UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D/A

Under the Securities Exchange Act of 1934

(Amendment No. 1)*

Tortoise Midstream Energy Fund, Inc

(Name of Issuer)

Common Shares, $0.001 par value

(Title of Class of Securities)

89148B200

(CUSIP Number)

Saba Capital Management, L.P.

405 Lexington Avenue

58th Floor

New York, NY 10174

Attention: Michael D'Angelo

(212) 542-4635

(Name, Address and Telephone Number of Person

Authorized to Receive Notices and Communications)

June 29, 2023

(Date of Event Which Requires Filing of This Statement)

If the filing person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of Rule 13d-1(e), Rule 13d-1(f) or Rule 13d-1(g), check the following box. [X]

(Page 1 of 8 Pages)

______________________________

* The remainder of this cover page shall be filled out for a reporting person's initial filing on this form with respect to the subject class of securities, and for any subsequent amendment containing information which would alter disclosures provided in a prior cover page.

The information required on the remainder of this cover page shall not be deemed to be "filed" for the purpose of Section 18 of the Securities Exchange Act of 1934 ("Act") or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see the Notes).

1

|

NAME OF REPORTING PERSON |

| Saba Capital Management, L.P. |

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a) ☐ |

| |

(b) ☐ |

3

|

SEC USE ONLY |

| |

4

|

SOURCE OF FUNDS |

| OO (see Item 3) |

| 5 |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDING IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e)

|

☐ |

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION |

| Delaware |

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON WITH: |

7

|

SOLE VOTING POWER |

| -0- |

8

|

SHARED VOTING POWER |

| 489,221 |

9

|

SOLE DISPOSITIVE POWER |

| -0- |

10

|

SHARED DISPOSITIVE POWER |

| 489,221 |

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH PERSON |

| 489,221 |

| 12 |

CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

|

☐ |

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) |

| 9.13% |

14

|

TYPE OF REPORTING PERSON |

| PN; IA |

| |

|

|

|

The percentages used herein are calculated based upon 5,361,000 shares of common stock outstanding as of 11/30/22, as disclosed in the company's N-CSR filed 2/22/23

1

|

NAME OF REPORTING PERSON |

| Boaz R. Weinstein |

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a) ☐ |

| |

(b) ☐ |

3

|

SEC USE ONLY |

| |

4

|

SOURCE OF FUNDS |

| OO (see Item 3) |

| 5 |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDING IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e)

|

☐ |

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION |

| United States |

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON WITH: |

7

|

SOLE VOTING POWER |

| -0- |

8

|

SHARED VOTING POWER |

| 489,221 |

9

|

SOLE DISPOSITIVE POWER |

| -0- |

10

|

SHARED DISPOSITIVE POWER |

| 489,221 |

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH PERSON |

| 489,221 |

| 12 |

CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

|

☐ |

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) |

| 9.13% |

14

|

TYPE OF REPORTING PERSON |

| IN |

| |

|

|

|

The percentages used herein are calculated based upon 5,361,000 shares of common stock outstanding as of 11/30/22, as disclosed in the company's N-CSR filed 2/22/23

1

|

NAME OF REPORTING PERSON |

| Saba Capital Management GP, LLC |

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a) ☐ |

| |

(b) ☐ |

3

|

SEC USE ONLY |

| |

4

|

SOURCE OF FUNDS |

| OO (see Item 3) |

| 5 |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDING IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e)

|

☐ |

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION |

| Delaware |

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON WITH: |

7

|

SOLE VOTING POWER |

| -0- |

8

|

SHARED VOTING POWER |

| 489,221 |

9

|

SOLE DISPOSITIVE POWER |

| -0- |

10

|

SHARED DISPOSITIVE POWER |

| 489,221 |

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH PERSON |

| 489,221 |

| 12 |

CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

|

☐ |

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) |

| 9.13% |

14

|

TYPE OF REPORTING PERSON |

| OO |

| |

|

|

|

The percentages used herein are calculated based upon 5,361,000 shares of common stock outstanding as of 11/30/22, as disclosed in the company's N-CSR filed 2/22/23

|

Item 1.

|

SECURITY AND ISSUER

|

|

|

|

|

|

This Amendment No. 1 amends and supplements on Schedule 13D filed with the SEC on 3/20/23; with respect to Tortoise Midstream Energy Fund, Inc.This Amendment No. 1 amends Items 3, 4, 5 and 7 as set forth below.

|

|

|

|

|

Item 3.

|

SOURCE AND AMOUNT OF FUNDS OR OTHER CONSIDERATION

|

|

|

|

|

|

Funds for the purchase of the Common Shares were derived from the subscription proceeds from investors and the capital appreciation thereon and margin account borrowings made in the ordinary course of business. In such instances, the positions held in the margin accounts are pledged as collateral security for the repayment of debit balances in the account, which may exist from time to time. Since other securities are held in the margin accounts, it is not possible to determine the amounts, if any, of margin used to purchase the Common Shares reported herein. A total of approximately $16,524,209 was paid to acquire the Common Shares reported herein.

|

| |

|

|

Item 4.

|

PURPOSE OF TRANSACTION

|

| |

|

|

|

Item 4 is hereby amended and supplemented as follows:

On June 29, 2023, Saba Capital Master Fund, Ltd. and Saba Capital Management, L.P., filed a complaint (the "Complaint") in the United States District Court's Southern District of New York against the Issuer, among others, seeking to invalidate as unlawful under the Investment Company Act of 1940, provisions in the Issuer's (and others) governing documents purporting to opt-in to the Maryland Control Share Acquisition Act, which strips voting rights with respect to a shareholder's acquisition of shares constituting as little as 10% of the Issuer's voting power.

The foregoing summary of the Complaint does not purport to be complete and is qualified in its entirety by reference to the full text of the Complaint, a copy of which is attached as Exhibit 2 and is incorporated by reference herein.

|

| |

|

|

Item 5.

|

INTEREST IN SECURITIES OF THE ISSUER

|

|

|

|

|

(a)

|

See rows (11) and (13) of the cover pages to this Schedule 13D for the aggregate number of Common Shares and percentages of the Common Shares beneficially owned by each of the Reporting Persons. The percentages used herein are calculated based upon 5,361,000 shares of common stock outstanding as of 11/30/22, as disclosed in the company's N-CSR filed 2/22/23

|

|

|

|

|

(b)

|

See rows (7) through (10) of the cover pages to this Schedule 13D/A for the number of Common Shares as to which each Reporting Person has the sole or shared power to vote or direct the vote and sole or shared power to dispose or to direct the disposition.

|

|

(c)

|

The transactions in the Common Shares effected since the Schedule 13D filing on 3/20/23 by the Reporting Persons, which were all in the open market, are set forth in Schedule A, and are incorporated herein by reference

|

|

|

|

|

(d)

|

The funds and accounts advised by Saba Capital have the right to receive the dividends from and proceeds of sales from the Common Shares.

|

|

|

|

|

(e)

|

Not applicable.

|

|

|

|

|

Item 7.

|

MATERIAL TO BE FILED AS EXHIBITS

|

|

|

|

|

Exhibit 2:

|

Complaint.

|

SIGNATURES

After reasonable inquiry and to the best of his or its knowledge and belief, each of the undersigned certifies that the information set forth in this statement is true, complete and correct.

Date: June 30, 2023

| |

SABA CAPITAL MANAGEMENT, L.P.

By: /s/ Michael D'Angelo |

| |

Name: Michael D'Angelo

Title: Chief Compliance Officer |

| |

|

| |

|

| |

SABA CAPITAL MANAGEMENT GP, LLC

By: /s/ Michael D'Angelo

Name: Michael D'Angelo

Title: Authorized Signatory |

| |

|

| |

|

| |

BOAZ R. WEINSTEIN

By: /s/ Michael D'Angelo |

| |

Name: Michael D'Angelo |

| |

Title: Attorney-in-fact* |

* Pursuant to a power of attorney dated as of November 16, 2015, which is incorporated herein by reference to Exhibit 2 to the Schedule 13G filed by the Reporting Persons on December 28, 2015, accession number: 0001062993-15-006823 |

|

Schedule A

This Schedule sets forth information with respect to each purchase and sale of Common Shares which were effectuated by Saba Capital since the filing of the Schedule 13D on 3/20/23. All transactions were effectuated in the open market through a broker.

| Trade Date |

Buy/Sell |

Shares |

Price |

| 3/20/2023 |

Sell |

(5,200) |

31.53 |

| 3/21/2023 |

Sell |

(3,500) |

32.43 |

| 3/22/2023 |

Sell |

(7,845) |

32.05 |

| 3/23/2023 |

Sell |

(3,223) |

31.67 |

| 3/27/2023 |

Sell |

(5,565) |

31.21 |

| 3/31/2023 |

Sell |

(11,670) |

33.05 |

| 4/3/2023 |

Sell |

(7,033) |

34.15 |

| 5/22/2023 |

Sell |

(9,364) |

32.67 |

EXHIBIT 2

COMPLAINT

|

UNITED STATES DISTRICT COURT

SOUTHERN DISTRICT OF NEW YORK

|

|

SABA CAPITAL MASTER FUND, LTD., and SABA CAPITAL MANAGEMENT, L.P.,

Plaintiffs,

v.

CLEARBRIDGE ENERGY MIDSTREAM OPPORTUNITY FUND INC., CLEARBRIDGE MLP AND MIDSTREAM TOTAL RETURN FUND INC., CLEARBRIDGE MLP AND MIDSTREAM FUND INC., WESTERN ASSET INTERMEDIATE MUNI FUND INC., TORTOISE MIDSTREAM ENERGY FUND, INC., TORTOISE ENERGY INDEPENDENCE FUND INC., TORTOISE PIPELINE & ENERGY FUND INC., TORTOISE ENERGY INFRASTRUCTURE CORP., ADAMS DIVERSIFIED EQUITY FUND, INC., ADAMS NATURAL RESOURCES FUND, MUNICIPAL INCOME FUND, INC, FS CREDIT OPPORTUNITIES CORP., ECOFIN SUSTAINABLE AND SOCIAL IMPACT TERM FUND, BLACKROCK ESG CAPITAL ALLOCATION TRUST, BLACKROCK INNOVATION AND GROWTH TERM TRUST, ROYCE GLOBAL VALUE TRUST, INC.; R. GLENN HUBBARD, W. CARL KESTER, CYNTHIA L. EGAN, FRANK J. FABOZZI, LORENZO A. FLORES, STAYCE D. HARRIS, J. PHILLIP HOLLOMAN, CATHERINE A. LYNCH, ROBERT FAIRBAIRN, and JOHN M. PERLOWSKI, in their capacity as Trustees of the BlackRock ESG Capital Allocation Trust and BlackRock Innovation and Growth Term Trust; and P. BRADLEY ADAMS, in his capacity as Trustee of the Ecofin Sustainable and Social Impact Term Fund,

Defendants.

|

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

|

Civil Action No. __ Civ. __

COMPLAINT

JURY TRIAL DEMANDED

|

Plaintiffs Saba Capital Management, L.P. ("Saba Capital") and Saba Capital Master Fund, Ltd. ("Saba Master Fund") (together, "Saba"), for their Complaint against defendants ClearBridge Energy Midstream Opportunity Fund Inc. ("EMO"), ClearBridge MLP and Midstream Total Return Fund Inc. ("CTR"), ClearBridge MLP and Midstream Fund Inc. ("CEM"), Western Asset Intermediate Muni Fund Inc. ("SBI"), Tortoise Midstream Energy Fund, Inc. ("NTG"), Tortoise Energy Independence Fund, Inc. ("NDP"), Tortoise Pipeline & Energy Fund, Inc. ("TTP"), Tortoise Energy Infrastructure Corp. ("TYG"), Adams Diversified Equity Fund, Inc. ("ADX"), Adams Natural Resources Fund ("PEO"), Municipal Income Fund, Inc. ("MUI"), FS Credit Opportunities Corp. ("FSCO"), Royce Global Value Trust, Inc. ("RGT"), Ecofin Sustainable and Social Impact Term Fund ("TEAF," or the "Ecofin Trust"), BlackRock ESG Capital Allocation Trust ("ECAT," or the "Blackrock ECAT Trust"), BlackRock Innovation and Growth Term Trust ("BIGZ," or the "BlackRock BIGZ Trust," and collectively with the BlackRock ECAT Trust, the "BlackRock Trusts," and together with the Ecofin Trust, the "Trusts") (together, the "Funds"); P. Bradley Adams, in his capacity as trustee of the Ecofin Trust (the "Ecofin Trustee"); R. Glenn Hubbard, W. Carl Kester, Cynthia L. Egan, Frank J. Fabozzi, Lorenzo A. Flores, Stayce D. Harris, J. Phillip Holloman, Catherine A. Lynch, Robert Fairbairn, and John M. Perlowski, in their capacity as trustees of the BlackRock Trusts (the "BlackRock Trustees," and collectively with the Ecofin Trustee, the "Trustees"; and the Trustees, collectively with the Funds, "Defendants"), state as follows:

NATURE OF THE ACTION

1. This civil action arises from the Funds' adoption of provisions in their governing documents purporting to opt-in to the Maryland Control Share Acquisition Act ("MCSAA"), Md. Code Ann., Corps. & Ass'ns §§ 3-701 et seq., which strips voting rights from shares acquired in a "Control Share Acquisition," defined to include the acquisition of shares constituting as little as 10% of the voting power of the Funds, id. §§ 3-701(d)(1), (e)(1), 3-702(a)(1). See Plaintiffs' Rule 56.1 Statement of Undisputed Material Facts ¶¶ 29-48 (collectively, the "Control Share Provisions").

2. The Control Share Provisions violate the Investment Company Act of 1940 (the "40 Act"), pursuant to which all common shares "shall be a voting stock and have equal voting rights with every other outstanding voting stock." 15 U.S.C. § 80a-18(i).

3. As the beneficial owner of sizable holdings of the outstanding common shares of each of the Funds, Saba Capital and the funds it manages, including Saba Master Fund, have been harmed by the Control Share Provisions.

4. Saba seeks rescission of the Control Share Provisions pursuant to Section 47(b)(2) of the 40 Act. Oxford Univ. Bank v. Lansuppe Feeder, LLC, 933 F.3d 99, 109 (2d Cir. 2019) ("ICA § 47(b)(2) [15 U.S.C. § 80a-46(b)(1)] creates an implied private right of action for a party to a contract that violates the ICA to seek rescission of that violative contract.").

PARTIES

5. Plaintiff Saba Capital is a limited partnership organized under the laws of Delaware with its principal place of business located at 405 Lexington Avenue, New York, New York. It is the investment manager of Saba Master Fund and other investment funds, which are collectively the beneficial owners of 17.7% of the outstanding shares of EMO, 12.9% of the outstanding shares of CTR, 10.6% of the outstanding shares of CEM, 6.2% of the outstanding shares of SBI, 9.1% of the outstanding shares of NTG, 9.1% of the outstanding shares of NDP, 7.9% of the outstanding shares of TTP, 3.7% of the outstanding shares of ADX, 6.6% of the outstanding shares of TEAF, 12.8% of the outstanding shares of ECAT, 3.5% of the outstanding shares of TYG, 2.7% of the outstanding shares of PEO, 2.7% of the outstanding shares of MUI, 3.2% of the outstanding shares of FSCO, 2.0% of the outstanding shares of RGT, and 7.7% of the outstanding shares of BIGZ.

6. Plaintiff Saba Master Fund is a Cayman Islands exempted company that currently beneficially holds common shares of each of the Funds.

7. Defendant ClearBridge Energy Midstream Opportunity Fund Inc. is a Maryland corporation, listed on the New York Stock Exchange under ticker symbol "EMO," which conducts substantial business in New York.

8. Defendant ClearBridge MLP and Midstream Total Return Fund Inc. is a Maryland corporation, listed on the New York Stock Exchange under ticker symbol "CTR," which conducts substantial business in New York.

9. Defendant ClearBridge MLP and Midstream Fund Inc. is a Maryland corporation, listed on the New York Stock Exchange under ticker symbol "CEM," which conducts substantial business in New York.

10. Defendant Western Asset Intermediate Muni Fund Inc. is a Maryland corporation, listed on the New York Stock Exchange under ticker symbol "SBI," which conducts substantial business in New York.

11. Defendant Tortoise Midstream Energy Fund, Inc. is a Maryland corporation, listed on the New York Stock Exchange under ticker symbol "NTG," which conducts substantial business in New York.

12. Defendant Tortoise Energy Independence Fund, Inc. is a Maryland corporation, listed on the New York Stock Exchange under ticker symbol "NDP," which conducts substantial business in New York.

13. Defendant Tortoise Pipeline & Energy Fund, Inc. is a Maryland corporation, listed on the New York Stock Exchange under ticker symbol "TTP," which conducts substantial business in New York.

14. Defendant Tortoise Energy Infrastructure Corp. is a Maryland corporation listed on the New York Stock Exchange under ticker symbol "TYG," which conducts substantial business in New York.

15. Defendant Adams Diversified Equity Fund, Inc. is a Maryland corporation, listed on the New York Stock Exchange under ticker symbol "ADX," which conducts substantial business in New York.

16. Defendant Adams Natural Resources Fund is a Maryland corporation listed on the New York Stock Exchange under ticker symbol "PEO," which conducts substantial business in New York.

17. Defendant Municipal Income Fund, Inc. is a Maryland corporation listed on the New York Stock Exchange under ticker symbol "MUI," which conducts substantial business in New York.

18. Defendant FS Credit Opportunities Corp. is a Maryland corporation listed on the New York Stock Exchange under ticker symbol "FSCO," which conducts substantial business in New York.

19. Defendant Royce Global Value Trust, Inc. is a Maryland corporation listed on the New York Stock Exchange under ticker symbol "RGT," which conducts substantial business in New York

20. Defendant Ecofin Sustainable and Social Impact Term Fund is a Maryland business trust, listed on the New York Stock Exchange under ticker symbol "TEAF," which conducts substantial business in New York.

21. Defendant BlackRock ESG Capital Allocation Trust is a Maryland business trust, listed on the New York Stock Exchange under ticker symbol "ECAT," which conducts substantial business in New York.

22. Defendant BlackRock Innovation and Growth Term Trust is a Maryland business trust, listed on the New York Stock Exchange under ticker symbol "BIGZ," which conducts substantial business in New York.

23. Defendant P. Bradley Adams is a citizen of Kansas, a current trustee of the Ecofin Trust, and has been its sole trustee since 2018.

24. Defendant R. Glenn Hubbard is a citizen of New York, a current trustee of the BlackRock Trusts, and has been a trustee of the BlackRock Trusts since 2007.

25. Defendant W. Carl Kester is a citizen of Massachusetts, a current trustee of the BlackRock Trusts, and has been a trustee of the BlackRock Trusts since 2007.

26. Defendant Cynthia L. Egan is a citizen of Florida, a current trustee of the BlackRock Trusts, and has been a trustee of the BlackRock Trusts since 2016.

27. Defendant Frank J. Fabozzi is a citizen of Maryland, a current trustee of the BlackRock Trusts, and has been a trustee of the BlackRock Trusts since 2007.

28. Defendant Lorenzo A. Flores is a citizen of California, a current trustee of the BlackRock Trusts, and has been a trustee of the BlackRock Trusts since 2021.

29. Defendant Stayce D. Harris is a citizen of California, a current trustee of the BlackRock Trusts, and has been a trustee of the BlackRock Trusts since 2021.

30. Defendant J. Phillip Holloman is a citizen of Ohio, a current trustee of the BlackRock Trusts, and has been a trustee of the BlackRock Trusts since 2021.

31. Defendant Catherine A. Lynch is a citizen of Virginia, a current trustee of the BlackRock Trusts, and has been a trustee of the BlackRock Trusts since 2016.

32. Defendant Robert Fairbairn is a citizen of New York, a current trustee of the BlackRock Trusts, and has been a trustee of the BlackRock Trusts since 2018.

33. Defendant John M. Perlowski is a citizen of New Jersey, a current trustee of the BlackRock Trusts, and has been a trustee of the BlackRock Trusts since 2015.

JURISDICTION AND VENUE

34. This Court has jurisdiction over the subject matter of this action pursuant to Section 44 of the 40 Act, 15 U.S.C. § 80a-43, 28 U.S.C.A. § 1331, and 28 U.S.C. § 1391(b).

35. This Court has personal jurisdiction over the Funds because each of the Funds has sufficient minimum contacts within the District as to render the exercise of jurisdiction over Defendants by this Court permissible under traditional notions of due process and the law of the State of New York, including N.Y. C.P.L.R. § 302, including by conducting continuous and systematic business in this District and causing harm to Saba in this District.

36. Venue is proper in this judicial district pursuant to 28 U.S.C. §§ 1391(b)-(c) because a substantial part of the events giving rise to the claim occurred in this District, Saba has been harmed in this District, and the Defendants are subject to personal jurisdiction in this District.

FACTUAL BACKGROUND

37. The Funds are diversified, closed-end management investment companies registered under the 40 Act.

38. The MCSAA, which applies "only" to "Maryland corporation[s]," strips voting rights from shares acquired in a "Control Share Acquisition," which is defined to include the acquisition of shares constituting as little as 10% of the voting power of the company. Md. Code Ann., Corps. & Ass'ns §§ 3-701(d), 3-709.

39. Closed-end funds registered under the 40 Act are exempt from the requirements of the MCSAA, unless they voluntarily choose to "opt-in" to the statutory scheme. Md. Code Ann., Corps. & Ass'ns § 3-702(c)(3) (this "subtitle does not apply to . . . [a] corporation registered under the Investment Company Act of 1940 as a closed end investment company unless its board of directors adopts a resolution to be subject to this subtitle").

40. The defendant Maryland corporations (namely, EMO, CTR, CEM, SBI, NTG, NDP, TTP, ADX, TYG, PEO, MUI, FSCO, and RGT), have opted-in to the MCSAA pursuant to Section 3-702(c)(3). The defendant Maryland trusts (namely, TEAF, ECAT, and BIGZ) have likewise purported to opt-in to the MCSAA, even though they are not eligible corporations. In any event, all defendants have adopted Control Share Provisions in their governing documents that effectively incorporate the vote-stripping provisions of the MCSAA.

41. By purporting to opt-in to Maryland's Control Share Acquisition Act, the Control Share Provisions strip voting rights from shares acquired in a "Control Share Acquisition." See Md. Code Ann., Corps. & Ass'ns §§ 3-701 et seq. In doing so, the Control Share Provisions deny "voting rights with respect to the control shares" acquired "in a control share acquisition," except "to the extent approved by stockholders . . . by the affirmative vote of two-thirds of all the votes entitled to be cast on the matter, excluding all interested shares." Id. § 3-702(a)(1).

42. The Control Share Provisions are unlawful under the 40 Act, including the "one-share, one-vote" principle enshrined in the 40 Act. Under the 40 Act, all common shares "shall be a voting stock and have equal voting rights with every other outstanding voting stock." 15 U.S.C. § 80a-18(i).

43. The Control Share Provisions directly conflict with the 40 Act's stated policies and purposes, including to prevent discrimination among or against shareholders, and to prevent entrenched management by insiders, by ensuring that every stock be voting stock and have equal voting rights.

44. The Funds' adoption of binding resolutions opting in to the MCSAA, as reflected in, but not limited to, their various Amended and Restated Bylaws and Declarations of Trust are binding contracts between the Funds and Saba.

45. As the beneficial owner of sizable holdings of the outstanding common shares of each of the Funds and a party to the illegal contracts made by the Funds, Saba Capital and the funds it manages, including Saba Master Fund, have been and continue to be harmed by the Control Share Provisions.

46. Saba's ownership interest in EMO, CTR, CEM, and ECAT is over 10%. Because of the Control Share Provisions, none of Saba's incremental shares over 10% in these Funds has voting rights. Accordingly, EMO, CTR, CEM, and ECAT have issued unequal voting stock, and Saba is unable to buy any additional shares that have equal voting rights with all other shares.

47. Funds managed by Saba, including Saba Master Fund, have not acquired, and will not acquire, as many additional shares in the Funds as they would were the Control Share Provisions not in effect, and the Control Share Provisions have prevented Saba from acquiring voting shares in the Funds with equal voting rights as required by the 40 Act.

48. The Control Share Provisions are harmful to the value of Saba's investment in the Funds, and to Saba's trading activity and business practices, well before Saba approaches accumulating a 10% beneficial stake in any given Fund.

49. The Funds trade at a substantial discount to their net asset value (in other words, the market value of each Fund is less than the combined value of the assets held by that Fund). By interfering with shareholders' ability to hold underperforming fund managers to account, the Control Share Provisions decrease the value of Saba's shares in the Funds. By entrenching the Funds' management, the Control Share Provisions create an agency cost wherein expense ratios, director compensation levels, and managerial advisor fees are higher than they would be absent the Control Share Provisions, decreasing the value of Saba's shares in the Funds.

50. One of Saba's business practices is to exercise the voting rights rightfully associated with Saba's economic stake, in order to make its voice heard in matters pertaining to the management of shareholder capital by the defendant Funds, as well as informing the Funds' directors that shareholders have a means of holding them accountable in votes for the election of directors, approval of advisory agreements, and other governance matters. The Control Share Provisions prevent Saba from trading in the Funds' shares with knowledge that it will be able to acquire sufficient shares to accomplish those goals.

51. Saba cannot determine whether it will be a worthwhile investment to accumulate or maintain more than a 10% beneficial ownership without clarity as to what its voting rights will be if it in fact triggers the Funds' Control Share Provisions. Because Saba develops its position in funds over a number of months and years, and is currently developing positions in the defendant Funds (each of which has an upcoming annual meeting), Saba's trading activity is currently being impeded and harmed by the Funds' Control Share Provisions.

52. Given current market conditions, Saba would acquire more than a 10% beneficial ownership stake in the Funds (to the extent it has not already) were it not for the Funds' Control Share Provisions and the imminent risk that those Control Share Provisions will strip Saba of its equal voting rights.

FIRST CLAIM FOR RELIEF

(Rescission Under the Investment Company Act)

53. Saba repeats and realleges each of the allegations contained in paragraphs 1 through 52 above as if set forth in full herein.

54. The 40 Act provides a private right of action for a party to a contract that violates the 40 Act to seek rescission of that violative contract. Oxford Univ. Bank v. Lansuppe Feeder, LLC, 933 F.3d 99, 109 (2d Cir. 2019) ("ICA § 47(b)(2) [15 U.S.C. § 80a-46(b)(1)] creates an implied private right of action for a party to a contract that violates the ICA to seek rescission of that violative contract.").

55. The Funds' adoption of binding resolutions opting in to the MCSAA, as reflected in, but not limited to, their Amended and Restated Bylaws and Declarations of Trust constitute binding contracts between the Funds and Saba.

56. The Control Share Provisions are unlawful under the 40 Act, rendering so much of the Amended and Restated Bylaws, Declarations of Trust, or other binding resolutions of the Funds as include the Control Share Provisions illegal under the 40 Act. For example, under the 40 Act, all common shares "shall be a voting stock and have equal voting rights with every other outstanding voting stock." 15 U.S.C. § 80a-18(i). Absent relief from the Court, Saba will be irreparably harmed in its ability to beneficially own, hold, and/or acquire shares having the equal voting rights required by the 40 Act and in its ability to exercise its right to vote shares in the Funds.

57. Saba has no adequate remedy at law.

SECOND CLAIM FOR RELIEF

(Declaratory Judgment)

58. Saba repeats and realleges each of the allegations contained in paragraphs 1 through 57 above as if set forth in full herein.

59. The Control Share Provisions prevent funds managed by Saba Capital, including Saba Master Fund, from acquiring voting stock in the Funds with the "equal voting rights" to which such shares are entitled under 15 U.S.C. § 80a-18(i).

60. By adopting bylaws, declaring a trust, and/or otherwise adopting binding resolutions stripping such shares of their voting rights, the Funds have created a substantial and immediate controversy between the parties, of sufficient immediacy and reality to warrant declaratory relief, as to whether doing so violates § 80a-18(i).

61. Accordingly, Saba seeks a declaratory judgment under 28 U.S.C. § 2201 et seq. to determine its rights and obligations, including whether the Control Share Provisions are illegal under 15 U.S.C. § 80a-18(i), and void pursuant to 15 U.S.C. § 80a-46.

PRAYER FOR RELIEF

WHEREFORE, Plaintiff prays for judgment as follows:

a. Declaring that the Control Share Provisions violate the 40 Act, 15 U.S.C. § 80a-18(i);

b. Rescinding the Control Share Provisions, pursuant to 15 U.S.C. § 80a-46;

c. Declaring the Control Share Provisions void, pursuant to 15 U.S.C. § 80a-46;

d. Permanently enjoining Defendants, their agents and representatives, and all other persons acting in concert with them, from applying the Control Share Provisions;

e. Awarding Saba costs and disbursements, including a reasonable allowance for Saba's attorneys' fees and experts' fees and pre- and post-judgment interest; and

f. Such other and further relief as the Court may deem necessary and proper.

DEMAND FOR JURY TRIAL

Pursuant to Rule 38 of the Federal Rules of Civil Procedure, Plaintiff hereby demands a trial by jury as to all issues so triable.

Dated: June 29, 2023

/s/ Mark Musico

Jacob W. Buchdahl

Mark P. Musico

Brandon H. Thomas*

SUSMAN GODFREY LLP

1301 Avenue of the Americas, 32nd Floor New York, NY 10019

Tel: 212-336-8330

jbuchdahl@susmangodfrey.com

mmusico@susmangodfrey.com

bthomas@susmangodfrey.com

* Motion to appear pro hac vice pending.

Attorneys for Plaintiff

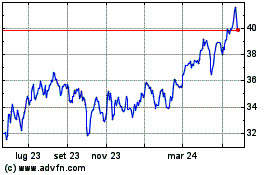

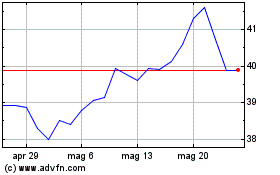

Grafico Azioni Tortoise Midstream Energy (NYSE:NTG)

Storico

Da Apr 2024 a Mag 2024

Grafico Azioni Tortoise Midstream Energy (NYSE:NTG)

Storico

Da Mag 2023 a Mag 2024