Lincoln Level Advantage 2 offers investors more

opportunities for growth with industry-exclusive Capital Group ETF

options and control with first-of-its-kind Secure Lock+SM

feature

Lincoln Financial Group (NYSE: LNC) today announced a new

version of its award-winning Lincoln Level Advantage® indexed

variable annuity with the launch of Lincoln Level Advantage 2SM

index-linked annuity. Building on the innovations of the first

generation, Lincoln Level Advantage 2 offers investors even more

opportunities for protection and growth with the industry’s first

indexed accounts that track the performance of Capital Group active

ETFs. Lincoln Level Advantage 2, with its newest feature Secure

Lock+SM, is also the first Registered Index Linked Annuity (RILA)

in the industry to offer a lock-in feature that allows investors to

reset protection within their existing term.

“Lincoln Financial consistently enhances its product suite to

help meet investor needs and provide features they can’t find

anywhere else,” said Tim Seifert, senior vice president, Head of

Retirement Solutions Distribution. “With Lincoln Level Advantage 2,

we've tailored the product to offer what consumers are looking for:

more choice for investors seeking growth with Capital Group active

ETFs, better protection and control with Secure Lock+ and the same

award-winning client experience offered by Lincoln Financial.”

Lincoln Level Advantage 2 provides investors with expanded

diversification and growth opportunities as the only RILA to track

Capital Group active ETF strategies. For the first time, investors

will have access to indexed accounts that track the performance of

Capital Group Growth ETF (CGGR), a flexible approach to growth

investing and Capital Group Global Growth Equity ETF (CGGO), a

global strategy focused on long-term capital growth. In 2023, CGGR

was named the “Best New U.S. Equity ETF” by etf.com1. Voted one of

the most trusted investment managers among financial

professionals2, Capital Group is a brand that advisors and clients

have had confidence in for more than 90 years.

“Being a partner of choice means continually evolving to help

meet our clients’ needs, including expanding access to our

investment capabilities with our insurance partners,” said Melissa

Buccilli, Head of Insurance Strategy and Product at Capital Group.

“We are excited to collaborate with Lincoln to offer active ETFs –

Capital Group Growth ETF and Capital Group Global Growth Equity ETF

– in a RILA annuity solution. This innovation will bring Capital

Group’s investment capabilities to the annuity marketplace to help

even more investors pursue their long-term investment goals.”

Lincoln Financial’s new offering comes as RILA sales continue to

reach record highs3. Demand is expected to remain strong as

consumers express concerns about inflation and having enough income

in retirement, according to a recent study from Lincoln Financial4.

The study also found that consumers who work with financial

professionals look for investment/insurance products that protect

their initial investment from losing value (50%), provide income or

cash flow (44%) and protect from market volatility (34%).

Lincoln Level Advantage 2’s first-of-its-kind Secure Lock+

feature lets investors adjust their strategy in the near term

without undermining long-term plans, helping them feel more in

control and confident about staying in the market through

volatility. This new feature allows investors to:

- Lock in performance: Investors have the flexibility and

control to capture gains in their indexed accounts any time and as

often as once per year.

- Reset growth potential and downside protection: Continue

the current indexed account term with a new crediting rate and

reset the full protection level on the next monthly anniversary

after a lock-in.

- Hold and reallocate: Investors also have the option to

hold the locked in indexed account value until the next yearly

anniversary if they prefer to reallocate to a different indexed

account.

Building on the success of Lincoln Level Advantage

Lincoln Level Advantage indexed variable annuity has earned

recognition from Structured Retail Products in 2023, 2021 and 2019,

was named in Barron's annual “100 Best Annuities for Today's

Market” feature more times than any other RILA and is consistently

one of the top selling RILAs in the industry.

Since launching in 2018, Lincoln Level Advantage indexed

variable annuity has been Lincoln Financial’s most successful

product launch to-date, with more than $23 billion in lifetime

sales. The RILA provides investors the ability to tailor a

combination of protection levels with indexed account options to

help meet their risk tolerance, individual investment style and

retirement income planning goals.

For more information about Lincoln Level Advantage 2, visit

https://www.lincolnfinancial.com/public/microsite/leveladvantage/ratesheets.

About Lincoln Financial Group

Lincoln Financial Group helps people to plan, protect and retire

with confidence. As of December 31, 2023, approximately 17 million

customers trust our guidance and solutions across four core

businesses – annuities, life insurance, group protection, and

retirement plan services. As of March 31, 2024, the company had

$310 billion in end-of-period account balances, net of reinsurance.

Headquartered in Radnor, Pa., Lincoln Financial Group is the

marketing name for Lincoln National Corporation (NYSE: LNC) and its

affiliates. Learn more at LincolnFinancial.com.

About Capital Group

Capital Group, home of American Funds, has been singularly

focused on delivering superior results for long-term investors

using high-conviction portfolios, rigorous research, and individual

accountability since 1931.

As of March 31, 2024, Capital Group manages more than $2.6

trillion in equity and fixed income assets for millions of

individuals and institutional investors around the world. Capital

Group manages equity assets through three investment groups. These

groups make investment and proxy voting decisions independently.

Fixed income investment professionals provide fixed income research

and investment management across the Capital organization; however,

for securities with equity characteristics, they act solely on

behalf of one of the three equity investment groups.

For more information, visit capitalgroup.com.

This material is authorized for use only when preceded or

accompanied by a prospectus, which describes investment objectives,

risk factors, fees and charges that may apply as well as other

important information.

Please read the prospectus carefully before you invest or

send money. The prospectus can be obtained by calling

888-868-2583.

Important information:

Lincoln Financial Group® affiliates, their distributors, and

their respective employees, representatives, and/or insurance

agents do not provide tax, accounting, or legal advice. Please

consult an independent professional as to any tax, accounting, or

legal statements made herein.

Lincoln Level Advantage® indexed variable and Lincoln Level

Advantage 2SM index-linked annuities are long-term investment

products designed for retirement purposes and offer tax‐deferred

growth, access to a lifetime income stream, and death benefit

protection. To decide if Lincoln Level Advantage® or Lincoln Level

Advantage 2SM is right for you, consider that its value will

fluctuate; it is subject to investment risk and possible loss of

principal; and there are costs associated with the variable

investment options such as product charges and administrative fees.

All guarantees, including those for optional features, and all

amounts invested into the indexed accounts are subject to the

claims‐paying ability of the issuer. Limitations and conditions

apply.

There are no explicit fees associated with the index-linked

account options available. With Lincoln Level Advantage® indexed

variable annuity there are associated fees with the variable

annuity subaccounts, which include a product charge, and

administrative fees. Annuities are subject to market risk including

loss of principal. Withdrawals are subject to ordinary income tax

treatment and, if taken prior to age 59½ in nonqualified contracts,

may be subject to an additional 10% federal tax.

Indexed-linked variable annuity products are complex insurance

and investment vehicles and are subject to surrender charges for

early withdrawals. Please reference the prospectus for information

about the levels of protection available and other important

product information.

Any distribution or transfer from an indexed account (other than

on the term end date) is based on the interim value of each indexed

segment. This value is based on a formula and may not correspond to

the current performance of the index you selected. Any distribution

or transfer during a term will have a negative impact on the value

at the end of the term. This reduction could be larger than the

dollar amount of the distribution or transfer. See prospectus for

details.

Upon a lock in, the account value of the indexed account is

locked in and will be adjusted for withdrawals and any charges. On

the next monthly anniversary date, the daily adjustments to the

account value of the indexed account will resume, the starting

index value to determine the performance at the end of the term is

reset and your Crediting Base is reset to the locked in value. If

you request a lock in when the indexed account value is below the

Indexed Crediting Base, protection levels do not apply and you

assume all loss.

The risk of loss occurs each time you move into a new indexed

account after the end of an indexed term. The protection level

option selected in the indexed account helps protect you from some

downside risk. If the negative return is in excess of the

protection level selected, there is a risk of loss of principal.

Protection levels that vary based on the index and term selected

are subject to change and may not be available with every option.

Please see the prospectus for details.

Investors are advised to consider the investment objectives,

risks, and charges and expenses of the variable annuity and its

underlying investment options carefully before investing. The

applicable prospectuses contain this and other important

information about the variable annuity and its underlying

investment options. Please call 888-868-2583 for free prospectuses.

Read them carefully before investing or sending money. Products and

features are subject to state availability.

Lincoln Level Advantage® indexed variable annuities (contract

form 30070-B and state variations; contract form 30070-BID in

Idaho) and Lincoln Level Advantage 2SM index-linked annuities

(contract forms 24-50090, 24-50091, and state variations) are

issued by The Lincoln National Life Insurance Company, Fort

Wayne, IN, and distributed by Lincoln Financial Distributors, Inc.,

a broker-dealer. The Lincoln National Life Insurance Company

does not solicit business in the state of New York, nor is it

authorized to do so.

All contract and rider guarantees, including those for optional

benefits, payment from the indexed accounts, or annuity payout

rates, are subject to the claims-paying ability of the issuing

insurance company. They are not backed by any selling entity other

than the issuing company affiliates, and none makes any

representations or guarantees regarding the claims-paying ability

of the issuer.

This product and the components and features contained within

are not available in all states or firms.

There is no additional tax-deferral benefit for an annuity

contract purchased in an IRA or other tax-qualified plan.

Not available in New York.

________________________

1 etf.com awards, Best New U.S. Equity

ETF, May 2023

2 Escalent, Cogent Syndicated, Retail

Advisor Brandscape® June 2023

3 LIMRA, U.S. Individual Annuity Sales

Survey, April 2024

4Lincoln Financial Group, Consumer

Sentiment Tracker, January 2024

LCN-6544275-041124

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240516361202/en/

Media: Mallory Horshaw, Lincoln Financial Group

Mallory.horshaw@lfg.com

Caroline Semerdjian, Capital Group

Caroline.semerdjian@capgroup.com

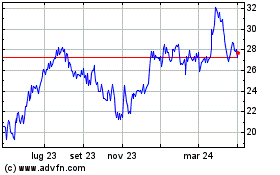

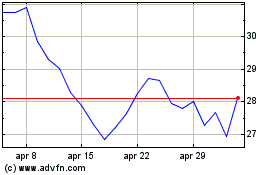

Grafico Azioni Lincoln National (NYSE:LNC)

Storico

Da Feb 2025 a Mar 2025

Grafico Azioni Lincoln National (NYSE:LNC)

Storico

Da Mar 2024 a Mar 2025