Filed Pursuant to Rule 424(b)(5)

Registration No. 333-272826

PROSPECTUS SUPPLEMENT

(To prospectus dated June 22, 2023)

Virgin Galactic Holdings, Inc.

Up to $300,000,000 of Common Stock

We have entered into an Open Market Sale AgreementSM (the “Sales Agreement”) with Jefferies LLC (the “Agent”), dated November 6, 2024, relating to the sale of shares of our common stock offered by this prospectus supplement and the accompanying prospectus. In accordance with the terms of the Sales Agreement, we may offer and sell shares of our common stock, $0.0001 par value per share, having an aggregate offering price of up to $300,000,000 from time to time through or to the Agent, acting as our agent or as principal.

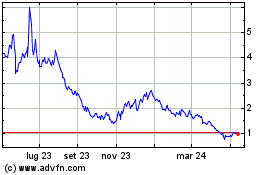

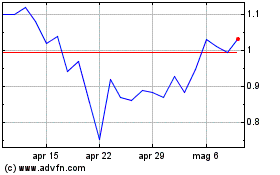

Our common stock is listed on the New York Stock Exchange (the “NYSE”) under the symbol “SPCE”. On November 5, 2024, the last reported sale price of our common stock was $6.88 per share.

Sales of our common stock, if any, under this prospectus supplement and the accompanying prospectus will be made in sales deemed to be “at the market offerings” as defined in Rule 415 promulgated under the Securities Act of 1933, as amended, or the Securities Act. The Agent is not required to sell any specific amount of securities, but will act as our sales agent using commercially reasonable efforts consistent with its normal trading and sales practices. There is no arrangement for funds to be received in any escrow, trust or similar arrangement.

The Agent will be entitled to compensation at a commission rate of up to 3.0% of the gross sales price per share sold under the Sales Agreement. See “Plan of Distribution” beginning on page S-5 for additional information regarding the compensation to be paid to the Agent. In connection with the sale of shares of our common stock on our behalf, the Agent will be deemed to be an “underwriter” within the meaning of the Securities Act and the compensation of the Agent will be deemed to be underwriting commissions or discounts. We have also agreed to provide indemnification and contribution to the Agent with respect to certain liabilities, including liabilities under the Securities Act. Investing in our common stock involves risks. You should read carefully and consider the risks referenced under “Risk Factors” beginning on page S-3 of this prospectus supplement, as well as the other information contained in or incorporated by reference in this prospectus supplement and the accompanying prospectus before making a decision to invest in our securities. Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus supplement or the accompanying prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus supplement is November 6, 2024

TABLE OF CONTENTS

Prospectus Supplement

Prospectus

ABOUT THIS PROSPECTUS SUPPLEMENT

This prospectus supplement relates to the offering of shares of our common stock having an aggregate offering price of up to $300,000,000 from time to time pursuant to an Open Market Sale AgreementSM (the “Sales Agreement”) with Jefferies LLC (the “Agent”). Before buying any of the shares of common stock that we are offering, we urge you to carefully read this prospectus supplement, together with the information incorporated by reference as described under the headings “Where You Can Find More Information; Incorporation by Reference” in this prospectus supplement, the accompanying prospectus and any free writing prospectus that we have authorized for use in connection with this offering. These documents contain important information that you should consider when making your investment decision. In general, when we refer to the prospectus, we are referring to both the prospectus supplement and the accompanying prospectus combined.

This prospectus describes the terms of this offering of shares of common stock and also adds to and updates information contained in the documents incorporated by reference into this prospectus. To the extent there is a conflict between the information contained in this prospectus, on the one hand, and the information contained in any document incorporated by reference into this prospectus that was filed with the Securities and Exchange Commission (the “SEC”) before the date of this prospectus, on the other hand, you should rely on the information in this prospectus. If any statement in one of these documents is inconsistent with a statement in another document having a later date, the statement in the document having the later date modifies or supersedes the earlier statement.

We have not, and the Agent has not, authorized any other person to provide you with information that is in addition to or different from that contained or incorporated by reference in this prospectus, along with the information contained in any permitted free writing prospectuses we have authorized for use in connection with this offering. Neither we nor the Agent take any responsibility for, or can provide any assurance as to the reliability of, any information other than the information contained or incorporated by reference in this prospectus or any permitted free writing prospectuses we have authorized for use in connection with this offering. You should assume that the information appearing in this prospectus supplement, the accompanying prospectus, the documents incorporated by reference into this prospectus, and in any free writing prospectus that we may authorize for use in connection with this offering, is accurate only as of the date of those respective documents or any earlier date specified for such information unless we indicate otherwise. Our business, financial condition, results of operations and prospects may have changed since those dates. You should read this prospectus supplement, the accompanying prospectus, the documents incorporated by reference into this prospectus, and any free writing prospectus that we may authorize for use in connection with this offering, in their entirety before making an investment decision.

Information contained on, or accessible through, our website is not part of this prospectus. We and the Agent are offering to sell, and seeking offers to buy, shares of common stock only in jurisdictions where offers and sales are permitted. The distribution of this prospectus and the offering of the common stock in certain jurisdictions may be restricted by law. Persons outside the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the offering of the common stock and the distribution of this prospectus outside the United States. This prospectus does not constitute, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy, any securities offered by this prospectus by any person in any jurisdiction in which it is unlawful for such person to make such an offer or solicitation.

Unless the context otherwise requires, we use the terms “Virgin Galactic,” “company,” “we,” “us,” and “our” in this prospectus to refer to Virgin Galactic Holdings, Inc. and its subsidiaries.

PROSPECTUS SUPPLEMENT SUMMARY

The following summary highlights information contained elsewhere in this prospectus supplement and the accompanying prospectus and documents incorporated by reference. It does not contain all of the information that may be important to you. You should read this entire prospectus supplement and the accompanying prospectus and documents incorporated by reference carefully, including the section titled “Risk Factors” and our historical consolidated financial statements and related notes incorporated by reference herein.

We are an aerospace and space travel company offering access to space for private individuals, researchers and government agencies. Our missions include flying passengers to space, as well as flying scientific payloads and researchers to space in order to conduct experiments for scientific and educational purposes. Our operations include the design and development, manufacturing, ground and flight testing, spaceflight operation, and post-flight maintenance of our spaceflight system. Our spaceflight system was developed using our proprietary technology and processes and is focused on providing space experiences for private astronauts, researcher flights and professional astronaut training. We have also leveraged our knowledge and expertise in manufacturing spaceships to occasionally perform engineering services for third parties.

We were initially formed on May 5, 2017 under the name “Social Capital Hedosophia Holdings Corp.” as a Cayman Islands exempted company for the purpose of effecting a merger, share exchange, asset acquisition, share purchase, reorganization or similar business combination with one or more businesses. On October 25, 2019, we domesticated as a Delaware corporation and consummated the merger transactions contemplated by the Agreement and Plan of Merger, dated as of July 29, 2019, as amended on October 2, 2019, by and among us, Vieco USA, Inc., Vieco 10 Limited, TSC Vehicle Holdings, Inc., Virgin Galactic Vehicle Holdings, Inc., Virgin Galactic Holdings, LLC and the other parties thereto.

Our principal executive offices are located at 1700 Flight Way, Tustin, California 92782 and our telephone number is (949) 774-7640.

THE OFFERING

| | | | | | | | |

| Issuer | | Virgin Galactic Holdings, Inc. |

| | |

| Shares of common stock offered by us | | Shares of our common stock having an aggregate offering price of up to $300,000,000. |

| | |

| Plan of distribution | | “At the market offering” that may be made from time to time through or to the Agent, as sales agent or principal under the Sales Agreement. See “Plan of Distribution” beginning on page S-5. |

| | |

| Use of proceeds | | We intend to use the net proceeds from this offering to further accelerate the development and production of our next-generation spaceflight fleet, including an additional mothership and third and fourth Delta Class spaceships, as well as for general corporate purposes, including working capital and general and administrative matters. See the section titled “Use of Proceeds” on page S-4 of this prospectus supplement. |

| | |

| Market for common stock | | Our common stock is listed on the New York Stock Exchange (the “NYSE”) under the symbol “SPCE”. |

| | |

| Risk factors | | Investing in our common stock involves a high degree of risk. See “Risk Factors” beginning on page S-3 of this prospectus supplement, on page 5 of the accompanying prospectus and in any subsequent prospectus supplement for a discussion of factors you should carefully consider before investing in our common stock. |

RISK FACTORS

Investing in our securities involves risks. You should carefully consider the risks, uncertainties and other factors described in our most recent Annual Report on Form 10-K, as supplemented and updated by subsequent Quarterly Reports on Form 10-Q and Current Reports on Form 8-K that we have filed or will file with the SEC, and in other documents which are incorporated by reference into this prospectus, including the risk factors and other information contained in or incorporated by reference into this prospectus before investing in any of our securities. Our business, financial condition, results of operations, cash flows or prospects could be materially adversely affected by any of these risks. The risks and uncertainties described in the documents incorporated by reference herein are not the only risks and uncertainties that we may face.

Risks Relating to Our Common Stock and this Offering

We have broad discretion as to the use of proceeds from this offering and may not use the proceeds effectively.

Our management will retain broad discretion as to the allocation of the proceeds and may spend these proceeds in ways in which you may not agree. The failure of our management to apply these funds effectively could result in unfavorable returns and uncertainty about our prospects, each of which could cause the price of our common stock to decline.

If you purchase shares of our common stock in this offering, you may incur immediate and substantial dilution.

The price per share of common stock being offered may be higher than the net tangible book value per share of our outstanding common stock at the time you are purchasing shares in this offering. In addition, you may also experience additional dilution after this offering on any future equity issuances. To the extent we issue equity securities, our stockholders may experience substantial additional dilution.

The actual number of shares of common stock we will issue under the Sales Agreement, at any one time or in total, is uncertain.

Subject to certain limitations in the Sales Agreement and compliance with applicable law, we have the discretion to deliver a placement notice to the Agent at any time throughout the term of the Sales Agreement. The number of shares of common stock that are sold by the Agent after our delivery of a placement notice to the Agent will depend on the market price of the shares of common stock during the sales period and limits we set with the Agent. Because the price per share of each share sold will fluctuate based on the market price of shares of our common stock during the sales period, it is not possible at this stage to predict the number of shares of common stock that will or may be ultimately issued.

The shares of common stock offered hereby will be sold in “at the market offerings,” and investors who buy common stock at different times will likely pay different prices.

Investors who purchase shares of common stock in this offering at different times will likely pay different prices, and so may experience different outcomes in their investment results. We will have discretion, subject to market demand, to vary the timing, prices, and numbers of shares of common stock sold, and there is no minimum or maximum per share sales price. Investors may experience a decline in the value of their shares of common stock as a result of share sales made at prices lower than the prices they paid.

USE OF PROCEEDS

We will retain broad discretion over the use of the net proceeds, if any, from the sale of the securities offered hereby. We may issue and sell shares of common stock having aggregate sales proceeds of up to $300,000,000 from time to time. Because there is no minimum offering amount required as a condition to close this offering, the actual total public offering amount, commissions and proceeds to us, if any, are not determinable at this time.

We intend to use the net proceeds from the sale by us of the securities to which this prospectus supplement relates to further accelerate the development and production of our next-generation spaceflight fleet, including an additional mothership and third and fourth Delta Class spaceships, as well as for general corporate purposes, including working capital and general and administrative matters. We may also use a portion of our net proceeds to co-develop, acquire or invest in products, technologies or businesses that are complementary to our business. However, we currently have no agreements or commitments to complete any such transaction.

Pending the use of the net proceeds, we may invest the proceeds in interest-bearing, investment-grade securities, certificates of deposit or government securities.

PLAN OF DISTRIBUTION

We have entered into a Sales Agreement with Jefferies LLC (the "Agent" or "Jefferies"), under which we may offer and sell shares of our common stock having an aggregate offering price of up to $300,000,000 from time to time through Jefferies acting as agent. Sales of our shares of common stock, if any, under this prospectus supplement and the accompanying prospectus will be made by any method that is deemed to be an “at the market offering” as defined in Rule 415(a)(4) under the Securities Act.

Each time we wish to issue and sell our shares of common stock under the Sales Agreement, we will notify Jefferies of the number of shares to be issued, the dates on which such sales are anticipated to be made, any limitation on the number of shares to be sold in any one day and any minimum price below which sales may not be made. Once we have so instructed Jefferies, unless Jefferies declines to accept the terms of such notice, Jefferies has agreed to use its commercially reasonable efforts consistent with its normal trading and sales practices to sell such shares up to the amount specified on such terms. The obligations of Jefferies under the Sales Agreement to sell our shares of common stock are subject to a number of conditions that we must meet.

The settlement of sales of shares between us and Jefferies is generally anticipated to occur on the first trading day following the date on which the sale was made. Sales of our shares of common stock as contemplated in this prospectus supplement will be settled through the facilities of The Depository Trust Company or by such other means as we and Jefferies may agree upon. There is no arrangement for funds to be received in an escrow, trust or similar arrangement.

We will pay Jefferies a commission of up to 3.0% of the aggregate gross proceeds we receive from each sale of our shares of common stock. Because there is no minimum offering amount required as a condition to close this offering, the actual total public offering amount, commissions and proceeds to us, if any, are not determinable at this time. In addition, we have agreed to reimburse Jefferies for the fees and disbursements of its counsel, payable upon execution of the Sales Agreement, in an amount not to exceed $75,000, in addition to certain ongoing disbursements of its legal counsel not to exceed $25,000 in connection with each diligence bring-down thereafter. We estimate that the total expenses for the offering, excluding any commissions or expense reimbursement payable to Jefferies under the terms of the Sales Agreement, will be approximately $300,000. The remaining sale proceeds, after deducting any other transaction fees, will equal our net proceeds from the sale of such shares.

Jefferies will provide written confirmation to us before the open on the NYSE on the day following each day on which our shares of common stock are sold under the Sales Agreement. Each confirmation will include the number of shares sold on that day, the aggregate gross proceeds of such sales and the proceeds to us.

In connection with the sale of our shares of common stock on our behalf, Jefferies may be deemed to be an “underwriter” within the meaning of the Securities Act, and the compensation of Jefferies will be deemed to be underwriting commissions or discounts. We have agreed to indemnify Jefferies against certain civil liabilities, including liabilities under the Securities Act. We have also agreed to contribute to payments Jefferies may be required to make in respect of such liabilities.

The offering of our shares of common stock pursuant to the Sales Agreement will terminate upon the earlier of (i) the sale of all shares of common stock subject to the Sales Agreement and (ii) the termination of the Sales Agreement as permitted therein. We and Jefferies may each terminate the Sales Agreement at any time upon ten days’ prior notice.

This summary of the material provisions of the Sales Agreement does not purport to be a complete statement of its terms and conditions. A copy of the Sales Agreement will be filed as an exhibit to a current report on Form 8-K filed under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and incorporated by reference in this prospectus supplement.

Jefferies and its affiliates may in the future provide various investment banking, commercial banking, financial advisory and other financial services for us and our affiliates, for which services they may in the future receive

customary fees. In the course of its business, Jefferies may actively trade our securities for its own account or for the accounts of customers, and, accordingly, Jefferies may at any time hold long or short positions in such securities.

A prospectus supplement and the accompanying prospectus in electronic format may be made available on a website maintained by Jefferies, and Jefferies may distribute the prospectus supplement and the accompanying prospectus electronically.

LEGAL MATTERS

The validity of the shares of common stock offered hereby will be passed upon for us by Latham & Watkins LLP. The Agent is being represented in connection with this offering by Skadden, Arps, Slate, Meagher & Flom LLP.

EXPERTS

The consolidated financial statements of Virgin Galactic Holdings, Inc. as of and for the year ended December 31, 2023, and management’s assessment of the effectiveness of internal control over financial reporting as of December 31, 2023, have been incorporated by reference herein in reliance upon the report of Ernst & Young LLP, independent registered public accounting firm, incorporated by reference herein, and upon the authority of said firm as experts in accounting and auditing.

The consolidated financial statements of Virgin Galactic Holdings, Inc. as of December 31, 2022 and for the years ended December 31, 2022 and 2021 have been incorporated by reference herein in reliance upon the report of KPMG LLP, independent registered public accounting firm, incorporated by reference herein, and upon the authority of said firm as experts in accounting and auditing.

WHERE YOU CAN FIND MORE INFORMATION; INCORPORATION BY REFERENCE

Available Information

We have filed with the SEC a registration statement on Form S-3 under the Securities Act with respect to, among other securities, the shares of common stock offered by this prospectus supplement and accompanying prospectus. This prospectus supplement and the accompanying prospectus do not contain all of the information included in the registration statement. For further information pertaining to us and our common stock we are offering under this prospectus supplement and the accompanying prospectus, you should refer to the registration statement and its exhibits. Statements contained in this prospectus supplement and the accompanying prospectus concerning any of our contracts, agreements or other documents are not necessarily complete. If a contract or document has been filed as an exhibit to the registration statement, we refer you to the copy of the contract or document that has been filed. Each statement in this prospectus supplement and the accompanying prospectus relating to a contract or document filed as an exhibit is qualified in all respects by the filed exhibit.

We are subject to the informational requirements of the Exchange Act and file annual, quarterly and current reports and other information with the SEC. Our filings with the SEC are available to the public on the SEC’s website at http://www.sec.gov. You may access these materials free of charge as soon as reasonably practicable after they are electronically filed with or furnished to the SEC. Those filings are also available to the public on, or accessible through, our website under the heading “Investor Information” at www.virgingalactic.com. The information on our web site, however, is not, and should not be deemed to be, a part of this prospectus supplement and accompanying prospectus.

Incorporation by Reference

The SEC’s rules allow us to “incorporate by reference” information into this prospectus, which means that we can disclose important information to you by referring you to another document filed separately with the SEC. The information incorporated by reference is deemed to be part of this prospectus, and subsequent information that we file with the SEC will automatically update and supersede that information. Any statement contained in this prospectus or a previously filed document incorporated by reference will be deemed to be modified or superseded for purposes of this prospectus to the extent that a statement contained in this prospectus or a subsequently filed document incorporated by reference modifies or replaces that statement.

This prospectus supplement and the accompanying prospectus incorporate by reference the documents set forth below that have previously been filed with the SEC:

•Our Annual Report on Form 10-K for the year ended December 31, 2023, filed with the SEC on February 27, 2024. •Our Quarterly Reports on Form 10-Q for the quarters ended March 31, 2024, June 30, 2024 and September 30, 2024, filed with the SEC on May 7, 2024, August 7, 2024, and November 6, 2024, respectively. •Our Current Reports on Form 8-K filed with the SEC on March 14, 2024, May 29, 2024 (other than with respect to information furnished in respect of Item 7.01), June 12, 2024, June 14, 2024, July 3, 2024 and November 1, 2024. •The description of our common stock contained in the registration statement on Form 8-A, dated September 11, 2017 and filed with the SEC on September 12, 2017, and any amendment or report filed with the SEC for the purpose of updating the description, including Exhibit 4.2 to our Annual Report on Form 10-K for the year ended December 31, 2021. All reports and other documents we subsequently file pursuant to Section 13(a), 13(c), 14 or 15(d) of the Securities Exchange Act of 1934, as amended, prior to the termination of this offering, including all such documents

we may file with the SEC after the date of the initial registration statement and prior to the effectiveness of the registration statement, but excluding any information furnished to, rather than filed with, the SEC, will also be incorporated by reference into this prospectus and deemed to be part of this prospectus from the date of the filing of such reports and documents.

You may request a free copy of any of the documents incorporated by reference in this prospectus by writing or telephoning us at the following address:

Virgin Galactic Holdings, Inc.

1700 Flight Way

Tustin, California 92782

(949) 774-7640

Exhibits to the filings will not be sent, however, unless those exhibits have specifically been incorporated by reference in this prospectus or any accompanying prospectus supplement.

PROSPECTUS

Virgin Galactic Holdings, Inc.

Common Stock

Preferred Stock

Debt Securities

Depositary Shares

Warrants

Purchase Contracts

Units

We may offer and sell the securities identified above from time to time in one or more offerings. This prospectus provides you with a general description of the securities.

Each time we offer and sell securities, we will provide a supplement to this prospectus that contains specific information about the offering, as well as the amounts, prices and terms of the securities. The supplement may also add, update or change information contained in this prospectus with respect to that offering. You should carefully read this prospectus and the applicable prospectus supplement before you invest in any of our securities.

We may offer and sell the securities described in this prospectus and any prospectus supplement to or through one or more underwriters, dealers and agents, or directly to purchasers, or through a combination of these methods. If any underwriters, dealers or agents are involved in the sale of any of the securities, their names and any applicable purchase price, fee, commission or discount arrangement between or among them will be set forth, or will be calculable from the information set forth, in the applicable prospectus supplement. See the sections of this prospectus entitled “About this Prospectus” and “Plan of Distribution” for more information. No securities may be sold without delivery of this prospectus and the applicable prospectus supplement describing the method and terms of the offering of such securities.

INVESTING IN OUR SECURITIES INVOLVES RISKS. SEE THE “RISK FACTORS” ON PAGE 5 OF THIS PROSPECTUS AND ANY SIMILAR SECTION CONTAINED IN THE APPLICABLE PROSPECTUS SUPPLEMENT CONCERNING FACTORS YOU SHOULD CONSIDER BEFORE INVESTING IN OUR SECURITIES. Our common stock is listed on the New York Stock Exchange under the symbol “SPCE.” On June 21, 2023, the last reported sale price of our common stock on the New York Stock Exchange was $5.71 per share.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is June 22, 2023.

TABLE OF CONTENTS

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement that we filed with the U.S. Securities and Exchange Commission, or the SEC, as a “well-known seasoned issuer” as defined in Rule 405 under the Securities Act of 1933, as amended (the “Securities Act”), using a “shelf” registration process. By using a shelf registration statement, we may sell securities from time to time and in one or more offerings as described in this prospectus. Each time that we offer and sell securities, we will provide a prospectus supplement to this prospectus that contains specific information about the securities being offered and sold and the specific terms of that offering. We may also authorize one or more free writing prospectuses to be provided to you that may contain material information relating to these offerings. The prospectus supplement or free writing prospectus may also add, update or change information contained in this prospectus with respect to that offering. If there is any inconsistency between the information in this prospectus and the applicable prospectus supplement or free writing prospectus, you should rely on the prospectus supplement or free writing prospectus, as applicable. Before purchasing any securities, you should carefully read both this prospectus and the applicable prospectus supplement (and any applicable free writing prospectuses), together with the additional information described under the heading “Where You Can Find More Information; Incorporation by Reference.”

We have not authorized anyone to provide you with any information or to make any representations other than those contained in this prospectus, any applicable prospectus supplement or any free writing prospectuses prepared by or on behalf of us or to which we have referred you. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. We will not make an offer to sell these securities in any jurisdiction where the offer or sale is not permitted. You should assume that the information appearing in this prospectus and the applicable prospectus supplement to this prospectus is accurate only as of the date on its respective cover, that the information appearing in any applicable free writing prospectus is accurate only as of the date of that free writing prospectus, and that any information incorporated by reference is accurate only as of the date of the document incorporated by reference, unless we indicate otherwise. Our business, financial condition, results of operations and prospects may have changed since those dates. This prospectus incorporates by reference, and any prospectus supplement or free writing prospectus may contain and incorporate by reference, market data and industry statistics and forecasts that are based on independent industry publications and other publicly available information. Although we believe these sources are reliable, we do not guarantee the accuracy or completeness of this information and we have not independently verified this information. In addition, the market and industry data and forecasts that may be included or incorporated by reference in this prospectus, any prospectus supplement or any applicable free writing prospectus may involve estimates, assumptions and other risks and uncertainties and are subject to change based on various factors, including those discussed under the heading “Risk Factors” contained in this prospectus, the applicable prospectus supplement and any applicable free writing prospectus, and under similar headings in other documents that are incorporated by reference into this prospectus. Accordingly, investors should not place undue reliance on this information.

When we refer to “Virgin Galactic,” “we,” “our,” “us” and the “Company” in this prospectus, we mean Virgin Galactic Holdings, Inc. and its consolidated subsidiaries, unless otherwise specified. When we refer to “you,” we mean the potential holders of the applicable series of securities.

WHERE YOU CAN FIND MORE INFORMATION; INCORPORATION BY REFERENCE

Available Information

We file reports, proxy statements and other information with the SEC. The SEC maintains a web site that contains reports, proxy and information statements and other information about issuers, such as us, who file electronically with the SEC. The address of that website is http://www.sec.gov.

Our web site address is www.virgingalactic.com. The information on our web site, however, is not, and should not be deemed to be, a part of this prospectus.

This prospectus and any prospectus supplement are part of a registration statement that we filed with the SEC and do not contain all of the information in the registration statement. The full registration statement may be obtained from the SEC or us, as provided below. Forms of the indenture and other documents establishing the terms of the offered securities are or may be filed as exhibits to the registration statement or documents incorporated by reference in the registration statement. Statements in this prospectus or any prospectus supplement about these documents are summaries and each statement is qualified in all respects by reference to the document to which it refers. You should refer to the actual documents for a more complete description of the relevant matters. You may inspect a copy of the registration statement through the SEC’s website, as provided above.

Incorporation by Reference

The SEC’s rules allow us to “incorporate by reference” information into this prospectus, which means that we can disclose important information to you by referring you to another document filed separately with the SEC. The information incorporated by reference is deemed to be part of this prospectus, and subsequent information that we file with the SEC will automatically update and supersede that information. Any statement contained in this prospectus or a previously filed document incorporated by reference will be deemed to be modified or superseded for purposes of this prospectus to the extent that a statement contained in this prospectus or a subsequently filed document incorporated by reference modifies or replaces that statement.

This prospectus and any accompanying prospectus supplement incorporate by reference the documents set forth below that have previously been filed with the SEC:

•Our Annual Report on Form 10-K for the year ended December 31, 2022, filed with the SEC on February 28, 2023. •Our Quarterly Report on Form 10-Q for the quarter ended March 31, 2023, filed with the SEC on May 9, 2023. •The description of our common stock contained in the registration statement on Form 8-A, dated September 11, 2017 and filed with the SEC on September 12, 2017, and any amendment or report filed with the SEC for the purpose of updating the description, including Exhibit 4.2 to our Annual Report on Form 10-K for the year ended December 31, 2021. All reports and other documents we subsequently file pursuant to Section 13(a), 13(c), 14 or 15(d) of the Securities Exchange Act of 1934, as amended, which we refer to as the “Exchange Act” in this prospectus, prior to the termination of this offering, but excluding any information furnished to, rather than filed with, the SEC, will also be incorporated by reference into this prospectus and deemed to be part of this prospectus from the date of the filing of such reports and documents.

You may request a free copy of any of the documents incorporated by reference in this prospectus by writing or telephoning us at the following address:

| | |

| Virgin Galactic Holdings, Inc. |

| 1700 Flight Way |

| Tustin, California 92782 |

| (949) 774-7640 |

Exhibits to the filings will not be sent, however, unless those exhibits have specifically been incorporated by reference in this prospectus or any accompanying prospectus supplement.

THE COMPANY

We are at the vanguard of a new industry, pioneering a consumer space experience using reusable spaceflight systems. We believe the commercial exploration of space represents one of the most exciting and important technological initiatives of our time. Approximately 640 humans have ever traveled above the Earth’s atmosphere into space. This industry is growing dramatically due to new products, new sources of private and government funding, and new technologies. Demand is emerging from new sectors and demographics, which we believe is broadening the total addressable market. As government space agencies have retired or reduced their capacity to send humans into space, private companies are beginning to make exciting inroads into the fields of human space exploration. We have embarked on this journey with a mission to put humans and research experiments into space and return them safely to Earth on a routine and consistent basis. We believe that opening access to space will connect the world to the wonder and awe created by space travel, offering customers a transformative experience, and providing the foundation for a myriad of exciting new industries.

We were initially formed on May 5, 2017 as a Cayman Islands exempted company for the purpose of effecting a merger, share exchange, asset acquisition, share purchase, reorganization or similar business combination with one or more businesses. On October 25, 2019, we domesticated as a Delaware corporation and consummated the merger transactions contemplated by the Agreement and Plan of Merger, dated as of July 29, 2019, as amended on October 2, 2019, by and among us, Vieco USA, Inc. (“Vieco US”), Vieco 10 Limited, TSC Vehicle Holdings, Inc., Virgin Galactic Vehicle Holdings, Inc., Virgin Galactic Holdings, LLC and the other parties thereto. From the time of our formation to the time of the consummation of the Virgin Galactic Business Combination in October 2019, our name was “Social Capital Hedosophia Holdings Corp.”

Our principal executive offices are located at 1700 Flight Way, Tustin, California 92782, and our telephone number is (949) 774-7640.

RISK FACTORS

Investment in any securities offered pursuant to this prospectus and the applicable prospectus supplement involves risks. You should carefully consider the risk factors incorporated by reference to our most recent Annual Report on Form 10-K and any subsequent Quarterly Reports on Form 10-Q or Current Reports on Form 8-K, and all other information contained or incorporated by reference into this prospectus, as updated by our subsequent filings under the Exchange Act, and the risk factors and other information contained in the applicable prospectus supplement and any applicable free writing prospectus before acquiring any of such securities. The risks and uncertainties we have described are not the only ones facing our company. Additional risks and uncertainties not previously known to us or that we currently deem immaterial may also affect our business operations. The occurrence of any of these risks might cause you to lose all or part of your investment in the offered securities. The discussion of risks includes or refers to forward-looking statements. You should read the explanation of the qualifications and limitations on such forward-looking statements contained or incorporated by reference into this prospectus and any applicable prospectus supplement.

USE OF PROCEEDS

We intend to use the net proceeds from the sale of the securities as set forth in the applicable prospectus supplement.

DESCRIPTION OF CAPITAL STOCK

The following description of our capital stock is not complete and may not contain all the information you should consider before investing in our capital stock. This description is summarized from, and qualified in its entirety by reference to, our certificate of incorporation and bylaws, which have been publicly filed with the SEC. See “Where You Can Find More Information; Incorporation by Reference.” The summary below is also qualified by reference to the provisions of the General Corporation Law of the State of Delaware (the “DGCL”).

Authorized Capital Stock

The total amount of our authorized capital stock consists of 700,000,000 shares of common stock, par value $0.0001 per share, and 10,000,000 shares of preferred stock, par value $0.0001 per share.

Common Stock

General

Holders of our common stock are not entitled to preemptive or other similar subscription rights to purchase any of our securities. Our common stock is neither convertible nor redeemable. Unless our board of directors determines otherwise, we expect to issue all shares of our capital stock in uncertificated form.

Voting Rights

Each holder of our common stock is entitled to one vote per share on each matter submitted to a vote of stockholders, as provided by our certificate of incorporation. Our bylaws provide that the holders of a majority of the capital stock issued and outstanding and entitled to vote thereat, present in person or represented by proxy, will constitute a quorum at all meetings of stockholders for the transaction of business. When a quorum is present, the affirmative vote of a majority of the votes cast is required to take action, unless otherwise specified by law, the Stockholders’ Agreement, dated October 25, 2019, by and among us, Virgin Investments Limited, a company limited by shares under the laws of the British Virgin Islands (“VIL”), and the other parties thereto (as may be amended from time to time, the “Stockholders’ Agreement”), our bylaws or our certificate of incorporation, and except for the election of directors, which is determined by a plurality vote. There are no cumulative voting rights.

Under the Stockholders’ Agreement, VIL has the right to designate two directors for as long as VIL beneficially owns a number of shares of our common stock representing at least 25% of the number of shares beneficially owned by Vieco US immediately following the effective time of the transactions effected on October 25, 2019 in connection with our initial business combination, provided that (x) when such percentage falls below 25%, VIL will have the right to designate only one director and (y) when such percentage falls below 10%, VIL will not have the right to designate any directors.

Dividend Rights

Each holder of shares of our common stock is entitled to the payment of dividends and other distributions as may be declared by our board of directors from time to time out of our assets or funds legally available for dividends or other distributions. These rights are subject to the preferential rights of the holders of our preferred stock, if any, and any contractual limitations on our ability to declare and pay dividends.

Other Rights

Each holder of our common stock is subject to, and may be adversely affected by, the rights of the holders of any series of our preferred stock that we may designate and issue in the future.

Liquidation Rights

If we are involved in voluntary or involuntary liquidation, dissolution or winding up of our affairs, or a similar event, each holder of our common stock will participate pro rata in all assets remaining after payment of liabilities, subject to prior distribution rights of our preferred stock, if any, then outstanding.

Anti-Takeover Effects of the Certificate of Incorporation and the Bylaws

Our certificate of incorporation and our bylaws contain provisions that may delay, defer or discourage another party from acquiring control of our company. We expect that these provisions, which are summarized below, will

discourage coercive takeover practices and inadequate takeover bids. These provisions are also designed to encourage persons seeking to acquire control of our company to first negotiate with our board of directors, which we believe may result in an improvement of the terms of any such acquisition in favor of our stockholders. However, they also give our board of directors the power to discourage mergers that some stockholders may favor.

Special Meetings of Stockholders

Our certificate of incorporation provides that a special meeting of stockholders may be called by the (a) the chairperson of our board of directors or (b) our board of directors.

No Stockholder Action by Written Consent

Our certificate of incorporation provides that any action required or permitted to be taken by our stockholders of the Corporation must be effected at a duly called annual or special meeting of stockholders and not by written consent.

Removal of Directors

Pursuant to the Stockholders’ Agreement, VIL has the exclusive right to remove one or more of the VIL-designated directors from our board of directors. VIL has the exclusive right to designate directors for election to our board of directors to fill vacancies created by reason of death, removal or resignation of its designees as contemplated by the Stockholders’ Agreement.

VIL’s Approval Rights

Amendment to Certificate of Incorporation and Bylaws

The DGCL provides generally that the affirmative vote of a majority of the outstanding stock entitled to vote on amendments to a corporation’s certificate of incorporation or bylaws is required to approve such amendment, unless a corporation’s certificate of incorporation or bylaws, as the case may be, requires a greater percentage. Our bylaws may be further amended, altered, changed or repealed by a majority vote of our board of directors. However, pursuant to the Stockholders’ Agreement, no amendment to our certificate of incorporation or bylaws may be made without VIL’s prior written consent for so long as VIL has the right to designate at least one director to our board of directors under the Stockholders’ Agreement.

Operational Matters

VIL has expansive rights of approval for certain material operational and other matters for us, including:

•for so long as VIL is entitled to designate at least one director to our board of directors under the Stockholders’ Agreement, in addition to any vote or consent of the stockholders or our board of directors as required by law, we and our subsidiaries must obtain VIL’s prior written consent to engage in:

◦any business combination or similar transaction;

◦a liquidation or related transaction; or

◦an issuance of capital stock in excess of 5% of our then issued and outstanding shares or those of any of our subsidiaries; and

•for so long as VIL is entitled to designate at least two directors to our board of directors under the Stockholders’ Agreement, in addition to any vote or consent of our stockholders or board of directors as required by law, we must obtain VIL’s prior written consent to engage in:

◦a business combination or similar transaction having a fair market value of $10.0 million or more;

◦a non-ordinary course sale of assets or equity interest having a fair market value of $10.0 million or more;

◦an acquisition of any business or assets having a fair market value of $10.0 million or more;

◦approval of any non-ordinary course investment having a fair market value of $10.0 million or more;

◦an issuance or sale of any shares of our capital stock, other than an issuance of shares of our capital stock upon the exercise of options to purchase shares of our capital stock;

◦making any dividends or distribution to our stockholders other than those made in connection with the cessation of services of employees;

◦incurring indebtedness outside of the ordinary course in an amount greater than $25.0 million in a single transaction or $100.0 million in aggregate consolidated indebtedness;

◦amendment of the terms of the Stockholders’ Agreement or the Amended and Restated Registration Rights Agreement, dated October 25, 2019, by and among us, VIL, and the other parties thereto;

◦a liquidation or similar transaction;

◦transactions with any interested stockholder pursuant to Item 404 of Regulation S-K; or

◦increasing or decreasing the size of our board of directors.

Delaware Anti-Takeover Statute

Section 203 of the DGCL provides that if a person acquires 15% or more of the voting stock of a Delaware corporation, such person becomes an “interested stockholder” and may not engage in certain “business combinations” with such corporation for a period of three years from the time such person acquired 15% or more of such corporation’s voting stock, unless: (1) the board of directors of such corporation approves the acquisition of stock or the merger transaction before the time that the person becomes an interested stockholder, (2) the interested stockholder owns at least 85% of the outstanding voting stock of such corporation at the time the merger transaction commences (excluding voting stock owned by directors who are also officers and certain employee stock plans) or (3) the merger transaction is approved by the board of directors of such corporation and at a meeting of stockholders, not by written consent, by the affirmative vote of two-thirds of the outstanding voting stock which is not owned by the interested stockholder. A Delaware corporation may elect in its certificate of incorporation or bylaws not to be governed by this particular Delaware law.

Under our certificate of incorporation, we have opted out of Section 203 of the DGCL.

Under certain circumstances, this provision would make it more difficult for us to effect various transactions with a person who would be an “interested stockholder” for these purposes. However, this provision would not be likely to discourage any parties interested in entering into a potential transaction with us, other than VIL and its affiliates. This provision may encourage VIL and VIL’s affiliates, to the extent they are interested in entering into certain significant transactions with us, to negotiate in advance with the full board of directors because the board approval requirement would be satisfied by the affirmative vote of at least a majority of our directors that are not designees of VIL.

Corporate Opportunity

Under our certificate of incorporation, an explicit waiver regarding corporate opportunities is granted to certain “exempted persons” (including VIL and its affiliates, successors, directly or indirectly managed funds or vehicles, partners, principals, directors, officers, members, managers and employees, including any of the foregoing who serve as our directors). Such “exempted persons” will not include us or our officers or employees and such waiver will not apply to any corporate opportunity that is expressly offered to any of our directors in their capacity as such (in which such opportunity we do not renounce an interest or expectancy). Our certificate of incorporation provides that, to the fullest extent permitted by law, (i) the exempted persons do not have any fiduciary duty to refrain from engaging directly or indirectly in the same or similar business activities or lines of business as us, (ii) we renounce any interest or expectancy in, or in being offered an opportunity to participate in, business opportunities that are from time to time presented to the exempted persons, even if the opportunity is one that we might reasonably be deemed to have pursued or had the ability or desire to pursue if granted the opportunity to do so and (iii) no

exempted person will have any duty to communicate or offer such business opportunity to us and no exempted person will be liable to us for breach of any fiduciary or other duty, as a director or officer or otherwise, by reason of the fact that such exempted person pursues or acquires such business opportunity, directs such business opportunity to another person or fails to present such business opportunity, or information regarding such business opportunity, to us.

Limitations on Liability and Indemnification of Officers and Directors

Our certificate of incorporation limits the liability of our officers and directors to the fullest extent permitted by the DGCL, and our bylaws provide that we will indemnify them to the fullest extent permitted by such law. We have entered into and expect to continue to enter into agreements to indemnify our directors, officers and other employees as determined by our board of directors. Under the terms of such indemnification agreements, we are required to indemnify each of our directors and officers, to the fullest extent permitted by the laws of the state of Delaware, if the basis of the indemnitee’s involvement was by reason of the fact that the indemnitee is or was our director or officer or was serving at our request in an official capacity for another entity. We must indemnify our officers and directors against all reasonable fees, expenses, charges and other costs of any type or nature whatsoever, including any and all expenses and obligations paid or incurred in connection with investigating, defending, being a witness in, participating in (including on appeal), or preparing to defend, be a witness or participate in any completed, actual, pending or threatened action, suit, claim or proceeding, whether civil, criminal, administrative or investigative, or establishing or enforcing a right to indemnification under the indemnification agreement. The indemnification agreements also require us, if so requested, to advance all reasonable fees, expenses, charges and other costs that such director or officer incurred, provided that such person will return any such advance if it is ultimately determined that such person is not entitled to indemnification by us. Any claims for indemnification by our directors and officers may reduce our available funds to satisfy successful third-party claims against us and may reduce the amount of money available to us.

Exclusive Jurisdiction of Certain Actions

Our certificate of incorporation requires, to the fullest extent permitted by law, that derivative actions brought in our name against our directors, officers or employees for breach of fiduciary duty, any provision of the DGCL, our certificate of incorporation or our bylaws or other similar actions may be brought only in the Court of Chancery in the State of Delaware and, if brought outside of Delaware, the stockholder bringing the suit will be deemed to have consented to service of process on such stockholder’s counsel. Notwithstanding the foregoing, our certificate of incorporation provides that the exclusive forum provision will not apply to suits brought to enforce a duty or liability created by the Securities Act, the Exchange Act or any other claim for which the federal courts have exclusive jurisdiction. Section 22 of the Securities Act creates concurrent jurisdiction for federal and state courts over all suits brought to enforce any duty or liability created by the Securities Act or the rules and regulations thereunder. Similarly, Section 27 of the Exchange Act creates exclusive federal jurisdiction over all suits brought to enforce any duty or liability created by the Exchange Act or the rules and regulations thereunder. Although we believe this provision benefits us by providing increased consistency in the application of Delaware law in the types of lawsuits to which it applies, the provision may have the effect of discouraging lawsuits against our directors and officers.

Transfer Agent

The transfer agent for our common stock is Continental Stock Transfer & Trust Company.

DESCRIPTION OF DEBT SECURITIES

The following description, together with the additional information we include in any applicable prospectus supplement or free writing prospectus, summarizes certain general terms and provisions of the debt securities that we may offer under this prospectus. When we offer to sell a particular series of debt securities, we will describe the specific terms of the series in a supplement to this prospectus. We will also indicate in the supplement to what extent the general terms and provisions described in this prospectus apply to a particular series of debt securities.

We may issue debt securities either separately, or together with, or upon the conversion or exercise of or in exchange for, other securities described in this prospectus. Debt securities may be our senior, senior subordinated or subordinated obligations and, unless otherwise specified in a supplement to this prospectus, the debt securities will be our direct, unsecured obligations and may be issued in one or more series.

The debt securities will be issued under an indenture between us and U.S. Bank Trust Company, National Association, as trustee. We have summarized select portions of the indenture below. The summary is not complete. The form of the indenture has been filed as an exhibit to the registration statement and you should read the indenture for provisions that may be important to you. In the summary below, we have included references to the section numbers of the indenture so that you can easily locate these provisions. Capitalized terms used in the summary and not defined herein have the meanings specified in the indenture.

As used in this section only, “Virgin Galactic,” “we,” “our” or “us” refer to Virgin Galactic Holdings, Inc., excluding our subsidiaries, unless expressly stated or the context otherwise requires.

General

The terms of each series of debt securities will be established by or pursuant to a resolution of our board of directors and set forth or determined in the manner provided in a resolution of our board of directors, in an officer’s certificate or by a supplemental indenture. (Section 2.2) The particular terms of each series of debt securities will be described in a prospectus supplement relating to such series (including any pricing supplement or term sheet).

We can issue an unlimited amount of debt securities under the indenture that may be in one or more series with the same or various maturities, at par, at a premium, or at a discount. (Section 2.1) We will set forth in a prospectus supplement (including any pricing supplement or term sheet) relating to any series of debt securities being offered, the aggregate principal amount and the following terms of the debt securities, if applicable:

•the title and ranking of the debt securities (including the terms of any subordination provisions);

•the price or prices (expressed as a percentage of the principal amount) at which we will sell the debt securities;

•any limit on the aggregate principal amount of the debt securities;

•the date or dates on which the principal of the securities of the series is payable;

•the rate or rates (which may be fixed or variable) per annum or the method used to determine the rate or rates (including any commodity, commodity index, stock exchange index or financial index) at which the debt securities will bear interest, the date or dates from which interest will accrue, the date or dates on which interest will commence and be payable and any regular record date for the interest payable on any interest payment date;

•the place or places where principal of, and interest, if any, on the debt securities will be payable (and the method of such payment), where the securities of such series may be surrendered for registration of transfer or exchange, and where notices and demands to us in respect of the debt securities may be delivered;

•the period or periods within which, the price or prices at which and the terms and conditions upon which we may redeem the debt securities;

•any obligation we have to redeem or purchase the debt securities pursuant to any sinking fund or analogous provisions or at the option of a holder of debt securities and the period or periods within which, the price or

prices at which and in the terms and conditions upon which securities of the series shall be redeemed or purchased, in whole or in part, pursuant to such obligation;

•the dates on which and the price or prices at which we will repurchase debt securities at the option of the holders of debt securities and other detailed terms and provisions of these repurchase obligations;

•the denominations in which the debt securities will be issued, if other than denominations of $1,000 and any integral multiple thereof;

•whether the debt securities will be issued in the form of certificated debt securities or global debt securities;

•the portion of principal amount of the debt securities payable upon declaration of acceleration of the maturity date, if other than the principal amount;

•the currency of denomination of the debt securities, which may be United States Dollars or any foreign currency, and if such currency of denomination is a composite currency, the agency or organization, if any, responsible for overseeing such composite currency;

•the designation of the currency, currencies or currency units in which payment of principal of, premium and interest on the debt securities will be made;

•if payments of principal of, premium or interest on the debt securities will be made in one or more currencies or currency units other than that or those in which the debt securities are denominated, the manner in which the exchange rate with respect to these payments will be determined;

•the manner in which the amounts of payment of principal of, premium, if any, or interest on the debt securities will be determined, if these amounts may be determined by reference to an index based on a currency or currencies or by reference to a commodity, commodity index, stock exchange index or financial index;

•any provisions relating to any security provided for the debt securities;

•any addition to, deletion of or change in the Events of Default described in this prospectus or in the indenture with respect to the debt securities and any change in the acceleration provisions described in this prospectus or in the indenture with respect to the debt securities;

•any addition to, deletion of or change in the covenants described in this prospectus or in the indenture with respect to the debt securities;

•any depositaries, interest rate calculation agents, exchange rate calculation agents or other agents with respect to the debt securities;

•the provisions, if any, relating to conversion or exchange of any debt securities of such series, including if applicable, the conversion or exchange price and period, provisions as to whether conversion or exchange will be mandatory, the events requiring an adjustment of the conversion or exchange price and provisions affecting conversion or exchange;

•any other terms of the debt securities, which may supplement, modify or delete any provision of the indenture as it applies to that series, including any terms that may be required under applicable law or regulations or advisable in connection with the marketing of the securities; and

•whether any of our direct or indirect subsidiaries will guarantee the debt securities of that series, including the terms of subordination, if any, of such guarantees. (Section 2.2)

We may issue debt securities that provide for an amount less than their stated principal amount to be due and payable upon declaration of acceleration of their maturity pursuant to the terms of the indenture. We will provide you with information on the federal income tax considerations and other special considerations applicable to any of these debt securities in the applicable prospectus supplement.

If we denominate the purchase price of any of the debt securities in a foreign currency or currencies or a foreign currency unit or units, or if the principal of and any premium and interest on any series of debt securities is payable in a foreign currency or currencies or a foreign currency unit or units, we will provide you with information on the restrictions, elections, general tax considerations, specific terms and other information with respect to that issue of debt securities and such foreign currency or currencies or foreign currency unit or units in the applicable prospectus supplement.

Transfer and Exchange

Each debt security will be represented by either one or more global securities registered in the name of The Depository Trust Company, or the Depositary, or a nominee of the Depositary (we will refer to any debt security represented by a global debt security as a “book-entry debt security”), or a certificate issued in definitive registered form (we will refer to any debt security represented by a certificated security as a “certificated debt security”) as set forth in the applicable prospectus supplement. Except as set forth under the heading “Global Debt Securities and Book-Entry System” below, book-entry debt securities will not be issuable in certificated form.

Certificated Debt Securities. You may transfer or exchange certificated debt securities at any office we maintain for this purpose in accordance with the terms of the indenture. (Section 2.4) No service charge will be made for any transfer or exchange of certificated debt securities, but we may require payment of a sum sufficient to cover any tax or other governmental charge payable in connection with a transfer or exchange. (Section 2.7)

You may effect the transfer of certificated debt securities and the right to receive the principal of, premium and interest on certificated debt securities only by surrendering the certificate representing those certificated debt securities and either reissuance by us or the trustee of the certificate to the new holder or the issuance by us or the trustee of a new certificate to the new holder.

Global Debt Securities and Book-Entry System. Each global debt security representing book-entry debt securities will be deposited with, or on behalf of, the Depositary, and registered in the name of the Depositary or a nominee of the Depositary. Please see “Global Securities.”

Covenants

We will set forth in the applicable prospectus supplement any restrictive covenants applicable to any issue of debt securities. (Article IV)

No Protection in the Event of a Change of Control

Unless we state otherwise in the applicable prospectus supplement, the debt securities will not contain any provisions which may afford holders of the debt securities protection in the event we have a change in control or in the event of a highly leveraged transaction (whether or not such transaction results in a change in control) which could adversely affect holders of debt securities.

Consolidation, Merger and Sale of Assets

We may not consolidate with or merge with or into, or convey, transfer or lease all or substantially all of our properties and assets to any person (a “successor person”) unless:

•we are the surviving corporation or the successor person (if other than Virgin Galactic) is a corporation organized and validly existing under the laws of any U.S. domestic jurisdiction and expressly assumes our obligations on the debt securities and under the indenture; and

•immediately after giving effect to the transaction, no Default or Event of Default, shall have occurred and be continuing.

Notwithstanding the above, any of our subsidiaries may consolidate with, merge into or transfer all or part of its properties to us. (Section 5.1)

Events of Default

“Event of Default” means with respect to any series of debt securities, any of the following:

•default in the payment of any interest upon any debt security of that series when it becomes due and payable, and continuance of such default for a period of 30 days (unless the entire amount of the payment is deposited by us with the trustee or with a paying agent prior to the expiration of the 30-day period);

•default in the payment of principal of any security of that series at its maturity;

•default in the performance or breach of any other covenant or warranty by us in the indenture (other than a covenant or warranty that has been included in the indenture solely for the benefit of a series of debt securities other than that series), which default continues uncured for a period of 60 days after we receive written notice from the trustee or Virgin Galactic and the trustee receive written notice from the holders of not less than 25% in principal amount of the outstanding debt securities of that series as provided in the indenture;

•certain voluntary or involuntary events of bankruptcy, insolvency or reorganization of Virgin Galactic;

•any other Event of Default provided with respect to debt securities of that series that is described in the applicable prospectus supplement. (Section 6.1)

No Event of Default with respect to a particular series of debt securities (except as to certain events of bankruptcy, insolvency or reorganization) necessarily constitutes an Event of Default with respect to any other series of debt securities. (Section 6.1) The occurrence of certain Events of Default or an acceleration under the indenture may constitute an event of default under certain indebtedness of ours or our subsidiaries outstanding from time to time.

We will provide the trustee written notice of any Default or Event of Default within 30 days of becoming aware of the occurrence of such Default or Event of Default, which notice will describe in reasonable detail the status of such Default or Event of Default and what action we are taking or propose to take in respect thereof. (Section 6.1)

If an Event of Default with respect to debt securities of any series at the time outstanding occurs and is continuing, then the trustee or the holders of not less than 25% in principal amount of the outstanding debt securities of that series may, by a notice in writing to us (and to the trustee if given by the holders), declare to be due and payable immediately the principal of (or, if the debt securities of that series are discount securities, that portion of the principal amount as may be specified in the terms of that series) and accrued and unpaid interest, if any, on all debt securities of that series. In the case of an Event of Default resulting from certain events of bankruptcy, insolvency or reorganization, the principal (or such specified amount) of and accrued and unpaid interest, if any, on all outstanding debt securities will become and be immediately due and payable without any declaration or other act on the part of the trustee or any holder of outstanding debt securities. At any time after a declaration of acceleration with respect to debt securities of any series has been made, but before a judgment or decree for payment of the money due has been obtained by the trustee, the holders of a majority in principal amount of the outstanding debt securities of that series may rescind and annul the acceleration if all Events of Default, other than the non-payment of accelerated principal and interest, if any, with respect to debt securities of that series, have been cured or waived as provided in the indenture. (Section 6.2) We refer you to the prospectus supplement relating to any series of debt securities that are discount securities for the particular provisions relating to acceleration of a portion of the principal amount of such discount securities upon the occurrence of an Event of Default.

The indenture provides that the trustee may refuse to perform any duty or exercise any of its rights or powers under the indenture unless the trustee receives indemnity or security satisfactory to it against any cost, liability or expense which might be incurred by it in performing such duty or exercising such right or power. (Section 7.1(e)) Subject to certain rights of the trustee, the holders of a majority in principal amount of the outstanding debt securities of any series will have the right to direct the time, method and place of conducting any proceeding for any remedy available to the trustee or exercising any trust or power conferred on the trustee with respect to the debt securities of that series. (Section 6.12)

No holder of any debt security of any series will have any right to institute any proceeding, judicial or otherwise, with respect to the indenture or for the appointment of a receiver or trustee, or for any remedy under the indenture, unless:

•that holder has previously given to the trustee written notice of a continuing Event of Default with respect to debt securities of that series; and

•the holders of not less than 25% in principal amount of the outstanding debt securities of that series have made written request, and offered indemnity or security satisfactory to the trustee, to the trustee to institute the proceeding as trustee, and the trustee has not received from the holders of not less than a majority in principal amount of the outstanding debt securities of that series a direction inconsistent with that request and has failed to institute the proceeding within 60 days. (Section 6.7)

Notwithstanding any other provision in the indenture, the holder of any debt security will have an absolute and unconditional right to receive payment of the principal of, premium and any interest on that debt security on or after the due dates expressed in that debt security and to institute suit for the enforcement of payment. (Section 6.8)

The indenture requires us, within 120 days after the end of our fiscal year, to furnish to the trustee a statement as to compliance with the indenture. (Section 4.3) If a Default or Event of Default occurs and is continuing with respect to the securities of any series and if it is known to a responsible officer of the trustee, the trustee shall mail to each Securityholder of the securities of that series notice of a Default or Event of Default within 90 days after it occurs or, if later, after a responsible officer of the trustee has knowledge of such Default or Event of Default. The indenture provides that the trustee may withhold notice to the holders of debt securities of any series of any Default or Event of Default (except in payment on any debt securities of that series) with respect to debt securities of that series if the trustee determines in good faith that withholding notice is in the interest of the holders of those debt securities. (Section 7.5)

Modification and Waiver

We and the trustee may modify, amend or supplement the indenture or the debt securities of any series without the consent of any holder of any debt security:

•to cure any ambiguity, defect or inconsistency;

•to comply with covenants in the indenture described above under the heading “Consolidation, Merger and Sale of Assets”;

•to provide for uncertificated securities in addition to or in place of certificated securities;

•to add guarantees with respect to debt securities of any series or secure debt securities of any series;

•to surrender any of our rights or powers under the indenture;

•to add covenants or events of default for the benefit of the holders of debt securities of any series;

•to comply with the applicable procedures of the applicable depositary;

•to make any change that does not adversely affect the rights of any holder of debt securities;

•to provide for the issuance of and establish the form and terms and conditions of debt securities of any series as permitted by the indenture;

•to effect the appointment of a successor trustee with respect to the debt securities of any series and to add to or change any of the provisions of the indenture to provide for or facilitate administration by more than one trustee; or

•to comply with requirements of the SEC in order to effect or maintain the qualification of the indenture under the Trust Indenture Act. (Section 9.1)

We may also modify and amend the indenture with the consent of the holders of at least a majority in principal amount of the outstanding debt securities of each series affected by the modifications or amendments. We may not make any modification or amendment without the consent of the holders of each affected debt security then outstanding if that amendment will:

•reduce the amount of debt securities whose holders must consent to an amendment, supplement or waiver;

•reduce the rate of or extend the time for payment of interest (including default interest) on any debt security;

•reduce the principal of or premium on or change the fixed maturity of any debt security or reduce the amount of, or postpone the date fixed for, the payment of any sinking fund or analogous obligation with respect to any series of debt securities;

•reduce the principal amount of discount securities payable upon acceleration of maturity;

•waive a default in the payment of the principal of, premium or interest on any debt security (except a rescission of acceleration of the debt securities of any series by the holders of at least a majority in aggregate principal amount of the then outstanding debt securities of that series and a waiver of the payment default that resulted from such acceleration);

•make the principal of or premium or interest on any debt security payable in currency other than that stated in the debt security;

•make any change to certain provisions of the indenture relating to, among other things, the right of holders of debt securities to receive payment of the principal of, premium and interest on those debt securities and to institute suit for the enforcement of any such payment and to waivers or amendments; or

•waive a redemption payment with respect to any debt security. (Section 9.3)