As filed with the Securities and Exchange Commission on December 21, 2015

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM S-8

REGISTRATION STATEMENT

UNDER

THE

SECURITIES ACT OF 1933

WPP plc

(Exact name of

registrant as specified in its charter)

|

|

|

| JERSEY |

|

NONE |

| (State or other jurisdiction of

incorporation or organization) |

|

(I.R.S. Employer

Identification No.) |

27 Farm Street

London W1J 5RJ

Telephone: 011-44-20-7408-2204

(Address of principal executive offices)

WPP PLC RESTRICTED STOCK PLAN

(Full title of the plan)

ANDREA HARRIS, ESQ.

GROUP CHIEF COUNSEL

27

Farm Street

London W1J 5RJ

(Name and address of agent for service)

011-44-20-7318-0030

(Telephone number, including area code, of agent for service)

Copy to:

CURT C. MYERS, ESQ.

DAVIS & GILBERT LLP

1740 BROADWAY

NEW YORK,

N.Y. 10019

(212) 468-4800

Indicate by check mark whether

the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting

company” in Rule 12b-2 of the Exchange Act. (Check one):

|

|

|

|

|

|

|

| Large accelerated filer |

|

x |

|

Accelerated filer |

|

¨ |

|

|

|

|

| Non-accelerated filer |

|

¨ (Do not check if a smaller reporting company) |

|

Smaller reporting company |

|

¨ |

CALCULATION OF REGISTRATION FEE

|

|

|

|

|

|

|

|

|

| |

| Title of securities to be registered |

|

Amount to be

registered (1) |

|

Proposed

maximum offering

price per share |

|

Proposed

maximum aggregate

offering price |

|

Amount of

registration fee |

| Ordinary Shares, nominal value 10p each, (2) issuable under, or issuable to the

Registrant’s Depositary to support American Depositary Shares issuable under: |

|

|

|

|

|

|

|

|

| WPP PLC Restricted Stock Plan |

|

20,000,000 |

|

$22.393(3) |

|

$447,860,000.00 |

|

$45,099.50 |

| |

|

|

|

|

|

|

|

|

| TOTAL |

|

20,000,000 |

|

|

|

|

|

$45,099.50 |

| |

| |

| (1) |

Includes an indeterminate amount of additional Ordinary Shares that may be necessary to adjust the number of Ordinary Shares subject to issuance pursuant to the Plans set forth above, as a result of any future stock

split, stock dividend or similar transaction with respect to Ordinary Shares. |

| (2) |

American Depositary Shares of the Registrant (“ADS”), some of which may be evidenced by American Depositary Receipts issuable upon deposit of Ordinary Shares, nominal value 10p each, of the Registrant

(“Ordinary Shares”), have been registered under a separate registration statement on Form F-6 (File No. 333-185755). Each ADS represents five Ordinary Shares. |

| (3) |

Estimated solely for purposes of calculating the registration fee. Such estimate has been calculated pursuant to Rule 457(c) based on 20% of the average of the high and low prices of the ADSs as reported on NASDAQ on

December 14, 2015. |

In accordance with the provisions of Rule 462 under the Securities Act, this registration statement will become

effective upon filing with the Securities and Exchange Commission.

EXPLANATORY NOTE

References to the “Company” and the “Registrant” mean WPP plc, a public limited company incorporated under the Companies (Jersey) Law 1991

(as amended).

This Registration Statement registers an additional 20,000,000 Ordinary Shares, nominal value 10p each, for which registration statements

filed on this form relating to the same employee benefit plan are effective. Consequently, pursuant to General Instruction E of Form S-8, the contents of the Registration Statement on Form S-8 filed by WPP Group plc (Registration Nos. 333-129640 and

333-152662) and the contents of the Registration Statements on Form S-8 filed by WPP plc (Registration No. 333-185890), are incorporated by reference into this Registration Statement. Any statement contained in a document incorporated or deemed

to be incorporated herein by reference shall be deemed to be modified or superseded for purposes of this Registration Statement to the extent that a statement contained herein or in any other subsequently filed document that also is or is deemed to

be incorporated by reference herein modifies or supersedes such statement.

2

PART I

INFORMATION REQUIRED IN THE SECTION 10(a) PROSPECTUS

The document(s) containing the information specified in Part I of Form

S-8 will be sent or given to participants in the WPP plc Restricted Stock Plan (the “Plan”) as specified by Rule 428(b)(1) under the Securities Act. In accordance with the rules and regulations of the Commission, such documents are not

required to be filed with the Commission as part of this Registration Statement. These documents and the documents incorporated by reference in this Registration Statement pursuant to Item 3 of Part II of this Registration Statement, taken

together, constitute a prospectus that meets the requirements of Section 10(a) of the Securities Act.

| ITEM 2. |

REGISTRANT INFORMATION AND EMPLOYEE PLAN ANNUAL INFORMATION |

Upon written or oral

request, any of the documents incorporated by reference in Item 3 of Part II of the Registration Statement (which documents are incorporated by reference in the Section 10(a) prospectus), other documents required to be delivered to

eligible employees pursuant to Rule 428(a) or additional information about the Plans is available without charge by contacting:

Andrea Harris, Esq.

Group Chief Counsel

27 Farm Street

London W1J 5RJ

011-44-20-7318-0030

3

PART II

INFORMATION REQUIRED IN THE REGISTRATION STATEMENT

| ITEM 3. |

INCORPORATION OF DOCUMENTS BY REFERENCE |

The following documents previously filed with

the Commission by the Registrant are incorporated by reference in the Registration Statement:

| |

(a) |

Annual Report on Form 20-F for the year ended December 31, 2014. |

| |

(b) |

Report on Form 6-K filed on August 28, 2015, which includes the Unaudited Condensed Consolidated Interim Financial Statements of WPP plc for the six months ended June 30, 2015. |

| |

(c) |

Report on Form 6-K filed on January 2, 2013 which includes a description of the Registrant’s share capital and American Depositary Shares, representing the Registrant’s ordinary shares. |

All documents filed by the Registrant pursuant to Sections 13(a), 13(c), 14 and 15(d) of the Exchange Act prior to the filing of a

post-effective amendment to the Registration Statement that indicates that all securities offered hereby have been sold or that deregisters all securities remaining unsold, shall be deemed to be incorporated by reference in the Registration

Statement and to be a part hereof from the date of filing of such documents. Any statement contained in a document incorporated or deemed to be incorporated by reference herein shall be deemed to be modified or superseded for purposes of the

Registration Statement to the extent that a statement contained herein or in any other subsequently filed document that also is deemed to be incorporated by reference herein modifies or supersedes such statement. Any such statement so modified or

superseded shall not be deemed, except as so modified or superseded, to constitute a part of the Registration Statement.

| ITEM 4. |

DESCRIPTION OF SECURITIES |

Not applicable.

| ITEM 5. |

INTERESTS OF NAMED EXPERTS AND COUNSEL |

Not applicable.

| ITEM 6. |

INDEMNIFICATION OF DIRECTORS AND OFFICERS |

Article 146 of WPP plc’s Articles of

Association provides:

“As far as the legislation allows, the Company may:

| |

(a) |

indemnify any director of the Company (or of an associated body corporate) against any liability; |

| |

(b) |

indemnify a director of a company that is a trustee of an occupational pension scheme for employees (or former employees) of the Company (or of an associated body corporate) against liability incurred in connection with

the company’s activities as trustee of the scheme; |

| |

(c) |

purchase and maintain insurance against any liability for any director referred to in (a) or (b) above; and |

| |

(d) |

provide any director referred to in (a) or (b) above with funds (whether by loan or otherwise) to meet expenditure incurred or to be incurred by him in defending any criminal, regulatory or civil proceedings

or in connection with an application for relief (or to enable any such director to avoid incurring such expenditure). |

II-1

The powers given by this article shall not limit any general powers of the Company to grant indemnities, purchase

and maintain insurance or provide funds (whether by way of loan or otherwise) to any person in connection with any legal or regulatory proceedings or applications for relief.”

Article 77 of the Companies (Jersey) Law 1991 (as amended) provides:

| |

“(1) |

Subject to paragraphs (2) and (3), any provision, whether contained in the articles of, or in a contract with, a company or otherwise, whereby the company or any of its subsidiaries or any other person, for some

benefit conferred or detriment suffered directly or indirectly by the company, agrees to exempt any person from, or indemnify any person against, any liability which by law would otherwise attach to the person by reason of the fact that the person

is or was an officer of the company shall be void. |

| |

(2) |

Paragraph (1) does not apply to a provision for exempting a person from or indemnifying the person against – |

| |

(a) |

any liabilities incurred in defending any proceedings (whether civil or criminal) – |

| |

(i) |

in which judgment is given in the person’s favor or the person is acquitted, |

| |

(ii) |

which are discontinued otherwise than for some benefit conferred by the person or on the person’s behalf or some detriment suffered by the person, or |

| |

(iii) |

which are settled on terms which include such benefit or detriment and, in the opinion of a majority of the directors of the company (excluding any director who conferred such benefit or on whose behalf such benefit was

conferred or who suffered such detriment), the person was substantially successful on the merits in the person’s resistance to the proceedings; |

| |

(b) |

any liability incurred otherwise than to the company if the person acted in good faith with a view to the best interests of the company; |

| |

(c) |

any liability incurred in connection with an application made under Article 212 in which relief is granted to the person by the court; or |

| |

(d) |

any liability against which the company normally maintains insurance for persons other than directors. |

| |

(3) |

Nothing in this Article shall deprive a person of any exemption or indemnity to which the person was lawfully entitled in respect of anything done or omitted by the person before the coming into force of this Article.

|

| |

(4) |

This Article does not prevent a company from purchasing and maintaining for any such officer insurance against any such liability.” |

WPP plc maintains an insurance policy for its directors and officers in respect of liabilities arising from any act, error or omission while acting in their

capacities as directors or officers of WPP plc or any associated company.

| ITEM 7. |

EXEMPTION FROM REGISTRATION CLAIMED |

Not applicable.

II-2

|

|

|

| Exhibit No. |

|

Description |

|

|

| 4.1 |

|

Memorandum and Articles of Association of WPP plc (incorporated herein by reference to Exhibit 1 of the Registrant’s Report on Form 6-K filed with the Commission on January 2, 2013 (File No. 000-16350)). |

|

|

| 4.2 |

|

Deposit Agreement, dated as of January 2, 2013, among WPP plc, Citibank, N.A., as Depositary, and all holders and beneficial owners from time to time of American Depositary Receipts issued thereunder (incorporated herein by

reference to Exhibit 99.(A) of the Registrant’s Registration Statement on Form F-6 filed with the Commission on December 31, 2012 (File No. 333-185755)). |

|

|

| 4.3 |

|

Form of American Depositary Receipt (incorporated herein by reference to Exhibit 99.(A) of the Registrant’s Registration Statement on Form F-6 filed with the Commission on December 31, 2012 (File No.

333-185755)). |

|

|

| 5.1 |

|

Opinion of Mourant Ozannes regarding the validity of the securities to be registered.* |

|

|

| 23.1 |

|

Consent of Deloitte LLP.* |

|

|

| 23.2 |

|

Consent of Mourant Ozannes (included in the opinion filed as Exhibit 5.1). |

|

|

| 24 |

|

Powers of Attorney (included on signature page).* |

| |

(a) |

The undersigned registrant hereby undertakes: |

(1) To file, during any period

in which offers or sales are being made, a post-effective amendment to the Registration Statement;

(i) To include any

prospectus required by Section 10(a)(3) of the Securities Act of 1933;

(ii) To reflect in the prospectus any facts or

events arising after the effective date of the Registration Statement (or the most recent post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth in the Registration

Statement. Notwithstanding the foregoing, any increase or decrease in the volume of securities offered (if the total dollar value of securities offered would not exceed that which was registered) and any deviation from the low or high end of the

estimated maximum offering range may be reflected in the form of prospectus filed with the Commission pursuant to Rule 424(b) if, in the aggregate, the changes in volume and price represent no more than a 20 percent change in the maximum aggregate

offering price set forth in the “Calculation of Registration Fee” table in the effective registration statement;

(iii) To include any material information with respect to the plan of distribution not previously disclosed in the Registration

Statement or any material change to such information in the Registration Statement;

provided, however, that paragraphs (a)(1)(i) and (a)(1)(ii) do not

apply if the information required to be included in a post-effective amendment by those paragraphs is contained in periodic reports filed with or furnished to the Commission by the registrant pursuant to Section 13 or Section 15(d) of the

Securities Exchange Act of 1934 that are incorporated by reference in this Registration Statement.

(2) That, for the

purpose of determining any liability under the Securities Act of 1933, each such post-effective amendment shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time

shall be deemed to be the initial bona fide offering thereof.

II-3

(3) To remove from registration by means of a post-effective amendment any of the

securities being registered which remain unsold at the termination of the offering.

(b) The undersigned registrant hereby undertakes

that, for purposes of determining any liability under the Securities Act, each filing of the registrant’s annual report pursuant to Section 13(a) or Section 15(d) of the Exchange Act (and, where applicable, each filing of an employee

benefit plan’s annual report pursuant to section 15(d) of the Exchange Act) that is incorporated by reference in the Registration Statement shall be deemed to be a new registration statement relating to the securities offered therein, and the

offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

(h) Insofar as indemnification for

liabilities arising under the Securities Act of 1933 may be permitted to directors, officers and controlling persons of the registrant, pursuant to the provisions described in Item 6 above, or otherwise, the registrant has been advised that in

the opinion of the Commission, such indemnification is against public policy as expressed in the Securities Act and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment by the

registrant of expenses incurred or paid by a director, officer or controlling person of the registrant in the successful defense of any action, suit or proceeding) is asserted by such director, officer or controlling person in connection with the

securities being registered, the registrant will, unless in the opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question of whether or not such indemnification is against

public policy as expressed in the Securities Act and will be governed by the final adjudication of such issue.

II-4

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933, the Registrant certifies that it has reasonable grounds to believe that it meets all of the

requirements for filing on Form S-8 and has duly caused this Registration Statement on Form S-8 to be signed on its behalf by the undersigned, thereunto duly authorized, in the City of New York, State of New York on December 21, 2015.

|

| WPP plc |

|

| /s/ Paul W.G. Richardson |

| By: Paul W.G. Richardson |

| Title: Finance Director |

POWER OF ATTORNEY

Pursuant to the requirements of the Securities Act of 1933, this Registration Statement on Form S-8 has been signed by the following persons

in the capacities and on the dates indicated in respect of WPP plc. In addition, each of the undersigned hereby severally and individually constitutes and appoints Sir Martin Sorrell and Paul W. G. Richardson his or her true and lawful

attorneys-in-fact, each with power of substitution, in his name, place and stead, in any and all capacities, to sign any and all amendments (including post-effective amendments) to the Registration Statement on Form S-8, and to file the same, with

all exhibits thereto, and other documents in connection therewith, with the Securities and Exchange Commission, to do any and all acts and things and to execute any and all instruments that said attorneys-in-fact and agents may deem necessary or

advisable to enable WPP plc to comply with the Securities Act of 1933, as amended, and any rules, regulations and requirements of the Securities and Exchange Commission in respect thereof, in connection with the registration under said Act of

securities registered pursuant hereto, granting unto each said attorneys-in-fact and agents full power and authority to do and perform each and every act and thing requisite and necessary to be done in and about the premises, as fully to all intents

and purposes as he/she might or could do in person, hereby ratifying and confirming all that said attorneys-in-fact and agents, or any of their or his substitute or substitutes, may lawfully do or cause to be done by virtue thereof.

II-5

|

|

|

|

|

| Signature |

|

Title |

|

Date |

|

|

|

| /s/ Roberto Quarta

Roberto Quarta |

|

Chairman (non-executive) of the Board of Directors |

|

December 21, 2015 |

|

|

|

| /s/ Sir Martin Sorrell

Sir Martin Sorrell |

|

Chief Executive Officer

(Principal Executive Officer and Director) |

|

December 21, 2015 |

|

|

|

| /s/ Paul W. G. Richardson

Paul W. G. Richardson |

|

Finance Director

(Principal Financial Officer and Director) and

Authorized Representative in the United States |

|

December 21, 2015 |

|

|

|

| /s/ Roger Agnelli

Roger Agnelli |

|

Non-Executive Director |

|

December 21, 2015 |

|

|

|

| /s/ Jacques Aigrain

Jacques Aigrain |

|

Non-Executive Director |

|

December 21, 2015 |

|

|

|

| /s/ Charlene Begley

Charlene Begley |

|

Non-Executive Director |

|

December 21, 2015 |

|

|

|

| /s/ Sir John Hood

Sir John Hood |

|

Non-Executive Director |

|

December 21, 2015 |

|

|

|

|

Ruigang Li |

|

Non-Executive Director |

|

|

|

|

|

| /s/ Daniela Riccardi

Daniela Riccardi |

|

Non-Executive Director |

|

December 21, 2015 |

|

|

|

| /s/ Nicole Seligman

Nicole Seligman |

|

Non-Executive Director |

|

December 21, 2015 |

|

|

|

|

Hugo Shong |

|

Non-Executive Director |

|

|

|

|

|

| /s/ Timothy Shriver

Timothy Shriver |

|

Non-Executive Director |

|

December 21, 2015 |

|

|

|

| /s/ Sally Susman

Sally Susman |

|

Non-Executive Director |

|

December 21, 2015 |

|

|

|

| /s/ Sol Trujillo

Sol Trujillo |

|

Non-Executive Director |

|

December 21, 2015 |

II-6

EXHIBIT INDEX

|

|

|

| Exhibit No. |

|

Description |

|

|

| 5.1 |

|

Opinion of Mourant Ozannes regarding validity of securities being registered. |

|

|

| 23.1 |

|

Consent of Deloitte LLP. |

|

|

| 23.2 |

|

Consent of Mourant Ozannes (included in the opinion filed as Exhibit 5.1). |

|

|

| 24 |

|

Powers of Attorney (included on signature page). |

II-7

EXHIBIT 5.1

|

|

|

| MOURANT OZANNES |

|

22 Grenville Street St Helier

Jersey JE4 8PX Channel Islands

T +44 1534 676 000

F +44 1534 676 333

mourantozannes.com |

The Directors

WPP plc

27 Farm Street

London W1J 5RJ

17 December 2015

Our ref: 2043443/65764766/3

Dear Sirs

WPP plc (the Company)

WPP plc Restricted Stock Plan (the Plan)

We have acted as Jersey legal advisers to the Company in connection with the registration statement on Form S-8 to be filed on or about 21 December 2015

(the Form S-8) relating to the Plan.

Under the Plan, the Company has granted, and may from time to time grant, awards relating to Plan Shares (as

defined below) to employees of the Company or one of its subsidiaries (each, an award holder).

| 1. |

Documents examined and related matters |

| |

(a) |

For the purposes of this opinion we have examined and relied upon copies of the following documents: |

| |

(i) |

a draft of the Form S-8 in the form in which it is to be filed with the US Securities and Exchange Commission; and |

| |

(ii) |

the Company’s memorandum and articles of association. |

| |

(b) |

For the purposes of this opinion, we have, with the Company’s consent, relied upon certificates or other written confirmations of officers or employees of the Company or its subsidiaries as to matters of fact,

without having independently verified such factual matters. |

| |

(c) |

For the purposes of this opinion, we have not: |

| |

(i) |

examined any other document relating to the Plan or the Plan Shares (including, without limitation, any document incorporated by reference in, or otherwise referred to in, the Form

S-8); and |

| |

(ii) |

undertaken any exercise that is not described in this opinion and, in particular, we have not conducted any searches or enquiries in relation to the Company at any public office or registry in Jersey. |

| |

(i) |

non-assessable means, in relation to any Plan Shares, that no further sum shall be payable by a holder of those Plan Shares in respect of the purchase price of those Plan Shares pursuant to an award made under

the Plan; and |

Mourant Ozannes is a Jersey partnership

A list of the partners is available at mourantozannes.com

Page

2

| |

(ii) |

Plan Shares means ordinary shares of 10 pence each in the capital of the Company which are to be issued or transferred to an award holder (or to the Company’s depositary on behalf of the award holder)

pursuant to, or in connection with, an award made or to be made under the Plan. |

| |

(e) |

In this opinion, headings are for convenience only and do not affect its interpretation. |

In giving this opinion, we have assumed:

| |

(a) |

that the rules of the Plan have been properly adopted by the Company and that the Plan has been, and will at all times be, operated in accordance with its rules; |

| |

(b) |

that the Company’s board of directors (or a duly authorised committee thereof): |

| |

(i) |

has authorised and granted all existing awards relating to Plan Shares; and |

| |

(ii) |

has resolved to satisfy all existing awards relating to Plan Shares, |

in a manner consistent

with the board’s or committee’s (as the case may be) fiduciary duties and in accordance with the rules of the Plan and the Company’s articles of association;

| |

(c) |

that the Company’s board of directors (or a duly authorised committee thereof): |

| |

(i) |

will duly authorise and grant all future awards relating to Plan Shares; and |

| |

(ii) |

will resolve to satisfy all future awards relating to Plan Shares, |

in a manner consistent

with the board’s or committee’s (as the case may be) fiduciary duties and in accordance with the rules of the Plan and the Company’s articles of association;

| |

(d) |

that all Plan Shares currently in issue which may be transferred to an award holder (or to the Company’s depositary on behalf of the award holder) under the Plan in settlement of an award have been validly issued

and are credited as fully paid; |

| |

(e) |

that a meeting of the Company’s board of directors (or a duly authorised committee thereof) has been, or will be, duly convened and held at which it was, or will be, resolved to allot and issue, or (where

applicable) approve the transfer of, the Plan Shares to the relevant award holder (or to the Company’s depositary on behalf of the award holder); |

| |

(f) |

that the shareholders of the Company have conferred, or will confer, on the directors of the Company any authority to allot ordinary shares necessary under the Company’s articles of association for the directors to

allot and issue the Plan Shares; |

Page

3

| |

(g) |

that no allotment and issue of Plan Shares will result in a breach of any authority to allot ordinary shares conferred on the directors of the Company by the shareholders of the Company or in the authorised share

capital of the Company being exceeded; |

| |

(h) |

that all Plan Shares have been, or will be, duly allotted and issued and (where applicable) transferred, in accordance with the Company’s articles of association; |

| |

(i) |

the authenticity, accuracy, completeness and conformity to original documents of all documents and certificates examined by us; |

| |

(j) |

that all signatures purporting to be on behalf of (or to witness the execution on behalf of) the Company or any officer of the Company or of one of its subsidiaries are genuinely those of the persons whose signatures

they purport to be; |

| |

(k) |

that words and phrases used in the Form S-8 have the same meaning and effect as they would if the Form S-8 were governed by Jersey law; |

| |

(l) |

that there is no provision of any law (other than Jersey law) that would affect anything in this opinion; and |

| |

(m) |

that no event occurs after today’s date that would affect anything in this opinion. |

As a matter of Jersey law and based on, and subject to, the assumptions,

limitations and qualifications set out in this opinion, we are of the opinion that:

| |

(a) |

in relation to any Plan Shares to be allotted and issued to an award holder (or to the Company’s depositary on behalf of the award holder) under the Plan in settlement of the award holder’s award, upon the:

|

| |

(i) |

receipt in full by the Company of all amounts payable by the award holder under the Plan in respect of the award holder’s award; and |

| |

(ii) |

entry of the name of the award holder (or the Company’s depositary on behalf of the award holder) as the holder of those Plan Shares in the Company’s register of members, |

those Plan Shares will be validly issued, fully paid and non-assessable; and

| |

(b) |

in relation to any Plan Shares to be transferred to an award holder (or to the Company’s depositary on behalf of the award holder) under the Plan in settlement of the award holder’s award, upon the:

|

| |

(i) |

receipt in full by the Company of all amounts payable by the award holder under the Plan in respect of the award holder’s award; and |

| |

(ii) |

entry of the name of the award holder (or the Company’s depositary on behalf of the award holder) as the holder of those Plan Shares in the Company’s register of members, |

Page

4

the award holder (or the Company’s depositary on behalf of the award holder) will be the

legal owner of those Plan Shares and those Plan Shares will be non-assessable.

Our opinion is subject to any matter of fact not disclosed to us and to

the following qualifications:

| |

(a) |

under Jersey law and the Company’s articles of association, there are restrictions on the transfer of shares and exercise of voting rights in certain circumstances, including the following: |

| |

(i) |

transfers of shares may be avoided under the provisions of insolvency law, or where any criminal or illegal activity is involved, or where the transferor or transferee does not have the requisite legal capacity or

authority, or where the transferee is subject to restrictions or constraints; |

| |

(ii) |

under the Company’s articles of association, the registration of a transfer of shares by a particular shareholder may be restricted if that shareholder has failed to disclose his interest in shares in the Company

after having been served with notice by the Company requesting such disclosure; |

| |

(iii) |

under the Company’s articles of association (but subject to the Companies (Uncertificated Securities) (Jersey) Order 1999 where applicable) the board of directors of the Company may decline to register certain

transfers of shares; |

| |

(iv) |

after the declaration of the property of the Company en désastre or the commencement of the insolvent winding up of the Company, a transfer of shares in the Company is void without the sanction of the

Viscount or (as the case may be) the liquidator; |

| |

(v) |

a company or the Jersey court may impose restrictions on the transferability and other rights of shares held by persons who do not comply with the company’s proper enquiries, under the company’s articles of

association (if they so provide), concerning the ownership of shares; and |

| |

(vi) |

there may be circumstances in which a holder of shares is obliged to transfer those shares under the provisions of the Companies (Jersey) Law 1991, for example, following the implementation of a takeover when minority

shareholders are compulsorily bought out or following the implementation of a scheme of arrangement. Once a holder of shares becomes obliged to make such a transfer, the holder may not transfer those shares to another person; |

| |

(b) |

shareholders can make arrangements outside the Company’s constitutional documents in respect of restrictions on transfer or pre-emptive rights relating to shares, about which we express no opinion; and

|

| |

(c) |

the obligations of the Company under, or in respect of, the Plan Shares will be subject to any law from time to time in force relating to bankruptcy, insolvency, liquidation, reorganisation or administration or any

other law or legal procedure affecting generally the enforcement of creditors’ rights. |

Page

5

This opinion is limited to matters of, and is interpreted in accordance

with, Jersey law as at the date of this opinion. We express no opinion with respect to the laws of any other jurisdiction. We assume no obligation to update or supplement this opinion to reflect any facts or circumstances which may come to our

attention, or any changes in law which may occur, after the date of this opinion.

| |

(a) |

This opinion is only addressed to, and for the benefit of, the Company. It is given solely in connection with the issue and transfer of Plan Shares pursuant to the Plan. This opinion may not, without our prior written

consent, be transmitted or disclosed to, or used or relied upon by, any other person (including, without limitation, any award holder) or be relied upon for any other purpose whatsoever. |

| |

(b) |

We consent to the disclosure of this opinion as an exhibit to the Form S-8 and its filing with the US Securities and Exchange Commission. |

Yours faithfully

/s/ Mourant Ozannes

Mourant Ozannes

EXHIBIT 23.1

CONSENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

We consent to the incorporation by reference in this Registration Statement on Form S-8 of our reports dated April 30, 2015, relating to the consolidated

financial statements of WPP plc and subsidiaries (the “Company”) and the effectiveness of the Company’s internal control over financial reporting, appearing in the Annual Report on Form 20-F of WPP plc for the year ended

December 31, 2014.

/s/ Deloitte LLP

Deloitte LLP

London, United Kingdom

December 21, 2015

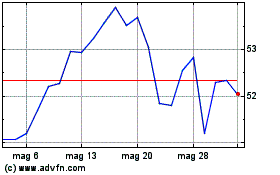

Grafico Azioni WPP (NYSE:WPP)

Storico

Da Lug 2024 a Ago 2024

Grafico Azioni WPP (NYSE:WPP)

Storico

Da Ago 2023 a Ago 2024