Form 8-K - Current report

21 Novembre 2024 - 6:44PM

Edgar (US Regulatory)

false000035630900003563092024-11-212024-11-21

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): November 21, 2024

NEW JERSEY RESOURCES CORPORATION

(Exact Name of registrant as specified in its charter)

|

New Jersey

|

001-08359

|

22-2376465

|

|

(State or Other Jurisdiction of Incorporation)

|

(Commission File Number)

|

(IRS Employer Identification No.)

|

|

1415 Wyckoff Road

Wall, New Jersey

|

|

07719

|

|

(Address of Principal Executive Offices)

|

|

(Zip Code)

|

(732) 938-1480

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the

following provisions:

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common Stock - $2.50 par value

|

NJR

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter)

or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or

revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 7.01 |

Regulation FD Disclosure.

|

Base Rate Case Settlement

On November 21, 2024, New Jersey Natural Gas Company (“NJNG”) issued a press release announcing it received approval from the New Jersey Board of Public

Utilities on the settlement of its rate case resulting in a $157.0 million increase to its base rates (the “Press Release”) and published an investor fact sheet summarizing the base rate case filing (the “Investor Fact Sheet”). A copy of the Press

Release and Investor Fact Sheet are attached hereto as Exhibit 99.1 and Exhibit 99.2, respectively.

The information in Item 7.01 of this Current Report on Form 8-K is being furnished and shall not be deemed “filed” for the purposes of Section 18 of the

Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that Section and shall not be deemed to be incorporated by reference into any registration statement or other document pursuant to the Securities Act of 1933, as

amended.

| Item 9.01 |

Financial Statements and Exhibits.

|

(d) Exhibits.

|

Exhibit Number

|

|

Exhibit

|

|

|

|

Press Release dated November 21, 2024 (furnished, not filed)

|

|

|

|

Investor Fact Sheet (furnished, not filed)

|

|

104

|

|

Cover page in Inline XBRL format

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the

undersigned hereunto duly authorized.

|

NEW JERSEY RESOURCES CORPORATION

|

|

|

Date: November 21, 2024

|

By:

|

/s/ Roberto F. Bel

|

|

|

Roberto F. Bel

|

|

|

Senior Vice President and Chief Financial Officer

|

Exhibit 99.1

NEW JERSEY BOARD OF PUBLIC UTILITIES APPROVES NEW RATES

FOR NEW JERSEY NATURAL GAS

WALL, NJ, November 21, 2024 – New Jersey Natural

Gas (NJNG) today received approval from the New Jersey Board of Public Utilities on the settlement of its base rate case resulting in a $157 million increase to its base rates. NJNG requested the increase to recover costs associated with the

company’s infrastructure investments, system enhancements and the overall operation of its business.

“This is a reasonable, fair settlement that recognizes the value of the approximately $850 million of investments New Jersey Natural Gas has made in its operations and

system since 2021,” said Steve Westhoven, President and CEO of New Jersey Natural Gas. “These investments have significantly enhanced the reliability of our delivery system and supported the critical operation of our lifeline utility service. We

thank the Board of Public Utilities and the Division of Rate Counsel for their work in reaching an outcome that balances the interests of our customers and our company.”

After a thorough review by regulators, the settlement reflects a rate base of $3.25 billion, an increase in revenue requirement of $157 million, an overall rate of return

of 7.08% (including a return on equity of 9.6% with a 54% equity ratio) and a composite depreciation rate of 3.21%.

The approved rates help ensure the continued responsible operation of NJNG’s business and recovers costs associated with investments made to support critical resiliency

efforts, such as looping and reinforcement projects and the replacement of 140 miles of vintage distribution mains and associated services, as well as the modernization of NJNG’s Customer Service and Dispatch operations and cybersecurity enhancements

consistent with industry standards. It also resolves any outstanding arrearages incurred due to the COVID-19 pandemic.

NJNG’s infrastructure investments have made its system one of the most environmentally sound in the state as measured by the fewest leaks per mile of any natural gas

utility in New Jersey. These investments also position NJNG to deliver the next generation of lower and zero carbon fuels, like clean hydrogen and renewable natural gas, which will play a key role in achieving a cleaner energy future for New Jersey.

Energy assistance is available for customers struggling to pay their natural gas bill. Email energyassist@njng.com or call 800-221-0051 to learn more about eligibility and available programs. Through SAVEGREEN®, NJNG also offers energy-efficiency rebates and financing options for

high-efficiency equipment to help customers save energy and money. For more information, visit savegreenproject.com.

About New Jersey Resources:

New Jersey Resources (NYSE: NJR) is

a Fortune 1000 company that, through its subsidiaries, provides safe and reliable natural gas and clean energy services, including transportation, distribution, asset management and home services. NJR is composed of five primary businesses:

| • |

New Jersey Natural Gas, NJR’s principal

subsidiary, operates and maintains natural gas transportation and distribution infrastructure to serve customers in New Jersey’s Monmouth, Ocean, Morris, Middlesex, Sussex and Burlington counties.

|

| • |

Clean Energy Ventures invests in, owns and

operates solar projects, providing residential and commercial customers with low-carbon solutions.

|

| • |

Energy Services manages a diversified

portfolio of natural gas transportation and storage assets and provides physical natural gas services and customized energy solutions to its customers across North America.

|

| • |

Storage and Transportation serves customers

from local distributors and producers to electric generators and wholesale marketers through its ownership of Leaf River and the Adelphia Gateway Pipeline, as well as our 50% equity ownership in the Steckman Ridge natural gas storage

facility.

|

| • |

Home Services provides service contracts as

well as heating, central air conditioning, water heaters, standby generators, solar and other indoor and outdoor comfort products to residential homes throughout New Jersey.

|

NJR and its over 1,300 employees are committed to helping customers save energy and money by promoting conservation and encouraging efficiency through

Conserve to Preserve® and initiatives such as The SAVEGREEN Project® and The Sunlight Advantage®.

For more information about NJR, visit www.njresources.com.

Follow us on X.com (Twitter) @NJNaturalGas.

“Like” us on facebook.com/NewJerseyNaturalGas.

# # #

Exhibit 99.2

NJR CONTACT:

Adam Prior

Director, Investor Relations

Office Phone: 732-938-1145

aprior@njresources.com

www.njresources.com

1415 Wyckoff Road Wall, NJ 07719

November 21, 2024

NEW JERSEY NATURAL GAS COMPANY

SUMMARY OF BASE RATE CASE SETTLEMENT

A 29% Increase in Rate Base to $3.245 Billion

At its regularly scheduled meeting today, the New Jersey Board of Public Utilities (“BPU”) approved a $157.0 million base rate increase for New Jersey Natural Gas

Company (“NJNG” or the “Company”), the principal subsidiary of New Jersey Resources Corporation (NJR). New base rates will be effective on November 21, 2024.

BACKGROUND

NJNG filed a base rate case in January 2024 seeking a $222.6 million increase in its delivery rates. Based upon its final update, NJNG supported an

increase of $219.9 million, reflecting the Company’s actual test year. Since the conclusion of its last base rate case in 2021, NJNG has invested approximately $850 million to upgrade and enhance the safety and reliability of its transmission and

distribution systems.

KEY PROVISIONS

The rate case settlement (the “Settlement”) contains several important components including:

| • |

A 29% increase in rate base to $3.245 billion from $2.523 billion.

|

| • |

An overall rate of return of 7.08% calculated as follows:

|

| |

Ratios

|

Cost Rate

|

Weighted Cost Rate

|

|

Long-term Debt

|

46.0%

|

4.11%

|

1.89%

|

|

Common Equity

|

54.0%

|

9.60%

|

5.18%

|

|

Total

|

100.0%

|

|

7.08%

|

| • |

An agreed upon Return on Equity of 9.60% with a 54.0% equity ratio. This maintains the 9.60% ROE with a 54.0% equity ratio in NJNG’s last base rate case in 2021.

|

| • |

Increasing the existing composite depreciation rate to 3.21%.

|

REVENUE INCREASE DETAILS

The following components support the revenue increase in the Settlement:

|

($ millions, except as noted)

|

|

|

|

|

Rate Base

|

|

$

|

3,245

|

|

|

Rate of Return

|

|

|

7.08

|

%

|

|

Income Requirement

|

|

$

|

229.6

|

|

|

Pro-Forma Income

|

|

$

|

117.7

|

|

|

Operating Income Deficiency

|

|

$

|

111.9

|

|

|

Revenue Factor

|

|

|

1.4029

|

|

|

Revenue Requirement

|

|

$

|

157.0

|

|

RECONCILIATION

The primary differences between the Company’s original request and the increase granted are as follows:

|

($ millions)

|

|

Amount

|

|

|

AMOUNT REQUESTED – January 2024

|

|

|

|

|

$

|

222.6

|

|

| |

|

|

|

|

|

|

|

|

UPDATES

|

|

|

|

|

|

|

|

|

Rate Base/Cost of Debt Updates

|

|

|

(3.7

|

)

|

|

|

|

|

|

Operating Income Updates

|

|

|

1.0

|

|

|

|

(2.7

|

)

|

|

SUPPORTED AMOUNT AFTER UPDATES – November 2024

|

|

|

|

|

|

$

|

219.9

|

|

| |

|

|

|

|

|

|

|

|

|

SETTLEMENT RECONCILIATION

|

|

|

|

|

|

|

|

|

|

Reduction in Rate Base/WACC

|

|

|

(31.0

|

)

|

|

|

|

|

|

Operating Income Adjustments

|

|

|

(31.9

|

)

|

|

|

(62.9

|

)

|

| |

|

|

|

|

|

|

|

|

|

SETTLEMENT AMOUNT

|

|

|

|

|

|

$

|

157.0

|

|

| |

|

|

|

|

|

|

|

|

COMPARISON OF PREVIOUS NJNG BASE RATE CASES

Listed below is a comparison of the major financial aspects of NJNG’s last three base rate cases:

|

($ millions, except as noted)

|

|

November 2024 Order

|

|

|

November 2021

Order

|

|

|

November 2019

Order

|

|

|

Rate Base

|

|

$

|

3,245

|

|

|

$

|

2,523

|

|

|

$

|

1,764

|

|

|

Common Equity Component

|

|

|

54.0

|

%

|

|

|

54.0

|

%

|

|

|

54.0

|

%

|

|

Return on Equity

|

|

|

9.60

|

%

|

|

|

9.60

|

%

|

|

|

9.60

|

%

|

|

Depreciation Rate

|

|

|

3.21

|

%

|

|

|

2.78

|

%

|

|

|

2.78

|

%

|

|

Filing Date

|

|

January 2024

|

|

|

March 2021

|

|

|

March 2019

|

|

FORWARD-LOOKING STATEMENTS:

This investor fact sheet contains forward-looking statements within the meaning of

Section 27A of the Securities Act of 1933, as amended, Section 21E of the Securities Exchange Act of 1934, as amended, and the Private Securities Litigation Reform Act of 1995. NJR cautions readers that the assumptions forming the basis for

forward-looking statements include many factors that are beyond NJR’s ability to control or estimate precisely, such as estimates of future market conditions and the behavior of other market participants. Words such as “anticipates,” “estimates,”

“expects,” “projects,” “may,” “will,” “intends,” “plans,” “believes,” “should” and similar expressions may identify forward-looking statements and such forward-looking statements are made based upon management’s current expectations, assumptions

and beliefs as of this date concerning future developments and their potential effect upon NJR. There can be no assurance that future developments will be in accordance with management’s expectations, assumptions and beliefs or that the effect of future developments on NJR will be those anticipated by management. Forward-looking statements in this investor fact sheet include, but are not limited to, certain statements NJNG’s base rate case and

investment programs.

Additional information and factors that could cause actual results to differ materially from NJR’s expectations are contained in NJR’s filings with

the U.S. Securities Exchange Commission (“SEC”), including NJR’s Annual Reports on Form 10-K and subsequent Quarterly Reports on Form 10-Q, recent Current Reports on Form 8-K, and other SEC filings, which are available at the SEC’s web site,

http://www.sec.gov. Information included in this investor fact sheet is representative as of today only and while NJR periodically reassesses material trends and uncertainties affecting NJR’s results of operations and financial condition in

connection with its preparation of management’s discussion and analysis of results of operations and financial condition contained in its Quarterly and Annual Reports filed with the SEC, NJR does not, by including this statement, assume any

obligation to review or revise any particular forward-looking statement referenced herein in light of future events.

About New Jersey Resources

New Jersey Resources (NYSE: NJR) is a Fortune 1000 company that, through its subsidiaries, provides safe and reliable natural gas and clean energy

services, including transportation, distribution, asset management and home services. NJR is composed of five primary businesses:

| • |

New Jersey Natural Gas, NJR’s principal subsidiary, operates and maintains natural gas transportation and distribution infrastructure to serve customers in New Jersey’s Monmouth,

Ocean, Morris, Middlesex, Sussex and Burlington counties.

|

| • |

Clean Energy Ventures invests in, owns and operates solar projects, providing residential and customers with low-carbon solutions.

|

| • |

Energy Services manages a diversified portfolio of natural gas transportation and storage assets and provides physical natural gas services and customized energy solutions to its

customers across North America.

|

| • |

Storage and Transportation serves customers from local distributors and producers to electric generators and wholesale marketers through its ownership of Leaf River and the

Adelphia Gateway Pipeline, as well as our 50% equity ownership in the Steckman Ridge natural gas storage facility.

|

| • |

Home Services provides service contracts as well as heating, central air conditioning, water heaters, standby generators, solar and other indoor and outdoor comfort products to

residential homes throughout New Jersey.

|

NJR and its over 1,300 employees are committed to helping customers save energy and money by promoting conservation and encouraging efficiency

through Conserve to Preserve® and initiatives such as The SAVEGREEN Project® and The Sunlight Advantage®.

For more information about NJR: www.njresources.com.

Follow us on X.com (Twitter) @NJNaturalGas.

“Like” us on facebook.com/NewJerseyNaturalGas

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

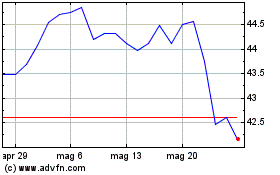

Grafico Azioni New Jersey Resources (NYSE:NJR)

Storico

Da Feb 2025 a Mar 2025

Grafico Azioni New Jersey Resources (NYSE:NJR)

Storico

Da Mar 2024 a Mar 2025