Survey: Nearly 1 in 4 of All Parents and Half of Gen X Parents Worry Their Kids Will Be Financially Dependent on Them in Adulthood

26 Settembre 2024 - 2:00PM

Business Wire

Although parents are reluctant to discuss their

own finances, they are having more in-depth financial conversations

with their children than their parents did with them

Parents today are talking with their children about topics like

investing in stocks and bonds and choosing career paths that align

with their child’s financial goals – discussions many didn’t have

with their own parents growing up, a new survey from U.S. Bank

found. In addition, nearly 1 in 4 of all parents and more than half

of Gen X parents worry their children will be financially dependent

on them well into adulthood.

The survey also found that the majority of Americans would

rather discuss who they are voting for in the upcoming presidential

election than their personal finances, and that many people might

not be truthful with their partner about money – driven by feelings

of shame and embarrassment.

“For many people, discussing money is extremely uncomfortable;

this is especially true with families,” said Scott Ford, president

of Wealth Management at U.S. Bank. “We did this survey to really

dig in and see how people from different generations felt about a

wide variety of sensitive financial topics – asking family members

for money, talking about debt, savings and inheritance – so we can

better help them solve for these challenging conversations. While

the survey revealed that many families and couples are talking

about financial concepts around the dinner table, many do not feel

comfortable talking about their own financial situations – possibly

because they are worried about being judged or feeling

embarrassed.”

Beth Lawlor, president of Private and Affluent Wealth Management

at U.S. Bank, said, “Our hope is that these survey findings spark a

dialogue on the importance of families discussing challenging

financial topics, ultimately empowering more families to engage in

the tough conversations that are critical to building wealth.”

Additional key findings from the survey:

Americans would rather discuss who they’re voting for in the

2024 presidential election than their finances.

- Parents would rather talk to their kids about their choice of

candidate (76%), than their finances (63%).

- Dads (67%; vs. 58% of moms) and millennial (63%) and Boomer

(62%) parents felt the most uncomfortable discussing their

finances.

- When talking to their parents, Americans feel more comfortable

discussing their choice for president (68%) than their personal

finances (55%) with their parents.

- Gen Zers (58%), millennials (55%) and Gen Xers (49%) felt the

most uncomfortable discussing their finances with their

parents.

Today’s parents are having more in-depth financial

conversations with their children than their parents did with

them.

- Today’s parents are almost twice as likely to regularly discuss

financial topics such as investing in stocks and bonds (44%) with

their kids than their parents were with them (24%).

- Despite these conversations happening more frequently, mothers

were less likely to discuss investing in stocks and bonds

with their kids than fathers. (35% women vs. 51% men).

- Today’s parents are also more likely to say they’ve had

conversations with their children about how to choose a career path

that aligns with their child’s financial goals – a discussion they

may not have had growing up. (65% of parents discussed this concept

with their children when they were growing up, while only 41% of

Americans recall discussing this concept with their parents when

they were growing up.)

Although parents are more regularly discussing financial

concepts with their kids, kids aren’t necessarily looking to their

parents for financial advice.

- Less than half of Americans (44%) ask a parent for money

advice.

- However, women are more likely (49%) than men (35%) to seek

advice from their parents about money.

- While many parents acknowledge that their children don’t manage

their money in ways they agree with (43%), they are very confident

in their children’s financial fortitude, with more than

three-quarters (79%) of parents saying their children are able to

successfully manage their finances.

- Additionally, 54% of Americans feel their children will be able

to take care of them financially if needed. More women (57%) than

men (51%) felt this way.

- Despite this confidence, nearly 4 in 10 (37%) parents of all

generations worry their children will require financial assistance

well into adulthood.

- More than half of Gen X parents (53%) worry their children will

be financially dependent on them well into adulthood.

- It’s not just parents who worry, however. 45% of millennials

and 39% of Gen Xers worry they’ll be responsible for taking care of

their parents/in-laws financially.

Americans often don't see eye to eye with their partner on

handling their finances and might not be truthful about money –

propelled by feelings of shame and embarrassment.

- More than a third of Americans do not agree with their partner

on how to best manage their money, both now (39%) and in retirement

(34%). A little less than a third (31%) also say they are unaware

of their partner’s finances and that they have different opinions

on what to do with their money after they’re both gone (29%).

- Almost two-thirds (60%) of Americans think they make better

financial decisions than their partner.

- A third of Americans say they have lied to their partner about

money (30%).

- The driving force behind the deceit may be embarrassment – a

third (36%) of unmarried Americans say they’d be embarrassed to be

fully transparent about their finances with the person they’re

dating.

- This is especially true among younger Americans (Gen Z &

millennials) as 4 in 10 (41%) report the same feelings of

embarrassment in being fully transparent about their finances with

the person they're dating (vs. 31% Gen X, Boomers and

Silent+).

Americans are often unaware of their family's financial

status, but many suspect they will need to provide help to parents

or in-laws in the future.

- Almost half of Americans (45%) have no idea what their parents’

financial situation is.

- Americans still in contact with their parents are more likely

to know about their parents’ financial liabilities (60%) than their

savings (38%) and daughters are much less likely to know about

their parents’ savings (33%) than sons (46%)

- Although many Americans are uncertain about their parents’

financial situation, about half (48%) say they suspect they will

need to provide for their parents or in-laws in the future.

- While most Americans are willing to help their parents, those

in need may hesitate to ask for help themselves; 56% of Americans

say they are uncomfortable asking their family for financial help

and 58% say they are too ashamed to ask.

For most parents, talking to their kids about giving to

charity is important, and for some, making sure some of their

inheritance goes to a good cause is important.

- More than half (55%) of U.S. parents discussed giving money to

charity with their children while they were growing up.

- Slightly more women (58%) than men (52%) discussed this with

their children.

- More than half (55%) say creating generational wealth is a

priority.

Financial advisors are the new therapists. They’re getting

families to talk about money openly and honestly.

- Aside from providing practical investment (87% mass affluent)

or tax advice (77% mass affluent), financial advisors are helping

to bridge gaps in conversation among mass affluent families. Over

half (53%) of mass affluent Americans say their financial advisor

has helped their family work through uncomfortable conversations

about money.

- This is especially true for younger affluent Americans: 8 in 10

say their financial advisor has helped their family with

uncomfortable conversations about money (82% mass affluent and high

net worth Gen Z & millennials) nearly twice as many as their

older counterparts (45% mass affluent and high net worth Gen X,

Boomers and Silent+).

- In fact, financial advisors provide further comfort to mass

affluent and high net worth Gen Z and millennials as 8 in 10 (79%)

who have a financial advisor also report feeling positive emotions

(vs. 71% mass affluent and high net worth Gen X, Boomers and

Silent+ with a financial advisor).

Find a copy of the full report here.

Survey Methodology U.S. Bank fielded a 20-minute online

survey of 1,000 US General Population Individuals, 1,000 Mass

Affluent Individuals and 500 High Net-Worth Individuals. Mass

Affluent Individuals are defined as having at least $250,000 in

investable assets, not including retirement accounts or the value

of their primary home. High Net-Worth Individuals need at least $1M

not including retirement accounts or their primary home. The US

General Population sample is nationally representative, while Mass

Affluent and High Net-Worth samples are natural fallout. The margin

of error for this study is ±3% for the US General Population, ±3%

for Mass Affluent Individuals, and ±4% for High Net-Worth

Individuals.

About U.S. Bank U.S. Bancorp, with more than 70,000

employees and $680 billion in assets as of June 30, 2024, is the

parent company of U.S. Bank National Association. Headquartered in

Minneapolis, the company serves millions of customers locally,

nationally and globally through a diversified mix of businesses

including consumer banking, business banking, commercial banking,

institutional banking, payments and wealth management. U.S. Bancorp

has been recognized for its approach to digital innovation,

community partnerships and customer service, including being named

one of the 2024 World’s Most Ethical Companies and Fortune’s most

admired superregional bank. Learn more at usbank.com/about.

Investment products and services are: NOT A DEPOSIT • NOT

FDIC INSURED • MAY LOSE VALUE • NOT BANK GUARANTEED • NOT INSURED

BY ANY FEDERAL GOVERNMENT AGENCY U.S. Bank and its

representatives do not provide tax or legal advice. Each

individual's tax and financial situation is unique. Individuals

should consult their tax and/or legal advisor for advice and

information concerning their particular situation.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240926905969/en/

Kristin Kelly, U.S. Bank Public Affairs and Communications

303.585.4129 kristin.kelly@usbank.com

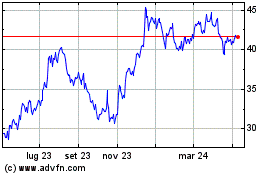

Grafico Azioni US Bancorp (NYSE:USB)

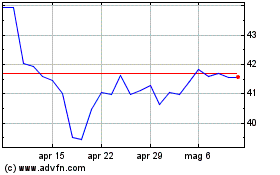

Storico

Da Feb 2025 a Mar 2025

Grafico Azioni US Bancorp (NYSE:USB)

Storico

Da Mar 2024 a Mar 2025