WPP Forecasts Flat Revenue, Sales; to Simplify Structure -- Earnings Review

01 Marzo 2018 - 1:00PM

Dow Jones News

By Adria Calatayud

WPP PLC (WPP.LN), the world's largest advertising company,

reported its results for 2017 on Thursday. Here's what you need to

know:

REVENUE: The London-based company generated revenue of 15.27

billion pounds ($21.13 billion), a rise of 6.1% from GBP14.39

billion in 2016. This beat a consensus forecast of GBP14.02

billion, based on estimates by 25 analysts polled by FactSet.

However, revenue grew only 1.6% at constant-currency terms and

declined 0.3% on a like-for-like basis--excluding foreign-exchange

swings and acquisitions. This was WPP's first like-for-like revenue

fall since 2009 and sent the company's shares down as much as 14%

in morning trade Thursday, its biggest one-day drop since May

1998.

NET PROFIT: The owner of creative and media agencies such as J.

Walter Thompson and Ogilvy & Mather made a net profit of

GBP1.82 billion for 2017, increasing 30% year-on-year and well

ahead of analysts expectations of GBP1.46 billion.

WHAT WE WATCHED

YEAR AHEAD: WPP forecasts flat like-for-like revenue and net

sales for 2018, as well as a stable headline operating margin

target, after a slow performance in the first weeks of the year.

January like-for-like revenue was flat and net sales fell 1.2%, the

company added. "Nobody was expecting these results to sparkle, but

WPP saying trading conditions have deteriorated to the extent it

doesn't think it'll deliver underlying growth next year has come as

a surprise," Hargreaves Lansdown analyst said.

SALES: The advertising giant posted a 0.9% like-for-like decline

in net sales--a closely watched metric for the company's underlying

performance--for 2017, against guidance that they should be

"broadly flat." In 2016, like-for-like net sales rose 3.1%. "2017

for us was not a pretty year, with flat like-for-like, top-line

growth, and operating margins and operating profits also flat, or

up marginally," WPP Chief Executive Martin Sorrell said.

CORPORATE SIMPLIFICATION: WPP said it intends to simplify its

structure, to better compete in a market increasingly disrupted by

Google and Facebook. Mr. Sorrell said these changes seek to improve

coordination and sharing of functions, systems and platforms across

the group, building a more unified WPP. "The company, essentially a

conglomerate of lots of individual advertising businesses, plans to

merge several of its agencies to create a simpler proposition for

clients and strip out costs," AJ Bell Investment Director Russ

Mould said.

Write to Adria Calatayud at

adria.calatayudvaello@dowjones.com

(END) Dow Jones Newswires

March 01, 2018 06:45 ET (11:45 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

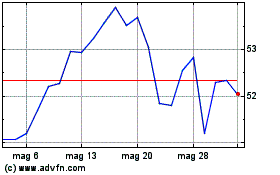

Grafico Azioni WPP (NYSE:WPP)

Storico

Da Lug 2024 a Ago 2024

Grafico Azioni WPP (NYSE:WPP)

Storico

Da Ago 2023 a Ago 2024