Rio Tinto releases fourth quarter production results

15 Gennaio 2025 - 10:30PM

Business Wire

Rio Tinto Chief Executive Jakob Stausholm said: “Our operating

performance in 2024 was good, consistent with our ongoing

commitment to strengthen the business as we execute our strategy to

deliver profitable growth. The implementation of our Safe

Production System has again contributed to greater consistency

across key operations, including our iron ore assets in the Pilbara

and our bauxite operations in Australia, where Amrun and Gove

achieved record annual production.

“We are making strong progress in delivering organic growth from

our major projects. The Oyu Tolgoi underground copper mine in

Mongolia continues to successfully ramp up, while the Simandou

high-grade iron ore project in Guinea and our Western Range mine in

the Pilbara are on schedule for first production this year.

“Significant milestones were achieved at our Rincon project in

Argentina during the quarter, with first lithium delivered and

receipt of Board approval to expand the operation, demonstrating

both our operational capabilities and ambition to grow in battery

materials.

"We remain focused on executing our strategy to deliver

attractive shareholder returns and build a stronger, more

diversified, and growing business, driven by our confidence in the

long-term demand for materials essential to the global energy

transition.”

Production1

Q4 2024

vs Q4

2023

vs Q3 2024

2024

vs 2023

Pilbara iron ore shipments (100% basis)

(Mt)

85.7

-1%

+1%

328.6

-1%

Pilbara iron ore production (100% basis)

(Mt)

86.5

-1%

+3%

328.0

-1%

Bauxite (Mt)

15.4

+2%

+2%

58.7

+7%

Aluminium2 (kt)

837

-1%

+3%

3,296

+1%

Mined copper (consolidated basis) (kt)

202

+26%

+21%

697

+13%

Titanium dioxide slag (kt)

235

-14%

-11%

990

-11%

IOC3 iron ore pellets and concentrate

(Mt)

2.5

-6%

+20%

9.4

-2%

1 Rio Tinto share unless otherwise stated.

2 Includes primary aluminium only. 3 Iron Ore Company of

Canada.

Q4 2024 operational highlights and other key

announcements

- In October, Morlaye Camara, an employee of one of our

contractors at the SimFer Port Project in Morebaya, part of the

Simandou project, was injured, and subsequently passed away. During

the quarter, we completed our internal investigation and the

findings were shared across the business.

- Our all injury frequency rate (AIFR) for the fourth quarter was

0.38, a decrease from the third quarter of this year (0.41) and the

fourth quarter of 2023 (0.39). The health, safety and wellbeing of

our people and partners remains our priority.

- In 2024, we delivered 1% production growth and a 3% increase

in sales volumes, both on a copper equivalent basis (based on

long-term consensus pricing). At our Investor Seminar in December,

our Executive Committee outlined our ambition for a decade of

around 3% compound annual growth in copper equivalent production,

driven by Oyu Tolgoi, Simandou and our new lithium portfolio.

- Pilbara operations produced 328.0 million tonnes in

2024, with shipments of 328.6 million tonnes, each 1% lower than

2023. Productivity improvements of 10 million tonnes did not fully

offset depletion, predominantly at Yandicoogina and Paraburdoo, as

we transition to Western Range. The Safe Production System target

of 5 million tonnes for 2024 was achieved and Gudai-Darri reached

50 million tonne per annum rates during 2024.

- Bauxite production was 58.7 million tonnes in 2024, 7%

higher than 2023, exceeding our guidance. The improvement was

driven by the implementation of the Safe Production System,

delivering record annual production at Amrun and Gove, with the

former currently operating above nameplate capacity.

- Aluminium production of 3.3 million tonnes was 1% higher

than 2023, following the ramp-up of Kitimat and completion of cell

recovery efforts at Boyne in the prior year, together with

increased ownership of Boyne and New Zealand Aluminium Smelter

(NZAS). These were partially offset by the continued closure

program at Arvida and a request to reduce energy usage at NZAS,

resulting in lower output. Production at NZAS is expected to be

fully ramped up in the second quarter of 2025.

- Mined copper production of 697 thousand tonnes

(consolidated basis) in 2024 was 13% higher than 2023, reflecting

the ramp up of Oyu Tolgoi underground and increased production from

Escondida due to higher grades fed to the concentrator (0.99%

versus 0.83%). This offset geotechnical challenges at Kennecott as

instabilities in the pit wall impacted the mining sequence from the

second quarter.

- On 4 December, we signed a Term Sheet with Sumitomo Metal

Mining (SMM) for a Joint Venture to deliver the Winu copper-gold

project in Western Australia. We will continue to develop and

operate Winu as managing partner and SMM will pay $195 million

upfront, and $204 million in deferred consideration, contingent on

milestones and adjustments to be agreed. We will now work to

finalise definitive agreements in the first half of 2025, along

with formalising the broader strategic partnership.

- Titanium dioxide slag production of 990 thousand tonnes

in 2024 was 11% lower than 2023 due to reduced market demand. A

furnace reconstruction, starting in the first quarter of 2024,

continues at our RTIT Quebec Operations. Through 2024, we operated

six out of nine furnaces in Quebec and three out of four at

Richards Bay Minerals (RBM).

- IOC production of 9.4 million tonnes in 2024 was 2%

lower than 2023 due to an 11-day site-wide shutdown driven by

forest fires in mid-July, resulting in a revised mine plan and

maintenance schedule. We also experienced operational challenges in

the mine and concentrator throughout the year.

- At the end of 2024, we had commenced deployment of the Safe

Production System at 31 (~80%) of our sites, including three

additional sites in the fourth quarter. We achieved our Safe

Production System target of 5 million tonnes production uplift for

Pilbara Iron Ore and two of our sites delivered their best

production performance on record in the quarter.

- On 9 October, we announced a definitive agreement to acquire

Arcadium Lithium plc (Arcadium) in an all-cash transaction

for US$5.85 per share. This transaction will bring Arcadium’s

world-class, complementary lithium business into our portfolio,

establishing a global leader in energy transition commodities.

During the quarter, we made good progress on the outstanding

conditions, with Arcadium announcing that it had obtained all

requisite shareholder approvals for the proposed acquisition. We

have received most of the required foreign investment approvals,

including clearance by the Committee on Foreign Investment in the

United States (CFIUS) in January 2025, and all of the required

merger control clearances. Closing of the transaction remains

subject to foreign investment approvals in Australia and Canada,

approval of the Royal Court of Jersey and other closing conditions,

and is expected to occur before mid-2025.

- On 2 December, we completed the sale of Dampier Salt

Limited’s Lake MacLeod operation to Leichhardt Industrials

Group. The consideration of A$375 million was received in

December.

- On 6 December, we completed the sale of Sweetwater, a

former uranium legacy site in Wyoming, United States. The

consideration of $175 million was received in December.

- On 12 December, we announced the approval of $2.5 billion1 to

expand the Rincon project in Argentina, our first commercial

scale lithium operation, to an annual capacity of 60,000 tonnes of

battery grade lithium carbonate. Mine life is expected to be 40

years2, with construction of the expanded plant scheduled to begin

in mid-2025, subject to permitting. First production is expected in

2028 with a three-year ramp-up to full capacity. The project uses

direct lithium extraction (DLE) technology, a process that supports

water conservation, reduces waste and produces lithium carbonate

more consistently than other methods.

- On 19 December, we announced the appointment of Georgie Bezette

as our new Chief People Officer, succeeding James Martin, who

retired at the end of 2024.

All figures in this report are unaudited. All currency figures

in this report are US dollars, and comments refer to Rio Tinto’s

share of production, unless otherwise stated.

1 Included in the Group’s capital expenditure guidance provided

at our Investor Seminar on 4 December 2024.

2 The production target of approximately 53 kt of battery grade

lithium carbonate per year for a period of 40 years was previously

reported in a release to the ASX dated 4 December 2024 titled

“Rincon Project Mineral Resources and Ore Reserves: Table 1”. Rio

Tinto confirms that all material assumptions underpinning that

production target continue to apply and have not materially

changed. Plans are in place to build for a capacity of 60 kt of

battery grade lithium carbonate per year with debottlenecking and

improvement programs scheduled to unlock this additional

throughput.

This announcement is authorised for release to the market by

Andy Hodges, Rio Tinto’s Group Company Secretary.

LEI: 213800YOEO5OQ72G2R82

Classification: 3.1 Additional regulated information required to

be disclosed under the laws of a Member State

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250115353989/en/

Please direct all enquiries to

media.enquiries@riotinto.com

Media Relations, United Kingdom David Outhwaite M +44

7787 597 493

Media Relations, Australia Matt Chambers

M +61 433 525 739 Michelle Lee M +61 458 609

322 Rachel Pupazzoni M +61 438 875 469

Media Relations, Canada Simon Letendre M +1 514 796 4973

Malika Cherry M +1 418 592 7293 Vanessa Damha M +1

514 715 2152

Media Relations, US Jesse Riseborough M +1 202 394

9480

Investor Relations, United Kingdom Rachel Arellano M: +44

7584 609 644 David Ovington M +44 7920 010 978 Laura

Brooks M +44 7826 942 797 Wei Wei Hu M +44 7825 907

230

Investor Relations, Australia Tom Gallop M +61 439

353 948 Amar Jambaa M +61 472 865 948

Rio Tinto plc 6 St James’s Square London SW1Y 4AD United

Kingdom T +44 20 7781 2000 Registered in England No.

719885

Rio Tinto Limited Level 43, 120 Collins Street Melbourne

3000 Australia T +61 3 9283 3333 Registered in Australia ABN

96 004 458 404

riotinto.com

Category: General

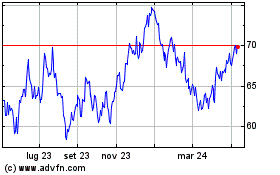

Grafico Azioni Rio Tinto (NYSE:RIO)

Storico

Da Dic 2024 a Gen 2025

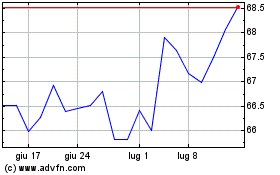

Grafico Azioni Rio Tinto (NYSE:RIO)

Storico

Da Gen 2024 a Gen 2025