Defiance ETFs is proud to unveil ORCX, the first 2X long ETF for

Oracle Corporation. ORCX seeks to provide 200% long daily targeted

exposure to Oracle Corporation (NYSE: ORCL) (the “Underlying

Security” or “ORCL”). Defiance’s single-stock ETFs provide

leveraged exposure to disruptive companies without the need for a

margin account.

"Defiance is excited to launch ORCX, which seeks to provide

amplified exposure to Oracle. Oracle’s Stargate initiative is a

game-changer, enhancing multi-cloud connectivity and driving

seamless data integration across platforms. This innovation

enhances Oracle’s position in enterprise AI and cloud

infrastructure, presenting a potential growth avenue for investors

interested in the evolving tech landscape,” said Sylvia Jablonski,

CEO of Defiance ETFs.

The Fund is not intended to be used by, and is not appropriate

for, investors who do not intend to actively monitor and manage

their portfolios. The Fund pursues a daily leveraged investment

objective, which means that the Fund is riskier than alternatives

that do not use leverage because the Fund magnifies the performance

of its Underlying Security. The Fund is not suitable for

all investors. The Fund is designed to be utilized only by

knowledgeable investors who understand the potential consequences

of seeking daily leveraged (2X) investment results, understand the

risks associated with the use of leverage, and are willing to

monitor their portfolios frequently. The Fund is not intended to be

used by, and is not appropriate for, investors who do not intend to

actively monitor and manage their portfolios. For periods longer

than a single day, the Fund will lose money if the Underlying

Security’s performance is flat, and it is possible that the Fund

will lose money even if the Underlying Security’s performance

increases over a period longer than a single day. An investor could

lose the full principal value of his/her investment within a single

day.

An investment in the ETF is not an investment in Oracle

Corporation.

About Defiance ETFs

Founded in 2018, Defiance is at the forefront of ETF innovation.

Defiance is a leading ETF issuer specializing in thematic, income,

and leveraged ETFs.

Our first-mover leveraged single-stock ETFs empower investors to

take amplified positions in high-growth companies, providing

precise leverage exposure without the need to open a margin

account.

Important Disclosures

The fund attempts to provide daily investment results

that correspond to two times (200%) the share price performance of

an underlying exchange-traded fund (an “Underlying Security”). The

Fund is not intended to be used by, and are not appropriate for,

investors who do not intend to actively monitor and manage their

portfolios. The Fund is very different from most mutual funds and

exchange-traded funds. The Fund may not achieve

investment results, before fees and expenses, that correspond to

two times (2x) the daily performance of the Underlying Security,

and may return substantially less during such periods. During such

periods, the Fund's actual leverage levels may differ substantially

from its intended target, both intraday and at the close of

trading, potentially resulting in significantly lower

returns.

The Fund’s investment adviser will not attempt to

position a Fund’s portfolio to ensure that the Fund does not gain

or lose more than a maximum percentage of its net asset value on a

given trading day. As a consequence, if an Underlying Security’s

share price referenced by a Fund decreases by more than 50% on a

given trading day, the corresponding Fund’s investors could lose

all of their money.

Defiance ETFs LLC is the ETF sponsor. The Fund’s investment

adviser is Tidal Investments, LLC (“Tidal” or the “Adviser”).

The Funds' investment objectives, risks, charges, and expenses

must be considered carefully before investing. The prospectus

contains this and other important information about the investment

company. Please read carefully before investing. A hard copy of the

prospectuses can be requested by calling 833.333.9383.

Investing involves risk. Principal loss is possible. As

an ETF, the funds may trade at a premium or discount to NAV. Shares

of any ETF are bought and sold at market price (not NAV) and are

not individually redeemed from the Fund. A portfolio concentrated

in a single industry or country, may be subject to a higher degree

of risk.

Underlying Security Risk. The Fund invests in

swap contracts and options that are based on the share price of

ORCL. This subjects the Fund to certain of the same risks as if it

owned shares of ORCL, even though it does not.

Indirect Investment in ORCL Risk. ORCL is not affiliated with

the Trust, the Fund, or the Adviser, or their respective affiliates

and is not involved with this offering in any way and has no

obligation to consider your Shares in taking any corporate actions

that might affect the value of Shares.

ORCL Trading Risk. The trading price of ORCL may be subject to

volatility and could experience wide fluctuations due to various

factors. Short sellers may also play a significant role in trading

ORCL, potentially affecting the supply and demand dynamics and

contributing to market price volatility. Public perception and

external factors beyond the company’s control may influence ORCL’s

stock price disproportionately.

ORCL Performance Risk. ORCL may fail to meet its publicly

announced guidelines or other expectations about its business,

which could cause the price of ORCL to decline. ORCL provides

guidance regarding its expected financial and business performance,

such as projections regarding sales and production, as well as

anticipated future revenues, gross margins, profitability and cash

flows. Correctly identifying key factors affecting business

conditions and predicting future events is inherently an uncertain

process, and the guidance ORCL provides may not ultimately be

accurate.

Software Industry Risk. The software industry can be

significantly affected by intense competition, aggressive pricing,

technological innovations, and product obsolescence. Companies in

the software industry are subject to significant competitive

pressures, such as aggressive pricing, new market entrants,

competition for market share, short product cycles due to an

accelerated rate of technological developments and the potential

for limited earnings and/or falling profit margins.

Operations and Business Risks. ORCL may be unsuccessful in

developing and selling new products and services, integrating

acquired products and services and enhancing its existing products

and services.

Data Security Risks. If ORCL’s security measures for its

products and services are compromised and as a result, its data,

its customers’ data or its IT systems are accessed improperly, made

unavailable, or improperly modified, ORCL’s products and services

may be perceived as vulnerable, its brand and reputation could be

damaged, the IT services ORCL provides to its customers could be

disrupted, and customers may stop using ORCL’s products and

services, any of which could reduce ORCL’s revenue and earnings,

increase its expenses and expose it to legal claims and regulatory

actions.

Intellectual Property Risks. ORCL relies on copyright,

trademark, patent and trade secret laws, confidentiality

procedures, controls and contractual commitments to protect its

intellectual property. Despite ORCL’s efforts, these protections

may be limited.

Leverage Risk. The Fund obtains investment

exposure in excess of its net assets by utilizing leverage and may

lose more money in market conditions that are adverse to its

investment objective than a fund that does not utilize leverage. An

investment in the Fund is exposed to the risk that a decline in the

daily performance of the Underlying Security will be magnified.

High Portfolio Turnover Risk. Daily rebalancing

of the Fund’s holdings pursuant to its daily investment objective

causes a much greater number of portfolio transactions when

compared to most ETFs.

Liquidity Risk. Some securities held by the

Fund may be difficult to sell or be illiquid, particularly during

times of market turmoil. Markets for securities or financial

instruments could be disrupted by a number of events, including,

but not limited to, an economic crisis, natural disasters,

epidemics/pandemics, new legislation or regulatory changes inside

or outside the United States.

Derivatives Risk. The Fund’s investments in

derivatives may pose risks in addition to, and greater than, those

associated with directly investing in securities or other ordinary

investments, including risk related to the market, leverage,

imperfect daily correlations with underlying investments or the

Fund’s other portfolio holdings, higher price volatility, lack of

availability, counterparty risk, liquidity, valuation and legal

restrictions.

Compounding and Market Volatility Risk. The

Fund has a daily leveraged investment objective and the Fund’s

performance for periods greater than a trading day will be the

result of each day’s returns compounded over the period, which is

very likely to differ from two times (200%) the Underlying

Security’s performance, before the Fund’s management fee and other

expenses.

Fixed Income Securities Risk. When the Fund

invests in fixed income securities, the value of your investment in

the Fund will fluctuate with changes in interest rates. Typically,

a rise in interest rates causes a decline in the value of fixed

income securities owned by the Fund.

Single Issuer Risk. Issuer-specific attributes

may cause an investment in the Fund to be more volatile than a

traditional pooled investment which diversifies risk or the market

generally. The value of the Fund, which focuses on an individual

security, may be more volatile than a traditional pooled investment

or the market as a whole and may perform differently from the value

of a traditional pooled investment or the market as a whole.

New Fund Risk. The Fund is a recently organized

management investment company with no operating history. As a

result, prospective investors do not have a track record or history

on which to base their investment decisions.

Diversification does not ensure a profit nor protect against

loss in a declining market.

Brokerage Commissions may be charged on trades.

Distributed by Foreside Fund Services, LLC

Contact Information:

David Hanono

833.333.9383info@defianceetfs.com

A photo accompanying this announcement is available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/9a2f6854-1043-4edc-8250-60065d17e319

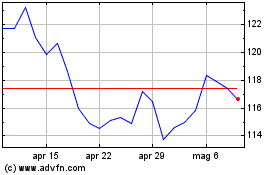

Grafico Azioni Oracle (NYSE:ORCL)

Storico

Da Gen 2025 a Feb 2025

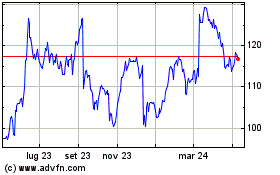

Grafico Azioni Oracle (NYSE:ORCL)

Storico

Da Feb 2024 a Feb 2025