|

Main Post Office, P.O. Box 751 |

www.asyousow.org |

Berkeley, CA 94704

|

BUILDING A SAFE, JUST, AND SUSTAINABLE WORLD SINCE 1992 |

Notice of Exempt Solicitation Pursuant to Rule 14a-103

Name of the Registrant: ExxonMobil Corporation (XOM)

Name of persons relying on exemption: As You Sow on behalf of Andrew Behar

Address of persons relying on exemption: Main Post Office, P.O. Box 751, Berkeley, CA 94704

Written materials are submitted pursuant to Rule 14a-6(g)(1) promulgated

under the Securities Exchange Act of 1934. Submission is not required of this filer under the terms of the Rule, but is made voluntarily

in the interest of public disclosure and consideration of these important issues.

ExxonMobil Corporation (XOM)

Vote Yes: Item #11 – GHG Reporting on Adjusted Basis

Report Impact of Asset Transfers on Disclosed

Greenhouse Gas Emissions

Annual Meeting: May 31, 2023

CONTACT: Danielle Fugere | dfugere@asyousow.org

THE

RESOLUTION

BE IT RESOLVED: Shareholders request that ExxonMobil, at reasonable

cost and omitting proprietary information, disclose a recalculated emissions baseline that excludes the aggregated GHG emissions from

material asset divestitures occurring since 2016, the year ExxonMobil uses to baseline its emissions.

SUPPORTING STATEMENT: Proponents recommend disclosing, at management

discretion:

| · | The emissions associated with ExxonMobil’s material asset divestments since 2016; |

| · | What portion, if any, of ExxonMobil’s current emissions reduction targets relies on accounting for asset transfers as emissions

reductions; |

| · | A base year emissions recalculation policy establishing a threshold for future recalculations related to divestitures. |

SUMMARY

To address growing climate-related risk, investors expect companies

to set greenhouse gas (GHG) emissions reduction targets aligned with the Paris Agreement’s 1.5-degree Celsius goal and to report

their reduction progress. Fundamental to target-setting and reporting is accuracy.

When polluting assets are transferred from one company to another but

continue operating, their emissions should not be counted toward the selling company’s emissions reduction goals. To do so would

be to take credit for climate progress where none has occurred.

|

2023

Proxy Memo

ExxonMobil

| Report Impact of Asset Transfers on Disclosed Greenhouse Gas Emissions |

Investors must stand firm in requiring that company-reported progress

toward GHG emissions reduction targets reflect only real-world emissions cuts. Transferring emissions from one company to another may

appear to reduce an individual company’s emissions but it does not necessarily reduce actual GHG emissions, contribute to the goal

of limiting global temperature rise to 1.5 degrees Celsius, or reduce company or stakeholder exposure to climate risk.

ExxonMobil Corporation (“ExxonMobil” or “the Company”)

and Proponent agree on a fundamental principle: In ExxonMobil’s Board’s words, “divesting assets to reduce emissions

and meet an emissions target does not reduce global emissions and could result in potentially higher emissions depending on the capabilities

of the acquiring company.”1 While the Board asserts that ExxonMobil “make[s] divestment decisions to maximize value

and improve competitiveness, not to manage emissions,” ExxonMobil remains unwilling to provide clarity as to the role that divestments

play in achieving the Company’s net zero emissions reduction goal or the role of divestments in the approximately 13 percent reduction

in absolute emissions that ExxonMobil has reported achieving since its 2016 baseline year.2

This clarity is of particular importance in ExxonMobil’s case.

Between 2017 and 2021, ExxonMobil sold more assets than all but one other American oil and gas company, ranking fourth globally among

sellers by deal volume.3 Despite these significant asset transfers, ExxonMobil does not disclose the percentage of its reported

emissions reductions that are the result of actual emissions reductions versus those that are the result of transferring

assets to other companies where they continue to produce GHG emissions.

ExxonMobil can clarify this uncertainty by disclosing a recalculated

baseline that excludes emissions associated with material asset transfers and by establishing a policy for future recalculations. An emissions

baseline provides a reference point in the past against which current emissions are compared, allowing investors to assess progress against

a company’s GHG reduction targets. To avoid giving the appearance that emissions are being reduced when they are simply transferred

elsewhere, an emissions baseline must be adjusted to exclude such transfers. By adjusting its baseline in this way, ExxonMobil can ensure

that its GHG target reporting gives an accurate picture of its real-world success in achieving its emissions reductions targets.

The Proposal’s requested disclosures align with the recommendations

of expert standard-setters such as the Greenhouse Gas Protocol, the global oil and gas association Ipieca, and peer companies that have

adopted this standard. Through this small change to its climate reporting, ExxonMobil can provide investors with clarity on its actual

emissions performance.

RATIONALE FOR A

“YES” VOTE

| | | |

| 1. | Recalculating baseline emissions disincentivizes the practice of transferring emissions from one company

to another, while claiming success in achieving emissions reduction targets. |

_____________________________

1 https://ir.exxonmobil.com/static-files/602abfaf-40c8-4ffe-9fe9-84b208a06e01

p. 90

2 https://corporate.exxonmobil.com/news/reporting-and-publications/advancing-climate-solutions-progress-report#:~:text=Reduced%20our%20Scope%201%20and,end%202021%20vs.

%202016%20levels.

3 https://business.edf.org/files/Transferred-Emissions-How-Oil-Gas-MA-Hamper-Energy-Transition.pdf

p. 22

|

2023

Proxy Memo

ExxonMobil

| Report Impact of Asset Transfers on Disclosed Greenhouse Gas Emissions |

| 2. | ExxonMobil’s failure to recalculate baseline emissions to exclude divestitures may create a misleading impression of the

real-world impact of reported reductions and targets. |

| 3. | Accurate reporting of ExxonMobil’s emissions reduction performance and targets is important to investor decision-making. |

| 4. | ExxonMobil’s current disclosures do not address any of the Proposal’s recommendations. |

| 5. | ExxonMobil lags peers in disclosing the impact of divestitures on its emissions, and its reporting is misaligned with the guidance

of leading standard-setters. |

DISCUSSION

| 1. | Recalculating baseline emissions disincentivizes the practice of transferring emissions from one company to another, while claiming

success in achieving emissions reduction targets. |

Transferring operated assets from one company to another may reduce

an individual company’s emissions but does not contribute to the goals of reducing actual GHG emissions, preventing global temperature

rise, or mitigating company and stakeholder exposure to climate risk. As ExxonMobil’s Board notes in its opposition statement, the

Company and the Proponent are aligned on this basic principle.

Stakeholders and investors across the market agree. The world’s

largest asset managers have begun warning of the potential consequences of oil and gas companies “decarbonizing” by selling

their assets. Cyrus Taraporevala, the former head of State Street Global Advisors, wrote in the Financial Times in 2021 about the risk

of “selling off the highest-emitting components of businesses to private equity and hedge fund actors.”4 Taraporevala

noted that this could lead to public markets appearing to reach net-zero emissions while global emissions actually increase. In his 2022

letter to CEOs, BlackRock’s Larry Fink wrote that “passing carbon-intensive assets from public markets to private markets…will

not get the world to net zero.”5 The Glasgow Financial Alliance for Net Zero also states that “divestment of carbon-intensive

assets can be ineffective and even lead to real-world increases in emissions.”6

Legislators are examining this phenomenon as well. In December 2022,

the House Committee on Oversight and Reform issued a memo on its investigation of fossil fuel industry disinformation, which included

a section entitled “Selling Polluting Assets to Other Fossil Fuel Companies Rather than Offering Real Solutions.”7

The memo asserts that “divestment does not reduce greenhouse gas emissions—it simply moves those

emissions from one company’s balance sheet to another’s.”8

_____________________________

4 https://www.ft.com/content/c586e4cd-9fb7-47a3-8b43-3839e668fe3a

5 https://www.blackrock.com/corporate/investor-relations/larry-fink-ceo-letter

6 https://assets.bbhub.io/company/sites/63/2021/11/GFANZ-Progress-Report.pdf

p. 52

7 https://oversightdemocrats.house.gov/sites/democrats.oversight.house.gov/files/2022-12-09.COR_Supplemental_Memo-Fossil_Fuel_Industry_Disinformation.pdf

p. 19

8 Ibid.

|

2023

Proxy Memo

ExxonMobil

| Report Impact of Asset Transfers on Disclosed Greenhouse Gas Emissions |

The concerns of investors and legislators are supported by research

from the Environmental Defense Fund (EDF) showing that, in aggregate, upstream oil and gas assets are moving from operators with stronger

climate commitments to operators with weaker climate targets and disclosures, an outcome that likely increases total global emissions.9

In response to these widespread concerns, EDF and Ceres have developed

“Climate Principles for Oil and Gas Mergers and Acquisitions” in consultation with asset managers, private equity firms, banks,

oil and gas companies, and nonprofit organizations.10 These principles address the transferred emissions problem.

Given the consensus that transferring emissions from one company to

another will not lead to lower global emissions, it is imperative that companies are not incentivized to pursue this strategy to achieve

their stated GHG reduction targets. ExxonMobil agrees: “greenhouse gas metrics and calculation methods should incentivize actions

to address emissions.”11

The best way to ensure accuracy in target reporting is to recalculate

emissions baselines in the event of material divestitures. This avoids creating the impression that an asset transfer has resulted in

an emissions reduction when comparing annually adjusted emissions to an unadjusted baseline.

| 2. | ExxonMobil’s failure to recalculate baseline emissions to exclude divestitures may create a misleading impression of the

real-world impact of reported reductions and targets. |

To accurately account for GHG emissions reductions, the Greenhouse

Gas Protocol -- the world's most widely used GHG accounting standard12 -- recommends that companies recalculate base year emissions

in the event of a “transfer of ownership or control of emissions-generating activities.”13 The Greenhouse Gas Protocol

recommends recalculation “to reflect changes in the company that would otherwise compromise the consistency and relevance of the

reported GHG emissions information.”14

Ipieca, the global oil and gas association dedicated to advancing performance

on environmental and social issues, of which ExxonMobil is a member,15 similarly recommends “adjustments to the base

year emissions” to account for asset divestiture. Ipieca warns that companies should avoid giving the appearance of “increases

or decreases in emissions, when in fact. . . emissions would merely be transferred from one company to another.”16 Ipieca

indicates that recalculating emissions baselines in the event of divestitures avoids creating a misleading

impression of real-world emissions performance.

_____________________________

9 https://business.edf.org/files/Transferred-Emissions-How-Oil-Gas-MA-Hamper-Energy-Transition.pdf

10 https://www.ceres.org/resources/reports/climate-principles-oil-and-gas-mergers-and-acquisitions

11 https://ir.exxonmobil.com/static-files/602abfaf-40c8-4ffe-9fe9-84b208a06e01

p. 90

12 https://ghgprotocol.org/about-us

13 https://ghgprotocol.org/sites/default/files/standards/ghg-protocol-revised.pdf

p. 35

14 Ibid.

15 https://www.ipieca.org/membership

16 https://www.ipieca.org/resources/good-practice/petroleum-industry-guidelines-for-reporting-greenhouse-gas-emissions-2nd-edition/

p. 39

|

2023

Proxy Memo

ExxonMobil

| Report Impact of Asset Transfers on Disclosed Greenhouse Gas Emissions |

The discussion of the transferred emissions problem in the House Committee

on Oversight and Reform’s “Investigation of Fossil Fuel Industry Disinformation” goes further, suggesting that the “claim

that sales of carbon-intensive assets are advancing [companies’] net-zero pledges” could constitute disinformation.17

ExxonMobil sold more assets than almost any other American oil and

gas company between 2017 and 2021, only surpassed globally by Shell, Repsol, and Chevron.18 Shell and Repsol are pursuing divestment

as part of their emissions reduction strategies, while Chevron faces a shareholder proposal on this same topic.19 To present

an accurate picture of ExxonMobil’s performance against its ambition to achieve net zero operated Scope 1 and 2 emissions by 2050,

and to understand the extent to which ExxonMobil’s roughly 13 percent reported absolute emissions reductions since 2016 resulted

in real-world reductions, it is essential that the Company recalculate its baseline to account for asset transfers. Failure to do so could

leave investors with a misleading impression of its real-world emissions performance.

| 3. | Accurate reporting of ExxonMobil’s emissions reduction performance and targets is important to investor decision-making. |

Reporting against GHG reduction targets should reflect company progress

in reducing GHG emissions. To the extent such targets do not accurately reflect a company’s real-world emissions reductions, investors

may be misled. Accuracy in target-related reporting matters to investors.

A significant percentage of global investors have now committed to

reducing their portfolio emissions to net zero over the next few decades, and many have also set interim targets. The Net Zero Asset Managers

initiative (NZAM) includes approximately 300 signatories committing to manage $21.8 trillion in line with achieving net zero by 2050 or

sooner.20 Five of ExxonMobil’s ten largest institutional shareholders21 -- BlackRock, State Street Global

Advisors, Northern Trust Asset Management, J.P. Morgan Asset Management, and T. Rowe Price Group -- are all NZAM signatories, while Norges

Bank Investment Management, another top ten ExxonMobil shareholder, has a separate net zero commitment for its portfolio companies.22

To fulfill these public commitments, investors need to achieve absolute reductions in their portfolio emissions between now and 2050.

An accurate understanding of the absolute emissions performance of their portfolio companies is a prerequisite to accomplishing these

commitments.

Given ExxonMobil’s position as one of the world’s highest

emitting companies and one of the world’s largest companies by market capitalization,23 it is of particular importance

that investors have an accurate understanding of the Company’s emissions performance if they are to

achieve their own financed emissions reduction targets. Accurate target reporting is a must.

_____________________________

17 https://oversightdemocrats.house.gov/sites/democrats.oversight.house.gov/files/2022-12-09.COR_Supplemental_Memo-Fossil_Fuel_Industry_Disinformation.pdf

p. 19

18 https://business.edf.org/files/Transferred-Emissions-How-Oil-Gas-MA-Hamper-Energy-Transition.pdf

p. 22

19 https://reports.shell.com/sustainability-report/2021/_assets/downloads/shell-sustainability-report-2021.pdf

p. 63; https://www.reuters.com/business/energy/spains-repsol-sells-25-oil-gas-unit-eig-48-bln-2022-09-07/

20 https://www.netzeroassetmanagers.org/nzam-update-november-2022-initial-target-disclosure/#:~:text=The%20latest%20targets%20mean%20that,around%2039%25%20of%20total%20assets.

21 https://money.cnn.com/quote/shareholders/shareholders.html?symb=XOM&subView=institutional

22 https://www.netzeroassetmanagers.org/signatories/; https://www.nbim.no/en/the-fund/responsible-investment/2025-climate-action-plan/

23 https://www.climateaction100.org/whos-involved/companies/page/2/;

https://companiesmarketcap.com/

|

2023

Proxy Memo

ExxonMobil

| Report Impact of Asset Transfers on Disclosed Greenhouse Gas Emissions |

| 4. | ExxonMobil’s current disclosures do not address any of the Proposal’s recommendations. |

ExxonMobil does not currently address the Proposal’s requested

actions. It does not recalculate its baseline emissions to reflect material asset transfers, as acknowledged in the Board’s opposition

statement. It has further not adopted a base year emissions recalculation policy establishing a threshold for future recalculations, as

also recommended by the GHG Protocol.24 ExxonMobil does not disclose the emissions associated with material divestitures since

2016, its baseline year, nor is the Company transparent about the portion of its emissions targets that will be achieved through counting

divestments as emissions reductions.

While the Board’s opposition statement indicates that the Board

is concerned with the issues raised by the Proposal, it does not contend that ExxonMobil’s current disclosures address the Proposal’s

recommendations, nor does it sufficiently explain this failure. The Company’s current reporting does not allow investors to assess

how much of the reported 13 percent reduction in absolute emissions since 2016 is attributable to divestments.25 Further, while

the Board emphasizes the Company’s preference for intensity-based targets, the ambition to achieve net zero Scope 1 and 2 emissions

by 2050 is functionally an absolute emissions reduction target. As such, it is important that ExxonMobil disclose whether it plans to

use divestments to achieve this target—the Company’s current reporting does not provide a definitive answer.

| 5. | ExxonMobil lags peers in disclosing the impact of divestitures on its emissions, and its reporting is misaligned with the guidance

of leading standard-setters. |

ExxonMobil’s reporting not only fails to meet the recommendations

of the Greenhouse Gas Protocol, Ipieca, and the disclosure recommendations of Ceres and EDF’s “Climate Principles for Oil

and Gas Mergers and Acquisitions,”26 it is also misaligned with that of several leading peers.

Devon Energy recalculates its emissions baseline when asset divestitures

or investments result in “a change to its emissions baseline of 5% or higher” to ensure accuracy and comparability of emissions

reporting.27 Devon Energy notes that this “recalculation methodology affirms our commitment to structurally drive down

emissions, rather than divesting assets as a means to achieve our ambitious emissions reduction targets.”28

Investors deserve the same transparency from ExxonMobil.

_____________________________

24 https://ghgprotocol.org/sites/default/files/standards/ghg-protocol-revised.pdf

p. 35

25 https://corporate.exxonmobil.com/news/reporting-and-publications/advancing-climate-solutions-progress-report#:~:text=Reduced%20our%20Scope%201%20and,end%202021%20vs.

%202016%20levels.

26 https://www.ceres.org/sites/default/files/reports/2023-01/Climate%20Principles%20-%20Asset%20Transfer.pdf

p. 14-15

27 https://dvnweb.azureedge.net/assets/documents/Sustainability/DVN_2022_SustainabilityReport.pdf

p. 20

28 https://dvnweb.azureedge.net/assets/documents/Sustainability/DVN_2022_SustainabilityReport.pdf

p. 20

|

2023

Proxy Memo

ExxonMobil

| Report Impact of Asset Transfers on Disclosed Greenhouse Gas Emissions |

BP and Shell do not yet recalculate their emissions baselines to adjust

for divestitures, but they are transparent about the degree to which divestments factor into their reported emissions reductions, and

also describe the role of divestments in achieving their GHG reduction targets.29 This transparency signals that the companies’

GHG reduction targets do not necessarily reflect real-world decreases in emissions.

RESPONSE TO EXXONMOBIL

BOARD OF DIRECTORS’ STATEMENT IN OPPOSITION

The Board’s opposition statement begins with a basic inaccuracy,

asserting that this Proposal “is one of 10 new reports requested by proponents at this annual shareholder meeting.”30

To the contrary, this Proposal does not call for a standalone report. It simply requests the disclosure of a recalculated emissions baseline

that excludes divestitures. The Company could easily include this disclosure in its existing annual climate reporting.

The Board’s response to the Proposal indicates that ExxonMobil

shares the concerns that motivate the Proposal: “divesting assets to manipulate company-specific absolute emissions is not a constructive

way to reduce global emissions.”31 This response does not, however, explain how the Company’s current disclosures

address the issues raised by the Proposal. ExxonMobil’s current disclosures do not address any of the Proposal’s recommendations,

and do not make it clear whether ExxonMobil’s long-term emissions reduction strategy incorporates divestments, nor whether its reported

absolute emissions reductions are the result of divestments.

The Board’s opposition statement offers a single explanation

for why it does not think that ExxonMobil should adopt the requested disclosures: the Board argues that doing so would be “inconsistent

with the GHGRP [U.S. EPA Greenhouse Gas Reporting Program] regulatory requirements and reporting practices for reserves and financial

data.”32 There is, however, no reason why ExxonMobil cannot report in accordance with GHGRP regulatory requirements,

and also in alignment with the GHG Protocol, which provides the world's most widely used greenhouse gas accounting standards for companies

and is therefore the most useful and comparable reporting format for investors.

In fact, Devon Energy both recalculates its baseline emissions in the

event of material divestments in accordance with GHG Protocol guidance, and also aligns with GHGRP regulatory requirements in its emissions

reporting.33 It is evidently possible for a company to do both and would not be especially complicated for a company like ExxonMobil,

which already provides extensive annual climate reporting.

ExxonMobil annually reports its total emissions. This reporting

necessarily reflects emissions reductions or additions due to operational changes, the building or buying of new assets, and transferring

of assets to other companies. The information required to adjust baselines to reflect asset transfers should therefore be readily available.

_____________________________

29 https://www.bp.com/content/dam/bp/business-sites/en/global/corporate/pdfs/investors/bp-net-zero-report-2022.pdf

p. 14; https://reports.shell.com/sustainability-report/2021/_assets/downloads/shell-sustainability-report-2021.pdf p. 25, p. 63

30 https://ir.exxonmobil.com/static-files/602abfaf-40c8-4ffe-9fe9-84b208a06e01

p. 90

31 https://ir.exxonmobil.com/static-files/602abfaf-40c8-4ffe-9fe9-84b208a06e01

p. 90

32 https://ir.exxonmobil.com/static-files/602abfaf-40c8-4ffe-9fe9-84b208a06e01

p. 90

33 https://dvnweb.azureedge.net/assets/documents/Sustainability/DVN_2022_SustainabilityReport.pdf

|

2023

Proxy Memo

ExxonMobil

| Report Impact of Asset Transfers on Disclosed Greenhouse Gas Emissions |

The Board argues that the Proposal “fails to recognize the Company’s

disclosures and clear actions to achieve its emission-reduction plans, and the progress that is being made to achieve them.” However,

this progress cannot be properly assessed absent the requested disclosures. The additional disclosures requested by the Proposal will

provide useful information for investors seeking to track ExxonMobil’s success in achieving its GHG emissions reduction targets

over time, as well as its progress toward achieving net zero Scope 1 and 2 emissions by 2050.

Finally, in its opposition statement ExxonMobil’s Board has taken

the unusual step of disputing the Proponent’s right to submit this shareholder proposal. The Board asserts that the Proposal “misuses

the shareholder proposal process by violating the clear intent of the SEC’s one-proposal limitation.”34 The Board

asserts that the Proponent submitted both this Proposal and an entirely unrelated proposal submitted by Anna Marie Lyles. The SEC has

rejected this assertion:

“We are unable to concur in your view that the Company

may exclude the Proposals under Rule 14a-8(c). In our view, neither Proponent submitted more than one of the Proposals, directly or indirectly,

to the Company.”35

The Proponent would urge ExxonMobil’s board to focus its resources

on transparent reporting of emissions and reduction targets rather than on alleging improper motives by long-term shareholders and shareholder

representatives.36

CONCLUSION

Vote “Yes” on this Shareholder Proposal to Report Impact

of Asset Transfers on Disclosed Greenhouse Gas Emissions. ExxonMobil has not implemented the Proposal’s recommended disclosures

which are necessary to assess the Company’s success in achieving its greenhouse gas reduction targets. We urge a “Yes”

vote.

--

For questions, please contact Danielle Fugere, As You Sow, dfugere@asyousow.org

THE FOREGOING INFORMATION MAY BE DISSEMINATED TO SHAREHOLDERS VIA TELEPHONE,

U.S. MAIL, E-MAIL, CERTAIN WEBSITES AND CERTAIN SOCIAL MEDIA VENUES, AND SHOULD NOT BE CONSTRUED AS INVESTMENT ADVICE OR AS A SOLICITATION

OF AUTHORITY TO VOTE YOUR PROXY. THE COST OF DISSEMINATING THE FOREGOING INFORMATION TO SHAREHOLDERS IS BEING BORNE ENTIRELY BY ONE OR

MORE OF THE CO-FILERS. PROXY CARDS WILL NOT BE ACCEPTED BY ANY CO-FILER. PLEASE DO NOT SEND YOUR PROXY TO ANY CO-FILER. TO VOTE YOUR PROXY,

PLEASE FOLLOW THE INSTRUCTIONS ON YOUR PROXY CARD.

_____________________________

34 https://ir.exxonmobil.com/static-files/602abfaf-40c8-4ffe-9fe9-84b208a06e01

p. 90

35 https://www.sec.gov/divisions/corpfin/cf-noaction/14a-8/2023/beharexxon032423-14a8.pdf

36 The Board’s opposition statement asserts that As

You Sow, which employs both the Proponent and his representative, "is an organization with a history of activism against the

oil and natural gas industry. This includes working with 350.org and EarthJustice [sic] to promote ‘keep it in the ground’

efforts.” As You Sow engages with oil and gas companies on behalf of investors seeking to promote best practices in climate-related

disclosures and target-setting, as well as addressing the risks of hydraulic fracturing and stranded assets. As You Sow appreciates

the work of 350.org and Earthjustice, but it has not campaigned with them on “‘keep it in the ground’ efforts,”

as the Board incorrectly asserts.

8

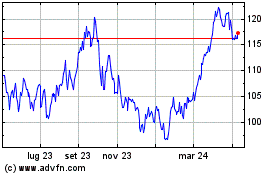

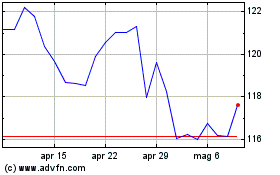

Grafico Azioni Exxon Mobil (NYSE:XOM)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Exxon Mobil (NYSE:XOM)

Storico

Da Apr 2023 a Apr 2024