U-Haul Holding Company (NYSE: UHAL, UHAL.B), parent of U-Haul

International, Inc., Oxford Life Insurance Company, Repwest

Insurance Company and Amerco Real Estate Company, today reported

net earnings available to common shareholders for its first quarter

ended June 30, 2024, of $195.4 million, compared with net earnings

of $256.8 million for the same period last year. Earnings per share

for Non-Voting Shares (UHAL.B) were $1.00 for the first quarter of

fiscal 2025 compared to $1.31 for the same period in fiscal

2024.

“We are making incremental progress serving more moving

customers and filling storage rooms,” stated Joe Shoen, chairman of

U-Haul Holding Company. “Transactions and revenue per transaction

improved for both In-Town and One-way moves this quarter. Storage

rooms rented are up. Most of our lines of business are hotly

contested. As competitors continue to mimic our customer service,

we have to implement more ways to satisfy the customer. This is a

race, and the customer is the eventual winner.”

Highlights of First Quarter Fiscal 2025 Results

- Self-storage revenues increased $16.8 million, or 8.4% versus

the first quarter of fiscal year 2024.

- Same store occupancy decreased 1.2% to 93.9%, revenue per foot

increased 4.7%, and the number of locations qualifying for the pool

increased by 59.

- Total portfolio occupied rooms increased 31,582 or 5.6%

compared to June 30, 2023.

- During the quarter we added 17 new locations with storage and

1.7 million net rentable square feet (nrsf). Eight were

acquisitions of existing storage locations totaling 0.4 million

nrsf and nine were internally developed. These newly developed

locations along with expansion projects at existing facilities

accounted for the remaining 1.3 million nrsf.

- We have approximately 16.9 million nrsf in development or

pending.

- Self-moving equipment rental revenues increased $15.1 million,

or 1.5% versus first quarter of fiscal year 2024 marking our first

year-over-year improvement in eight quarters. Transactions and

revenue per transaction improved for both our In-Town and One-Way

markets compared to the first quarter of fiscal 2024.

- Moving and Storage Other Revenue increased $9.0 million or 7.3%

versus the first quarter of fiscal 2024 due to growth of our U-Box

product offering.

- Moving and Storage earnings from operations, adjusted to remove

interest income, decreased $64.3 million compared to the first

quarter of fiscal 2024.

- Reduced gains from the disposal of retired rental equipment

accounted for $47.9 million of the decrease while fleet

depreciation increased $22.3 million and real estate related

depreciation increased $6.8 million.

- Fleet maintenance and repair costs declined $20.8 million.

- Moving and Storage earnings before interest, taxes and

depreciation (EBITDA), adjusted to remove interest income,

increased $16.5 million compared to the first quarter of fiscal

2024.

- Cash and credit availability at the Moving and Storage segment

was $1,566.8 million as of June 30, 2024 compared with $1,886.3

million at March 31, 2024.

- On June 5, 2024, we declared a cash dividend on our Non-Voting

Common Stock of $0.05 per share to holders of record on June 17,

2024. The dividend was paid on June 28, 2024.

- We are holding our 18th Annual Virtual Analyst and Investor

meeting on Thursday, August 15, 2024 at 11 a.m. Arizona Time (2

p.m. Eastern). This is an opportunity to interact directly with

Company representatives through a live video webcast at

investors.uhaul.com. A brief presentation by the Company will be

followed by a question-and-answer session.

- Supplemental financial information as of June 30, 2024 is

available at investors.uhaul.com under “Investor Kit”.

U-Haul Holding Company will hold its investor call for the first

quarter of fiscal 2025 on Thursday, August 8, 2023, at 8 a.m.

Arizona Time (11 a.m. Eastern). The call will be broadcast live

over the Internet at investors.uhaul.com. To hear a simulcast of

the call, or a replay, visit investors.uhaul.com.

About U-Haul Holding Company

U-Haul Holding Company is the parent company of U-Haul

International, Inc., Oxford Life Insurance Company, Repwest

Insurance Company and Amerco Real Estate Company. U-Haul is in the

shared use business and was founded on the fundamental philosophy

that the division of use and specialization of ownership is good

for both U-Haul customers and the environment.

About U-Haul

Since 1945, U-Haul has been the No. 1 choice of do-it-yourself

movers, with a network of more than 23,000 locations across all 50

states and 10 Canadian provinces. U-Haul Truck Share 24/7 offers

secure access to U-Haul trucks every hour of every day through the

customer dispatch option on their smartphones and our patented Live

Verify technology. Our customers' patronage has enabled the U-Haul

fleet to grow to approximately 192,000 trucks, 138,700 trailers and

39,500 towing devices. U-Haul is the third largest self-storage

operator in North America and offers 1,024,000 rentable storage

units and 88.5 million square feet of self-storage space at owned

and managed facilities. U-Haul is the largest retailer of propane

in the U.S., and continues to be the largest installer of permanent

trailer hitches in the automotive aftermarket industry. U-Haul has

been recognized repeatedly as a leading "Best for Vets" employer

and was recently named one of the 15 Healthiest Workplaces in

America.

Certain of the statements made in this press release regarding

our business constitute forward-looking statements as contemplated

under the Private Securities Litigation Reform Act of 1995. Actual

results may differ materially from those anticipated as a result of

various risks and uncertainties. Readers are cautioned not to place

undue reliance on these forward-looking statements that speak only

as of the date hereof. The Company undertakes no obligation to

publish revised forward-looking statements to reflect events or

circumstances after the date hereof or to reflect the occurrence of

unanticipated events, except as required by law. For a brief

discussion of the risks and uncertainties that may affect U-Haul

Holding Company’s business and future operating results, please

refer to our Form 10-Q for the quarter ended June 30, 2024, which

is on file with the SEC.

Report on Business Operations

Listed below on a consolidated basis are revenues for our major

product lines for the first quarter of fiscal 2025 and 2024.

Quarter Ended June 30,

2024

2023

(Unaudited)

(In thousands)

Self-moving equipment rental revenues

$

1,014,332

$

999,206

Self-storage revenues

215,737

198,961

Self-moving and self-storage product and

service sales

96,591

100,872

Property management fees

9,495

9,177

Life insurance premiums

20,740

23,131

Property and casualty insurance

premiums

21,229

20,322

Net investment and interest income

37,125

64,592

Other revenue

133,241

124,047

Consolidated revenue

$

1,548,490

$

1,540,308

Listed below are revenues and earnings from operations at each

of our operating segments for the first quarter of fiscal 2025 and

2024.

Quarter Ended June 30,

2024

2023

(Unaudited)

(In thousands)

Moving and storage

Revenues

$

1,469,161

$

1,459,513

Earnings from operations before equity in

earnings of subsidiaries

295,058

386,691

Property and casualty insurance

Revenues

28,178

27,839

Earnings from operations

11,483

11,982

Life insurance

Revenues

53,749

55,681

Earnings (losses) from operations

(47

)

1,356

Eliminations

Revenues

(2,598

)

(2,725

)

Earnings from operations before equity in

earnings of subsidiaries

(252

)

(371

)

Consolidated Results

Revenues

1,548,490

1,540,308

Earnings from operations

306,242

399,658

Debt Metrics

Debt Metrics

(in thousands)(unaudited)

June 30,

March 31,

December 31,

September 30,

June 30,

2024

2024

2023

2023

2023

Real estate secured debt

$

2,497,239

$

2,562,620

$

2,716,180

$

2,771,027

$

2,744,416

Unsecured debt

1,200,000

1,200,000

1,200,000

1,200,000

1,200,000

Fleet secured debt

2,544,235

2,470,603

2,482,356

2,392,021

2,305,116

Other secured debt

70,202

70,815

72,869

73,752

74,250

Total debt

6,311,676

6,304,038

6,471,405

6,436,800

6,323,782

Moving and Storage cash

$

1,071,779

$

1,380,165

$

1,736,295

$

2,068,790

$

2,302,380

Moving and Storage assets

16,447,193

16,149,748

16,193,912

16,156,182

15,742,770

Moving and Storage EBITDA (TTM)**

1,584,461

1,567,985

1,593,446

1,683,912

1,789,024

Net debt to EBITDA

3.3

3.1

3.0

2.6

2.2

Net debt to total assets

31.9%

30.5%

29.2%

27.0%

25.5%

Percent of debt floating

7.7%

7.2%

6.9%

6.3%

7.7%

Percent of debt fixed

92.3%

92.8%

93.1%

93.7%

92.3%

Percent of debt unsecured

19.0%

19.0%

18.5%

18.6%

19.0%

Unencumbered asset ratio*

4.72x

4.43x

4.00x

3.74x

3.55x

*

Unencumbered asset value compared

to unsecured debt committed, outstanding or not. Unencumbered

assets valued at the higher of historical cost or allocated NOI

valued at a 10% cap rate, minimum required is 2.0x

**

Moving and Storage EBITDA (TTM)

for December 31, 2023, September 30, 2023 and June 30, 2023 have

been adjusted from previously presented earnings releases as Moving

and Storage interest income has been classified as Other interest

income.

The components of depreciation, net of gains on disposals are as

follows:

Quarter Ended June 30,

2024

2023

(Unaudited)

(In thousands)

Depreciation expense - rental

equipment

$

157,528

$

135,192

Depreciation expense - non rental

equipment

23,961

22,302

Depreciation expense - real estate

42,824

35,981

Total depreciation expense

$

224,313

$

193,475

Gains on disposals of rental equipment

(7,948

)

(55,807

)

Losses on disposals of non-rental

equipment

180

146

Total gains on disposals equipment

$

(7,768

)

$

(55,661

)

Depreciation, net of gains on

disposals

$

216,545

$

137,814

Losses on disposals of real estate

$

3,104

$

1,021

The Company owns and manages self-storage facilities.

Self-storage revenues reported in the consolidated financial

statements represent Company-owned locations only. Self-storage

data for our owned locations follows:

Quarter Ended June 30,

2024

2023

(Unaudited)

(In thousands, except occupancy

rate)

Unit count as of June 30

748

683

Square footage as of June 30

63,586

57,530

Average monthly number of units

occupied

594

563

Average monthly occupancy rate based on

unit count

80.0%

82.8%

End of June occupancy rate based on unit

count

81.0%

83.9%

Average monthly square footage

occupied

51,717

48,627

Self-Storage Portfolio Summary

As of June 30, 2024

(unaudited)

U-Haul Owned Store Data by

State

Rentable

Annual

State/

Units

Square

Revenue

Occupancy

Province

Stores

Occupied

Feet

Per Foot

During Qtr

Texas

94

38,312

4,464,055

$14.68

77.1%

California

88

33,736

3,167,630

$21.03

81.9%

Florida

85

33,797

3,734,856

$18.33

76.0%

Illinois

81

37,664

3,697,392

$15.66

84.7%

Pennsylvania

69

28,798

2,856,385

$17.47

77.2%

New York

66

27,974

2,610,967

$23.12

78.5%

Ohio

58

24,937

2,538,932

$14.86

81.6%

Michigan

57

20,317

2,080,132

$15.58

84.5%

Georgia

49

22,415

2,402,474

$16.24

85.6%

Arizona

43

25,181

2,736,396

$15.40

81.8%

Wisconsin

43

17,296

1,961,885

$13.30

77.8%

Washington

37

13,689

1,496,099

$16.77

74.3%

North Carolina

37

16,851

1,837,893

$15.25

76.4%

Tennessee

36

15,228

1,520,055

$14.76

87.6%

Missouri

35

13,042

1,590,061

$14.56

73.5%

New Jersey

34

16,114

1,516,125

$20.73

81.5%

Indiana

33

11,006

1,173,055

$13.75

81.2%

Ontario

32

11,439

1,209,530

$23.14

72.4%

Massachusetts

31

11,269

995,742

$20.45

85.8%

Alabama

27

7,337

843,169

$13.92

77.9%

Top 20 Totals

1,035

426,402

44,432,835

$16.91

79.9%

All Others

461

179,637

19,229,462

$16.20

80.3%

1Q 2025 Totals

1,496

606,039

63,662,297

$16.70

80.0%

Same Store 1Q25

879

310,441

28,233,523

$17.05

93.9%

Same Store 1Q24

820

266,447

24,473,487

$16.28

95.1%

Same Store 1Q23

718

222,894

20,716,950

$14.79

96.8%

Non Same Store 1Q25

617

295,598

35,428,773

$16.30

69.1%

Non Same Store 1Q24

616

307,371

33,132,703

$16.03

74.4%

Non Same Store 1Q23

659

308,734

31,203,865

$15.14

77.1%

Same Store Pool Held Constant for Prior

Periods

Same Store 1Q25

879

310,441

28,233,523

$17.05

93.9%

Same Store 1Q24

879

313,525

28,216,246

$16.30

94.9%

Same Store 1Q23

879

312,171

28,196,738

$14.98

94.4%

Non-Same Store 1Q25

617

295,598

35,428,773

$16.30

69.1%

Non-Same Store 1Q24

555

260,952

29,457,657

$15.95

71.7%

Non-Same Store 1Q23

497

220,545

23,825,830

$14.97

73.3%

Note: Store Count, Units, and NRSF

figures reflect active storage locations for the last month of the

reporting quarter.

Occupancy % reflects average occupancy

during the reporting quarter.

Revenue per foot is average revenue per

occupied foot over the trailing twelve months ending June

2024.

Same store includes storage locations

with rentable storage inventory for more than three years and have

had a capacity change of less than twenty units for any

year-over-year period of the reporting month.

The locations have occupancy each month

during the last three years and have achieved 80% or greater

physical occupancy for the last two years.

Prior year Same Store figures are for

locations meeting the Same Store criteria as of the prior year

reporting month.

U-HAUL HOLDING COMPANY AND

CONSOLIDATED SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE

SHEETS

June 30,

March 31,

2024

2024

(Unaudited)

(In thousands)

ASSETS

Cash and cash equivalents

$

1,153,161

$

1,534,544

Trade receivables and reinsurance

recoverables, net

253,638

215,908

Inventories and parts

157,625

150,940

Prepaid expenses

248,147

246,082

Fixed maturity securities

available-for-sale, net, at fair value

2,395,890

2,442,504

Equity securities, at fair value

74,066

66,274

Investments, other

638,423

633,936

Deferred policy acquisition costs, net

119,806

121,224

Other assets

123,878

111,743

Right of use assets - financing, net

265,744

289,305

Right of use assets - operating, net

53,255

53,712

Related party assets

67,254

57,934

5,550,887

5,924,106

Property, plant and equipment, at

cost:

Land

1,727,668

1,670,033

Buildings and improvements

8,591,016

8,237,354

Furniture and equipment

1,014,086

1,003,770

Rental trailers and other rental

equipment

960,853

936,303

Rental trucks

6,670,443

6,338,324

18,964,066

18,185,784

Less: Accumulated depreciation

(5,209,526

)

(5,051,132

)

Total property, plant and equipment,

net

13,754,540

13,134,652

Total assets

$

19,305,427

$

19,058,758

LIABILITIES AND STOCKHOLDERS'

EQUITY

Liabilities:

Accounts payable and accrued expenses

$

833,296

$

783,084

Notes, loans and finance leases payable,

net

6,280,305

6,271,362

Operating lease liabilities

54,485

55,032

Policy benefits and losses, claims and

loss expenses payable

841,861

849,113

Liabilities from investment contracts

2,406,464

2,411,352

Other policyholders' funds and

liabilities

5,832

18,070

Deferred income

62,587

51,175

Deferred income taxes, net

1,470,156

1,447,125

Total liabilities

11,954,986

11,886,313

Common stock

10,497

10,497

Non-voting common stock

176

176

Additional paid-in capital

462,548

462,548

Accumulated other comprehensive loss

(231,813

)

(223,216

)

Retained earnings

7,786,683

7,600,090

Cost of common stock in treasury, net

(525,653

)

(525,653

)

Cost of preferred stock in treasury,

net

(151,997

)

(151,997

)

Total stockholders' equity

7,350,441

7,172,445

Total liabilities and stockholders'

equity

$

19,305,427

$

19,058,758

U-HAUL HOLDING COMPANY AND

CONSOLIDATED SUBSIDIARIES

CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS

Quarter Ended June 30,

2024

2023

(Unaudited)

(In thousands, except share and

per share data)

Revenues:

Self-moving equipment rental revenues

$

1,014,332

$

999,206

Self-storage revenues

215,737

198,961

Self-moving and self-storage products and

service sales

96,591

100,872

Property management fees

9,495

9,177

Life insurance premiums

20,740

23,131

Property and casualty insurance

premiums

21,229

20,322

Net investment and interest income

37,125

64,592

Other revenue

133,241

124,047

Total revenues

1,548,490

1,540,308

Costs and expenses:

Operating expenses

789,757

763,241

Commission expenses

112,571

106,927

Cost of sales

66,014

70,675

Benefits and losses

44,006

45,344

Amortization of deferred policy

acquisition costs

4,646

8,045

Lease expense

5,605

7,583

Depreciation, net of gains on

disposals

216,545

137,814

Net losses on disposal of real estate

3,104

1,021

Total costs and expenses

1,242,248

1,140,650

Earnings from operations

306,242

399,658

Other components of net periodic benefit

costs

(372

)

(365

)

Other interest income

18,235

-

Interest expense

(67,218

)

(60,598

)

Fees on early extinguishment of debt and

costs of defeasance

(495

)

-

Pretax earnings

256,392

338,695

Income tax expense

(60,975

)

(81,857

)

Earnings available to common

stockholders

$

195,417

$

256,838

Basic and diluted earnings per share of

Common Stock

$

0.95

$

1.27

Weighted average shares outstanding of

Common Stock: Basic and diluted

19,607,788

19,607,788

Basic and diluted earnings per share of

Non-Voting Common Stock

$

1.00

$

1.31

Weighted average shares outstanding of

Non-Voting Common Stock: Basic and diluted

176,470,092

176,470,092

EARNINGS PER SHARE

We calculate earnings per share using the two-class method in

accordance with Accounting Standards Codification Topic 260,

Earnings Per Share. The two-class method allocates the

undistributed earnings available to common stockholders to the

Company’s outstanding common stock, $0.25 par value (the “Voting

Common Stock”) and the Series N Non-Voting Common Stock, $0.001 par

value (the “Non-Voting Common Stock”) based on each share’s

percentage of total weighted average shares outstanding. The Voting

Common Stock and Non-Voting Common Stock are allocated 10% and 90%,

respectively, of our undistributed earnings available to common

stockholders. This represents earnings available to common

stockholders less the dividends declared for both the Voting Common

Stock and Non-Voting Common Stock.

Our undistributed earnings per share is calculated by taking the

undistributed earnings available to common stockholders and

dividing this number by the weighted average shares outstanding for

the respective stock. If there was a dividend declared for that

period, the dividend per share is added to the undistributed

earnings per share to calculate the basic and diluted earnings per

share. The process is used for both Voting Common Stock and

Non-Voting Common Stock.

The calculation of basic and diluted earnings per share for the

quarters ended June 30, 2024 and 2023 for our Voting Common Stock

and Non-Voting Common Stock were as follows:

For the Quarter Ended

June 30,

2024

2023

(Unaudited)

(In thousands, except share and

per share amounts)

Weighted average shares outstanding of

Voting Common Stock

19,607,788

19,607,788

Total weighted average shares outstanding

for Voting Common Stock and Non-Voting Common Stock

196,077,880

196,077,880

Percent of weighted average shares

outstanding of Voting Common Stock

10%

10%

Net earnings available to common

stockholders

$

195,417

$

256,838

Voting Common Stock dividends declared

–

–

Non-Voting Common Stock dividends

declared

(8,824

)

(7,059

)

Undistributed earnings available to common

stockholders

$

186,593

$

249,779

Undistributed earnings available to common

stockholders allocated to Voting Common Stock

$

18,659

$

24,978

Undistributed earnings per share of Voting

Common Stock

$

0.95

$

1.27

Dividends declared per share of Voting

Common Stock

$

–

$

–

Basic and diluted earnings per share of

Voting Common Stock

$

0.95

$

1.27

Weighted average shares outstanding of

Non-Voting Common Stock

176,470,092

176,470,092

Total weighted average shares outstanding

for Voting Common Stock and Non-Voting Common Stock

196,077,880

196,077,880

Percent of weighted average shares

outstanding of Non-Voting Common Stock

90%

90%

Net earnings available to common

stockholders

$

195,417

$

256,838

Voting Common Stock dividends declared

–

–

Non-Voting Common Stock dividends

declared

(8,824

)

(7,059

)

Undistributed earnings available to common

stockholders

$

186,593

$

249,779

Undistributed earnings available to common

stockholders allocated to Non-Voting Common Stock

$

167,934

$

224,801

Undistributed earnings per share of

Non-Voting Common Stock

$

0.95

$

1.27

Dividends declared per share of Non-Voting

Common Stock

$

0.05

$

0.04

Basic and diluted earnings per share of

Non-Voting Common Stock

$

1.00

$

1.31

NON-GAAP FINANCIAL RECONCILIATION

SCHEDULE

As of April 1, 2019, we adopted the new accounting standard for

leases. Part of this adoption resulted in approximately $1 billion

of property, plant and equipment, net (“PPE”) being reclassed to

Right of use assets - financing, net (“ROU-financing”). The tables

below show adjusted PPE as of June 30, 2024 and March 31, 2024, by

including the ROU-financing. The assets included in ROU-financing

are not a true book value as some of the assets are recorded at

between 70% and 100% of value based on the lease agreement. This

non-GAAP measure is intended as a supplemental measure of our

balance sheet that is neither required by, nor presented in

accordance with, GAAP. We believe that the use of this non-GAAP

measure provides an additional tool for investors to use in

evaluating our financial condition. This non-GAAP measure should

not be considered in isolation or as a substitute for other

measures calculated in accordance with GAAP.

June 30,

March 31,

2024

2024

June 30,

ROU Assets

Property, Plant and

Equipment

Property, Plant and

Equipment

2024

Financing

Adjusted

Adjusted

(Unaudited)

(In thousands)

Property, plant and equipment, at cost

Land

$

1,727,668

$

-

$

1,727,668

$

1,670,033

Buildings and improvements

8,591,016

-

8,591,016

8,237,354

Furniture and equipment

1,014,086

61

1,014,147

1,003,831

Rental trailers and other rental

equipment

960,853

104,092

1,064,945

1,050,910

Rental trucks

6,670,443

585,415

7,255,858

6,945,845

Subtotal

18,964,066

689,568

19,653,634

18,907,973

Less: Accumulated depreciation

(5,209,526

)

(423,824

)

(5,633,350

)

(5,484,016

)

Total property, plant and equipment,

net

$

13,754,540

$

265,744

$

14,020,284

$

13,423,957

March 31,

2024

March 31,

ROU Assets

Property, Plant and

Equipment

2024

Financing

Adjusted

(In thousands)

Property, plant and equipment, at cost

Land

$

1,670,033

$

-

$

1,670,033

Buildings and improvements

8,237,354

-

8,237,354

Furniture and equipment

1,003,770

61

1,003,831

Rental trailers and other rental

equipment

936,303

114,607

1,050,910

Rental trucks

6,338,324

607,521

6,945,845

Subtotal

18,185,784

722,189

18,907,973

Less: Accumulated depreciation

(5,051,132

)

(432,884

)

(5,484,016

)

Total property, plant and equipment,

net

$

13,134,652

$

289,305

$

13,423,957

Non-GAAP Financial Measures

Below is a reconciliation of Moving and Storage non-GAAP

financial measures as defined under SEC rules, such as earnings

before interest, taxes, depreciation, and amortization ("EBITDA").

The Company believes that these widely accepted measures of

operating profitability improve the transparency of the Company's

disclosures and provide a meaningful presentation of the Company's

results from its core business operations excluding the impact of

items not related to the Company's ongoing core business operations

and improve the period-to-period comparability of the Company's

results from its core business operations. These non-GAAP financial

measures are not substitutes for GAAP financial results and should

only be considered in conjunction with the Company's financial

information that is presented in accordance with GAAP. The earnings

from operations for December 31, 2023, September 30, 2023 and June

30, 2023 have been adjusted from previously presented earnings

releases as Moving and Storage interest income has been classified

as Other interest income.

Moving and Storage EBITDA

(In thousands, unaudited)

TTM

June 30,

March 31,

December 31,

September 30,

June 30,

2024

2024

2023

2023

2023

Earnings from operations *

$

831,802

$

896,140

$

980,169

$

1,132,142

$

1,273,901

Depreciation

848,727

817,889

793,940

768,475

749,210

Net gains on disposals

(106,065

)

(153,958

)

(186,541

)

(220,858

)

(238,397

)

Net losses on disposal of real estate

9,997

7,914

5,878

4,153

4,310

Depreciation, net of (gains) losses on

disposals

752,659

671,845

613,277

551,770

515,123

EBITDA

$

1,584,461

$

1,567,985

$

1,593,446

$

1,683,912

$

1,789,024

* before insurance subsidiaries

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240807454436/en/

Sebastien Reyes Director of Investor Relations

U-Haul Holding Company (602) 263-6601

Sebastien_Reyes@uhaul.com

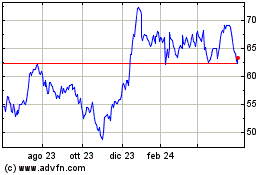

Grafico Azioni U Haul (NYSE:UHAL)

Storico

Da Nov 2024 a Dic 2024

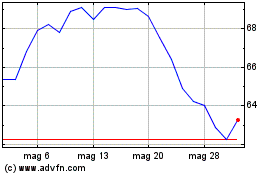

Grafico Azioni U Haul (NYSE:UHAL)

Storico

Da Dic 2023 a Dic 2024