0001576018false00015760182023-11-082023-11-080001576018us-gaap:CommonStockMember2023-11-082023-11-080001576018tpre:A800ResettableFixedRatePreferenceSharesSeriesBMember2023-11-082023-11-08

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported): November 8, 2023 (November 8, 2023)

SIRIUSPOINT LTD.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| | | | |

| Bermuda | | 001-36052 | | 98-1599372 |

(State or other jurisdiction

of incorporation) | | (Commission

File Number) | | (I.R.S. Employer

Identification No.) |

Point Building

3 Waterloo Lane

Pembroke HM 08 Bermuda

(Address of principal executive offices and Zip Code)

Registrant’s telephone number, including area code: +1 441 542-3300

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading symbol(s) | Name of each exchange on which registered |

| Common Shares, $0.10 par value | SPNT | New York Stock Exchange |

8.00% Resettable Fixed Rate Preference Shares,

Series B, $0.10 par value,

$25.00 liquidation preference per share | SPNT PB | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR 230.405) or Rule 12b-2 of the Exchange Act of 1934 (17 CFR 240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

☐

| | | | | |

| Item 2.02 | Results of Operations and Financial Condition. |

On November 8, 2023, SiriusPoint Ltd. issued a press release reporting its financial results for the third quarter ended September 30, 2023 attached hereto as Exhibit 99.1.

The information contained in this Item 2.02 of this Current Report on Form 8-K, including Exhibit 99.1 attached hereto, is being furnished pursuant to this Item 2.02. This information shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that Section, or incorporated by reference into any filing under the Securities Act of 1933, as amended (the “Securities Act”), or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

| | | | | |

| Item 7.01 | Regulation FD Disclosure. |

On November 8, 2023, SiriusPoint Ltd. made available to investors its third quarter financial supplement attached hereto as Exhibit 99.2, and slide presentation attached hereto as Exhibit 99.3 by SiriusPoint Ltd. in presentations to investors.

The information contained in this Item 7.01 of this Current Report on Form 8-K, including Exhibit 99.2 and Exhibit 99.3 attached hereto, are being furnished pursuant to this Item 7.01. This information shall not deemed to be “filed” for purposes of Section 18 of the Exchange Act, or otherwise subject to the liabilities of that Section, or incorporated by reference into any filing under the Securities Act or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

Item 8.01 Other Events.

On November 7, 2023, the Board of Directors of SiriusPoint Ltd. approved a quarterly cash dividend of $0.50 per share on its 8.00% Resettable Fixed Rate Preference Shares, Series B, $0.10 par value, $25.00 liquidation preference per share payable on August 31, 2023 to Series B shareholders of record as of November 15, 2023. A copy of the press release is attached hereto as Exhibit 99.4.

| | | | | |

| Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits

| | | | | | | | |

| | |

Exhibit

No. | | Description |

| | |

| 99.1 | | |

| 99.2 | | |

| 99.3 | | |

| 99.4 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

| | |

| | |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | | |

| Date: November 8, 2023 | | /s/ Scott Egan |

| | Name: | Scott Egan |

| | Title: | Chief Executive Officer |

| | | |

SiriusPoint reports 87.6% Combined ratio for its Core operations with Net Income up $622m at 9M’23

HAMILTON, Bermuda, November 8, 2023 - SiriusPoint Ltd. (“SiriusPoint” or the “Company”) (NYSE:SPNT) today announced results for its third quarter ended September 30, 2023.

•Report another quarter of positive capital generation as we delivered first-ever underwriting profit during Q3 since the Merger as our actions have led to significantly reduced Catastrophe losses

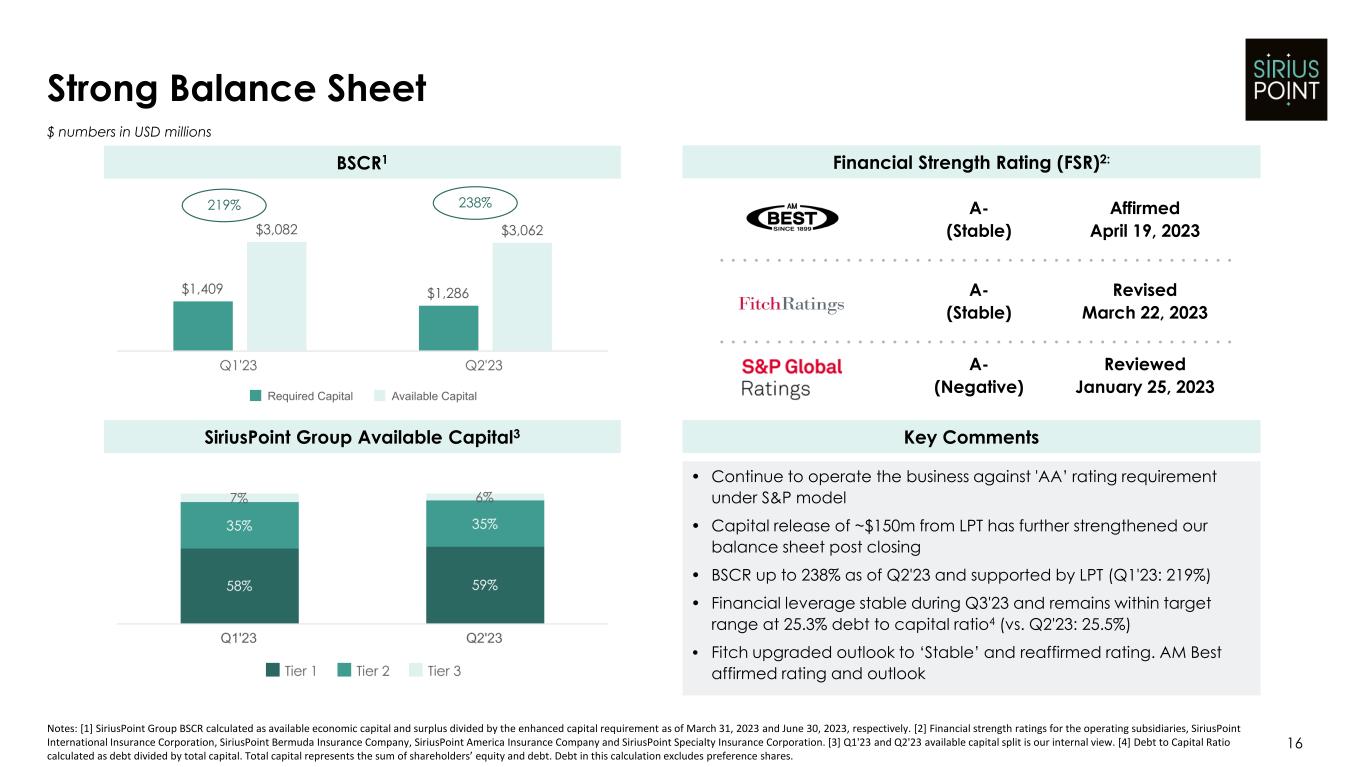

•Capital position remains strong, financial leverage is stable and our investment portfolio remains defensively positioned

•We are on track to deliver double-digit return on average common equity in 2023, reiterating guidance on 2024 cost savings of >$50 million and increasing 2023 net investment income guidance to $250-260 million

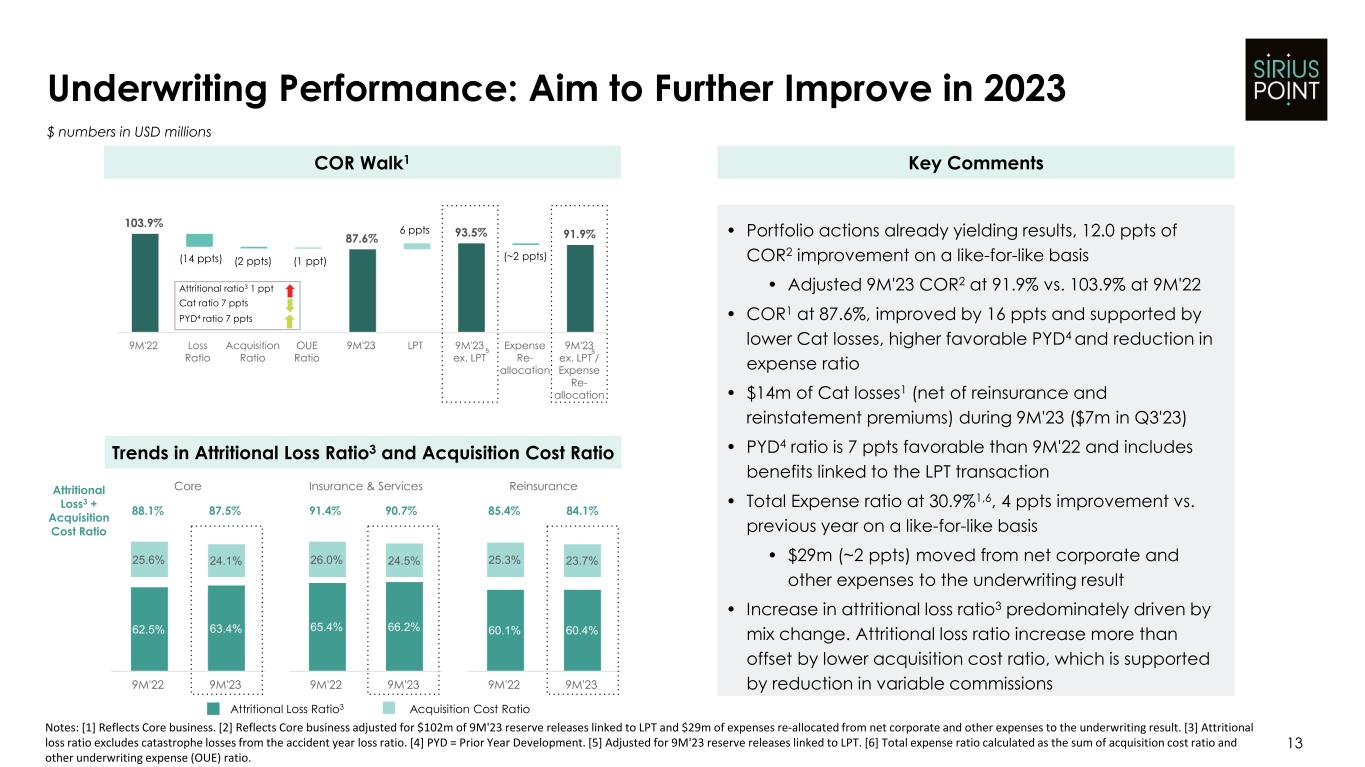

Scott Egan, Chief Executive Officer, said: “We have had a strong quarter as we delivered positive underwriting results in the third quarter for the first time in the Group’s history. Our combined ratio for the Group’s Core operations was 87.6% with Catastrophe losses materially down at $14 million compared to $138 million in the prior year period. There has been improvement across all areas of our business and our actions are having the desired impact.

Investment results remain strong, and we raise our guidance on full year net investment income to $250 million to $260 million from $220 million to $240 million. MGA revenues grew at 7% while margins increased to 21%. Our balance sheet is strong, and we remain on track to hit double-digit ROE this year.

During the quarter, we also entered into a standstill agreement with Mr. Daniel Loeb. This removes any lingering uncertainty and underlines Mr Loeb’s support for the strategy and progress he outlined in his 13D.

I have now completed one year at SiriusPoint, and I am incredibly proud of the progress made to date. We have created significant shareholder value and our aim is to continue to improve as we go into 2024. We believe strongly there is the potential to do so. I would like to thank our shareholders and customers for their support and patience as we turnaround the performance of the Group and my colleagues for their hard work and dedication to the task.”

Third Quarter 2023 Highlights

•Net income available to SiriusPoint common shareholders of $58 million, or $0.32 per diluted common share

•Core income of $50 million, which includes underwriting income of $43 million, Core combined ratio of 92.5%

•Net investment income of $75 million and total investment result of $68 million

•Tangible book value per diluted common share decreased $0.04 per share, or 0.4%, from June 30, 2023 to $11.19 per share

•Annualized return on average common equity of 11.3%

•Asset duration increased to 2.7 years, from 2.5 years at June 30, 2023

Nine months ended September 30, 2023 Highlights

•Net income available to SiriusPoint common shareholders of $245 million, or $1.36 per diluted common share

•Consolidated combined ratio of 81.6%, underwriting income of $339 million

•Core income of $245 million, which includes underwriting income of $213 million, Core combined ratio of 87.6%

•Core net services fee income of $38 million, up 10.6% from the nine months ended September 30, 2022, with service margin of 20.7%

•Net investment income of $205 million and total investment result of $208 million

•Tangible book value per diluted common share increased $0.76, or 7.3%, from December 31, 2022 to $11.19 per share

•Annualized return on average common equity of 16.7%

Key Financial Metrics

The following table shows certain key financial metrics for the three and nine months ended September 30, 2023 and 2022:

| | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended | | Nine months ended |

| September 30, 2023 | | September 30, 2022 | | September 30, 2023 | | September 30, 2022 |

| ($ in millions, except for per share data and ratios) |

| Combined ratio | 88.0 | % | | 107.7 | % | | 81.6 | % | | 98.5 | % |

| Core underwriting income (loss) (1) | $ | 42.5 | | | $ | (88.3) | | | $ | 213.2 | | | $ | (66.0) | |

| Core net services income (1) | $ | 7.5 | | | $ | 9.2 | | | $ | 31.9 | | | $ | 34.6 | |

| Core income (loss) (1) | $ | 50.0 | | | $ | (79.1) | | | $ | 245.1 | | | $ | (31.4) | |

Core combined ratio (1) | 92.5 | % | | 114.5 | % | | 87.6 | % | | 103.9 | % |

| Annualized return on average common shareholders’ equity attributable to SiriusPoint common shareholders | 11.3 | % | | (20.1) | % | | 16.7 | % | | (24.0) | % |

| Book value per common share (2) | $ | 12.42 | | | $ | 11.56 | | | $ | 12.42 | | | $ | 11.56 | |

| Book value per diluted common share (2) | $ | 12.11 | | | $ | 11.32 | | | $ | 12.11 | | | $ | 11.32 | |

| Tangible book value per diluted common share (1)(2) | $ | 11.19 | | | $ | 10.43 | | | $ | 11.19 | | | $ | 10.43 | |

| | | | | | | |

(1)Core underwriting income (loss), Core net services income, Core income (loss) and Core combined ratio are non-GAAP financial measures. See definitions in “Non-GAAP Financial Measures” and reconciliations in “Segment Reporting.” Tangible book value per diluted common share is a non-GAAP financial measure. See definition and reconciliation in “Non-GAAP Financial Measures.”

(2)Prior year comparatives represent amounts as of December 31, 2022.

Third Quarter 2023 Summary

Consolidated underwriting income for the three months ended September 30, 2023 was $73.8 million compared to underwriting loss of $46.9 million for the three months ended September 30, 2022. The improvement in net underwriting results was driven by lower catastrophe losses and improved favorable prior year loss reserve development. Catastrophe losses, net of reinsurance and reinstatement premiums, for the three months ended September 30, 2023 were $12.0 million, or 2.0 percentage points on the combined ratio, including Hawaii wildfires, Hurricane Idalia, and Storm Hans, compared to $114.6 million or 18.7 points on the combined ratio for the three months ended September 30, 2022, primarily from Hurricane Ian. The lower catastrophe losses were a result of the Company’s significant reduction in catastrophe exposed business. Favorable prior year loss reserve development of $24.7 million for the three months ended September 30, 2023 compared to $5.3 million for the three months ended September 30, 2022 was primarily the result of management reflecting the continued favorable reported loss emergence through September 30, 2023 in its best estimate of reserves.

Consolidated underwriting income for the nine months ended September 30, 2023 was $339.2 million compared to $25.4 million for the nine months ended September 30, 2022. The improvement in net underwriting results was driven by improved favorable prior year loss reserve development of $163.1 million for the nine months ended September 30, 2023 compared to $17.2 million for the nine months ended September 30, 2022. This increase in favorable prior year loss reserve development was primarily the result of management reflecting the continued favorable reported loss emergence through September 30, 2023 in its best estimate of reserves, which was further validated by the pricing of the 2023 LPT from external reinsurers, which represents $122.2 million of the favorable prior year loss reserve development. In addition, catastrophe losses, net of reinsurance and reinstatement premiums, were $24.9 million, or 1.3 percentage points on the combined ratio, for the nine months ended September 30, 2023, primarily driven by the Turkey Earthquake and Chile Wildfire, compared to $137.7 million, or 8.0 percentage points on the combined ratio, for the nine months ended September 30, 2022, primarily driven by Hurricane Ian. The lower catastrophe losses were a result of the Company’s significant reduction in catastrophe exposed business.

Reportable Segments

The determination of our reportable segments is based on the manner in which management monitors the performance of our operations, which consist of two reportable segments - Reinsurance and Insurance & Services.

Core Underwriting Results

Collectively, the sum of our two segments, Reinsurance and Insurance & Services, constitute our “Core” results. Core underwriting income, Core net services income, Core income and Core combined ratio are non-GAAP financial measures. See reconciliations in “Segment Reporting”. We believe it is useful to review Core results as it better reflects how management views the business and reflects our decision to exit the runoff business. The sum of Core results and Corporate results are equal to the consolidated results of operations.

Three months ended September 30, 2023 and 2022

Core results for the three months ended September 30, 2023 included income of $50.0 million compared to a loss of $79.1 million for the three months ended September 30, 2022. Income for the three months ended September 30, 2023 consists of underwriting income of $42.5 million (92.5% combined ratio) and net services income of $7.5 million, compared to an underwriting loss of $88.3 million (114.5% combined ratio) and net services income of $9.2 million for the three months ended September 30, 2022. The improvement in net underwriting results was primarily driven by increased favorable prior year loss reserve development, lower catastrophe losses and favorable expense ratios (both commission and other underwriting expense ratios), which results in a higher underwriting gain. Net services income for the three months ended September 30, 2023 included services noncontrolling income from our consolidated MGAs of $2.4 million compared to a loss of $0.5 million for the three months ended September 30, 2022.

Losses incurred included $12.6 million of favorable prior year loss reserve development for the three months ended September 30, 2023, compared to $2.6 million of adverse prior year loss reserve development for the three months ended September 30, 2022. For the three months ended September 30, 2023, favorable prior year loss reserve development was driven by decreases in property in Reinsurance and A&H in Insurance & Services, partially offset by loss emergence in the casualty business lines in the Insurance & Service segment. This increase in favorable prior year loss reserve development was primarily the result of management reflecting the continued favorable reported loss emergence through September 30, 2023 in its best estimate of reserves.

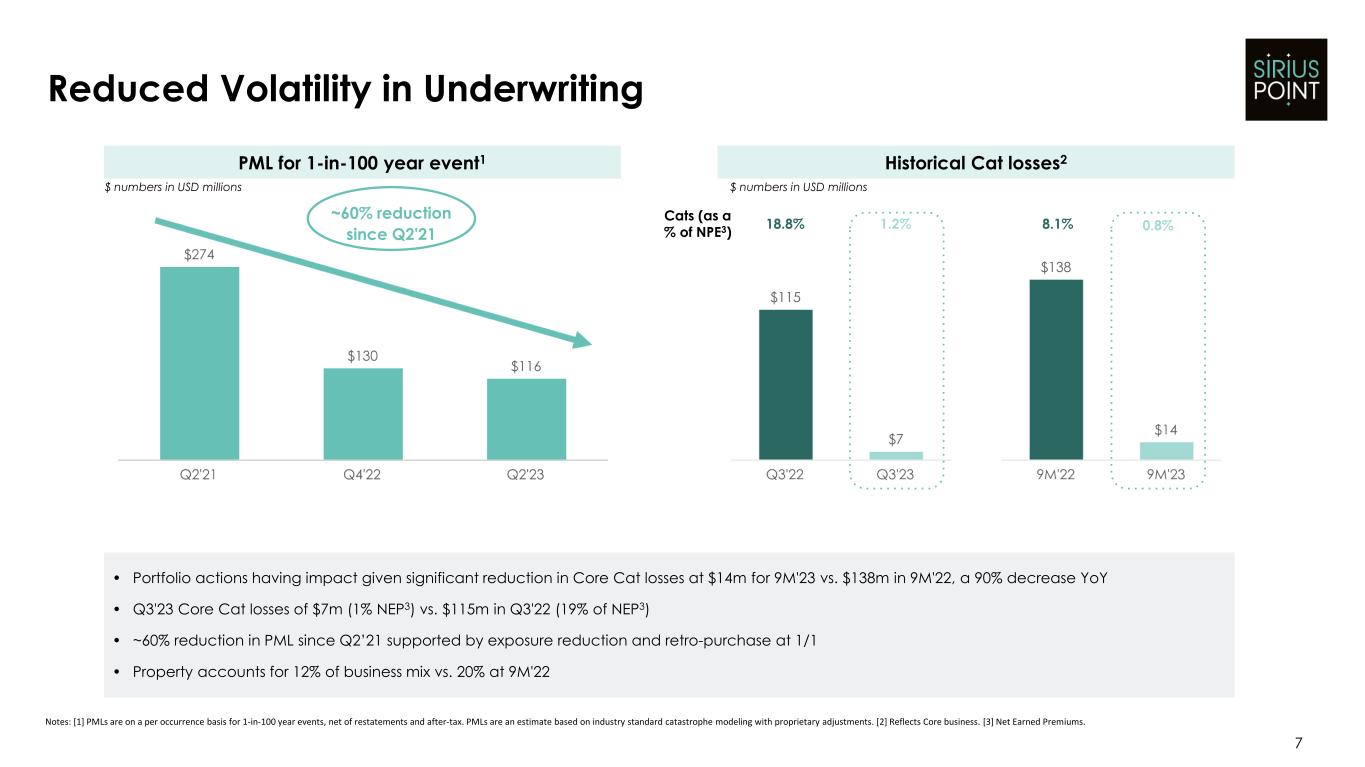

For the three months ended September 30, 2023, catastrophe losses, net of reinsurance and reinstatement premiums, were $6.7 million or 1.2 percentage points on the combined ratio, which includes losses of $3.8 million from the Hawaii wildfires and $3.3 million from Hurricane Idalia, compared to $114.6 million, or 18.8 percentage points on the combined ratio, for the three months ended September 30, 2022, including $80.1 million for Hurricane Ian and $34.5 million for other third quarter 2022 catastrophe events.

Nine months ended September 30, 2023 and 2022

Core results for the nine months ended September 30, 2023 included income of $245.1 million compared to a loss of $31.4 million for the nine months ended September 30, 2022. The income for the nine months ended September 30, 2023 consists of underwriting income of $213.2 million (87.6% combined ratio) and net services income of $31.9 million, compared to an underwriting loss of $66.0 million (103.9% combined ratio) and net services income of $34.6 million for the nine months ended September 30, 2022. The improvement in net underwriting results was primarily driven by favorable prior year loss reserve development, lower catastrophe losses, and favorable expense ratios (both commission and other underwriting expense ratios), which results in a higher underwriting gain. Net services income for the nine months ended September 30, 2023 included services noncontrolling income from our consolidated MGAs of $5.7 million compared to a loss of $0.6 million for the nine months ended September 30, 2022.

Losses incurred included $129.7 million of favorable prior year loss reserve development for the nine months ended September 30, 2023 compared to favorable prior year loss reserve development of $3.9 million for the nine months ended September 30, 2022. This increase in favorable prior year loss reserve development was primarily the result of management reflecting the continued favorable reported loss emergence through September 30, 2023 in its best estimate of reserves, which was further validated by the pricing of the 2023 LPT from external reinsurers, in addition to a reduction in unallocated loss adjustment expense reserves related to the claims that will no longer be managed by SiriusPoint under the terms of the 2023 LPT.

For the nine months ended September 30, 2023, catastrophe losses, net of reinsurance and reinstatement premiums, were $13.7 million, or 0.8 percentage points on the combined ratio, which includes losses of $6.8 million from the Turkey Earthquake, $3.8 million from the Hawaii wildfires and $3.3 million from Hurricane Idalia, compared to $137.7 million, or 8.1 percentage points on the combined ratio for the nine months ended September 30, 2022, including $80.1 million for Hurricane Ian and $57.6 million for other catastrophe events, including the South Africa floods and France hail storms. For the nine months ended September 30, 2022, losses from the Russia/Ukraine conflict, including losses from the political risk, trade credit, and aviation lines of business, were $12.9 million, or 0.8 percentage points on the combined ratio.

Reinsurance Segment

Three months ended September 30, 2023 and 2022

Reinsurance generated underwriting income of $36.9 million (85.6% combined ratio) for the three months ended September 30, 2023, compared to an underwriting loss of $79.6 million (126.1% combined ratio) for the three months ended September 30, 2022. The improvement in net underwriting results was primarily due to lower catastrophe losses.

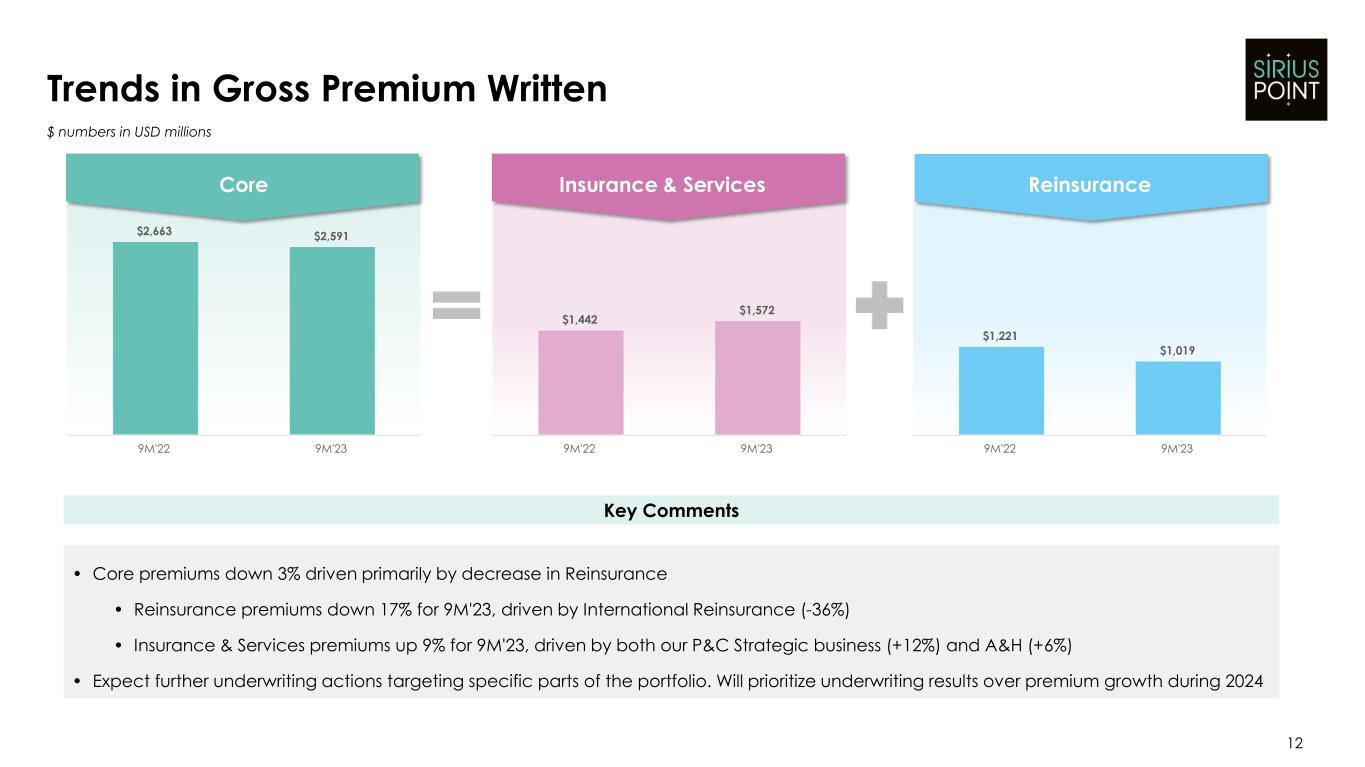

Reinsurance gross premiums written were $265.4 million for the three months ended September 30, 2023, a decrease of $53.0 million, or 16.6%, compared to the three months ended September 30, 2022, primarily driven by lower premiums written in International reinsurance, primarily in the property lines, as we execute the Restructuring Plan.

Nine months ended September 30, 2023 and 2022

Reinsurance generated underwriting income of $178.4 million (77.4% combined ratio) for the nine months ended September 30, 2023, compared to a loss of $76.7 million (108.2% combined ratio) for the nine months ended September 30, 2022. The improvement in net underwriting results for the nine months ended September 30, 2023 compared to the nine months ended September 30, 2022 was primarily due to higher favorable prior year loss reserve development and lower catastrophe losses.

Reinsurance gross premiums written were $1,019.3 million for the nine months ended September 30, 2023, a decrease of $201.6 million, or 16.5%, compared to the nine months ended September 30, 2022, primarily driven by lower premiums written in International reinsurance, primarily in the property lines, as we execute the Restructuring Plan. This was partially offset by growth in North America reinsurance in the property and casualty lines of business.

Insurance & Services Segment

Three months ended September 30, 2023 and 2022

Insurance & Services generated segment income of $13.3 million for the three months ended September 30, 2023, compared to a loss of $2.9 million for the three months ended September 30, 2022. Segment income for the three months ended September 30, 2023 consists of underwriting income of $5.6 million (98.3% combined ratio) and net services income of $7.7 million, compared to an underwriting loss of $8.7 million (102.8% combined ratio) and net services income of $5.8 million for the three months ended September 30, 2022. The improvement in underwriting results was primarily due to decreased adverse prior year loss reserve development. The increase in services income was primarily due to higher margins achieved in Arcadian.

Insurance & Services gross premiums written were $460.1 million for the three months ended September 30, 2023, a decrease of $64.8 million, or 12.3%, compared to the three months ended September 30, 2022, primarily driven by decreases in premiums from strategic partnerships.

Nine months ended September 30, 2023 and 2022

Insurance & Services generated segment income of $69.5 million for the nine months ended September 30, 2023, compared to $41.9 million for the nine months ended September 30, 2022. Segment income for the nine months ended September 30, 2023 consists of underwriting income of $34.8 million (96.3% combined ratio) and net services income of $34.7 million, compared to underwriting income of $10.7 million (98.5% combined ratio) and net services income of $31.2 million for the nine months ended September 30, 2022. The increase in underwriting results was primarily driven by the increased favorable prior loss reserve development. The increase in services income was primarily due to higher margins achieved in Arcadian.

Insurance & Services gross premiums written were $1,571.6 million for the nine months ended September 30, 2023, an increase of $129.3 million, or 9.0%, compared to the nine months ended September 30, 2022, primarily driven by growth across Insurance & Services, including growth in premiums from strategic partnerships, and A&H.

Investments

Three months ended September 30, 2023 and 2022

Total realized and unrealized investment gains (losses) and net investment income was $68.1 million for the three months ended September 30, 2023, compared to $(28.2) million for the three months ended September 30, 2022.

Total realized and unrealized investment gains and net investment income for the three months ended September 30, 2023 was primarily attributable to investment results from our debt and short-term investment portfolio of $71.0 million. These returns were driven by dividend and interest income primarily on U.S. treasury bills and corporate debt positions, which make up 46.2% of our total investments as of September 30, 2023, compared to 28.6% of our portfolio as of September 30, 2022. In addition, the Company has elected to classify debt securities purchased on or after April 1, 2022 as available for sale which has resulted in decreased volatility in net income.

Investment results for the three months ended September 30, 2022 was primarily attributable to losses on the fixed income portfolio of $8.7 million or a (1.2)% return, on our debt securities primarily due to rising interest rates and to a lesser extent foreign currency movements and widening credit spreads. We also recognized a net investment loss of $8.4 million from our investment in the TP Enhanced Fund, corresponding to a (3.2)% return.

Nine months ended September 30, 2023 and 2022

Total realized and unrealized investment gains (losses) and net investment income was $207.7 million for the nine months ended September 30, 2023, compared to $(374.8) million for the nine months ended September 30, 2022.

Total realized and unrealized investment gains and net investment income for the nine months ended September 30, 2023 was primarily attributable to net investment income related to interest income from our debt and short-term investment portfolio of $208.5 million. Increased dividend and investment income is due to the ongoing re-positioning of the portfolio to focus on investing in high grade fixed income securities.

Investment results for the nine months ended September 30, 2022 were primarily attributable to the net investment loss of $194.0 million from our investment in the TP Enhanced Fund, corresponding to a (28.2)% return. We also recognized losses of $126.0 million, or a (4.7)% return, on our debt securities and $5.0 million, or a 0.7% return, on our equity securities and other long-term investment portfolios, primarily due to rising interest rates and to a lesser extent foreign currency movements and widening credit spreads.

Standstill Agreement with Mr. Daniel S. Loeb

On April 12, 2023, the Company acknowledged that Dan Loeb, and certain of his affiliates, disclosed in a Schedule 13D/A filing an indication of interest to explore a potential acquisition of all, or substantially all, of the outstanding common shares of the Company (“Indication of Interest”).

On May 12, 2023, the Company acknowledged that Dan Loeb, and certain of his affiliates, disclosed in a Schedule 13D/A filing the decision to conclude discussions regarding a potential transaction to acquire the Company.

On August 9, 2023, we entered into a standstill agreement (the “Agreement”) with Dan Loeb, which provides that he will not, subject to certain limited exceptions, make a take-over or purchase proposal for the Company or acquire more than 9.5% of the outstanding shares of the Company or an amount of ownership requiring regulatory approval. Further, the Agreement provides that Dan Loeb would not take any action in support of or make any proposal with respect to controlling, changing or influencing the Company’s management, business, capitalization or corporate structure.

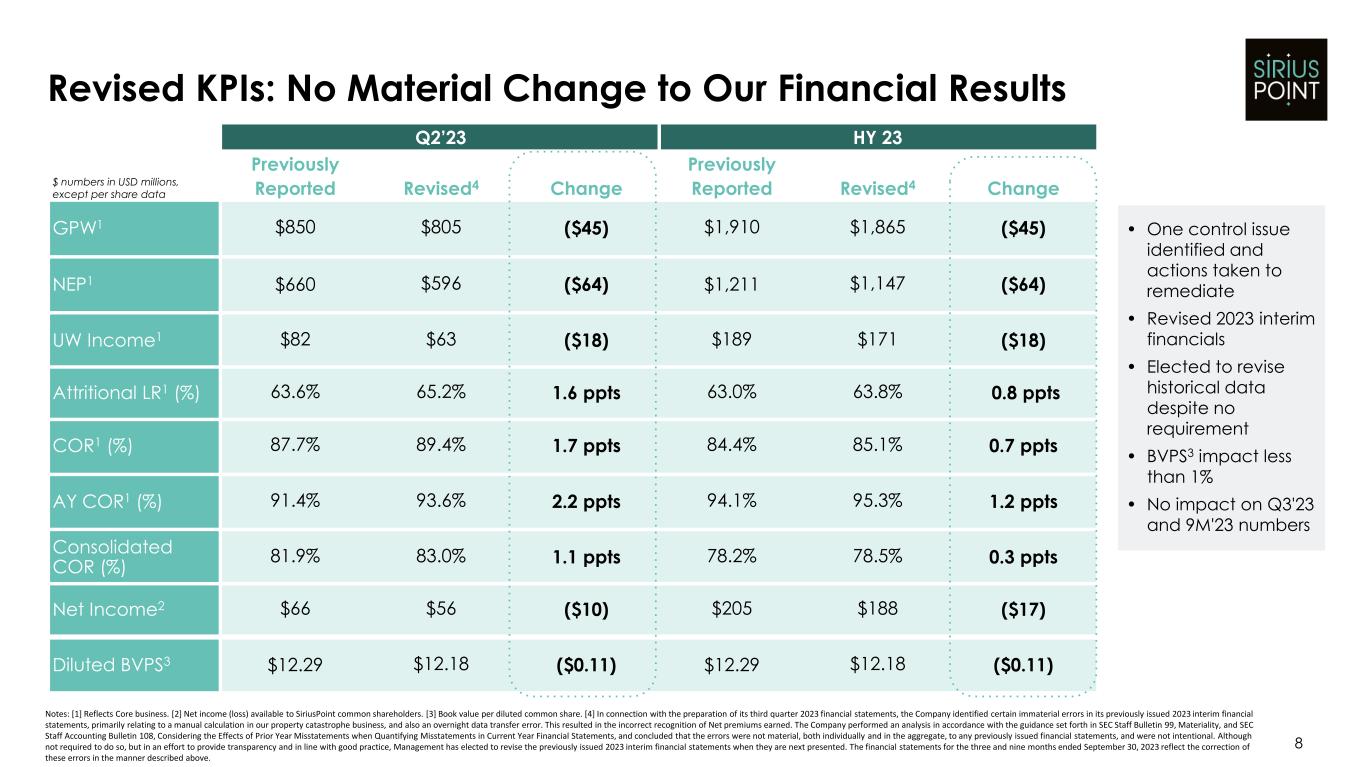

Revision of Q2 and Q1 2023 interim financial statements

In connection with the preparation of its third quarter 2023 financial statements, the Company identified certain immaterial errors in its previously issued 2023 interim financial statements, primarily relating to a manual calculation in our property catastrophe business, and also an overnight data transfer error. This resulted in the incorrect recognition of Net premiums earned. The Company performed an analysis in accordance with the guidance set forth in SEC Staff Bulletin 99, Materiality, and SEC Staff Accounting Bulletin 108, Considering the Effects of Prior Year Misstatements when Quantifying Misstatements in Current Year Financial Statements, and concluded that the errors were not material, both individually and in the aggregate, to any previously issued financial statements, and were not intentional. Although not required to do so, but in an effort to provide transparency and in line with good practice, Management has elected to revise the previously issued 2023 interim financial statements when they are next presented. The financial statements for the three and nine months ended September 30, 2023 reflect the correction of these errors in the manner described above.

Webcast Details

The Company will hold a webcast to discuss its third quarter 2023 results at 8:30 a.m. Eastern Time on November 9, 2023. The webcast of the conference call will be available over the Internet from the Company’s website at www.siriuspt.com under the “Investor Relations” section. Participants should follow the instructions provided on the website to download and install any necessary audio applications. The conference call will be available by dialing 1-877-451-6152 (domestic) or 1-201-389-0879 (international). Participants should ask for the SiriusPoint Ltd. third quarter 2023 earnings call.

The online replay will be available on the Company's website immediately following the call at www.siriuspt.com under the “Investor Relations” section.

Safe Harbor Statement Regarding Forward-Looking Statements

This press release includes “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are subject to known and unknown risks and uncertainties, many of which may be beyond the Company’s control. The Company cautions you that the forward-looking information presented in this press release is not a guarantee of future events, and that actual events may differ materially from those made in or suggested by the forward-looking information contained in this press release. In addition, forward-looking statements generally can be identified by the use of forward-looking terminology such as “believes,” “intends,” “seeks,” “anticipates,” “aims,” “plans,” “targets,” “estimates,” “expects,” “assumes,” “continues,” “should,” “could,” “will,” “may” and the negative of these or similar terms and phrases. Actual events, results and outcomes may differ materially from the Company’s expectations due to

a variety of known and unknown risks, uncertainties and other factors. Among the risks and uncertainties that could cause actual results to differ from those described in the forward-looking statements are the following: our ability to execute on our strategic transformation, including re-underwriting to reduce volatility and improving underwriting performance, de-risking our investment portfolio, and transforming our business, including re-balancing our portfolio and growing the Insurance & Services segment; the impact of unpredictable catastrophic events including uncertainties with respect to current and future COVID-19 losses across many classes of insurance business and the amount of insurance losses that may ultimately be ceded to the reinsurance market, supply chain issues, labor shortages and related increased costs, changing interest rates and equity market volatility; inadequacy of loss and loss adjustment expense reserves, the lack of available capital, and periods characterized by excess underwriting capacity and unfavorable premium rates; the performance of financial markets, impact of inflation and interest rates, and foreign currency fluctuations; our ability to compete successfully in the (re)insurance market and the effect of consolidation in the (re)insurance industry; technology breaches or failures, including those resulting from a malicious cyber-attack on us, our business partners or service providers; the effects of global climate change, including increased severity and frequency of weather-related natural disasters and catastrophes and increased coastal flooding in many geographic areas; geopolitical uncertainty, including the ongoing conflicts in Europe and the Middle East; our ability to retain key senior management and key employees; a downgrade or withdrawal of our financial ratings; fluctuations in our results of operations; legal restrictions on certain of SiriusPoint’s insurance and reinsurance subsidiaries’ ability to pay dividends and other distributions to SiriusPoint; the outcome of legal and regulatory proceedings and regulatory constraints on our business; reduced returns or losses in SiriusPoint’s investment portfolio; our potential exposure to U.S. federal income and withholding taxes and our significant deferred tax assets, which could become devalued if we do not generate future taxable income or applicable corporate tax rates are reduced; risks associated with delegating authority to third party managing general agents; future strategic transactions such as acquisitions, dispositions, investments, mergers or joint ventures; SiriusPoint’s response to any acquisition proposal that may be received from any party, including any actions that may be considered by the Company’s board of directors or any committee thereof; and other risks and factors listed under "Risk Factors" in the Company's most recent Annual Report on Form 10-K and other subsequent periodic reports filed with the Securities and Exchange Commission. All forward-looking statements speak only as of the date made and the Company undertakes no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise.

Non-GAAP Financial Measures and Other Financial Metrics

In presenting SiriusPoint’s results, management has included financial measures that are not calculated under standards or rules that comprise accounting principles generally accepted in the United States (“GAAP”). SiriusPoint’s management uses this information in its internal analysis of results and believes that this information may be informative to investors in gauging the quality of SiriusPoint’s financial performance, identifying trends in our results and providing meaningful period-to-period comparisons. Core underwriting income, Core net services income, Core income, and Core combined ratio are non-GAAP financial measures. Management believes it is useful to review Core results as it better reflects how management views the business and reflects the Company’s decision to exit the runoff business. Tangible book value per diluted common share is also a non-GAAP financial measure and the most comparable U.S. GAAP measure is book value per common share. Tangible book value per diluted common share excludes intangible assets. Starting in 2023, the Company will no longer exclude restricted shares from the calculation of Tangible Book Value per Diluted Common Share, as the unvested restricted shares outstanding are no longer considered material. The resulting change in Tangible Book Value per Diluted Common Share is ($0.04) per share at September 30, 2023 and thus the Company will no longer adjust the calculation. Further, management believes that effects of intangible assets are not indicative of underlying underwriting results or trends and make book value comparisons to less acquisitive peer companies less meaningful. The tangible book value per diluted common share is also useful because it provides a more accurate measure of the realizable value of shareholder returns, excluding intangible assets. Reconciliations of such measures to the most comparable GAAP figures are included in the attached financial information in accordance with Regulation G.

About the Company

SiriusPoint is a global underwriter of insurance and reinsurance providing solutions to clients and brokers around the world. Bermuda-headquartered with offices in New York, London, Stockholm and other locations, we are listed on the New York Stock Exchange (SPNT). We have licenses to write Property & Casualty and Accident & Health insurance and reinsurance globally. Our offering and distribution capabilities are strengthened by a portfolio of strategic partnerships with Managing General Agents within our Insurance & Services segment. With over $3.0 billion total capital, SiriusPoint’s operating companies have a financial strength rating of A- (Excellent) from AM Best, S&P and Fitch. For more information please visit www.siriuspt.com.

Contacts

Investor Relations

Dhruv Gahlaut, Head of Investor Relations and Chief Strategy Officer

Dhruv.gahlaut@siriuspt.com

+44 7514 659 918

Media

Natalie King, Global Head of Marketing and External Communications

Natalie.king@siriuspt.com

+ 44 20 3772 3102

SIRIUSPOINT LTD.

CONSOLIDATED BALANCE SHEETS (UNAUDITED)

As of September 30, 2023 and December 31, 2022

(expressed in millions of U.S. dollars, except per share and share amounts)

| | | | | | | | | | | |

| | | |

| September 30,

2023 | | December 31, 2022 |

| Assets | | | |

| Debt securities, available for sale, at fair value, net of allowance for credit losses of $0.0 (2022 - $0.0) (cost - $4,554.8; 2022 - $2,678.1) | $ | 4,423.3 | | | $ | 2,635.5 | |

| Debt securities, trading, at fair value (cost - $659.1; 2022 - $1,630.1) | 616.4 | | | 1,526.0 | |

| Short-term investments, at fair value (cost - $544.7; 2022 - $984.5) | 548.7 | | | 984.6 | |

| Investments in related party investment funds, at fair value | 109.9 | | | 128.8 | |

| Other long-term investments, at fair value (cost - $356.0; 2022 - $392.0) (includes related party investments at fair value of $188.1 (2022 - $201.2)) | 326.1 | | | 377.2 | |

| Equity securities, trading, at fair value (cost - $1.8; 2022 - $1.8) | 1.6 | | | 1.6 | |

| Total investments | 6,026.0 | | | 5,653.7 | |

| Cash and cash equivalents | 703.5 | | | 705.3 | |

| Restricted cash and cash equivalents | 107.7 | | | 208.4 | |

| | | |

| Redemption receivable from related party investment fund | 2.4 | | | 18.5 | |

| Due from brokers | 21.5 | | | 4.9 | |

| Interest and dividends receivable | 41.1 | | | 26.7 | |

| Insurance and reinsurance balances receivable, net | 2,057.6 | | | 1,876.9 | |

| Deferred acquisition costs, net | 333.0 | | | 294.9 | |

| Unearned premiums ceded | 464.7 | | | 348.8 | |

| Loss and loss adjustment expenses recoverable, net | 2,314.2 | | | 1,376.2 | |

| Deferred tax asset | 180.6 | | | 200.3 | |

| Intangible assets | 155.6 | | | 163.8 | |

| | | |

| Other assets | 183.3 | | | 157.9 | |

| Total assets | $ | 12,591.2 | | | $ | 11,036.3 | |

| Liabilities | | | |

| Loss and loss adjustment expense reserves | $ | 5,448.8 | | | $ | 5,268.7 | |

| Unearned premium reserves | 1,762.8 | | | 1,521.1 | |

| Reinsurance balances payable | 1,733.4 | | | 813.6 | |

| Deposit liabilities | 135.8 | | | 140.5 | |

| Deferred gain on retroactive reinsurance | 25.8 | | | — | |

| Debt | 763.5 | | | 778.0 | |

| Securities sold, not yet purchased, at fair value | — | | | 27.0 | |

| Securities sold under an agreement to repurchase | — | | | 18.0 | |

| Due to brokers | 39.1 | | | — | |

| Deferred tax liability | 81.2 | | | 59.8 | |

| Liability-classified capital instruments | 62.0 | | | 60.4 | |

| Accounts payable, accrued expenses and other liabilities | 273.4 | | | 266.6 | |

| Total liabilities | 10,325.8 | | | 8,953.7 | |

| Commitments and contingent liabilities | | | |

| Shareholders’ equity | | | |

| | | |

| Series B preference shares (par value $0.10; authorized and issued: 8,000,000) | 200.0 | | | 200.0 | |

| Common shares (issued and outstanding: 165,068,101; 2022 - 162,177,653) | 16.5 | | | 16.2 | |

| Additional paid-in capital | 1,661.4 | | | 1,641.3 | |

| Retained earnings | 507.5 | | | 262.2 | |

| Accumulated other comprehensive loss, net of tax | (135.4) | | | (45.0) | |

| Shareholders’ equity attributable to SiriusPoint shareholders | 2,250.0 | | | 2,074.7 | |

| Noncontrolling interests | 15.4 | | | 7.9 | |

| Total shareholders’ equity | 2,265.4 | | | 2,082.6 | |

| Total liabilities, noncontrolling interests and shareholders’ equity | $ | 12,591.2 | | | $ | 11,036.3 | |

| | | |

SIRIUSPOINT LTD.

CONSOLIDATED STATEMENTS OF INCOME (LOSS) (UNAUDITED)

For the three and nine months ended September 30, 2023 and 2022

(expressed in millions of U.S. dollars, except per share and share amounts)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended | | Nine months ended |

| September 30, 2023 | | September 30, 2022 | | September 30, 2023 | | September 30, 2022 |

| Revenues | | | | | | | |

| Net premiums earned | $ | 613.0 | | | $ | 612.6 | | | $ | 1,848.2 | | | $ | 1,710.7 | |

| Net realized and unrealized investment gains (losses) | (7.1) | | | (56.1) | | | 2.4 | | | (236.4) | |

| Net realized and unrealized investment gains (losses) from related party investment funds | 0.1 | | | (8.3) | | | — | | | (199.8) | |

| Net investment income | 75.1 | | | 36.2 | | | 205.3 | | | 61.4 | |

| Net realized and unrealized investment gains (losses) and net investment income | 68.1 | | | (28.2) | | | 207.7 | | | (374.8) | |

| Other revenues | 21.5 | | | 13.1 | | | 35.6 | | | 96.1 | |

| Total revenues | 702.6 | | | 597.5 | | | 2,091.5 | | | 1,432.0 | |

| Expenses | | | | | | | |

| Loss and loss adjustment expenses incurred, net | 373.1 | | | 497.9 | | | 1,015.9 | | | 1,198.3 | |

| Acquisition costs, net | 129.5 | | | 116.8 | | | 361.0 | | | 348.9 | |

| Other underwriting expenses | 36.6 | | | 44.8 | | | 132.1 | | | 138.1 | |

| Net corporate and other expenses | 63.4 | | | 70.8 | | | 193.7 | | | 220.2 | |

| Intangible asset amortization | 2.9 | | | 2.1 | | | 8.2 | | | 6.0 | |

| Interest expense | 19.8 | | | 9.4 | | | 44.3 | | | 28.1 | |

| Foreign exchange (gains) losses | (1.8) | | | (51.6) | | | 15.7 | | | (127.5) | |

| Total expenses | 623.5 | | | 690.2 | | | 1,770.9 | | | 1,812.1 | |

| Income (loss) before income tax (expense) benefit | 79.1 | | | (92.7) | | | 320.6 | | | (380.1) | |

| Income tax (expense) benefit | (15.3) | | | (0.9) | | | (56.6) | | | 17.1 | |

| Net income (loss) | 63.8 | | | (93.6) | | | 264.0 | | | (363.0) | |

| Net income attributable to noncontrolling interests | (2.3) | | | (0.8) | | | (6.7) | | | (1.2) | |

| Net income (loss) available to SiriusPoint | 61.5 | | | (94.4) | | | 257.3 | | | (364.2) | |

| Dividends on Series B preference shares | (4.0) | | | (4.0) | | | (12.0) | | | (12.0) | |

| Net income (loss) available to SiriusPoint common shareholders | $ | 57.5 | | | $ | (98.4) | | | $ | 245.3 | | | $ | (376.2) | |

| Earnings (loss) per share available to SiriusPoint common shareholders | | | | | | | |

| Basic earnings (loss) per share available to SiriusPoint common shareholders | $ | 0.33 | | | $ | (0.61) | | | $ | 1.40 | | | $ | (2.35) | |

| Diluted earnings (loss) per share available to SiriusPoint common shareholders | $ | 0.32 | | | $ | (0.61) | | | $ | 1.36 | | | $ | (2.35) | |

| Weighted average number of common shares used in the determination of earnings (loss) per share | | | | | | | |

| Basic | 163,738,528 | | | 160,321,270 | | | 162,233,695 | | | 160,150,911 | |

| Diluted | 168,516,508 | | | 160,321,270 | | | 166,920,744 | | | 160,150,911 | |

| | | | | | | |

SIRIUSPOINT LTD.

SEGMENT REPORTING

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended September 30, 2023 |

| Reinsurance | | Insurance & Services | | Core | | Eliminations (2) | | Corporate | | Segment Measure Reclass | | Total |

Gross premiums written | $ | 265.4 | | | $ | 460.1 | | | $ | 725.5 | | | $ | — | | | $ | 33.3 | | | $ | — | | | $ | 758.8 | |

| Net premiums written | 243.2 | | | 290.4 | | | 533.6 | | | — | | | 32.4 | | | — | | | 566.0 | |

| Net premiums earned | 256.9 | | | 318.4 | | | 575.3 | | | — | | | 37.7 | | | — | | | 613.0 | |

| Loss and loss adjustment expenses incurred, net | 136.2 | | | 219.6 | | | 355.8 | | | (1.2) | | | 18.5 | | | — | | | 373.1 | |

| Acquisition costs, net | 69.4 | | | 76.3 | | | 145.7 | | | (37.2) | | | 21.0 | | | — | | | 129.5 | |

| Other underwriting expenses | 14.4 | | | 16.9 | | | 31.3 | | | — | | | 5.3 | | | — | | | 36.6 | |

| Underwriting income (loss) | 36.9 | | | 5.6 | | | 42.5 | | | 38.4 | | | (7.1) | | | — | | | 73.8 | |

| Services revenues | (0.2) | | | 58.8 | | | 58.6 | | | (38.3) | | | — | | | (20.3) | | | — | |

| Services expenses | — | | | 48.7 | | | 48.7 | | | — | | | — | | | (48.7) | | | — | |

| Net services fee income (loss) | (0.2) | | | 10.1 | | | 9.9 | | | (38.3) | | | — | | | 28.4 | | | — | |

| Services noncontrolling income | — | | | (2.4) | | | (2.4) | | | — | | | — | | | 2.4 | | | — | |

| | | | | | | | | | | | | |

| Net services income (loss) | (0.2) | | | 7.7 | | | 7.5 | | | (38.3) | | | — | | | 30.8 | | | — | |

| Segment income (loss) | 36.7 | | | 13.3 | | | 50.0 | | | 0.1 | | | (7.1) | | | 30.8 | | | 73.8 | |

| Net realized and unrealized investment losses | | (7.1) | | | — | | | (7.1) | |

| Net realized and unrealized investment gains from related party investment funds | | 0.1 | | | — | | | 0.1 | |

| Net investment income | | | | | | | | | 75.1 | | | — | | | 75.1 | |

| Other revenues | | | | | | | | | 1.2 | | | 20.3 | | | 21.5 | |

| Net corporate and other expenses | | | | | | | | | (14.7) | | | (48.7) | | | (63.4) | |

| Intangible asset amortization | | | | | | | | | (2.9) | | | — | | | (2.9) | |

| Interest expense | | | | | | | | | (19.8) | | | — | | | (19.8) | |

| Foreign exchange losses | | | | | | | | | 1.8 | | | — | | | 1.8 | |

| Income before income tax expense | $ | 36.7 | | | $ | 13.3 | | | 50.0 | | | 0.1 | | | 26.6 | | | 2.4 | | | 79.1 | |

| Income tax expense | | | | | — | | | — | | | (15.3) | | | — | | | (15.3) | |

| Net income | | | | | 50.0 | | | 0.1 | | | 11.3 | | | 2.4 | | | 63.8 | |

| Net (income) loss attributable to noncontrolling interest | | — | | | — | | | 0.1 | | | (2.4) | | | (2.3) | |

| Net income available to SiriusPoint | | $ | 50.0 | | | $ | 0.1 | | | $ | 11.4 | | | $ | — | | | $ | 61.5 | |

| | | | | | | | | | | | | |

Underwriting Ratios: (1) | | | | | | | | | | | | | |

| Loss ratio | 53.0 | % | | 69.0 | % | | 61.8 | % | | | | | | | | 60.9 | % |

| Acquisition cost ratio | 27.0 | % | | 24.0 | % | | 25.3 | % | | | | | | | | 21.1 | % |

| Other underwriting expenses ratio | 5.6 | % | | 5.3 | % | | 5.4 | % | | | | | | | | 6.0 | % |

Combined ratio | 85.6 | % | | 98.3 | % | | 92.5 | % | | | | | | | | 88.0 | % |

(1)Underwriting ratios are calculated by dividing the related expense by net premiums earned.

(2)Insurance & Services MGAs recognize fees for service using revenue from contracts with customers accounting standards, whereas insurance companies recognize acquisition expenses using insurance contract accounting standards. While ultimate revenues and expenses recognized will match, there will be recognition timing differences based on the different accounting standards.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended September 30, 2022 |

| Reinsurance | | Insurance & Services | | Core | | Eliminations (2) | | Corporate | | Segment Measure Reclass | | Total |

Gross premiums written | $ | 318.4 | | | $ | 524.9 | | | $ | 843.3 | | | $ | — | | | $ | 0.5 | | | $ | — | | | $ | 843.8 | |

| Net premiums written | 267.1 | | | 366.7 | | | 633.8 | | | — | | | 0.6 | | | — | | | 634.4 | |

| Net premiums earned | 304.5 | | | 305.4 | | | 609.9 | | | — | | | 2.7 | | | — | | | 612.6 | |

| Loss and loss adjustment expenses incurred, net | 286.3 | | | 217.8 | | | 504.1 | | | (1.5) | | | (4.7) | | | — | | | 497.9 | |

| Acquisition costs, net | 69.8 | | | 81.0 | | | 150.8 | | | (34.0) | | | — | | | — | | | 116.8 | |

| Other underwriting expenses | 28.0 | | | 15.3 | | | 43.3 | | | — | | | 1.5 | | | — | | | 44.8 | |

| Underwriting income (loss) | (79.6) | | | (8.7) | | | (88.3) | | | 35.5 | | | 5.9 | | | — | | | (46.9) | |

| Services revenues | 3.4 | | | 52.5 | | | 55.9 | | | (35.4) | | | — | | | (20.5) | | | — | |

| Services expenses | — | | | 47.2 | | | 47.2 | | | — | | | — | | | (47.2) | | | — | |

| Net services fee income | 3.4 | | | 5.3 | | | 8.7 | | | (35.4) | | | — | | | 26.7 | | | — | |

| Services noncontrolling loss | — | | | 0.5 | | | 0.5 | | | — | | | — | | | (0.5) | | | — | |

| | | | | | | | | | | | | |

| Net services income | 3.4 | | | 5.8 | | | 9.2 | | | (35.4) | | | — | | | 26.2 | | | — | |

| Segment income (loss) | (76.2) | | | (2.9) | | | (79.1) | | | 0.1 | | | 5.9 | | | 26.2 | | | (46.9) | |

| Net realized and unrealized investment losses | | (56.1) | | | — | | | (56.1) | |

| Net realized and unrealized investment losses from related party investment funds | | (8.3) | | | — | | | (8.3) | |

| Net investment income | | | | | | | | | 36.2 | | | — | | | 36.2 | |

| Other revenues | | | | | | | | | (7.4) | | | 20.5 | | | 13.1 | |

| Net corporate and other expenses | | | | | | | | | (23.6) | | | (47.2) | | | (70.8) | |

| Intangible asset amortization | | | | | | | | | (2.1) | | | — | | | (2.1) | |

| Interest expense | | | | | | | | | (9.4) | | | — | | | (9.4) | |

| Foreign exchange gains | | | | | | | | | 51.6 | | | — | | | 51.6 | |

| Loss before income tax expense | $ | (76.2) | | | $ | (2.9) | | | (79.1) | | | 0.1 | | | (13.2) | | | (0.5) | | | (92.7) | |

| Income tax expense | | | | | — | | | — | | | (0.9) | | | — | | | (0.9) | |

| Net loss | | | | | (79.1) | | | 0.1 | | | (14.1) | | | (0.5) | | | (93.6) | |

| Net income attributable to noncontrolling interest | | — | | | — | | | (1.3) | | | 0.5 | | | (0.8) | |

| Net loss attributable to SiriusPoint | | $ | (79.1) | | | $ | 0.1 | | | $ | (15.4) | | | $ | — | | | $ | (94.4) | |

| | | | | | | | | | | | | |

Underwriting Ratios: (1) | | | | | | | | | | | | | |

| Loss ratio | 94.0 | % | | 71.3 | % | | 82.7 | % | | | | | | | | 81.3 | % |

| Acquisition cost ratio | 22.9 | % | | 26.5 | % | | 24.7 | % | | | | | | | | 19.1 | % |

| Other underwriting expenses ratio | 9.2 | % | | 5.0 | % | | 7.1 | % | | | | | | | | 7.3 | % |

| Combined ratio | 126.1 | % | | 102.8 | % | | 114.5 | % | | | | | | | | 107.7 | % |

(1)Underwriting ratios are calculated by dividing the related expense by net premiums earned.

(2)Insurance & Services MGAs recognize fees for service using revenue from contracts with customers accounting standards, whereas insurance companies recognize acquisition expenses using insurance contract accounting standards. While ultimate revenues and expenses recognized will match, there will be recognition timing differences based on the different accounting standards.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Nine months ended September 30, 2023 |

| Reinsurance | | Insurance & Services | | Core | | Eliminations (2) | | Corporate | | Segment Measure Reclass | | Total |

Gross premiums written | $ | 1,019.3 | | | $ | 1,571.6 | | | $ | 2,590.9 | | | $ | — | | | $ | 120.9 | | | $ | — | | | $ | 2,711.8 | |

| Net premiums written | 866.1 | | | 1,019.4 | | | 1,885.5 | | | — | | | 97.8 | | | — | | | 1,983.3 | |

| Net premiums earned | 788.2 | | | 934.0 | | | 1,722.2 | | | — | | | 126.0 | | | — | | | 1,848.2 | |

| Loss and loss adjustment expenses incurred, net | 368.5 | | | 608.8 | | | 977.3 | | | (4.0) | | | 42.6 | | | — | | | 1,015.9 | |

| Acquisition costs, net | 186.7 | | | 228.7 | | | 415.4 | | | (105.6) | | | 51.2 | | | — | | | 361.0 | |

| Other underwriting expenses | 54.6 | | | 61.7 | | | 116.3 | | | — | | | 15.8 | | | — | | | 132.1 | |

| Underwriting income | 178.4 | | | 34.8 | | | 213.2 | | | 109.6 | | | 16.4 | | | — | | | 339.2 | |

| Services revenues | (2.8) | | | 184.6 | | | 181.8 | | | (109.6) | | | — | | | (72.2) | | | — | |

| Services expenses | — | | | 144.2 | | | 144.2 | | | — | | | — | | | (144.2) | | | — | |

| Net services fee income (loss) | (2.8) | | | 40.4 | | | 37.6 | | | (109.6) | | | — | | | 72.0 | | | — | |

| Services noncontrolling income | — | | | (5.7) | | | (5.7) | | | — | | | — | | | 5.7 | | | — | |

| | | | | | | | | | | | | |

| Net services income (loss) | (2.8) | | | 34.7 | | | 31.9 | | | (109.6) | | | — | | | 77.7 | | | — | |

| Segment income | 175.6 | | | 69.5 | | | 245.1 | | | — | | | 16.4 | | | 77.7 | | | 339.2 | |

| Net realized and unrealized investment gains | | 2.4 | | | — | | | 2.4 | |

| Net realized and unrealized investment gains from related party investment funds | | — | | | — | | | — | |

| Net investment income | | | | | | | | | 205.3 | | | — | | | 205.3 | |

| Other revenues | | | | | | | | | (36.6) | | | 72.2 | | | 35.6 | |

| Net corporate and other expenses | | | | | | | | | (49.5) | | | (144.2) | | | (193.7) | |

| Intangible asset amortization | | | | | | | | | (8.2) | | | — | | | (8.2) | |

| Interest expense | | | | | | | | | (44.3) | | | — | | | (44.3) | |

| Foreign exchange losses | | | | | | | | | (15.7) | | | — | | | (15.7) | |

| Income before income tax expense | $ | 175.6 | | | $ | 69.5 | | | 245.1 | | | — | | | 69.8 | | | 5.7 | | | 320.6 | |

| Income tax expense | | | | | — | | | — | | | (56.6) | | | — | | | (56.6) | |

| Net income | | | | | 245.1 | | | — | | | 13.2 | | | 5.7 | | | 264.0 | |

| Net income attributable to noncontrolling interest | | — | | | — | | | (1.0) | | | (5.7) | | | (6.7) | |

| Net income available to SiriusPoint | | $ | 245.1 | | | $ | — | | | $ | 12.2 | | | $ | — | | | $ | 257.3 | |

| | | | | | | | | | | | | |

Underwriting Ratios: (1) | | | | | | | | | | | | | |

| Loss ratio | 46.8 | % | | 65.2 | % | | 56.7 | % | | | | | | | | 55.0 | % |

| Acquisition cost ratio | 23.7 | % | | 24.5 | % | | 24.1 | % | | | | | | | | 19.5 | % |

| Other underwriting expenses ratio | 6.9 | % | | 6.6 | % | | 6.8 | % | | | | | | | | 7.1 | % |

Combined ratio | 77.4 | % | | 96.3 | % | | 87.6 | % | | | | | | | | 81.6 | % |

| | | | | | | | | | | | | |

(1)Underwriting ratios are calculated by dividing the related expense by net premiums earned.

(2)Insurance & Services MGAs recognize fees for service using revenue from contracts with customers accounting standards, whereas insurance companies recognize acquisition expenses using insurance contract accounting standards. While ultimate revenues and expenses recognized will match, there will be recognition timing differences based on the different accounting standards.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Nine months ended September 30, 2022 |

| Reinsurance | | Insurance & Services | | Core | | Eliminations (2) | | Corporate | | Segment Measure Reclass | | Total |

Gross premiums written | $ | 1,220.9 | | | $ | 1,442.3 | | | $ | 2,663.2 | | | $ | — | | | $ | 2.9 | | | $ | — | | | $ | 2,666.1 | |

| Net premiums written | 963.5 | | | 1,005.6 | | | 1,969.1 | | | — | | | 2.2 | | | — | | | 1,971.3 | |

| Net premiums earned | 931.6 | | | 762.5 | | | 1,694.1 | | | — | | | 16.6 | | | — | | | 1,710.7 | |

| Loss and loss adjustment expenses incurred, net | 685.5 | | | 506.6 | | | 1,192.1 | | | (3.8) | | | 10.0 | | | — | | | 1,198.3 | |

| Acquisition costs, net | 236.0 | | | 198.4 | | | 434.4 | | | (86.4) | | | 0.9 | | | — | | | 348.9 | |

| Other underwriting expenses | 86.8 | | | 46.8 | | | 133.6 | | | — | | | 4.5 | | | — | | | 138.1 | |

| Underwriting income (loss) | (76.7) | | | 10.7 | | | (66.0) | | | 90.2 | | | 1.2 | | | — | | | 25.4 | |

| Services revenues | 3.4 | | | 165.9 | | | 169.3 | | | (102.9) | | | — | | | (66.4) | | | — | |

| Services expenses | — | | | 135.3 | | | 135.3 | | | — | | | — | | | (135.3) | | | — | |

| Net services fee income | 3.4 | | | 30.6 | | | 34.0 | | | (102.9) | | | — | | | 68.9 | | | — | |

| Services noncontrolling loss | — | | | 0.6 | | | 0.6 | | | — | | | — | | | (0.6) | | | — | |

| | | | | | | | | | | | | |

| Net services income | 3.4 | | | 31.2 | | | 34.6 | | | (102.9) | | | — | | | 68.3 | | | — | |

| Segment income (loss) | (73.3) | | | 41.9 | | | (31.4) | | | (12.7) | | | 1.2 | | | 68.3 | | | 25.4 | |

| Net realized and unrealized investment losses | | (236.4) | | | — | | | (236.4) | |

| Net realized and unrealized investment losses from related party investment funds | | (199.8) | | | — | | | (199.8) | |

| Net investment income | | | | | | | | | 61.4 | | | — | | | 61.4 | |

| Other revenues | | | | | | | | | 29.7 | | | 66.4 | | | 96.1 | |

| Net corporate and other expenses | | | | | | | | | (84.9) | | | (135.3) | | | (220.2) | |

| Intangible asset amortization | | | | | | | | | (6.0) | | | — | | | (6.0) | |

| Interest expense | | | | | | | | | (28.1) | | | — | | | (28.1) | |

| Foreign exchange gains | | | | | | | | | 127.5 | | | — | | | 127.5 | |

| Income (loss) before income tax benefit | $ | (73.3) | | | $ | 41.9 | | | (31.4) | | | (12.7) | | | (335.4) | | | (0.6) | | | (380.1) | |

| Income tax benefit | | | | | — | | | — | | | 17.1 | | | — | | | 17.1 | |

| Net loss | | | | | (31.4) | | | (12.7) | | | (318.3) | | | (0.6) | | | (363.0) | |

| Net income attributable to noncontrolling interest | | — | | | — | | | (1.8) | | | 0.6 | | | (1.2) | |

| Net loss attributable to SiriusPoint | | $ | (31.4) | | | $ | (12.7) | | | $ | (320.1) | | | $ | — | | | $ | (364.2) | |

| | | | | | | | | | | | | |

Underwriting Ratios: (1) | | | | | | | | | | | | | |

| Loss ratio | 73.6 | % | | 66.4 | % | | 70.4 | % | | | | | | | | 70.0 | % |

| Acquisition cost ratio | 25.3 | % | | 26.0 | % | | 25.6 | % | | | | | | | | 20.4 | % |

| Other underwriting expenses ratio | 9.3 | % | | 6.1 | % | | 7.9 | % | | | | | | | | 8.1 | % |

| Combined ratio | 108.2 | % | | 98.5 | % | | 103.9 | % | | | | | | | | 98.5 | % |

| | | | | | | | | | | | | |

(1)Underwriting ratios are calculated by dividing the related expense by net premiums earned.

(2)Insurance & Services MGAs recognize fees for service using revenue from contracts with customers accounting standards, whereas insurance companies recognize acquisition expenses using insurance contract accounting standards. While ultimate revenues and expenses recognized will match, there will be recognition timing differences based on the different accounting standards.

SIRIUSPOINT LTD.

NON-GAAP FINANCIAL MEASURES AND RECONCILIATIONS & OTHER FINANCIAL MEASURES

Non-GAAP Financial Measures

Core Results

Collectively, the sum of the Company's two segments, Reinsurance and Insurance & Services, constitute "Core" results. Core underwriting income, Core net services income, Core income and Core combined ratio are non-GAAP financial measures. We believe it is useful to review Core results as it better reflects how management views the business and reflects our decision to exit the runoff business. The sum of Core results and Corporate results are equal to the consolidated results of operations.

Core underwriting income - calculated by subtracting loss and loss adjustment expenses incurred, net, acquisition costs, net, and other underwriting expenses from net premiums earned.

Core net services income - consists of services revenues which include commissions, brokerage and fee income related to consolidated MGAs, and other revenues, and services expenses which include direct expenses related to consolidated MGAs, services noncontrolling income which represent minority ownership interests in consolidated MGAs. Net investment gains (losses) from Strategic Investments which are net investment gains/losses from our investment holdings, are no longer included in Core net services income, with comparative financial periods restated. Net services income is a key indicator of the profitability of the Company's services provided.

Core income - consists of two components, core underwriting income and core net services income. Core income is a key measure of our segment performance.

Core combined ratio - calculated by dividing the sum of Core loss and loss adjustment expenses incurred, net, acquisition costs, net and other underwriting expenses by Core net premiums earned. Accident year loss ratio and accident year combined ratio are calculated by excluding prior year loss reserve development to present the impact of current accident year net loss and loss adjustment expenses on the Core loss ratio and Core combined ratio, respectively. Attritional loss ratio excludes catastrophe losses from the accident year loss ratio as they are not predictable as to timing and amount. These ratios are useful indicators of our underwriting profitability.

Tangible Book Value Per Diluted Common Share

Tangible book value per diluted common share, as presented, is a non-GAAP financial measure and the most comparable U.S. GAAP measure is book value per common share. Tangible book value per diluted common share excludes intangible assets. Starting in 2023, the Company will no longer exclude restricted shares from calculation of Tangible Book Value per Diluted Common Share, as the unvested restricted shares outstanding are no longer considered material. The resulting change in Tangible Book Value per Diluted Common Share is ($0.04) per share at September 30, 2023 and thus the Company will no longer adjust the calculation. Further, management believes that effects of intangible assets are not indicative of underlying underwriting results or trends and make book value comparisons to less acquisitive peer companies less meaningful. The tangible book value per diluted common share is also useful because it provides a more accurate measure of the realizable value of shareholder returns, excluding intangible assets.

The following table sets forth the computation of book value per common share, book value per diluted common share and tangible book value per diluted common share as of September 30, 2023 and December 31, 2022:

| | | | | | | | | | | |

| September 30,

2023 | | December 31,

2022 |

| ($ in millions, except share and per share amounts) |

| | | |

| | | |

| Common shareholders’ equity attributable to SiriusPoint common shareholders | $ | 2,050.0 | | | $ | 1,874.7 | |

| | | |

| | | |

| Intangible assets | (155.6) | | | (163.8) | |

| Tangible common shareholders' equity attributable to SiriusPoint common shareholders | $ | 1,894.4 | | | $ | 1,710.9 | |

| | | |

| Common shares outstanding | 165,068,101 | | 162,177,653 |

| Effect of dilutive stock options, restricted share units, warrants and Series A preference shares | 4,236,254 | | 3,492,795 |

| Book value per diluted common share denominator | 169,304,355 | | 165,670,448 |

| Unvested restricted shares | — | | (1,708,608) |

| Tangible book value per diluted common share denominator | 169,304,355 | | 163,961,840 |

| | | |

| Book value per common share | $ | 12.42 | | | $ | 11.56 | |

| Book value per diluted common share | $ | 12.11 | | | $ | 11.32 | |

| Tangible book value per diluted common share | $ | 11.19 | | | $ | 10.43 | |

Other Financial Measures

Annualized Return on Average Common Shareholders’ Equity Attributable to SiriusPoint Common Shareholders

Annualized return on average common shareholders’ equity attributable to SiriusPoint common shareholders is calculated by dividing annualized net income (loss) available to SiriusPoint common shareholders for the period by the average common shareholders’ equity determined using the common shareholders’ equity balances at the beginning and end of the period.

Annualized return on average common shareholders’ equity attributable to SiriusPoint common shareholders for the three and nine months ended September 30, 2023 and 2022 was calculated as follows:

| | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended | | Nine months ended |

| September 30, 2023 | | September 30, 2022 | | September 30, 2023 | | September 30, 2022 |

| ($ in millions) |

| Net income (loss) available to SiriusPoint common shareholders | $ | 57.5 | | | $ | (98.4) | | | $ | 245.3 | | | $ | (376.2) | |

| | | | | | | |

| Common shareholders’ equity attributable to SiriusPoint common shareholders - beginning of period | 2,036.0 | | | 2,023.3 | | | 1,874.7 | | | 2,303.7 | |

| | | | | | | |

| | | | | | | |

| Common shareholders’ equity attributable to SiriusPoint common shareholders - end of period | 2,050.0 | | | 1,884.5 | | | 2,050.0 | | | 1,884.5 | |

| Average common shareholders’ equity attributable to SiriusPoint common shareholders | $ | 2,043.0 | | | $ | 1,953.9 | | | $ | 1,962.4 | | | $ | 2,094.1 | |

| | | | | | | |

| Annualized return on average common shareholders’ equity attributable to SiriusPoint common shareholders | 11.3 | % | | (20.1) | % | | 16.7 | % | | (24.0) | % |

| | | | | | | |

SiriusPoint Ltd.

Financial Supplement

September 30, 2023

(UNAUDITED)

This financial supplement is for informational purposes only. It should be read in conjunction with documents filed with the Securities and Exchange Commission by SiriusPoint Ltd., including the Company’s Quarterly Report on Form 10-Q.

| | | | | | | | |

| Point Building | Dhruv Gahlaut - Head of Investor Relations and Chief Strategy Officer |

| 3 Waterloo Lane | Tel: (044) 20 3772 3111 |

| Pembroke HM 08 | Email: investor.relations@siriuspt.com |

| Bermuda | Website: www.siriuspt.com |

SiriusPoint Ltd.

Revision of Q2 and Q1 2023 interim financial statements:

In connection with the preparation of its third quarter 2023 financial statements, the Company identified certain immaterial errors in its previously issued 2023 interim financial statements, primarily relating to a manual calculation in our property catastrophe business, and also an overnight data transfer error. This resulted in the incorrect recognition of Net premiums earned. The Company performed an analysis in accordance with the guidance set forth in SEC Staff Bulletin 99, Materiality, and SEC Staff Accounting Bulletin 108, Considering the Effects of Prior Year Misstatements when Quantifying Misstatements in Current Year Financial Statements, and concluded that the errors were not material, both individually and in the aggregate, to any previously issued financial statements, and were not intentional. Although not required to do so, but in an effort to provide transparency and in line with good practice, Management has elected to revise the previously issued 2023 interim financial statements when they are next presented. The financial statements for the three and nine months ended September 30, 2023 reflect the correction of these errors in the manner described above.

Basis of Presentation and Non-GAAP Financial Measures:

Unless the context otherwise indicates or requires, as used in this financial supplement references to “we,” “our,” “us,” the “Company,” and "SiriusPoint" refer to SiriusPoint Ltd. and its directly and indirectly owned subsidiaries, as a combined entity, except where otherwise stated or where it is clear that the terms mean only SiriusPoint Ltd. exclusive of its subsidiaries. We have made rounding adjustments to reach some of the figures included in this financial supplement and, unless otherwise indicated, percentages presented in this financial supplement are approximate.

In presenting SiriusPoint’s results, management has included financial measures that are not calculated under standards or rules that comprise accounting principles generally accepted in the United States (“GAAP”). SiriusPoint’s management uses this information in its internal analysis of results and believes that this information may be informative to investors in gauging the quality of SiriusPoint’s financial performance, identifying trends in our results and providing meaningful period-to-period comparisons. Core underwriting income, Core net services income, Core income, Core combined ratio, accident year loss ratio, accident year combined ratio and attritional loss ratio are non-GAAP financial measures. Management believes it is useful to review Core results as it better reflects how management views the business and reflects the Company’s decision to exit the runoff business. Tangible book value per diluted common share is also a non-GAAP financial measure. SiriusPoint's management believes that effects of intangible assets are not indicative of underlying underwriting results or trends and make book value comparisons to less acquisitive peer companies less meaningful. The tangible book value per diluted common share is also useful because it provides a more accurate measure of the realizable value of shareholder returns, excluding intangible assets. Reconciliations and definitions of such measures to the most comparable GAAP figures are included in the attached financial information in accordance with Regulation G.

Safe Harbor Statement Regarding Forward-Looking Statements:

This financial supplement includes “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are subject to known and unknown risks and uncertainties, many of which may be beyond the Company’s control. The Company cautions you that the forward-looking information presented in this financial supplement is not a guarantee of future events, and that actual events may differ materially from those made in or suggested by the forward-looking information contained in this financial supplement. In addition, forward-looking statements generally can be identified by the use of forward-looking terminology such as “believes,” “intends,” “seeks,” “anticipates,” “aims,” “plans,” “targets,” “estimates,” “expects,” “assumes,” “continues,” “should,” “could,” “will,” “may” and the negative of these or similar terms and phrases. Actual events, results and outcomes may differ materially from the Company’s expectations due to a variety of known and unknown risks, uncertainties and other factors. Among the risks and uncertainties that could cause actual results to differ from those described in the forward-looking statements are the following: our ability to execute on our strategic transformation, including re-underwriting to reduce volatility and improving underwriting performance, de-risking our investment portfolio, and transforming our business, including re-balancing our portfolio and growing the Insurance & Services segment; the impact of unpredictable catastrophic events including uncertainties with respect to current and future COVID-19 losses across many classes of insurance business and the amount of insurance losses that may ultimately be ceded to the reinsurance market, supply chain issues, labor shortages and related increased costs, changing interest rates and equity market volatility; inadequacy of loss and loss adjustment expense reserves, the lack of available capital, and periods characterized by excess underwriting capacity and unfavorable premium rates; the performance of financial markets, impact of inflation and interest rates, and foreign currency fluctuations; our ability to compete successfully in the (re)insurance market and the effect of consolidation in the (re)insurance industry; technology breaches or failures, including those resulting from a malicious cyber-attack on us, our business partners or service providers; the effects of global climate change, including increased severity and frequency of weather-related natural disasters and catastrophes and increased coastal flooding in many geographic areas; geopolitical uncertainty, including the ongoing conflicts in Europe and the Middle East; our ability to retain key senior management and key employees; a downgrade or withdrawal of our financial ratings; fluctuations in our results of operations; legal restrictions on certain of SiriusPoint’s insurance and reinsurance subsidiaries’ ability to pay dividends and other distributions to SiriusPoint; the outcome of legal and regulatory proceedings and regulatory constraints on our business; reduced returns or losses in SiriusPoint’s investment portfolio; our potential exposure to U.S. federal income and withholding taxes and our significant deferred tax assets, which could become devalued if we do not generate future taxable income or applicable corporate tax rates are reduced; risks associated with delegating authority to third party managing general agents; future strategic transactions such as acquisitions, dispositions, investments, mergers or joint ventures; SiriusPoint’s response to any acquisition proposal that may be received from any party, including any actions that may be considered by the Company’s board of directors or any committee thereof; and other risks and factors listed under "Risk Factors" in the Company's most recent Annual Report on Form 10-K and other subsequent periodic reports filed with the Securities and Exchange Commission. All forward-looking statements speak only as of the date made and the Company undertakes no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise.

SiriusPoint Ltd.

Table of Contents

| | | | | | | | |

| | |

| Key Performance Indicators | | |

| | |

| | |

| Consolidated Financial Statements | | |

| | |

| Consolidated Statements of Income (Loss) | | |

| Consolidated Statements of Income (Loss) - by Quarter | | |

| | |

| Operating Segment Information | | |

| Segment Reporting - Three months ended September 30, 2023 | | |

| Segment Reporting - Three months ended September 30, 2022 | | |

| Segment Reporting - Nine months ended September 30, 2023 | | |

| Segment Reporting - Nine months ended September 30, 2022 | | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| Investments | | |

| | |

| | |

| | |

| Other | | |

| | |

| Earnings (loss) per Share - by Quarter | | |

| Annualized Return on Average Common Shareholders’ Equity - by Quarter | | |

| Book Value per Share - by Quarter | | |

SiriusPoint Ltd.

Key Performance Indicators

September 30, 2023 and 2022

(expressed in millions of U.S. dollars, except per share data and ratios)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended | | Nine months ended |

| September 30, 2023 | | September 30, 2022 | | September 30, 2023 | | September 30, 2022 |

| | | | | | | |

| Combined ratio | 88.0 | % | | 107.7 | % | | 81.6 | % | | 98.5 | % |

| Core underwriting income (loss) (1) | $ | 42.5 | | | $ | (88.3) | | | $ | 213.2 | | | $ | (66.0) | |

| Core net services income (1) | $ | 7.5 | | | $ | 9.2 | | | $ | 31.9 | | | $ | 34.6 | |

| Core income (loss) (1) | $ | 50.0 | | | $ | (79.1) | | | $ | 245.1 | | | $ | (31.4) | |

Core combined ratio (1) | 92.5 | % | | 114.5 | % | | 87.6 | % | | 103.9 | % |

| Accident year loss ratio (1) | 64.0 | % | | 82.2 | % | | 64.3 | % | | 70.6 | % |

| Accident year combined ratio (1) | 94.8 | % | | 114.1 | % | | 95.2 | % | | 104.2 | % |

| Attritional loss ratio (1) | 62.9 | % | | 63.4 | % | | 63.4 | % | | 62.5 | % |

| Annualized return on average common shareholders’ equity attributable to SiriusPoint common shareholders | 11.3 | % | | (20.1) | % | | 16.7 | % | | (24.0) | % |

| Book value per common share (2) | $ | 12.42 | | | $ | 11.56 | | | $ | 12.42 | | | $ | 11.56 | |

| Book value per diluted common share (2) | $ | 12.11 | | | $ | 11.32 | | | $ | 12.11 | | | $ | 11.32 | |

| Tangible book value per diluted common share (1) (2) | $ | 11.19 | | | $ | 10.43 | | | $ | 11.19 | | | $ | 10.43 | |

(1)Core underwriting income, Core net services income, Core income and Core combined ratio are non-GAAP financial measures. See reconciliations in “Segment Reporting.” Accident year combined ratio, accident year loss ratio and attritional loss ratio are non-GAAP financial measures. See definitions in “Core Results by Quarter.” Tangible book value per diluted common share is a non-GAAP financial measure. See reconciliation in “Book Value per Share - by Quarter.”

(2)Prior year comparatives represent amounts as of December 31, 2022.

SiriusPoint Ltd.

Consolidated Balance Sheets - by Quarter

(expressed in millions of U.S. dollars)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | September 30,

2023 | | June 30,

2023 | | March 31,

2023 | | December 31,

2022 | | September 30,

2022 |

| Assets | | | | | | | | | | |

| Debt securities, available for sale, at fair value, net of allowance for credit losses | | $ | 4,423.3 | | | $ | 4,172.1 | | | $ | 3,565.9 | | | $ | 2,635.5 | | | $ | 1,324.0 | |

| Debt securities, trading, at fair value | | 616.4 | | | 753.2 | | | 1,120.2 | | | 1,526.0 | | | 1,697.1 | |

| Short-term investments, at fair value | | 548.7 | | | 559.2 | | | 594.0 | | | 984.6 | | | 1,991.6 | |

| Investments in related party investment funds, at fair value | | 109.9 | | | 111.3 | | | 117.9 | | | 128.8 | | | 309.0 | |

| Other long-term investments, at fair value | | 326.1 | | | 355.4 | | | 361.9 | | | 377.2 | | | 414.9 | |

| Equity securities, trading, at fair value | | 1.6 | | | 1.6 | | | 1.6 | | | 1.6 | | | 1.4 | |

| Total investments | | 6,026.0 | | | 5,952.8 | | | 5,761.5 | | | 5,653.7 | | | 5,738.0 | |

| Cash and cash equivalents | | 703.5 | | | 676.2 | | | 763.6 | | | 705.3 | | | 647.3 | |

| Restricted cash and cash equivalents | | 107.7 | | | 95.2 | | | 211.0 | | | 208.4 | | | 144.2 | |

| | | | | | | | | | |

| Redemption receivable from related party investment fund | | 2.4 | | | 5.0 | | | 11.6 | | | 18.5 | | | — | |

| Due from brokers | | 21.5 | | | 18.2 | | | 6.5 | | | 4.9 | | | 20.2 | |

| Interest and dividends receivable | | 41.1 | | | 36.8 | | | 33.5 | | | 26.7 | | | 17.0 | |

| Insurance and reinsurance balances receivable, net | | 2,057.6 | | | 2,219.6 | | | 2,261.0 | | | 1,876.9 | | | 1,952.7 | |

| Deferred acquisition costs, net | | 333.0 | | | 342.6 | | | 357.1 | | | 294.9 | | | 278.6 | |

| Unearned premiums ceded | | 464.7 | | | 484.8 | | | 462.3 | | | 348.8 | | | 379.1 | |