0001413329false00014133292024-02-212024-02-210001413329us-gaap:CommonStockMember2024-02-212024-02-210001413329pm:A2.875Notesdue20241Member2024-02-212024-02-210001413329pm:A2.875Notesdue20242Member2024-02-212024-02-210001413329pm:A0.625Notesdue2024Member2024-02-212024-02-210001413329pm:A3.250Notesdue2024Member2024-02-212024-02-210001413329pm:A2.750Notesdue2025Member2024-02-212024-02-210001413329pm:A3.375Notesdue2025Member2024-02-212024-02-210001413329pm:A2.750Notesdue2026Member2024-02-212024-02-210001413329pm:A2.875Notesdue2026Member2024-02-212024-02-210001413329pm:A0.125Notesdue2026Member2024-02-212024-02-210001413329pm:A3.125Notesdue2027Member2024-02-212024-02-210001413329pm:A3.125Notesdue2028Member2024-02-212024-02-210001413329pm:A2.875Notesdue2029Member2024-02-212024-02-210001413329pm:A3.375Notesdue2029Member2024-02-212024-02-210001413329pm:A0.800Notesdue2031Member2024-02-212024-02-210001413329pm:A3.125Notesdue2033Member2024-02-212024-02-210001413329pm:A2.000Notesdue2036Member2024-02-212024-02-210001413329pm:A1.875Notesdue2037Member2024-02-212024-02-210001413329pm:A6.375Notesdue2038Member2024-02-212024-02-210001413329pm:A1.450Notesdue2039Member2024-02-212024-02-210001413329pm:A4.375Notesdue2041Member2024-02-212024-02-210001413329pm:A4.500Notesdue2042Member2024-02-212024-02-210001413329pm:A3.875Notesdue2042Member2024-02-212024-02-210001413329pm:A4.125Notesdue2043Member2024-02-212024-02-210001413329pm:A4.875Notesdue2043Member2024-02-212024-02-210001413329pm:A4.250Notesdue2044Member2024-02-212024-02-21

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 21, 2024

Philip Morris International Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| | | | |

Virginia | | 1-33708 | | 13-3435103 |

(State or other jurisdiction of incorporation) | | (Commission File Number) | | (I.R.S. Employer Identification No.) |

| | | | | | | | | | | | | | | | | |

| 677 Washington Blvd, Ste. 1100 | Stamford | Connecticut | | | 06901 |

| (Address of principal executive offices) | | | (Zip Code) |

Registrant's telephone number, including area code: (203) 905-2410

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock, no par value | | PM | | New York Stock Exchange |

| | | | | | | | | | | | | | |

| 2.875% Notes due 2024 | | PM24 | | New York Stock Exchange |

| 2.875% Notes due 2024 | | PM24C | | New York Stock Exchange |

| 0.625% Notes due 2024 | | PM24B | | New York Stock Exchange |

| 3.250% Notes due 2024 | | PM24A | | New York Stock Exchange |

| 2.750% Notes due 2025 | | PM25 | | New York Stock Exchange |

| 3.375% Notes due 2025 | | PM25A | | New York Stock Exchange |

| 2.750% Notes due 2026 | | PM26A | | New York Stock Exchange |

| 2.875% Notes due 2026 | | PM26 | | New York Stock Exchange |

| 0.125% Notes due 2026 | | PM26B | | New York Stock Exchange |

| 3.125% Notes due 2027 | | PM27 | | New York Stock Exchange |

| 3.125% Notes due 2028 | | PM28 | | New York Stock Exchange |

| 2.875% Notes due 2029 | | PM29 | | New York Stock Exchange |

| 3.375% Notes due 2029 | | PM29A | | New York Stock Exchange |

| 0.800% Notes due 2031 | | PM31 | | New York Stock Exchange |

| 3.125% Notes due 2033 | | PM33 | | New York Stock Exchange |

| 2.000% Notes due 2036 | | PM36 | | New York Stock Exchange |

| 1.875% Notes due 2037 | | PM37A | | New York Stock Exchange |

| 6.375% Notes due 2038 | | PM38 | | New York Stock Exchange |

| 1.450% Notes due 2039 | | PM39 | | New York Stock Exchange |

| 4.375% Notes due 2041 | | PM41 | | New York Stock Exchange |

| 4.500% Notes due 2042 | | PM42 | | New York Stock Exchange |

| 3.875% Notes due 2042 | | PM42A | | New York Stock Exchange |

| 4.125% Notes due 2043 | | PM43 | | New York Stock Exchange |

| 4.875% Notes due 2043 | | PM43A | | New York Stock Exchange |

| 4.250% Notes due 2044 | | PM44 | | New York Stock Exchange |

| | | | | |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). | |

| | | | | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. | ☐ |

| | | | | |

Item 7.01. | Regulation FD Disclosure. |

On February 21, 2024, Philip Morris International Inc. ("PMI") hosts a live audio webcast at the Consumer Analyst Group of New York Conference where PMI’s Chief Executive Officer, Jacek Olczak, and Chief Financial Officer, Emmanuel Babeau, will address investors. In connection with the presentation, PMI is furnishing to the Securities and Exchange Commission the following documents attached as exhibits to this Current Report on Form 8-K and incorporated by reference to this Item 7.01: (i) the press release, dated February 21, 2024, attached as Exhibit 99.1 hereto; and (ii) the presentation slides, dated February 21, 2024, attached as Exhibit 99.2 hereto.

In accordance with General Instruction B.2 of Form 8-K, the information in Item 7.01 of this Current Report on Form 8-K, including Exhibits 99.1 and 99.2, shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section. The information in Item 7.01 of this Current Report on Form 8-K shall not be incorporated by reference into any filing or other document pursuant to the Securities Act of 1933, as amended, except as may be expressly set forth by specific reference in such filing or document.

| | | | | |

Item 9.01. | Financial Statements and Exhibits. |

| | | | | |

| 104 | Cover Page Interactive Data File (the cover page XBRL tags are embedded within the Inline XBRL document and contained in Exhibit 101). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| | |

| PHILIP MORRIS INTERNATIONAL INC. |

| |

| By: | | /s/ DARLENE QUASHIE HENRY |

| Name: | | Darlene Quashie Henry |

| Title: | | Vice President, Associate General Counsel & Corporate Secretary

|

Date: February 21, 2024

| | | | | | | | | | | | | | |

| PRESS RELEASE | | |

| | | | |

| Investor Relations: | | Media: David Fraser | | |

| Stamford, CT: +1 (203) 904 2413 | | Lausanne: +41 (0)58 242 4500 | | |

| Lausanne: +41 (0)58 242 4666 | | Email: David.Fraser@pmi.com | | |

| Email: InvestorRelations@pmi.com | | | | |

PHILIP MORRIS INTERNATIONAL PRESENTS AT

2024 CAGNY CONFERENCE;

REAFFIRMS 2024 FULL-YEAR FORECAST FOR REPORTED DILUTED EPS

OF $5.90 TO $6.02 AND ADJUSTED DILUTED EPS OF $6.32 TO $6.44,

REPRESENTING CURRENCY-NEUTRAL GROWTH OF 7% TO 9%

STAMFORD, CT, February 21, 2024 – Philip Morris International Inc.’s (PMI) (NYSE: PM) Chief Executive Officer, Jacek Olczak and Chief Financial Officer, Emmanuel Babeau, will address investors today at the 2024 Consumer Analyst Group of New York (CAGNY) Conference.

The event will be webcast live in listen-only mode, beginning at approximately 10:00 a.m. ET, at www.pmi.com/2024cagny and on the PMI Investor Relations Mobile Application (www.pmi.com/irapp). Presentation slides will also be available on the same site and the App. An archived copy of the webcast will be available until Friday, March 22, 2024.

The presentation will cover:

•PMI’s progress to date on becoming a substantially smoke-free business by 2030;

•the science demonstrating why smoke-free products are a much better alternative;

•PMI’s responsible marketing practices;

•the success of company’s strong multi-category portfolio with leading premium brands in heat-not-burn and oral nicotine;

•the first anniversary of our successful combination with Swedish Match, including progress on integration and a planned strategic review of the U.S. cigar business;

•the financial model underlying the company’s smoke-free transformation; and the company’s strong financial and non-financial performance.

2024 Full-Year Forecast

PMI reaffirms its 2024 full-year reported diluted EPS forecast, announced on February 8th, of $5.90 to $6.02. Excluding a total 2024 adjustment of $0.42 per share and an unfavorable currency impact, at currently prevailing exchange rates, of $0.11 per share, this forecast represents a projected currency-neutral increase of 7% to 9% versus adjusted diluted EPS of $6.01 in 2023, as outlined in the below table.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Full-Year |

| 2024 Forecast | | 2023 | Growth |

| | | | | | | | | |

| Reported Diluted EPS | $5.90 | - | $6.02 | | $ 5.02 | | | | |

| | | | | | | | | |

| | | | | | | | | |

| Adjustments: | | | | | | | | | |

| Asset impairment and exit costs | — | | 0.06 | | | | |

| Termination of distribution arrangement in the Middle East | — | | 0.04 | | | | |

| Income tax impact associated with Swedish Match AB financing | — | | (0.11) | | | | |

| Amortization of intangibles | 0.42 | | 0.25 | | | | |

| Impairment of goodwill and other intangibles | — | | 0.44 | | | | |

| Charges related to the war in Ukraine | — | | 0.03 | | | | |

| Swedish Match AB acquisition accounting related item | — | | 0.01 | | | | |

| Termination of agreement with Foundation for a Smoke-Free World | — | | 0.07 | | | | |

| South Korea indirect tax charge | — | | 0.11 | | | | |

| Fair value adj. for equity security investments | — | | (0.02) | | | | |

Tax items (1) | — | | 0.11 | | | | |

| Total Adjustments | 0.42 | | 0.99 | | | | |

| | | | | | | |

| | | | | | | | | |

| Adjusted Diluted EPS | $6.32 | - | $6.44 | | $ 6.01 | | | | |

| Less: Currency | (0.11) | | | | | | |

| Adjusted Diluted EPS, excluding currency | $6.43 | - | $6.55 | | $ 6.01 | | 7.0% | - | 9.0% |

| (1) 2023 Tax items relate to the unilateral suspension of certain Russian double tax treaties by the Russian government |

The assumptions underlying this forecast remain unchanged versus those communicated by PMI in its earnings release of February 8, 2024.

Factors described in the Forward-Looking and Cautionary Statements section of this release represent continuing risks to these projections.

Forward-Looking & Cautionary Statements

The presentation, related discussion and this press release contain projections of future results and goals and other forward-looking statements, including statements regarding business plans and strategies. Achievement of future results is subject to risks, uncertainties and inaccurate assumptions. In the event that risks or uncertainties materialize, or underlying assumptions prove inaccurate, actual results could vary materially from those contained in such forward-looking statements. Pursuant to the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995, PMI is identifying important factors that, individually or in the aggregate, could cause actual results and outcomes to differ materially from those contained in any forward-looking statements made by PMI.

PMI's business risks include: excise tax increases and discriminatory tax structures; increasing marketing and regulatory restrictions that could reduce our competitiveness, eliminate our ability to communicate with adult consumers, or ban certain of our products in certain markets or countries; health concerns relating to the use of tobacco and other nicotine-containing products and exposure to environmental tobacco smoke; litigation related to

tobacco use and intellectual property; intense competition; the effects of global and individual country economic, regulatory and political developments, natural disasters and conflicts; the impact and consequences of Russia's invasion of Ukraine; changes in adult smoker behavior; the impact of COVID-19 on PMI's business; lost revenues as a result of counterfeiting, contraband and cross-border purchases; governmental investigations; unfavorable currency exchange rates and currency devaluations, and limitations on the ability to repatriate funds; adverse changes in applicable corporate tax laws; adverse changes in the cost, availability, and quality of tobacco and other agricultural products and raw materials, as well as components and materials for our electronic devices; and the integrity of its information systems and effectiveness of its data privacy policies. PMI's future profitability may also be adversely affected should it be unsuccessful in its attempts to produce and commercialize reduced-risk products or if regulation or taxation do not differentiate between such products and cigarettes; if it is unable to successfully introduce new products, promote brand equity, enter new markets or improve its margins through increased prices and productivity gains; if it is unable to expand its brand portfolio internally or through acquisitions and the development of strategic business relationships; if it is unable to attract and retain the best global talent, including women or diverse candidates; or if it is unable to successfully integrate and realize the expected benefits from recent transactions and acquisitions. Future results are also subject to the lower predictability of our reduced-risk product category's performance.

PMI is further subject to other risks detailed from time to time in its publicly filed documents, including PMI's Annual Report on Form 10-K for the fourth quarter and year ended December 31, 2023. PMI cautions that the foregoing list of important factors is not a complete discussion of all potential risks and uncertainties. PMI does not undertake to update any forward-looking statement that it may make from time to time, except in the normal course of its public disclosure obligations.

Philip Morris International: Delivering a Smoke-Free Future

Philip Morris International (PMI) is a leading international tobacco company, actively delivering a smoke-free future and evolving its portfolio for the long term to include products outside of the tobacco and nicotine sector. The company’s current product portfolio primarily consists of cigarettes and smoke-free products. Since 2008, PMI has invested $12.5 billion to develop, scientifically substantiate and commercialize innovative smoke-free products for adults who would otherwise continue to smoke, with the goal of completely ending the sale of cigarettes. This includes the building of world-class scientific assessment capabilities, notably in the areas of pre-clinical systems toxicology, clinical and behavioral research, as well as post-market studies. In 2022, PMI acquired Swedish Match – a leader in oral nicotine delivery – creating a global smoke-free champion led by the companies’ IQOS and ZYN brands. The U.S. Food and Drug Administration has authorized versions of PMI’s IQOS Platform 1 devices and consumables and Swedish Match’s General snus as Modified Risk Tobacco Products. As of December 31, 2023, PMI's smoke-free products were available for sale in 84 markets, and PMI estimates that approximately 20.8 million adults around the world had already switched to IQOS and stopped smoking. Smoke-free products accounted for approximately 37% of PMI’s total full-year 2023 net revenues. With a strong foundation and significant expertise in life sciences, PMI announced in February 2021 its ambition to expand into wellness and healthcare areas and, through its Vectura Fertin Pharma business, aims to enhance life through the delivery of seamless health experiences. For more information, please visit www.pmi.com and www.pmiscience.com.

Championing a Smoke-Free World CAGNY Conference February 21, 2024 Jacek Olczak, Chief Executive Officer Emmanuel Babeau, Chief Financial Officer Introduction • A glossary of terms, including the definition for smoke-free products(a) as well as adjustments, other calculations and reconciliations to the most directly comparable U.S. GAAP measures for non-GAAP financial measures cited in this presentation, and additional net revenue data are available on our Investor Relations website with additional non-GAAP reconciliations available at the end of this presentation • Growth rates presented on an organic basis reflect currency-neutral adjusted results, excluding acquisitions and disposals. As such, figures and comparisons presented on an organic basis exclude Swedish Match up until November 11, 2023 2(a) Following the acquisition of Swedish Match, PMI defines “smoke-free products” to include all Swedish Match products other than Swedish Match’s combustible tobacco products, in addition to its heat-not-burn, e-vapor, oral nicotine, and wellness and healthcare products Exhibit 99.2

Forward-Looking and Cautionary Statements • This presentation contains projections of future results and goals and other forward-looking statements, including statements regarding expected financial or operational performance; capital allocation plans; investment strategies; regulatory outcomes; market expectations; and business plans and strategies. Achievement of future results is subject to risks, uncertainties and inaccurate assumptions. In the event that risks or uncertainties materialize, or underlying assumptions prove inaccurate, actual results could vary materially from those contained in such forward-looking statements. Pursuant to the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995, PMI is identifying important factors that, individually or in the aggregate, could cause actual results and outcomes to differ materially from those contained in any forward-looking statements made by PMI • PMI's business risks include: excise tax increases and discriminatory tax structures; increasing marketing and regulatory restrictions that could reduce our competitiveness, eliminate our ability to communicate with adult consumers, or ban certain of our products in certain markets or countries; health concerns relating to the use of tobacco and other nicotine-containing products and exposure to environmental tobacco smoke; litigation related to tobacco use and intellectual property; intense competition; the effects of global and individual country economic, regulatory and political developments, natural disasters and conflicts; the impact and consequences of Russia's invasion of Ukraine; changes in adult smoker behavior; the impact of COVID-19 on PMI's business; lost revenues as a result of counterfeiting, contraband and cross-border purchases; governmental investigations; unfavorable currency exchange rates and currency devaluations, and limitations on the ability to repatriate funds; adverse changes in applicable corporate tax laws; adverse changes in the cost, availability, and quality of tobacco and other agricultural products and raw materials, as well as components and materials for our electronic devices; and the integrity of its information systems and effectiveness of its data privacy policies. PMI's future profitability may also be adversely affected should it be unsuccessful in its attempts to produce and commercialize reduced-risk products or if regulation or taxation do not differentiate between such products and cigarettes; if it is unable to successfully introduce new products, promote brand equity, enter new markets or improve its margins through increased prices and productivity gains; if it is unable to expand its brand portfolio internally or through acquisitions and the development of strategic business relationships; if it is unable to attract and retain the best global talent, including women or diverse candidates; or if it is unable to successfully integrate and realize the expected benefits from recent transactions and acquisitions. Future results are also subject to the lower predictability of our reduced-risk product category's performance • PMI is further subject to other risks detailed from time to time in its publicly filed documents, including PMI’s Annual Report on Form 10-K for the fourth quarter and year ended December 31, 2023. PMI cautions that the foregoing list of important factors is not a complete discussion of all potential risks and uncertainties. PMI does not undertake to update any forward-looking statement that it may make from time to time, except in the normal course of its public disclosure obligations 3 Structural Smoke-Free Growth, Accelerating Returns 4 • Clear demand for smoke-free products among 1bn+ smokers • Structural shift: 10 years of double-digit smoke-free category growth, momentum continues:⎼ All SFP categories and geographies have growth⎼ Growth rates & margin profiles are not uniform⎼ Upfront investment, higher returns than cigarettes • PMI: substantial, selective long-term investments in premium brands, unrivaled commercial and scientific capabilities • Accelerating growth for PMI smoke-free business

Real, Fast Smoke-Free Transformation 5 <1% 39.3% 2015 Q4, 2023 Smoke-Free Products Net Revenues (% of Total PMI Net Revenues) (a) Smoke-free volumes reflects shipments of HTUs and oral smoke-free products (in pouches, excl. snuff, snuff leaf and U.S. Chew) Source: PMI Financials or estimates. IQOS user panels and PMI Market Research. Estimated user numbers for oral nicotine and e-vapor are approximate, with further methodology details to be provided in future disclosures >20% Smoke-Free Volumes / Total(a) ~33m Smoke-Free Users 25 Markets SFP >50% Net Revenue / Total >40% Smoke-Free Gross Profit / Total 84 Smoke-Free Markets PMI: Q4, 2023 IQOS Net Revenues Surpassed Marlboro in Q4, 2023 6 $0 $2 $4 $6 $8 $10 $12 2015 2016 2017 2018 2019 2020 2021 2022 2023 PMI Annual Net Revenues(a) ($ billion) (a) Marlboro includes Marlboro combustibles, IQOS represents Heat-not-Burn net revenues Source: PMI Financials or estimates

2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 Smoke-Free Rapidly Approaching $15 billion Top-Line 7 Est. (a) Forecast provided in Q4’23 Earnings Release presented February 8, 2024, at prevailing rates February 7, 2024 Source: PMI Financials or estimates ~$15bn Annual Smoke-Free Net Revenues ($ billion) (a) 8Note: Smoke-free markets are markets where PMI smoke-free products are available in key cities or nationwide Source: PMI Financials or estimates 2030 Ambition: Substantially Smoke-Free 2/3 Smoke-Free Net Revenues ~> ~20 markets ~40 markets 50-75% net revenues >75% net revenues 60 Markets Majority Smoke-Free ~

(a) Excluding China and the U.S. Including cigarillos in Japan (b) Markets where IQOS was present as of Q4, 2017 Source: PMI Financials or estimates Cigarette Industry Declines Faster When SFPs are Present 9 Cigarette Industry Volume % Change Vs. Previous Year 2018 2019 2020 2021 2022 2023 (6.3)% 1.3% (4.5)% (8.1)% (3.3)% (3.0)%(2.8)% (2.6)% (6.5)% IQOS Markets(b)International(a) (2.4)% (2.7)% • SFPs are switching adult smokers away from cigarettes • PMI cigarette volume in current SFP markets vs. 2015 baseline: – Already >33% lower in 2023 – Expect >50% lower by 2030 on current trajectory (0.9)% The Science is Clear: SFPs Are A Much Better Alternative 10Note: Charts are used for illustrative purposes; not to scale. Combustible Products include cigarettes, cigars and cigarillos. Inhalable Smoke-Free Products include Heat-not-Burn and e-vapor. Oral Smoke-Free Products include nicotine pouches and snus. Nicotine Replacement Therapy products include patches and gums Tobacco Harm Reduction: Continuum of Risk H ig he r R is k Combustion No Combustion Inhalable Smoke-Free Products Cessation Lo w er R is k Oral Smoke- Free Products Combustible Products

Significant Decline of Cigarette Sales in Sweden 11 0 100 200 300 400 500 600 700 Volumes Sold Per Year In Sweden (Million Packs/Cans) 1973: First portion Swedish snus launched Snus / Nicotine Pouches Cigarettes Note: Temporal associations do not demonstrate cause and effect and are subject to inherent limitations. Specific factors associated with changing cigarette sales volumes over time have not been fully analyzed. 20 cigarettes per pack; 21 estimated average pouches in can for snus and nicotine pouches Source: Swedish Match Estimates, SMD Logistics; 2019 TPSAC Meeting Materials and Information | FDA. Investor Day 2023, presented September 28, 2023 Cigarettes Now Less Than Half of Nicotine in Tokyo Within 10y 12 100% 2015 2019 2020 2021 2022 20232016 2017 2018 Combustibles Tokyo Monthly Offtake Category Share(a) (a) Based on 3 C-Store Chains offtake. Base includes cigarettes, cigarillos and HTUs Source: PMI Financials or estimates HTUs Jan’24 50.4% 49.6%

Sweden: Lowest Male Smoking Prevalence and Tobacco- Attributable Mortality in EU 13 6 22 34 49 Sweden United Kingdom Netherlands Finland Denmark Ireland Belgium Spain Portugal Germany France Italy Austria Poland Slovakia Hungary Czechia Romania Croatia Lithuania Greece Bulgaria 72 108 177 267 Sweden Finland France Italy Portugal Austria Ireland Germany Netherlands Spain Belgium Denmark Czechia Greece Slovakia Poland Lithuania Romania Hungary Bulgaria Male Smoking Prevalence (2020) Male Deaths per 100,000 Attributable to Tobacco (2019) Note: The charts in this slide do not demonstrate cause and effect and are subject to inherent limitations Source: Dataset Special Eurobarometer 506: Attitudes of Europeans towards tobacco and electronic cigarettes, February 2021 Lars M. Ramström: National availability of snus is clearly associated with lower rates of mortality attributable to tobacco—while country-level implementation of WHO tobacco control measures is not, Global Forum on Nicotine 2022, https://gfn.events/new-research/lars-m-ramstrom-2022/ Nicotine Misinformation Slowing Tobacco Harm Reduction •Many misperceptions on smoke-free products & nicotine •Nicotine is not the primary cause of smoking-related disease(a), combustion is • Science from existing laboratory and clinical data(b) is conclusive: heated tobacco, e-vapor, & oral products ARE NOT equally or more harmful than cigarettes 14 “Nicotine, though not benign, is not directly responsible for the tobacco- caused cancer, lung disease, and heart disease that kill hundreds of thousands of Americans each year. The FDA’s approach to reducing the devastating toll of tobacco use must be rooted in this foundational understanding: other chemical compounds in tobacco, and in the smoke created by combustion, are primarily to blame for such health harms.” (c) [emphasis added] FDA – September 2017 (a) Nicotine is addictive and not risk-free (b) Available scientific data from third-party laboratory and clinical studies, published in scientific journals (c) FDA - September 21, 2017, N Engl J Med 2017; 377:1111-1114 DOI: 10.1056/NEJMp1707409

• SFPs marketed in a responsible manner to legal age smokers and nicotine users • Those under the legal age of purchase should not have access to, or use, any nicotine product • Adult-oriented flavors can play an important role in switching legal age smokers to SFPs, particularly where corresponding flavors are present for combustible products • National regulation and enforcement critical to minimizing underage usage and the availability of illicit products • After ~10 years in-market, rates of underage use of IQOS and ZYN remain very low 15 Responsible Marketing Practices U.S. Responsible Marketing, Compliance & Innovation 16 www.21PLUSresponsibly.com Responsible Marketing Responsible Social Media Innovation for Age Restriction Responsible Retail Practices Retail Technology Advancement Enforcement Monitoring Underage Use

Around 33 Million Users of PMI Smoke-Free Products 17 Heat-not-Burn Oral Nicotine E-Vapor ~29m Users(a) ~4m Users ~0.5m Users (a) See Glossary for definition Source: PMI Financials or estimates, IQOS user panels and PMI Market Research. Estimated user numbers for oral nicotine and e-vapor are approximate, with further methodology details to be provided in future disclosures #1 Smoke-Free Brand #1 Nicotine Pouch Brand Selective Strategy Estimated legal-age users as of December 31, 2023 IQOS: Strong Consumer Momentum 18 HTU Adjusted IMS change vs. PY (a) (in %) 14% 15% 14-16% 2022 2023 2024 Est. (a) Excluding the impact of estimated distributor and wholesaler inventory movements (b) Forecast provided in Q4’23 Earnings Release presented February 8, 2024 Source: PMI Financials or estimates (b)

(a) Adjusted market share for HTUs is defined as the total in-market sales volume for PMI HTUs as a percentage of the total estimated sales volume for cigarettes, HTUs and excluding the impact of estimated distributor and wholesaler inventory movement; Note: Chart not to scale. Key Cities selected are respectively: Athens, London, Rome, Stockholm, Munich and Madrid; Source: PMI Financials or estimates Key Cities Lead the Way For National Shares Over Time 19 Italy Greece PMI Adjusted National Share(a) and Key City Offtake Share of Total Cigarette and HTU Market Key City Offtake SharePMI Adjusted National Share 6.1% 12.7% 17.1% 10.7% 21.6% 28.2% Q4, 2019 Q4, 2021 Q4, 2023 10.5% 15.8% 20.8% 16.5% 22.3% 29.7% Q4, 2019 Q4, 2021 Q4, 2023 Germany UK 1.6% 3.4% 5.6%4.4% 8.6% 11.1% Q4, 2019 Q4, 2021 Q4, 2023 0.6% 2.4% 3.9% 1.6% 5.9% 7.0% Q4, 2019 Q4, 2021 Q4, 2023 Sweden 0.5% 1.8% 3.2%3.7% 6.8% Q4, 2019 Q4, 2021 Q4, 2023 N/A Spain 0.8% 1.3% 2.4%1.5% 2.9% 5.5% Q4, 2019 Q4, 2021 Q4, 2023 Japan: ~40% Category Penetration and Growing Double-Digit 20 16.6% 18.8% 21.1% 23.4% 26.7% 2019 2020 2021 2022 2023 (a) Adjusted market share for HTUs is defined as the total in-market sales volume for PMI HTUs as a percentage of the total estimated sales volume for cigarettes, HTUs and cigarillos and excluding the impact of estimated distributor and wholesaler inventory movements Source: PMI Financials or estimates; Note: all data presented on Adj. IMS basis PMI HTU Adj. SoM(a)HnB Category Share of Total Tobacco 20.6% 22.5% 25.8% 29.6% 33.8% 37.9% 2018 2019 2020 2021 2022 2023 Adj. IMS change vs. PY, % 4% 8% 9% 9% 14% ~70% PMI Share of HnB, 2022 PMI Outgrowing HnB Category in 2023 ~40% Q4’23 ~80% PMI Share of HnB Category Growth, 2023

Continuous Innovation Supports Growth 21 • ILUMA: the core platform for multi-year growth and innovation •Broadening HTU offerings •Rich pipeline of ILUMA device innovations • IQOS uniqueness: evolving features for a customized and personalized experience IQOS Successful Across Many Emerging Markets 22 3.2% 3.4% 3.5% 3.7% 6.5% 9.4% 10.3% 11.9% 12.4% 14.3% 14.8% 15.1% 15.4% Manila Tunis Urban Jakarta Rabat Santo Domingo Cairo Kuala Lumpur Sarajevo Belgrade Beirut Skopje Sofia Podgorica +2.0pp +1.8pp +3.0pp -0.2pp +1.5pp PMI HTU Offtake Shares (Q4, 2023) +2.0pp Change vs. PY +0.7pp +1.5pp +1.4pp+3.6pp+1.1pp +2.8pp Note: Urban Jakarta represents West, Central and South Jakarta which include an estimated 1.5 million Legal Age Nicotine Users; in Indonesia IQOS is sold via the IQOS club member program. Cairo represents Urban Cairo, Manila represents Metro Manila, Tunis represents Greater Tunis. Low and Middle-Income markets defined using World Bank classification Source: PMI Financials or estimates +0.7pp

Clear Strategy For Low & Middle-Income Markets • IQOS comes first:⎼ Premium offer with ILUMA to build brand equity⎼ Best product for switching smokers⎼ Substantial premium CC segment to switch •Below premium offering to address full volume opportunity:⎼ LIL(a) with intuitive innovation⎼ BONDS pilot learnings being taken to refine product offering 23 LMIC Cigarette Industry(b) (2023) 23% ~400 billion sticks ~1,700 billion sticks Total Industry Premium Segment (a) Commercialized under partnership with KT&G (b) Excluding China Note: LMIC refers to Low and Middle-Income countries and defined using World Bank classification Source: PMI Financials or estimates Swedish Match: Excellent First Year 24 •Delivered strong growth in 2023, driven by U.S. ZYN •ROIC/WACC crossover expected well ahead of 5 year target • Strong progress on integration • Expanding & diversifying U.S. ZYN manufacturing •U.S. Cigar business strategic review Source: Swedish Match Financials or estimates

Strong Resonance of ZYN with U.S. Adult Nicotine Users 25(a) Based on 13-week period; (b) Other primary uses before ZYN include cigars, snus, OTP, other nicotine pouch brands Source: PMI and Swedish Match Financials or estimates. Circana, LLC, Nicotine Pouches, Week ending 12/24/23. PMI Market Research (Legal Age 21+) Smoke-Free Oral Product #1 (Q4, 2023, by volumes) Shipment Volume Growth >60% (2023 vs. PY) Share of Category(a) 72.8% (Q4,2023) ZYN Consumer Avg. Age 39 Years (2023) Primary Use Before ZYN(b) 20% Cigarettes 25% Vape 36% Trad. Oral (2023) U.S. IQOS: Building Towards ILUMA Success 26 Ambition 10% share 5 years from ILUMA launch(a) • Investing to support ZYN’s growth and building capabilities for IQOS • ILUMA at-scale launch remains core focus • Flexibility to leverage global supply chain • First city test planned with IQOS 3 system in Q2 (a) Illustrative target share of U.S. Cigarette and HTU Industry Volume within five years of ILUMA launch Source: PMI Financials or estimates

VEEV: Good Progress on Targeted Strategy • Substantial consumer demand with >60 million adult vape users(a) • Emerging signs of better regulation & enforcement • Promising early results from VEEV relaunch • Remains a selective market play, but in specific markets can be an important growth driver 27 VEEV (SoS in Closed Pod Systems) Czech Republic(b)Italy(b) 15% 14% 28% 33% Q1 Q2 Q3 Q4 2023 10% 11% 21% 36% Q1 Q2 Q3 Q4 2023(a) PMI Market Research, excluding Russia and China (b) Nielsen. Italy based on tobacco shops only Source: PMI Financials or estimates Combustible Leadership Supports SFP Growth • Leading portfolio well-positioned for evolving adult smoker base • Infrastructure and expertise benefits smoke-free portfolio • Responsible category stewardship – market leader driving the obsolescence of combustible tobacco • Continue to target stable combustible share over time and profit growth contribution 28 Share of Cigarette Category(a) (Change vs. PY in pp) (0.7) 0.1 0.22021 2022 2023 (a) Excludes China and the U.S. Reflects in-market sales volume of PMI cigarettes as a percentage of cigarette industry sales volume and includes cigarillos in Japan Source: PMI Financials or estimates

29 Strong Overall Financial Model for Sustainable Growth Delivering sustainable growth while investing and rewarding shareholders Volume Growth Positive Product Mix Pricing Invest for Growth / Cost Efficiencies Strong Top- & Bottom-Line Performance =&++ Target 6 consecutive years of volume growth through 2026 Higher smoke-free volumes at higher net revenue per unit Strong combustible pricing power with potential for smoke- free Disciplined investment in high return categories while generating cost efficiencies Source: PMI Financials or estimates (a) Includes heat-not-burn consumables and devices and U.S. ZYN; Note: 1 can of U.S. ZYN contains 15 pouches Source: PMI Financials or estimates Smoke-Free: Attractive & Substantial Growth Opportunity 30 Equivalent Cigarette Volumes Smoke-Free Products 2023 Net Revenue Per Unit (Index = Equivalent Cigarette Volumes) 2023 Gross Profit Per Unit (Index = Equivalent Cigarette Volumes) ~2.5 1 Equivalent Cigarette Volumes Smoke-Free Products ~2.6 1 (a) (a)

Increasingly Smoke-Free, Profitability Accelerating 31 Adj. Net Revenues (Q4, 2023) (a) Excludes snuff, snuff leaf and U.S. chew; (b) Includes heat-not-burn and e-vapor Note: Total may not foot due to rounding Source: PMI Financials or estimates Adj. Gross Profit (Q4, 2023) 61% 32% 6% 59% 41% Combustibles Smoke-Free Inhalable Products(b) Smoke-Free Oral Products Smoke-Free Other Shipment Volumes (Q4, 2023) 80% 18% Cigarettes HTUs Oral Nicotine(a) 1% 2% Combustibles Smoke-Free Products Total SFPs 20% Total SFPs 39% Smoke-Free Driving Net Revenue & Profit Growth 32 2023 Net Revenues (Organic Variance vs. PY)(a) (a) Organic variance, reflecting currency-neutral adjusted results, excluding acquisitions Note: Chart not to scale. Adjusted gross margin is calculated by dividing adjusted gross profit by adjusted net revenues Source: PMI Financials or estimates Combustibles Smoke-Free Products 12.8% 5.5% 2023 Gross Profit (Organic Variance vs. PY)(a) 19.2% 0.3% 63.4% 64.2% Adj. Gross Margin Organic OI growth of 8-9.5% expected in 2024, driven by SFP acceleration

(a) Includes Czech Krona, Egyptian Pound, Indonesian Rupiah, Mexican Peso, Philippine Peso, Polish Zloty, Russian Ruble and Turkish Lira (b) JPY, CHF, KRW, GBP, ILS, AUD, HKD, NOK, SGD, SEK, DKK, CAD and NZD Note: Reflects currencies in which net revenues are generated. Source: PMI Financials or estimates Delivering USD Performance is a Key Priority • Best-in-class constant currency growth • Increasing USD revenue contribution with rapid smoke-free growth in the U.S. • Currency risk mitigation:⎼ Debt matching: >60% effectively in EUR⎼ Hedging programs: JPY rolling hedge⎼ Strategic cost allocation • Focused on delivering strong USD growth in 2024 and beyond 33 9% 13% 28% 27% 13% 36% 50% 24% Combustibles Smoke-Free Products 2023 Net Revenues by Currency Other Developed(b) Euro USD Emerging(a) 76% 50% Delivering Strong Financial & Non-Financial Performance 34 (a) Excluding PMI Duty Free. World Bank report issued in July 2023 is used on a comparative basis for income level classification. For definition of low- and middle-income markets, see pages 205-209 of PMI Integrated Report 2022; (b) Total shipment volume includes cigarettes, OTPs, and smoke-free product consumables; (c) Including Swedish Match; (d) Emissions from PMI-operated IQOS stores are partially excluded from scope 1+2 emissions, as de minimis. PMI was included for the first time in the Dow Jones Sustainability World Index, and for the fourth consecutive year in the Dow Jones Sustainability North America Composite Index (Indices effective as of December 18, 2023). PMI achieved industry leadership, improving to a rating of “C+” in ISS ESG Corporate Rating and gaining “Prime” status” for the first time (score as of November 21, 2023). Source: PMI Financials or estimates PR O D U CT IM PA CT 2025 Aspiration20232022Selected Performance Indicators 1008473Number of markets where PMI smoke-free products are available for sale Maximize benefits of SFPs >50%47%42%Proportion of markets where smoke-free products are available for sale that are low- and middle-income markets(a) >90%>90%91%% of shipment volume covered by markets with youth access prevention programs in indirect retail channels(b) ≥80%On Track68%% of shipment volumes covered by markets with anti-littering programs for cigarettes Reduce post-consumer waste 100%On Track73%% of contracted tobacco farmers making a living incomeImprove quality of life of people in our supply chain 0On Track328Net carbon emissions scope 1+2 in thousands of metric tons(c)(d)Tackle climate change O PE RA TI O N A L IM PA CT

Shipment Volume(a) (Variance) ~1.6% Positive Strong Past & Future Growth Trajectory 2021-23 CAGR 35 Adj. Diluted EPS (Currency-neutral variance) ~12.1% 9-11%(b) Net Revenues (Organic variance) ~7.5% 6-8% 2024-26 CAGR Targets Operating Income (Organic variance) ~7.3% 8-10% (a) Reflects total shipment volume for cigarettes and HTUs in 2021-23 and for cigarettes, HTUs and oral smoke-free products (in pouches or equivalent, excl. U.S. Chew) in 2024-26 (b) At 2023 corporate income tax rates Note: Growth rates presented on an organic basis reflect currency-neutral adjusted results, excluding acquisitions Source: PMI Financials or estimates Transforming, Growing & Delivering 36 • Unparalleled transformation continues • Accelerating returns from smoke-free leadership • Confident in 2024-26 targets, with ambition to reach >2/3 smoke-free net revenues by 2030 • Highly cash generative with focus on rapid deleveraging • Steadfast commitment to progressive dividend policy Source: PMI Financials or estimates

Championing a Smoke-Free World CAGNY Conference February 21, 2024 Have you downloaded the new PMI Investor Relations App yet? The free IR App is available to download at the Apple App Store for iOS devices and at Google Play for Android mobile devices iOS Download Android Download Championing a Smoke-Free World Appendix and Reconciliation of Non-GAAP Measures 38

Europe: PMI HTU Adjusted Share of Market(a) Growth vs. PYFY, 2023 Growth vs. PYFY, 2023 Growth vs. PYFY, 2023 +1.7pp7.7%Romania+4.5pp28.8%Hungary+1.9pp7.1%Austria +1.816.5Slovak Republic+2.416.7Italy+1.48.4Croatia +1.812.3Slovenia(0.5)27.8Lithuania+2.014.8Czech Republic +2.011.5Switzerland+1.09.0Poland+1.35.3Germany +0.83.5United Kingdom+3.919.7Portugal+3.319.5Greece 39(a) Adjusted market share for HTUs is defined as the total in-market sales volume for PMI HTUs as a percentage of the total estimated sales volume for cigarettes, HTUs and excluding the impact of estimated distributor and wholesaler inventory movement; Note: Select markets where HTU share is ≥ 1%; Source: PMI Financials or estimates Growth vs. PYQ4, 2023 Growth vs. PYQ4, 2023 Growth vs. PYQ4, 2023 +1.4pp8.4%Romania+3.9pp30.8%Hungary+1.7pp7.7%Austria +1.417.2Slovak Republic+2.517.1Italy+0.88.8Croatia +2.413.1Slovenia(3.2)27.2Lithuania+1.315.3Czech Republic +1.812.3Switzerland+0.59.8Poland+0.95.6Germany +0.83.9United Kingdom+3.021.4Portugal+2.720.8Greece 40 Europe: PMI HTU Adjusted Share of Market(a) (a) Adjusted market share for HTUs is defined as the total in-market sales volume for PMI HTUs as a percentage of the total estimated sales volume for cigarettes, HTUs and excluding the impact of estimated distributor and wholesaler inventory movement; Note: Select markets where HTU share is ≥ 1%; Source: PMI Financials or estimates

Impressive Progress in European Key Cities 41Note: Athens represents Attica Region Source: PMI Financials or estimates 5.5% 5.8% 6.8% 7.0% 8.2% 11.1% 15.7% 17.6% 22.0% 22.3% 23.9% 26.8% 28.2% 29.7% 37.8% Madrid Amsterdam Stockholm London Vienna Munich Bucharest Zurich Prague Warsaw Lisbon Bratislava Rome Athens Budapest -0.2pp +1.6pp +1.3pp +4.9pp +2.7pp PMI HTU Offtake Share (Q4, 2023) +3.4pp Change vs. PY +1.1pp +1.2pp +3.0pp +5.1pp+4.2pp +3.3pp +3.1pp+2.0pp +3.7pp 42 PHILIP MORRIS INTERNATIONAL INC. and Subsidiaries Reconciliation of Non-GAAP Measures Reconciliation of Operating Income to Adjusted Operating Income, excluding Currency, Acquisitions and RBH Impact ($ in millions) / (Unaudited) (a) See Slide 46 (b) Represents the impact attributable to RBH from January 1, 2019 through March 21, 2019 (c) Adjusted Operating Income reflects the historical financials as reported and includes amortization and impairment of intangible assets for the comparison 2020 vs. 2019 Operating Income Special Items(a) Adjusted Operating Income Currency Adjusted Operating Income excluding Currency Acquisitions Adjusted Operating Income excluding Currency & Acquisitions Operating Income Special Items(a) Operating Income attributable to RBH(b) Adjusted Operating Income Total Excluding Currency Excluding Currency & Acquisitions 2020 Full Year Ended December 31, 2019 $ 11,668 $ (30) $ 11,698 $ (474) $ 12,172 $ - $ 12,172 Total PMI(c) $ 10,531 $ (1,229) $ 126 $ 11,634 0.6% 4.6% 4.6% 2021 Full Year Ended December 31, 2020 $ 12,975 $ (609) $ 13,584 $ 269 $ 13,315 $ 19 $ 13,296 Total PMI $ 11,668 $ (103) $ - $ 11,771 15.4% 13.1% 13.0% 2022 Full Year Ended December 31, 2021 $ 12,246 $ (662) $ 12,908 $ (1,507) $ 14,415 $ 99 $ 14,316 Total PMI $ 12,975 $ (609) $ - $ 13,584 (5.0)% 6.1% 5.4% 2023 2022 $ 5,297 $ (1,254) $ 6,551 $ (485) $ 7,036 $ 574 $ 6,462 Total PMI $ 6,354 $ (248) $ - $ 6,602 (0.8)% 6.6% (2.1)% 2023 2022 $ 2,889 $ (163) $ 3,052 $ (301) $ 3,353 $ 138 $ 3,215 Total PMI $ 2,924 $ (52) $ - $ 2,976 2.6% 12.7% 8.0% 2023 2022 $ 6,259 $ (527) $ 6,786 $ (588) $ 7,374 $ 453 $ 6,921 Total PMI $ 5,892 $ (414) $ - $ 6,306 7.6% 16.9% 9.8% 2023 Full Year Ended December 31, 2022 $ 11,556 $ (1,781) $ 13,337 $ (1,073) $ 14,410 $ 1,027 $ 13,383 Total PMI $ 12,246 $ (662) $ - $ 12,908 3.3% 11.6% 3.7% % Change % Change % Change Six months ended June 30, % Change Six months ended December 31, % Change % Change Quarters Ended December 31, % Change

43 Reconciliation of Reported Operating Income to Adjusted Operating Income and RBH Impact ($ in millions) / (Unaudited) PHILIP MORRIS INTERNATIONAL INC. and Subsidiaries Reconciliation of Non-GAAP Measures Year Ended Dec 31, 2019 Year Ended Dec 31, 2020 Year Ended Dec 31, 2021 Six Months Ended Jun 30, 2022 Quarter Ended Dec 30, 2022 Six Months Ended Dec 31, 2022 Year Ended Dec 31, 2022 Six Months Ended Jun 30, 2023 Quarter Ended Dec 30, 2023 Six Months Ended Dec 31, 2023 Year Ended Dec 31, 2023 Reported Operating Income $ 10,531 $ 11,668 $ 12,975 $ 6,354 $ 2,924 $ 5,892 $ 12,246 $ 5,297 $ 2,889 $ 6,259 $ 11,556 Loss on deconsolidation of RBH (239) - - - - - - - - - - Russia excise and VAT audit charge (374) - - - - - - - - - - Canadian tobacco litigation-related expense (194) - - - - - - - - - - Asset impairment and exit costs (422) (149) (216) - - - - (109) - - (109) Brazil Indirect Tax Credit - 119 - - - - - - - - - Asset acquisition cost - - (51) - - - - - - - - Saudi Arabia customs assessments - - (246) - - - - - - - - Impairment of goodwill and other intangibles - - - - - (112) - (680) - - (680) Amortization of intangibles - (73) (96) (74) (58) (85) (271) (163) (129) (334) (497) Cost associated to Swedish Match AB offer - - - (52) 154 (63) (115) - - - - Swedish Match AB acquisition accounting related items - - - - (125) (125) (125) (18) - - (18) Charges related to the war in Ukraine - - - (122) (23) (29) (151) - (34) (53) (53) Termination of distribution arrangement in the Middle East - - - - - - - (80) - - (80) South Korea Indirect Tax Charge - - - - - - - (204) - - (204) Termination of agreement with Foundation for a Smoke-Free World - - - - - - - - - (140) (140) Adjusted Operating Income $ 11,760 $ 11,771 $ 13,584 $ 6,602 $ 2,976 $ 6,306 $ 12,908 $ 6,551 $ 3,052 $ 6,786 $ 13,337 Less Operating Income attributable to RBH 126 Adjusted Operating Income $ 11,634 44 Reconciliation of Net Revenues to Adjusted Net Revenues by Product Category ($ in millions) / (Unaudited) PHILIP MORRIS INTERNATIONAL INC. and Subsidiaries Reconciliation of Non-GAAP Measures Quarter ended December 31, 2023 Quarter ended December 31, 2023 Net Revenues Special Items Adj. Net Revenues Total PMI $ 9,047 $ - $ 9,047 5,489 - 5,489 61% 2,880 - 2,880 32% 575 - 575 6% 104 - 104 1% Smoke-Free Inhalable Products % of total adjusted Smoke-Free Oral Products % of total adjusted Smoke-Free Other % of total adjusted Combustible Tobacco % of total adjusted Note: Sum of product categories and special items might not foot due to roundings

Championing a Smoke-Free World CAGNY Conference February 21, 2024 Jacek Olczak, Chief Executive Officer Emmanuel Babeau, Chief Financial Officer

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=pm_A2.875Notesdue20241Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=pm_A2.875Notesdue20242Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=pm_A0.625Notesdue2024Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=pm_A3.250Notesdue2024Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=pm_A2.750Notesdue2025Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=pm_A3.375Notesdue2025Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=pm_A2.750Notesdue2026Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=pm_A2.875Notesdue2026Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=pm_A0.125Notesdue2026Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=pm_A3.125Notesdue2027Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=pm_A3.125Notesdue2028Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=pm_A2.875Notesdue2029Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=pm_A3.375Notesdue2029Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=pm_A0.800Notesdue2031Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=pm_A3.125Notesdue2033Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=pm_A2.000Notesdue2036Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=pm_A1.875Notesdue2037Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=pm_A6.375Notesdue2038Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=pm_A1.450Notesdue2039Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=pm_A4.375Notesdue2041Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=pm_A4.500Notesdue2042Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=pm_A3.875Notesdue2042Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=pm_A4.125Notesdue2043Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=pm_A4.875Notesdue2043Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=pm_A4.250Notesdue2044Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

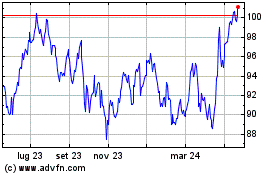

Grafico Azioni Philip Morris (NYSE:PM)

Storico

Da Mar 2024 a Apr 2024

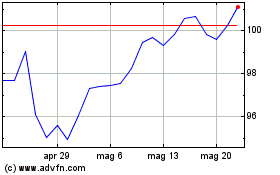

Grafico Azioni Philip Morris (NYSE:PM)

Storico

Da Apr 2023 a Apr 2024