Team, Inc. (NYSE: TISI) (“TEAM” or the “Company”),

a global, leading provider of specialty industrial services

offering clients access to a full suite of conventional,

specialized, and proprietary mechanical, heat-treating, and

inspection services, today reported its financial results for the

first quarter ended March 31, 2024.

First Quarter 2024

Highlights:

- Announced first quarter 2024

revenues of $199.6 million.

- Improved gross margin by 120 basis

points to 24.4% as compared to 23.2% in the 2023 first

quarter.

- Reported first quarter 2024 net

loss of $17.2 million, a $7.5 million improvement over the

2023 first quarter net loss of $24.7 million.

- Grew consolidated Adjusted EBITDA1

to $6.5 million (3.3% of consolidated revenue), an increase of

54.7% from $4.2 million (2.1% of consolidated revenue) in the

2023 first quarter.

- Reduced Adjusted Selling, General

and Administrative Expense1 by $0.8 million, as compared to the

2023 first quarter.

- Provided cash flow from operations

of $1.9 million, an increase of $19.6 million as compared to

the 2023 first quarter.

- Completed a comprehensive

commercial review and established near-term and long-term revenue

growth plan.

- Released full year 2024 Adjusted EBITDA guidance of $58 million

to $68 million.

1 See the accompanying reconciliation of

non-GAAP financial measures at the end of this press release.

“Our first quarter results demonstrate tangible

progress in our ongoing program to lower our cost structure and

increase margins. In the first quarter, we improved our gross

margin to 24.4% and Adjusted EBITDA by 55% to $6.5 million,

building on our accelerating financial and operational momentum

throughout 2023. Despite relatively flat year over year revenue,

first quarter Adjusted EBITDA for our Inspection and Heat Treating

and Mechanical Services segments increased by roughly 7% and 11%,

respectively,” said Keith D. Tucker, Team’s Chief Executive

Officer. “These improvements were delivered in what is typically

our slowest quarterly period of the year and further demonstrates

the sustainable benefit to margins and cash flow of our ongoing

efforts to improve our cost structure and streamline

operations.”

“For the past 18 months, we focused on expanding

our margins and cash flow from operations by optimizing our cost

structure and improving operational efficiency, and while that

remains a key ongoing priority, we also see opportunities to grow

our market share in both our current and adjacent end markets. With

the completion of our comprehensive commercial review performed

over the last several months, we identified a number of

opportunities to leverage our technical expertise into high-growth

and attractive margin service lines and end markets. As a result,

in the first quarter of 2024, we launched a set of targeted

commercial initiatives designed to achieve mid to high single digit

revenue growth within our core markets, while also accelerating our

expansion into attractive adjacent markets such as aerospace and

renewable energy. We believe these initiatives, together with our

ongoing commitment to improving cost efficiency, should further

strengthen our financial position and enhance shareholder value,”

commented Tucker.

“Looking to the second quarter, we believe the

strong activity levels across both of our segments, coupled with

our continued focus on cost optimization, will drive improved

margins and cash flow compared to last year’s second quarter.

Furthermore, we anticipate this strength to continue into the

second half of the year and as such, our full year 2024 Adjusted

EBITDA guidance of $58 million to $68 million represents a 48%

improvement at the midpoint over 2023. This is further evidence of

our tangible progress to date and our confidence in the underlying

strength of our franchise.”

“Finally, on Tuesday, May 21, we will present an

updated investor presentation that discusses our first quarter

results and our longer-term strategic and financial objectives

designed to further unlock the intrinsic value of TEAM,” concluded

Tucker.

Financial Results

First quarter revenues were down

$2.7 million to $199.6 million as compared to

$202.3 million in the prior-year period. This decrease was

primarily driven by an Inspection and Heat Treating (“IHT”) revenue

decline of $2.4 million due to lower activity in call out and

turnaround services, and a decline in Mechanical Services (“MS”)

revenue of $0.3 million, reflecting lower project activity in

our Canada region. Despite lower revenues in the first quarter of

2024, consolidated gross margin was $48.7 million, or 24.4% of

revenue, up 120 basis points from 23.2% or $47.0 million, in the

same quarter a year ago. Gross margin for the quarter was impacted

by favorable project mix, improved pricing, and lower overall

direct costs due to the Company’s cost reduction efforts.

Selling, general and administrative expenses for

the first quarter were $55.1 million, up by $0.4 million,

or 0.7%, from the first quarter of 2023. Adjusted Selling, General,

and Administrative Expense, which excludes expenses not

representative of TEAM’s ongoing operations as well as non-cash

expenses such as depreciation and amortization and share-based

compensation expense, declined by $0.8 million as compared to the

2023 period.

Net loss in the first quarter of 2024 was $17.2

million (a loss of $3.89 per share) compared to a net loss of $24.7

million (a loss of $5.69 per share) in the 2023 first quarter. The

Company’s Adjusted EBIT, a non-GAAP measure, was a loss of $3.8

million in the 2024 first quarter compared to a loss of $5.7

million in the prior year quarter. Consolidated Adjusted EBITDA, a

non-GAAP measure, was $6.5 million for the first quarter of 2024 up

54.7% as compared to $4.2 million for the prior year quarter, with

the improvement largely driven by the factors noted above.

Adjusted net loss, consolidated Adjusted EBIT,

Adjusted EBITDA and Adjusted Selling, General and Administrative

Expense are non-GAAP financial measures that exclude certain items

that are not indicative of TEAM’s core operating activities. A

reconciliation of these non-GAAP financial measures to the most

comparable GAAP financial measures is at the end of this earnings

release.

Segment Results

The following table illustrates the composition

of the Company’s revenue and operating income (loss) by segment for

the quarter ended March 31, 2024 and 2023 (in thousands):

|

|

|

TEAM, INC. AND SUBSIDIARIES |

|

SEGMENT INFORMATION |

|

(unaudited, in thousands) |

| |

|

|

|

|

| |

|

Three Months EndedMarch 31, |

|

Better (Worse) |

| |

|

2024 |

|

2023 |

|

$ |

|

% |

| Revenues |

|

|

|

|

|

|

|

|

|

IHT |

|

$ |

99,448 |

|

|

$ |

101,829 |

|

|

$ |

(2,381 |

) |

|

(2.3 |

)% |

|

MS |

|

|

100,152 |

|

|

|

100,448 |

|

|

|

(296 |

) |

|

(0.3 |

)% |

| |

|

$ |

199,600 |

|

|

$ |

202,277 |

|

|

$ |

(2,677 |

) |

|

(1.3 |

)% |

| |

|

|

|

|

|

|

|

|

| Operating income

(loss) |

|

|

|

|

|

|

|

|

|

IHT |

|

$ |

5,185 |

|

|

$ |

4,723 |

|

|

$ |

462 |

|

|

9.8 |

% |

|

MS |

|

|

4,091 |

|

|

|

3,193 |

|

|

|

898 |

|

|

28.1 |

% |

|

Corporate and shared support services |

|

|

(15,662 |

) |

|

|

(15,662 |

) |

|

|

— |

|

|

— |

% |

| |

|

$ |

(6,386 |

) |

|

$ |

(7,746 |

) |

|

$ |

1,360 |

|

|

17.6 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenues. IHT revenues

decreased by $2.4 million, or 2.3%, for the 2024 first quarter as

compared to prior year period, primarily due to lower callout and

turnaround activities in the U.S. and Canada regions. MS revenue

decreased by $0.3 million, or 0.3%, for the quarter, with lower

period over period revenue in Canada of $4.3 million due to

turnaround projects that did not repeat in the 2024 quarter,

partially offset by a $1.2 million increase in U.S. operations and

a $2.8 million increase in other international operations mainly

attributable to higher nested and turnaround activity.

Operating income (loss). IHT’s

first quarter 2024 operating income increased by $0.5 million to

$5.2 million primarily driven by lower direct costs and improved

margins resulting from the Company’s ongoing cost reduction efforts

and improved job mix. MS operating income was higher compared to

prior year quarter by approximately $0.9 million or 28.1%. MS

operating income from the U.S. and other international operations

increased by $1.9 million, and $0.6 million, respectively, driven

by higher activity and improved margins, partially offset by a

decrease of $1.6 million in Canada, primarily driven by

non-repeating projects in the 2023 period. Corporate and shared

support services costs remained consistent with the prior year

period. Consolidated operating loss improved by $1.4 million to a

loss of $6.4 million driven by the factors discussed above.

Balance Sheet and Liquidity

At March 31, 2024, the Company had

$35.9 million of total liquidity, consisting of consolidated

cash and cash equivalents of $19.2 million, (excluding

$5.0 million of restricted cash) and $16.7 million of

undrawn availability under its various credit facilities.

At May 10, 2024, the Company had

$36.7 million of total liquidity, consisting of consolidated

cash and cash equivalents of $15.4 million (excluding

$5.1 million of cash held mainly as collateral for letters of

credit) and approximately $21.3 million of undrawn

availability under its various credit facilities. The Company

typically experiences negative working capital and liquidity

impacts in the run up to the higher activity routinely experienced

during the spring and fall turnaround seasons, when these negative

working capital trends have historically reversed.

The Company’s total debt as of March 31, 2024

was $307.2 million as compared to $311.4 million as of

fiscal year end 2023. The Company’s net debt (total debt less cash

and cash equivalents), a non-GAAP financial measure, was $283.0

million at March 31, 2024.

2024 Outlook

For fiscal year 2024, the Company has provided

the following operating and cash flow guidance:

- Total Company Revenue of $850

million to $900 million

- Gross Margin of between $235

million and $265 million

- Adjusted EBITDA of between $58

million and $68 million

- Capital expenditures of between $9

million to $11 million

Non-GAAP Financial Measures

The non-GAAP measures in this earnings release

are provided to enable investors, analysts and management to

evaluate Team’s performance excluding the effects of certain items

that management believes impact the comparability of operating

results between reporting periods. These measures should be used in

addition to, and not in lieu of, results prepared in conformity

with generally accepted accounting principles (“GAAP”). A

reconciliation of each of the non-GAAP financial measures to the

most directly comparable historical GAAP financial measure is

contained in the accompanying schedule for each of the fiscal

periods indicated.

About Team, Inc.

Headquartered in Sugar Land, Texas, Team, Inc.

(NYSE: TISI) is a global, leading provider of specialty industrial

services offering clients access to a full suite of conventional,

specialized, and proprietary mechanical, heat-treating, and

inspection services. We deploy conventional to highly specialized

inspection, condition assessment, maintenance, and repair services

that result in greater safety, reliability, and operational

efficiency for our client’s most critical assets. Through locations

in 15 countries, we unite the delivery of technological innovation

with over a century of progressive, yet proven integrity and

reliability management expertise to fuel a better tomorrow. For

more information, please visit www.teaminc.com.

Certain forward-looking information contained

herein is being provided in accordance with the provisions of the

Private Securities Litigation Reform Act of 1995. We have made

reasonable efforts to ensure that the information, assumptions, and

beliefs upon which this forward-looking information is based are

current, reasonable, and complete. However, such forward-looking

statements involve estimates, assumptions, judgments, and

uncertainties. They include but are not limited to statements

regarding the Company’s financial prospects and the implementation

of cost-saving measures. There are known and unknown factors that

could cause actual results or outcomes to differ materially from

those addressed in the forward-looking information. Although it is

not possible to identify all of these factors, they include, among

others: the Company’s ability to generate sufficient cash from

operations, access its credit facility, or maintain its compliance

with covenants under its credit facility and debt agreement, the

duration and magnitude of accidents, extreme weather, natural

disasters, and pandemics and related global economic effects and

inflationary pressures, the Company’s liquidity and ability to

obtain additional financing, the Company’s ability to continue as a

going concern, the Company’s ability to execute on its cost

management actions, the impact of new or changes to existing

governmental laws and regulations and their application, including

tariffs; the outcome of tax examinations, changes in tax laws, and

other tax matters; foreign currency exchange rate and interest rate

fluctuations; the Company’s ability to successfully divest assets

on terms that are favorable to the Company; our ability to repay,

refinance or restructure our debt and the debt of certain of our

subsidiaries; anticipated or expected purchases or sales of assets;

the Company’s continued listing on the New York Stock Exchange, and

such known factors as are detailed in the Company’s Annual Report

on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on

Form 8-K, each as filed with the Securities and Exchange

Commission, and in other reports filed by the Company with the

Securities and Exchange Commission from time to time. Accordingly,

there can be no assurance that the forward-looking information

contained herein, including statements regarding the Company’s

financial prospects and the implementation of cost-saving measures,

will occur or that objectives will be achieved. We assume no

obligation to publicly update or revise any forward-looking

statements made today or any other forward-looking statements made

by the Company, whether as a result of new information, future

events or otherwise, except as may be required by law.

Contact:Nelson M. HaightExecutive Vice

President, Chief Financial Officer(281) 388-5521

|

|

|

TEAM, INC. AND SUBSIDIARIES |

|

SUMMARY OF CONSOLIDATED OPERATING RESULTS |

|

(unaudited, in thousands, except per share

data) |

| |

| |

|

Three Months Ended |

| |

|

March 31, |

| |

|

2024 |

|

2023 |

| |

|

|

|

|

|

Revenues |

|

$ |

199,600 |

|

|

$ |

202,277 |

|

| Operating

expenses |

|

|

150,869 |

|

|

|

155,275 |

|

|

Gross margin |

|

|

48,731 |

|

|

|

47,002 |

|

| Selling, general, and

administrative expenses |

|

|

55,117 |

|

|

|

54,748 |

|

|

Operating loss |

|

|

(6,386 |

) |

|

|

(7,746 |

) |

| Interest expense,

net |

|

|

(12,098 |

) |

|

|

(16,741 |

) |

| Other income,

net |

|

|

1,362 |

|

|

|

635 |

|

| Loss before income

taxes |

|

|

(17,122 |

) |

|

|

(23,852 |

) |

| Provision for income

taxes |

|

|

(73 |

) |

|

|

(859 |

) |

| Net loss |

|

$ |

(17,195 |

) |

|

$ |

(24,711 |

) |

| |

|

|

|

|

| Loss per common

share: |

|

|

|

|

|

Basic and Diluted |

|

$ |

(3.89 |

) |

|

$ |

(5.69 |

) |

| |

|

|

|

|

| Weighted-average

number of shares outstanding: |

|

|

|

|

|

Basic and Diluted |

|

|

4,415 |

|

|

|

4,344 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TEAM, INC. AND SUBSIDIARIES |

|

SUMMARY CONSOLIDATED BALANCE SHEET

INFORMATION |

|

(in thousands) |

| |

|

|

|

| |

March 31, |

|

December 31, |

| |

2024 |

|

2023 |

| |

(unaudited) |

|

|

| |

|

|

|

|

Cash and cash equivalents |

$ |

24,190 |

|

|

$ |

35,427 |

|

| |

|

|

|

| Other current

assets |

|

274,012 |

|

|

|

286,674 |

|

| |

|

|

|

| Property, plant, and

equipment, net |

|

123,137 |

|

|

|

127,057 |

|

| |

|

|

|

| Other non-current

assets |

|

114,144 |

|

|

|

116,586 |

|

| |

|

|

|

|

Total assets |

$ |

535,483 |

|

|

$ |

565,744 |

|

| |

|

|

|

| Current portion of

long-term debt and finance lease obligations |

$ |

7,123 |

|

|

$ |

5,212 |

|

| |

|

|

|

| Other current

liabilities |

|

163,883 |

|

|

|

169,726 |

|

| |

|

|

|

| Long-term debt and

finance lease obligations, net of current maturities |

|

300,038 |

|

|

|

306,214 |

|

| |

|

|

|

| Other non-current

liabilities |

|

38,148 |

|

|

|

38,996 |

|

| |

|

|

|

| Shareholders’

equity |

|

26,291 |

|

|

|

45,596 |

|

| |

|

|

|

|

Total liabilities and shareholders’ equity |

$ |

535,483 |

|

|

$ |

565,744 |

|

|

|

|

|

|

|

|

|

|

|

|

|

TEAM INC. AND SUBSIDIARIES |

|

SUMMARY CONSOLIDATED CASH FLOW INFORMATION |

|

(unaudited, in thousands) |

| |

|

|

| |

|

Three Months Ended |

| |

|

March 31, |

| |

|

2024 |

|

2023 |

| |

|

|

|

|

| |

|

|

|

|

|

Net loss |

|

$ |

(17,195 |

) |

|

$ |

(24,711 |

) |

| |

|

|

|

|

| Depreciation and

amortization expense |

|

|

9,640 |

|

|

|

9,546 |

|

| |

|

|

|

|

| Amortization of debt

issuance costs, debt discounts and deferred financing

costs |

|

|

1,975 |

|

|

|

8,486 |

|

| |

|

|

|

|

| Deferred income

taxes |

|

|

(626 |

) |

|

|

(37 |

) |

| |

|

|

|

|

| Non-cash compensation

cost |

|

|

665 |

|

|

|

382 |

|

| |

|

|

|

|

| Working Capital and

Other |

|

|

7,427 |

|

|

|

(11,429 |

) |

| |

|

|

|

|

|

Net cash provided by (used in) operating

activities |

|

|

1,886 |

|

|

|

(17,763 |

) |

| |

|

|

|

|

| Capital

expenditures |

|

|

(3,016 |

) |

|

|

(2,692 |

) |

| |

|

|

|

|

| Proceeds from disposal

of assets |

|

|

— |

|

|

|

332 |

|

| |

|

|

|

|

|

Net cash used in investing activities |

|

|

(3,016 |

) |

|

|

(2,360 |

) |

| |

|

|

|

|

| Borrowings (payments)

under ABL Facilities, net |

|

|

(9,909 |

) |

|

|

(6,001 |

) |

| |

|

|

|

|

| Payments under ME/RE

Loans, net |

|

|

(711 |

) |

|

|

— |

|

| |

|

|

|

|

| Payments under Corre

Incremental Term Loans |

|

|

(356 |

) |

|

|

— |

|

| |

|

|

|

|

| Payments for debt

issuance costs |

|

|

(1,400 |

) |

|

|

— |

|

| |

|

|

|

|

| Other |

|

|

2,542 |

|

|

|

(235 |

) |

| |

|

|

|

|

|

Net cash used in financing activities |

|

|

(9,834 |

) |

|

|

(6,236 |

) |

| |

|

|

|

|

| Effect of exchange

rate changes |

|

|

(273 |

) |

|

|

153 |

|

| |

|

|

|

|

|

Net change in cash and cash equivalents |

|

$ |

(11,237 |

) |

|

$ |

(26,206 |

) |

| |

|

|

|

|

|

|

|

TEAM, INC. AND SUBSIDIARIES |

|

SEGMENT INFORMATION |

|

(unaudited, in thousands) |

| |

| |

|

Three Months EndedMarch 31, |

| |

|

2024 |

|

2023 |

| Revenues |

|

|

|

|

|

IHT |

|

$ |

99,448 |

|

|

$ |

101,829 |

|

|

MS |

|

|

100,152 |

|

|

|

100,448 |

|

| |

|

$ |

199,600 |

|

|

$ |

202,277 |

|

| |

|

|

|

|

| Operating income

(loss) |

|

|

|

|

|

IHT |

|

$ |

5,185 |

|

|

$ |

4,723 |

|

|

MS |

|

|

4,091 |

|

|

|

3,193 |

|

|

Corporate and shared support services |

|

|

(15,662 |

) |

|

|

(15,662 |

) |

| |

|

$ |

(6,386 |

) |

|

$ |

(7,746 |

) |

| |

|

|

|

|

| Segment Adjusted

EBIT1 |

|

|

|

|

|

IHT |

|

$ |

5,320 |

|

|

$ |

4,763 |

|

|

MS |

|

|

4,498 |

|

|

|

3,469 |

|

|

Corporate and shared support services |

|

|

(13,616 |

) |

|

|

(13,953 |

) |

| |

|

$ |

(3,798 |

) |

|

$ |

(5,721 |

) |

| |

|

|

|

|

| Segment Adjusted

EBITDA1 |

|

|

|

|

|

IHT |

|

$ |

8,349 |

|

|

$ |

7,817 |

|

|

MS |

|

|

9,147 |

|

|

|

8,222 |

|

|

Corporate and shared support services |

|

|

(10,989 |

) |

|

|

(11,832 |

) |

| |

|

$ |

6,507 |

|

|

$ |

4,207 |

|

___________________

1 See the accompanying

reconciliation of non-GAAP financial measures at the end of this

earnings release.

| |

|

TEAM, INC. AND SUBSIDIARIESNon-GAAP

Financial Measures(Unaudited) |

| |

The Company uses supplemental non-GAAP financial

measures which are derived from the consolidated financial

information, including adjusted net income (loss); adjusted net

income (loss) per share; earnings before interest and taxes

(“EBIT”); Adjusted EBIT (defined below); adjusted earnings before

interest, taxes, depreciation, and amortization (“Adjusted

EBITDA”), free cash flow and net debt to supplement financial

information presented on a GAAP basis.

The Company defines adjusted net income (loss)

and adjusted net income (loss) per share to exclude the following

items: non-routine legal costs and settlements, non-routine

professional fees, (gain) loss on debt extinguishment, certain

severance charges, non-routine write off of assets and certain

other items that we believe are not indicative of core operating

activities. Consolidated Adjusted EBIT, as defined by us, excludes

the costs excluded from adjusted net income (loss) as well as

income tax expense (benefit), interest charges, foreign currency

(gain) loss, pension credit, and items of other (income) expense.

Consolidated Adjusted EBITDA further excludes from consolidated

Adjusted EBIT depreciation, amortization and non-cash share-based

compensation costs. Segment Adjusted EBIT is equal to segment

operating income (loss) excluding costs associated with non-routine

legal costs and settlements, non-routine professional fees, certain

severance charges, and certain other items as determined by

management. Segment Adjusted EBITDA further excludes from segment

Adjusted EBIT depreciation, amortization, and non-cash share-based

compensation costs. Adjusted Selling, General and Administrative

Expense is defined to exclude non-routine legal costs and

settlements, non-routine professional fees, certain severance

charges, certain other items that we believe are not indicative of

core operating activities and non-cash expenses such as

depreciation and amortization and non-cash compensation. Free Cash

Flow is defined as net cash provided by (used in) operating

activities minus capital expenditures. Net debt is defined as the

sum of the current and long-term portions of debt, including

finance lease obligations, less cash and cash equivalents.

Management believes these non-GAAP financial

measures are useful to both management and investors in their

analysis of our financial position and results of operations. In

particular, adjusted net income (loss), adjusted net income (loss)

per share, consolidated Adjusted EBIT, and consolidated Adjusted

EBITDA are meaningful measures of performance which are commonly

used by industry analysts, investors, lenders, and rating agencies

to analyze operating performance in our industry, perform

analytical comparisons, benchmark performance between periods, and

measure our performance against externally communicated targets.

Our segment Adjusted EBIT and segment Adjusted EBITDA are also used

as a basis for the Chief Operating Decision Maker to evaluate the

performance of our reportable segments. Free cash flow is used by

our management and investors to analyze our ability to service and

repay debt and return value directly to stakeholders.

Non-GAAP measures have important limitations as

analytical tools, because they exclude some, but not all, items

that affect net earnings and operating income. These measures

should not be considered substitutes for their most directly

comparable U.S. GAAP financial measures and should be read only in

conjunction with financial information presented on a GAAP basis.

Further, our non-GAAP financial measures may not be comparable to

similarly titled measures of other companies who may calculate

non-GAAP financial measures differently, limiting the usefulness of

those measures for comparative purposes. The liquidity measure of

free cash flow does not represent a precise calculation of residual

cash flow available for discretionary expenditures. Reconciliations

of each non-GAAP financial measure to its most directly comparable

GAAP financial measure are presented below.

|

|

|

TEAM, INC. AND SUBSIDIARIES |

|

RECONCILIATION OF NON-GAAP FINANCIAL MEASURES |

|

(unaudited, in thousands except per share

data) |

| |

|

|

|

|

| |

|

Three Months EndedMarch 31, |

| |

|

2024 |

|

2023 |

| Adjusted Net

Loss: |

|

|

|

|

|

Net loss |

|

$ |

(17,195 |

) |

|

$ |

(24,711 |

) |

|

Professional fees and other1 |

|

|

2,081 |

|

|

|

1,721 |

|

|

Legal costs |

|

|

82 |

|

|

|

— |

|

|

Severance charges, net2 |

|

|

425 |

|

|

|

305 |

|

|

Tax impact of adjustments and other net tax items3 |

|

|

(112 |

) |

|

|

(78 |

) |

| Adjusted Net

Loss |

|

$ |

(14,719 |

) |

|

$ |

(22,763 |

) |

| |

|

|

|

|

| Adjusted Net Loss per

common share: |

|

|

|

|

|

Basic and Diluted |

|

$ |

(3.33 |

) |

|

$ |

(5.24 |

) |

| |

|

|

|

|

| Consolidated Adjusted

EBIT and Adjusted EBITDA: |

|

|

|

|

|

Net loss |

|

$ |

(17,195 |

) |

|

$ |

(24,711 |

) |

|

Provision for income taxes |

|

|

73 |

|

|

|

859 |

|

|

Gain on equipment sale |

|

|

(10 |

) |

|

|

(303 |

) |

|

Interest expense, net |

|

|

12,098 |

|

|

|

16,741 |

|

|

Professional fees and other1 |

|

|

2,081 |

|

|

|

1,721 |

|

|

Legal costs |

|

|

82 |

|

|

|

— |

|

|

Severance charges, net2 |

|

|

425 |

|

|

|

305 |

|

|

Foreign currency gain |

|

|

(1,239 |

) |

|

|

(177 |

) |

|

Pension credit4 |

|

|

(113 |

) |

|

|

(156 |

) |

| Consolidated Adjusted

EBIT |

|

|

(3,798 |

) |

|

|

(5,721 |

) |

|

Depreciation and amortization |

|

|

|

|

|

Amount included in operating expenses |

|

|

3,583 |

|

|

|

3,719 |

|

|

Amount included in SG&A expenses |

|

|

6,057 |

|

|

|

5,827 |

|

|

Total depreciation and amortization |

|

|

9,640 |

|

|

|

9,546 |

|

|

Non-cash share-based compensation costs |

|

|

665 |

|

|

|

382 |

|

| Consolidated Adjusted

EBITDA |

|

$ |

6,507 |

|

|

$ |

4,207 |

|

| |

|

|

|

|

| Free Cash

Flow: |

|

|

|

|

|

Cash provided by (used in) operating activities |

|

$ |

1,886 |

|

|

$ |

(17,763 |

) |

|

Capital expenditures |

|

|

(3,016 |

) |

|

|

(2,692 |

) |

| Free Cash

Flow |

|

$ |

(1,130 |

) |

|

$ |

(20,455 |

) |

____________________________________

|

1 |

|

For the three months ended March 31, 2024, includes $1.9 million

related to debt financing, and $0.2 million related to support

costs. For the three months ended March 31, 2023, includes $1.7

million related to costs associated with corporate support. |

|

2 |

|

Represents customary severance costs associated with staff

reductions. |

|

3 |

|

Represents the tax effect of the adjustments. |

|

4 |

|

Represents pension credits for the U.K. pension plan based on the

difference between the expected return on plan assets and the cost

of the discounted pension liability. The pension plan was frozen in

1994 and no new participants have been added since that date. |

|

|

|

|

|

|

|

TEAM, INC. AND SUBSIDIARIES |

|

RECONCILIATION OF NON-GAAP FINANCIAL MEASURES

(Continued) |

|

(unaudited, in thousands) |

| |

|

|

|

| |

|

Three Months EndedMarch 31, |

| |

|

2024 |

|

2023 |

| |

|

|

|

|

| Segment Adjusted EBIT

and Adjusted EBITDA: |

|

|

|

|

| |

|

|

|

|

| IHT |

|

|

|

|

|

Operating income |

|

$ |

5,185 |

|

|

$ |

4,723 |

|

|

Severance charges, net1 |

|

|

95 |

|

|

|

40 |

|

|

Professional fees and other2 |

|

|

40 |

|

|

|

— |

|

|

Adjusted EBIT |

|

|

5,320 |

|

|

|

4,763 |

|

|

Depreciation and amortization |

|

|

3,029 |

|

|

|

3,054 |

|

|

Adjusted EBITDA |

|

$ |

8,349 |

|

|

$ |

7,817 |

|

| |

|

|

|

|

| MS |

|

|

|

|

|

Operating income |

|

$ |

4,091 |

|

|

$ |

3,193 |

|

|

Severance charges, net1 |

|

|

325 |

|

|

|

256 |

|

|

Professional fees and other2 |

|

|

82 |

|

|

|

20 |

|

|

Adjusted EBIT |

|

|

4,498 |

|

|

|

3,469 |

|

|

Depreciation and amortization |

|

|

4,649 |

|

|

|

4,753 |

|

|

Adjusted EBITDA |

|

$ |

9,147 |

|

|

$ |

8,222 |

|

| |

|

|

|

|

| Corporate and shared

support services |

|

|

|

|

|

Net loss |

|

$ |

(26,471 |

) |

|

$ |

(32,627 |

) |

|

Provision for income taxes |

|

|

73 |

|

|

|

859 |

|

|

Gain on equipment sale |

|

|

(10 |

) |

|

|

(303 |

) |

|

Interest expense, net |

|

|

12,098 |

|

|

|

16,741 |

|

|

Foreign currency gain |

|

|

(1,239 |

) |

|

|

(177 |

) |

|

Pension credit3 |

|

|

(113 |

) |

|

|

(156 |

) |

|

Professional fees and other2 |

|

|

1,959 |

|

|

|

1,701 |

|

|

Legal costs |

|

|

82 |

|

|

|

— |

|

|

Severance charges, net1 |

|

|

5 |

|

|

|

9 |

|

|

Adjusted EBIT |

|

|

(13,616 |

) |

|

|

(13,953 |

) |

|

Depreciation and amortization |

|

|

1,962 |

|

|

|

1,739 |

|

|

Non-cash share-based compensation costs |

|

|

665 |

|

|

|

382 |

|

|

Adjusted EBITDA |

|

$ |

(10,989 |

) |

|

$ |

(11,832 |

) |

___________________

|

1 |

|

Represents customary severance costs associated with staff

reductions |

|

2 |

|

For the three months ended March 31, 2024, includes $1.9 million

related to debt financing, and $0.2 million related to support

costs. For the three months ended March 31, 2023, includes $1.7

million related to costs associated with corporate support. |

|

3 |

|

Represents pension credits for the U.K. pension plan based on the

difference between the expected return on plan assets and the cost

of the discounted pension liability. The pension plan was frozen in

1994 and no new participants have been added since that date. |

|

|

|

|

|

|

|

TEAM, INC. AND SUBSIDIARIES |

|

RECONCILIATION OF NON-GAAP FINANCIAL MEASURES

(Continued) |

|

(unaudited, in thousands) |

| |

|

|

|

|

| |

|

Three Months EndedMarch 31, |

| |

|

2024 |

|

2023 |

| |

|

|

|

|

|

Selling, general, and administrative expenses |

|

$ |

55,117 |

|

|

$ |

54,748 |

|

| Less: |

|

|

|

|

|

Depreciation and Amortization in SG&A

expenses |

|

|

6,057 |

|

|

|

5,827 |

|

|

Non-cash share-based compensation costs |

|

|

665 |

|

|

|

382 |

|

|

Professional fees and other1 |

|

|

2,081 |

|

|

|

1,721 |

|

|

Legal costs |

|

|

82 |

|

|

|

— |

|

|

Severance charges included in SG&A

expenses |

|

|

425 |

|

|

|

220 |

|

|

Total non-cash/non-recurring items |

|

|

9,310 |

|

|

|

8,150 |

|

| Adjusted Selling,

General and Administrative Expense |

|

$ |

45,807 |

|

|

$ |

46,598 |

|

___________________

|

1 |

|

For the three months ended March 31, 2024, includes $1.9 million

related to debt financing, and $0.2 million related to support

costs. For the three months ended March 31, 2023, includes $1.7

million related to costs associated with corporate support. |

|

|

|

|

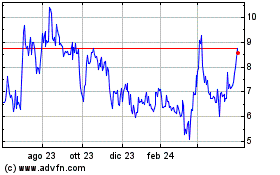

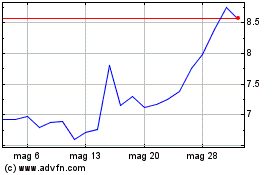

Grafico Azioni Team (NYSE:TISI)

Storico

Da Gen 2025 a Feb 2025

Grafico Azioni Team (NYSE:TISI)

Storico

Da Feb 2024 a Feb 2025