 1.

2Computed with revenue, excluding fuel surcharge and intersegment transactions. In order to improve comparability, average tractors of 18,541 is used as the denominator in the average revenue per tractor and total miles per tractor calculations for year-to-date 2023, reflecting the pro-rata portion of the year for which U.S. Xpress' results of operations were reported following the close of the U.S. Xpress acquisition.

3Third quarter 2023 and 2022 includes 8,432 and 7,952 trailers, respectively, related to leasing activities recorded within our non-reportable operating segments.

The year-to-date period ending September 30, 2023 and 2022 includes 8,599 and 7,282 trailers, respectively, related to leasing activities recorded within our non-reportable operating segments.

4Operating statistics within the LTL segment exclude dedicated and other businesses.

5Our LTL tractor fleet includes 609 and 720 tractors from ACT's and MME's dedicated and other businesses for the third quarter of 2023 and 2022, respectively. Our LTL tractor fleet includes 610 and 705 tractors from ACT's and MME's dedicated and other businesses for the year-to-date period ending September 30, 2023 and 2022, respectively.

6Our LTL trailer fleet includes 777 and 999 trailers from ACT's and MME's dedicated and other businesses for the third quarter of 2023 and 2022, respectively. Our LTL trailer fleet includes 778 and 956 trailers from ACT's and MME's dedicated and other businesses for the year-to-date period ending September 30, 2023 and 2022, respectively.

7Computed with revenue, excluding intersegment transactions.

| | |

| Non-GAAP Financial Measures and Reconciliations |

The terms "Adjusted Net Income Attributable to Knight-Swift," "Adjusted Operating Income," "Adjusted EPS," "Adjusted Operating Ratio," and "Free Cash Flow," as we define them, are not presented in accordance with GAAP. These financial measures supplement our GAAP results in evaluating certain aspects of our business. We believe that using these measures improves comparability in analyzing our performance because they remove the impact of items from our operating results that, in our opinion, do not reflect our core operating performance. Management and the board of directors focus on Adjusted Net Income Attributable to Knight-Swift, Adjusted EPS, Adjusted Operating Income, and Adjusted Operating Ratio as key measures of our performance, all of which are reconciled to the most comparable GAAP financial measures and further discussed below. Management and the board of directors use Free Cash Flow as a key measure of our liquidity. Free Cash Flow does not represent residual cash flow available for discretionary expenditures. We believe our presentation of these non-GAAP financial measures is useful because it provides investors and securities analysts the same information that we use internally for purposes of assessing our core operating performance.

Adjusted Net Income Attributable to Knight-Swift, Adjusted Operating Income, Adjusted EPS, Adjusted Operating Ratio, and Free Cash Flow, are not substitutes for their comparable GAAP financial measures, such as net income, cash flows from operating activities, operating margin, or other measures prescribed by GAAP. There are limitations to using non-GAAP financial measures. Although we believe that they improve comparability in analyzing our period to period performance, they could limit comparability to other companies in our industry if those companies define these measures differently. Because of these limitations, our non-GAAP financial measures should not be considered measures of income generated by our business or discretionary cash available to us to invest in the growth of our business. Management compensates for these limitations by primarily relying on GAAP results and using non-GAAP financial measures on a supplemental basis.

| | |

Non-GAAP Reconciliation (Unaudited): |

Adjusted Operating Income and Adjusted Operating Ratio 1 2 |

| | | | | | | | | | | | | | | | | | | | | | | |

| Quarter Ended September 30, | | Year-to-Date September 30, |

| 2023 | | 2022 | | 2023 | | 2022 |

| GAAP Presentation | (Dollars in thousands) |

| Total revenue | $ | 2,019,936 | | | $ | 1,896,839 | | | $ | 5,209,847 | | | $ | 5,684,959 | |

| Total operating expenses | (1,938,880) | | | (1,631,398) | | | (4,889,974) | | | (4,795,654) | |

| Operating income | $ | 81,056 | | | $ | 265,441 | | | $ | 319,873 | | | $ | 889,305 | |

| Operating ratio | 96.0 | % | | 86.0 | % | | 93.9 | % | | 84.4 | % |

| | | | | | | |

| Non-GAAP Presentation | | | | | | | |

| Total revenue | $ | 2,019,936 | | | $ | 1,896,839 | | | $ | 5,209,847 | | | $ | 5,684,959 | |

| Truckload and LTL fuel surcharge | (244,687) | | | (246,857) | | | (593,857) | | | (692,568) | |

| Revenue, excluding truckload and LTL fuel surcharge | 1,775,249 | | | 1,649,982 | | | 4,615,990 | | | 4,992,391 | |

| | | | | | | |

| Total operating expenses | 1,938,880 | | | 1,631,398 | | | 4,889,974 | | | 4,795,654 | |

| Adjusted for: | | | | | | | |

| Truckload and LTL fuel surcharge | (244,687) | | | (246,857) | | | (593,857) | | | (692,568) | |

Amortization of intangibles 3 | (18,907) | | | (16,254) | | | (51,595) | | | (48,635) | |

Impairments 4 | — | | | — | | | — | | | (810) | |

Legal accruals 5 | (150) | | | 2,640 | | | (1,150) | | | (415) | |

Transaction fees 6 | — | | | — | | | (6,868) | | | — | |

Other acquisition related expenses 7 | (6,546) | | | — | | | (6,546) | | | — | |

Severance expense 8 | (3,699) | | | — | | | (5,151) | | | — | |

Change in fair value of deferred earnout 9 | 859 | | | — | | | 3,359 | | | — | |

| Adjusted Operating Expenses | 1,665,750 | | | 1,370,927 | | | 4,228,166 | | | 4,053,226 | |

| Adjusted Operating Income | $ | 109,499 | | | $ | 279,055 | | | $ | 387,824 | | | $ | 939,165 | |

| Adjusted Operating Ratio | 93.8 | % | | 83.1 | % | | 91.6 | % | | 81.2 | % |

| | | | | | | |

1 Pursuant to the requirements of Regulation G, this table reconciles consolidated GAAP operating ratio to consolidated non-GAAP Adjusted Operating Ratio.

2 Refer to Condensed Consolidated Statements of Comprehensive Income — footnote 1.

3 "Amortization of intangibles" reflects the non-cash amortization expense relating to intangible assets identified in the 2017 Merger, the ACT acquisition, the U.S. Xpress acquisition, and other acquisitions.

4 "Impairments" reflects the non-cash impairment of building improvements (within our non-reportable segments).

5 "Legal accruals" are included in "Miscellaneous operating expenses" in the condensed consolidated statements of comprehensive income and reflect the following:

•During the second and third quarters of 2023, legal expense reflects the increased estimated exposures for various accrued legal matters based on recent settlement agreements. First quarter 2023 legal expense reflects a decrease in the estimated exposure related to an accrued legal matter previously identified as probable and estimable in prior periods based on a recent settlement agreement.

•During the second and third quarters of 2022, the company decreased the estimated exposure related to an accrued legal matter previously identified as probable and estimable in prior periods based on a recent settlement agreement. Additional 2022 legal costs relate to certain lawsuits arising from employee and contract related matters.

6 "Transaction fees" reflects certain legal and professional fees associated with the July 1, 2023 acquisition of U.S. Xpress. The transaction fees are primarily included within "Miscellaneous operating expenses" and "Salaries, Wages, and benefits" and with smaller amounts included in other line items in the condensed statements of comprehensive income.

7 "Other acquisition related expenses" represents one-time expenses associated with the U.S. Xpress acquisition, including certain severance expense, including the acceleration of stock compensation as well as other operating expenses. These are primarily included within "Salaries, wages, and benefits" in the condensed statements of comprehensive income.

8 "Severance expense" is included within "Salaries, wages, and benefits" in the condensed statements of comprehensive income.

9 "Change in fair value of deferred earnout" reflects the benefits for the change in fair value of deferred earnouts related to various acquisitions in the prior years, which are recorded in "Miscellaneous operating expenses."

| | |

Non-GAAP Reconciliation (Unaudited): |

Adjusted Net Income Attributable to Knight-Swift and Adjusted EPS 1 2 |

| | | | | | | | | | | | | | | | | | | | | | | |

| Quarter Ended September 30, | | Year-to-Date September 30, |

| 2023 | | 2022 | | 2023 | | 2022 |

| (Dollars in thousands, except per share data) |

| GAAP: Net income attributable to Knight-Swift | $ | 60,194 | | | $ | 194,795 | | | $ | 227,804 | | | $ | 622,624 | |

| Adjusted for: | | | | | | | |

| Income tax (benefit) expense attributable to Knight-Swift | (1,220) | | | 65,679 | | | 53,474 | | | 206,943 | |

| Income before income taxes attributable to Knight-Swift | 58,974 | | | 260,474 | | | 281,278 | | | 829,567 | |

Amortization of intangibles 3 | 18,907 | | | 16,254 | | | 51,595 | | | 48,635 | |

Impairments 4 | — | | | — | | | — | | | 810 | |

Legal accruals 5 | 150 | | | (2,640) | | | 1,150 | | | 415 | |

Transaction fees 6 | — | | | — | | | 6,868 | | | — | |

Other acquisition related expenses 7 | 6,546 | | | — | | | 6,546 | | | — | |

Severance expense 8 | 3,699 | | | — | | | 5,151 | | | — | |

Change in fair value of deferred earnout 9 | (859) | | | — | | | (3,359) | | | — | |

| Adjusted income before income taxes | 87,417 | | | 274,088 | | | 349,229 | | | 879,427 | |

Provision for income tax expense at effective rate 10 | (20,255) | | | (69,121) | | | (84,958) | | | (219,408) | |

| Non-GAAP: Adjusted Net Income Attributable to Knight-Swift | $ | 67,162 | | | $ | 204,967 | | | $ | 264,271 | | | $ | 660,019 | |

| | | | | | | |

Note: Because the numbers reflected in the table below are calculated on a per share basis, they may not foot due to rounding.

| | | | | | | | | | | | | | | | | | | | | | | |

| Quarter Ended September 30, | | Year-to-Date September 30, |

| 2023 | | 2022 | | 2023 | | 2022 |

| GAAP: Earnings per diluted share | $ | 0.37 | | | $ | 1.21 | | | $ | 1.41 | | | $ | 3.80 | |

| Adjusted for: | | | | | | | |

| Income tax (benefit) expense attributable to Knight-Swift | (0.01) | | | 0.41 | | | 0.33 | | | 1.26 | |

| Income before income taxes attributable to Knight-Swift | 0.36 | | | 1.61 | | | 1.74 | | | 5.07 | |

Amortization of intangibles 3 | 0.12 | | | 0.10 | | | 0.32 | | | 0.30 | |

Impairments 4 | — | | | — | | | — | | | — | |

Legal accruals 5 | — | | | (0.02) | | | 0.01 | | | — | |

Transaction fees 6 | — | | | — | | | 0.04 | | | — | |

Other acquisition related expenses 7 | 0.04 | | | — | | | 0.04 | | | — | |

Severance expense 8 | 0.02 | | | — | | | 0.03 | | | — | |

Change in fair value of deferred earnout 9 | (0.01) | | | — | | | (0.02) | | | — | |

| Adjusted income before income taxes | 0.54 | | | 1.70 | | | 2.16 | | | 5.37 | |

Provision for income tax expense at effective rate 10 | (0.13) | | | (0.43) | | | (0.53) | | | (1.34) | |

| Non-GAAP: Adjusted EPS | $ | 0.41 | | | $ | 1.27 | | | $ | 1.63 | | | $ | 4.03 | |

| | | | | | | |

1Pursuant to the requirements of Regulation G, these tables reconcile consolidated GAAP net income attributable to Knight-Swift to non-GAAP consolidated Adjusted Net Income Attributable to Knight-Swift and consolidated GAAP diluted earnings per share to non-GAAP consolidated Adjusted EPS.

2Refer to Condensed Consolidated Statements of Comprehensive Income — footnote 1.

3Refer to Non-GAAP Reconciliation (Unaudited): Adjusted Operating Income and Adjusted Operating Ratio – footnote 3.

4Refer to Non-GAAP Reconciliation (Unaudited): Adjusted Operating Income and Adjusted Operating Ratio – footnote 4.

5Refer to Non-GAAP Reconciliation (Unaudited): Adjusted Operating Income and Adjusted Operating Ratio – footnote 5.

6Refer to Non-GAAP Reconciliation (Unaudited): Adjusted Operating Income and Adjusted Operating Ratio – footnote 6.

7Refer to Non-GAAP Reconciliation (Unaudited): Adjusted Operating Income and Adjusted Operating Ratio – footnote 7.

8Refer to Non-GAAP Reconciliation (Unaudited): Adjusted Operating Income and Adjusted Operating Ratio – footnote 8.

9Refer to Non-GAAP Reconciliation (Unaudited): Adjusted Operating Income and Adjusted Operating Ratio – footnote 9.

10For the third quarter and year-to-date of 2023, an effective tax rate of 23.2% and 24.3%, respectively was applied in our Adjusted EPS calculation to exclude the tax benefit from the partial release of the pre-acquisition allowance associated with the U.S. Xpress net operating loss and tax credit carryforward benefits.

| | |

Non-GAAP Reconciliation (Unaudited): |

Segment Adjusted Operating Income and Adjusted Operating Ratio 1 |

| | | | | | | | | | | | | | | | | | | | | | | |

| Quarter Ended September 30, | | Year-to-Date September 30, |

Truckload Segment 2 | 2023 | | 2022 | | 2023 | | 2022 |

| GAAP Presentation | (Dollars in thousands) |

| Total revenue | $ | 1,380,781 | | | $ | 1,160,735 | | | $ | 3,346,685 | | | $ | 3,430,075 | |

| Total operating expenses | (1,332,420) | | | (984,933) | | | (3,114,514) | | | (2,842,860) | |

| Operating income | $ | 48,361 | | | $ | 175,802 | | | $ | 232,171 | | | $ | 587,215 | |

| Operating ratio | 96.5 | % | | 84.9 | % | | 93.1 | % | | 82.9 | % |

| Non-GAAP Presentation | | | | | | | |

| Total revenue | $ | 1,380,781 | | | $ | 1,160,735 | | | $ | 3,346,685 | | | $ | 3,430,075 | |

| Fuel surcharge | (200,503) | | | (192,685) | | | (469,771) | | | (538,277) | |

| Intersegment transactions | (300) | | | (281) | | | (1,583) | | | (1,016) | |

| Revenue, excluding fuel surcharge and intersegment transactions | 1,179,978 | | | 967,769 | | | 2,875,331 | | | 2,890,782 | |

| | | | | | | |

| Total operating expenses | 1,332,420 | | | 984,933 | | | 3,114,514 | | | 2,842,860 | |

| Adjusted for: | | | | | | | |

| Fuel surcharge | (200,503) | | | (192,685) | | | (469,771) | | | (538,277) | |

| Intersegment transactions | (300) | | | (281) | | | (1,583) | | | (1,016) | |

Amortization of intangibles 3 | (2,605) | | | (324) | | | (3,247) | | | (971) | |

Other acquisition related expenses 4 | (6,546) | | | — | | | (6,546) | | | — | |

Severance 5 | (2,636) | | | — | | | (2,636) | | | — | |

| | | | | | | |

| | | | | | | |

| Adjusted Operating Expenses | 1,119,830 | | | 791,643 | | | 2,630,731 | | | 2,302,596 | |

| Adjusted Operating Income | $ | 60,148 | | | $ | 176,126 | | | $ | 244,600 | | | $ | 588,186 | |

| Adjusted Operating Ratio | 94.9 | % | | 81.8 | % | | 91.5 | % | | 79.7 | % |

| | | | | | | |

1 Pursuant to the requirements of Regulation G, this table reconciles GAAP operating ratio to non-GAAP Adjusted Operating Ratio.

2 Refer to Condensed Consolidated Statements of Comprehensive Income — footnote 1.

3"Amortization of intangibles" reflects the non-cash amortization expense relating to intangible assets identified in historical Knight acquisitions and the U.S. Xpress acquisition.

4Refer to Non-GAAP Reconciliation (Unaudited): Adjusted Operating Income and Adjusted Operating Ratio – footnote 7.

5Refer to Non-GAAP Reconciliation (Unaudited): Adjusted Operating Income and Adjusted Operating Ratio – footnote 8.

| | |

Non-GAAP Reconciliation (Unaudited): |

Segment Adjusted Operating Income and Adjusted Operating Ratio 1 — (Continued) |

| | | | | | | | | | | | | | | | | | | | | | | |

| Quarter Ended September 30, | | Year-to-Date September 30, |

| LTL Segment | 2023 | | 2022 | | 2023 | | 2022 |

| GAAP Presentation | (Dollars in thousands) |

| Total revenue | $ | 284,168 | | | $ | 278,615 | | | $ | 806,577 | | | $ | 817,587 | |

| Total operating expenses | (251,893) | | | (247,756) | | | (717,482) | | | (716,584) | |

| Operating income | $ | 32,275 | | | $ | 30,859 | | | $ | 89,095 | | | $ | 101,003 | |

| Operating ratio | 88.6 | % | | 88.9 | % | | 89.0 | % | | 87.6 | % |

| Non-GAAP Presentation | | | | | | | |

| Total revenue | $ | 284,168 | | | $ | 278,615 | | | $ | 806,577 | | | $ | 817,587 | |

| Fuel surcharge | (44,184) | | | (54,172) | | | (124,086) | | | (154,291) | |

| | | | | | | |

| Revenue, excluding fuel surcharge | 239,984 | | | 224,443 | | | 682,491 | | | 663,296 | |

| | | | | | | |

| Total operating expenses | 251,893 | | | 247,756 | | | 717,482 | | | 716,584 | |

| Adjusted for: | | | | | | | |

| Fuel surcharge | (44,184) | | | (54,172) | | | (124,086) | | | (154,291) | |

| | | | | | | |

Amortization of intangibles 2 | (3,920) | | | (4,032) | | | (11,760) | | | (11,972) | |

| | | | | | | |

| | | | | | | |

| Adjusted Operating Expenses | 203,789 | | | 189,552 | | | 581,636 | | | 550,321 | |

| Adjusted Operating Income | $ | 36,195 | | | $ | 34,891 | | | $ | 100,855 | | | $ | 112,975 | |

| Adjusted Operating Ratio | 84.9 | % | | 84.5 | % | | 85.2 | % | | 83.0 | % |

| | | | | | | |

1Pursuant to the requirements of Regulation G, this table reconciles GAAP operating ratio to non-GAAP Adjusted Operating Ratio.

2"Amortization of intangibles" reflects the non-cash amortization expense relating to intangible assets identified in the ACT and MME acquisitions.

| | |

Non-GAAP Reconciliation (Unaudited): |

Segment Adjusted Operating Income and Adjusted Operating Ratio 1 — (Continued) |

| | | | | | | | | | | | | | | | | | | | | | | |

| Quarter Ended September 30, | | Year-to-Date September 30, |

Logistics Segment 2 | 2023 | | 2022 | | 2023 | | 2022 |

| GAAP Presentation | (Dollars in thousands) |

| Total revenue | $ | 159,489 | | | $ | 210,673 | | | $ | 417,715 | | | $ | 741,374 | |

| Total operating expenses | (149,125) | | | (183,214) | | | (384,965) | | | (630,565) | |

| Operating income | $ | 10,364 | | | $ | 27,459 | | | $ | 32,750 | | | $ | 110,809 | |

| Operating ratio | 93.5 | % | | 87.0 | % | | 92.2 | % | | 85.1 | % |

| Non-GAAP Presentation | |

| Total revenue | $ | 159,489 | | | $ | 210,673 | | | $ | 417,715 | | | $ | 741,374 | |

| | | | | | | |

| Intersegment transactions | (888) | | | (709) | | | (4,555) | | | (3,920) | |

| Revenue, excluding intersegment transactions | 158,601 | | | 209,964 | | | 413,160 | | | 737,454 | |

| | | | | | | |

| Total operating expenses | 149,125 | | | 183,214 | | | 384,965 | | | 630,565 | |

| Adjusted for: | | | | | | | |

| | | | | | | |

| Intersegment transactions | (888) | | | (709) | | | (4,555) | | | (3,920) | |

Amortization of intangibles 3 | (335) | | | (335) | | | (1,003) | | | (1,003) | |

| | | | | | | |

| | | | | | | |

| Adjusted Operating Expenses | 147,902 | | | 182,170 | | | 379,407 | | | 625,642 | |

| Adjusted Operating Income | $ | 10,699 | | | $ | 27,794 | | | $ | 33,753 | | | $ | 111,812 | |

| Adjusted Operating Ratio | 93.3 | % | | 86.8 | % | | 91.8 | % | | 84.8 | % |

| | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Quarter Ended September 30, | | Year-to-Date September 30, |

| Intermodal Segment | 2023 | | 2022 | | 2023 | | 2022 |

| GAAP Presentation | (Dollars in thousands) |

| Total revenue | $ | 101,219 | | | $ | 130,777 | | | $ | 316,118 | | | $ | 372,870 | |

| Total operating expenses | (105,743) | | | (117,943) | | | (322,172) | | | (330,694) | |

| Operating (loss) income | $ | (4,524) | | | $ | 12,834 | | | $ | (6,054) | | | $ | 42,176 | |

| Operating ratio | 104.5 | % | | 90.2 | % | | 101.9 | % | | 88.7 | % |

| Non-GAAP Presentation | |

| Total revenue | $ | 101,219 | | | $ | 130,777 | | | $ | 316,118 | | | $ | 372,870 | |

| Intersegment transactions | — | | | — | | | — | | | (47) | |

| Revenue, excluding intersegment transactions | 101,219 | | | 130,777 | | | 316,118 | | | 372,823 | |

| | | | | | | |

| Total operating expenses | 105,743 | | | 117,943 | | | 322,172 | | | 330,694 | |

| Adjusted for: | | | | | | | |

| Intersegment transactions | — | | | — | | | — | | | (47) | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Adjusted Operating Expenses | 105,743 | | | 117,943 | | | 322,172 | | | 330,647 | |

| Adjusted Operating (Loss) Income | $ | (4,524) | | | $ | 12,834 | | | $ | (6,054) | | | $ | 42,176 | |

| Adjusted Operating Ratio | 104.5 | % | | 90.2 | % | | 101.9 | % | | 88.7 | % |

| | | | | | | |

1Pursuant to the requirements of Regulation G, this table reconciles GAAP operating ratio to non-GAAP Adjusted Operating Ratio.

2 Refer to Condensed Consolidated Statements of Comprehensive Income — footnote 1.

3 "Amortization of intangibles" reflects the non-cash amortization expense relating to intangible assets identified in the UTXL acquisition.

| | |

Non-GAAP Reconciliation (Unaudited): |

Free Cash Flow 1 2 |

| | | | | |

| Year-to-Date September 30, 2023 |

| |

| GAAP: Cash flows from operations | $ | 873,502 | |

| Adjusted for: | |

| Proceeds from sale of property and equipment, including assets held for sale | 214,234 | |

| Purchases of property and equipment | (852,677) | |

| Non-GAAP: Free cash flow | $ | 235,059 | |

| |

1Pursuant to the requirements of Regulation G, this table reconciles GAAP cash flows from operations to non-GAAP Free Cash Flow.

2Refer to Condensed Consolidated Statements of Comprehensive Income — footnote 1.

Third Quarter 2023 Earnings Exhibit 99.2

2 Disclosure This presentation, including documents incorporated herein by reference, will contain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended and Section 21E of the Securities Exchange Act of 1934, as amended. Such forward-looking statements are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are subject to risks and uncertainties that could cause actual results to differ materially from those contemplated by the forward-looking statements. Please review our disclosures in filings with the United States Securities and Exchange Commission. Non-GAAP Financial Data This presentation includes the use of adjusted operating income, operating ratio, adjusted operating ratio, adjusted earnings per share, adjusted income before taxes and adjusted operating expenses, which are financial measures that are not in accordance with United States generally accepted accounting principles (“GAAP”). Each such measure is a supplemental non-GAAP financial measure that is used by management and external users of our financial statements, such as industry analysts, investors and lenders. While management believes such measures are useful for investors, they should not be used as a replacement for financial measures that are in accordance with GAAP. In addition, our use of these non-GAAP measures should not be interpreted as indicating that these or similar items could not occur in future periods. In addition, adjusted operating ratio excludes truckload and LTL segment fuel surcharges from revenue and nets these surcharges against fuel expense.

3 1 See GAAP to non-GAAP reconciliation in the schedules following this presentation (Adj. NI / EPS uses normalized tax rate) KNX Q3 2023 Comparative Results 1,897 2,020 3Q22 3Q23 Total Revenue 6.5% 1,650 1,775 3Q22 3Q23 Revenue xFSC 7.6% 3Q22 3Q23 Operating Income (69.5%) 3Q22 3Q23 Adj. Operating Inc. 1 (60.8%) 3Q22 3Q23 Net Income (69.1%) 3Q22 3Q23 Adj. Net Income 1 (67.2%) 3Q22 3Q23 Earnings Per Share (69.4%) 3Q22 3Q23 Adj. EPS 1 In m ill io ns In m ill io ns In m ill io ns Truckload market remains challenging while LTL demand is strong (U.S. Xpress now included) Adjustments • $18.9M in Q3 2023 and $16.3M in Q3 2022 of amortization expense from mergers and acquisitions • $0.2M increase and $2.6M decrease in legal accrual related to settlements in Q3 2023 and Q3 2022, respectively • $0.9M decrease in fair value of contingent consideration in Q3 2023 (67.7%) $0.37 $1.21 $1.27 $0.41 67 205195 60 265 81 279 109

4 Truckload 981.5 57.3 % LTL 224.2 13.1 % Logistics 247.3 14.4 % Intermodal 132.9 7.8 % Other 128.1 7.5 % 1714 1 See GAAP to non-GAAP reconciliation in the schedules following this presentation 2 Truckload YTD Revenue includes proforma results of USX prior to the July 1st acquisition 3 Excludes intersegment transactions Q3 2023 YTD Q3 2023 Revenue xFSC 3 $ 1,180.0 M $ 2,875.3 M Adjusted Op Income 1 $ 60.1 M $ 244.6 M Adjusted OR 1 94.9 % 91.5 % ~ 16,952 irregular and 7,207 dedicated tractors Q3 2023 YTD Q3 2023 Revenue 3 $ 101.2 M $ 316.1 M Adjusted Op Income 1 $ (4.5) M $ (6.1) M Adjusted OR 1 104.5 % 101.9 % ~ 677 tractors, 12,669 containers Q3 2023 YTD Q3 2023 Revenue 3 $ 158.6 M $ 413.2 M Adjusted Op Income 1 $ 10.7 M $ 33.8 M Adjusted OR 1 93.3 % 91.8 % Q3 2023 YTD Q3 2023 Revenue xFSC $ 240.0 M $ 682.5 M Adjusted Op Income 1 $ 36.2 M $ 100.9 M Adjusted OR 1 84.9 % 85.2 % ~ Approximately 112 Service Centers ~ Terminal door count of 4,462 Truckload 66% LTL 13% Logistics 9% Other 7% Intermodal 5% OTR 45% / Dedicated 21% Segment Overview LTL strength helping offset truckload freight demand weakness Truckload 2 Less-than-Truckload Intermodal Logistics Q3 2023 Revenue Diversification

5 Truckload Financial Metrics Q3 2023 Q3 2022 Change (Dollars in thousands) Revenue xFSC $1,179,978 $967,769 21.9 % Operating income $48,361 $175,802 (72.5 %) Adjusted Operating Income 1 $60,148 $176,126 (65.8 %) Operating ratio 96.5% 84.9% 1,160 bps Adjusted Operating Ratio 1 94.9% 81.8% 1,310 bps • 94.9% Adjusted Operating Ratio1 in Q3 2023 compared to 81.8% the previous year • Excluding the results of U.S. Xpress, Adjusted Operating Ratio improved sequentially • Sequentially our cost actions helped offset lower rates and higher fuel prices • Inclusion of U.S. Xpress truckload business negatively impacted the Adjusted Operating Ratio by 340 bps 1 See GAAP to non-GAAP reconciliation in the schedules following this presentation. Truckload Operating Statistics Q3 2023 Q3 2022 Change Average revenue per tractor $48,842 $53,186 (8.2 %) Average tractors 24,159 18,196 32.8 % Average trailers 95,976 75,432 27.2 % Miles per tractor 20,384 19,391 5.1 % Demand stable, but lower rates and rising fuel prices were headwinds Operating Performance - Truckload

6 • 84.9% Adjusted Operating Ratio1 in Q3 2023 • $36.2M of Adjusted Operating Income1 • Volumes built throughout the quarter as a result of disruption in the industry • Connected LTL network and use of shipment dimensioning technology will provide revenue growth opportunities LTL Operating Statistics Q3 2023 Q3 2022 Change LTL shipments per day 19,712 18,809 4.8 % LTL weight per shipment 1,042 1,052 (1.0 %) LTL revenue xFSC per hundredweight $15.91 $14.37 10.7 % LTL revenue xFSC per shipment $165.80 $151.07 9.8 % 1 See GAAP to non-GAAP reconciliation in the schedules following this presentation. LTL Financial Metrics Q3 2023 Q3 2022 Change (Dollars in thousands) Revenue xFSC $239,984 $224,443 6.9 % Operating income $32,275 $30,859 4.6 % Adjusted Operating Income 1 $36,195 $34,891 3.7 % Operating ratio 88.6% 88.9% (30 bps) Adjusted Operating Ratio 1 84.9% 84.5% 40 bps Operating Performance - LTL Continued strong performance, poised for further growth

7 • 93.3% Adjusted Operating Ratio1 during the quarter • 18.0% Gross margin, 290 bps decrease from prior year • Excluding the results of U.S.Xpress, revenue was stable sequentially 1 See GAAP to non-GAAP reconciliation in the schedules following this presentation. Logistics Operating Statistics Q3 2023 Q3 2022 Change Revenue per load $1,671 $1,985 (15.8 %) Gross margin 18.0% 20.9% (290 bps) Logistics Financial Metrics Q3 2023 Q3 2022 Change (Dollars in thousands) Revenue ex intersegment $158,601 $209,964 (24.5 %) Operating income $10,364 $27,459 (62.3 %) Adjusted Operating Income 1 $10,699 $27,794 (61.5 %) Operating ratio 93.5% 87.0% 650 bps Adjusted Operating Ratio 1 93.3% 86.8% 650 bps Remaining nimble in a challenging environment, U.S. Xpress making meaningful progress Operating Performance - Logistics Extensive Trailer Network Powers Supply Chains

8 • 104.5% operating ratio during Q3 2023 compared with 90.2% the prior year • 26.6% year-over-year decrease in average revenue per load • 5.5% increase in load counts • Average container count stable sequentially at approximately 12,700 units • Intermodal reached breakeven in September, expect additional modest improvement for balance of year Intermodal Operating Statistics Q3 2023 Q3 2022 Change Average revenue per load $2,714 $3,699 (26.6 %) Load count 37,292 35,354 5.5 % Average tractors 677 628 7.8 % Average containers 12,669 12,138 4.4 % Intermodal Financial Metrics Q3 2023 Q3 2022 Change (Dollars in thousands) Revenue ex intersegment $101,219 $130,777 (22.6 %) Operating income $(4,524) $12,834 (135.3 %) Operating ratio 104.5% 90.2% 1,430 bps Operating Performance - Intermodal Competitive truckload market continues to challenge revenue

9 Q3 Non-Reportable Performance: • (14.2%) decrease in revenue to $119.7M • ($5.4M) in operating loss ◦ Third party insurance business posted $15.9M loss largely due to prior year unfavorable claim development Insurance challenges continue, evaluating strategic alternatives Executing Strategic Pivot on Third Party Insurance • Significantly reduced exposure to third party insurance risk in an unusually difficult environment for small operators • Near term headwind to revenue growth for this program • Evaluating strategic alternatives to mitigate volatility, including reinsurance strategies Operating Performance - Non-Reportable Non-Reportable Financial Metrics Q3 2023 Q3 2022 Change (Dollars in thousands) Revenue $119,677 $139,435 (14.2 %) Operating (loss) income $(5,420) $18,487 (129.3 %)

10 Measurable and meaningful progress underway • Cost per mile improved mid-single digits sequentially • Rate per mile up low-single digits sequentially • Converted 9 of 10 locations to terminal-centric model • Reduced spot exposure from ~45% to ~15% • Eliminated broker freight • Capturing synergies, realizing ~$8M per month exiting Q3 Ahead of schedule to achieve operating profit, before interest expense, in 1H of 2024 • Expect business to be accretive to EPS for full year 2024 • On track to achieve $1.00 EPS accretion in 2026 U.S. Xpress - Business Update Ahead of schedule, positioning for accretion

11 • LTL demand remains solid as recent disruption continues to be sorted out • LTL improvement in revenue (excluding fuel) per hundredweight year-over-year • Truckload - muted peak season demand with limited non-contract opportunities • Truckload - spot rates show minimal improvement in line with seasonal patterns • Truckload - capacity continues to exit at an accelerating rate • Cost inflation continues to be a challenge, though pace eases • Equipment availability continues to improve • Demand in the used equipment market weakens further as small carriers struggle • Labor alternatives in the general economy remain attractive, providing a headwind to hiring and utilization until freight conditions improve Market Outlook Q4 2023

12 Q4 2023 Guidance Assumptions • Truckload rates stabilize at current levels for the fourth quarter • Truckload tractor count down modestly sequentially • Excluding the results of U.S. Xpress miles per tractor increase low single digits year-over-year in Q4 • LTL revenue (xFSC) increases mid-teens Q4 year over year with similar margin profile • LTL shipment count and revenue (xFSC) per hundredweight improve high single digit % year over year in Q4 • U.S. Xpress Adjusted EPS estimated dilutive impact in Q4 expected to be approximately ($0.05) as performance continues to improve • Logistics volume and revenue per load stabilize in Q4 with OR stable in the low 90's • Intermodal Operating Ratio slightly profitable with volumes stable sequentially • Non-reportable operating income to decline roughly $10M - $15M sequentially as third-party insurance losses are expected to be $10M - $15M and our other businesses experience their typical seasonal slowdown • Gain on sale range $8M to $12M including U.S. Xpress • Expect minimal increase in interest expense from Q3 • Net cash capex is expected to be $700M - $750M for the full year including U.S. Xpress • Tax rate expected to be approximately 26% for 4Q 2023 Updated expected Adjusted EPS for 2023 from $2.10 - $2.30 to new range of $2.10 - $2.20 2023 Guidance

Appendix

14 Adjusted Operating Income and Adjusted Operating Ratio 1 2 (Unaudited) Quarter Ended September 30, Year-to-Date September 30, 2023 2022 2023 2022 GAAP Presentation (Dollars in thousands) Total revenue $ 2,019,936 $ 1,896,839 $ 5,209,847 $ 5,684,959 Total operating expenses (1,938,880) (1,631,398) (4,889,974) (4,795,654) Operating income $ 81,056 $ 265,441 $ 319,873 $ 889,305 Operating ratio 96.0 % 86.0 % 93.9 % 84.4 % Non-GAAP Presentation Total revenue $ 2,019,936 $ 1,896,839 $ 5,209,847 $ 5,684,959 Truckload fuel surcharge (244,687) (246,857) (593,857) (692,568) Revenue, excluding truckload fuel surcharge 1,775,249 1,649,982 4,615,990 4,992,391 Total operating expenses 1,938,880 1,631,398 4,889,974 4,795,654 Adjusted for: Truckload fuel surcharge (244,687) (246,857) (593,857) (692,568) Amortization of intangibles 3 (18,907) (16,254) (51,595) (48,635) Impairments 4 — — — (810) Legal accruals 5 (150) 2,640 (1,150) (415) Transaction fees 6 — — (6,868) — Other acquisition related expenses 7 (6,546) — (6,546) — Severance expense 8 (3,699) — (5,151) — Change in fair value of deferred earnout 9 859 — 3,359 — Adjusted Operating Expenses 1,665,750 1,370,927 4,228,166 4,053,226 Adjusted Operating Income $ 109,499 $ 279,055 $ 387,824 $ 939,165 Adjusted Operating Ratio 93.8 % 83.1 % 91.6 % 81.2 % Non-GAAP Reconciliation