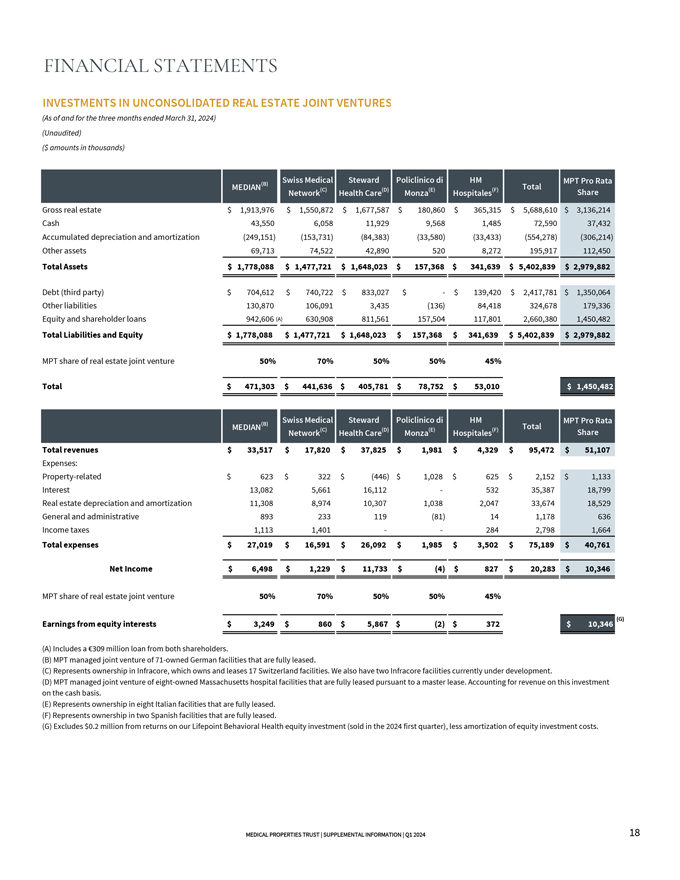

FINANCIAL STATEMENTS

INVESTMENTS IN UNCONSOLIDATED

REAL ESTATE JOINT VENTURES

(As of and for the three months ended March 31, 2024) (Unaudited) ($ amounts in thousands)

Gross real estate $ 1,913,976 $ 1,550,872 $ 1,677,587 $ 180,860 $ 365,315 $ 5,688,610

$ 3,136,214 Cash 43,550 6,058 11,929 9,568 1,485

72,590 37,432 Accumulated depreciation and

amortization (249,151) (153,731) (84,383) (33,580) (33,433) (554,278) (306,214)

Other assets 69,713 74,522

42,890 520 8,272 195,917 112,450

Total Assets

$ 1,778,088 $ 1,477,721 $ 1,648,023 $ 157,368 $ 341,639 $ 5,402,839 $ 2,979,882

Debt (third party) $ 704,612 $ 740,722 $ 833,027

$ — $ 139,420 $ 2,417,781 $ 1,350,064 Other

liabilities 130,870 106,091 3,435 (136) 84,418 324,678 179,336

Equity and shareholder loans 942,606

(A) 630,908 811,561 157,504 117,801 2,660,380 1,450,482

Total Liabilities and Equity $ 1,778,088 $ 1,477,721 $ 1,648,023 $ 157,368 $ 341,639 $ 5,402,839

$ 2,979,882

MPT share of real estate joint venture 50% 70% 50% 50% 45%

Total $ 471,303 $ 441,636 $ 405,781 $ 78,752

$ 53,010

Total revenues $ 33,517 $ 17,820 $ 37,825

$ 1,981 $ 4,329 $ 95,472 $ 51,107

Expenses:

Property-related $ 623 $ 322 $ (446) $ 1,028

$ 625 $ 2,152 $ 1,133 Interest 13,082

5,661 16,112 — 532 35,387 18,799 Real estate depreciation and

amortization 11,308 8,974 10,307 1,038

2,047 33,674 18,529 General and

administrative 893 233 119 (81) 14 1,178 636 Income

taxes 1,113 1,401 — — 284 2,798 1,664

Total expenses $ 27,019 $ 16,591 $ 26,092 $ 1,985

$ 3,502 $ 75,189 $ 40,761

Net Income $ 6,498

$ 1,229 $ 11,733 $ (4) $ 827 $ 20,283 $ 10,346

MPT share of real estate joint venture 50% 70% 50% 50% 45%

(G)

Earnings from equity interests $ 3,249 $ 860 $ 5,867 $ (2)

$ 372

(A) Includes a €309 million loan from both shareholders.

(B) MPT managed joint venture of 71-owned German facilities that are fully leased.

(C) Represents ownership in Infracore, which owns and leases 17 Switzerland facilities. We also have two Infracore facilities currently under development.

(D) MPT managed joint venture of eight-owned Massachusetts hospital facilities that are fully leased pursuant to a master lease. Accounting for revenue on this investment on the

cash basis.

(E) Represents ownership in eight Italian facilities that are fully leased. (F) Represents ownership in two Spanish facilities that are fully

leased.

(G) Excludes $0.2 million from returns on our Lifepoint Behavioral Health equity investment (sold in the 2024 first quarter), less amortization of

equity investment costs.

MEDICAL PROPERTIES TRUST | SUPPLEMENTAL INFORMATION | Q1 2024 18