Today, New Jersey Resources Corporation (NYSE: NJR) reported

results for the second quarter of fiscal 2024. Highlights

include:

- Consolidated net income of $120.8 million, compared with $110.2

million in the second quarter of fiscal 2023

- Consolidated net financial earnings (NFE), a non-GAAP financial

measure, of $138.6 million, or $1.41 per share, compared to $112.3

million, or $1.16 per share, in the second quarter of fiscal

2023

- Re-affirmed fiscal 2024 net financial earnings per share

(NFEPS) guidance range of $2.85 to $3.00, which was increased by

$0.15 in February 2024 as a result of strong performance from

Energy Services

- Maintained long-term projected NFEPS growth rate of 7 to 9

percent(1)

- On January 31, 2024, New Jersey Natural Gas (NJNG) filed a rate

case with the New Jersey Board of Public Utilities (BPU), seeking a

$222.6 million increase in delivery rates

Second-quarter fiscal 2024 net income totaled $120.8 million, or

$1.23 per share, compared with $110.2 million, or $1.14 per share,

for the same period in fiscal 2023. Fiscal 2024 year-to-date net

income totaled $210.2 million, or $2.14 per share, compared with

$226.2 million, or $2.34 per share, for the same period in fiscal

2023.

Second-quarter fiscal 2024 NFE totaled $138.6 million, or $1.41

per share, compared with $112.3 million, or $1.16 per share, for

the same period in fiscal 2023. Fiscal 2024 year-to-date NFE

totaled $211.0 million, or $2.15 per share, compared with $222.6

million, or $2.30 per share, for the same period in fiscal

2023.

Management Commentary Steve Westhoven, President and CEO

of New Jersey Resources, stated, "In February, we raised our fiscal

2024 NFEPS guidance range by $0.15 as a result of Energy Services

capitalizing on natural gas price volatility at the beginning of

our second quarter, and we continued to make solid progress on our

organic growth initiatives. These accomplishments reflect the

strength of our diversified business model as well as our

commitment to delivering value for our shareholders."

Key Performance Metrics

Three Months Ended

Six Months Ended

March 31,

March 31,

($ in Thousands)

2024

2023

2024

2023

Net income

$

120,812

$

110,247

$

210,223

$

226,168

Basic EPS

$

1.23

$

1.14

$

2.14

$

2.34

Net financial earnings

$

138,576

$

112,310

$

211,020

$

222,594

Basic net financial earnings per share

$

1.41

$

1.16

$

2.15

$

2.30

(1) NFEPS long-term annual growth

projections are based on the midpoint of the $2.20 - $2.30 initial

guidance range for fiscal 2022, provided on February 1, 2021.

A reconciliation of net income to NFE for the three and six

months ended March 31, 2024 and 2023, is provided below.

Three Months Ended

Six Months Ended

March 31,

March 31,

(Thousands)

2024

2023

2024

2023

Net income

$

120,812

$

110,247

$

210,223

$

226,168

Add:

Unrealized loss (gain) on derivative

instruments and related transactions

25,457

13,971

20,057

(17,532

)

Tax effect

(6,049

)

(3,320

)

(4,767

)

4,167

Effects of economic hedging related to

natural gas inventory

(2,845

)

(11,203

)

(19,073

)

12,769

Tax effect

676

2,662

4,533

(3,035

)

Gain on equity method investment

—

(200

)

—

(200

)

Tax effect

—

50

—

50

NFE tax adjustment

525

103

47

207

Net financial earnings

$

138,576

$

112,310

$

211,020

$

222,594

Weighted Average Shares

Outstanding

Basic

98,377

96,893

98,123

96,689

Diluted

99,102

97,556

98,839

97,346

Basic earnings per share

$

1.23

$

1.14

$

2.14

$

2.34

Add:

Unrealized loss (gain) on derivative

instruments and related transactions

0.25

0.14

0.20

(0.18

)

Tax effect

(0.06

)

(0.03

)

(0.05

)

0.04

Effects of economic hedging related to

natural gas inventory

(0.03

)

(0.12

)

(0.19

)

0.13

Tax effect

0.01

0.03

0.05

(0.03

)

NFE tax adjustment

0.01

—

—

—

Basic net financial earnings per

share

$

1.41

$

1.16

$

2.15

$

2.30

NFE is a measure of earnings based on the elimination of timing

differences to effectively match the earnings effects of the

economic hedges with the physical sale of natural gas, Solar

Renewable Energy Certificates (SRECs) and foreign currency

contracts. Consequently, to reconcile net income and NFE,

current-period unrealized gains and losses on the derivatives are

excluded from NFE as a reconciling item. Realized derivative gains

and losses are also included in current-period net income. However,

NFE includes only realized gains and losses related to natural gas

sold out of inventory, effectively matching the full earnings

effects of the derivatives with realized margins on physical

natural gas flows. NFE also excludes certain transactions

associated with equity method investments, including impairment

charges, which are non-cash charges, and return of capital in

excess of the carrying value of our investment. These are not

indicative of the Company's performance for its ongoing operations.

Included in the tax effects are current and deferred income tax

expense corresponding with the components of NFE.

A table detailing NFE for the three and six months ended March

31, 2024 and 2023, is provided below.

Net financial earnings (loss) by

business unit

Three Months Ended

Six Months Ended

March 31,

March 31,

(Thousands)

2024

2023

2024

2023

New Jersey Natural Gas

$

107,095

$

100,697

$

158,539

$

155,361

Clean Energy Ventures

(5,616

)

(9,379

)

4,906

(12,961

)

Storage and Transportation

1,981

2,450

5,621

8,693

Energy Services

37,644

21,125

45,475

73,658

Home Services and Other

384

813

(216

)

784

Subtotal

141,488

115,706

214,325

225,535

Eliminations

(2,912

)

(3,396

)

(3,305

)

(2,941

)

Total

$

138,576

$

112,310

$

211,020

$

222,594

Fiscal 2024 NFE Guidance:

NJR re-affirmed its fiscal 2024 NFEPS guidance range of $2.85 to

$3.00, which was increased by $0.15 in February 2024, subject to

the risks and uncertainties identified below under "Forward-Looking

Statements."

In fiscal 2024, NJR expects Energy Services will represent a

higher percentage of NFEPS than in prior years due to contributions

from the Asset Management Agreements signed in 2020*. The following

chart represents NJR’s current expected contributions from its

business segments for fiscal 2024:

Company

Expected Fiscal 2024

Net Financial Earnings Contribution

New Jersey Natural Gas

40 to 45 percent

Clean Energy Ventures

12 to 17 percent

Storage and Transportation

3 to 7 percent

Energy Services

38 to 43 percent*

Home Services and Other

0 to 1 percent

* NJR expects to recognize the majority of

the fiscal 2024 AMA revenues in the fiscal fourth quarter

In providing fiscal 2024 NFE guidance, management is aware there

could be differences between reported GAAP earnings and NFE due to

matters such as, but not limited to, the positions of our

energy-related derivatives. Management is not able to reasonably

estimate the aggregate impact or significance of these items on

reported earnings and, therefore, is not able to provide a

reconciliation to the corresponding GAAP equivalent for its

operating earnings guidance without unreasonable efforts.

New Jersey Natural Gas (NJNG)

NJNG reported second-quarter fiscal 2024 NFE of $107.1 million,

compared to NFE of $100.7 million during the same period in fiscal

2023. Fiscal 2024 year-to-date NFE were $158.5 million, compared to

NFE of $155.4 million during the same period in fiscal 2023. NJNG

reported higher utility gross margin for the second quarter of

fiscal 2024, driven by higher contribution from BGSS incentive

programs, partially offset by increased depreciation and operating

expenses, while year-to-date utility gross margin improved as a

result of continued customer growth.

Customer Growth:

- NJNG added 4,058 new customers during the first six months of

fiscal 2024, compared with 4,064 during the same period of fiscal

2023. NJNG expects these new customers to contribute approximately

$3.4 million of incremental utility gross margin on an annualized

basis.

Base Rate Filing:

- On January 31, 2024, NJNG filed a base rate case with the BPU,

seeking a $222.6 million increase to its base rates. The filing is

based on an overall return of 7.57 percent with a return on equity

of 10.42 percent. The proposed increase reflects a 55.42 percent

common equity component.

Infrastructure Update:

- NJNG's Infrastructure Investment Program (IIP) is a

five-year, $150 million accelerated recovery program that began in

fiscal 2021. IIP consists of a series of infrastructure projects

designed to enhance the safety and reliability of NJNG's natural

gas distribution system. During the first six months of fiscal

2024, NJNG spent $13.7 million under the program on various

distribution system reinforcement projects. On March 28, 2024, NJNG

submitted its annual IIP filing to the BPU requesting a rate

increase for capital expenditures of $43.5 million through June 30,

2024, which will result in a $5.6 million revenue increase, with a

proposed effective date of October 1, 2024.

Basic Gas Supply Service (BGSS) Incentive Programs:

BGSS incentive programs contributed $7.9 million to utility

gross margin in the second quarter of fiscal 2024, compared with

$5.8 million during the same period of fiscal 2023. This increase

for the second quarter was due primarily to higher margins from

off-system sales. During the first six months of fiscal 2024, these

programs contributed $13.3 million to utility gross margin,

compared with $14.5 million during the same period in fiscal

2023.

For more information on utility gross margin, please see

"Non-GAAP Financial Information" below.

Energy-Efficiency Programs:

SAVEGREEN™ invested $33.4 million year-to-date in fiscal 2024 in

energy-efficiency upgrades for customers' homes and businesses.

NJNG recovered $15.1 million of its outstanding investments during

the first six months of fiscal 2024 through its energy efficiency

rate.

Clean Energy Ventures (CEV)

CEV reported second-quarter fiscal 2024 net financial loss of

$(5.6) million, compared with a net financial loss of $(9.4)

million during the same period in fiscal 2023. The decrease in net

financial loss for the second quarter of fiscal 2024 was largely

due to the recognition of Investment Tax Credits associated with

solar sale leaseback financing transactions. Fiscal 2024

year-to-date NFE was $4.9 million, compared with a net financial

loss of $(13.0) million during the same period in fiscal 2023. The

increase in fiscal 2024 year-to-date NFE was due primarily to

higher SREC and TREC revenue for the period.

Solar Investment Update:

- As of March 31, 2024, CEV had approximately 474MW of solar

capacity in service in New Jersey, New York, Connecticut, Rhode

Island, Indiana, and Michigan.

Storage and Transportation

Storage and Transportation reported second-quarter fiscal 2024

NFE of $2.0 million, compared with NFE of $2.4 million during the

same period in fiscal 2023. Fiscal 2024 year-to-date NFE were $5.6

million, compared with NFE of $8.7 million during the same period

in fiscal 2023. NFE for the second quarter of fiscal 2024 remained

largely flat when compared to the prior year, while the

year-to-date decrease in NFE was largely due to higher operating

revenues in the prior year period.

Energy Services

Energy Services reported second-quarter fiscal 2024 NFE of $37.6

million compared with NFE of $21.1 million for the same period in

fiscal 2023. The increase in the second quarter of fiscal 2024 was

due to higher natural gas price volatility in January, allowing

Energy Services to capture additional financial margin. Fiscal 2024

year-to-date NFE were $45.5 million, compared with NFE of $73.7

million during the same period in fiscal 2023. The decrease in

fiscal 2024 year-to-date NFE was due primarily to higher natural

gas price volatility in the prior year period, largely as a result

of Winter Storm Elliott.

Home Services and Other Operations

Home Services and Other Operations reported second-quarter

fiscal 2024 NFE of $0.4 million, compared to NFE of $0.8 million

for the same period in fiscal 2023. Fiscal 2024 year-to-date net

financial loss was $(0.2) million, compared with NFE of $0.8

million during the same period in fiscal 2023.

Capital Expenditures and Cash Flows:

NJR is committed to maintaining a strong financial profile:

- During the first six months of fiscal 2024, capital

expenditures were $232.6 million, including accruals, compared with

$253.7 million during the same period of fiscal 2023. The decrease

in capital expenditures was primarily due to lower solar capital

expenditures during the period as a result of the timing of several

projects being placed into service in the prior year.

- During the first six months of fiscal 2024, cash flows from

operations were $338.6 million, which was largely consistent with

cash flows from operations of $343.1 million during the same period

of fiscal 2023.

Forward-Looking Statements:

This earnings release contains forward-looking statements within

the meaning of Section 27A of the Securities Act of 1933, as

amended, Section 21E of the Securities Exchange Act of 1934, as

amended, and the Private Securities Litigation Reform Act of 1995.

NJR cautions readers that the assumptions forming the basis for

forward-looking statements include many factors that are beyond

NJR’s ability to control or estimate precisely, such as estimates

of future market conditions and the behavior of other market

participants. Words such as “anticipates,” “estimates,” “expects,”

“projects,” “may,” “will,” “intends,” “plans,” “believes,” “should”

and similar expressions may identify forward-looking statements and

such forward-looking statements are made based upon management’s

current expectations, assumptions and beliefs as of this date

concerning future developments and their potential effect upon NJR.

There can be no assurance that future developments will be in

accordance with management’s expectations, assumptions and beliefs

or that the effect of future developments on NJR will be those

anticipated by management. Forward-looking statements in this

earnings release include, but are not limited to, certain

statements regarding NJR’s NFEPS guidance for fiscal 2024,

projected NFEPS growth rates and our guidance range, NFEPS

Contributions, forecasted contribution of business segments to

NJR’s NFE for fiscal 2024, customer growth at NJNG and their

expected contributions, expected contributions from Asset

Management Agreements, infrastructure programs and investments,

future decarbonization opportunities including IIP, Energy

Efficiency programs, including BGSS, the outcome or timing of our

Base Rate Case with the BPU, and other legal and regulatory

expectations.

Additional information and factors that could cause actual

results to differ materially from NJR’s expectations are contained

in NJR’s filings with the SEC, including NJR’s Annual Reports on

Form 10-K and subsequent Quarterly Reports on Form 10-Q, recent

Current Reports on Form 8-K, and other SEC filings, which are

available at the SEC’s web site, http://www.sec.gov. Information

included in this earnings release is representative as of today

only and while NJR periodically reassesses material trends and

uncertainties affecting NJR's results of operations and financial

condition in connection with its preparation of management's

discussion and analysis of results of operations and financial

condition contained in its Quarterly and Annual Reports filed with

the SEC, NJR does not, by including this statement, assume any

obligation to review or revise any particular forward-looking

statement referenced herein in light of future events.

Non-GAAP Financial Information:

This earnings release includes the non-GAAP financial measures

NFE/net financial loss, NFE per basic share, financial margin and

utility gross margin. A reconciliation of these non-GAAP financial

measures to the most directly comparable financial measures

calculated and reported in accordance with GAAP can be found below.

As an indicator of NJR’s operating performance, these measures

should not be considered an alternative to, or more meaningful

than, net income or operating revenues as determined in accordance

with GAAP. This information has been provided pursuant to the

requirements of SEC Regulation G.

NFE and financial margin exclude unrealized gains or losses on

derivative instruments related to NJR’s unregulated subsidiaries

and certain realized gains and losses on derivative instruments

related to natural gas that has been placed into storage at Energy

Services, net of applicable tax adjustments as described below.

Financial margin also differs from gross margin as defined on a

GAAP basis as it excludes certain operations and maintenance

expense and depreciation and amortization as well as the effects of

derivatives as discussed above. Volatility associated with the

change in value of these financial instruments and physical

commodity reported on the income statement in the current period.

In order to manage its business, NJR views its results without the

impacts of the unrealized gains and losses, and certain realized

gains and losses, caused by changes in value of these financial

instruments and physical commodity contracts prior to the

completion of the planned transaction because it shows changes in

value currently instead of when the planned transaction ultimately

is settled. An annual estimated effective tax rate is calculated

for NFE purposes and any necessary quarterly tax adjustment is

applied to NJR Energy Services Company.

NJNG’s utility gross margin is defined as operating revenues

less natural gas purchases, sales tax, and regulatory rider

expense. This measure differs from gross margin as presented on a

GAAP basis as it excludes certain operations and maintenance

expense and depreciation and amortization. Utility gross margin may

also not be comparable to the definition of gross margin used by

others in the natural gas distribution business and other

industries. Management believes that utility gross margin provides

a meaningful basis for evaluating utility operations since natural

gas costs, sales tax and regulatory rider expenses are included in

operating revenues and passed through to customers and, therefore,

have no effect on utility gross margin.

Management uses these non-GAAP financial measures as

supplemental measures to other GAAP results to provide a more

complete understanding of NJR’s performance. Management believes

these non-GAAP financial measures are more reflective of NJR’s

business model, provide transparency to investors and enable

period-to-period comparability of financial performance. A

reconciliation of all non-GAAP financial measures to the most

directly comparable financial measures calculated and reported in

accordance with GAAP can be found below. For a full discussion of

NJR’s non-GAAP financial measures, please see NJR’s most recent

Report on Form 10-K, Item 7.

About New Jersey Resources

New Jersey Resources (NYSE: NJR) is a Fortune 1000

company that, through its subsidiaries, provides safe and reliable

natural gas and clean energy services, including transportation,

distribution, asset management and home services. NJR is composed

of five primary businesses:

- New Jersey Natural Gas, NJR’s principal subsidiary,

operates and maintains natural gas transportation and distribution

infrastructure to serve approximately 582,000 customers in New

Jersey’s Monmouth, Ocean, Morris, Middlesex, Sussex and Burlington

counties.

- Clean Energy Ventures invests in, owns and operates

solar projects with a total capacity of approximately 474

megawatts, providing residential and commercial customers with

low-carbon solutions.

- Energy Services manages a diversified portfolio of

natural gas transportation and storage assets and provides physical

natural gas services and customized energy solutions to its

customers across North America.

- Storage and Transportation serves customers from local

distributors and producers to electric generators and wholesale

marketers through its ownership of Leaf River and the Adelphia

Gateway Pipeline, as well as our 50% equity ownership in the

Steckman Ridge natural gas storage facility.

- Home Services provides service contracts as well as

heating, central air conditioning, water heaters, standby

generators, solar and other indoor and outdoor comfort products to

residential homes throughout New Jersey.

NJR and its over 1,300 employees are committed to helping

customers save energy and money by promoting conservation and

encouraging efficiency through Conserve to Preserve® and

initiatives such as The SAVEGREEN Project® and The Sunlight

Advantage®.

For more information about NJR: www.njresources.com.

Follow us on X.com (Twitter) @NJNaturalGas. “Like” us on

facebook.com/NewJerseyNaturalGas.

NEW JERSEY RESOURCES

CONSOLIDATED STATEMENTS OF

OPERATIONS

(Unaudited)

Three Months Ended

Six Months Ended

March 31,

March 31,

(Thousands, except per share data)

2024

2023

2024

2023

OPERATING REVENUES

Utility

$

462,863

$

400,500

$

755,956

$

757,909

Nonutility

195,050

243,527

369,167

609,685

Total operating revenues

657,913

644,027

1,125,123

1,367,594

OPERATING EXPENSES

Gas purchases

Utility

204,347

156,370

320,467

338,816

Nonutility

105,018

160,364

164,495

392,434

Related parties

1,799

1,770

3,678

3,597

Operation and maintenance

107,223

99,095

201,662

178,596

Regulatory rider expenses

29,229

23,154

48,418

41,405

Depreciation and amortization

40,075

38,090

80,362

74,773

Total operating expenses

487,691

478,843

819,082

1,029,621

OPERATING INCOME

170,222

165,184

306,041

337,973

Other income, net

15,420

4,779

21,761

9,434

Interest expense, net of capitalized

interest

31,621

30,261

63,094

59,752

INCOME BEFORE INCOME TAXES AND EQUITY

IN EARNINGS OF AFFILIATES

154,021

139,702

264,708

287,655

Income tax provision

33,947

30,586

56,883

63,564

Equity in earnings of affiliates

738

1,131

2,398

2,077

NET INCOME

$

120,812

$

110,247

$

210,223

$

226,168

EARNINGS PER COMMON SHARE

Basic

$

1.23

$

1.14

$

2.14

$

2.34

Diluted

$

1.22

$

1.13

$

2.13

$

2.32

WEIGHTED AVERAGE SHARES

OUTSTANDING

Basic

98,377

96,893

98,123

96,689

Diluted

99,102

97,556

98,839

97,346

RECONCILIATION OF NON-GAAP

PERFORMANCE MEASURES

(Unaudited)

Three Months Ended

Six Months Ended

March 31,

March 31,

(Thousands)

2024

2023

2024

2023

NEW JERSEY RESOURCES

A reconciliation of net income, the

closest GAAP financial measure, to net financial earnings is as

follows:

Net income

$

120,812

$

110,247

$

210,223

$

226,168

Add:

Unrealized (gain) loss on derivative

instruments and related transactions

25,457

13,971

20,057

(17,532

)

Tax effect

(6,049

)

(3,320

)

(4,767

)

4,167

Effects of economic hedging related to

natural gas inventory

(2,845

)

(11,203

)

(19,073

)

12,769

Tax effect

676

2,662

4,533

(3,035

)

Gain on equity method investment

—

(200

)

—

(200

)

Tax effect

—

50

—

50

NFE tax adjustment

525

103

47

207

Net financial earnings

$

138,576

$

112,310

$

211,020

$

222,594

Weighted Average Shares

Outstanding

Basic

98,377

96,893

98,123

96,689

Diluted

99,102

97,556

98,839

97,346

A reconciliation of basic earnings per

share, the closest GAAP financial measure, to basic net financial

earnings per share is as follows:

Basic earnings per share

$

1.23

$

1.14

$

2.14

$

2.34

Add:

Unrealized (gain) loss on derivative

instruments and related transactions

$

0.25

$

0.14

$

0.20

$

(0.18

)

Tax effect

$

(0.06

)

$

(0.03

)

$

(0.05

)

$

0.04

Effects of economic hedging related to

natural gas inventory

$

(0.03

)

$

(0.12

)

$

(0.19

)

$

0.13

Tax effect

$

0.01

$

0.03

$

0.05

$

(0.03

)

NFE tax adjustment

$

0.01

$

—

$

—

$

—

Basic net financial earnings per

share

$

1.41

$

1.16

$

2.15

$

2.30

NATURAL GAS DISTRIBUTION

A reconciliation of gross margin, the

closest GAAP financial measure, to utility gross margin is as

follows:

Operating revenues

$

463,201

$

400,838

$

756,631

$

758,584

Less:

Natural gas purchases

206,675

158,694

325,119

343,465

Operating and maintenance (1)

29,558

30,711

55,341

57,005

Regulatory rider expense

29,229

23,154

48,418

41,405

Depreciation and amortization

27,464

25,319

54,381

50,209

Gross margin

170,275

162,960

273,372

266,500

Add:

Operating and maintenance (1)

29,558

30,711

55,341

57,005

Depreciation and amortization

27,464

25,319

54,381

50,209

Utility gross margin

$

227,297

$

218,990

$

383,094

$

373,714

(1) Excludes selling, general and

administrative expenses of $30.0 million and $27.8 million for the

three months ended March 31, 2024 and 2023, respectively, and $58.9

million and $51.2 million for the six months ended March 31, 2024

and 2023, respectively.

RECONCILIATION OF NON-GAAP

PERFORMANCE MEASURES (continued)

(Unaudited)

Three Months Ended

Six Months Ended

March 31,

March 31,

(Thousands)

2024

2023

2024

2023

ENERGY SERVICES

A reconciliation of gross margin, the

closest GAAP financial measure, to Energy Services' financial

margin is as follows:

Operating revenues

$

144,862

$

196,730

$

244,530

$

518,512

Less:

Natural Gas purchases

105,634

161,114

165,800

394,401

Operation and maintenance (1)

13,102

7,668

17,791

11,123

Depreciation and amortization

56

62

113

119

Gross margin

26,070

27,886

60,826

112,869

Add:

Operation and maintenance (1)

13,102

7,668

17,791

11,123

Depreciation and amortization

56

62

113

119

Unrealized (gain) loss on derivative

instruments and related transactions

29,198

13,795

24,932

(26,091

)

Effects of economic hedging related to

natural gas inventory

(2,845

)

(11,203

)

(19,073

)

12,769

Financial margin

$

65,581

$

38,208

$

84,589

$

110,789

(1) Excludes selling, general and

administrative expenses of $0.5 million and $0.7 million for the

three months ended March 31, 2024 and 2023, respectively, and $1.0

million and $(1.7) million for the six months ended March 31, 2024

and 2023, respectively.

A reconciliation of net income, the

closest GAAP financial measure, to net financial earnings is as

follows:

Net income

$

17,028

$

19,046

$

40,961

$

83,607

Add:

Unrealized (gain) loss on derivative

instruments and related transactions

29,198

13,795

24,932

(26,091

)

Tax effect

(6,938

)

(3,278

)

(5,925

)

6,201

Effects of economic hedging related to

natural gas

(2,845

)

(11,203

)

(19,073

)

12,769

Tax effect

676

2,662

4,533

(3,035

)

NFE tax adjustment

525

103

47

207

Net financial earnings

$

37,644

$

21,125

$

45,475

$

73,658

FINANCIAL STATISTICS BY

BUSINESS UNIT

(Unaudited)

Three Months Ended

Six Months Ended

March 31,

March 31,

(Thousands, except per share data)

2024

2023

2024

2023

NEW JERSEY RESOURCES

Operating Revenues

Natural Gas Distribution

$

463,201

$

400,838

$

756,631

$

758,584

Clean Energy Ventures

9,325

14,406

44,620

27,198

Energy Services

144,862

196,730

244,530

518,512

Storage and Transportation

23,042

20,887

46,904

47,725

Home Services and Other

14,905

13,448

29,739

27,714

Sub-total

655,335

646,309

1,122,424

1,379,733

Eliminations

2,578

(2,282

)

2,699

(12,139

)

Total

$

657,913

$

644,027

$

1,125,123

$

1,367,594

Operating Income (Loss)

Natural Gas Distribution

$

140,279

$

135,196

$

214,454

$

215,309

Clean Energy Ventures

(7,679

)

(5,002

)

10,644

(5,323

)

Energy Services

25,533

27,232

59,870

114,547

Storage and Transportation

5,910

6,700

13,234

19,317

Home Services and Other

778

1,137

570

1,188

Sub-total

164,821

165,263

298,772

345,038

Eliminations

5,401

(79

)

7,269

(7,065

)

Total

$

170,222

$

165,184

$

306,041

$

337,973

Equity in Earnings of

Affiliates

Storage and Transportation

$

85

$

977

$

1,078

$

1,886

Eliminations

653

154

1,320

191

Total

$

738

$

1,131

$

2,398

$

2,077

Net Income (Loss)

Natural Gas Distribution

$

107,095

$

100,697

$

158,539

$

155,361

Clean Energy Ventures

(5,616

)

(9,379

)

4,906

(12,961

)

Energy Services

17,028

19,046

40,961

83,607

Storage and Transportation

1,981

2,600

5,621

8,843

Home Services and Other

384

813

(216

)

784

Sub-total

120,872

113,777

209,811

235,634

Eliminations

(60

)

(3,530

)

412

(9,466

)

Total

$

120,812

$

110,247

$

210,223

$

226,168

Net Financial Earnings (Loss)

Natural Gas Distribution

$

107,095

$

100,697

$

158,539

$

155,361

Clean Energy Ventures

(5,616

)

(9,379

)

4,906

(12,961

)

Energy Services

37,644

21,125

45,475

73,658

Storage and Transportation

1,981

2,450

5,621

8,693

Home Services and Other

384

813

(216

)

784

Sub-total

141,488

115,706

214,325

225,535

Eliminations

(2,912

)

(3,396

)

(3,305

)

(2,941

)

Total

$

138,576

$

112,310

$

211,020

$

222,594

Throughput (Bcf)

NJNG, Core Customers

32.9

30.8

56.3

55.8

NJNG, Off System/Capacity Management

37.1

20.7

64.3

38.6

Energy Services Fuel Mgmt. and Wholesale

Sales

38.3

40.8

68.4

85.0

Total

108.3

92.3

189.0

179.4

Common Stock Data

Yield at March 31,

3.9

%

2.9

%

3.9

%

2.9

%

Market Price at March 31,

$

42.91

$

53.20

$

42.91

$

53.20

Shares Out. at March 31,

98,745

96,901

98,745

96,901

Market Cap. at March 31,

$

4,237,144

$

5,155,153

$

4,237,144

$

5,155,153

Three Months Ended

Six Months Ended

(Unaudited)

March 31,

March 31,

(Thousands, except customer and weather

data)

2024

2023

2024

2023

NATURAL GAS DISTRIBUTION

Utility Gross Margin

Operating revenues

$

463,201

$

400,838

$

756,631

$

758,584

Less:

Natural gas purchases

206,675

158,694

325,119

343,465

Operating and maintenance (1)

29,558

30,711

55,341

57,005

Regulatory rider expense

29,229

23,154

48,418

41,405

Depreciation and amortization

27,464

25,319

54,381

50,209

Gross margin

170,275

162,960

273,372

266,500

Add:

Operating and maintenance (1)

29,558

30,711

55,341

57,005

Depreciation and amortization

27,464

25,319

54,381

50,209

Total Utility Gross Margin

$

227,297

$

218,990

$

383,094

$

373,714

(1) Excludes selling, general and

administrative expenses of $30.0 million and $27.8 million for the

six months ended March 31, 2024 and 2023, respectively, and $58.9

million and $51.2 million for the six months ended March 31, 2024

and 2023, respectively.

Utility Gross Margin, Operating Income

and Net Income

Residential

$

163,495

$

157,276

$

271,532

$

261,294

Commercial, Industrial & Other

28,676

30,066

49,507

50,845

Firm Transportation

26,490

25,208

47,254

45,688

Total Firm Margin

218,661

212,550

368,293

357,827

Interruptible

750

662

1,534

1,423

Total System Margin

219,411

213,212

369,827

359,250

Basic Gas Supply Service Incentive

7,886

5,778

13,267

14,464

Total Utility Gross Margin

227,297

218,990

383,094

373,714

Operation and maintenance expense

59,554

58,475

114,259

108,196

Depreciation and amortization

27,464

25,319

54,381

50,209

Operating Income

$

140,279

$

135,196

$

214,454

$

215,309

Net Income

$

107,095

$

100,697

$

158,539

$

155,361

Net Financial Earnings

$

107,095

$

100,697

$

158,539

$

155,361

Throughput (Bcf)

Residential

21.0

19.5

34.9

34.2

Commercial, Industrial & Other

3.9

3.8

6.5

6.5

Firm Transportation

4.7

4.5

8.3

8.5

Total Firm Throughput

29.6

27.8

49.7

49.2

Interruptible

3.3

3.0

6.6

6.6

Total System Throughput

32.9

30.8

56.3

55.8

Off System/Capacity Management

37.1

20.7

64.3

38.6

Total Throughput

70.0

51.5

120.6

94.4

Customers

Residential

525,391

516,453

525,391

516,453

Commercial, Industrial & Other

33,108

33,160

33,108

33,160

Firm Transportation

22,992

24,777

22,992

24,777

Total Firm Customers

581,491

574,390

581,491

574,390

Interruptible

83

87

83

87

Total System Customers

581,574

574,477

581,574

574,477

Off System/Capacity Management*

26

23

26

23

Total Customers

581,600

574,500

581,600

574,500

*The number of customers represents those

active during the last month of the period.

Degree Days

Actual

2,135

1,937

3,543

3,480

Normal

2,436

2,457

3,970

4,004

Percent of Normal

87.6

%

78.8

%

89.2

%

86.9

%

Three Months Ended

Six Months Ended

(Unaudited)

March 31,

March 31,

(Thousands, except customer, RECs and

megawatt)

2024

2023

2024

2023

CLEAN ENERGY VENTURES

Operating Revenues

SREC sales

$

100

$

6,237

$

26,031

$

10,123

TREC sales

2,257

2,085

4,660

3,287

SREC II sales (1)

415

97

662

282

Solar electricity sales

3,696

3,067

7,350

7,649

Sunlight Advantage

2,857

2,920

5,917

5,857

Total Operating Revenues

$

9,325

$

14,406

$

44,620

$

27,198

Depreciation and Amortization

$

6,931

$

6,465

$

13,853

$

12,041

Operating (Loss) Income

$

(7,679

)

$

(5,002

)

$

10,644

$

(5,323

)

Income Tax (Benefit) Provision

$

(1,594

)

$

(3,005

)

$

1,537

$

(4,842

)

Net (Loss) Income

$

(5,616

)

$

(9,379

)

$

4,906

$

(12,961

)

Net Financial (Loss) Earnings

$

(5,616

)

$

(9,379

)

$

4,906

$

(12,961

)

Solar Renewable Energy Certificates

Generated

57,635

63,313

151,205

161,775

Solar Renewable Energy Certificates

Sold

714

30,745

123,153

47,557

Transition Renewable Energy

Certificates Generated

15,847

12,524

32,552

20,869

Solar Renewable Energy Certificates II

Generated

4,693

1,046

7,466

2,830

Solar Megawatts Under

Construction

34.2

11.2

34.2

11.2

(1) Prior year SREC II revenue was

previously included in Solar electricity sales and other

ENERGY SERVICES

Operating Income

Operating revenues

$

144,862

$

196,730

$

244,530

$

518,512

Less:

Gas purchases

105,634

161,114

165,800

394,401

Operation and maintenance expense

13,639

8,322

18,747

9,445

Depreciation and amortization

56

62

113

119

Operating Income

$

25,533

$

27,232

$

59,870

$

114,547

Net Income

$

17,028

$

19,046

$

40,961

$

83,607

Financial Margin

$

65,581

$

38,208

$

84,589

$

110,789

Net Financial Earnings

$

37,644

$

21,125

$

45,475

$

73,658

Gas Sold and Managed (Bcf)

38.3

40.8

68.4

85.0

STORAGE AND TRANSPORTATION

Operating Revenues

$

23,042

$

20,887

$

46,904

$

47,725

Equity in Earnings of

Affiliates

$

85

$

977

$

1,078

$

1,886

Operation and Maintenance

Expense

$

10,563

$

7,790

$

20,663

$

15,264

Other Income, Net

$

2,473

$

1,647

$

4,761

$

3,014

Interest Expense

$

5,868

$

6,128

$

11,801

$

12,835

Income Tax Provision

$

619

$

596

$

1,651

$

2,539

Net Income

$

1,981

$

2,600

$

5,621

$

8,843

Net Financial Earnings

$

1,981

$

2,450

$

5,621

$

8,693

HOME SERVICES AND OTHER

Operating Revenues

$

14,905

$

13,448

$

29,739

$

27,714

Operating Income

$

778

$

1,137

$

570

$

1,188

Net Income (Loss)

$

384

$

813

$

(216

)

$

784

Net Financial Earnings (Loss)

$

384

$

813

$

(216

)

$

784

Total Service Contract Customers at Mar

31

100,341

102,057

100,341

102,057

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240506741614/en/

Media Contact: Mike Kinney 732-938-1031

mkinney@njresources.com

Investor Contact: Adam Prior 732-938-1145

aprior@njresources.com

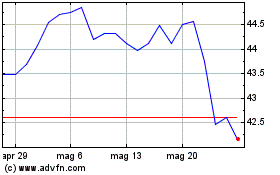

Grafico Azioni New Jersey Resources (NYSE:NJR)

Storico

Da Feb 2025 a Mar 2025

Grafico Azioni New Jersey Resources (NYSE:NJR)

Storico

Da Mar 2024 a Mar 2025