Innovating to Lead

WPP (NYSE: WPP) is today announcing the next phase of its

strategy to capture the opportunities offered by AI, maximise the

potential of creative transformation and deliver faster growth,

higher margins and improved cash generation.

Four strategic pillars support these goals:

1. Lead through AI, data and technology

- Capitalise on WPP’s lead in artificial intelligence built on:

the acquisition of Satalia in 2021; organic investment in AI,

client technology and data; and deep partnerships with Adobe,

Google, IBM, Microsoft, Nvidia and OpenAI

- Drive improved returns to clients through a set of AI-enabled

services and tools, delivered by WPP Open, our common technology

platform, and powered by proprietary AI models

- Fuel AI services with WPP’s proprietary data sets together with

client, platform and market-level data to improve marketing

performance for clients

- Ensure appropriate safeguards for client information, brand

safety, copyright and ethics

- Expand the reach of our AI services through WPP Open, with more

than 28,000 current users across WPP and adoption by key clients

including L’Oréal and Nestlé

2. Unlock the full potential of creative transformation to

drive growth

- Expand our client relationships by further leveraging WPP’s

global scale, integrated offer in creative, media, production and

PR, and capabilities in growth areas such as commerce, influencer

marketing and retail media to capture share in a growing

market

3. Build world-class, market-leading brands

- Lead the industry through six powerful agency networks – AKQA,

Ogilvy, VML, Hogarth, GroupM and Burson – which now represent close

to 90% of WPP’s revenue less pass-through costs

- Realise the opportunities from VML as the world’s largest

integrated creative agency and leverage GroupM’s simplified

operating model and scale as the world’s largest media agency

- Establish Burson as a leading global strategic communications

agency bringing together BCW and Hill & Knowlton

4. Execute efficiently to drive strong financial

returns

- Deliver growth and structural cost savings as a result of the

creation of VML and Burson and simplification of GroupM, unlocking

scale advantages and further efficiency savings. Structural savings

to deliver annualised net cost savings of c.£125m in 2025, with

40-50% of that saving expected to be achieved in 2024. Associated

restructuring cost of c.£125m in 2024

- Target c.£175m gross savings from efficiency opportunities

across both back office and commercial delivery which will be used

to invest in growth and support delivery of our medium-term margin

target

This strategy will be underpinned by a disciplined approach to

capital allocation with continued organic investment, a progressive

dividend policy and a disciplined approach to M&A supported by

a strong balance sheet and an investment grade credit rating.

Updated medium-term targets

- 3%+ LFL growth in revenue less pass-through costs

- 16-17% headline operating profit margin

- Adjusted operating cash flow conversion of 85%+1

Previous medium-term targets, outlined at WPP’s Capital Markets

Day in December 2020, were for 3-4% growth in revenue less

pass-through costs including an M&A benefit of 0.5-1.0%

annually; with a headline operating profit margin of

15.5-16.0%.

2023 expected out-turn and 2024 outlook

WPP will report 2023 results on February 22nd. We expect to

report results in line with our guidance ranges with:

- 2023 LFL revenue less pass-through costs expected to be 0.9%

consistent with guidance given at Q3 2023 of 0.5-1.0%

- 2023 headline operating profit margin expected to be 14.8%,

equivalent to 15.0% on a constant currency basis, which is at the

top end of guidance of 14.8-15.0% (excluding the impact of FX)

Looking ahead,

- 2024 LFL revenue less pass-through costs growth of 0-1%

- 2024 headline operating profit margin improvement of 20-40bps

(excluding the impact of FX)

- Our plans include annual cash investment of around £250m in

proprietary technology to support our AI and data strategy

Mark Read, CEO of WPP, said:

“The past three years have demonstrated the power of brands,

creativity and investment in marketing to drive growth for clients

and to build significant value. Research demonstrates that those

companies with the strongest brands deliver the highest returns to

shareholders.

“AI is transforming our industry and we see it as an opportunity

not a threat. We firmly believe that AI will enhance, not replace,

human creativity. We are already empowering our people with

AI-based tools to augment their skills, produce work more

efficiently and improve media performance, all of which will

increase the effectiveness of our work. We also see opportunities

to sell new AI-driven products and services to our clients and to

capture more growth in areas like production.

“Our long-standing investments in AI, including our AI-powered

platform, WPP Open, and our acquisition in 2021 of Satalia, a

leading UK AI company, are at the heart of our competitive offer.

An ongoing annual investment of £250m in data and technology to

support our AI strategy is included in our 2024 financial

plans.

“While we had to navigate a more challenging environment in

2023, we see strong future demand for our services and are

confident we can accelerate our growth over the medium-term.

“Today, the team and I look forward to demonstrating our

commitment to leadership through innovation and sharing our plans

for improved and sustained returns for our people, our clients, our

communities and our shareholders.”

The Capital Markets Day for analysts and investors will take

place at our offices at Sea Containers House in London with

presentations beginning from 1pm (UK time) today. Investors and

analysts who wish to attend in person are required to pre-register

by emailing irteam@wpp.com. The event will feature demonstrations

of our AI capabilities along with presentations from creative,

production and media agencies, and contributions from key clients

and partners. A live stream of the event will be available from 1pm

(UK time) today at www.wpp.com/investors and will subsequently be

made available for replay.

Cautionary statement regarding forward-looking

statements

This document contains statements that are, or may be deemed to

be, “forward-looking statements”. Forward-looking statements give

the Company’s current expectations or forecasts of future events.

An investor can identify these statements by the fact that they do

not relate strictly to historical or current facts.

These forward-looking statements may include, among other

things, plans, objectives, beliefs, intentions, strategies,

projections and anticipated future economic performance based on

assumptions and the like that are subject to risks and

uncertainties. These statements can be identified by the fact that

they do not relate strictly to historical or current facts. They

use words such as ‘aim’, ‘anticipate’, ‘believe’, ‘estimate’,

‘expect’, ‘forecast’, ‘guidance’, ‘intend’, 'may', ‘will’,

‘should’, ‘potential’, ‘possible’, ‘predict’, ‘project’, ‘plan’,

‘target’, and other words and similar references to future periods

but are not the exclusive means of identifying such statements. As

such, all forward-looking statements involve risk and uncertainty

because they relate to future events and circumstances that are

beyond the control of the Company. Actual results or outcomes may

differ materially from those discussed or implied in the

forward-looking statements. Therefore, you should not rely on such

forward-looking statements, which speak only as of the date they

are made, as a prediction of actual results or otherwise. Important

factors which may cause actual results to differ include but are

not limited to: the impact of, epidemics or pandemics including

restrictions on businesses, social activities and travel; the

unanticipated loss of a material client or key personnel; delays or

reductions in client advertising budgets; shifts in industry rates

of compensation; regulatory compliance costs or litigation; changes

in competitive factors in the industries in which we operate and

demand for our products and services; changes in client

advertising, marketing and corporate communications requirements;

our inability to realise the future anticipated benefits of

acquisitions; failure to realise our assumptions regarding goodwill

and indefinite lived intangible assets; natural disasters or acts

of terrorism; the Company’s ability to attract new clients; the

economic and geopolitical impact of the Russian invasion of

Ukraine; the risk of global economic downturn, slower growth,

increasing interest rates and high and sustained inflation; supply

chain issues affecting the distribution of our clients’ products;

technological changes and risks to the security of IT and

operational infrastructure, systems, data and information resulting

from increased threat of cyber and other attacks; the Company’s

exposure to changes in the values of other major currencies

(because a substantial portion of its revenues are derived and

costs incurred outside of the UK); and the overall level of

economic activity in the Company’s major markets (which varies

depending on, among other things, regional, national and

international political and economic conditions and government

regulations in the world’s advertising markets). In addition, you

should consider the risks described in Item 3D, captioned “Risk

Factors” in the Group’s Annual Report on Form-20F for 2022, which

could also cause actual results to differ from forward-looking

information.

Neither the Company, nor any of its directors, officers or

employees, provides any representation, assurance or guarantee that

the occurrence of any events anticipated, expressed or implied in

any forward-looking statements will actually occur. Accordingly, no

assurance can be given that any particular expectation will be met

and investors are cautioned not to place undue reliance on the

forward-looking statements.

Other than in accordance with its legal or regulatory

obligations (including under the Market Abuse Regulation, the UK

Listing Rules and the Disclosure and Transparency Rules of the

Financial Conduct Authority), The Company undertakes no obligation

to update or revise any such forward-looking statements, whether as

a result of new information, future events or otherwise.

Any forward-looking statements made by or on behalf of the Group

speak only as of the date they are made and are based upon the

knowledge and information available to the Directors at the

time.

______________________________

1 Adjusted operating cash flow conversion

is calculated as headline EBITDA plus non-cash compensation, less

repayment of lease liabilities and related interest, cash

restructuring costs, capex and working capital.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240129527680/en/

Investors and analysts Tom Waldron +44 7788 695864

Anthony Hamilton +44 7464 532903 Caitlin Holt +44 7392 280178

irteam@wpp.com Media Chris Wade +44 20 7282 4600

Richard Oldworth, +44 7710 130 634 Buchanan Communications +44

20 7466 5000 press@wpp.com wpp.com/investors

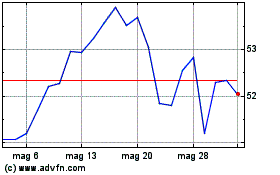

Grafico Azioni WPP (NYSE:WPP)

Storico

Da Gen 2025 a Feb 2025

Grafico Azioni WPP (NYSE:WPP)

Storico

Da Feb 2024 a Feb 2025