Regions Bank and the nonprofit Regions Foundation stand in

support of communities recovering from Ian’s impacts.

Regions Bank on Tuesday announced a series of financial services

to help people and businesses impacted by Hurricane Ian. In

addition, the Regions Foundation, a nonprofit initiative funded

primarily by Regions Bank, announced a commitment of $225,000 in

grant funding for organizations providing disaster relief.

Community Recovery:

The $225,000 total in grant funding from the Regions Foundation

will be divided among several agencies meeting short- and long-term

needs throughout the Florida Peninsula. From the $225,000 total,

specific allocations will include:

- $100,000 for the American Red Cross, which is providing

disaster relief services across Florida;

- $50,000 for United Way of Lee County, which has created the

Southwest Florida Emergency Relief Fund to support local nonprofits

and neighborhoods experiencing the most immediate needs;

- $35,000 for Collier Comes Together, a hurricane disaster relief

fund of the Collier Community Foundation that is helping Southwest

Florida residents recover;

- $10,000 for the Harry Chapin Food Bank’s Fort Myers

Distribution Center;

- $10,000 for the Harry Chapin Food Bank’s Collier County

Center;

- $10,000 for Feeding Tampa Bay, which brings emergency food

distributions to areas that need them most across the 10-county

Tampa Bay region;

- and $10,000 for Second Harvest Food Bank of Central Florida,

which serves Orlando and surrounding communities.

“As soon as the storm cleared, nonprofits and relief

organizations were on-site delivering emergency resources to

hard-hit communities. We are honored to support their important

work,” said Marta Mendes-Miguel Self, executive director of the

Regions Foundation. “We also encourage people and businesses who

are in a position to donate to consider how they can join us in

supporting agencies that are on the front lines of hurricane

response.”

Special Bank Services:

Disaster-recovery financial services offered by Regions Bank

were developed with urgency and went into effect September 30; the

services are specifically designed for people and businesses in

impacted areas.1 Services available for a limited time include:

- Regions Mortgage Disaster Relief Purchase and Renovation loan

programs are available.

- Regions fees will be waived when Regions customers use other

banks’ ATMs in the impacted areas for a 14-day period effective

September 30. (Note: Fees charged by other banks or ATM owners may

still apply.)

- No check-cashing fees will be charged for FEMA-issued checks

when cashed in a Regions branch.2

- Payment deferrals for credit card holders may be available

based on individual circumstances.3

- Personal and business loan payment assistance may be available

based on individual circumstances.3

- Business loan payment deferrals of up to 90 days may be

available based on individual circumstances.3

- One penalty-free CD withdrawal is available upon request

(unless within seven days of issuance or renewal).

- An interest rate discount of 0.50% is available for a limited

time on new personal unsecured loans when customers apply in a

branch or by phone.4

- An interest rate discount of 0.50% on standard rates is

available for a limited time for new business loans or lines of

credit of up to $1 million to help with recovery needs in impacted

areas.4

- An interest rate discount of 0.50% is available for a limited

time on new unsecured business term loans of up to $50,000 with up

to 36-month terms, including waived origination and loan document

fees, as well as options for the first payments to be deferred by

up to 90 days.4

- Check www.regions.com/HurricaneIan for an updated list of areas

where these offers are available as damage assessments

continue.

“These are communities where our teams live and work – and our

local teams are backed by the strength and resources of the entire

Regions Bank organization as we support the recovery from Hurricane

Ian,” said Steve Nivet, Consumer Banking regional executive for

Regions Bank. “Regions Bank has a proud history of helping our

neighbors through difficult times, and we will be here in the days,

weeks and months to come as we recover from the storm –

together.”

The vast majority of Regions’ 234 bank branches serving the

Florida Peninsula are back open and serving customers. The branch

network suffered comparatively little damage overall and is well

positioned to meet customers’ needs as the recovery moves forward.

In addition, banking services remain available around the clock

through Regions.com, the Regions Mobile App, and other Regions

branch locations across Florida and beyond. Services are also

available by calling 1-800-REGIONS.

Here for You:

In addition to the above disaster-recovery services, Regions

Bank teams can be contacted at the following numbers for customized

guidance on a range of lending products, including:

- Mortgages, home equity loans and lines: 1-800-748-9498

- Other consumer loans: 1-866-298-1113

- Any other banking needs: 1-800-411-9393

“Across our company, we are united in a clear commitment to

serve and support our customers,” said Earnest Wilks, Regions

Bank’s market executive for Ft. Myers, Cape Coral, Sarasota,

Bradenton and surrounding communities. “This is our home. These are

our neighbors. And we are here to offer financial solutions, along

with understanding and compassion, every step of the way.”

Business Support:

Regions Bank’s support for business clients includes companies

of various sizes in cities large and small. Just as the bank

delivers customized financial guidance for individual consumers,

so, too, will Regions’ teams support business clients through all

aspects of recovery.

“Our clients include businesses large and small that are crucial

to the short-term and long-term recovery, and we will be here to

serve them along the way,” said Brian Willman, head of Commercial

Banking for Regions Bank. “Regions’ teams are experienced at

helping businesses address challenges and move forward. We are

keeping in touch with clients to see how we may assist, and we

encourage anyone needing financial guidance through the recovery

process to let us know how we can help.”

About Regions Foundation

Regions Foundation supports community investments that

positively impact the communities served by Regions Bank. The

Foundation engages in a grantmaking program focused on priorities

including economic and community development; education and

workforce readiness; and financial wellness. The Foundation is a

nonprofit 501(c)(3) corporation funded primarily through

contributions from Regions Bank.

About Regions Financial Corporation

Regions Financial Corporation (NYSE:RF), with $161 billion in

assets, is a member of the S&P 500 Index and is one of the

nation’s largest full-service providers of consumer and commercial

banking, wealth management, and mortgage products and services.

Regions serves customers across the South, Midwest and Texas, and

through its subsidiary, Regions Bank, operates approximately 1,300

banking offices and more than 2,000 ATMs. Regions Bank is an Equal

Housing Lender and Member FDIC. Additional information about

Regions and its full line of products and services can be found at

www.regions.com.

1Offers are available for a limited time to individuals and

businesses affected by Hurricane Ian and remnants of the storm in

the following ZIP codes; the current list of 525 ZIP codes may be

expanded as additional impacts from the remnants of Ian are

experienced and further damage assessments are concluded. Offers

may be subject to other exclusions and restrictions and are subject

to change or termination without notice. All loans and lines,

deferrals, extensions or forbearances are subject to required

documentation and credit approval. Residency restrictions may

apply. Special interest rates determined by applicant’s credit

profile may not extend to products offered by third parties, such

as Avant. Initially, impacted ZIP codes in Regions’ retail banking

footprint include the following list, which is subject to

expansion: 32701, 32704, 32707 - 32710, 32712 - 32716, 32718,

32719, 32725, 32728, 32730, 32732, 32733, 32738, 32739, 32744 -

32747, 32750 - 32754, 32762 - 32766, 32771 - 32773, 32776, 32779,

32789 - 32795, 32799, 32801 - 32812, 32814, 32816, 32817, 32820,

32822, 32824 - 32829, 32831 - 32834, 32839, 32853 - 32862, 32867 -

32869, 32872, 32877, 32878, 32885, 32886, 32891, 32896, 32897,

33857, 33867, 34739, 34743, 34744, 34769 - 34773, 32703, 32757,

32768, 32777, 32798, 32818, 32819, 32821, 32830, 32835 - 32837,

32887, 33503, 33508 - 33511, 33523 - 33527, 33530, 33534, 33537,

33539 - 33545, 33547 - 33550, 33556, 33558, 33559, 33563 - 33576,

33578, 33579, 33583, 33584, 33586, 33587, 33592 - 33596, 33598,

33601 - 33626, 33629 - 33631, 33633 - 33635, 33637, 33646, 33647,

33650, 33655, 33660, 33664, 33672 - 33675, 33677, 33679, 33680 -

33682, 33684 - 33689, 33694, 33701 - 33716, 33729 - 33734, 33736,

33738, 33740 - 33744, 33747, 33759, 33760, 33762, 33764, 33771 -

33773, 33777, 33780 - 33782, 33784, 33801 - 33807, 33809 - 33813,

33815, 33820, 33823, 33825 - 33827, 33830, 33831, 33834 - 33841,

33843 - 33856, 33858 - 33860, 33862, 33863, 33865, 33868, 33870 -

33873, 33875 - 33877, 33880 - 33885, 33888, 33890, 33896 - 33898,

33901 - 33922, 33924, 33927 - 33932, 33935, 33936, 33938, 33945 -

33957, 33960, 33965 - 33967, 33970 - 33976, 33980 - 33983, 33990,

33991, 33993, 33994, 34101 - 34110, 34112 - 34114, 34116, 34117,

34119, 34120, 34133 - 34136, 34140, 34142, 34143, 34145, 34146,

34201 - 34212, 34215 - 34224, 34228 - 34243, 34249 - 34251, 34260,

34264 - 34270, 34272, 34274 - 34277, 34280 - 34282, 34284 - 34293,

34295, 34638, 34639, 34695, 34705, 34711 - 34715, 34729, 34734,

34736, 34737, 34740, 34742, 34745 - 34747, 34753, 34755, 34756,

34758 - 34761, 34777, 34778, 34786, 34787, 32158, 32159, 32162,

32163, 32195, 32726, 32727, 32735, 32756, 32778, 33471, 33513,

33514, 33521, 33538, 33585, 33597, 33755 - 33758, 33761, 33763,

33765 - 33767, 33769, 33770, 33774 - 33776, 33778, 33779, 33785,

33786, 33944, 34137 - 34139, 34141, 34423, 34428 - 34434, 34436,

34441, 34442, 34445 - 34453, 34460, 34461, 34464, 34465, 34481,

34484, 34487, 34491, 34498, 34601 - 34611, 34613, 34614, 34636,

34637, 34652 - 34656, 34660, 34661, 34667 - 34669, 34673, 34674,

34677, 34679 - 34685, 34688 - 34692, 34697, 34698, 34731, 34748,

34749, 34762, 34785, 34788, 34789, 34797.

2The FEMA check no-check-cashing-fee offer is available only to

Regions customers; if you are not a Regions customer, you must

enroll in Regions Now Banking. No checking account is required to

enroll in Now Banking. Regions reserves the right to refuse to cash

any check.

3Subject to credit approval. Interest will continue to accrue

during the period that the payment is skipped or deferred. For

installment loans, deferring or skipping payment may extend the

maturity of your loan but will not automatically extend any

optional insurance. Forbearances, skipped payments, and deferrals

generally (a) vary by customer, (b) postpone – rather than forgive

– certain payment obligations, and (c) require payment in full of

the postponed payments at the end of the forbearance or deferral

period, in addition to any other amounts that come due, unless you

make other arrangements with Regions to resolve the

delinquency.

4New business loan and personal unsecured loan rate discounts

may not be combined with other special offers or discounts.

Interest will accrue during the optional 90-day payment deferral

period for unsecured business loans if elected.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20221004005489/en/

Veleka P. Finch Regions Bank (205) 264-4551

Regions News Online: regions.doingmoretoday.com Regions News on

Twitter: @RegionsNews

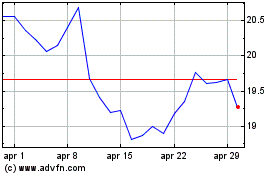

Grafico Azioni Regions Financial (NYSE:RF)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Regions Financial (NYSE:RF)

Storico

Da Apr 2023 a Apr 2024